Global 3D Printing Powder Market Size, Share Analysis Report By Type of Powder (Metal Powder, Plastic Powder, Ceramic Powder, Glass Powder, Others), By Process (Laser Sintering, Selective Laser Melting/ Direct Metal Laser Sintering, Electron Beam Melting, Multi Jet Fusion, High Speed Sintering, Others), By End Use (Aerospace, Defense, Medical & Dental, Automotive, Architecture, Consumer Products, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 172886

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

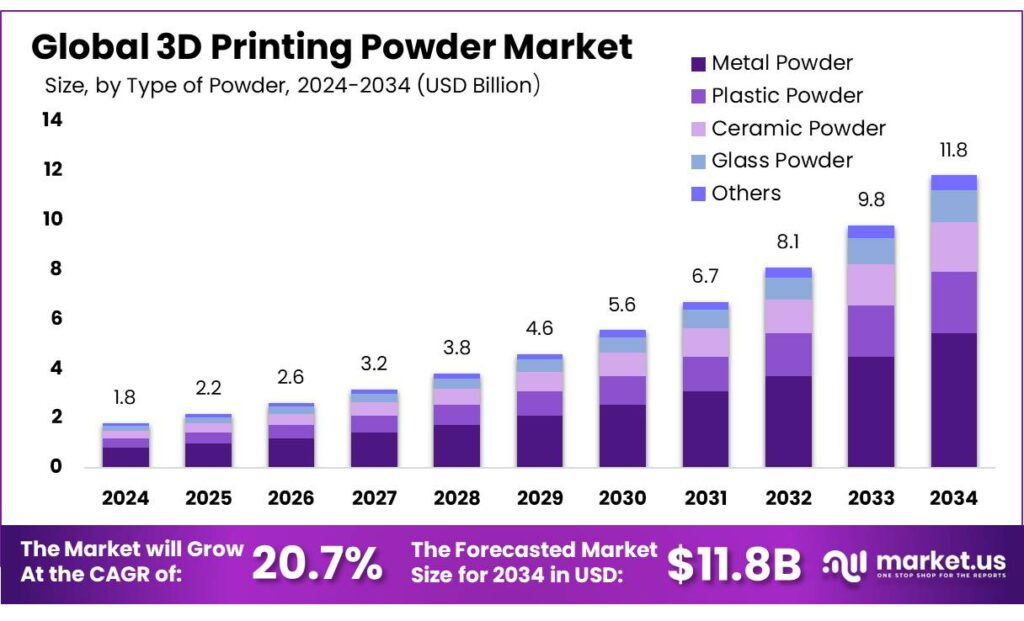

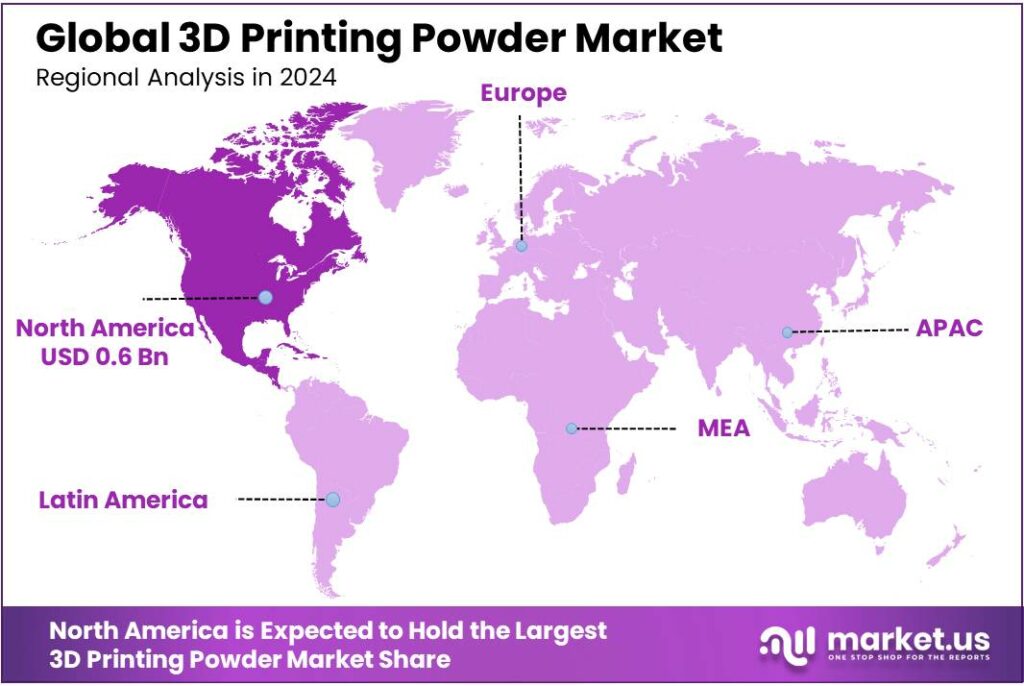

The Global 3D Printing Powder Market size is expected to be worth around USD 11.8 Billion by 2034, from USD 1.8 Billion in 2024, growing at a CAGR of 20.7% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 34.8% share, holding USD 0.6 Billion in revenue.

3D printing powder is the “engine fuel” of powder-based additive manufacturing (AM): fine, tightly controlled metal or polymer particles that are spread in thin layers and fused, sintered, or bonded into near-net-shape parts. Standards such as ISO/ASTM 52907:2019 formalize what “good powder” means by specifying requirements and test methods for traceability, sampling, particle-size distribution, chemistry, morphology, flowability, contamination, and storage.

Industrial scenario, demand is strongest where performance and qualification matter most—especially aerospace, defense, energy, and medical devices—because powders enable lightweight lattices, internal cooling channels, and rapid iteration without hard tooling. Powder bed fusion typically needs narrow particle-size windows to ensure consistent recoating and melt behavior; industry guidance commonly cites ~15–45 μm for many laser powder bed fusion systems, while electron-beam powder bed fusion often uses coarser ranges such as ~45–105 μm. In Europe, Horizon-funded projects are also pushing powder innovation and resource efficiency, including the REPAM initiative with an EU contribution of about €10,635,440.60.

Several forces are accelerating adoption. First, public funding is targeting measurement science and qualification bottlenecks: the U.S. National Institute of Standards and Technology (NIST) awarded $3.7 million in grants to help remove barriers to metals-based AM adoption through measurement research. Defense-linked programs are also financing interoperability and supplier qualification, including America Makes project calls worth $2.1 million and $1.7 million to expand qualified AM capacity and process controls across the industrial base.

A practical bridge to the food industry is hygienic design and faster maintenance in processing plants. Food safety systems rely on cleanable, corrosion-resistant surfaces and traceable materials; regulators such as the European Commission require food-contact materials to comply with Regulation (EC) No 1935/2004. In the U.S., FSIS indicates it monitors about 7.1 thousand establishments, underscoring how large the regulated processing footprint is and why rapid replacement of specialized parts can be valuable when downtime is costly.

Key Takeaways

- 3D Printing Powder Market size is expected to be worth around USD 11.8 Billion by 2034, from USD 1.8 Billion in 2024, growing at a CAGR of 20.7%.

- Metal Powder held a dominant market position, capturing more than a 46.2% share.

- Selective Laser Melting/ Direct Metal Laser Sintering held a dominant market position, capturing more than a 34.1% share.

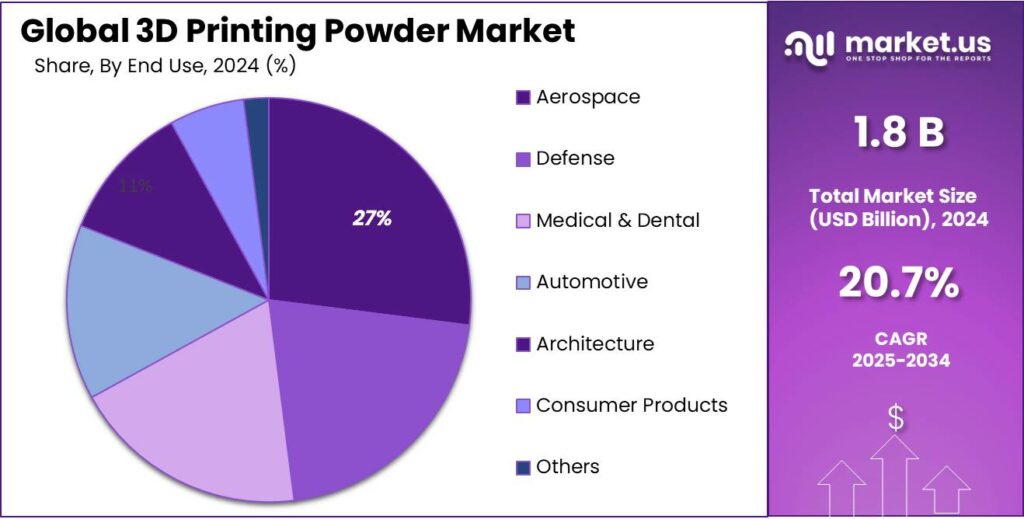

- Aerospace held a dominant market position, capturing more than a 27.8% share.

- North America emerged as the dominating region in the 3D printing powder market in 2024, capturing 34.80% of the global share with a market value of approximately USD 0.6 Billion.

By Type of Powder Analysis

Metal Powder dominates with 46.2% driven by its strength and precision in advanced manufacturing

In 2024, Metal Powder held a dominant market position, capturing more than a 46.2% share, supported by its widespread use in high-performance 3D printing applications across aerospace, automotive, healthcare, and industrial manufacturing. Metal powders are preferred because they deliver strong mechanical properties, high accuracy, and durability in printed parts, making them suitable for complex and load-bearing components.

During 2024, demand remained strong from aerospace and defense sectors where lightweight yet high-strength parts are essential for fuel efficiency and performance. Automotive manufacturers also increased adoption for prototyping and low-volume production of custom parts.

By Process Analysis

Selective Laser Melting / Direct Metal Laser Sintering leads with 34.1% driven by precision and strength needs

In 2024, Selective Laser Melting/ Direct Metal Laser Sintering held a dominant market position, capturing more than a 34.1% share, supported by its strong adoption in high-performance metal part manufacturing. This process was widely used because it allows complex geometries, high density, and excellent mechanical strength, which are difficult to achieve with traditional manufacturing methods. In 2024, demand was largely driven by aerospace, automotive, and medical sectors, where lightweight structures, design flexibility, and material efficiency are critical.

By End Use Analysis

Aerospace dominates with 27.8% supported by demand for lightweight and complex parts

In 2024, Aerospace held a dominant market position, capturing more than a 27.8% share, driven by the sector’s strong reliance on lightweight, high-performance components. Aerospace manufacturers used 3D printing powders to reduce part weight, improve fuel efficiency, and produce complex designs with fewer assemblies.

In 2024, metal powders were increasingly used for engine components, brackets, and structural parts. Entering 2025, the segment continued to grow as aircraft production rates improved and space-related programs expanded. The constant need for innovation, safety, and performance kept aerospace as the leading end-use segment in the 3D printing powder market.

Key Market Segments

By Type of Powder

- Metal Powder

- Plastic Powder

- Ceramic Powder

- Glass Powder

- Others

By Process

- Laser Sintering

- Selective Laser Melting/ Direct Metal Laser Sintering

- Electron Beam Melting

- Multi Jet Fusion

- High Speed Sintering

- Others

By End Use

- Aerospace

- Defense

- Medical & Dental

- Automotive

- Architecture

- Consumer Products

- Others

Emerging Trends

Closed-Loop Powder Reuse With Full Traceability

One of the latest trends in 3D printing powder is the move toward closed-loop powder management—meaning powders are tracked, handled, reused, and refreshed in a controlled way so manufacturers can cut waste without losing reliability. In real factories, powder is no longer treated like a “bag of material.” It is treated like a process input with a life story: where it came from, how it was stored, how many times it was cycled, what sieves and filters it passed through, and which builds it supported.

Sustainability pressure adds momentum. FAO has estimated that roughly one-third of food produced for human consumption is lost or wasted globally, equal to about 1.3 billion tonnes per year. When food companies and their equipment partners look for ways to reduce avoidable losses, reliability becomes a quiet priority: fewer breakdowns means fewer product dumps, fewer emergency clean-downs, and fewer scrapped batches caused by long stoppages.

Government-backed work is also nudging this trend forward by strengthening measurement and process control—two things that make powder reuse safer. In the U.S., NIST announced SBIR awards totaling over USD 1.8 million to 18 small businesses to advance technologies including additive manufacturing and standards-related R&D. This matters because better measurement tools and standards make it easier to set clear reuse limits, detect contamination risk earlier, and build trust in powder-based production.

Drivers

Fast, Hygienic Replacement Parts Drive Powder Demand

One major driving factor for 3D printing powder is the growing need for fast, reliable, and hygienic replacement parts in industries where downtime is expensive and safety rules are strict—especially food processing and packaging equipment. Many critical machine components are not “one size fits all.” When a small part fails, a whole line can stop. Powder-based additive manufacturing lets equipment makers and maintenance teams produce complex parts on demand, without waiting for long machining lead times or overseas shipments.

The scale of the food system makes this need feel very real. In the United States alone, USDA’s Food Safety and Inspection Service (FSIS) points to 7,100 USDA-regulated establishments, showing how large the regulated plant footprint is and how many sites depend on consistent equipment uptime. FSIS also reports its inspection personnel performed 7.7 million food safety and food defense procedures across those establishments—an indicator of how closely plants are monitored and how important process control and sanitation are.

Regulation strengthens this driver because printed parts used around food must not create new risks. In the EU, Regulation (EC) No 1935/2004 sets the framework for materials intended to come into contact with food, built around principles of safety and inertness. This kind of rule does not automatically “approve” 3D printing, but it pushes manufacturers toward better documentation, cleaner production routes, and materials discipline.

Government-backed innovation activity is helping this driver become more practical. For example, NIST announced awards of over USD 1.8 million to small businesses advancing areas including additive manufacturing. This type of funding matters because it supports better metrology, monitoring, and process controls—the “boring but essential” work that makes powder-based printing more repeatable and easier to qualify for demanding industrial environments.

Restraints

Strict Hygiene, Safety, and Qualification Burden

A major restraining factor for 3D printing powder is the high compliance and qualification burden that comes with handling fine powders—especially when printed parts may be used in or near food processing and packaging equipment. Industrial powders are not simple “raw materials.” They can pick up moisture, oxygen, or contaminants during shipping, storage, sieving, reuse, and cleaning. For food-adjacent applications, even a small risk of contamination or residue becomes a serious problem because plants are built around repeatable hygiene controls.

The inspection reality in food manufacturing reinforces why this restraint matters. USDA’s Food Safety and Inspection Service (FSIS) says it oversees about 7,100 USDA-regulated establishments, and its personnel conducted 7.7 million food safety and food defense procedures. In an environment that is audited and measured at this scale, manufacturers tend to be cautious about introducing any new process that could complicate sanitation or traceability.

Regulation adds another layer of friction. In the EU, Regulation (EC) No 1935/2004 sets the overall framework for food contact materials, focusing on safety and inertness so materials do not transfer substances to food at unsafe levels or change food quality. Even when a printed part is not directly touching food, companies often apply similar expectations because auditors and customers ask hard questions about risk.

Government work is trying to reduce these barriers, but the restraint remains real today. NIST, for example, announced SBIR awards of over USD 1.8 million to 18 small businesses to advance technologies including additive manufacturing and standards-related R&D. This kind of support helps improve measurement, repeatability, and process controls, which can make powder-based production easier to qualify.

Opportunity

Customized Spare Parts for Food Equipment Keeps Lines Running

A major growth opportunity for 3D printing powder lies in its ability to produce custom spare parts for food processing and packaging equipment quickly and without long waits for traditional machining or outsourced manufacturing. In food plants, every machine—from slicers to conveyors to sealing heads—has parts that wear out or break. When that happens, production can halt, leading to wasted product, delayed deliveries, and frustrated workers.

To grasp why this matters, think about the sheer size of the food processing world. The U.S. Department of Agriculture’s Food Safety and Inspection Service (FSIS) oversees roughly 7,100 regulated facilities, from slaughterhouses to ready-to-eat kitchens. Those plants need spare parts constantly. FSIS also reports its inspectors carry out approximately 7.7 million food safety and defense procedures each year, showing how intensely these plants are watched to keep food safe.

This opportunity is especially strong where hygiene and cleaning are strict. In food processing, even a tiny crease or poorly finished surface can trap residue and become a hazard in bacterial control. 3D printing powders allow designers to rethink parts so they have smooth transitions, fewer paused edges, and shapes that are easier to wash and sanitize. That matters because regulatory regimes like the European Union’s Regulation (EC) No 1935/2004 require that materials in contact with food must not transfer harmful substances or compromise food safety.

Public support for additive manufacturing research also makes this growth path more accessible. For example, in August 2025, the U.S. National Institute of Standards and Technology (NIST) announced awards totaling over USD 1.8 million to small businesses working on advanced manufacturing technologies, including 3D printing and related measurement challenges.

Regional Insights

North America leads with 34.80% share and USD 0.6 billion market value

North America emerged as the dominating region in the 3D printing powder market in 2024, capturing 34.80% of the global share with a market value of approximately USD 0.6 billion. This leading position was supported by strong adoption of additive manufacturing technologies across aerospace, healthcare, automotive, and industrial sectors.

The aerospace industry in North America relied heavily on advanced metal powders for lightweight, high-strength components that improve fuel efficiency and structural performance, while the medical segment expanded the use of customized implants and prosthetics produced with biocompatible powder materials.

Additionally, the automotive sector accelerated its integration of 3D printing powder solutions to support rapid prototyping and production of complex parts, contributing to increased regional powder consumption throughout 2024. Supportive government initiatives and industry collaborations further strengthened the ecosystem by encouraging innovation and technology adoption.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE is a global chemical company with a notable presence in the 3D printing powder sector through its Forward AM division. In 2024, BASF leveraged its global chemical manufacturing and resins expertise to supply polymer and specialty powders tailored to industrial additive manufacturing needs across automotive, aerospace, and consumer goods. BASF expanded production capacity at a new USD 60 million facility in Schwarzheide, Germany, by late 2024 to serve high-performance applications.

Evonik Industries AG of Germany is a major specialty chemicals firm that delivers a range of 3D printing powders, especially high-performance polymer powders under its INFINAM® brand. In 2024 and 2025, Evonik launched innovative formulations such as carbon-fiber reinforced and bio-based PA12 powders, offering up to 40 % higher strength-to-weight ratios and lower environmental impact.

General Electric participates in the 3D printing powder market through its GE Additive division, which focuses on atomised metal powders for aerospace and medical AM applications. In 2023-2025, GE Additive continued investing in manufacturing capabilities, including plans to invest over USD 450 million in facility upgrades, with a portion dedicated to additive materials production.

Top Key Players Outlook

- Arkema

- BASF SE

- ERASTEEL

- Evonik Industries AG

- ExOne

- GENERAL ELECTRIC

- GKN Powder Metallurgy

- Höganäs AB

- Metalysis

- Sandvik AB

Recent Industry Developments

Evonik’s work in material development reflected a clear focus on providing ready-to-use, high-performance 3D printing powders that balance mechanical strength, recyclability, and industrial scalability. Its broader Smart Materials division, which contributed €4.45 billion in sales in 2024 within a €15.2 billion group revenue, underlined the strategic importance of additive manufacturing materials within the company’s portfolio.

ExOne’s printer platforms, including the X1 25PRO™ series, were designed to process a wide range of industrial powders – from stainless steels like 316L and 304L to tool steels and high-performance alloys – with particle sizes as small as 5–10 microns, supporting high-density, precision parts production.

Report Scope

Report Features Description Market Value (2024) USD 1.8 Bn Forecast Revenue (2034) USD 11.8 Bn CAGR (2025-2034) 20.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type of Powder (Metal Powder, Plastic Powder, Ceramic Powder, Glass Powder, Others), By Process (Laser Sintering, Selective Laser Melting/ Direct Metal Laser Sintering, Electron Beam Melting, Multi Jet Fusion, High Speed Sintering, Others), By End Use (Aerospace, Defense, Medical & Dental, Automotive, Architecture, Consumer Products, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arkema, BASF SE, ERASTEEL, Evonik Industries AG, ExOne, GENERAL ELECTRIC, GKN Powder Metallurgy, Höganäs AB, Metalysis, Sandvik AB Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Arkema

- BASF SE

- ERASTEEL

- Evonik Industries AG

- ExOne

- GENERAL ELECTRIC

- GKN Powder Metallurgy

- Höganäs AB

- Metalysis

- Sandvik AB