Global Airway Management Devices Market Analysis By Product (Supraglottic Devices (Laryngeal Mask Airways (LMAs), Oropharyngeal Airways, Nasopharyngeal Airways), Infraglottic Devices (Endotracheal Tubes (ETTs), Tracheostomy Tubes, Endobronchial Tubes), Resuscitators, Laryngoscopes, Others), By Patient Type (Pediatrics/Neonates, Adult, Geriatric), By Application (Anaesthesia, Emergency Medicine, Critical Care, Others), By End-User (Hospitals, Homecare, Ambulatory Care Centers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160955

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

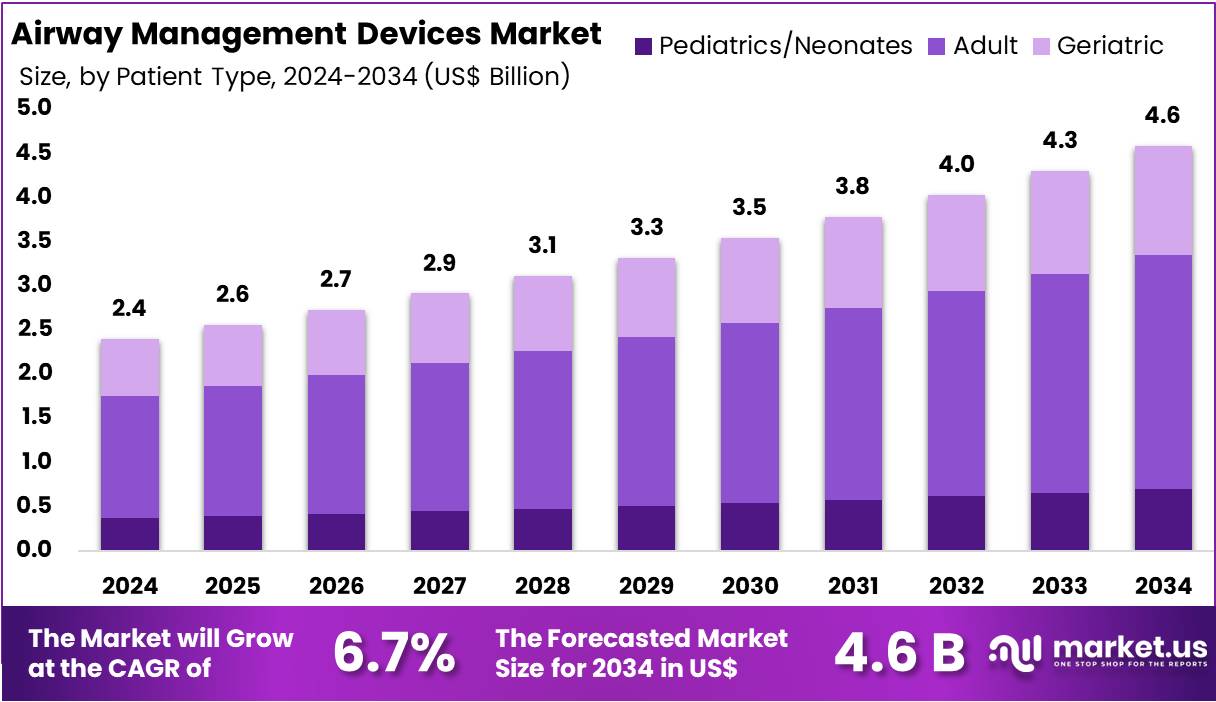

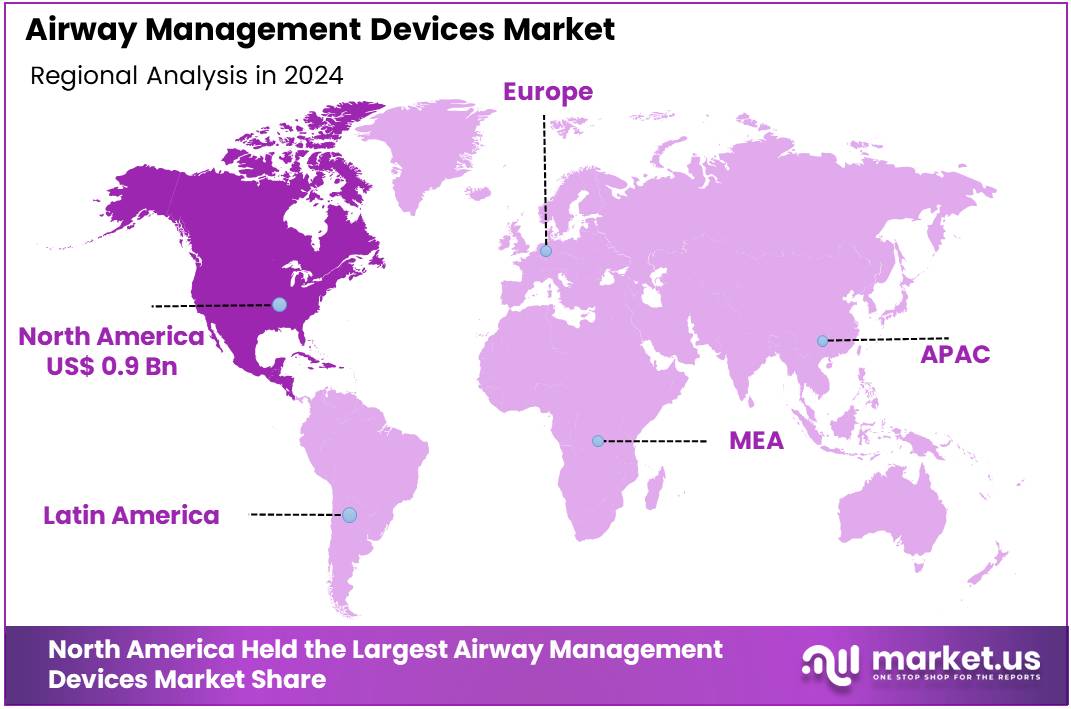

The Global Airway Management Devices Market size is expected to be worth around US$ 4.6 Billion by 2034, from US$ 2.4 Billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 37.6% share and reaching a market value of US$ 0.9 billion.

Airway management devices are essential tools used to secure patient airways during anesthesia, emergencies, or intensive care. Devices such as endotracheal tubes, laryngeal masks, tracheostomy tubes, and resuscitators form the core of this market. According to the World Health Organization (WHO), chronic respiratory diseases remain a leading driver of demand. In 2021, chronic obstructive pulmonary disease (COPD) caused 3.5 million deaths globally, while asthma affected about 262 million individuals in 2019.

Recent data highlight that the chronic disease burden is even greater than often recognized. A 2025 report by WHO and the European Respiratory Society estimated that over 80 million people in Europe are affected by respiratory diseases, many undiagnosed. A BioMed Central study in 2024 reported 213.4 million global COPD cases in 2021, with 3.72 million deaths and 79.78 million disability-adjusted life years (DALYs). The study also showed that smoking contributed 34.8% of COPD DALYs, while ambient particulate matter and household air pollution accounted for 22.2% and 19.5% respectively.

Air pollution further intensifies market growth. WHO estimates that about 7 million deaths annually are linked to air-pollution–related illnesses, including COPD and lung infections. For instance, the 2024 India–Pakistan smog event caused extreme PM2.5 levels, increasing respiratory admissions. Such seasonal and environmental surges keep airway management devices central to hospital preparedness. Seasonal infections also play a role. For example, in late 2024, WHO reported increased influenza, RSV, rhinovirus, and human metapneumovirus cases in China, with hMPV accounting for about 6.2% of pediatric positives and 5.4% of hospitalizations.

The aging population is another factor sustaining demand. Older patients face higher risks of airway complications during surgery and emergencies. In parallel, the COVID-19 pandemic reinforced structural investments in oxygen therapy and ventilation. WHO and UNICEF issued harmonized specifications for oxygen therapy equipment, supporting airway device procurement globally. Programs like the Global Oxygen Alliance further emphasize the integration of airway tools with oxygen and ventilation systems across all levels of care.

Surgical Volumes, Policy Shifts, and Innovation

Surgical activity represents a key growth driver for the airway devices market. According to the Lancet, the unmet global need for surgery is at least 160 million operations each year. WHO further notes that every anesthesia case requires airway management, while even procedural sedation requires rescue tools. By 2023, the World Bank reported that 123 countries, or about 56.9% of global economies, provided surgical volume data, a 70.8% increase in reporting compared to 2016. This transparency highlights the expansion of surgical services and the associated rise in demand for laryngoscopes, supraglottic devices, and endotracheal tubes.

The importance of airway management in perioperative care is also underlined by safety data. A Lancet model in 2025 estimated that 3.5 million adults die globally within 30 days of surgery each year. This underscores the critical need for reliable airway equipment to reduce complications. Infection prevention policies further shape procurement. CDC guidelines on sterilization and FDA recalls have reinforced a shift toward single-use or easier-to-reprocess devices. Hospitals increasingly adopt sterile, single-patient-use devices and validated reprocessing systems, supporting premium product adoption.

Emergency and critical care initiatives continue to strengthen installed bases. WHO has issued resolutions to expand essential emergency and operative care, explicitly including advanced airway capabilities in training. Governments and donors are procuring standardized kits for hospitals and ambulances, which broadens access to devices. For example, WHO’s technical training materials highlight advanced intubation and supraglottic airways as core competencies, encouraging system-wide adoption.

Device innovation adds a further layer of growth. FDA approvals for video laryngoscopes and endoscopic airway tools showcase the introduction of high-resolution imaging and ergonomic designs. As clinical teams favor video-assisted visualization for higher first-pass success, training investments and replacement cycles drive capital purchases. Post-pandemic rebuilding has also prioritized oxygen readiness and ICU capacity, ensuring long-term procurement. Together, rising surgical volumes, infection-control policies, emergency preparedness, and innovation create a durable pathway for airway management device growth.

Key Takeaways

- The global airway management devices market is projected to grow from US$ 2.4 billion in 2024 to US$ 4.6 billion by 2034.

- The supraglottic devices segment dominated the product category in 2024, securing over 35.2% of the global airway management devices market share.

- In patient type segmentation, the adult section led in 2024, capturing more than 57.6% share of the global market.

- The anaesthesia segment held the largest share in applications during 2024, accounting for more than 51.0% of total market revenues.

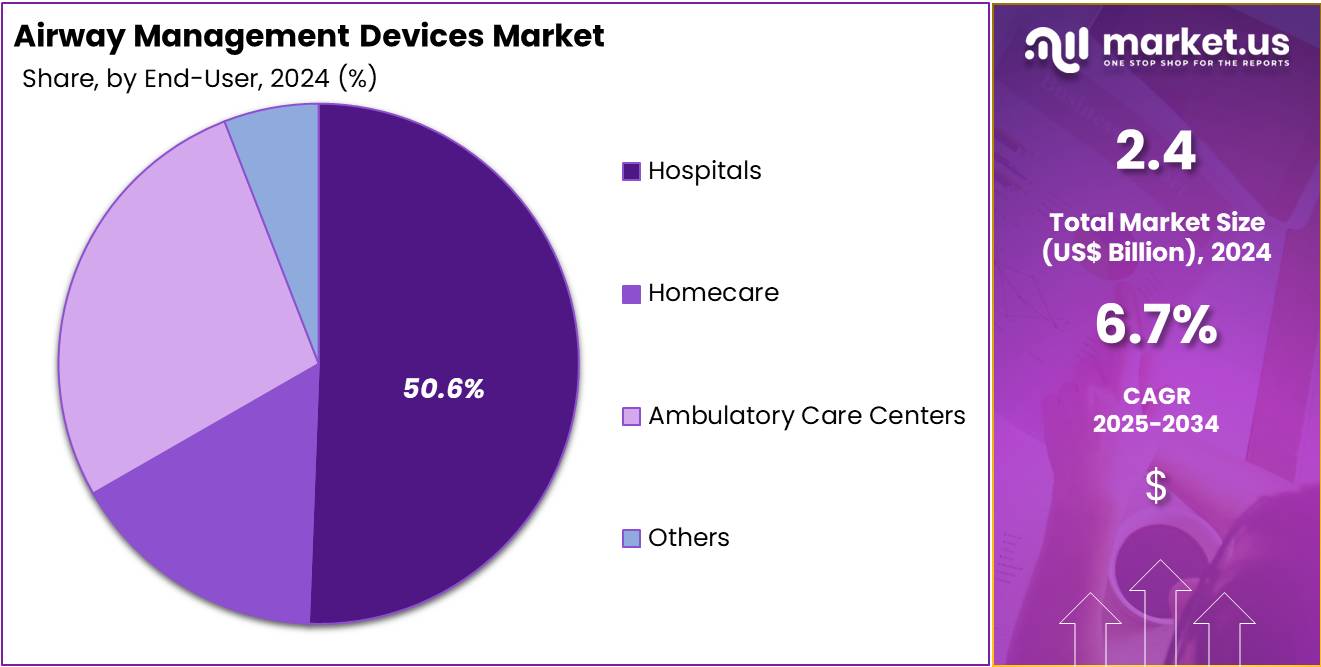

- In 2024, anaesthesia also dominated the end-user segment, capturing over 50.6% share of the global airway management devices market.

- North America led the regional market in 2024, representing 37.6% share and achieving a market value of approximately US$ 0.9 billion.

Product Analysis

In 2024, the Supraglottic Devices Section held a dominant market position in the Product Segment of Airway Management Devices Market, and captured more than a 35.2% share. This segment maintained leadership because of ease of use and reduced complications. Laryngeal Mask Airways (LMAs) were the most widely adopted sub-segment. Their acceptance in hospital and pre-hospital settings drove growth. Oropharyngeal and nasopharyngeal devices also supported demand. They are widely used in trauma care and short-term airway management, ensuring steady expansion.

The Infraglottic Devices segment ranked second after supraglottic devices. Endotracheal Tubes (ETTs) continued to be the most common choice for airway control in surgery and intensive care units. Tracheostomy tubes and endobronchial tubes also contributed to this growth. They are used for patients with long-term ventilation and chronic respiratory conditions. Rising cases of chronic obstructive pulmonary disease (COPD) and the growing need for prolonged intensive care have increased demand, strengthening the outlook for this product group.

Resuscitators and laryngoscopes formed other important product categories. Resuscitators gained market traction due to their role in emergency response and cardiac arrest management. Both manual and automated resuscitators are widely used across hospitals and ambulatory care. Laryngoscopes, particularly video-assisted types, advanced in adoption as they improved visualization in intubation procedures. Additional products, including disposable accessories, showed moderate growth. Rising preference for single-use devices supported this trend. Infection control measures across healthcare facilities are expected to maintain demand, providing consistent opportunities in these supporting product areas.

Patient Type Analysis

In 2024, the Adult Section held a dominant market position in the Patient Type Segment of Airway Management Devices Market, and captured more than a 57.6% share. This dominance was supported by the growing burden of chronic respiratory conditions and the higher prevalence of obstructive sleep apnea. Increased trauma cases and the need for emergency interventions among adults also boosted demand. Frequent surgical procedures in hospitals further contributed to the stronger adoption of airway management devices in this group.

The Pediatric and Neonatal Section represented a smaller share but remained significant within the market. Growth was influenced by a rise in preterm births and the increasing incidence of respiratory distress syndromes among newborns. Congenital airway anomalies also drove higher use of specialized devices in intensive care units. Awareness of modern airway technologies in pediatric hospitals enhanced the adoption rate. Although smaller in size compared to adults, this group continues to be essential for market expansion.

The Geriatric Section is anticipated to show consistent growth over the coming years. This can be linked to the global increase in aging populations and the greater risk of chronic respiratory diseases such as COPD and pneumonia. Higher demand for surgical interventions among elderly patients added to the rising usage of airway devices. Advancements in healthcare facilities, combined with improved access to minimally invasive treatments, supported this trend. As a result, the segment is expected to remain a key driver in the market.

Application Analysis

In 2024, the Anaesthesia Section held a dominant market position in the Application Segment of the Airway Management Devices Market, and captured more than a 51.0% share. This leadership is explained by the high demand for airway devices in surgical procedures. The increasing use of supraglottic airway devices and endotracheal tubes during operations added to its share. A rise in surgical volumes across hospitals also strengthened the dominance of this segment within the global market.

The Emergency Medicine segment was observed to occupy a notable portion of the market. This trend is closely linked to the increasing use of airway devices in trauma care and pre-hospital settings. A rising number of road accidents and emergency cases such as cardiac arrests have supported this demand. The requirement for rapid intubation in critical conditions has further contributed. These factors combined to establish Emergency Medicine as a key application area for airway management devices.

The Critical Care and Others segments contributed to steady growth within the market. Critical Care demand was supported by the rise in respiratory disorders, including COPD and ARDS, and by the prolonged use of ventilators in intensive care units. Expansion of ICU capacity worldwide is expected to further sustain this trend. Meanwhile, the Others segment, which includes outpatient care and dental surgeries, showed gradual growth. Portable airway devices in ambulatory surgical centers have also created additional opportunities in this smaller segment.

End-User Analysis

In 2024, the Anaesthesia Section held a dominant market position in the End-User Segment of the Airway Management Devices Market, and captured more than a 50.6% share. This section benefited from the rising number of surgeries performed worldwide. Increasing reliance on controlled ventilation in operation theatres further enhanced its growth. Hospitals and surgical facilities prioritized the use of advanced laryngoscopes and supraglottic devices. Such adoption trends positioned anaesthesia as the leading contributor within the overall end-user market landscape.

The Emergency Medicine Segment secured a notable share during the same period. A strong rise in road accidents and trauma cases boosted the demand for airway management devices. The role of rapid response units and ambulance services in using portable systems also added momentum. Emergency rooms increasingly relied on intubation and supportive devices for immediate care. These factors collectively supported the segment’s consistent performance, placing it among the important contributors to the market’s end-user structure.

The Critical Care and Other End-Users Segments also demonstrated steady growth. In critical care, the burden of respiratory diseases such as COPD and asthma expanded the need for intensive ventilation support. The rising geriatric population further contributed to demand in intensive care units. In addition, home healthcare providers and specialty clinics strengthened adoption in the other end-users category. Patients requiring long-term ventilation and at-home airway care drove this trend. These segments reinforced the market’s diversification beyond anaesthesia and emergency medicine.

Key Market Segments

By Product

- Supraglottic Devices

- Laryngeal Mask Airways (LMAs)

- Oropharyngeal Airways

- Nasopharyngeal Airways

- Infraglottic Devices

- Endotracheal Tubes (ETTs)

- Tracheostomy Tubes

- Endobronchial Tubes

- Resuscitators

- Laryngoscopes

- Others

By Patient Type

- Pediatrics/Neonates

- Adult

- Geriatric

By Application

- Anaesthesia

- Emergency Medicine

- Critical Care

- Others

By End-User

- Hospitals

- Homecare

- Ambulatory Care Centers

- Others

Drivers

Rise in AI-Assisted and Robotic Intubation Tools

The airway management devices market is being driven by the rapid advancement of AI-assisted and robotic intubation systems. Recent clinical evidence has highlighted how these systems reduce errors, especially in difficult airway scenarios. A 2025 Biomedical Engineering Online article reported a robotic airway system that minimizes risks during tracheal intubation. The incorporation of artificial intelligence in such devices is enhancing precision, improving patient safety, and providing clinicians with reliable support in complex procedures.

The growing demand for advanced critical care solutions is supporting the adoption of AI-enabled airway management devices. Hospitals and emergency departments are increasingly integrating robotic systems that assist physicians during intubation. These systems offer real-time decision support and adaptability, which are particularly valuable in urgent care. The ability to enhance efficiency while reducing complications is strengthening their role in modern healthcare systems. As a result, manufacturers are focusing investments on next-generation robotic airway tools.

The innovation trend also aligns with the broader shift toward digital healthcare technologies. Rising clinical acceptance of AI-driven systems is accelerating regulatory approvals and product launches. This, in turn, is creating significant growth opportunities for companies in the airway management devices market. By offering enhanced accuracy, lower error rates, and improved outcomes, robotic and AI-assisted devices are expected to capture increasing market share. Consequently, the rise of such technologies represents a key driver of market expansion in the coming years.

Restraints

Shortage of Trained Professionals in Low-Resource Settings

The global shortage of skilled anesthesiologists and critical care specialists has emerged as a major restraint in the airway management devices market. While medical technology has advanced, the safe and efficient use of these devices requires trained professionals. In low-resource settings, the lack of qualified personnel often results in limited or inappropriate device usage. This directly impacts patient safety, as unskilled handling of devices such as intubation equipment or ventilators may lead to adverse clinical outcomes.

The World Health Organization (WHO) data underline a persistent gap in healthcare workforce availability, especially in developing and under-resourced regions. In such markets, the presence of advanced airway management devices does not guarantee improved outcomes, since optimal performance is dependent on specialist expertise. Consequently, hospitals and clinics in these regions often underutilize available equipment, creating barriers to consistent adoption. This shortage also increases dependency on a small pool of experts, leading to operational inefficiencies and higher workload pressures.

This workforce limitation restrains the market by slowing down the integration of advanced devices across healthcare systems. Training initiatives and professional development programs are limited in many countries, resulting in uneven adoption rates between high-income and low-income regions. Moreover, the lack of skilled professionals contributes to safety concerns, discouraging healthcare providers from investing in new devices. Thus, despite growing technological advancements, the shortage of trained professionals in low-resource settings continues to act as a significant barrier to market growth.

Opportunities

Integration Of Biosensors And Iot For Real-Time Monitoring

The integration of biosensors with Internet of Things (IoT) technologies presents a significant opportunity in the airway management devices market. Academic prototypes already show devices embedded with sensors capable of monitoring airflow, CO₂, and cuff pressure. These smart features provide real-time insights that can enhance patient safety. Continuous monitoring of critical parameters allows for early detection of complications during anesthesia or emergency procedures. This trend is expected to drive demand for advanced, data-driven airway devices that support proactive patient management.

The development of connected airway devices is gaining traction in clinical research. Findings published in the Journal of Clinical Monitoring and Computing highlight advancements in wireless transmission of airway data directly to anesthesia workstations. This connectivity improves decision-making for anesthesiologists by reducing the risk of human error and enabling continuous oversight. Hospitals and surgical centers are likely to adopt these solutions, as they align with the broader shift toward digital health and integrated monitoring platforms.

The creation of “smart airway ecosystems” is a natural progression for the industry. Integration with hospital information systems and anesthesia records can deliver comprehensive patient insights in real time. This offers value not only for clinicians but also for healthcare administrators seeking efficiency and improved outcomes. Moreover, opportunities exist for device manufacturers to collaborate with IoT technology providers to deliver innovative solutions. As the demand for precision and safety in airway management increases, IoT-enabled biosensor integration stands as a key growth driver.

Trends

Integration of AR and Video-Enhanced Visualization in Airway Management Devices

The adoption of augmented reality (AR) and video-enhanced airway visualization is emerging as a key trend in airway management devices. Advanced centers are experimenting with AR headsets that overlay anatomical guidance during intubation, providing real-time support to clinicians. This innovation is aimed at improving first-pass success rates, which is critical in emergency and critical care settings. The integration of AR into video laryngoscopy represents a shift toward smarter, more precise airway management technologies.

The trend is supported by the growing combination of video laryngoscopy with AR and artificial intelligence (AI). These technologies provide enhanced visualization and decision support during airway procedures. By improving training outcomes, they offer a dual benefit—helping both experienced clinicians and trainees achieve higher accuracy. As healthcare institutions focus on reducing complications and improving patient safety, this technology is becoming a preferred solution. The demand is expected to rise with the need for advanced, data-driven airway management tools.

Furthermore, AR-assisted visualization is being positioned as a valuable tool for medical education and simulation-based training. By offering interactive, real-time anatomical overlays, it enhances learning efficiency for new practitioners. In clinical practice, the integration of AR and AI into airway management devices is expected to optimize procedural performance and support precision medicine. These innovations are aligned with the broader industry trend toward digital transformation in healthcare, contributing to improved patient outcomes and operational efficiency.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 37.6% share and reaching a market value of US$ 0.9 billion. The region’s strength can be attributed to the high prevalence of respiratory conditions and a large volume of surgical and critical care cases. According to U.S. data, chronic lower respiratory disease remained a top cause of death in 2023, accounting for 145,357 fatalities. Around 6.4% of adults reported a diagnosis of COPD, which reinforces consistent procedural demand for airway devices.

High surgical and procedural volumes further sustain market growth. For instance, U.S. hospitals recorded 9.6 million inpatient stays involving operating-room procedures and 14.4 million total procedures in 2018. Ambulatory surgeries were also significant, with 11.9 million major cases in 2019 and 12.1 million procedures captured in 2022. Each setting requires anesthesia and airway support tools such as endotracheal tubes and laryngoscopes, ensuring recurring purchasing and replacement cycles across providers.

Critical care infrastructure adds to regional demand. During the COVID-19 era, U.S. hospitals reported about 96,600 ICU beds, spanning adult, pediatric, and neonatal units. This extensive ICU base generates steady requirements for ventilator circuits, supraglottic airways, and related equipment. Similarly, emergency medical services (EMS) agencies have adopted national evidence-based guidelines for prehospital airway management, covering bag-valve-mask ventilation, supraglottic devices, and video laryngoscopy. Study findings suggest that widespread EMS use increases unit demand beyond hospital settings.

Spending capacity and regulation also play critical roles. According to estimates, per-person health expenditure in the U.S. reached USD 12,555 in 2022, which is well above the OECD average. This enables rapid procurement, training, and upgrades in anesthesia and emergency airway equipment. Canada, with high per-capita healthcare spending and national surveillance of asthma and COPD, contributes further to regional adoption. Additionally, the U.S. FDA’s 510(k) and Special 510(k) pathways support faster clearance of airway devices, encouraging frequent product iteration and expanding the market portfolio.

The North America’s leadership in the airway management devices market is supported by five factors: a high respiratory disease burden, large surgical and ICU procedure volumes, established EMS adoption of airway protocols, strong healthcare spending, and clear regulatory pathways. These factors create a robust and recurring demand for airway management devices across hospitals, ambulatory centers, and prehospital settings in the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The airway management devices market is led by multinational companies with broad product portfolios and strong clinical trust. Medtronic dominates with video laryngoscopes, tracheostomy tubes, and integrated respiratory solutions that support both ICU and operating room care. Teleflex Incorporated follows closely, with global leadership in supraglottic airways through its LMA brand and a strong consumables portfolio under Rüsch. Both companies focus on expanding single-use devices, clinical training, and infection-prevention technologies, which strengthen their long-term position in this competitive global market.

A significant part of market growth is supported by companies focusing on cost efficiency and reliability in consumables. Medline Industries, LP provides wide access to airway products through private-label solutions, customized kits, and strong supply chain management for hospitals and large healthcare systems. Intersurgical Ltd adds further strength by specializing in single-use circuits, HMEs, and airway adjuncts, especially in European markets. These companies compete by offering cost-effective, reliable, and safe solutions, while also addressing the rising demand for infection control and disposable products.

Innovation in single-use visualization and tracheostomy care is reshaping competition within this market. Ambu A/S has gained recognition as a leader in disposable video laryngoscopes and flexible scopes, supported by its strong infection-control value proposition. ICU Medical, through the Smiths Medical portfolio including Portex and Bivona, continues to hold an important role in tracheostomy and pediatric airway devices. Verathon remains a market leader in video laryngoscopy with GlideScope technology, while Karl Storz sustains its position in reusable visualization platforms favored in premium hospital settings.

Specialty players and value-focused suppliers contribute to broader market diversity and niche innovations. Cook Medical provides advanced difficult-airway tools and exchange devices, while VBM Medizintechnik strengthens safety through cuff-pressure monitoring. SunMed and Flexicare expand availability of consumables such as breathing circuits, ETTs, and laryngoscope blades. Mercury Medical and Armstrong Medical focus on neonatal resuscitation and humidification systems, while Boston Medical Products specializes in tracheostomy care. Convatec maintains selective exposure in critical-care lines. These companies address regional, specialty, and cost-sensitive needs, ensuring competitive balance.

Market Key Players

- Medtronic

- Medline Industries, LP

- Teleflex Incorporated

- Intersurgical Ltd

- BD

- Ambu A/S

- ICU Medical (Smiths Medical Inc.)

- Boston Medical Products Inc.

- Mercury Medical

- Armstrong Medical Ltd

- Verathon

- Convatec Inc.

- Cook Medical Inc.

- Karl Storz

- Flexicare

- SunMed

- VBM Medizintechnik

Recent Developments

- In February 2025: Teleflex entered into a definitive agreement to acquire substantially all of BIOTRONIK’s Vascular Intervention business (drug-coated balloons, stents, etc.). This acquisition is expected to expand Teleflex’s interventional device capabilities (though not airway devices directly), and Teleflex plans to leverage synergies with its existing interventional and vascular access businesses.

- In March 2024: Medline announced that it had acquired from Hospitech Respiration Ltd. the manufacturing rights and intellectual property for the AG Cuffill device, which is used for measuring both pressure and volume of airway cuffs in clinical settings. This move deepens Medline’s airway / respiratory product portfolio by integrating a critical respiratory care tool.

- In March 2024: Intersurgical announced that it will invest €10 million to expand its manufacturing facility and equipment in Pabradė, Lithuania. The first phase of this expansion aims to build a ~2,500 m² automated production facility adjacent to the existing factory. This expansion is intended to increase production capacity for Intersurgical’s respiratory and airway-related devices and support export to global markets.

- In February 2024: Medtronic announced that it would exit its ventilator product line and reorganize its respiratory / patient‐monitoring businesses into a new unit called Acute Care & Monitoring. This decision includes discontinuation of models such as Puritan Bennett™ 980, 840, and 500 series ventilators, while continuing to honor service contracts for installed units. The rationale cited includes declining profitability, evolving market dynamics (shift toward lower-acuity ventilators), and strategic focus on higher-growth assets in monitoring and airway management.

- In August 2023: Medline entered into a partnership with Flight Medical (Israel) such that the Flight 60 transportable ventilator would be made exclusively available via Medline’s distribution. The ventilator is turbine-driven and supports both invasive and non-invasive ventilation modes, intended for use across patient populations and in different care settings (transport, home, hospital).

Report Scope

Report Features Description Market Value (2024) US$ 2.4 Billion Forecast Revenue (2034) US$ 4.6 Billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Supraglottic Devices (Laryngeal Mask Airways (LMAs), Oropharyngeal Airways, Nasopharyngeal Airways), Infraglottic Devices (Endotracheal Tubes (ETTs), Tracheostomy Tubes, Endobronchial Tubes), Resuscitators, Laryngoscopes, Others), By Patient Type (Pediatrics/Neonates, Adult, Geriatric), By Application (Anaesthesia, Emergency Medicine, Critical Care, Others), By End-User (Hospitals, Homecare, Ambulatory Care Centers, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Medtronic, Medline Industries, LP, Teleflex Incorporated, Intersurgical Ltd, BD, Ambu A/S, ICU Medical (Smiths Medical Inc.), Boston Medical Products Inc., Mercury Medical, Armstrong Medical Ltd, Verathon, Convatec Inc., Cook Medical Inc., Karl Storz, Flexicare, SunMed, VBM Medizintechnik Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Airway Management Devices MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Airway Management Devices MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Medtronic

- Medline Industries, LP

- Teleflex Incorporated

- Intersurgical Ltd

- BD

- Ambu A/S

- ICU Medical (Smiths Medical Inc.)

- Boston Medical Products Inc.

- Mercury Medical

- Armstrong Medical Ltd

- Verathon

- Convatec Inc.

- Cook Medical Inc.

- Karl Storz

- Flexicare

- SunMed

- VBM Medizintechnik