Global Agricultural Sprayers Market Size, Share, And Business Benefits By Product Type (Self-propelled, Tractor Mounted, Trailed, Handheld, Aerial), By Farm Size (Large, Medium, Small), By Nozzle Type (Hydraulic Nozzle, Gaseous Nozzle, Centrifugal Nozzle, Thermal Nozzle), By Power Source (Fuel-Based, Electric and Battery-Driven, Solar, Manual), By Capacity (Ultra-Low Volume, Low Volume, High Volume), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157153

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

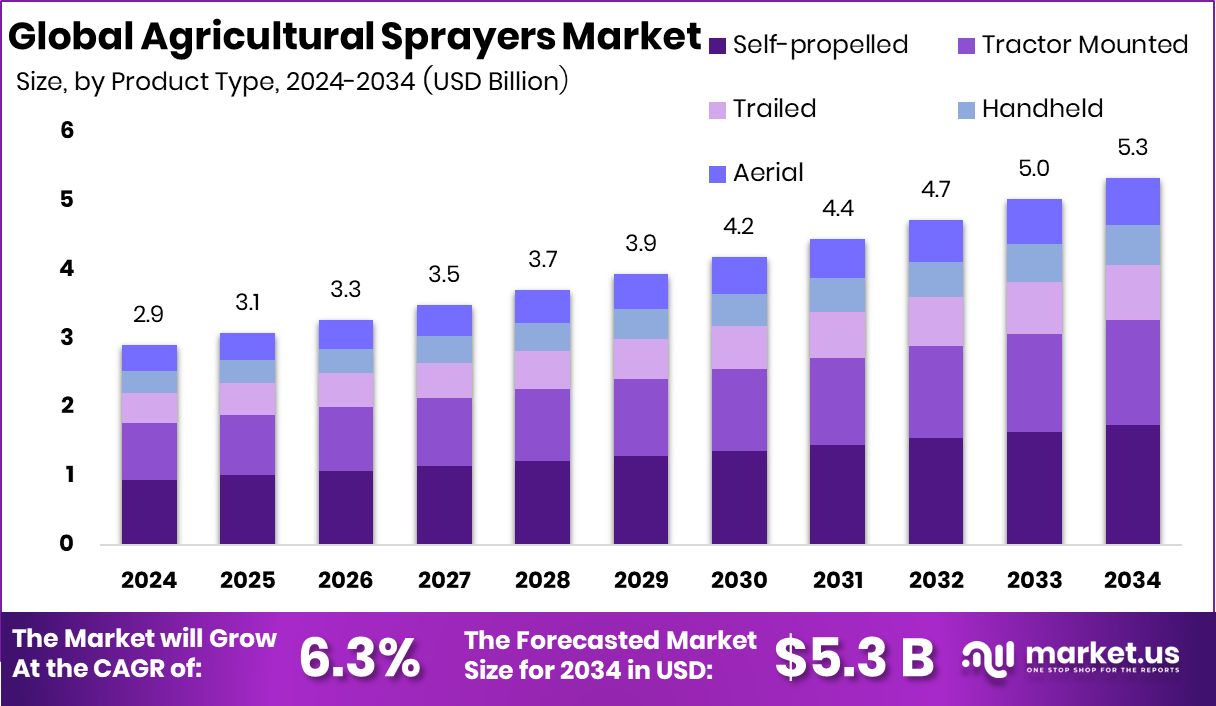

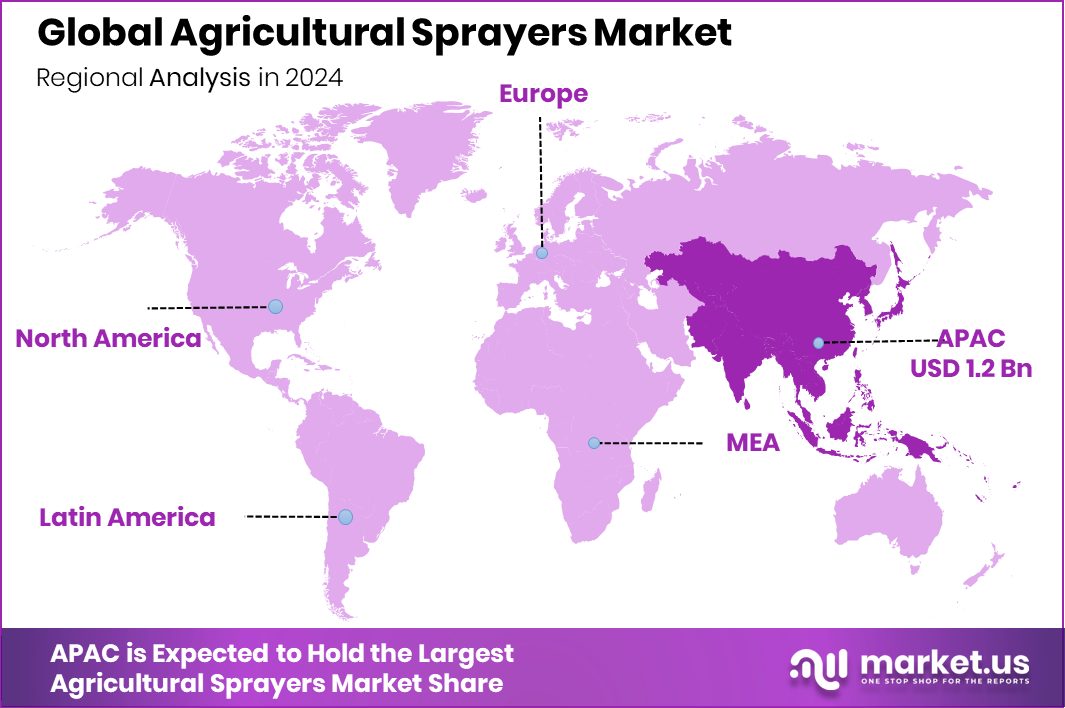

The Global Agricultural Sprayers Market is expected to be worth around USD 5.3 billion by 2034, up from USD 2.9 billion in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034. With a 42.80% share worth USD 1.2 Bn, Asia-Pacific leads the adoption of modern spraying technologies.

Agricultural sprayers are essential tools used by farmers to apply water, pesticides, herbicides, and fertilizers evenly across crops. They ensure efficient use of resources while protecting plants from pests and diseases, boosting overall yield. Available in various types like handheld, tractor-mounted, or drone-based, these sprayers save time and reduce labor efforts, making modern farming more productive and sustainable.

The agricultural sprayers market refers to the global demand and supply of these spraying machines and technologies. It reflects the growing adoption of advanced spraying methods that improve efficiency and crop protection. The market is shaped by rising food demand, evolving farming practices, and increasing focus on precision agriculture, driving farmers toward mechanized and automated solutions.

One major growth factor is the rising global population, which puts pressure on farmers to produce more food. To meet this demand, farmers are increasingly adopting mechanized spraying solutions that ensure higher productivity and healthier crops. According to an industry report, Marut Drones raised $6.2 million in Series A Funding as India Strengthens Local Drone Manufacturing Drive.

Demand is also driven by the growing need to control crop diseases and pests effectively. With unpredictable weather patterns and the spread of new pests, farmers rely on advanced sprayers for timely protection and better crop survival rates. According to an industry report, Agricultural drone maker Hylio secures $2 million to boost production capacity, reinforcing its ‘Made in America’ focus.

Key Takeaways

- The Global Agricultural Sprayers Market is expected to be worth around USD 5.3 billion by 2034, up from USD 2.9 billion in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034.

- In 2024, self-propelled agricultural sprayers captured 32.7%, showing a strong preference for advanced mechanized solutions.

- Large farm owners dominated the agricultural sprayers market with 43.1%, highlighting demand for efficiency across expansive fields.

- Hydraulic nozzles held the lead at 49.4%, proving their reliability and effectiveness in precise crop protection applications.

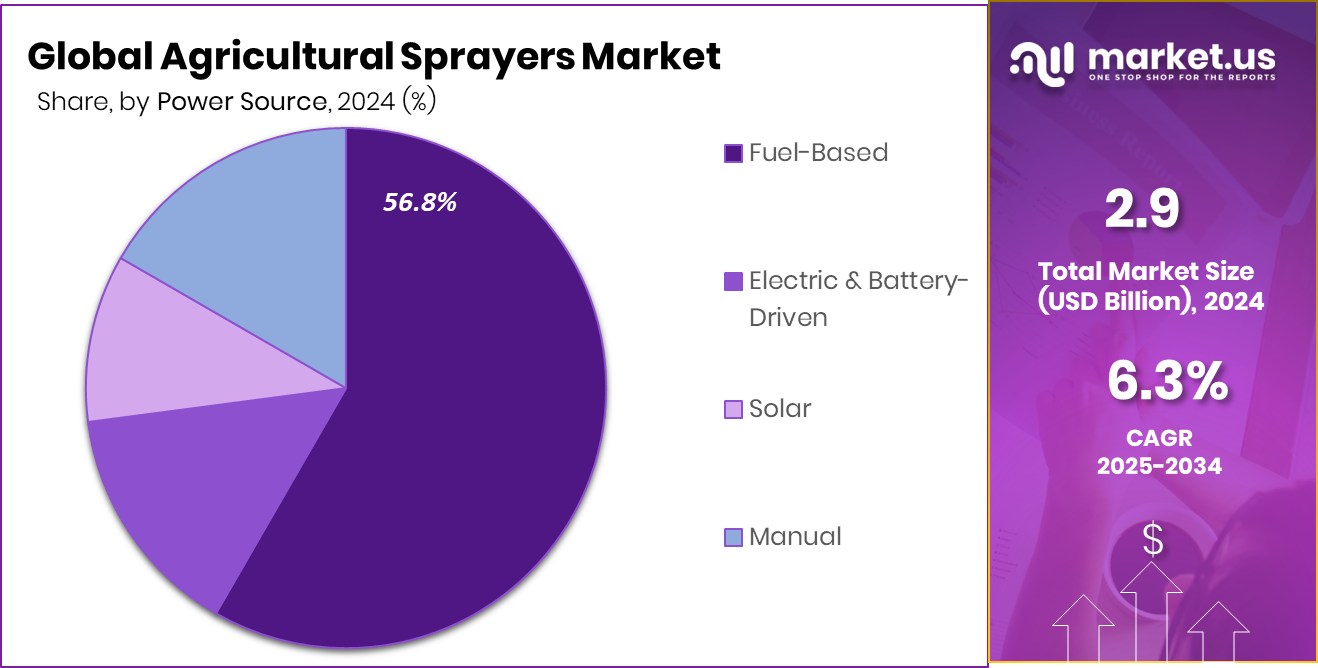

- Fuel-based sprayers accounted for 56.8%, reflecting farmers’ continued reliance on powerful, high-capacity equipment for large-scale spraying.

- Low-volume sprayers secured 51.2%, driven by cost-effectiveness and reduced chemical usage in modern agricultural practices.

- The Asia-Pacific region, holding a 42.80% share and USD 1.2 Bn, shows strong agricultural mechanization growth.

By Product Type Analysis

In 2024, self-propelled sprayers captured 32.7% of the agricultural sprayers market share.

In 2024, Self-propelled held a dominant market position in the By Product Type segment of the Agricultural Sprayers Market, with a 32.7% share. This segment’s leadership highlights the growing preference for highly efficient and technologically advanced sprayers that minimize manual intervention while maximizing coverage. Self-propelled sprayers are valued for their ability to operate independently, with features like adjustable boom widths, precise control systems, and enhanced fuel efficiency, making them ideal for large-scale farming operations.

The 32.7% share reflects how farmers are increasingly turning toward solutions that save time and labor while ensuring accurate spraying of fertilizers and pesticides. These machines are designed to cover vast agricultural lands quickly, offering consistency in application that directly supports better crop yield and healthier produce. Moreover, their adaptability to different terrains and crops makes them suitable for diverse farming conditions, further strengthening their demand.

Another factor behind this dominance is the rising emphasis on precision farming. With GPS-enabled and automated features becoming more common, self-propelled sprayers offer farmers the chance to reduce chemical wastage and improve resource efficiency. This not only benefits productivity but also supports sustainability goals, ensuring that self-propelled sprayers continue to lead the market segment.

By Farm Size Analysis

Large farms dominated the agricultural sprayers market with a 43.1% share due to mechanization.

In 2024, Large held a dominant market position in the By Farm Size segment of the Agricultural Sprayers Market, with a 43.1% share. This dominance is largely driven by the increasing adoption of advanced spraying technologies on extensive farmlands where efficiency, speed, and precision are crucial. Large farms often span hundreds of hectares, requiring equipment capable of covering vast areas quickly and consistently, making agricultural sprayers an indispensable tool.

The 43.1% share underscores how large-scale agricultural enterprises prioritize mechanized solutions to reduce labor costs and enhance productivity. These farms typically produce high-value crops in bulk, where timely application of pesticides, herbicides, and fertilizers is vital to prevent losses.

Agricultural sprayers designed for large farms are often integrated with advanced features such as high-capacity tanks, extended boom widths, and automated spraying systems, ensuring optimal coverage with minimal wastage.

Furthermore, the rising demand for food grains, fruits and vegetables on a global scale encourages large farms to invest in such equipment to sustain higher yields. With growing emphasis on precision farming and sustainability, large farms are increasingly using sprayers with GPS guidance and variable rate technology. This ensures efficient use of resources, reinforcing the segment’s leading position in the market.

By Nozzle Type Analysis

Hydraulic nozzles held a 49.4% share, leading the agricultural sprayers market segment.

In 2024, Hydraulic Nozzle held a dominant market position in the By Nozzle Type segment of the Agricultural Sprayers Market, with a 49.4% share. This leadership highlights the widespread use of hydraulic nozzles due to their versatility, cost-effectiveness, and ability to deliver uniform droplet sizes across various spraying applications. Farmers prefer hydraulic nozzles because they are simple to operate, durable, and adaptable to different types of crops and field conditions, making them the most common choice in agricultural spraying.

The 49.4% share demonstrates how crucial hydraulic nozzles are for effective pest, weed, and nutrient management. These nozzles allow precise control over application rates and spray patterns, ensuring even distribution of pesticides and fertilizers, which directly supports higher crop quality and yields. Their availability in multiple designs—such as flat fan, hollow cone, and flood—further enhances their adaptability, meeting the diverse needs of modern farms.

Another driver behind this dominance is their compatibility with both traditional and advanced sprayer systems. As farming practices evolve toward precision agriculture, hydraulic nozzles remain relevant due to their ability to integrate with pressure regulators and GPS-guided systems. This combination of reliability, flexibility, and efficiency ensures their strong position in the market segment.

By Power Source Analysis

Fuel-based sprayers contributed 56.8% of the agricultural sprayers market, showing a strong preference.

In 2024, Fuel-Based held a dominant market position in the By Power Source segment of the Agricultural Sprayers Market, with a 56.8% share. This dominance reflects the strong preference for fuel-powered sprayers among farmers who manage large and medium-sized farms requiring high-capacity and uninterrupted spraying operations. Fuel-based sprayers are valued for their mobility, durability, and ability to operate independently of electricity, making them reliable even in remote agricultural regions where power access can be limited.

The 56.8% share highlights how fuel-based sprayers remain a practical solution for intensive farming activities. These machines are designed to cover extensive areas quickly, ensuring the timely application of pesticides, herbicides, and fertilizers. Their higher spraying pressure and longer run times compared to manual or battery-operated alternatives allow farmers to achieve efficient coverage with minimal downtime, which is critical during peak farming seasons.

Another factor driving their market leadership is the continued demand for robust machinery that can withstand tough working conditions. Fuel-based sprayers are often equipped with large tanks and powerful engines, making them suitable for high-volume applications. As food demand grows globally, the efficiency and reliability of fuel-based sprayers reinforce their commanding share in the market segment.

By Capacity Analysis

Low-volume sprayers led the agricultural sprayers market with a 51.2% adoption rate.

In 2024, Low Volume held a dominant market position in the By Capacity segment of the Agricultural Sprayers Market, with a 51.2% share. This dominance is linked to the growing demand for efficient spraying solutions that minimize chemical usage while ensuring effective coverage. Low-volume sprayers are designed to deliver concentrated sprays with smaller amounts of liquid, making them ideal for farmers aiming to reduce input costs and adopt more sustainable practices in crop protection.

The 51.2% share demonstrates the preference among farmers for equipment that balances affordability with performance. Low-volume sprayers enable precise application of pesticides, herbicides, and fertilizers, reducing wastage and environmental impact while maintaining crop health. Their ease of use, lightweight design, and adaptability across different crops and farm sizes further contribute to their strong adoption.

Another reason behind this leading position is their compatibility with both small and large farms, where water availability may be limited. By requiring less water, these sprayers allow farmers to operate efficiently in areas facing resource constraints. With rising awareness of sustainability and cost efficiency in agriculture, low-volume sprayers continue to stand out as the most practical choice, securing their dominance in the market segment.

Key Market Segments

By Product Type

- Self-propelled

- Tractor Mounted

- Trailed

- Handheld

- Aerial

By Farm Size

- Large

- Medium

- Small

By Nozzle Type

- Hydraulic Nozzle

- Gaseous Nozzle

- Centrifugal Nozzle

- Thermal Nozzle

By Power Source

- Fuel-Based

- Electric and Battery-Driven

- Solar

- Manual

By Capacity

- Ultra-Low Volume

- Low Volume

- High Volume

Driving Factors

Rising Food Demand Boosts Need for Modern Sprayers

One of the top driving factors for the Agricultural Sprayers Market is the rising global demand for food, which pushes farmers to adopt advanced spraying equipment. As the world population continues to grow, there is pressure on agriculture to produce higher yields within limited farmland. Sprayers play a key role in this by ensuring the timely and even application of pesticides, fertilizers, and nutrients, which helps crops grow healthier and faster.

Farmers are shifting from manual methods to mechanized sprayers because they save time, reduce labor costs, and improve efficiency. This increasing reliance on technology-driven farming solutions directly drives the demand for agricultural sprayers, making them an essential tool for meeting future food security needs.

Restraining Factors

High Equipment Cost Limits Adoption Among Farmers

A key restraining factor for the Agricultural Sprayers Market is the high cost of advanced spraying equipment. While self-propelled and fuel-based sprayers offer efficiency and time savings, their initial investment is often too expensive for small and medium-scale farmers. Many growers in developing regions rely on low-cost manual methods because they cannot afford modern sprayers, even though they know the long-term benefits.

Maintenance expenses, fuel costs, and spare parts also add to the financial burden. This creates a gap where only large-scale farms can fully adopt advanced sprayers. As a result, the high equipment cost slows down widespread adoption, limiting the overall growth potential of the agricultural sprayers market despite strong demand.

Growth Opportunity

Technology Integration Creates New Opportunities in Sprayers

A major growth opportunity in the Agricultural Sprayers Market lies in the integration of modern technologies like GPS, sensors, drones, and automation. These innovations allow farmers to practice precision spraying, where fertilizers and pesticides are applied only where needed, reducing waste and improving crop health. Drone sprayers, for example, can cover difficult terrains quickly, while GPS-enabled systems ensure accurate application across large fields.

Such technology-driven solutions not only increase efficiency but also support sustainable farming by lowering chemical usage and protecting the environment. As governments and organizations promote smart agriculture, the demand for tech-enabled sprayers is expected to rise, opening new avenues for growth and transforming the way farmers manage their crops.

Latest Trends

Growing Shift Toward Sustainable and Eco-Friendly Spraying

One of the latest trends in the Agricultural Sprayers Market is the growing shift toward sustainable and eco-friendly spraying practices. Farmers are increasingly aware of the environmental impact of excessive chemical use, leading to higher demand for sprayers that optimize input usage. Low-volume sprayers, precision nozzles, and battery or solar-powered units are gaining traction as they reduce fuel dependency and chemical wastage.

In addition, modern sprayers are being designed to support organic and eco-friendly farming, aligning with consumer demand for healthier food. This trend is shaping product innovation, where manufacturers focus on efficiency, reduced emissions, and environmental safety. As sustainability becomes a central goal in agriculture, eco-friendly sprayers are set to become the industry standard.

Regional Analysis

In 2024, Asia-Pacific dominated the Agricultural Sprayers Market with 42.80% share, valued at USD 1.2 Bn.

In 2024, Asia-Pacific emerged as the leading region in the Agricultural Sprayers Market, capturing a dominant 42.80% share, valued at USD 1.2 billion. This strong position is driven by the region’s vast agricultural base, expanding farmlands, and rapid adoption of mechanized farming solutions.

Countries such as India, China, and Japan are investing heavily in modern farming technologies to improve efficiency and meet the rising food demand from their large populations. Government initiatives supporting farm mechanization, subsidies on agricultural equipment, and the growing popularity of precision farming further accelerate the adoption of sprayers across the region.

The presence of diverse crop varieties and climatic conditions also drives the need for advanced spraying solutions to ensure crop protection and productivity. Moreover, rising labor shortages in rural areas are pushing farmers toward automated sprayers, including fuel-based and self-propelled models, to save time and improve efficiency.

The region’s increasing focus on sustainable agriculture and eco-friendly practices is also creating demand for low-volume and precision sprayers that reduce chemical usage. With its significant share and continuous technological adoption, Asia-Pacific is expected to remain the dominant force in the agricultural sprayers market, reinforcing its leadership role in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AG Spray Equipment Inc. continues to strengthen its presence through a wide range of sprayers designed for both small and large-scale farming. The company emphasizes reliability and ease of use, making its solutions attractive to farmers seeking practical equipment that improves efficiency and lowers operating costs. Its ability to cater to diverse farm sizes has positioned it as a trusted choice in the market.

Amazon H. Dreyer GmbH & Co. KG stands out for its engineering excellence and commitment to technological advancement. The company’s sprayers are known for precision, durability, and integration with advanced farming techniques, aligning with the growing shift toward sustainable agriculture. Amazon’s focus on innovation ensures that its equipment supports accurate application of fertilizers and pesticides, reducing chemical waste while enhancing crop yields.

Bucher Industries AG further adds weight to the market with its diversified product portfolio and global presence. The company is recognized for manufacturing robust and high-performance agricultural machinery, with sprayers playing a key role in its lineup. By focusing on high-capacity, efficient spraying systems, Bucher supports large-scale farms in achieving timely crop protection.

Top Key Players in the Market

- AG Spray Equipment Inc.,

- Amazone H. Dreyer GmbH & Co. KG

- Bucher Industries AG

- CNH Industrial N.V.

- Deere & Company

- Exel Industries SA

- H&H Farm Machine Co.

- KisanKraft Limited

- Kubota Corporation

- STIHL

Recent Developments

- In June 2025, CNH introduced its SenseApply AI sprayer precision technology across its Case IH, New Holland, and Miller spray equipment. This smart system uses machine learning and camera sensors to detect weeds (“green on brown”) and selectively apply water, herbicides, or fertilizers—helping farmers reduce chemicals and save resources.

- In February 2024, John Deere and GUSS Automation introduced the world’s first fully electric autonomous herbicide orchard sprayer, named Electric GUSS, at the World Ag Expo. This battery-powered sprayer, which can run an entire shift on a single charge, delivers spot spraying using smart weed detection technology—helping farmers cut herbicide use by up to 90%.

Report Scope

Report Features Description Market Value (2024) USD 2.9 Billion Forecast Revenue (2034) USD 5.3 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Self-propelled, Tractor Mounted, Trailed, Handheld, Aerial), By Farm Size (Large, Medium, Small), By Nozzle Type (Hydraulic Nozzle, Gaseous Nozzle, Centrifugal Nozzle, Thermal Nozzle), By Power Source (Fuel-Based, Electric and Battery-Driven, Solar, Manual), By Capacity (Ultra-Low Volume, Low Volume, High Volume) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AG Spray Equipment Inc., Amazone H. Dreyer GmbH & Co. KG, Bucher Industries AG, CNH Industrial N.V., Deere & Company, Exel Industries SA, H&H Farm Machine Co., KisanKraft Limited, Kubota Corporation, STIHL Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Agricultural Sprayers MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Agricultural Sprayers MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AG Spray Equipment Inc.,

- Amazon H. Dreyer GmbH & Co. KG

- Bucher Industries AG

- CNH Industrial N.V.

- Deere & Company

- Exel Industries SA

- H&H Farm Machine Co.

- KisanKraft Limited

- Kubota Corporation

- STIHL