Global 1,8-Cineole (CAS 470-82-6) Market Market Size, Share, And Enhanced Productivity By Source(Natural, Synthetic), By Application (Pharmaceuticals, Cosmetics and Personal Care, Aromatherapy, Household Products, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170483

- Number of Pages: 318

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

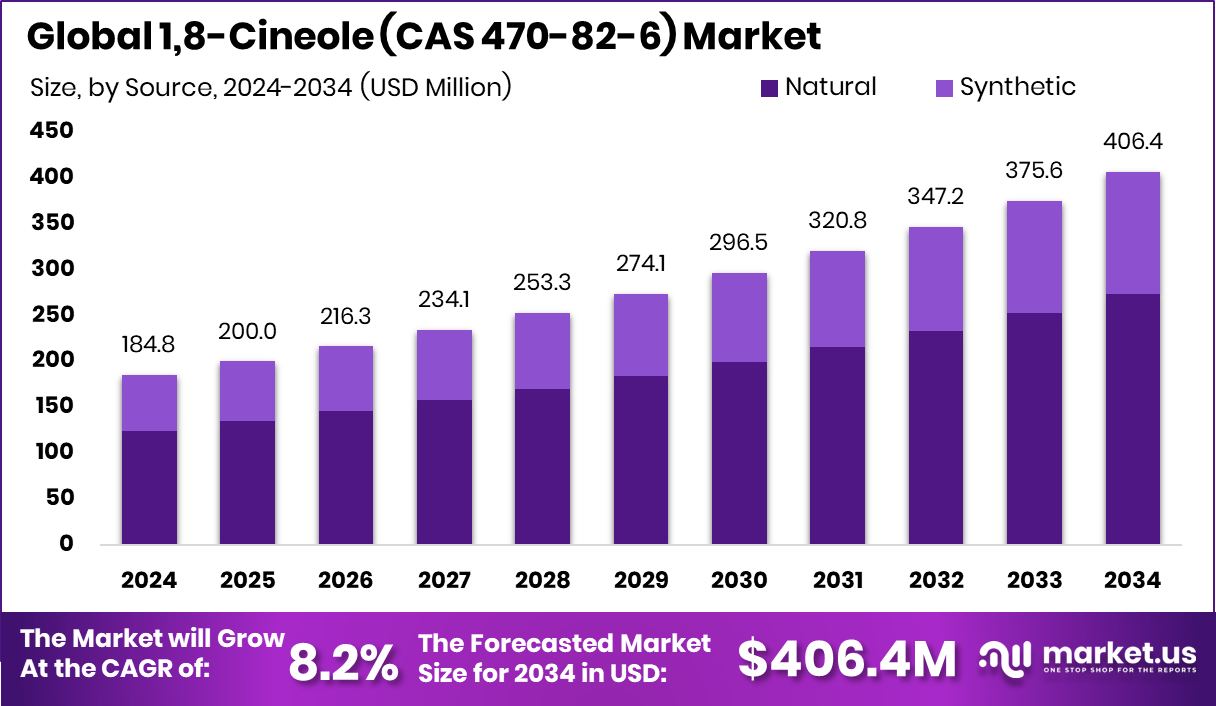

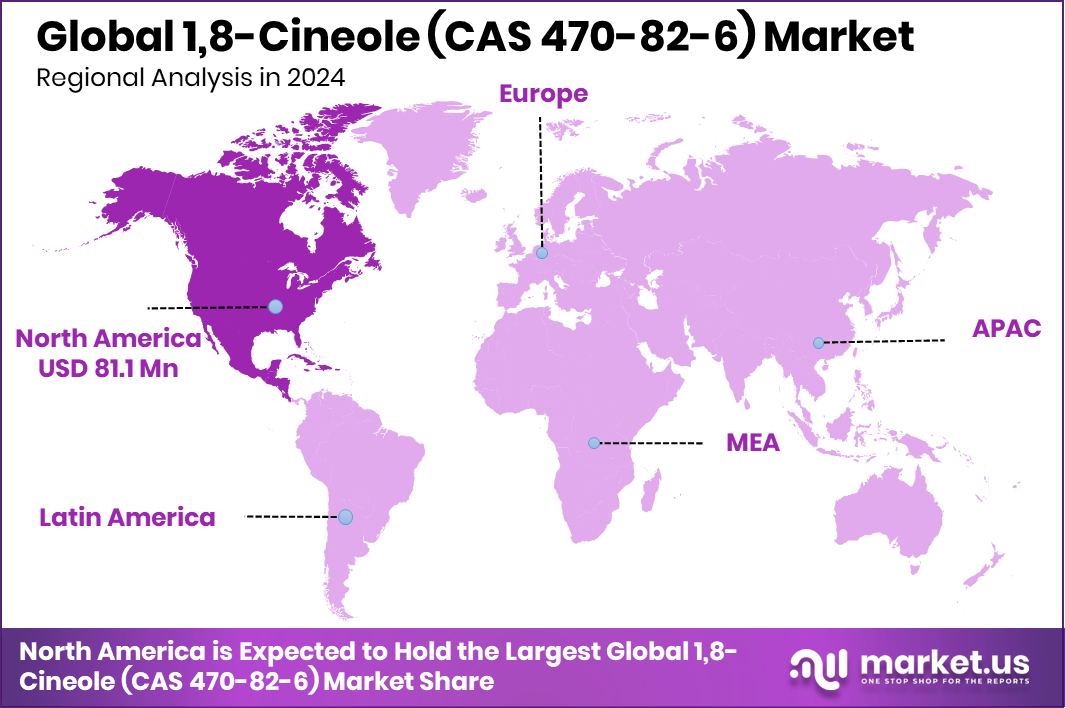

The Global 1,8-Cineole (CAS 470-82-6) Market is expected to be worth around USD 406.4 million by 2034, up from USD 184.8 million in 2024, and is projected to grow at a CAGR of 8.2% from 2025 to 2034. North America accounts for USD 81.1 Mn, reflecting a dominant 43.90% market share.

1,8-Cineole, also known as eucalyptol, is a naturally occurring organic compound mainly extracted from eucalyptus oil. It is widely used for its fresh aroma and functional properties in pharmaceuticals, personal care products, cosmetics, and wellness formulations. Its role as a fragrance ingredient and active component makes it valuable in both medicinal and beauty applications.

The 1,8-Cineole market represents the global production, processing, and supply of this compound across end-use industries such as beauty, personal care, healthcare, and food-related applications. Demand is closely linked to growth in cosmetics, skincare, aromatherapy, and hygiene products, where natural and plant-based ingredients are increasingly preferred.

Market growth is driven by rising investments in beauty and personal care manufacturing, particularly products emphasizing natural ingredients and sensory appeal. Increased use of fragrance-active compounds in skincare, haircare, and wellness products supports steady consumption of 1,8-Cineole.

Demand continues to strengthen as FMCG and beauty brands expand portfolios and distribution. Recent capital inflows highlight this momentum:

- Melt&Marble secured €7.3 million (US$8.5 million) to scale fermentation-based ingredients for beauty and food uses.

- Beauty and personal care brands raised over Rs 200 crore and $30 million across multiple funding rounds to expand production, retail presence, and technology.

Ongoing acquisitions worth Rs 4,000 crore by FMCG players and fresh funding for emerging beauty brands signal long-term opportunities for ingredient suppliers. As brands focus on innovation, premium formulations, and natural sensory profiles, 1,8-Cineole remains well-positioned to benefit from sustained industry expansion.

Key Takeaways

- The Global 1,8-Cineole (CAS 470-82-6) Market is expected to be worth around USD 406.4 million by 2034, up from USD 184.8 million in 2024, and is projected to grow at a CAGR of 8.2% from 2025 to 2034.

- In 2024, Natural sources dominated the 1,8-Cineole market with a 67.3% share globally due to sustainability.

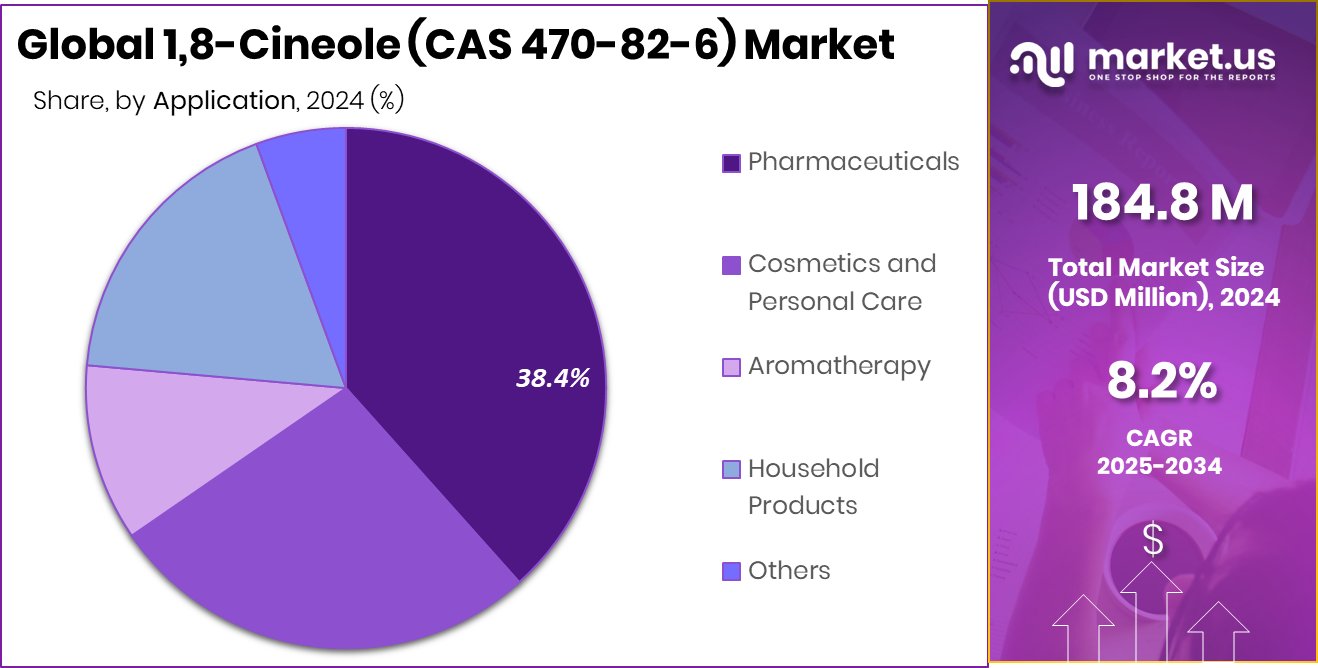

- Pharmaceuticals led applications in the 1,8-Cineole market, holding 38.4% share, driven by demand worldwide.

- Strong regional demand positions North America at 43.90%, representing a USD 81.1 Mn market.

By Source Analysis

In the 1,8-Cineole (CAS 470-82-6) market, natural sources dominate with a 67.3% share.

In 2024, Natural held a dominant market position in the By Source segment of the 1,8-Cineole (CAS 470-82-6) Market, with a 67.3% share. This leadership reflects a strong preference for naturally derived 1,8-Cineole, primarily obtained from plant-based essential oils, which are widely accepted across regulated and consumer-facing industries. Buyers consistently value natural sourcing due to its established origin, consistent chemical profile, and long-standing use history.

The dominance of the natural source segment is further supported by its alignment with quality expectations and regulatory acceptance in downstream applications. Natural 1,8-Cineole is often favored where purity perception, traceability, and formulation reliability are critical. As a result, the segment maintains strong demand stability, reinforcing its leading share within the overall market structure.

By Application Analysis

Pharmaceutical applications lead the 1,8-Cineole market, accounting for 38.4% of demand globally.

In 2024, Pharmaceuticals held a dominant market position in the By Application segment of the 1,8-Cineole (CAS 470-82-6) Market, with a 38.4% share. This position highlights the compound’s established role in pharmaceutical formulations, where it is widely used for its functional properties and compatibility with medicinal products. Its consistent performance profile supports its continued adoption in drug development and therapeutic preparations.

The pharmaceutical segment benefits from structured demand driven by formulation standards and recurring usage across healthcare products. The dominance of this application reflects sustained reliance on 1,8-Cineole within regulated pharmaceutical environments, where quality consistency and functional reliability remain essential. This steady utilization underpins the segment’s leading contribution to overall market demand.

Key Market Segments

By Source

- Natural

- Synthetic

By Application

- Pharmaceuticals

- Cosmetics and Personal Care

- Aromatherapy

- Household Products

- Others

Driving Factors

Rising Beauty And Fragrance Industry Investments Drive Demand

One of the key driving factors for the 1,8-Cineole (CAS 470-82-6) market is the rapid growth of the fragrance and beauty industry, supported by strong investment activity. 1,8-Cineole is widely used for its fresh, eucalyptus-like aroma in perfumes, personal care products, and wellness formulations. As brands focus on premium scents and natural aromatic profiles, the demand for high-quality fragrance ingredients continues to rise steadily.

- Fragrance brand Phool raised $8 million in a Series A funding round, supporting expansion of its product portfolio and strengthening its sourcing of aromatic ingredients.

- India Resurgence Fund invested Rs 1,000 crore in Anthea Aromatics, enabling capacity expansion and operational scaling in aroma chemical production.

These investments reflect increasing confidence in fragrance manufacturing and supply capabilities. As fragrance brands scale operations and innovate with new formulations, consistent demand for aroma compounds like 1,8-Cineole is expected to remain strong, supporting sustained market growth.

Restraining Factors

Limited Scaling Of Niche Natural Fragrance Brands

A key restraining factor for the 1,8-Cineole (CAS 470-82-6) market is the limited scale and cautious expansion of niche natural fragrance and personal care brands. While demand exists, many emerging brands operate with controlled budgets and small production volumes. This restricts bulk procurement of aroma ingredients like 1,8-Cineole, slowing large-scale demand growth. Smaller brands often prioritize selective formulations and gradual market entry, which limits the rapid consumption expansion of specialty fragrance compounds.

- Secret Alchemist secured $500K in seed funding, reflecting early-stage expansion and careful investment planning.

- Samantha Prabhu joined Secret Alchemist as co-founder alongside the $500,000 seed funding, strengthening brand visibility, but still indicating a cautious growth phase.

Such funding levels support brand building and niche product launches, but they also highlight restrained purchasing capacity. This slower scaling trend can temporarily limit demand acceleration for 1,8-Cineole in premium fragrance formulations.

Growth Opportunity

Expansion Of Herbal And Aromatic Processing Infrastructure

A major growth opportunity for the 1,8-Cineole (CAS 470-82-6) market lies in the development of large-scale herbal and aromatic processing infrastructure. 1,8-Cineole is mainly derived from eucalyptus and other aromatic plants, making it closely linked to organized cultivation and processing ecosystems. As governments and regional bodies focus on strengthening herbal value chains, the availability and quality of raw materials for aroma compounds are expected to improve, supporting long-term market growth.

- Uttarakhand’s herbal and aromatic park projects, valued at Rs 400 crore, are awaiting fund support to accelerate development and infrastructure creation.

Once operational, such parks can enable centralized extraction, processing, and quality control of aromatic compounds. This would reduce supply bottlenecks, improve consistency, and encourage wider industrial use of 1,8-Cineole across pharmaceuticals, personal care, and wellness applications, creating strong future demand potential.

Latest Trends

Shift Toward Sustainable And Bio-Based Aroma Ingredients

A key latest trend in the 1,8-Cineole (CAS 470-82-6) market is the growing shift toward sustainable and bio-based aroma production. Brands and formulators are increasingly looking for cleaner, environmentally responsible aroma ingredients that align with sustainability goals. This trend is encouraging innovation in fermentation and biotech-based aroma solutions, which can offer consistent quality while reducing dependence on traditional extraction methods.

- Copenhagen-based EvodiaBio secured €7 million to accelerate development of sustainable aroma ingredients, aiming to transform how aroma compounds are produced.

Such advancements are reshaping supplier strategies and buyer expectations across the fragrance, personal care, and wellness industries. As sustainability becomes a core purchasing criterion, naturally inspired and bio-engineered aroma compounds like 1,8-Cineole are gaining stronger attention, positioning this trend as a long-term driver of product innovation and market differentiation.

Regional Analysis

North America leads the 1,8-Cineole market with 43.90% share at USD 81.1 Mn.

North America dominates the 1,8-Cineole (CAS 470-82-6) market, holding a leading 43.90% share valued at USD 81.1 Mn, reflecting its strong industrial structure and consistent downstream demand. The region benefits from well-established pharmaceutical, personal care, and healthcare manufacturing bases, which continue to drive stable consumption of 1,8-Cineole.

Europe represents a mature market characterized by steady demand from regulated end-use industries, supported by structured quality standards and long-term formulation usage. Asia Pacific shows expanding market presence due to its broad manufacturing ecosystem and growing application base across consumer and industrial segments, positioning the region as an important demand center.

The Middle East & Africa market remains comparatively smaller but demonstrates gradual uptake, driven by increasing product awareness and expanding distribution networks. Latin America contributes steadily to global demand, supported by developing pharmaceutical and wellness industries and rising utilization of essential oil derivatives.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Musks & Fragrance holds a focused position in the global 1,8-Cineole (CAS 470-82-6) market through its strong alignment with aroma, flavor, and specialty ingredient requirements. The company’s strength lies in maintaining consistent product characteristics that meet formulation expectations across fragrance and allied applications. Its market presence benefits from long-term customer relationships and a clear understanding of quality-driven demand, allowing it to remain relevant in a niche yet stable segment of the value chain.

Extrasynthese is viewed as a technically oriented supplier with a clear emphasis on precision, purity, and controlled production standards. In the 1,8-Cineole market, the company’s analytical approach supports applications where specification accuracy and repeatability are critical. Its positioning reflects a strategic focus on serving customers that value detailed product documentation and reliable batch consistency, reinforcing its role in specialized and regulated end-use environments.

Parchem plays a distribution-centric role, connecting global supply with diverse regional demand for 1,8-Cineole. The company’s strength lies in market access, logistics coordination, and customer support, which help streamline procurement for downstream users. By offering dependable availability and technical coordination, Parchem contributes to market stability and facilitates broader adoption across multiple application segments.

Top Key Players in the Market

- Musks & Fragrance

- Extrasynthese

- Parchem

- Jiangxi Baicao Pharmaceutical Co. Ltd

- Others

Recent Developments

- In July 2025, Jiangxi Baicao Pharmaceutical Co. Ltd, a China-based manufacturer of natural essential oils and plant extracts, showcased its range of essential oil products at the 2025 European International Nutrition and Health Food exhibition, highlighting its expanded product portfolio and global outreach efforts. This participation reflects the company’s active engagement in international trade events to promote its oils used in medicine, cosmetics, food additives, and wellness industries, including products potentially relevant to 1,8-Cineole production derived from eucalyptus oils.

Report Scope

Report Features Description Market Value (2024) USD 184.8 Million Forecast Revenue (2034) USD 406.4 Million CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source(Natural, Synthetic), By Application (Pharmaceuticals, Cosmetics and Personal Care, Aromatherapy, Household Products, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Musks & Fragrance, Extrasynthese, Parchem, Jiangxi Baicao Pharmaceutical Co. Ltd, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  1,8-Cineole (CAS 470-82-6) MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

1,8-Cineole (CAS 470-82-6) MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Musks & Fragrance

- Extrasynthese

- Parchem

- Jiangxi Baicao Pharmaceutical Co. Ltd

- Others