Global Alginate Market Size, Share, And Business Benefits By Type (High M, High G), By Product (Sodium, Calcium, Potassium, Propylene Glycol, Others),By Form (Powder, Granules, Viscous Solution), By Application(Food (Bakery, Confectionery, Meat Products, Dairy Products, Sauces and Dressings, Others), Beverages, Pharmaceutical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156269

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

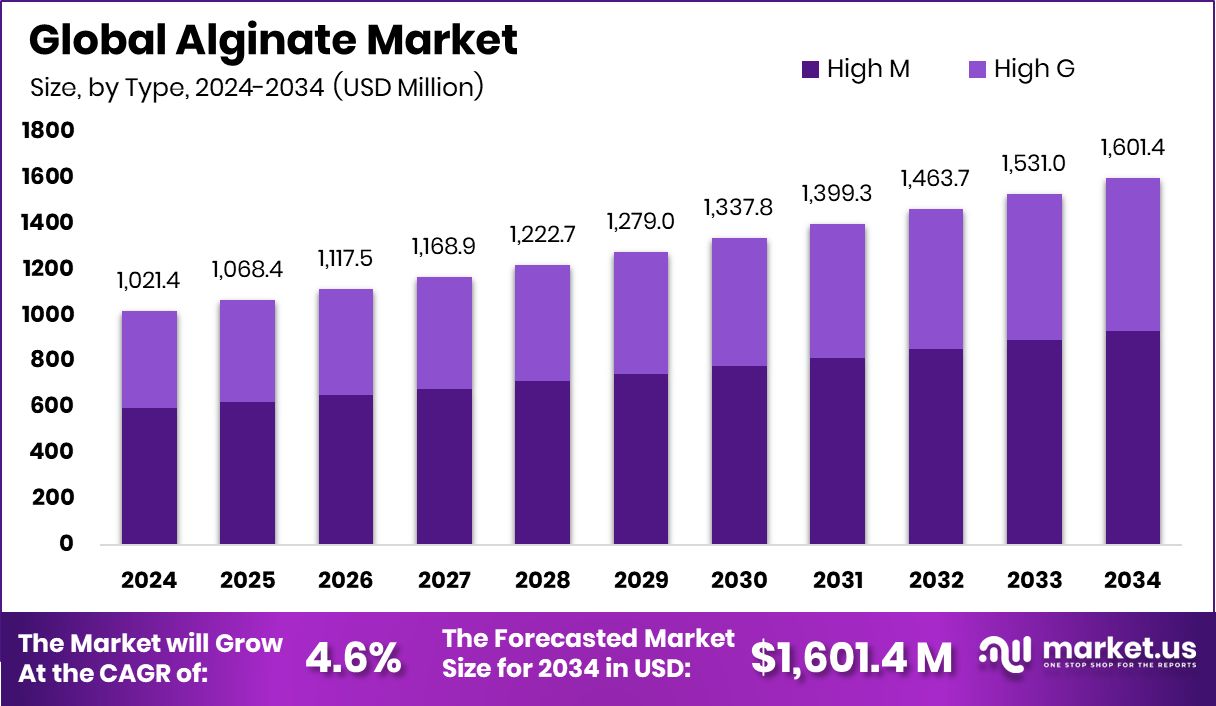

The Global Alginate Market is expected to be worth around USD 1,601.4 million by 2034, up from USD 1,021.4 million in 2024, and is projected to grow at a CAGR of 4.6% from 2025 to 2034. Strong growth in the North America Alginate Market reached 42.70%, USD 435.9 Mn.

Alginate is a natural polysaccharide extracted mainly from brown seaweed. It is valued for its thickening, gelling, and stabilizing properties, which make it widely used in food, pharmaceuticals, cosmetics, and industrial applications. Because it is biodegradable and biocompatible, alginate also finds use in biomedical fields such as wound dressings and drug delivery systems.

One major growth factor for the alginate market is the rising demand for natural and sustainable ingredients. Consumers are increasingly shifting toward eco-friendly products, and alginate, being derived from seaweed, offers a renewable option. Its functional versatility supports product innovation across the food, healthcare, and personal care industries.

On the demand side, the growing use of alginate in processed foods, dietary supplements, and pharmaceutical formulations is boosting market expansion. The trend toward healthier and plant-based food options also plays a role, as alginate is a safe and natural additive that enhances texture and quality without synthetic chemicals. According to an industry report, Moonwatt secures €8 million in funding to advance solar energy with innovative sodium-ion batteries.

Looking at opportunities, alginate’s role in biomedical and advanced material applications is opening new pathways. Its unique properties enable innovations in tissue engineering, encapsulated probiotics, and controlled drug delivery. Additionally, with increasing research in bio-based packaging, alginate holds strong potential in supporting sustainable industry growth. According to an industry report, Sunrise obtained $960,000 grant to develop a groundbreaking sodium-ion battery anode project.

Key Takeaways

- The Global Alginate Market is expected to be worth around USD 1,601.4 million by 2034, up from USD 1,021.4 million in 2024, and is projected to grow at a CAGR of 4.6% from 2025 to 2034.

- In the Alginate Market, High M type holds 58.3% share, showing its strong functional benefits.

- Sodium alginate dominates with a 39.7% share, driven by its widespread use in the food and pharmaceutical industries.

- The powder form leads with 48.6% share, highlighting convenience and versatility in multiple applications.

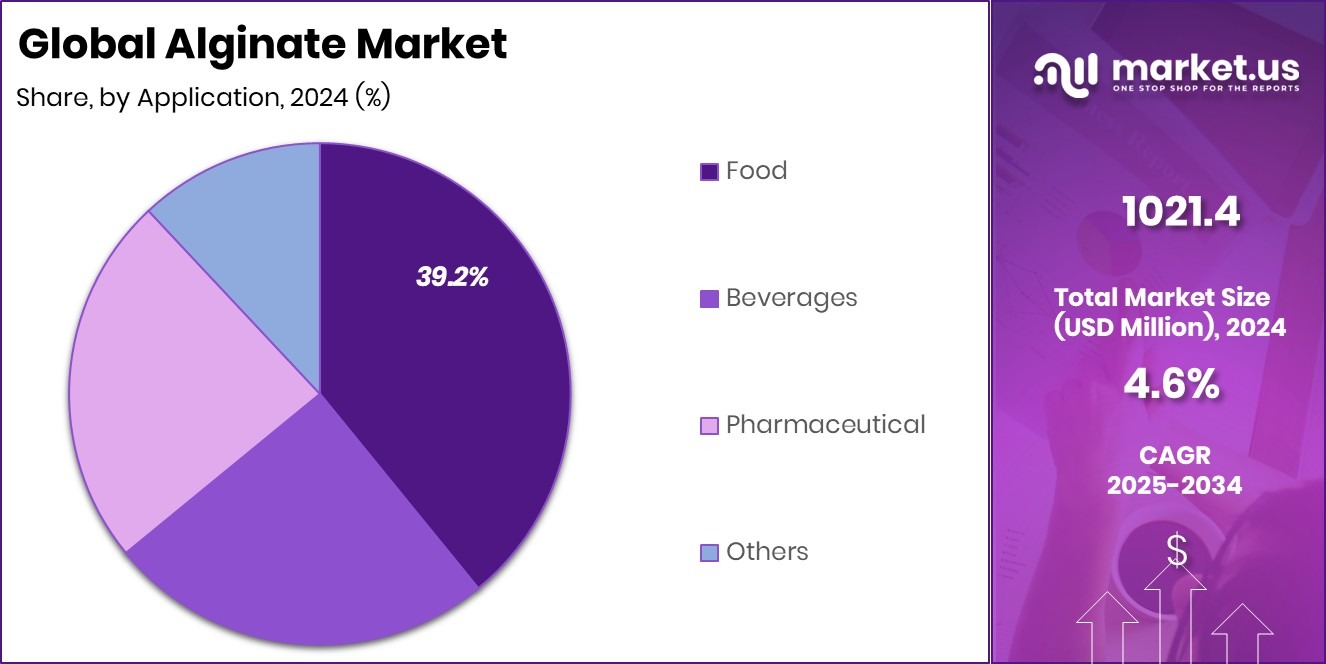

- The food application represents a 39.2% share, showcasing the vital role of alginate in texture, stability, and preservation.

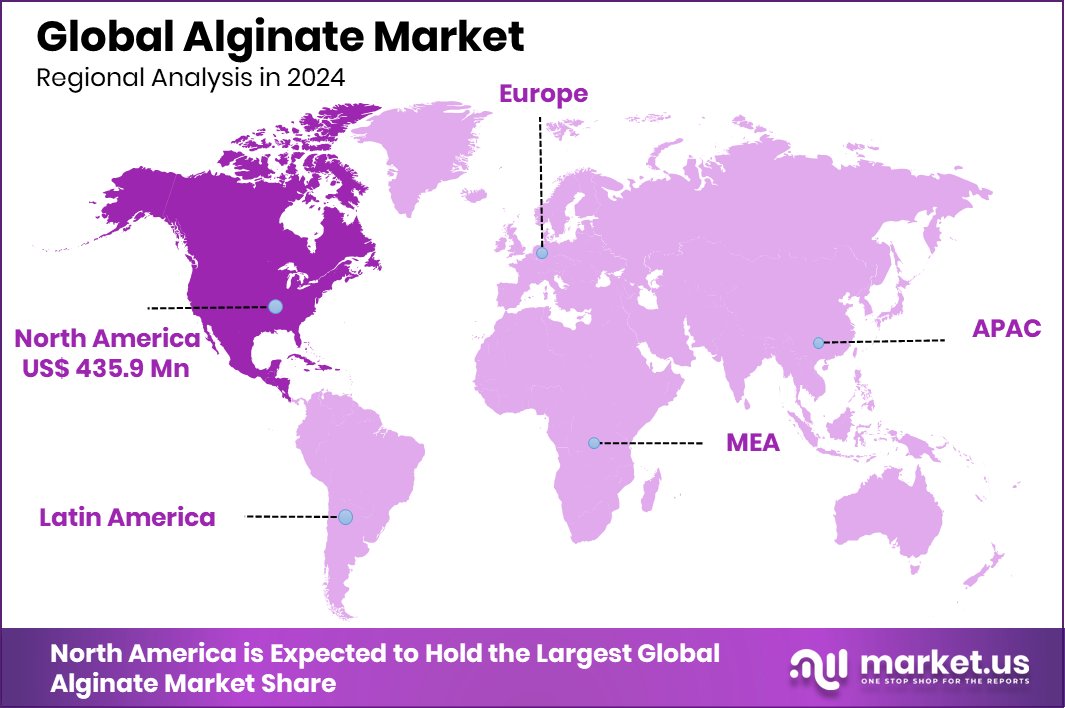

- The dominance of the North American Alginate Market was 42.70%, USD 435.9 Mn.

By Type Analysis

The Alginate Market by type shows High M holding 58.3% share.

In 2024, High M held a dominant market position in the By Type segment of the Alginate Market, with a 58.3% share. This strong presence highlights its importance as the preferred form of alginate across various industries.

High M grade alginate is valued for its superior gelling strength, viscosity control, and stability, making it highly suitable for applications in food, pharmaceuticals, and personal care products. Its ability to form strong gels without the need for excessive additives has positioned it as a key ingredient in processed foods, dairy products, and confectionery, where texture and consistency are critical quality factors.

In the pharmaceutical sector, High M alginate is widely used in drug formulations, wound care products, and controlled release systems, owing to its excellent biocompatibility and film-forming properties. The growing preference for natural and safe excipients in healthcare continues to boost its adoption.

Furthermore, in personal care and cosmetics, High M alginate plays an important role in thickening and stabilizing formulations, meeting consumer demand for natural, plant-derived ingredients. This broad scope of use across multiple industries, combined with the rising trend toward sustainable and bio-based products, has reinforced the segment’s leadership and ensured its continued growth trajectory in the market.

By Product Analysis

By product, Sodium dominates the Alginate Market with a 39.7% share.

In 2024, Sodium held a dominant market position in the By Product segment of the Alginate Market, with a 39.7% share. This leadership reflects the extensive utilization of sodium alginate across food, pharmaceutical, and textile industries due to its excellent solubility, stabilizing ability, and gelling properties.

In the food sector, sodium alginate has become a critical additive, particularly in bakery, dairy, and confectionery products, where it is used to improve texture, enhance mouthfeel, and act as a natural thickener. Its role as a clean-label, plant-derived ingredient aligns strongly with consumer demand for natural and sustainable alternatives to synthetic additives.

In pharmaceuticals, sodium alginate is widely recognized for its application in drug formulation, particularly in controlled-release medications and antacid preparations. Its ability to create protective gels enhances therapeutic effectiveness while maintaining safety, boosting its acceptance in modern healthcare solutions.

Moreover, the textile industry continues to adopt sodium alginate as a preferred thickening agent for reactive dye printing, where its performance consistency and eco-friendly profile support growing sustainability initiatives. The strong combination of cross-industry demand and increasing focus on bio-based, renewable products has consolidated sodium alginate’s market dominance, ensuring its continued relevance and growth within the broader alginate industry.

By Form Analysis

Powder form leads the Alginate Market, capturing 48.6% of the overall market share.

In 2024, Powder held a dominant market position in the By Form segment of the Alginate Market, with a 48.6% share. The powder form of alginate is highly preferred due to its ease of handling, longer shelf life, and superior functionality across food, pharmaceutical, and industrial applications.

Its ability to disperse uniformly and deliver consistent viscosity makes it particularly suitable for large-scale processing, where precision and stability are critical. In the food industry, powdered alginate is extensively used in dairy products, sauces, and confectionery, helping manufacturers achieve better texture, improved stability, and enhanced product appeal.

The pharmaceutical sector has also contributed significantly to the adoption of powdered alginate, as it serves as an effective excipient in tablet formulations and wound care products. Its controlled swelling and gelling properties provide reliable drug delivery mechanisms while ensuring patient safety.

Additionally, powdered alginate finds wide use in industrial processes such as textile printing and bio-based material development, where consistent performance and cost-effectiveness are key requirements. The preference for the powder form is further reinforced by its storage efficiency and compatibility with automated production systems, cementing its leadership position and supporting continued demand in both established and emerging application areas.

By Application Analysis

Food application accounts for a 39.2% share, driving Alginate Market global demand.

In 2024, Food held a dominant market position in the By Application segment of the Alginate Market, with a 39.2% share. The strong presence of alginate in the food sector is largely due to its functional versatility as a thickener, stabilizer, and gelling agent. Widely recognized for improving texture and consistency, alginate is a vital ingredient in products such as dairy items, bakery goods, sauces, and confectionery.

Its ability to enhance mouthfeel, stabilize emulsions, and provide uniformity in processed foods has made it indispensable for manufacturers aiming to meet consumer expectations for high-quality and reliable products.

Growing consumer demand for natural, plant-derived food ingredients has also strengthened alginate’s position in this segment. As alginate is derived from brown seaweed, it aligns well with clean-label and sustainable product trends that are increasingly shaping the global food industry. Moreover, its non-toxic, biodegradable profile provides an additional advantage, particularly as food producers look to replace synthetic additives with safer alternatives.

With the global food sector continuing to expand and innovate, especially in ready-to-eat and convenience products, the demand for alginate as a multifunctional and eco-friendly ingredient remains high. This sustained preference has reinforced the food segment’s leadership in the alginate market.

Key Market Segments

By Type

- High M

- High G

By Product

- Sodium

- Calcium

- Potassium

- Propylene Glycol

- Others

By Form

- Powder

- Granules

- Viscous Solution

By Application

- Food

- Bakery

- Confectionery

- Meat Products

- Dairy Products

- Sauces and Dressings

- Others

- Beverages

- Pharmaceutical

- Others

Driving Factors

Rising Demand for Natural and Sustainable Ingredients

One of the key driving factors for the alginate market is the growing demand for natural and sustainable ingredients across multiple industries. Consumers today are increasingly health-conscious and prefer products made from renewable, eco-friendly sources.

Alginate, which is extracted from brown seaweed, perfectly fits this demand as it is biodegradable, non-toxic, and plant-based. In the food industry, it is widely used to improve texture, stability, and appearance without relying on synthetic chemicals.

Similarly, in pharmaceuticals and personal care, alginate is valued for its safety and versatility. As companies continue shifting toward clean-label and eco-friendly formulations, alginate’s role becomes even stronger, making sustainability a key driver of its long-term market growth.

Restraining Factors

Fluctuating Seaweed Supply Limits Market Stability

A major restraining factor for the alginate market is the dependency on seaweed as its primary raw material. Since alginate is mainly extracted from brown seaweed, any fluctuation in seaweed availability directly affects production and pricing.

Environmental factors such as changing ocean temperatures, pollution, and overharvesting can reduce seaweed yields, making the supply unstable. Additionally, seaweed harvesting is often concentrated in specific coastal regions, which exposes the industry to regional risks like strict regulations or natural disruptions.

This dependence on limited resources creates uncertainty for manufacturers, leading to higher production costs and supply chain challenges. Such instability in raw material sourcing can restrict market growth despite rising demand across industries.

Growth Opportunity

Expanding Biomedical Applications Create New Market Opportunities

One of the strongest growth opportunities for the alginate market lies in its expanding use within the biomedical field. Alginate’s biocompatibility, biodegradability, and ability to form gels make it highly suitable for advanced medical applications.

It is increasingly being used in wound dressings, tissue engineering, and drug delivery systems, where controlled release and safe interaction with the body are essential. With global healthcare systems focusing more on innovative therapies and regenerative medicine, alginate’s role is expected to grow rapidly.

Additionally, research into encapsulated probiotics and bio-based implants is opening fresh avenues for demand. This shift toward biomedical applications ensures that alginate is not only a food additive but also a critical material for future healthcare solutions.

Latest Trends

Rising Adoption of Alginate in Eco-Friendly Packaging

A key trend shaping the alginate market is its increasing use in eco-friendly packaging solutions. With the global push to reduce plastic waste, industries are actively exploring biodegradable materials, and alginate has gained attention as a sustainable alternative.

Derived from seaweed, alginate can be processed into films and coatings that are safe, renewable, and environmentally friendly. Food and beverage companies, in particular, are testing alginate-based packaging to replace single-use plastics, driven by consumer demand and stricter government regulations.

This trend aligns with the growing sustainability movement, where businesses aim to reduce carbon footprints and promote circular economies. As awareness and innovation expand, alginate’s role in green packaging is set to become a major growth driver.

Regional Analysis

In 2024, Alginate Market North America held 42.70%, USD 435.9 Mn.

The Alginate Market demonstrates significant regional variations, with North America emerging as the leading contributor in 2024. Holding a dominant share of 42.70%, equivalent to USD 435.9 million, the region continues to strengthen its position, driven by the robust demand for natural and sustainable ingredients across food, pharmaceuticals, and personal care sectors.

The food industry in North America heavily relies on alginate for its thickening and stabilizing functions, particularly in dairy, bakery, and ready-to-eat products, which aligns with consumer preferences for clean-label and plant-based alternatives. Additionally, the pharmaceutical industry in the region benefits from alginate’s biocompatibility, using it extensively in drug formulations, wound care, and controlled-release applications.

The rising focus on health-conscious consumption patterns and growing regulatory support for bio-based ingredients further contribute to the region’s leadership. While Europe, Asia Pacific, the Middle East & Africa, and Latin America remain important markets with expanding applications, North America continues to dominate due to its strong industrial base, advanced R&D investments, and consistent adoption of innovative applications.

This combination of established demand, consumer awareness, and technological advancement ensures North America maintains its leading role in the global alginate market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Algaia has positioned itself as a strong innovator by focusing on sustainable sourcing of seaweed and advancing alginate formulations that cater to clean-label demands. Its commitment to eco-friendly processes resonates well with the global shift toward renewable ingredients.

Similarly, Marine Biopolymers Limited continues to emphasize high-quality production and precision in alginate extraction, catering to industries that demand consistency and performance, such as healthcare and biotechnology.

DuPont de Nemours, Inc., with its global scale and diverse portfolio, adds considerable weight to the alginate market. Leveraging its R&D capabilities, DuPont enhances product applications in pharmaceuticals and advanced material solutions, demonstrating how alginate can expand beyond traditional uses.

Meanwhile, Ingredients Solutions, Inc. focuses on providing tailored alginate solutions for food and beverage manufacturers, meeting the rising need for texture improvement and stability in processed foods.

Top Key Players in the Market

- Algaia

- Marine Biopolymers Limited

- DuPont de Nemours, Inc.

- Ingredients Solutions, Inc.

- KIMICA

- Ceamsa

- Shandong Jiejing Group Corporation

- Cp kelco

- FMC

Recent Developments

- In May 2025, KIMICA introduced its Calcium Alginate at the IFIA JAPAN 2025 exhibition. This product highlights both functional and physiological benefits, and was presented alongside offerings tailored to the growing plant‑based product market—underlining its role in clean-label and health-conscious applications.

- In June 2024, Tate & Lyle announced its plan to acquire CP Kelco for approximately US $1.8 billion, including cash and equity components. CP Kelco is recognized for manufacturing ingredients like pectin, carrageenan, citrus fiber, xanthan gum, and other natural stabilizers. This major move reflected Tate & Lyle’s strategy of expanding its portfolio in nature-based texture and clean-label solutions.

Report Scope

Report Features Description Market Value (2024) USD 1,021.4 Million Forecast Revenue (2034) USD 1,601.4 Million CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (High M, High G), By Product (Sodium, Calcium, Potassium, Propylene Glycol, Others),By Form (Powder, Granules, Viscous Solution), By Application(Food (Bakery, Confectionery, Meat Products, Dairy Products, Sauces and Dressings, Others), Beverages, Pharmaceutical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Algaia, Marine Biopolymers Limited, DuPont de Nemours, Inc., Ingredients Solutions, Inc., KIMICA, Ceamsa, Shandong Jiejing Group Corporation, Cp kelco, FMC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Algaia

- Marine Biopolymers Limited

- DuPont de Nemours, Inc.

- Ingredients Solutions, Inc.

- KIMICA

- Ceamsa

- Shandong Jiejing Group Corporation

- Cp kelco

- FMC