Global Agricultural Biologicals Testing Market Size, Share, And Business Benefits By Product Type (Bio Pesticides, Bio Fertilizers, Bio Stimulants, Others), By End-User (Field Support, Regulatory, Analytical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157733

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

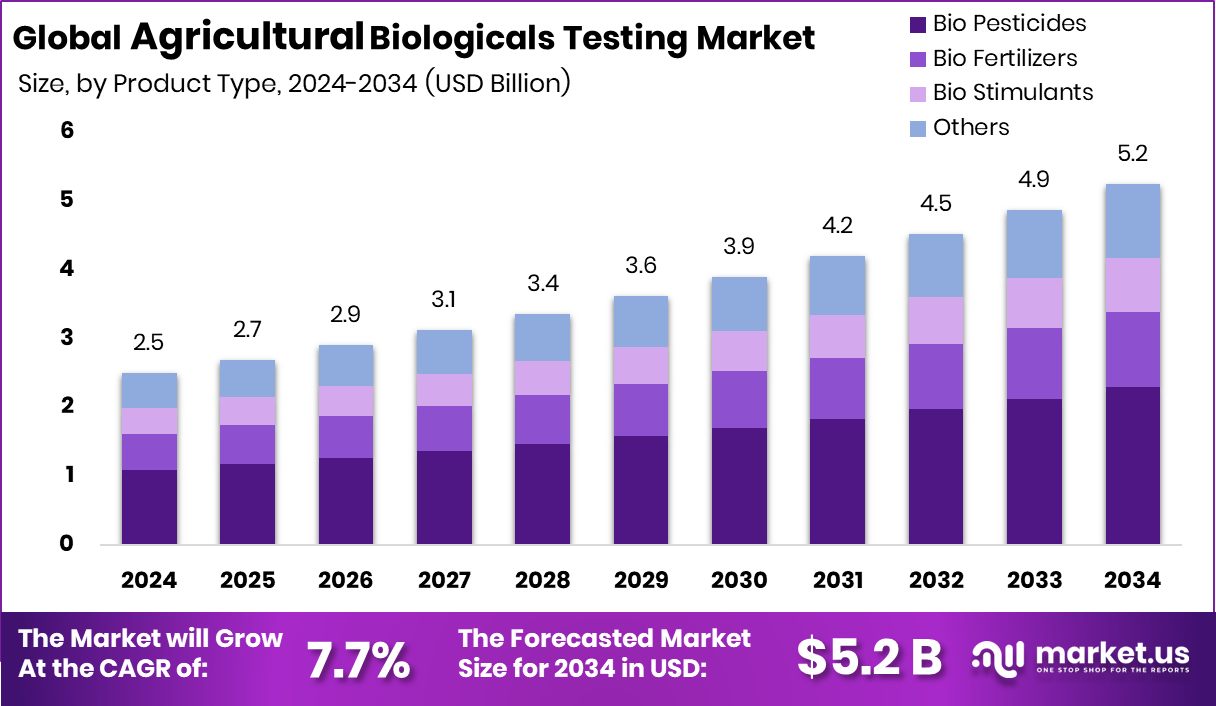

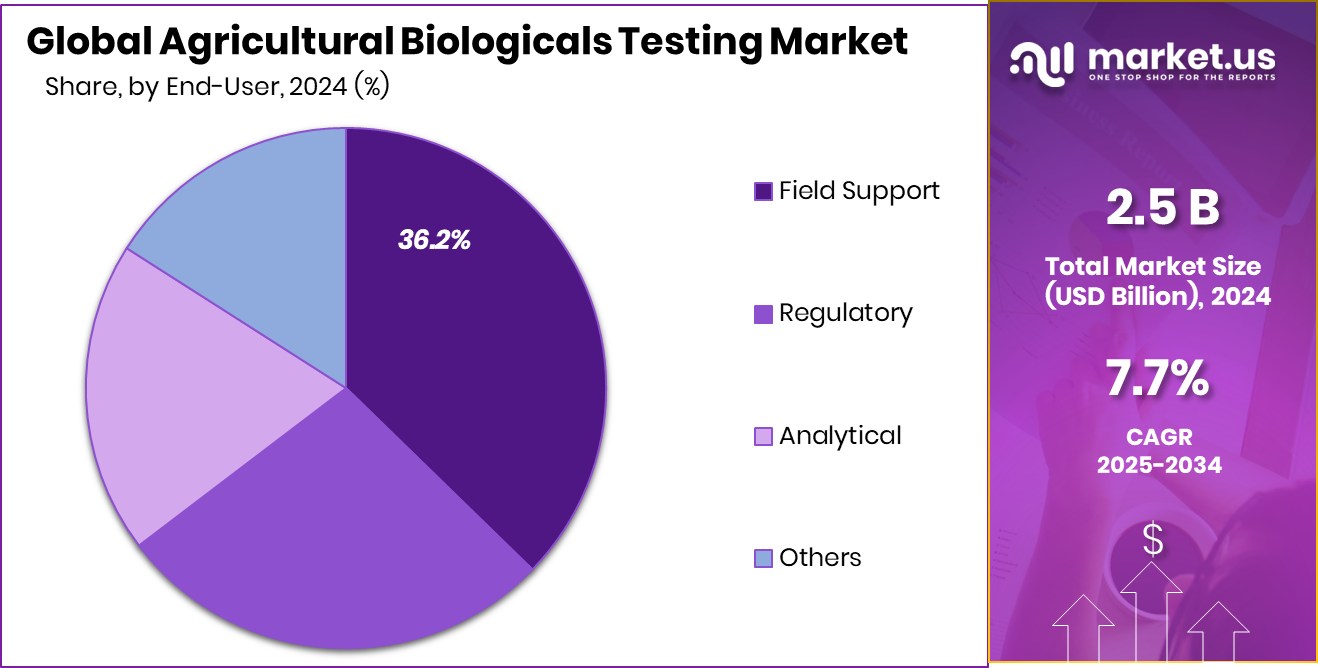

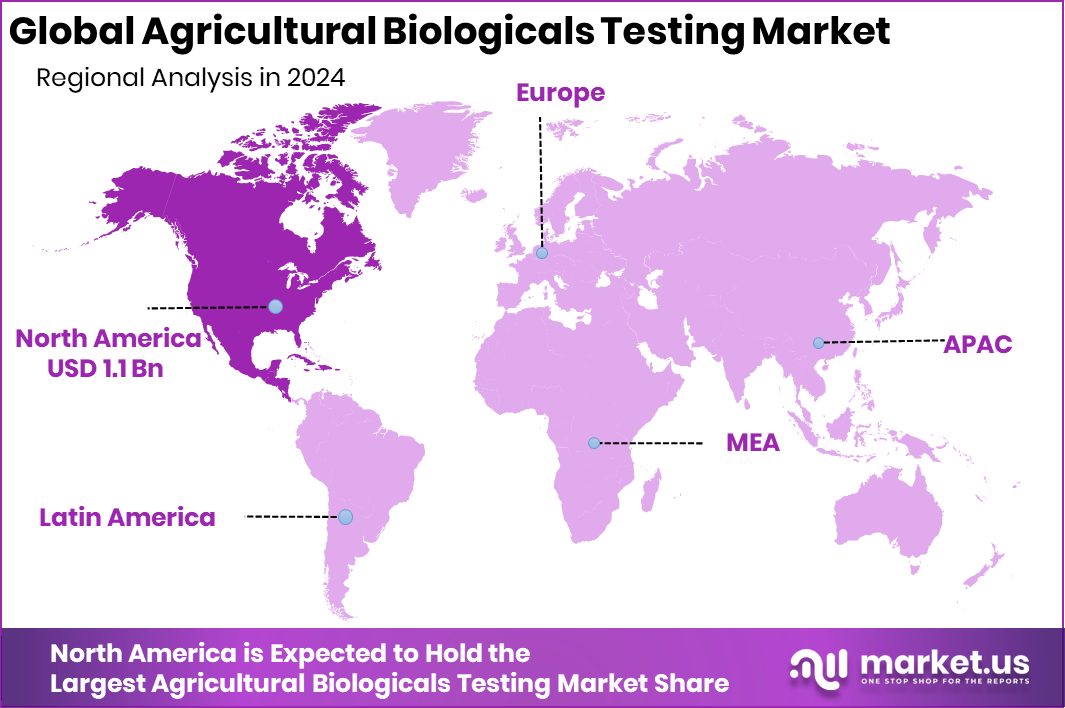

The Global Agricultural Biologicals Testing Market is expected to be worth around USD 5.2 billion by 2034, up from USD 2.5 billion in 2024, and is projected to grow at a CAGR of 7.7% from 2025 to 2034. With 45.8% dominance, North America’s Agricultural Biologicals Testing Market reached USD 1.1 Bn in value.

Agricultural biologicals testing is the process of evaluating bio-based products such as biopesticides, biofertilizers, and biostimulants to ensure they are safe, effective, and compliant with agricultural standards. These tests check the impact of such products on crops, soil health, and the environment before they reach farmers. It helps verify that biological solutions support sustainable farming practices while maintaining crop yield and quality.

The agricultural biologicals testing market refers to the industry that provides testing services and technologies for these natural crop protection and enhancement products. This market is growing as farmers, regulators, and consumers increasingly demand sustainable solutions that reduce reliance on synthetic chemicals. It includes lab testing, field trials, and regulatory compliance services that help bring safe and effective biological products to agriculture.

One key growth factor for this market is the global shift toward sustainable farming. With rising concerns about chemical residues and environmental impact, biological products are becoming preferred alternatives, boosting the need for thorough and standardized testing. According to an industry report, BiocSol raised €5.2M in seed funding to advance microbial pesticide solutions.

The demand is also driven by stricter government regulations. As authorities implement higher safety and environmental standards, manufacturers are required to test their products more rigorously, increasing reliance on specialized testing services. According to an industry report, India’s Agrim secures $17.3M to make seeds and pesticides more accessible for farmers.

A major opportunity lies in technological advancements such as advanced genomics, bioassays, and digital field trials. These innovations not only speed up testing but also improve accuracy, creating space for service providers to expand and support the fast-evolving agricultural biologicals sector. According to an industry report, Brazil grants tax exemptions on pesticides, totaling about US$2.2 billion annually.

Key Takeaways

- The Global Agricultural Biologicals Testing Market is expected to be worth around USD 5.2 billion by 2034, up from USD 2.5 billion in 2024, and is projected to grow at a CAGR of 7.7% from 2025 to 2034.

- In the Agricultural Biologicals Testing Market, Bio Pesticides lead with 43.6%, reflecting growing sustainable farming needs.

- Field Support accounts for 36.2% in the Agricultural Biologicals Testing Market, highlighting rising demand for on-ground validation.

- The North America market, at 45.8% share, worth USD 1.1 Bn, shows strong growth.

By Product Type Analysis

In the Agricultural Biologicals Testing Market, Bio Pesticides captured 43.6%.

In 2024, Bio Pesticides held a dominant market position in the By Product Type segment of the Agricultural Biologicals Testing Market, with a 43.6% share. This leadership reflects the rising global preference for safer and environmentally friendly crop protection solutions over traditional chemical pesticides.

Bio Pesticides, which are derived from natural organisms such as bacteria, fungi, and plants, are increasingly recognized for their ability to control pests without leaving harmful residues.

With governments worldwide enforcing stricter regulations on chemical pesticide use, demand for Bio Pesticides has surged, and with it, the need for rigorous biological testing to ensure their safety, stability, and effectiveness under varied farming conditions.

Testing plays a central role in validating product performance, covering aspects like target-specific action, environmental compatibility, and resistance management. Farmers and producers rely on such data to make informed decisions, while regulators demand comprehensive testing before market approvals.

The 43.6% market share indicates not only the dominance of Bio Pesticides but also highlights the expanding scope of testing services in this category. As sustainability goals continue to shape global agriculture, Bio Pesticides are expected to drive consistent growth within the Agricultural Biologicals Testing Market, positioning this segment as a cornerstone of innovation and reliability in modern crop protection practices.

By End-User Analysis

Field Support held 36.2% in the Agricultural Biologicals Testing Market.

In 2024, Field Support held a dominant market position in the end-user segment of the Agricultural Biologicals Testing Market, with a 36.2% share. This dominance highlights the critical role of on-field validation in ensuring the reliability and success of agricultural biological products.

Field Support services provide real-world testing conditions, enabling accurate assessment of how biopesticides, biostimulants, and biofertilizers perform across different soil types, climates, and crop varieties.

Unlike controlled laboratory settings, field testing delivers practical insights that farmers can directly rely on, making it an essential part of product adoption.

The growing demand for sustainable agriculture has accelerated the reliance on Field Support testing, as farmers and regulators require clear, data-driven evidence of product effectiveness and safety. By simulating actual farming environments, these services also help detect challenges such as pest resistance, environmental stress, or inconsistent results, ensuring solutions are refined before large-scale deployment.

Holding a 36.2% share, Field Support reflects the industry’s trust in practical, farmer-oriented testing approaches. As biologicals become more mainstream, this segment is expected to retain its strong position by bridging innovation with real-world agricultural needs, strengthening farmer confidence, and driving wider acceptance of biological solutions across global markets.

Key Market Segments

By Product Type

- Bio Pesticides

- Bio Fertilizers

- Bio Stimulants

- Others

By End-User

- Field Support

- Regulatory

- Analytical

- Others

Driving Factors

Rising Demand for Sustainable Farming Boosts Testing

One of the biggest driving factors for the agricultural biologicals testing market is the strong global push toward sustainable farming. Farmers and consumers alike are increasingly concerned about the harmful effects of synthetic pesticides and fertilizers on soil, water, and food safety.

Biological solutions such as biopesticides, biostimulants, and biofertilizers offer safer and eco-friendly alternatives, but they must be tested thoroughly to prove their effectiveness and safety.

This rising demand for cleaner farming practices is directly creating a greater need for testing services, as regulators and buyers require evidence that these products are effective without harming the environment. As a result, testing providers are seeing steady growth opportunities tied to the global shift toward sustainability-driven agriculture.

Restraining Factors

High Testing Costs Limit Wider Market Adoption

A key restraining factor for the agricultural biologicals testing market is the high cost involved in conducting detailed tests and field trials. Unlike chemical products, biologicals are living or naturally derived materials that require more complex and time-consuming testing to ensure consistency, safety, and effectiveness.

This process often includes lab research, greenhouse studies, and multi-season field evaluations, which can significantly increase expenses. For many small and mid-sized producers, these costs become a major barrier to entry, slowing down product launches and market expansion.

As a result, while demand for biologicals is rising, the financial burden of testing limits participation and delays innovation, particularly in emerging markets where resources are already constrained.

Growth Opportunity

Advanced Technologies Open New Avenues for Testing

A major growth opportunity in the agricultural biologicals testing market lies in the adoption of advanced technologies such as genomics, molecular diagnostics, and digital field monitoring. These tools allow researchers to study the behavior of biological products more precisely and at a faster pace, reducing the time required for validation.

For example, DNA-based methods can quickly identify microbial strains in biofertilizers or biopesticides, ensuring quality and safety. Similarly, digital field trials supported by sensors and AI-driven platforms provide real-time data on crop performance, making testing more efficient and cost-effective.

By leveraging these innovations, testing providers can expand services, cut costs, and meet the rising global demand for sustainable agricultural products with stronger credibility.

Latest Trends

Integrated Testing Approaches Gain Strong Market Attention

One of the latest trends in the agricultural biologicals testing market is the move toward integrated testing approaches. Instead of relying only on traditional lab tests, companies are combining laboratory analysis, greenhouse trials, and real-world field studies to get a complete picture of product performance.

This trend reflects the growing need to test biologicals under varied conditions, since their effectiveness can differ with soil type, climate, or crop variety. Integrated approaches also help reduce uncertainty for farmers and regulators by offering more reliable data.

As a result, testing providers that can deliver multi-layered, science-backed results are becoming preferred partners, setting a new standard in the industry and boosting confidence in biological solutions.

Regional Analysis

In North America, the Agricultural Biologicals Testing Market holds 45.8%, valued at USD 1.1 Bn.

The Agricultural Biologicals Testing Market is expanding steadily across major regions, with varying levels of adoption influenced by farming practices, regulatory frameworks, and sustainability goals.

North America stands out as the leading region, capturing 45.8% of the market share and reaching a value of USD 1.1 billion. The dominance of this region is fueled by strict agricultural regulations, advanced farming technologies, and strong demand for sustainable crop protection solutions.

Europe follows closely, driven by its proactive environmental policies and increasing restrictions on chemical inputs, which are pushing farmers toward biological alternatives. In the Asia Pacific, rapid population growth, rising food demand, and government initiatives for sustainable agriculture are accelerating the need for reliable biological testing.

Meanwhile, Latin America is showing steady growth, supported by its large-scale crop production and gradual adoption of bio-based solutions, while the Middle East & Africa are emerging with opportunities linked to improving agricultural infrastructure and water management challenges.

Together, these regions reflect a global movement toward safer and more sustainable agricultural practices, but North America continues to set the benchmark in terms of regulatory standards, testing sophistication, and overall market leadership, making it the dominant region in this industry.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

RJ Hill Laboratories Limited has built a strong reputation as a comprehensive testing service provider, particularly in soil, plant, and water analysis. Their broad testing portfolio helps validate the efficiency and safety of biological products, supporting sustainable farming practices while aligning with strict agricultural regulations.

Bionema Limited, on the other hand, stands out for its deep focus on biopesticide development and biological control solutions. The company’s work in providing scientific trials and validation for biological crop protection products ensures that farmers and manufacturers gain confidence in performance outcomes. Its specialization in natural pest control highlights the growing industry shift toward eco-friendly solutions.

Staphyt SA contributes with its extensive experience in contract research, offering field trials and regulatory expertise across multiple geographies. The company plays a crucial role in bridging the gap between biological product innovation and regulatory compliance, helping ensure products reach markets more efficiently.

Top Key Players in the Market

- RJ Hill Laboratories Limited

- Bionema Limited

- Staphyt SA

- Anadiag Group

- SGS SA

Recent Developments

- In August 2025, SGS explained that emerging tools such as nanotechnology, drones, remote sensors, IoT devices, and AI are being incorporated to enhance testing accuracy and efficiency. For example, the use of iron oxide nanoparticles was mentioned to help improve nutrient delivery in biostimulant formulations. Similarly, sensor-based monitoring allows real-time data on soil health and plant stress during field trials, helping generate more reliable and actionable results.

- In August 2024, Bionema introduced Permeate® SP 50, a specialized surfactant designed to improve crop protection and fertilization. This product enhances spreading, wetting, and uptake of crop inputs. It reduces spray volume by up to 30%, offers rain-fastness (effective even if rain occurs after one hour), and is compatible with various products, including herbicides, fungicides, insecticides, and micronutrients. The formulation is also microbial-compatible and suitable for tank mixes, making it valuable for both conventional and organic farming.

Report Scope

Report Features Description Market Value (2024) USD 2.5 Billion Forecast Revenue (2034) USD 5.2 Billion CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Bio Pesticides, Bio Fertilizers, Bio Stimulants, Others), By End-User (Field Support, Regulatory, Analytical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape RJ Hill Laboratories Limited, Bionema Limited, Staphyt SA, Anadiag Group, SGS SA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Agricultural Biologicals Testing MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Agricultural Biologicals Testing MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- RJ Hill Laboratories Limited

- Bionema Limited

- Staphyt SA

- Anadiag Group

- SGS SA