Global Glass Fiber Reinforced Polymer Market Size, Share, Growth Analysis By Resin Type (Polyester Resin, Vinyl Ester Resin, Epoxy Resin, Polyurethane Resin, Others), By Glass Fiber Type (E-Glass, S-Glass, Others), By Product Form (Sheets & Panels, Pipes & Tanks, Gratings, Profiles & Rods, Others), By End User Industry (Building & Construction, Automotive, Energy & Power, Aerospace & Defense, Marine, Electrical & Electronics, Chemical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176382

- Number of Pages: 238

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

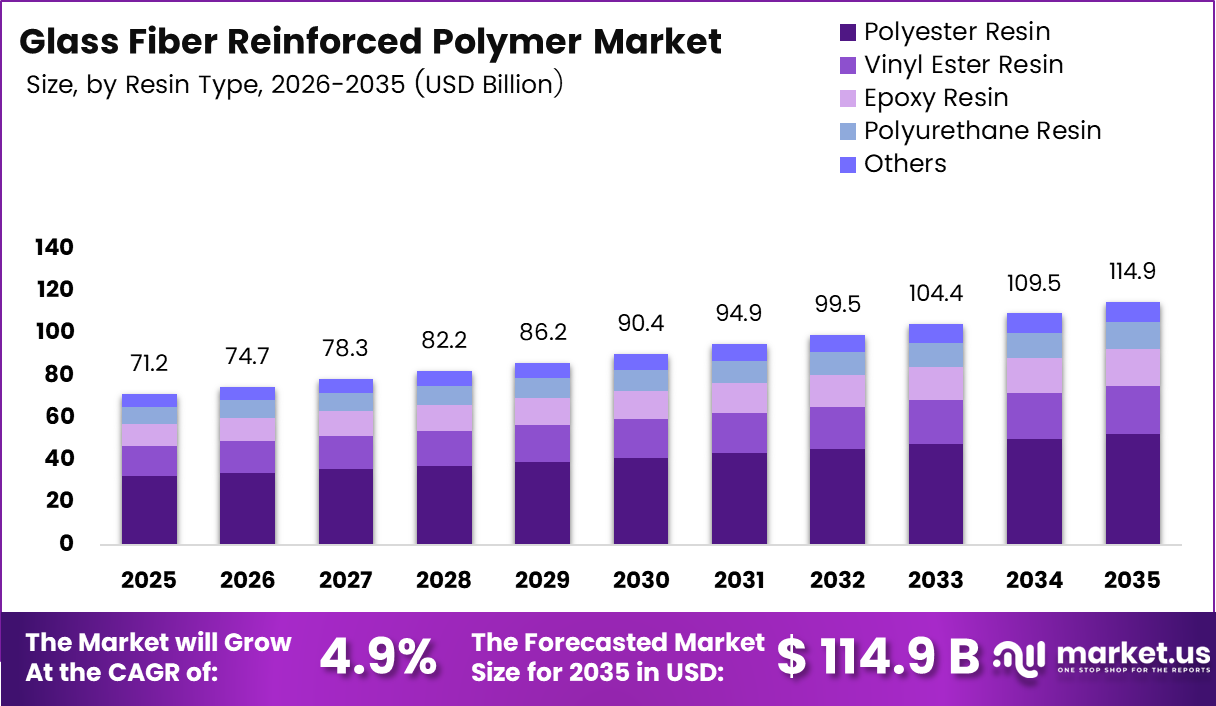

Global Glass Fiber Reinforced Polymer Market size is expected to be worth around USD 114.9 Billion by 2035 from USD 71.2 Billion in 2025, growing at a CAGR of 4.9% during the forecast period 2026 to 2035.

Glass Fiber Reinforced Polymer, also known as glass fiber reinforced plastic, represents a composite material combining fiber glass with polyester material. This advanced composite delivers exceptional performance characteristics while maintaining significantly lower weight compared to traditional materials. The material offers superior strength-to-weight ratios essential for modern applications.

The market encompasses various resin types including polyester, vinyl ester, epoxy, and polyurethane formulations. These composites serve diverse industries through different product forms such as sheets, panels, pipes, tanks, and structural profiles. Moreover, the versatility enables widespread adoption across multiple end-user sectors globally.

GFRP materials demonstrate remarkable mechanical properties with tensile strength ranging from 44 to 2358 MPa. Additionally, compressive strength varies from 140 to 350 MPa while weighing only one-quarter of steel’s weight. Therefore, these characteristics make GFRP ideal for applications requiring both strength and lightweight properties.

The construction sector increasingly adopts GFRP for corrosion-resistant infrastructure development worldwide. Furthermore, automotive and aerospace industries leverage these composites to achieve fuel efficiency through weight reduction. Consequently, renewable energy sectors utilize GFRP extensively in wind turbine blade manufacturing and related applications.

Emerging applications in electric vehicle components and battery enclosures present significant growth opportunities. However, the market faces challenges regarding recycling and end-of-life disposal of composite materials. Additionally, performance limitations under extreme thermal conditions require ongoing research and development efforts.

According to Stromberg Architectural, GFRP materials feature low weights of 2 to 4 lbs per square foot, enabling faster installation and reduced shipping costs. According to Technology in Architecture, these composites maintain exceptional strength while weighing approximately 25% of equivalent steel structures. These advantages drive continuous market expansion across industrial applications.

Government initiatives supporting infrastructure modernization and renewable energy projects accelerate market growth globally. Moreover, technological advancements in automated manufacturing and pultrusion technologies enhance production efficiency. Therefore, the integration of bio-based resins and sustainable composite solutions aligns with environmental regulations and industry sustainability goals.

Key Takeaways

- The global Glass Fiber Reinforced Polymer Market is projected to grow from USD 71.2 Billion in 2025 to USD 114.9 Billion by 2035 at a CAGR of 4.9%

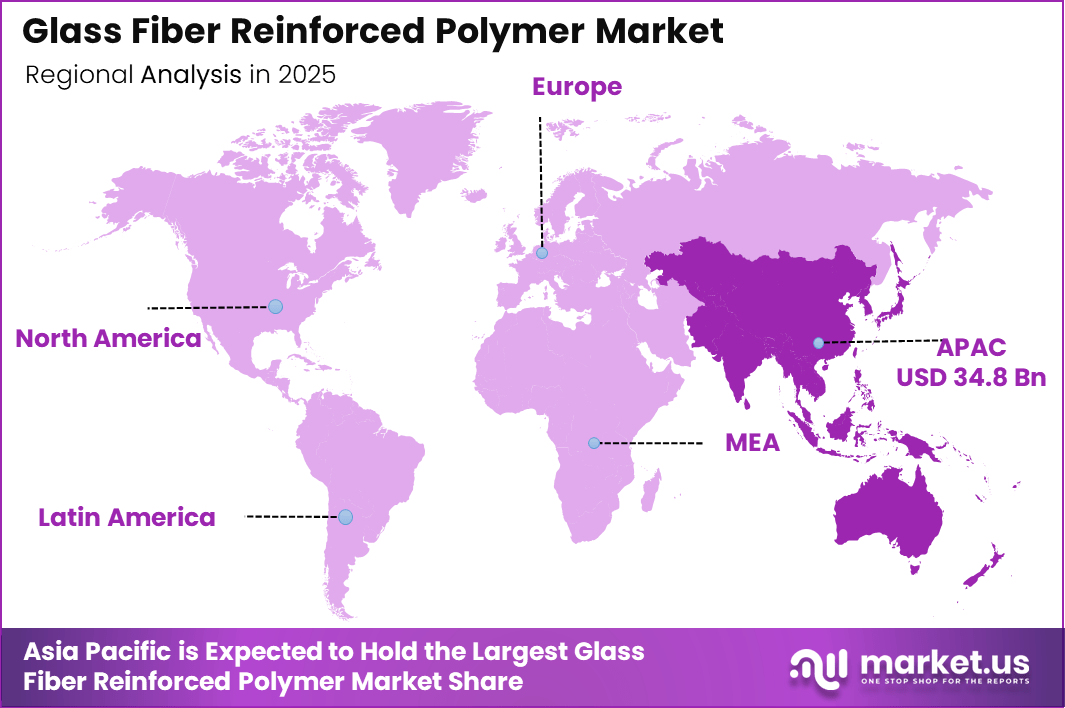

- Asia Pacific dominates the market with a 48.9% share, valued at USD 31 Billion

- Polyester Resin segment leads by Resin Type with 45.6% market share

- E-Glass holds 71% dominance in the Glass Fiber Type segment

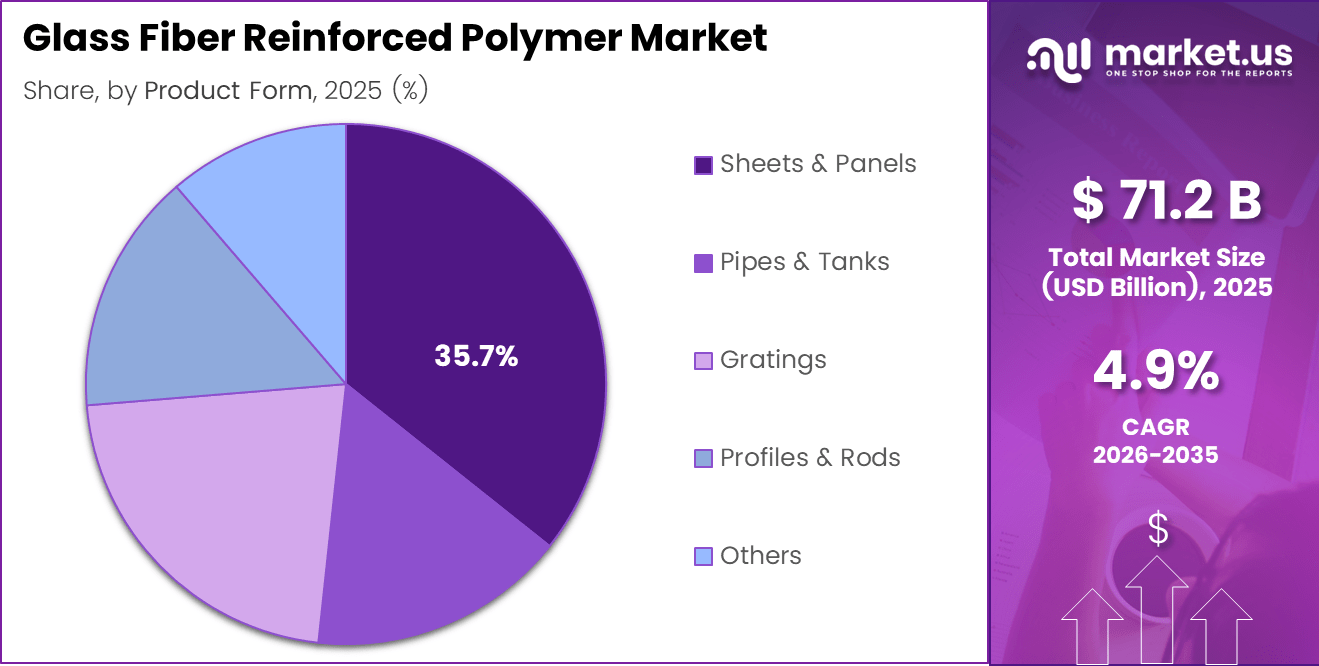

- Sheets & Panels dominate Product Form segment with 35.7% share

- Building & Construction sector leads End User Industry with 34% market share

Resin Type Analysis

Polyester Resin dominates with 45.6% due to cost-effectiveness and versatile processing capabilities across diverse applications.

In 2025, ‘Polyester Resin’ held a dominant market position in the ‘By Resin Type’ segment of Glass Fiber Reinforced Polymer Market, with a 45.6% share. This dominance stems from excellent mechanical properties, ease of processing, and competitive pricing compared to alternative resin systems. Moreover, polyester resins offer superior corrosion resistance and chemical stability for industrial applications.

Vinyl Ester Resin demonstrates enhanced performance in chemical processing and marine environments requiring superior corrosion resistance. Consequently, this resin type commands premium positioning in demanding applications where extended service life justifies higher material costs. Additionally, vinyl ester provides excellent adhesion properties for structural reinforcement applications.

Epoxy Resin delivers exceptional mechanical strength and thermal stability for aerospace and high-performance automotive components. Furthermore, epoxy formulations enable superior bonding characteristics and dimensional stability under varying environmental conditions. Therefore, specialized applications increasingly adopt epoxy-based GFRP composites despite higher costs.

Polyurethane Resin offers unique flexibility and impact resistance for specialized applications in automotive and consumer goods sectors. Moreover, polyurethane systems provide excellent weatherability and UV resistance for outdoor applications. However, processing requirements and cost considerations limit widespread adoption compared to polyester alternatives.

Glass Fiber Type Analysis

E-Glass dominates with 72.1% due to optimal balance of mechanical properties, electrical insulation, and cost-effectiveness.

In 2025, ‘E-Glass’ held a dominant market position in the ‘By Glass Fiber Type’ segment of Glass Fiber Reinforced Polymer Market, with a 72.1% share. This leadership reflects excellent electrical insulation properties, strong chemical resistance, and widespread availability at competitive prices. Additionally, E-Glass fibers deliver consistent performance across diverse manufacturing processes and applications.

S-Glass provides superior strength and modulus characteristics essential for aerospace, defense, and high-performance structural applications. Consequently, S-Glass commands premium pricing justified by exceptional mechanical properties and enhanced thermal resistance. However, higher costs limit adoption primarily to specialized applications requiring maximum performance characteristics.

Other glass fiber types including C-Glass and AR-Glass serve specialized niche applications requiring specific chemical or alkaline resistance properties. Moreover, these alternatives address particular performance requirements where standard E-Glass properties prove insufficient. Therefore, ongoing material innovation continues expanding the range of available glass fiber formulations.

Product Form Analysis

Sheets & Panels dominate with 35.7% due to widespread use in construction, transportation, and industrial fabrication applications.

In 2025, ‘Sheets & Panels’ held a dominant market position in the ‘By Product Form’ segment of Glass Fiber Reinforced Polymer Market, with a 35.7% share. This dominance reflects versatile applications in building facades, automotive body panels, and industrial equipment housings. Furthermore, sheets and panels offer ease of installation and excellent design flexibility for various applications.

Pipes & Tanks demonstrate exceptional corrosion resistance and durability for water treatment, chemical processing, and oil and gas infrastructure. Consequently, these products reduce maintenance costs and extend service life compared to traditional metallic alternatives. Additionally, GFRP pipes provide lightweight handling advantages during installation and transportation.

Gratings serve industrial flooring, walkways, and platform applications requiring corrosion resistance and load-bearing capabilities. Moreover, GFRP gratings offer superior safety features including slip resistance and electrical non-conductivity for hazardous environments. Therefore, adoption continues expanding across chemical plants, offshore platforms, and wastewater treatment Service.

Profiles & Rods provide structural reinforcement and support elements for construction, infrastructure, and industrial equipment applications. Furthermore, pultruded profiles deliver consistent dimensional accuracy and mechanical properties for standardized construction systems. However, customization requirements and tooling costs influence market penetration in certain applications.

End User Industry Analysis

Building & Construction dominates with 32.4% due to corrosion resistance, design flexibility, and infrastructure modernization initiatives globally.

In 2025, ‘Building & Construction’ held a dominant market position in the ‘By End User Industry’ segment of Glass Fiber Reinforced Polymer Market, with a 32.4% share. This leadership reflects increasing adoption for architectural facades, structural reinforcement, and prefabricated building components worldwide. Moreover, GFRP materials enable innovative designs while meeting stringent building codes and sustainability requirements.

Automotive sector increasingly adopts GFRP for lightweighting initiatives, body panels, and interior components to improve fuel efficiency. Consequently, electric vehicle development drives demand for composite battery enclosures and structural components requiring high strength-to-weight ratios. Additionally, GFRP components reduce manufacturing complexity while maintaining safety performance standards.

Energy & Power applications include wind turbine blades, electrical insulation components, and renewable energy infrastructure requiring durability and performance. Furthermore, GFRP materials withstand harsh environmental conditions while delivering reliable long-term operation in power generation facilities. Therefore, renewable energy expansion directly supports market growth in this sector.

Aerospace & Defense utilizes GFRP for aircraft interior panels, radomes, and structural components where weight reduction enhances operational efficiency. Moreover, defense applications leverage composite materials for vehicle armor, shelters, and specialized equipment requiring electromagnetic transparency. However, stringent certification requirements and performance standards influence material selection and qualification processes.

Marine This segment focuses on materials and solutions used in shipbuilding, offshore platforms, and coastal infrastructure.It emphasizes corrosion resistance, durability, and lightweight performance in harsh saltwater environments.Growing maritime trade and offshore energy projects continue to support demand growth.

Electrical & Electronics This segment covers applications in electrical components, insulation systems, and electronic enclosures.It prioritizes properties such as electrical insulation, thermal stability, and design flexibility.Rising adoption of advanced electronics and infrastructure modernization is driving usage.

Chemical This segment includes use in chemical processing plants, storage tanks, and pipelines.

Materials are selected for high resistance to chemicals, heat, and corrosive substances.Expansion of chemical manufacturing and safety-focused infrastructure supports market growth.Others This segment represents diverse applications across construction, automotive, industrial, and consumer uses.It benefits from versatility, cost efficiency, and adaptability across multiple end-use industries.Increasing cross-industry adoption continues to broaden the scope of this segment.

Drivers

Rising Demand for Lightweight and High-Strength Materials Drives Market Expansion

Automotive and aerospace sectors increasingly prioritize weight reduction to enhance fuel efficiency and operational performance. Consequently, GFRP materials deliver exceptional strength-to-weight ratios while maintaining structural integrity across demanding applications. Moreover, regulatory pressures for emissions reduction accelerate adoption of lightweight composite solutions globally.

Infrastructure development projects worldwide favor corrosion-resistant construction materials offering extended service life and reduced maintenance costs. Therefore, GFRP composites provide superior durability in harsh environments compared to traditional materials like steel and concrete. Additionally, construction industry modernization drives demand for innovative building materials enabling architectural flexibility.

Wind energy expansion and renewable power generation require reliable composite materials for turbine blades and structural components. Furthermore, GFRP delivers optimal performance characteristics for energy applications while maintaining cost-effectiveness compared to carbon fiber alternatives. Consequently, sustainable energy initiatives directly support market growth across multiple regions.

Restraints

Limited Recycling Infrastructure and Disposal Challenges Constrain Market Growth

Composite materials present significant end-of-life management challenges due to limited recycling technologies and infrastructure availability worldwide. Consequently, environmental concerns regarding composite waste disposal influence purchasing decisions and regulatory frameworks for sustainable materials. Moreover, thermoset matrix materials complicate mechanical and chemical recycling processes compared to thermoplastic alternatives.

Performance limitations emerge under extreme thermal conditions and fire exposure scenarios requiring enhanced flame retardancy and thermal stability. Therefore, certain applications demand specialized formulations or alternative materials meeting stringent safety and performance requirements. Additionally, high-temperature environments limit GFRP adoption where metal alternatives provide superior thermal resistance and fire performance.

Industry stakeholders increasingly focus on developing sustainable composite solutions addressing recycling challenges and circular economy principles. Furthermore, research initiatives explore innovative recycling methods including pyrolysis, solvolysis, and mechanical grinding for composite material recovery. However, economic viability and technical scalability remain critical barriers to widespread recycling implementation.

Growth Factors

Electric Vehicle Development and Marine Applications Accelerate Market Expansion

Electric vehicle manufacturing increasingly incorporates GFRP for battery enclosures, structural components, and interior elements requiring lightweight properties. Consequently, automotive electrification trends drive demand for corrosion-resistant materials protecting sensitive battery systems from environmental exposure. Moreover, composite solutions enable design flexibility while meeting stringent safety and crash performance requirements.

Marine and offshore structures require corrosion-free materials withstanding harsh saltwater environments and reducing long-term maintenance costs. Therefore, GFRP composites provide superior durability for boat hulls, offshore platforms, and coastal infrastructure applications worldwide. Additionally, weight reduction benefits improve vessel performance and fuel efficiency across commercial and recreational maritime sectors.

Water treatment facilities and chemical processing industries adopt advanced composite pipes and tanks offering chemical resistance and extended service life. Furthermore, GFRP infrastructure reduces contamination risks while maintaining structural integrity under aggressive chemical exposure and varying temperatures. Consequently, industrial infrastructure modernization supports continuous market growth across multiple applications.

Emerging Trends

Sustainable Materials and Advanced Manufacturing Technologies Transform Market Landscape

Development of bio-based resins and sustainable glass fiber composites addresses environmental concerns while maintaining performance characteristics required for industrial applications. Consequently, manufacturers increasingly invest in renewable raw materials and circular economy principles supporting long-term sustainability goals. Moreover, regulatory frameworks encourage adoption of environmentally responsible composite solutions across various industries.

Integration of automated manufacturing processes and pultrusion technologies enhances production efficiency while reducing labor costs and improving quality consistency. Therefore, advanced manufacturing capabilities enable higher output volumes meeting growing global demand for GFRP products. Additionally, digital technologies optimize process control and material utilization throughout composite manufacturing operations.

Hybrid composites combining glass fiber with other reinforcements create tailored material properties for specialized applications requiring specific performance characteristics. Furthermore, smart infrastructure applications incorporate GFRP materials with embedded sensors enabling structural health monitoring and predictive maintenance capabilities. Consequently, innovation continues expanding the application scope and market potential for advanced composite materials.

Regional Analysis

Asia Pacific Dominates the Glass Fiber Reinforced Polymer Market with a Market Share of 48.9%, Valued at USD 34.8 Billion

Asia Pacific leads the market driven by rapid industrialization, infrastructure development, and growing manufacturing capabilities across China, India, and Southeast Asian nations. The region benefits from strong automotive production, expanding renewable energy installations, and construction sector growth supporting GFRP demand. Moreover, cost-competitive manufacturing and increasing domestic consumption accelerate regional market expansion significantly.

North America Glass Fiber Reinforced Polymer Market Trends

North America demonstrates steady growth supported by advanced aerospace manufacturing, renewable energy projects, and infrastructure modernization initiatives. Furthermore, stringent environmental regulations and lightweighting requirements drive automotive sector adoption across the United States and Canada. Additionally, technological innovation and established composite manufacturing capabilities strengthen regional market positioning.

Europe Glass Fiber Reinforced Polymer Market Trends

Europe maintains significant market presence through automotive innovation, wind energy leadership, and sustainable construction practices across Germany, France, and the United Kingdom. Consequently, regulatory frameworks promoting carbon reduction and circular economy principles support composite material adoption. Moreover, established aerospace and marine industries provide consistent demand for high-performance GFRP applications.

Latin America Glass Fiber Reinforced Polymer Market Trends

Latin America shows growing adoption driven by infrastructure development, automotive manufacturing expansion, and renewable energy investments across Brazil and Mexico. Therefore, improving economic conditions and industrial modernization initiatives support gradual market growth. Additionally, construction sector development creates opportunities for corrosion-resistant building materials throughout the region.

Middle East & Africa Glass Fiber Reinforced Polymer Market Trends

Middle East & Africa region experiences increasing demand from oil and gas infrastructure, construction projects, and renewable energy development across GCC countries and South Africa. Furthermore, harsh environmental conditions favor corrosion-resistant composite materials for industrial and infrastructure applications. Consequently, economic diversification initiatives support market expansion beyond traditional energy sectors.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Owens Corning maintains global leadership in glass fiber manufacturing and composite solutions serving construction, automotive, and industrial markets worldwide. The company leverages extensive production capabilities, technological innovation, and strong distribution networks to deliver comprehensive GFRP product portfolios. Moreover, sustainability initiatives and customer-focused solutions strengthen market positioning across diverse applications and geographic regions.

Johns Manville provides engineered GFRP materials and composite systems for building, industrial, and specialty applications through advanced manufacturing capabilities. Consequently, the company delivers high-performance solutions meeting stringent quality standards and customer requirements across multiple industries. Additionally, technical expertise and application development support enable customized material solutions addressing specific performance challenges.

PPG Industries Inc. offers glass fiber products and composite resins supporting aerospace, automotive, and industrial manufacturing through integrated material solutions. Furthermore, innovation in fiber formulations and resin chemistry enhances product performance while optimizing manufacturing efficiency. Therefore, strategic partnerships and global presence support market expansion and customer engagement initiatives worldwide.

BASF SE supplies advanced resin systems and chemical solutions enabling high-performance GFRP composites across automotive, construction, and industrial sectors. The company invests significantly in sustainable material development and circular economy solutions addressing environmental challenges. Moreover, technical collaboration with customers drives innovation in composite formulations and processing technologies enhancing application performance.

Key Players

- Advanced Composites Inc.

- BASF SE

- BGF Industries

- Binani Industries Ltd.

- Celanese Corporation

- China Beihai Fiberglass Co. Ltd.

- China Jushi Co. Ltd.

- Chongqing Polycomp International Corp. (CPIC)

- Jiuding New Material Co., Ltd.

- Johns Manville

- Nippon Electric Glass Co., Ltd.

- Owens Corning

- PPG Industries Inc.

- Reliance Industries Limited

- SAERTEX GmbH & Co. KG

- Other Key Players

Recent Developments

- November 2024 – Toray announced expanded capacity and capabilities in continuous fiber reinforced thermoplastic product portfolio, strengthening its position in advanced composite manufacturing. This expansion enables increased production volumes meeting growing demand for thermoplastic composites across automotive and industrial applications globally.

- September 2024 – MPM Group completed strategic acquisition of Lamplas, joining composite molding expertise and GFRP capabilities to build enhanced technical competency and broader market reach across the United Kingdom. This alignment creates expanded service offerings and strengthened competitive positioning in European composite manufacturing markets.

Report Scope

Report Features Description Market Value (2025) USD 71.2 Billion Forecast Revenue (2035) USD 114.9 Billion CAGR (2026-2035) 4.9% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Resin Type (Polyester Resin, Vinyl Ester Resin, Epoxy Resin, Polyurethane Resin, Others), By Glass Fiber Type (E-Glass, S-Glass, Others), By Product Form (Sheets & Panels, Pipes & Tanks, Gratings, Profiles & Rods, Others), By End User Industry (Building & Construction, Automotive, Energy & Power, Aerospace & Defense, Marine, Electrical & Electronics, Chemical, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Advanced Composites Inc., BASF SE, BGF Industries, Binani Industries Ltd., Celanese Corporation, China Beihai Fiberglass Co. Ltd., China Jushi Co. Ltd., Chongqing Polycomp International Corp. (CPIC), Jiuding New Material Co., Ltd., Johns Manville, Nippon Electric Glass Co., Ltd., Owens Corning, PPG Industries Inc., Reliance Industries Limited, SAERTEX GmbH & Co. KG, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Glass Fiber Reinforced Polymer MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Glass Fiber Reinforced Polymer MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Advanced Composites Inc.

- BASF SE

- BGF Industries

- Binani Industries Ltd.

- Celanese Corporation

- China Beihai Fiberglass Co. Ltd.

- China Jushi Co. Ltd.

- Chongqing Polycomp International Corp. (CPIC)

- Jiuding New Material Co., Ltd.

- Johns Manville

- Nippon Electric Glass Co., Ltd.

- Owens Corning

- PPG Industries Inc.

- Reliance Industries Limited

- SAERTEX GmbH & Co. KG

- Other Key Players