Global Alcohol Wipes Market Size, Share, Growth Analysis By Fabric Material (Synthetic, Natural), By End-use (Personal & Household, Commercial), By Distribution Channel (Supermarkets/Hypermarkets, Online, Convenience Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167033

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

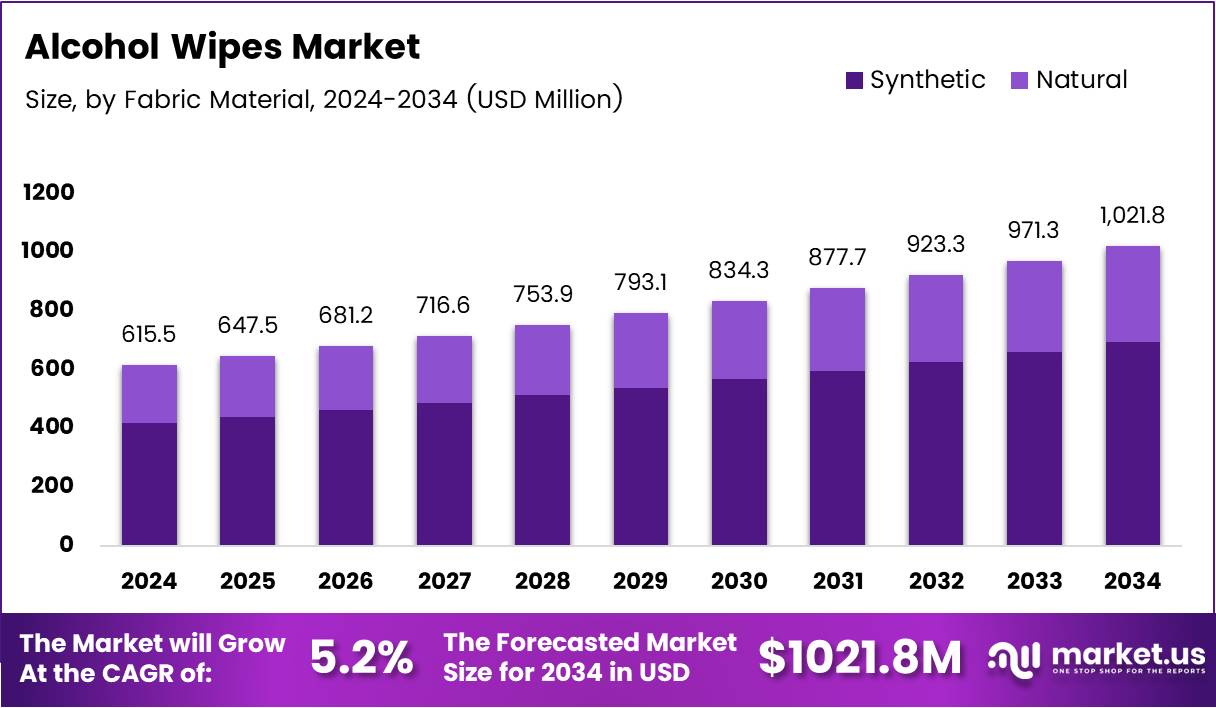

The Global Alcohol Wipes Market size is expected to be worth around USD 1021.8 Million by 2034, from USD 615.5 Million in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034.

Alcohol wipes are pre-moistened disposable sheets infused with isopropyl or ethyl alcohol that deliver quick disinfecting performance across medical, household, and industrial environments. Moreover, these wipes offer convenient hygiene support, enabling efficient germ removal while reducing cross-contamination risks. As demand rises, the category continues evolving with broader applications and stricter safety expectations.

The Alcohol Wipes Market reflects expanding hygiene priorities, driven by rising infection-control awareness and increased usage across healthcare, FMCG, and commercial facilities. Furthermore, manufacturers focus on safer formulations and sustainable wipe substrates, enhancing long-term adoption. This market also benefits from growing institutional purchases and private-label penetration within retail channels.

Alcohol wipes hold strategic value because they bridge consumer convenience and clinical-grade sanitation needs. Additionally, recurring demand from hospitals and travel sectors supports resilient revenue momentum. Companies benefit from predictable replenishment cycles, allowing stable capacity planning and innovation investment across surface-care and hand-disinfection segments.

The Alcohol Wipes Market shows steady growth, supported by hygiene-driven regulations and continuous public-health initiatives. Consequently, suppliers see strong opportunities in healthcare modernization programs, workplace sanitation upgrades, and rising household cleaning frequency. The sector advances as users seek reliable disinfection with faster drying times and effective microbial reduction.

Opportunities emerge as governments invest in infection-prevention infrastructure and mandate stricter sanitation compliance across hospitals, clinics, and food-service environments. Moreover, rising travel volumes and expansion of pharmaceutical manufacturing further stimulate demand for sterile-grade alcohol wipes. Emerging markets increasingly adopt these products as disposable hygiene solutions scale within urban populations.

According to a clinical study presented at an infectious diseases conference, alcohol-based wipes reduced transient hand bacteria by 90% among 75 study participants, reinforcing their medical relevance. Likewise, growing frontline usage strengthens the market’s credibility as healthcare professionals prioritize rapid, evidence-based disinfection tools across routine workflows.

According to a consumer survey, 92% of users have engaged with cleaning, disinfecting, or sanitizing wipes, while 83% of households use them weekly, confirming strong penetration. As a result, rising domestic adoption complements clinical demand, positioning the Alcohol Wipes Market for continued expansion supported by hygiene awareness and recurring purchase behavior.

Key Takeaways

- Global Alcohol Wipes Market expected to reach USD 1021.8 Million by 2034, growing from USD 615.5 Million in 2024 at a 5.2% CAGR.

- Synthetic fabric segment leads with a 69.2% market share in 2024.

- Personal & Household end-use segment dominates with a 67.1% share.

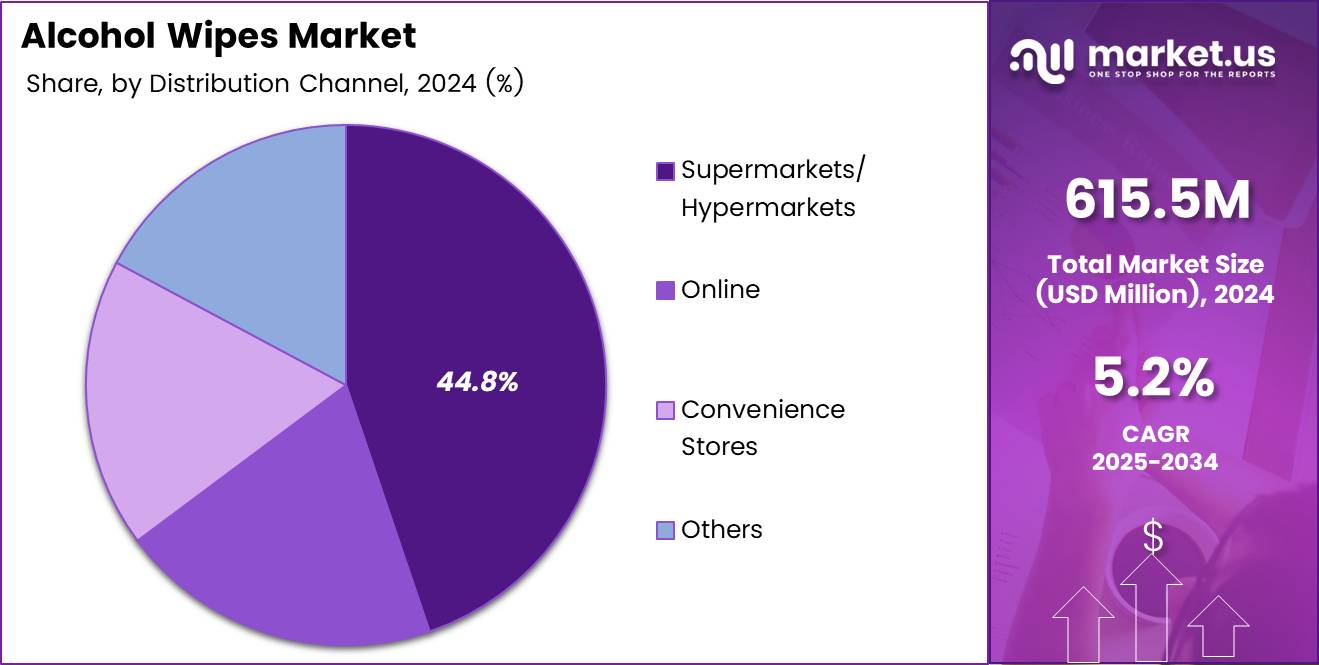

- Supermarkets/Hypermarkets distribution channel holds the largest share at 44.8%.

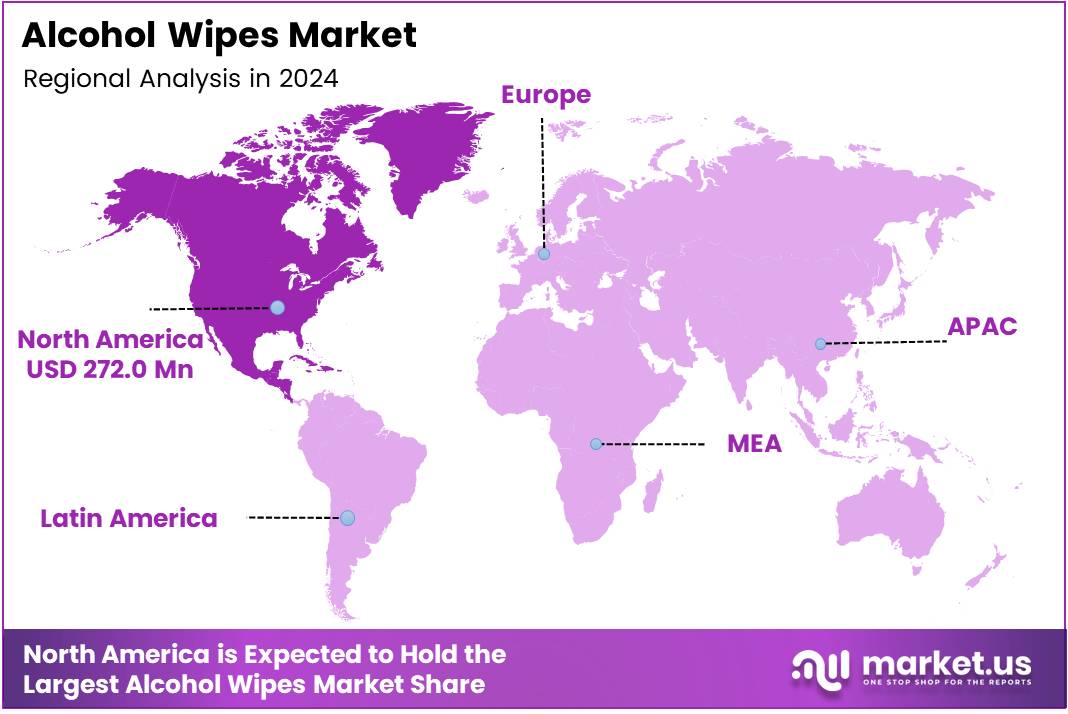

- North America leads regionally with 44.2% market share valued at USD 272.0 Million.

By Fabric Material Analysis

Synthetic dominates with 69.2% due to its enhanced durability and strong compatibility with alcohol-based formulations.

In 2024, Synthetic held a dominant market position in the By Fabric Material segment of the Alcohol Wipes Market, with a 69.2% share. This segment grew steadily as manufacturers prioritized high-strength, quick-drying, and low-lint materials. Moreover, synthetic fabrics improved product consistency, enabling brands to meet rising hygiene expectations effectively.

The Natural fabric material segment continued expanding as eco-conscious consumers increasingly preferred biodegradable options. Additionally, manufacturers explored sustainable fibers to reduce environmental impact. While it lagged behind synthetics, natural fabrics benefited from regulatory encouragement and growing awareness, gradually strengthening its presence in global markets.

By End-use Analysis

Personal & Household dominates with 67.1% driven by rising hygiene awareness and frequent daily-use applications.

In 2024, Personal & Household held a dominant market position in the By End-use segment of the Alcohol Wipes Market, with a 67.1% share. This leadership stemmed from increased consumer focus on sanitation, portability, and convenience. Furthermore, product innovation and multipurpose usage sustained demand across a wide range of home applications.

The Commercial segment expanded steadily as industries such as healthcare, hospitality, and food service adopted alcohol wipes for routine disinfection. Moreover, regulatory compliance and safety protocols boosted product consumption. Although smaller in share, this segment continued diversifying its applications in professional settings.

By Distribution Channel Analysis

Supermarkets/Hypermarkets dominate with 44.8% owing to broad availability and strong consumer trust.

In 2024, Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel segment of the Alcohol Wipes Market, with a 44.8% share. These stores offered extensive product visibility, competitive pricing, and bulk purchase options, encouraging consumers to choose alcohol wipes conveniently during routine shopping trips.

The Online segment expanded rapidly as consumers adopted digital purchasing for convenience and wider product variety. Additionally, attractive discounts and doorstep delivery accelerated market traction. This channel continued growing due to rising smartphone usage and improved e-commerce logistics.

Convenience Stores maintained steady demand by offering quick access and impulse-buy opportunities. Their strategic locations near residential and transit areas encouraged frequent purchases. Moreover, compact pack sizes appealed to on-the-go users seeking immediate hygiene solutions.

The Others distribution segment included pharmacies and specialty outlets, contributing to diversified availability. These channels particularly attracted customers seeking trusted, medically oriented products. Furthermore, professional recommendations supported stable market engagement across niche retail environments.

Key Market Segments

By Fabric Material

- Synthetic

- Natural

By End-use

- Personal & Household

- Commercial

By Distribution Channel

- Supermarkets/Hypermarkets

- Online

- Convenience Stores

- Others

Drivers

Rising Consumer Preference for Convenient, On-the-Go Disinfection Solutions Drives Market Growth

The alcohol wipes market is expanding as consumers increasingly prefer quick and portable cleaning solutions. People are looking for easy ways to disinfect hands and surfaces, especially when traveling or working outdoors. This growing lifestyle trend is pushing manufacturers to produce compact and easy-to-use alcohol wipe packs.

Hospitals and clinics are also a major driver of market demand. With healthcare spending on the rise and strict infection control rules in place, alcohol wipes are being used regularly to maintain hygiene and prevent cross-contamination.

In developing regions, awareness about personal hygiene has improved significantly. As education and incomes increase, consumers are adopting alcohol wipes as part of their daily routines for personal care and cleanliness.

Furthermore, many industries like food service, manufacturing, and hospitality are now adopting alcohol wipes for surface disinfection. This industrial and commercial use is creating steady demand and supporting the overall growth of the market.

Restraints

Fluctuating Raw Material Prices for Isopropyl and Ethyl Alcohol Restrains Market Expansion

The alcohol wipes market faces challenges due to changing prices of raw materials like isopropyl and ethyl alcohol. These materials are crucial for production, and their price fluctuations affect manufacturing costs and profit margins. When alcohol prices rise, producers often struggle to maintain stable pricing for consumers.

Another key restraint is health-related concern. Frequent use of alcohol wipes can cause skin dryness, irritation, or allergic reactions, especially among sensitive users. This has made some consumers cautious, limiting their daily use of such products.

Healthcare workers who use these wipes repeatedly during long shifts also report discomfort, prompting a demand for milder or skin-friendly alternatives. As a result, some consumers prefer non-alcoholic wipes, reducing the market potential for traditional formulations.

Together, these factors make it difficult for manufacturers to balance quality, cost, and consumer satisfaction, slowing down the overall market growth.

Growth Factors

Development of Biodegradable and Eco-Friendly Alcohol Wipe Formulations Creates New Market Opportunities

The alcohol wipes market is witnessing strong growth opportunities with the rise of biodegradable and eco-friendly products. Companies are focusing on sustainable materials to reduce plastic waste and attract environmentally conscious consumers. This shift is opening new product segments and boosting brand reputation.

The growing demand for medical-grade wipes, especially for telehealth and home-care use, is also creating potential for premium and specialized formulations. With more people receiving healthcare at home, the need for safe, hospital-quality wipes is increasing rapidly.

Additionally, alcohol wipes are finding new applications in the automotive and electronics sectors. They are now used for cleaning delicate surfaces, screens, and tools, helping expand the customer base beyond personal hygiene.

Retailers and online brands are also entering the market through private-label production. This gives them a cost advantage and allows customized branding, further increasing competition and innovation within the industry.

Emerging Trends

Rising Popularity of Multi-Functional Disinfectant Wipes with Added Skincare Benefits Shapes Market Trends

One of the most notable trends in the alcohol wipes market is the shift toward multi-functional products. Consumers now prefer wipes that not only disinfect but also moisturize and protect the skin. Manufacturers are adding ingredients like aloe vera and vitamin E to meet this demand.

Sustainability is another strong trend. Brands are introducing recyclable or refillable packaging systems to reduce waste and appeal to eco-conscious buyers. This approach is enhancing both environmental responsibility and brand loyalty.

The popularity of compact, travel-sized wipes is also increasing. As more people travel and engage in outdoor activities, small and portable packs have become essential for maintaining hygiene on the go.

Lastly, the use of alcohol wipes in gyms, hotels, and co-working spaces has surged. Businesses are prioritizing hygiene to ensure customer safety, which continues to drive steady demand across various sectors.

Regional Analysis

North America Dominates the Alcohol Wipes Market with a Market Share of 44.2%, Valued at USD 272.0 Million

North America leads the global alcohol wipes market, holding a significant 44.2% share and reaching a valuation of USD 272.0 Million. The region’s dominance is supported by strong consumer awareness regarding hygiene and a well-established healthcare infrastructure. Continuous product innovation and heightened adoption in both clinical and household settings further reinforce North America’s leadership in this market.

Europe Alcohol Wipes Market Trends

Europe represents a robust market driven by stringent regulatory standards for sanitation and increasing demand for disinfecting products across hospitals and commercial facilities. Rising health consciousness and government-led cleanliness initiatives continue to support market expansion. The region’s mature retail structure also enhances product accessibility, contributing to steady market performance.

Asia Pacific Alcohol Wipes Market Trends

Asia Pacific is witnessing rapid growth, fueled by expanding healthcare facilities, rising urbanization, and increasing awareness of personal hygiene. The region’s large population base and growing disposable income levels support the accelerated adoption of alcohol wipes. Emerging economies are also experiencing strong penetration of pharmaceutical and retail distribution networks, further boosting demand.

Middle East & Africa Alcohol Wipes Market Trends

The Middle East & Africa market is gradually expanding as healthcare modernization progresses and hygiene-focused consumer behavior strengthens. Increased investments in medical infrastructure and the rising presence of international retail brands are shaping the market landscape. Growing awareness of infection prevention is also contributing to higher usage across residential and commercial environments.

Latin America Alcohol Wipes Market Trends

Latin America shows steady growth supported by strengthening healthcare systems and rising emphasis on sanitation practices. Urban centers demonstrate higher adoption rates due to increased consumer awareness and improved product availability. Public health campaigns and the expanding retail sector also play a significant role in driving the regional alcohol wipes market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Alcohol Wipes Company Insights

The global alcohol wipes market in 2024 continues to expand steadily, driven by heightened hygiene awareness, institutional consumption, and the growing need for rapid-action disinfection solutions.

Among the leading manufacturers, Cardinal Health remains a dominant force, leveraging its extensive healthcare distribution network and strong brand credibility. Its alcohol wipe offerings benefit from broad hospital penetration and consistent investment in quality assurance, supporting stable global demand.

Pal International strengthens its position through a diversified portfolio of hygiene and cleaning products tailored for both medical and commercial environments. The company’s emphasis on manufacturing efficiency and regulatory compliance enables it to maintain competitiveness while expanding into emerging markets where demand for medical-grade wipes continues to rise.

Vernacare Ltd. stands out for its innovation in infection-prevention solutions, supported by long-standing relationships with healthcare providers. Its alcohol wipes segment benefits from the company’s strategic integration of sustainability initiatives and disposable healthcare solutions, giving it a unique value proposition in a market increasingly focused on environmental responsibility.

The Clorox Company remains one of the most recognized names in surface disinfection and consumer hygiene products. Its alcohol-based wipes enjoy strong visibility across retail channels worldwide, driven by brand trust and large-scale marketing capabilities. Clorox’s focus on expanding production capacity and optimizing supply chains continues to support its resilience amid fluctuating raw material costs.

Collectively, these key players contribute to shaping market trends through product innovation, scalable manufacturing, and investments in healthcare-oriented hygiene solutions. Their strategic initiatives, ranging from sustainability efforts to distribution expansion, continue to influence competitive dynamics and accelerate adoption of alcohol wipes across medical, commercial, and consumer applications.

Top Key Players in the Market

- Cardinal Health

- Pal International

- Vernacare Ltd.

- The Clorox Company

- GAMA Healthcare Ltd.

- Diamond Wipes International Inc

- Clarisan

- 3M

Recent Developments

- In Jun 2025: DUDE Wipes secured a strategic growth investment from TSG Consumer, strengthening its financial backing and accelerating its expansion plans across retail and product innovation.

- In Feb 2025: Harrisons announced the acquisition of Ecotech (Europe) LTD.’s business and assets, enhancing its capabilities and extending its footprint within the European sustainability and technology markets.

- In Nov 2025: Essity acquired Edgewell’s North American feminine care business, bringing the Carefree, Stayfree, and Playtex brands under its portfolio to reinforce its position in the hygiene and personal care sector.

Report Scope

Report Features Description Market Value (2024) USD 615.5 Million Forecast Revenue (2034) USD 1021.8 Million CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fabric Material (Synthetic, Natural), By End-use (Personal & Household, Commercial), By Distribution Channel (Supermarkets/Hypermarkets, Online, Convenience Stores, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Cardinal Health, Pal International, Vernacare Ltd., The Clorox Company, GAMA Healthcare Ltd., Diamond Wipes International Inc, Clarisan, 3M Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cardinal Health

- Pal International

- Vernacare Ltd.

- The Clorox Company

- GAMA Healthcare Ltd.

- Diamond Wipes International Inc

- Clarisan

- 3M