Global 1,4-Dichlorobenzene Market Size, Share, And Business Benefits By Purity (Purity Greater Than 99.0%, Purity Less Than 99.9%), By Application (PPS resin, Deodorizer, Insecticide, Others), By End user (Automotive, Electronic and Electrical, Consumer Goods, Agrochemical, Dyes and Pigments, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2025

- Report ID: 140177

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

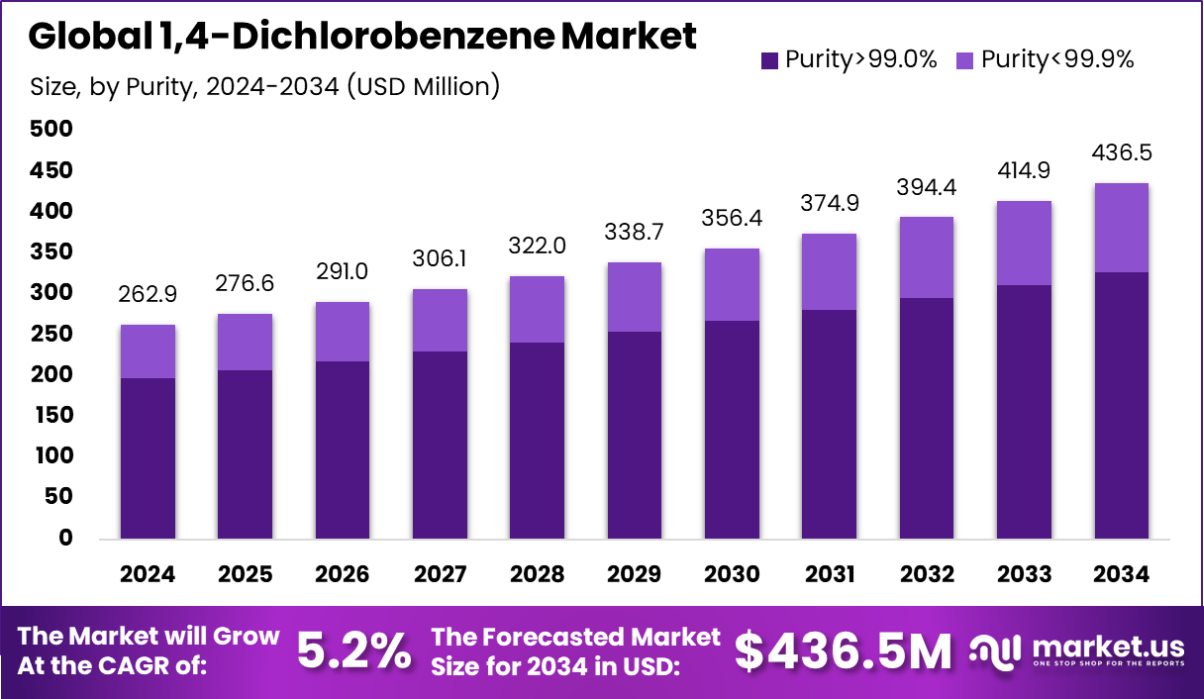

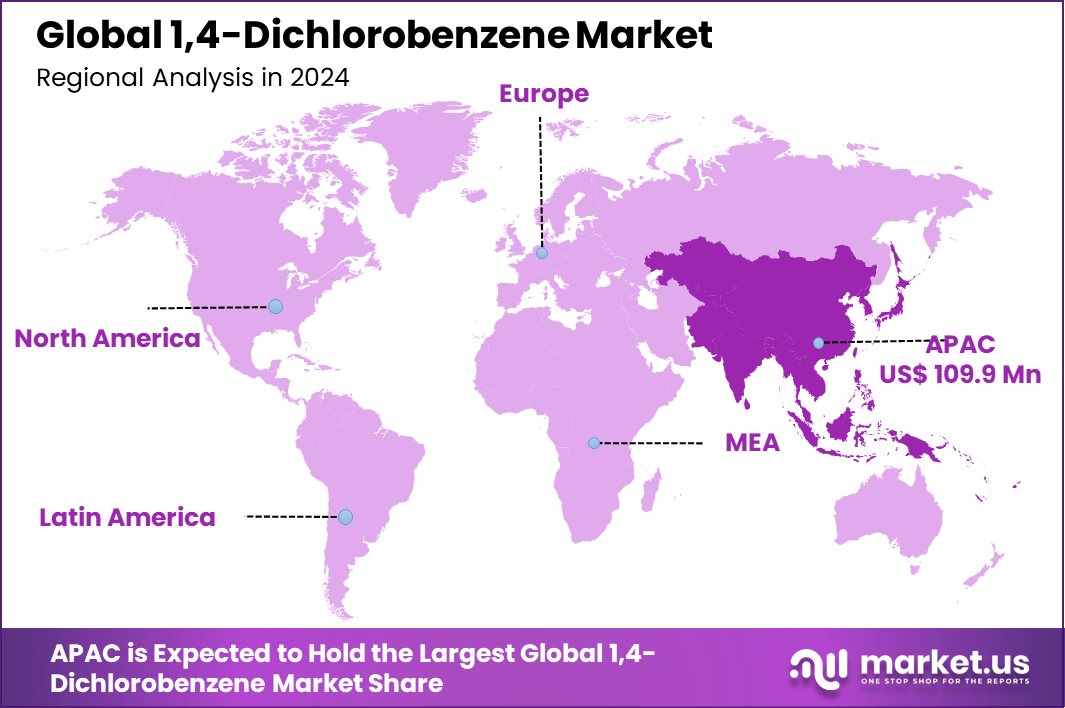

Global 1,4-Dichlorobenzene Market is expected to be worth around USD 436.5 Million by 2034, up from USD 262.9 Million in 2024, and grow at a CAGR of 5.2% from 2025 to 2034. Asia-Pacific held 38.5% of the 1,4-Dichlorobenzene market, USD 109.9 Mn.

1,4-Dichlorobenzene (C6H4Cl2) is a chemical compound with a benzene ring substituted by two chlorine atoms at the para positions. It is primarily used as a fumigant, deodorizer, and precursor in the production of various chemicals, including pesticides, perfumes, and plastics. 1,4-Dichlorobenzene is typically found in products like air fresheners, mothballs, and industrial cleaning agents. Due to its strong odor, it is often utilized in odor control applications.

The growth of the 1,4-Dichlorobenzene market is driven by increasing demand in sectors such as agriculture, textiles, and consumer products. The rise in consumer awareness regarding cleanliness and hygiene has led to higher consumption of mothballs, air fresheners, and other products containing 1,4-dichlorobenzene. Additionally, its use in agricultural applications as a pesticide and fungicide has expanded the market’s potential, especially in developing regions where agriculture is a key economic sector.

The demand for 1,4-Dichlorobenzene is fueled by its widespread use in domestic and industrial applications. As consumers continue to seek more efficient and long-lasting odor control products, the compound’s role in household goods remains crucial. In industrial settings, the need for versatile solvents and deodorizers further supports market demand, particularly in countries with growing manufacturing and production capacities.

There are significant opportunities for market expansion driven by innovation in product formulations and emerging markets. Companies focused on developing environmentally friendly alternatives or improving the safety profile of 1,4-Dichlorobenzene can capture a larger share of the market. Additionally, the increasing adoption of 1,4-Dichlorobenzene in niche industrial applications such as electronics and coatings presents new growth avenues.

Key Takeaways

- Global 1,4-Dichlorobenzene Market is expected to be worth around USD 436.5 Million by 2034, up from USD 262.9 Million in 2024, and grow at a CAGR of 5.2% from 2025 to 2034.

- Purity ≥99.0% of 1,4-Dichlorobenzene comprises 74.3% of the total global market share in chemicals.

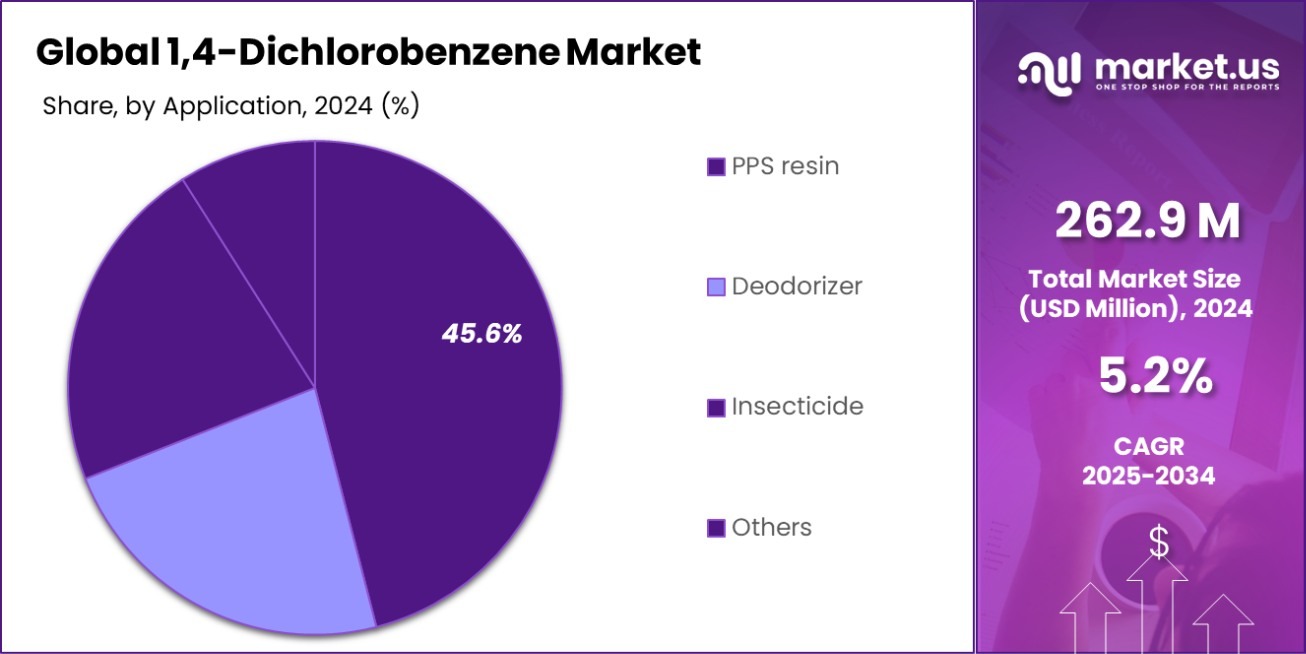

- 1,4-Dichlorobenzene’s application in PPS resin is crucial, with 45.6% of market share in this sector.

- Automotive industries utilize 1,4-Dichlorobenzene, making up 42.1% of total market consumption and applications.

- In 2024, the Asia-Pacific region held 38.5% of the 1,4-Dichlorobenzene market, valued at USD 109.9 million.

By Purity Analysis

High-purity 1,4-Dichlorobenzene, ≥99.0%, remains dominant in various chemical applications, leading market demand trends.

In 2024, Purity ≥99.0% held a dominant market position in the By Purity segment of the 1,4-Dichlorobenzene Market, with a 49.2% share. The higher purity grade, typically utilized in industries requiring stringent standards, accounted for the majority of market consumption, driven by applications in chemical synthesis, electronics, and pharmaceuticals. This segment’s significant share reflects the growing demand for high-quality 1,4-Dichlorobenzene in precision applications where even trace impurities could affect performance or product quality.

Conversely, the Purity <99.0% segment, while smaller, still captured a notable portion of the market. These grades are commonly used in more general industrial applications where purity requirements are less stringent, including in the manufacturing of solvents and as an intermediate in various chemical processes.

As industries continue to prioritize cost-efficiency alongside performance, the Purity <99.0% segment is expected to maintain steady demand in 2024, albeit at a smaller scale compared to the higher purity variants. The overall market dynamics are indicative of a bifurcated demand, with a clear preference for Purity ≥99.0% in critical applications, while the lower purity grades cater to more routine industrial uses.

By Application Analysis

PPS Resin accounts for 45.6% of 1,4-dichlorobenzene market applications, driving industrial demand significantly.

In 2024, PPS Resin held a dominant market position in the By Application segment of the 1,4-Dichlorobenzene Market, with a 45.6% share. This application is primarily driven by the increasing demand for high-performance materials in various industries such as automotive, electronics, and industrial manufacturing.

PPS resins, known for their superior thermal stability, chemical resistance, and mechanical properties, are widely used in the production of electronic components, automotive parts, and filtration systems, making them the largest contributor to the 1,4-Dichlorobenzene market in this segment.

The Deodorizer application followed with a considerable share in 2024. 1,4-Dichlorobenzene is commonly used in air fresheners and deodorizers, especially in solid air fresheners products like mothballs and deodorizer blocks. This segment benefits from the continued demand in residential and commercial spaces, where odor control is a significant concern. As environmental and health considerations around volatile organic compounds (VOCs) grow, the deodorizer sector is evolving with an increasing focus on safer alternatives.

Insecticide applications, while smaller in comparison, also contribute to the market. 1,4-Dichlorobenzene is used as an active ingredient in pest control products, particularly in the agricultural and household sectors, where its efficacy against various insects continues to drive demand. While this segment’s share remains relatively modest, it plays a key role in maintaining the overall balance in the market.

By End-User Analysis

The automotive sector drives 42.1% of the 1,4-Dichlorobenzene market’s end-user demand globally.

In 2024, Automotive held a dominant market position in the By End-User segment of the 1,4-Dichlorobenzene Market, with a 42.1% share. This can be attributed to the widespread use of 1,4-dichlorobenzene in automotive applications, particularly in the production of high-performance parts and components.

The chemical’s excellent resistance to heat, chemicals, and wear makes it an ideal choice for automotive manufacturing, where durability and performance are critical. The growing demand for advanced automotive systems, particularly in electric and hybrid vehicles, further supports the dominance of this segment.

The Electronic and Electrical sector followed closely behind, driven by the increasing need for high-quality materials in electronic devices and components. 1,4-Dichlorobenzene is often used in the production of insulating materials and high-performance coatings, which are essential in ensuring the reliability and longevity of electronic products. The rapid growth of the electronics industry is expected to continue supporting the demand in this segment.

The Consumer Goods sector also showed significant growth, with 1,4-dichlorobenzene being used in various household and personal care products, including deodorants and air fresheners. Meanwhile, other sectors such as Agrochemicals, Dyes and Pigments, and Pharmaceuticals contributed to the overall market but with comparatively smaller shares, catering to more specific industrial needs.

Key Market Segments

By Purity

- Purity>99.0%

- Purity<99.9%

By Application

- PPS resin

- Deodorizer

- Insecticide

- Others

By End-user

- Automotive

- Electronic and Electrical

- Consumer Goods

- Agrochemical

- Dyes and Pigments

- Pharmaceuticals

- Others

Driving Factors

Rising Demand in Automotive Industry Drives Growth

One of the key driving factors for the 1,4-dichlorobenzene market is the increasing demand in the automotive industry. As manufacturers seek high-performance materials that offer durability and resistance to heat and chemicals, 1,4-dichlorobenzene has become a crucial component in automotive production.

It is used in various automotive parts, including engine components and electrical systems. With the shift toward electric vehicles and advancements in automotive technology, the demand for high-quality materials like 1,4-dichlorobenzene is expected to continue growing, supporting long-term market growth.

Restraining Factors

Environmental Concerns Limit 1,4-Dichlorobenzene Usage

A significant restraining factor in the 1,4-Dichlorobenzene market is growing environmental concerns regarding its use. The chemical is classified as a volatile organic compound (VOC), which can contribute to air pollution and has been linked to health risks, including respiratory issues and skin irritation.

As governments and regulatory bodies tighten environmental standards and enforce stricter VOC limits, manufacturers are being pressured to reduce or find alternatives to 1,4-Dichlorobenzene. This shift towards safer, more environmentally friendly options could slow market growth in the coming years.

Growth Opportunity

Expansion of the Electric Vehicle Market Presents an Opportunity

A major growth opportunity for the 1,4-Dichlorobenzene market lies in the expansion of the electric vehicle (EV) market. As the demand for electric vehicles continues to rise, the need for high-performance, durable materials increases.

1,4-Dichlorobenzene, with its excellent heat resistance and chemical stability, is well-suited for use in various components within EVs, including batteries, electrical systems, and insulation. This growing shift towards sustainable automotive solutions presents a significant opportunity for manufacturers of 1,4-Dichlorobenzene to tap into the burgeoning EV market and drive future demand.

Latest Trends

Shift Towards Safer, Eco-Friendly Alternatives Emerging

A notable trend in the 1,4-Dichlorobenzene market is the increasing shift toward safer and more environmentally friendly alternatives. As concerns around the health and environmental impacts of volatile organic compounds (VOCs) rise, industries are exploring options that offer similar performance without the associated risks.

This trend is particularly evident in sectors like consumer goods, automotive, and electronics, where manufacturers are prioritizing sustainability. Companies are focusing on developing new formulations or substituting 1,4-Dichlorobenzene with chemicals that meet stricter environmental regulations and consumer demand for greener solutions.

Regional Analysis

In 2024, the Asia-Pacific region held 38.5% of the 1,4-Dichlorobenzene market, valued at USD 109.9 million.

In 2024, the 1,4-Dichlorobenzene market demonstrated strong regional variations, with Asia-Pacific holding the dominant share at 38.5%, valued at USD 109.9 Mn. This dominance can be attributed to the region’s rapidly expanding industrial base, particularly in the automotive, electronics, and consumer goods sectors, where 1,4-Dichlorobenzene is widely used. China and India, in particular, are leading contributors to the growth, driven by large-scale manufacturing and increasing demand for high-performance materials.

North America and Europe together account for a significant portion of the market, though at comparatively smaller shares than Asia-Pacific. North America’s demand is primarily driven by automotive and electronic applications, with the U.S. being a key player in the market. Europe follows closely, with substantial use of 1,4-Dichlorobenzene in consumer goods and agrochemical industries, supported by stringent regulatory frameworks encouraging safer formulations.

The Middle East & Africa region shows a moderate market share, with demand primarily coming from the chemical and petrochemical industries, where 1,4-Dichlorobenzene is used as a solvent and intermediate. Latin America remains the smallest market, with limited growth attributed to its relatively smaller industrial footprint, but it is expected to see gradual increases in demand over the forecast period.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global 1,4-Dichlorobenzene market continues to be shaped by the strategic positioning and innovations of key players such as Aarti Industries Limited (AIL), ABI Chemicals, Alfa Aesar, ChemieOrganic Chemicals Pvt. Ltd., Chirag Organic Pvt Ltd., ConierChem, and Zhejiang Fusheng Holding Group Co., Ltd.

These companies are playing a crucial role in addressing the growing demand for high-quality 1,4-Dichlorobenzene across multiple industries, including automotive, electronics, and consumer goods.

Aarti Industries, one of the prominent players, has maintained a significant presence in the market, leveraging its strong manufacturing capabilities and extensive distribution network. The company is expected to continue expanding its market share, especially in Asia-Pacific, by capitalizing on the rising demand for high-performance chemicals in automotive and industrial applications.

ABI Chemicals and Alfa Aesar, known for their high-purity chemical production, are also contributing to market growth, particularly by catering to industries with strict quality and safety requirements, such as pharmaceuticals and electronics.

ChemieOrganic Chemicals Pvt. Ltd., Chirag Organic Pvt Ltd., and ConierChem, while smaller players are focusing on innovation and cost-effective production to cater to niche applications in agrochemical and consumer goods sectors. Zhejiang Fusheng Holding Group, with its robust manufacturing capabilities, is positioning itself as a key supplier in the Asia-Pacific region, a dominant market for 1,4-Dichlorobenzene.

Top Key Players in the Market

- Aarti Industries Limited (AIL)

- ABI Chemicals

- Alfa Aesar

- ChemieOrganic Chemicals Pvt. Ltd.

- Chirag Organic Pvt Ltd.

- ConierChem

- Dacheng Shandong

- Finetech Industry

- Hangzhou Uniwise International Co., Ltd

- Hengyang KT Chemical Co., Ltd

- J, and K Scientific

- Jiangsu Huaijiang Technology Co., Ltd.

- Kureha Corporation

- Lanxess AG

- Merck Millipore

- Panoli Intermediates

- PCC Group (PCC Rokita SA)

- PPG

- Sumitomo Chemical

- TCI and Tractus Co. Ltd

- Yangzhou Jiangdu Haichen Chemical Co., Ltd.

- Zhejiang Fusheng Holding Group Co., Ltd.

Recent Developments

- In 2023, ABI Chemicals focused on expanding its production capacity and enhancing its supply chain efficiency, capitalizing on increasing demand for 1,4-Dichlorobenzene in the pharmaceutical and agrochemical industries.

- In 2023, TCI focused on expanding its product range and improving manufacturing processes for 1,4-Dichlorobenzene, with an emphasis on sustainability. Tractus Co. Ltd, in the same year, introduced new distribution channels to enhance its market presence.

Report Scope

Report Features Description Market Value (2024) USD 262.9 Million Forecast Revenue (2034) USD 436.5 Million CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (Purity>99.0%, Purity<99.9%), By Application (PPS resin, Deodorizer, Insecticide, Others), By End-user (Automotive, Electronic and Electrical, Consumer Goods, Agrochemical, Dyes and Pigments, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aarti Industries Limited (AIL), ABI Chemicals, Alfa Aesar, ChemieOrganic Chemicals Pvt. Ltd., Chirag Organic Pvt Ltd., ConierChem, Dacheng Shandong, Finetech Industry, Hangzhou Uniwise International Co., Ltd, Hengyang KT Chemical Co., Ltd, J, and K Scientific, Jiangsu Huaijiang Technology Co., Ltd., Kureha Corporation, Lanxess AG, Merck Millipore, Panoli Intermediates, PCC Group (PCC Rokita SA), PPG, Sumitomo Chemical, TCI and Tractus Co. Ltd, Yangzhou Jiangdu Haichen Chemical Co., Ltd., Zhejiang Fusheng Holding Group Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global 1,4-Dichlorobenzene MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Global 1,4-Dichlorobenzene MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aarti Industries Limited (AIL)

- ABI Chemicals

- Alfa Aesar

- ChemieOrganic Chemicals Pvt. Ltd.

- Chirag Organic Pvt Ltd.

- ConierChem

- Dacheng Shandong

- Finetech Industry

- Hangzhou Uniwise International Co., Ltd

- Hengyang KT Chemical Co., Ltd

- J, and K Scientific

- Jiangsu Huaijiang Technology Co., Ltd.

- Kureha Corporation

- Lanxess AG

- Merck Millipore

- Panoli Intermediates

- PCC Group (PCC Rokita SA)

- PPG

- Sumitomo Chemical

- TCI and Tractus Co. Ltd

- Yangzhou Jiangdu Haichen Chemical Co., Ltd.

- Zhejiang Fusheng Holding Group Co., Ltd.