Global Agriculture Adjuvants Market Size, Share, And Enhanced Productivity By Formulation (Suspension Concentrates, Emulsifiable Concentrates), By Adoption Stage (In-Formulation, Tank Mix), By Function (Activator Adjuvants (Surfactants, Oil-Based Adjuvants), Utility Adjuvants (Compatibility Agents, Buffers/Acidifiers , Antifoaming Agents , Water Conditioners, Drift Control Agents , Others)), Ву Сгор Туре (Cereals and Grains (Corn, Wheat, Rice, Others), Oilseeds and Pulses (Soybean, Sunflower, Others), Fruits and Vegetables, Others), By Application (Herbicides, Insecticides, Fungicides, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 176599

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

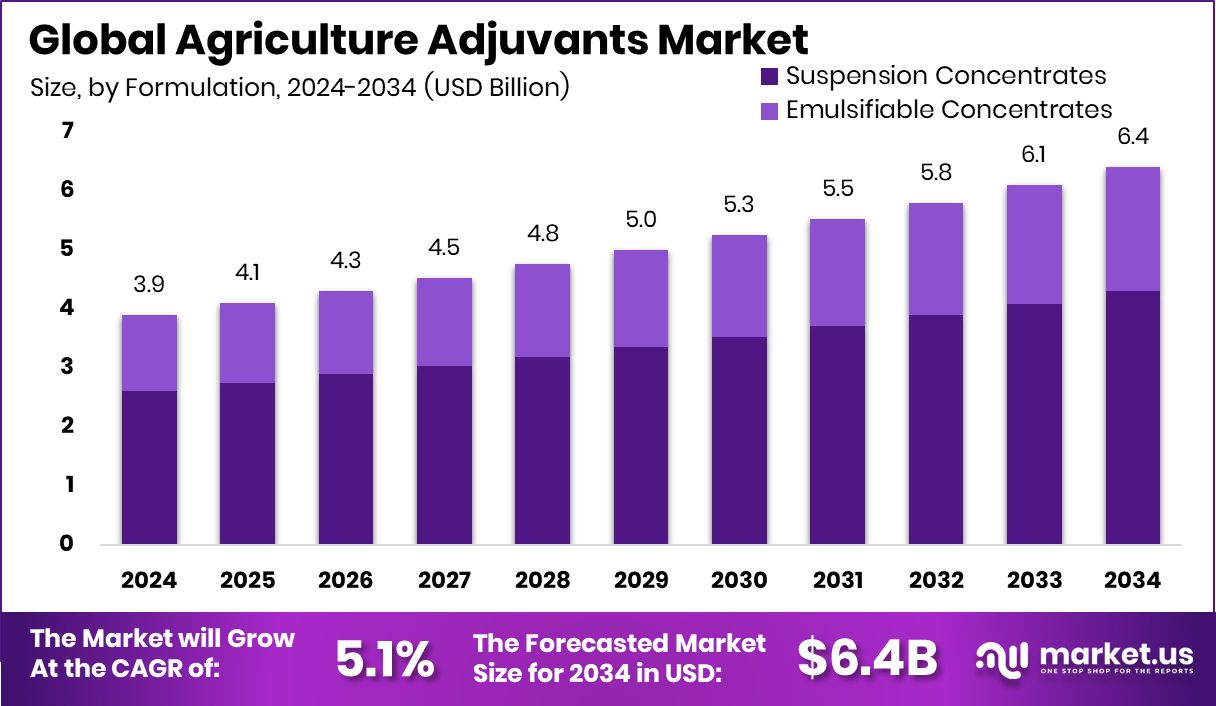

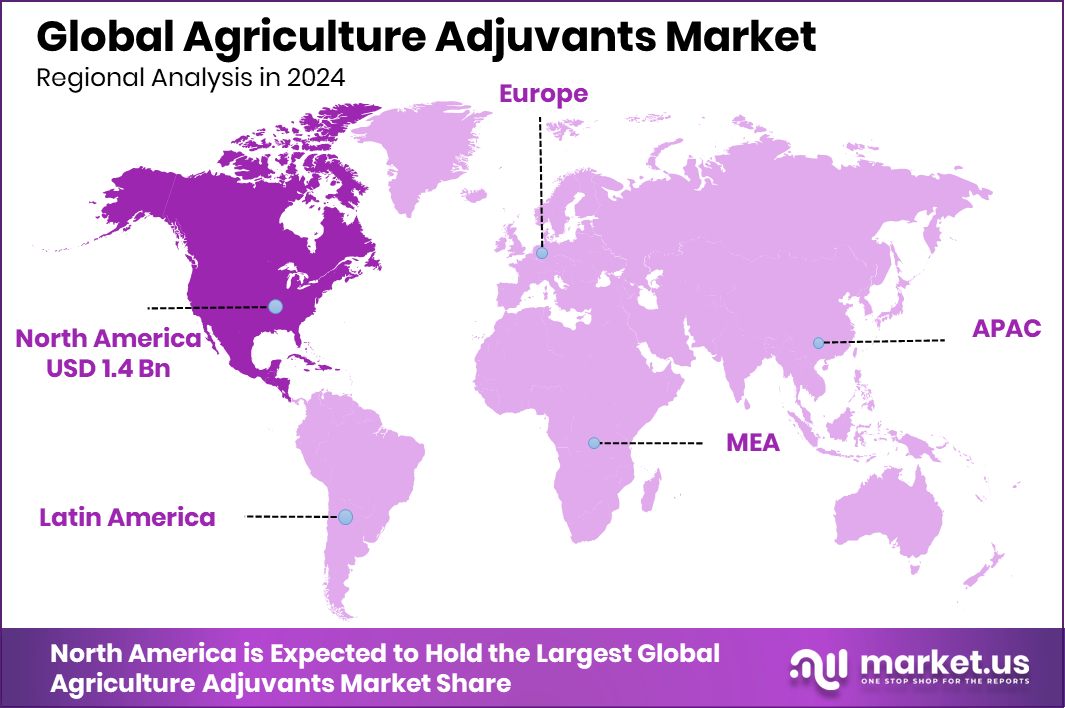

The Global Agriculture Adjuvants Market is expected to be worth around USD 6.4 billion by 2034, up from USD 3.9 billion in 2024, and is projected to grow at a CAGR of 5.1% from 2025 to 2034. The Agriculture Adjuvants Market in North America recorded 37.9% and USD 1.4 Bn.

Agriculture adjuvants are supporting ingredients added to crop protection products to improve how sprays spread, stick, mix, and perform in the field. They help pesticides work better by strengthening spray coverage, reducing drift, and increasing absorption on plant surfaces. The Agriculture Adjuvants Market includes different formulation types such as suspension concentrates and emulsifiable concentrates, adoption stages like in-formulation and tank mix, and multiple functions ranging from activator adjuvants and surfactants to oil-based adjuvants, buffers, antifoaming agents, and drift control agents. These products are used across cereals and grains, oilseeds, pulses, fruits, vegetables, and several crop protection applications, including herbicides, fungicides, and insecticides.

A key growth factor comes from the rising need for improved spray efficiency as farmers aim to reduce waste and improve yields. Strong investments in water-related industries also influence demand, with developments such as Membrane Group securing $50 million from GEF Capital Partners and VA Tech WABAG receiving a Rs 250–600 crore order for a major water treatment project, signaling broader support for input-enhancement technologies.

Demand continues to expand as growers face tougher climatic conditions and need better tank-mix performance. Opportunities arise from advancements in formulation chemistry, supported by moves like Chemtrade Logistics acquiring Polytec for $150 million, while market awareness also grows when events such as a water treatment stock falling 14% after PGIM India sold its stake draw attention to the importance of stable input supply chains.

Key Takeaways

- The Global Agriculture Adjuvants Market is expected to be worth around USD 6.4 billion by 2034, up from USD 3.9 billion in 2024, and is projected to grow at a CAGR of 5.1% from 2025 to 2034.

- The Agriculture Adjuvants Market sees strong growth as suspension concentrates dominate with 67.1% share.

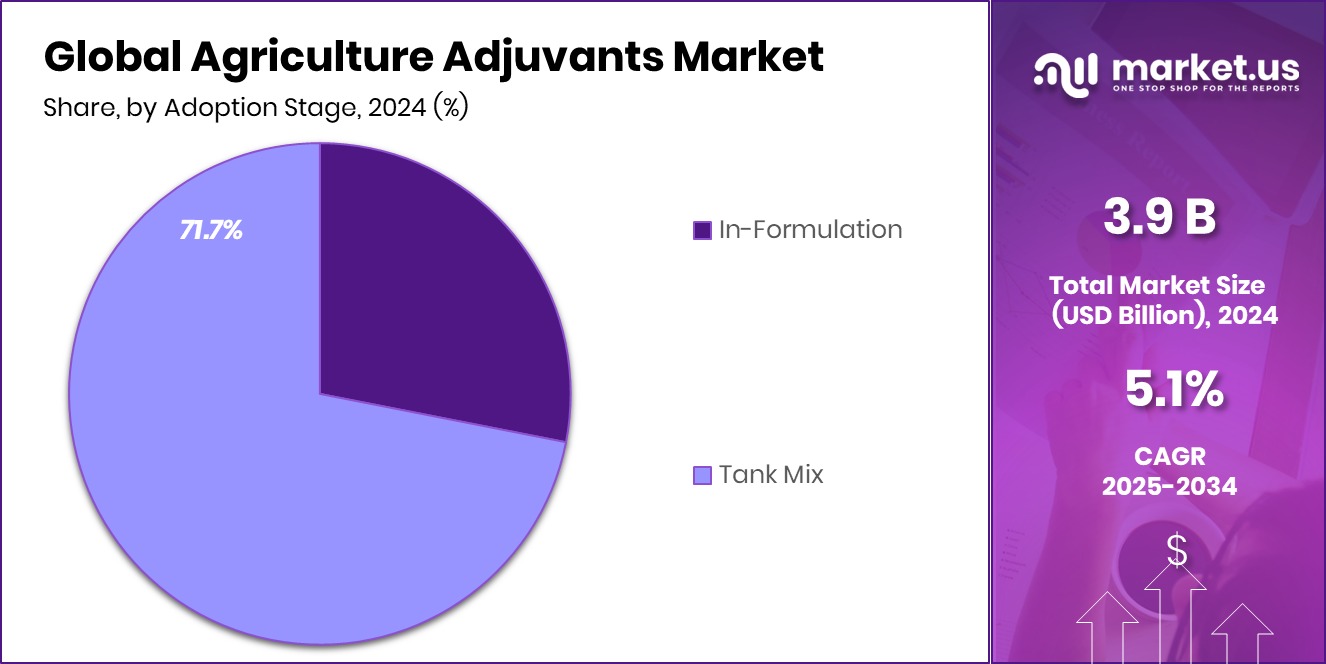

- Tank mix adoption continues shaping the Agriculture Adjuvants Market, holding a powerful 71.7% market position.

- Activator adjuvants lead the Agriculture Adjuvants Market performance by capturing a steady 62.5% share globally.

- Cereals and grains drive consistent demand within the Agriculture Adjuvants Market, representing 44.6% usage share.

- The Agriculture Adjuvants Market expands as herbicide applications account for a notable 49.7% market proportion.

- In North America, Agriculture Adjuvants achieved 37.9%, valued at USD 1.4 Bn.

By Formulation Analysis

The Agriculture Adjuvants Market grows strongly as Suspension Concentrates reach 67.1% demand.

In 2024, Suspension Concentrates held a leading 67.1% share in the Agriculture Adjuvants Market, driven by their stability, ease of handling, and strong compatibility with modern crop protection products. Farmers widely preferred this formulation as it reduces dust, improves active ingredient dispersion, and supports safer application across large-scale farms.

Its ability to deliver uniform spray coverage, even in challenging climatic conditions, boosted adoption among growers aiming for higher productivity. The shift toward precision agriculture also encouraged the use of formulations that reduce waste and enhance field efficiency. As sustainability practices increased across key farming regions, Suspension Concentrates became a practical choice for operators looking for reliable, low-risk adjuvant formats.

By Adoption Stage Analysis

Tank Mix leads the Agriculture Adjuvants Market with a dominant 71.7% adoption share.

In 2024, Tank Mix dominated the Agriculture Adjuvants Market with a strong 71.7% share, reflecting farmers’ preference for flexibility during field spraying operations. Growers increasingly relied on tank-mix adjuvants to optimize the performance of herbicides, fungicides, and insecticides in a single application. This approach enabled better time management, lower operational cost, and reduced field passes—critical benefits for large farms facing labor and weather constraints.

Tank Mix solutions also improved compatibility between different crop protection products, reducing spray failures and ensuring stronger absorption on plant surfaces. As crop resistance challenges intensified, farmers turned to tank-mix adjuvants to strengthen efficacy and extend protection windows. This approach quickly became mainstream among commercial growers.

By Function Analysis

Activator Adjuvants drive consistent expansion in the Agriculture Adjuvants Market at 62.5%.

In 2024, Activator Adjuvants accounted for 62.5% of the Agriculture Adjuvants Market, owing to their essential role in improving pesticide penetration and overall field performance. These adjuvants helped farmers achieve better spray retention, faster absorption, and stronger interaction with plant cuticles—especially crucial when dealing with tough weeds or disease pressure.

As climatic variability increased across major agricultural regions, farmers sought reliable ways to maintain consistency in spray results, and activator adjuvants became the preferred option. Their ability to enhance both systemic and contact pesticides made them a practical choice for row crops, specialty crops, and high-value plantation farming. Overall, activator adjuvants helped reduce input waste and improve yield outcomes.

Ву Сгор Туре Analysis

Cereals and Grains significantly influence the Agriculture Adjuvants Market trends with 44.6% usage.

In 2024, Cereals and Grains held a substantial 44.6% share of the Agriculture Adjuvants Market, supported by rising demand for wheat, rice, maize, and other staple crops. Large cultivation areas increased the need for effective adjuvants that improve the coverage and performance of herbicides and fungicides. Farmers producing cereals faced escalating issues like weed resistance and moisture-stress conditions, prompting higher use of adjuvants to protect crop productivity.

The expansion of mechanized farming further boosted usage, as growers required consistent spray results across wide acreage. With cereals forming the backbone of the global food supply, the segment continued attracting investments in crop protection optimization, making adjuvants a routine input across major grain-producing regions.

By Application Analysis

Herbicides remain the largest application segment within the Agriculture Adjuvants Market, hitting 49.7%.

In 2024, Herbicides dominated the Agriculture Adjuvants Market with a 49.7% share, reflecting the high global demand for weed-control solutions in large-scale farming. Weeds remained the biggest yield-limiting factor, prompting farmers to adopt adjuvants that increase herbicide absorption, improve droplet spread, and enhance performance under variable field conditions.

The rise of herbicide-resistant weed species made it necessary to use adjuvants that strengthen efficacy and reduce spray drift. Herbicide applications in crops such as soybeans, maize, cotton, and cereals relied heavily on customized adjuvant blends to ensure uniform field coverage. As sustainable farming practices increased, growers used adjuvants to cut chemical waste while still achieving effective weed control.

Key Market Segments

By Formulation

- Suspension Concentrates

- Emulsifiable Concentrates

By Adoption Stage

- In-Formulation

- Tank Mix

By Function

- Activator Adjuvants

- Surfactants

- Oil-Based Adjuvants

- Utility Adjuvants

- Compatibility Agents

- Buffers/Acidifiers

- Antifoaming Agents

- Water Conditioners

- Drift Control Agents

- Others

Ву Сгор Туре

- Cereals and Grains

- Corn

- Wheat

- Rice

- Others

- Oilseeds and Pulses

- Soybean

- Sunflower

- Others

- Fruits and Vegetables

- Others

By Application

- Herbicides

- Insecticides

- Fungicides

- Others

Driving Factors

Rising demand for improved crop efficiency

Rising demand for improved crop efficiency continues to shape the Agriculture Adjuvants Market, especially as growers work to maximize output with limited resources. The push toward higher productivity is reinforced by India’s foodgrain production target of 341.55 MT for 2024–25, which increases pressure on farmers to use adjuvants that enhance spray performance and reduce losses.

At the same time, the U.S. agriculture sector is receiving added momentum, with the USDA funding packaging innovations supporting a $143B specialty crop export industry, indirectly encouraging better crop protection practices to maintain quality. Together, these developments highlight a broader movement toward improved application efficiency, making adjuvants essential for farmers facing rising expectations and tighter performance standards across global agriculture.

Restraining Factors

High product costs limit adoption

High product costs remain a major barrier in the Agriculture Adjuvants Market, particularly for small and mid-scale farmers who weigh every input before application. While adjuvants improve spray effectiveness, many growers hesitate due to the added expense during rising operational costs. This restraint is becoming more visible as governments adjust expectations, with India projecting only 2.4% growth in foodgrain production for 2025–26, indicating cautious optimism in farming output.

When production growth is modest, farmers often avoid additional inputs unless absolutely necessary. As a result, the combination of price sensitivity and slower production expansion creates a challenging environment for wider adjuvant adoption, especially in regions where profitability margins are already under pressure.

Growth Opportunity

Expansion into precision farming technology use

Expansion into precision farming technology offers strong opportunities for the Agriculture Adjuvants Market, as growers shift to data-driven spraying and targeted application. These systems depend heavily on consistent spray performance, making adjuvants valuable for maximizing coverage and reducing drift. Momentum in this direction is supported by policy signals, including discussions in Budget 2025 suggesting the government may raise farm allocations by over 15% to reach $20 billion.

Higher sector funding boosts adoption of digital tools, mechanized sprayers, and optimized crop protection methods—all areas where adjuvants improve results. As precision farming becomes mainstream across major crop-growing regions, the need for more reliable tank-mix and in-formulation adjuvants continues to grow, opening new avenues for manufacturers.

Latest Trends

Shift toward eco-friendly adjuvant formulations

A clear trend in the Agriculture Adjuvants Market is the shift toward eco-friendly and low-impact formulations that support sustainable farming. Farmers are increasingly looking for products that enhance pesticide performance while reducing environmental burdens. This interest aligns with wider industry discussions, such as the call from G’s Growers chairman to renew the £40m fruit and vegetable fund, which reflects growing pressure to strengthen sustainable production systems.

Such initiatives push the sector toward greener inputs, encouraging the

Regional Analysis

North America led the Agriculture Adjuvants Market with 37.9%, reaching USD 1.4 Bn.

In the Agriculture Adjuvants Market, North America remained the leading region in 2024, holding a dominant 37.9% share and reaching a valuation of USD 1.4 Bn, supported by the region’s strong adoption of crop protection technologies and large-scale farming operations. Europe followed with steady demand as farmers focused on improving spray efficiency across cereals, grains, and high-value horticulture crops.

The Asia Pacific region continued expanding due to rising agricultural output and greater use of adjuvants to enhance herbicide and fungicide performance in densely cultivated countries. Markets in the Middle East & Africa showed gradual development, driven by efforts to improve crop resilience in arid conditions. Latin America maintained consistent adoption, supported by extensive soybean, corn, and sugarcane cultivation across major agricultural economies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Clariant AG continued positioning itself as a performance-driven player by focusing on adjuvant solutions that enhance spray effectiveness and support consistent field application. Its emphasis on formulation stability and compatibility allowed it to remain relevant across herbicide-dominant cropping systems, especially where growers demand better yield support and operational efficiency.

Solvay SA maintained strong engagement in functional additives that contribute to better penetration and improved spreadability. The company’s technical capabilities and chemistry-focused approach helped address the need for reliable activators and utility adjuvants, especially as farmers sought improved crop protection outcomes under variable weather conditions. Its strategic orientation toward performance-enhancing formulations kept it competitive among global input suppliers.

The Dow Chemical Company remained influential due to its long-standing expertise in agricultural chemistry, offering adjuvant components designed to improve spray uniformity, reduce drift, and support field consistency. The company’s broad presence across crop solutions contributed to stable demand for its adjuvant-related offerings, particularly in large-scale farming regions where application precision is a priority.

Top Key Players in the Market

- Clariant AG

- Solvay SA

- The Dow Chemical Company

- Huntsman International LLC

- Evonik Industries AG

- Ingevity

- Nufarm Limited

- Corteva Agriscience

- Croda International PLC

- BASF SE

- Miller Chemical & Fertilizer, LLC.

Recent Developments

- In September 2025, Ingevity announced it entered a deal to sell its North Charleston crude tall oil refinery and most of its Industrial Specialties product line to Mainstream Pine Products. This change is meant to simplify its portfolio and focus the company more on higher-value specialty chemicals and solutions. The sale is expected to be completed by early 2026.

- In May 2025, Huntsman announced the completion of its European Maleic Anhydride business review and confirmed the closure of its Moers, Germany, facility by the end of that quarter. This move was part of reshaping its chemical portfolio and may influence production support for related compounds used in agricultural applications, including adjuvant component sourcing.

Report Scope

Report Features Description Market Value (2024) USD 3.9 Billion Forecast Revenue (2034) USD 6.4 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Formulation (Suspension Concentrates, Emulsifiable Concentrates), By Adoption Stage (In-Formulation, Tank Mix), By Function (Activator Adjuvants (Surfactants, Oil-Based Adjuvants), Utility Adjuvants (Compatibility Agents, Buffers/Acidifiers , Antifoaming Agents , Water Conditioners, Drift Control Agents , Others)), Ву Сгор Туре (Cereals and Grains (Corn, Wheat, Rice, Others), Oilseeds and Pulses (Soybean, Sunflower, Others), Fruits and Vegetables, Others), By Application (Herbicides, Insecticides, Fungicides, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Clariant AG, Solvay SA, The Dow Chemical Company, Huntsman International LLC, Evonik Industries AG, Ingevity, Nufarm Limited, Corteva Agriscience, Croda International PLC, BASF SE, Miller Chemical & Fertilizer, LLC. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Agriculture Adjuvants MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Agriculture Adjuvants MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Clariant AG

- Solvay SA

- The Dow Chemical Company

- Huntsman International LLC

- Evonik Industries AG

- Ingevity

- Nufarm Limited

- Corteva Agriscience

- Croda International PLC

- BASF SE

- Miller Chemical & Fertilizer, LLC.