Global Agricultural Chelates Market Size, Share, And Business Benefits By Type (EDTA, EDDHA, DTPA, IDHA, Others), By Mode of Application (Soil Application, Seed Dressing, Foliar Sprays, Fertigation, Others), By Micronutrient Type (Iron, Manganese, Others), By Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others), By End Use (Agriculture, Indoor Farming), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 159625

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

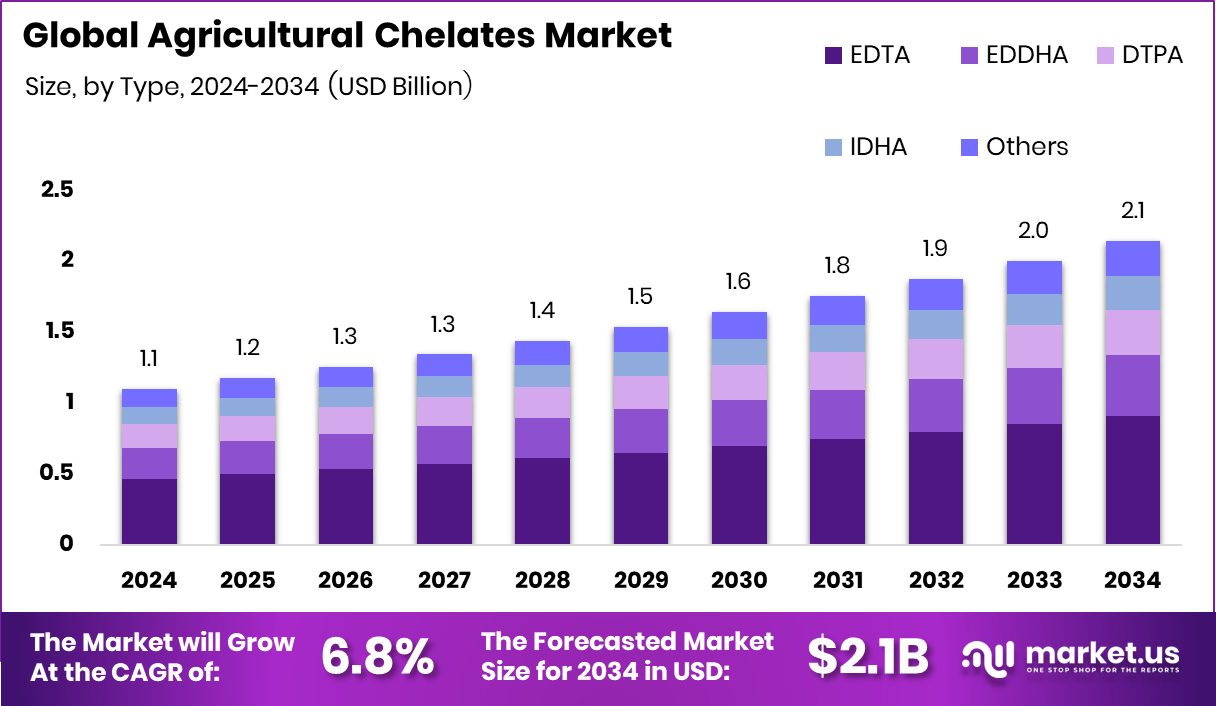

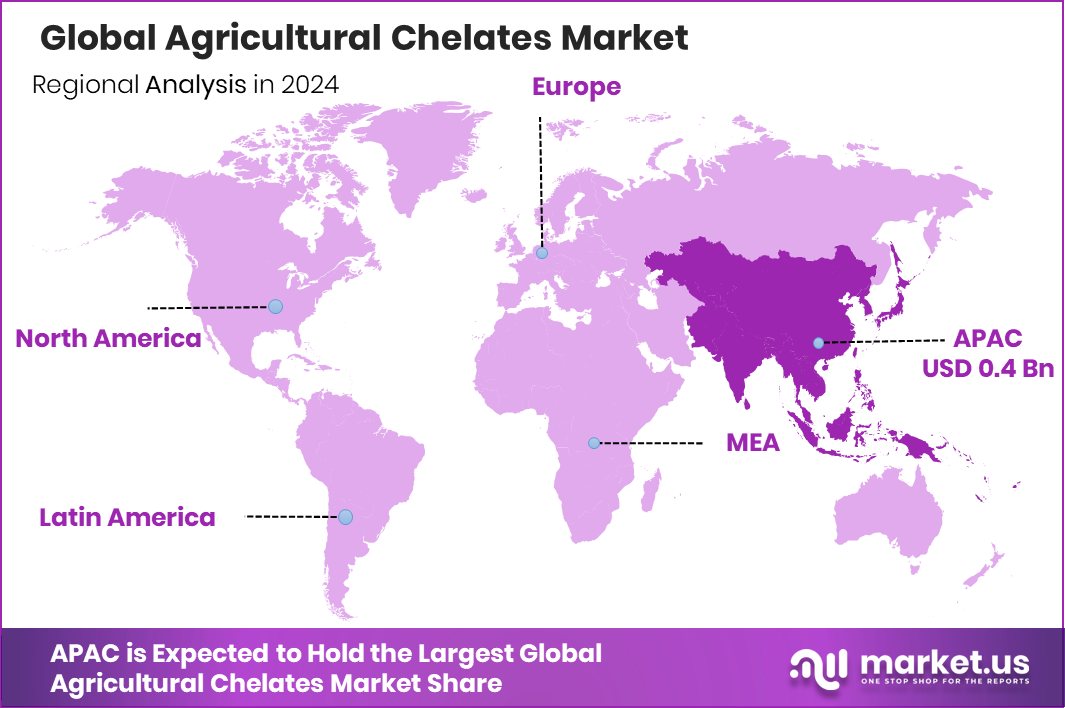

The Global Agricultural Chelates Market is expected to be worth around USD 2.1 billion by 2034, up from USD 1.1 billion in 2024, and is projected to grow at a CAGR of 6.9% from 2025 to 2034. With a 43.40% share, Asia Pacific’s market value stood at USD 0.4 Bn.

Agricultural chelates are special compounds that bind with nutrients such as iron, zinc, or manganese to make them more available for plant absorption. In simple terms, they act like carriers that protect micronutrients from getting locked in the soil, ensuring crops can absorb them efficiently. This makes them essential in modern farming, especially in areas with poor or imbalanced soils

Growth factors include rising awareness of soil degradation and nutrient deficiency. Farmers are turning to chelates as an efficient solution to improve crop productivity. The fact that startups like Uni Seoul are raising Rs 5 crore in seed funding and Oncare is securing $1 million to set up 10 units shows the sector is drawing new players and innovation.

Demand drivers lie in the need for sustainable farming. As global populations rise, ensuring nutrient-rich soils is critical. Collaborations like Pivot Bio & Hefty Seed Co. and Sound Agriculture, securing $25 million in funding, indicate the demand for advanced plant nutrition solutions. These moves not only create better soil practices but also make food security more reliable.

Key Takeaways

- The Global Agricultural Chelates Market is expected to be worth around USD 2.1 billion by 2034, up from USD 1.1 billion in 2024, and is projected to grow at a CAGR of 6.9% from 2025 to 2034.

- EDTA type holds 42.4% share, showing its strong preference in chelate formulations globally.

- Soil application dominates with 38.2%, highlighting farmers’ trust in direct nutrient delivery methods.

- Iron chelates lead at 66.1%, proving their essential role in addressing crop deficiencies.

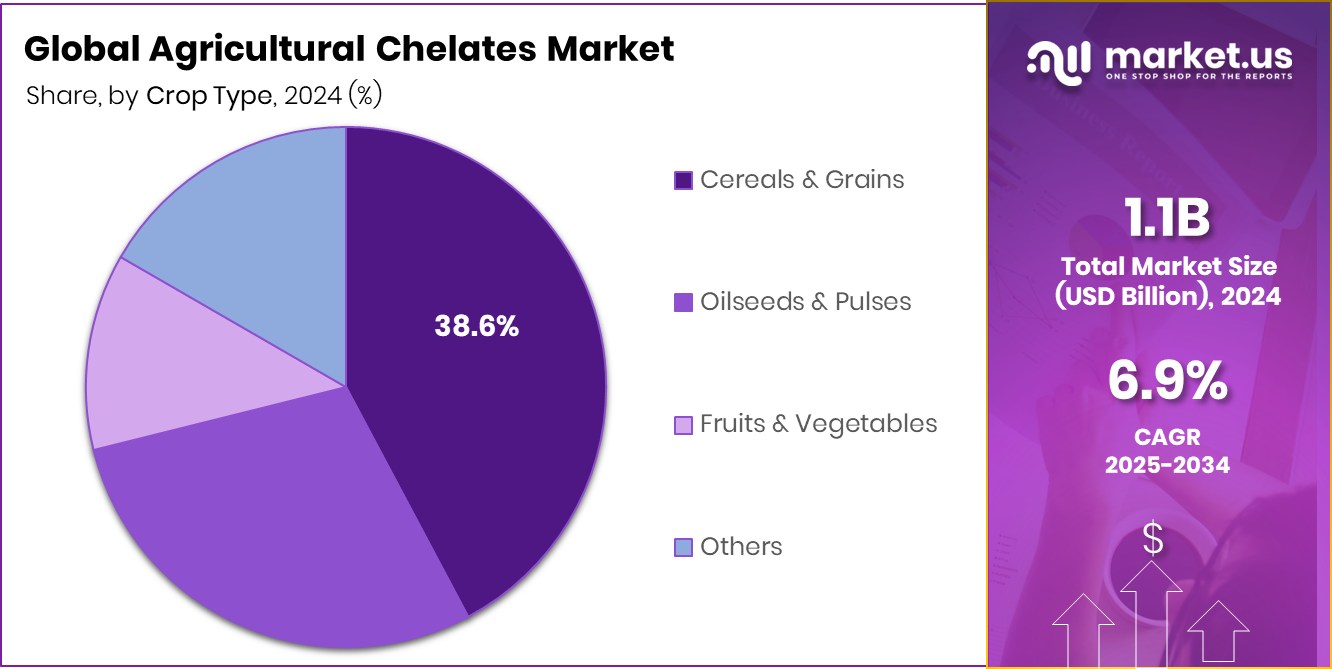

- Cereals and grains represent 38.6%, reflecting high adoption in staple food production worldwide.

- Agriculture accounts for 89.9%, making chelates a core tool for enhancing sustainable farming practices.

- The Asia Pacific Agricultural Chelates Market dominated with 43.40% share, reaching USD 0.4 Bn.

By Type Analysis

The EDTA type holds 42.4%, making it the largest segment globally.

In 2024, EDTA held a dominant market position in the By Type segment of the Agricultural Chelates Market, with a 42.4% share. EDTA’s strong performance reflects its widespread use as a reliable chelating agent for binding essential micronutrients such as iron, zinc, and manganese, ensuring their availability for plant uptake. Its compatibility with diverse soil conditions and cost-effectiveness make it the preferred choice for farmers and agronomists.

The ability of EDTA to improve nutrient solubility and prevent deficiencies in crops underlines its high adoption rate. This substantial market share highlights EDTA’s critical role in enhancing crop productivity and sustaining soil health, positioning it as the leading chelating solution within the agricultural sector.

By Mode of Application Analysis

Soil application dominates with 38.2%, reflecting farmers’ preference for direct nutrient use.

In 2024, Soil Application held a dominant market position in the By Mode of Application segment of the Agricultural Chelates Market, with a 38.2% share. The preference for soil application is driven by its effectiveness in delivering micronutrients directly to plant roots, ensuring better absorption and improved crop growth.

Farmers widely adopt this method as it integrates easily with existing irrigation systems and traditional farming practices. Its ability to address nutrient deficiencies across a range of crops and soil types makes it a practical and cost-efficient approach. Holding the largest share, soil application continues to be the most trusted and widely implemented method for enhancing soil fertility and sustaining agricultural productivity.

By Micronutrient Type Analysis

Iron chelates lead the market at 66.1%, essential for crop health.

In 2024, Iron held a dominant market position in the By Micronutrient Type segment of the Agricultural Chelates Market, with a 66.1% share. Iron’s leading share highlights its essential role in correcting chlorosis and promoting healthy photosynthesis in crops, particularly in soils prone to iron deficiency. Its widespread application across cereals, fruits, and vegetables underscores its importance in ensuring higher yields and better crop quality.

Farmers prefer iron chelates for their efficiency in improving nutrient uptake and enhancing plant vigor under varying soil conditions. With its proven effectiveness and broad demand, iron chelates continue to be the most utilized micronutrient, reinforcing their position as a cornerstone in agricultural nutrition solutions.

By Crop Type Analysis

Cereals and grains account for 38.6%, highlighting strong agricultural crop dependency.

In 2024, Cereals and Grains held a dominant market position in the By Crop Type segment of the Agricultural Chelates Market, with a 38.6% share. This dominance reflects the critical role of chelates in improving nutrient uptake for staple crops like wheat, rice, and corn, which form the backbone of global food security.

The use of chelates in cereals and grains supports better root development, chlorophyll production, and resistance to nutrient deficiencies, ensuring higher yields and consistent quality. Given their large-scale cultivation and rising demand for food grains, farmers prioritize chelate use to maintain productivity and soil health. This strong adoption rate has firmly established cereals and grains as the leading segment in the market.

By End Use Analysis

Agriculture end-use captures 89.9%, proving chelates’ vital role in farming sustainability.

In 2024, Agriculture held a dominant market position in the by-end-use segment of the agricultural chelates market, with an 89.9% share. This overwhelming share highlights the extensive reliance on chelates in farming practices to address soil nutrient deficiencies and boost crop productivity.

Chelates play a crucial role in ensuring the efficient delivery of micronutrients like iron and zinc, which are vital for healthy plant growth. Their widespread application across diverse farming systems demonstrates their importance in improving yields, sustaining soil fertility, and supporting global food supply needs. With such a significant share, agriculture remains the core end-use sector driving demand and shaping the overall growth of the agricultural chelates market.

Key Market Segments

By Type

- EDTA

- EDDHA

- DTPA

- IDHA

- Others

By Mode of Application

- Soil Application

- Seed Dressing

- Foliar Sprays

- Fertigation

- Others

By Micronutrient Type

- Iron

- Manganese

- Others

By Crop Type

- Cereals and Grains

- Oilseeds and Pulses

- Fruits and Vegetables

- Others

By End Use

- Agriculture

- Indoor Farming

Driving Factors

Rising Need for Healthy Soil and Better Yields

One of the top driving factors for the Agricultural Chelates Market is the urgent need to improve soil health and crop productivity. As soils in many regions face nutrient deficiencies, chelates are helping farmers make vital micronutrients more available to plants, leading to stronger growth and better harvests. Governments and organizations are also supporting soil health programs, which makes chelates even more important in farming.

For example, Aerofarms raised new equity to strengthen sustainable farming, while TerraBlaster secured $4 million to develop advanced agri solutions. In addition, Rihanna’s backing of Africa’s female climate founders highlights global interest in sustainable agriculture. Beyond agriculture, innovation funding flows in, such as Sammmm raising Rs 10 crore and MedVital securing ₹8.4 crore, showing strong support for science-driven growth.

Restraining Factors

High Costs and Limited Awareness Among Farmers

A key restraining factor for the Agricultural Chelates Market is the relatively high cost of chelating agents compared to traditional fertilizers. Many small and medium-scale farmers, especially in developing regions, find it difficult to afford these products regularly. Along with cost barriers, limited awareness about the long-term benefits of chelates also slows down their adoption.

Farmers often prefer cheaper, immediate solutions even if they are less effective in the long run. In addition, a lack of proper training and technical knowledge about how to apply chelates correctly creates hesitation. These challenges make it harder for chelates to reach their full potential despite their proven effectiveness in improving crop yields and soil health.

Growth Opportunity

Expanding Use of Advanced Solutions in Farming

A major growth opportunity for the Agricultural Chelates Market lies in the expanding use of advanced solutions to improve farming efficiency and soil health. As farmers search for better ways to increase yields and reduce nutrient losses, chelates can play a central role in sustainable agriculture. They ensure plants get the right nutrients even in challenging soils, supporting higher productivity. Innovation in agriculture is also drawing strong financial backing.

For instance, Ascribe Bioscience received $2.5 million to fight crop loss using soil “signaling molecules,” while Plant Impact raised $5 million on the London Stock Exchange to launch new chemical crop enhancers. Such investments show how science-backed innovations can accelerate the wider adoption of chelates globally.

Latest Trends

Focus on Nutritious Crops and Sustainable Farming

One of the latest trends in the Agricultural Chelates Market is the strong focus on growing more nutritious crops while ensuring farming remains sustainable. Chelates are increasingly used to enrich fruits and vegetables with essential micronutrients, which helps improve both quality and yield. This trend is gaining global support through new programs and investments in healthy food production.

For example, Tesco invested £4 million to supply fruits and vegetables to 400 schools, promoting better nutrition. Similarly, the CalFresh fruit and vegetable program restarted with $10 million in funding, and Central State led a $5 million grant to grow produce more sustainably. These initiatives highlight how nutrition-focused agriculture is shaping the chelates market’s future.

Regional Analysis

In 2024, the Asia Pacific captured a 43.40% share, valued at USD 0.4 Bn.

The Agricultural Chelates Market shows varied growth patterns across different regions, reflecting diverse farming practices and soil conditions. In North America, the market benefits from modern farming systems and higher awareness about advanced soil nutrition, creating steady adoption of chelates for sustainable yield improvements. Europe follows closely, driven by stringent regulations on soil management and the growing emphasis on eco-friendly agricultural inputs.

Asia Pacific stands out as the dominant region, capturing 43.40% share with a market value of USD 0.4 billion in 2024. This dominance is linked to the region’s large-scale cereal and grain cultivation, coupled with rising efforts to address soil deficiencies in countries with heavy agricultural dependence. Meanwhile, the Middle East & Africa region reflects a rising need for nutrient-efficient solutions to tackle challenging soil conditions and boost productivity under arid climates.

Latin America, with its extensive crop base and growing focus on enhancing yields, also contributes steadily to the demand for chelates. Among all regions, Asia Pacific clearly leads, both in share and market value, setting the tone for global growth as demand for improved crop nutrition and sustainable agricultural practices expands.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE advanced its chelate portfolio with the launch of Trilon® G, a GLDA-based solution designed to offer improved biodegradability compared to conventional agents like EDTA. This step aligns with BASF’s broader focus on sustainable agriculture and efficient soil nutrition, highlighting its strategy to blend environmental responsibility with product performance.

Nouryon emphasized its commitment to green chemistry by achieving ISCC PLUS certification at its Herkenbosch facility in the Netherlands. This milestone allows the production of chelates based on 100% renewable carbon index (RCI) feedstocks, demonstrating its leadership in circular and bio-based solutions. Alongside this, the company expanded its distribution footprint in Mexico, ensuring its chelating agents reach wider agricultural markets. Nouryon’s direction clearly shows a balance between environmental innovation and global accessibility of chelate products.

Dow, while more widely recognized for its diversified chemical operations, continues to integrate specialty solutions into agriculture, with its chelating chemistry supporting nutrient delivery systems. Its focus remains on enhancing soil and plant health through advanced formulations that improve nutrient uptake and efficiency. By embedding chelates within broader agricultural

Top Key Players in the Market

- BASF SE

- Nouryon

- Dow

- Yara International

- ICL

- Haifa Chemicals Ltd.

- Syngenta

- Nufarm Ltd.

- Aries Agro Ltd.

- The Andersons, Inc.

Recent Developments

- In April 2025, BASF launched Trilon® G, a chelating agent based on GLDA (glutamic acid diacetate). This addition enhances their portfolio alongside MGDA and EDTA, with a focus on more sustainable and biodegradable chemistry.

- In January 2025, Nouryon’s Herkenbosch facility in the Netherlands achieved ISCC PLUS certification, enabling the production of biodegradable chelates using 100% renewable carbon index (RCI) feedstocks.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Billion Forecast Revenue (2034) USD 2.1 Billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (EDTA, EDDHA, DTPA, IDHA, Others), By Mode of Application (Soil Application, Seed Dressing, Foliar Sprays, Fertigation, Others), By Micronutrient Type (Iron, Manganese, Others), By Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others), By End Use (Agriculture, Indoor Farming) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Nouryon, Dow, Yara International, ICL, Haifa Chemicals Ltd., Syngenta, Nufarm Ltd., Aries Agro Ltd., The Andersons, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Agricultural Chelates MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Agricultural Chelates MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Nouryon

- Dow

- Yara International

- ICL

- Haifa Chemicals Ltd.

- Syngenta

- Nufarm Ltd.

- Aries Agro Ltd.

- The Andersons, Inc.