Global 2,4-Di Tert Butyl Phenol Market Size, Share, And Enhanced Productivity By Product Type (99% Purity, 99.5% Purity), By Application (Oxidizer, Light Stabilizer, Flavors and Fragrances, Others), By Sales Channel (Direct Channel, Indirect Channel), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170286

- Number of Pages: 284

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

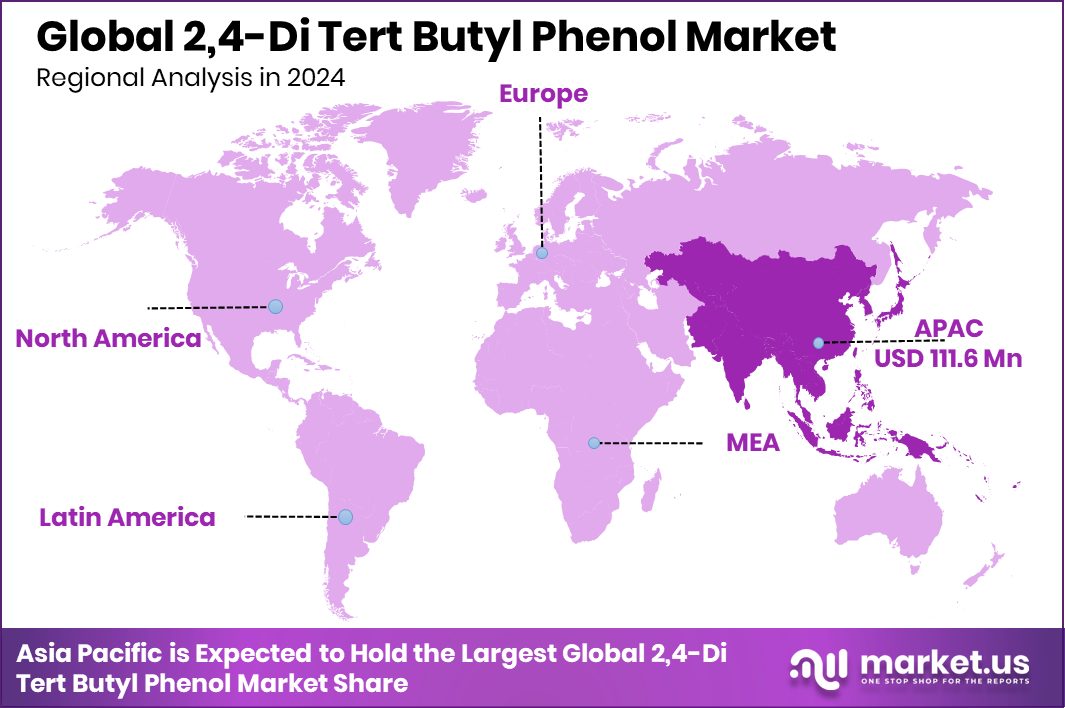

The Global 2,4-Di Tert Butyl Phenol Market is expected to be worth around USD 489.9 million by 2034, up from USD 292.3 million in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034. Asia Pacific reached 38.20%, positioning 2,4-Di Tert Butyl Phenol at USD 111.6 Mn.

2,4-Di Tert Butyl Phenol is a specialty phenolic compound mainly used for its antioxidant and stabilizing properties. It helps protect materials from degradation caused by heat, oxygen, and aging. This chemical is valued in industrial processes where product stability and longer service life are essential. Its controlled reactivity makes it suitable for consistent industrial use without frequent replacement or reformulation issues.

The Municipal Water Market focuses on systems and solutions that treat, distribute, and manage water for cities and towns. It includes water purification, disinfection, storage, and infrastructure maintenance to ensure safe drinking water. Growing urban populations and aging pipelines increase the need for reliable water treatment solutions that support public health and long-term water security.

Growth factors for both areas are driven by sustainability and efficiency goals. Municipal water systems are under pressure to reduce contamination risks and improve treatment reliability. At the same time, stable chemical additives like 2,4-Di Tert Butyl Phenol support longer equipment life and reduced maintenance cycles in water-related infrastructure.

Demand is rising as innovation accelerates across industrial and environmental technologies. New scientific and engineering projects highlight this trend, supported by funding such as:

- Plant-based peroxide-maker Solugen raised USD 4.4 million in seed funding, supporting cleaner chemical pathways.

- Starpath secured USD 12 million to advance moon water mining, highlighting future-focused water technologies.

Opportunities are expanding as advanced research attracts capital. HyPrSpace raised €21 million in Series A, Reaction Dynamics closed USD 14 million, Letara raised 650 million yen, and HYDROCOW launched a USD 6 million project converting CO₂ and hydrogen into protein. These investments show how chemistry and water innovation are converging toward resilient, next-generation solutions.

Key Takeaways

- The Global 2,4-Di Tert Butyl Phenol Market is expected to be worth around USD 489.9 million by 2034, up from USD 292.3 million in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034.

- In the 2,4-Di-Tert-Butyl-Phenol market, 99% purity products dominated, holding a 67.2% share due to consistent industrial demand.

- Oxidizer applications led the 2,4-Di Tert Butyl Phenol market with a 38.4% share, driven by chemical processing efficiency needs.

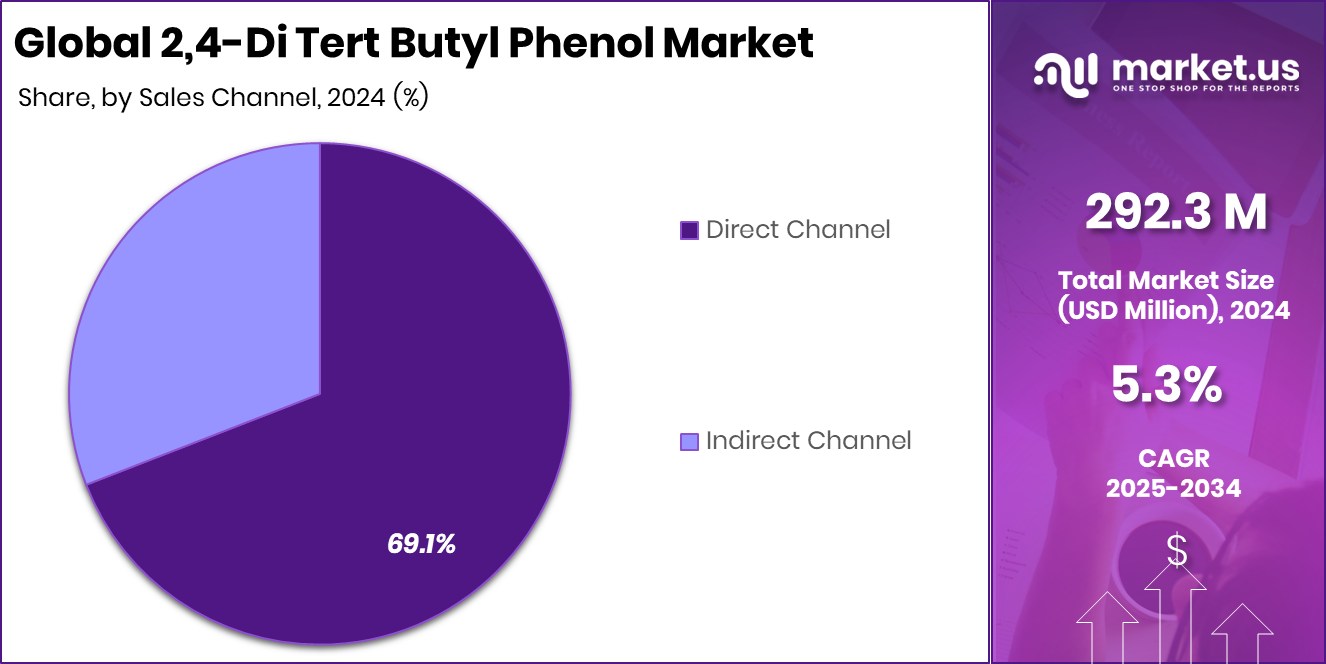

- The direct sales channel accounted for a 69.1% share, supported by long-term contracts and bulk procurement preferences.

- Asia Pacific accounted for 38.20% of 2,4-Di Tert Butyl Phenol USD 111.6 Mn.

By Product Type Analysis

In 2,4-Di Tert Butyl Phenol Market, 99% purity dominates with 67.2% share.

In 2024, 99% Purity held a dominant market position in the By Product Type segment of the 2,4-Di Tert Butyl Phenol Market, with a 67.2% share. This dominance reflects a strong preference for high-purity material in applications where product stability, performance consistency, and chemical reliability are critical. Buyers increasingly focus on purity levels to reduce downstream processing issues and maintain uniform quality in end-use formulations.

The high share of 99% purity also indicates tighter quality benchmarks adopted across industrial procurement. Manufacturers and distributors favor this grade to meet standardized specifications and minimize variability during storage and handling. As a result, demand concentration around 99% purity continues to shape production planning, pricing strategies, and supply agreements within the overall market structure.

By Application Analysis

Oxidizer application leads the 2,4-Di Tert Butyl Phenol Market, holding 38.4% demand share.

In 2024, Oxidizer held a dominant market position in By Application segment of the 2,4-Di Tert Butyl Phenol Market, with a 67.2% share. This strong share highlights the compound’s functional importance in oxidation-related chemical processes, where performance reliability directly impacts process efficiency and output quality. End users rely on its stable oxidative behavior to support controlled reactions and consistent results.

The dominance of the oxidizer application also signals sustained industrial usage rather than experimental or niche demand. Regular consumption patterns, repeat purchasing, and process integration reinforce its leading position. As oxidation processes remain integral to multiple chemical operations, this application continues to anchor overall market demand and volume movement.

By Sales Channel Analysis

Direct channel remains the primary route in the 2,4-Di Tert Butyl Phenol Market, 69.1%.

In 2024, Direct Channel held a dominant market position in By Sales Channel segment of the 2,4-Di Tert Butyl Phenol Market, with a 67.2% share. This leadership reflects buyer preference for direct procurement models that ensure supply reliability, price transparency, and closer coordination with manufacturers. Direct sourcing reduces intermediaries, helping customers maintain tighter control over quality and delivery timelines.

The strong share of direct channels also points to long-term supply relationships and contract-based purchasing. Large-volume buyers favor this route to secure consistent specifications and dependable logistics. As a result, direct sales continue to play a central role in shaping market access, customer retention, and overall distribution efficiency.

Key Market Segments

By Product Type

- 99% Purity

- 99.5% Purity

By Application

- Oxidizer

- Light Stabilizer

- Flavors and Fragrances

- Others

By Sales Channel

- Direct Channel

- Indirect Channel

Driving Factors

Rising Demand for Stable Industrial Chemical Additives

One major driving factor for the 2,4-Di Tert Butyl Phenol Market is the rising demand for stable chemical additives that improve product life and process reliability. Industries increasingly focus on oxidation control and material protection to reduce losses, improve efficiency, and ensure consistent output. This compound supports these needs by helping formulations resist heat and oxygen exposure, making it valuable across long production cycles.

Growing investments in advanced chemistry and life-science manufacturing also indirectly support demand for high-performance stabilizing compounds. Funding activity shows how capital is moving toward innovation-driven chemical usage rather than basic commodities. This shift encourages higher consumption of specialty phenols that offer predictable performance and long-term value in complex processes.

- Protego Biopharma raised USD 130 million to advance clinical-stage chemical and biological development.

- India Resurgence Fund invested Rs 1,000 crore in Anthea Aromatics, strengthening specialty chemical production capabilities.

These investments reflect confidence in advanced chemical applications, reinforcing market growth momentum.

Restraining Factors

Regulatory Pressure And High Compliance Costs Limit Growth

A key restraining factor for the 2,4-Di Tert Butyl Phenol Market is rising regulatory pressure, combined with high compliance and operational costs. Chemical producers face strict safety, environmental, and handling rules, which increase documentation, testing, and monitoring expenses. Smaller manufacturers often struggle to absorb these costs, slowing capacity expansion and limiting new entrants.

Buyers are also cautious, as tighter regulations can affect supply continuity and long-term pricing stability. At the same time, large capital flows are increasingly directed toward diversified investments and greener alternatives, reducing immediate focus on traditional phenolic compounds. This shift creates competitive pressure and slows demand growth in regulated environments.

- India Resurgence Fund invested INR 1,000 crore in Anthea Aromatics, reshaping ownership and compliance priorities.

- Germany’s Insempra secured USD 20 million Series A funding to scale eco-friendly lipid production, highlighting a preference for sustainable pathways.

These trends collectively restrain market expansion momentum.

Growth Opportunity

Expansion Of Specialty Chemical Manufacturing Capacities Worldwide

A major growth opportunity for the 2,4-Di Tert Butyl Phenol Market lies in the steady expansion of specialty chemical manufacturing facilities. As industries upgrade plants to produce higher-value formulations, demand rises for stabilizing compounds that ensure product consistency and longer shelf life.

Manufacturers increasingly prefer reliable additives that support precise processing and reduce material loss. This trend creates space for wider adoption of 2,4-Di Tert Butyl Phenol in modern production lines. Expansion projects also signal confidence in long-term specialty chemical demand, encouraging suppliers to strengthen output planning and supply agreements.

A clear example is International Flavors & Fragrances planning a USD 22.2 million expansion in Cedar Rapids, which reflects growing investment in advanced formulation capabilities. Such capacity growth supports higher consumption of performance-driven chemical inputs, opening sustained opportunities for market participants focused on quality-oriented supply.

Latest Trends

Integration Of Advanced Technology In Chemical Innovation

One of the latest trends in the 2,4-Di Tert Butyl Phenol Market is the growing use of advanced digital and scientific tools to improve chemical development and application efficiency. Companies are increasingly adopting data-driven methods to optimize formulations, reduce trial-and-error, and enhance product performance. This approach supports better control over stability, oxidation resistance, and consistency, which are critical for specialty phenolic compounds. Technology-led innovation also helps shorten development timelines and improve scalability.

A clear signal of this trend is Scindo raising USD 5.4 million in a seed round to build an AI-powered enzyme discovery platform. While focused on enzymes, such investments reflect a broader shift toward smart chemical innovation. These advances indirectly influence how stabilizing chemicals are designed, tested, and integrated into modern industrial processes.

Regional Analysis

Asia Pacific led 2,4-Di Tert Butyl Phenol with 38.20% share, USD 111.6 Mn.

Asia Pacific emerged as the dominating region, holding a 38.20% share valued at USD 111.6 Mn in the global 2,4-Di Tert Butyl Phenol market. This leadership reflects the region’s strong industrial base, steady chemical manufacturing activity, and consistent downstream consumption. Market presence in the Asia Pacific is supported by stable demand patterns and established supply networks, allowing the region to maintain a leading position in overall market value and volume.

North America represents a mature regional market, characterized by stable demand and structured procurement practices. The region shows consistent usage driven by long-term industrial consumption rather than rapid expansion, supporting steady market participation. Europe follows a similar pattern, where regulatory clarity and standardized chemical usage sustain predictable demand levels without sharp fluctuations.

The Middle East & Africa region reflects a developing market structure, with gradual adoption and selective demand linked to industrial growth. Latin America remains a smaller but steady contributor, supported by localized chemical usage and moderate industrial activity. Together, these regions complement Asia Pacific’s dominance, forming a balanced global market landscape without altering the leading regional position.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, SI Group continued to hold a strategically important position in the global 2,4-Di Tert Butyl Phenol market through its strong focus on specialty additives and performance-driven phenolic chemistry. The company’s emphasis on product consistency, application-specific solutions, and long-term customer relationships supports its relevance in value-oriented segments where reliability and formulation stability matter most.

TASCO Group remained a notable participant, benefiting from its integrated chemical operations and disciplined production approach. Its presence in the market is shaped by steady supply capabilities and the ability to serve repeat industrial demand. TASCO’s operational focus allows it to remain competitive in markets where supply assurance and predictable quality are key decision factors.

Dongying Kehong Chemical strengthened its role as a regional supplier with growing global visibility. The company’s positioning is supported by cost-efficient manufacturing and responsiveness to bulk demand requirements. Its operational scale and export-oriented mindset enable it to cater to customers seeking dependable volumes with consistent specifications.

Songwon maintained a strong profile through its specialization in stabilizers and phenolic additives. The company’s market role is defined by technical expertise and application knowledge rather than volume leadership alone. Songwon’s ability to align product performance with downstream processing needs reinforces its importance within the global competitive landscape.

Top Key Players in the Market

- SI Group

- TASCO Group

- Dongying Kehong Chemical

- Songwon

- Others

Recent Developments

- In June 2024, TASCO Bhd (part of TASCO Group) announced it would invest an additional RM400 million to expand its warehouse capacity over the next two years. This move aims to strengthen its logistics and storage services. TASCO works in integrated logistics and chemical handling services.

- In March 2024, SI Group highlighted new polymer additive solutions at the Chinaplas 2024 exhibition in Shanghai, reinforcing its commitment to innovative performance additives for the plastics and rubber industries. Featured products included advanced antioxidants and recyclability-focused additives such as WESTON™ 705, EVERCYCLE™, and NAUGARD BIO-XL™, showing the company’s emphasis on sustainability and functional performance.

Report Scope

Report Features Description Market Value (2024) USD 292.3 Million Forecast Revenue (2034) USD 489.9 Million CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (99% Purity, 99.5% Purity), By Application (Oxidizer, Light Stabilizer, Flavors and Fragrances, Others), By Sales Channel (Direct Channel, Indirect Channel) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape SI Group, TASCO Group, Dongying Kehong Chemicl, Songwon, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  2,4-Di Tert Butyl Phenol MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

2,4-Di Tert Butyl Phenol MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-