Global Geocells Market Size, Share, And Industry Analysis Report By Material (HDPE, PP, Polyester, Polymeric Alloys), By Distribution Channel (Direct Sales, Indirect Sales), By Application (Slope Protection, Load Support, Earth Reinforcement, Channel Protection, Tree-root and Landscaping), By End-user (Transportation, Environmental and Water, Industrial and Mining, Defense), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177646

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

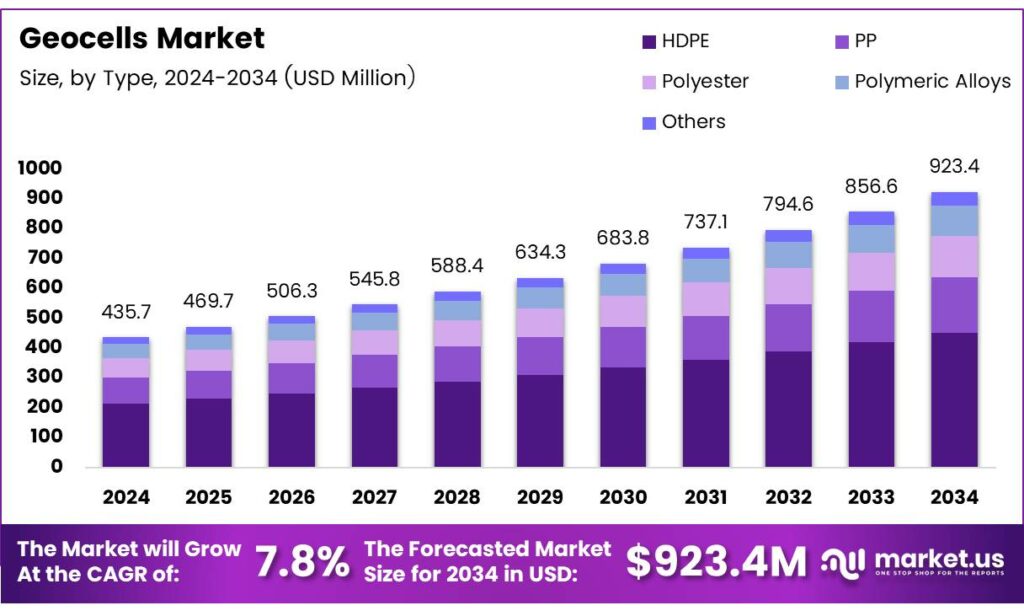

The Global Geocells Market size is expected to be worth around USD 923.4 Million by 2034 from USD 435.7 Million in 2024, growing at a CAGR of 7.8% during the forecast period 2025 to 2034.

Geocells represent three-dimensional cellular confinement systems manufactured from polymeric materials. These honeycomb-like structures provide soil stabilization, erosion control, and load distribution across civil engineering applications. Moreover, geocells enhance ground bearing capacity while reducing material consumption in infrastructure projects.

Transportation agencies adopt geocell technology to reinforce roadways and railway subgrades. Industrial sectors utilize these geosynthetic solutions for mining haul roads and site development. Additionally, environmental applications include slope protection, channel lining, and coastal defense structures.

- The Neoweb geocell material costs approximately $10 per square meter, translating to about $60,000 per mile for roadway applications. This cost-effectiveness positions geocells competitively against traditional reinforcement methods. However, performance testing demonstrates that synthetic geocells achieve 1.73 times higher bearing capacity than coir alternatives for 10 cm height configurations.

Market expansion stems from accelerating infrastructure modernization initiatives globally. Governments invest heavily in highway rehabilitation and flood control systems. Furthermore, construction industries recognize that geocells reduce excavation depth and aggregate requirements significantly.

Sustainability concerns accelerate the adoption of eco-friendly geosynthetic alternatives. Recycled polymer content reduces environmental impact during production. Therefore, biodegradable options emerge for temporary applications in landscaping and erosion control projects.

Key Takeaways

- The Global Geocells Market is projected to reach USD 923.4 million by 2034 from USD 435.7 million in 2024, growing at a CAGR of 7.8% from 2024 to 2034.

- The HDPE material segment dominates with 65.2% market share due to superior strength and chemical resistance properties.

- Direct Sales distribution channel leads with 63.2% share, driven by technical consultation requirements and project customization needs.

- Slope Protection application holds 43.6% market share, addressing erosion control and embankment stabilization demands globally.

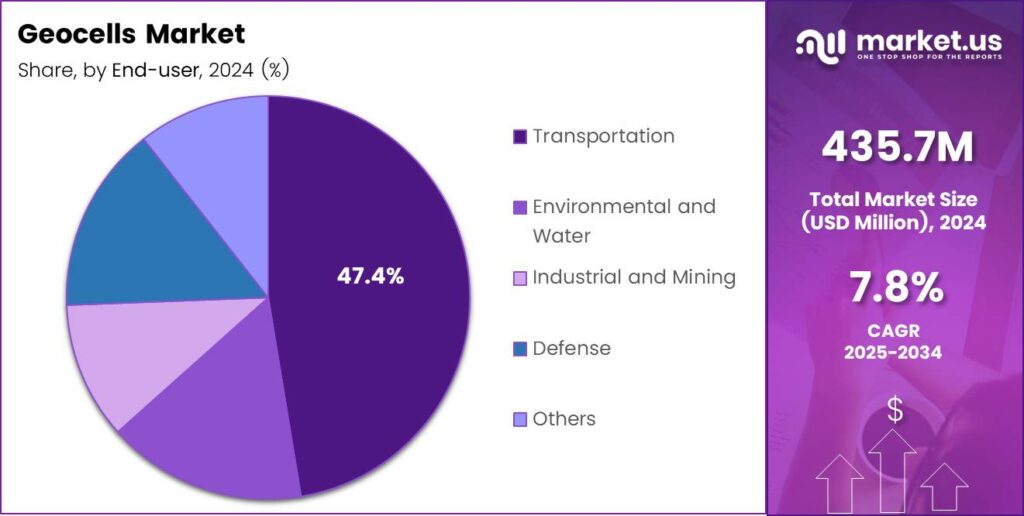

- The Transportation end-user segment commands 47.4% share, fueled by highway reinforcement and railway infrastructure development projects.

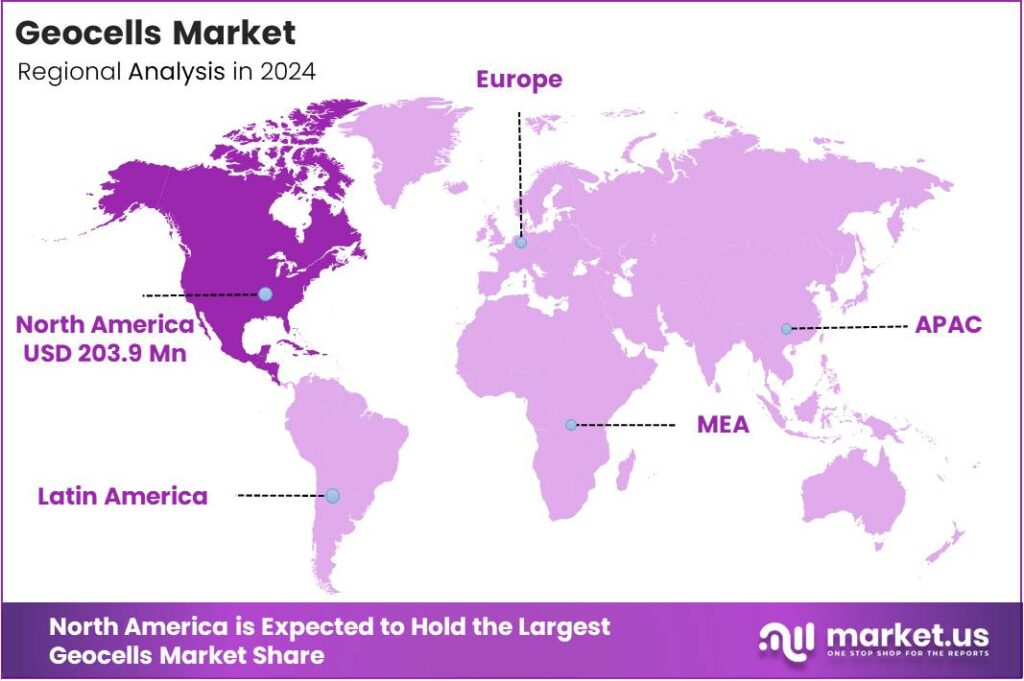

- North America dominates the regional market with 46.8% share, valued at USD 203.9 Million, supported by extensive infrastructure investment.

Material Analysis

HDPE dominates with 65.2% due to exceptional durability and cost-effectiveness.

In 2025, High-Density Polyethylene (HDPE) held a dominant market position in the By Material segment of the Geocells Market, with a 65.2% share. HDPE geocells deliver superior tensile strength and chemical resistance across diverse environmental conditions. Transportation agencies prefer HDPE for highway and railway applications requiring long-term performance. Moreover, manufacturers achieve consistent quality through advanced extrusion processes and quality control systems.

Polypropylene (PP) geocells offer lightweight characteristics and excellent flexibility for temporary applications. Construction projects utilize PP variants where rapid deployment and removal cycles occur frequently. Additionally, PP materials demonstrate reliable performance in landscaping and erosion control installations requiring moderate load-bearing capacity.

Polyester geocells provide enhanced dimensional stability under sustained loading conditions. Mining operations employ polyester solutions for haul road construction in high-stress environments. Furthermore, polyester composites exhibit resistance to ultraviolet degradation and biological deterioration over extended service life.

Polymeric Alloys combine multiple material properties to optimize specific application requirements. Engineers specify alloy formulations for projects demanding unique strength, flexibility, and environmental resistance combinations. Other materials include biodegradable options and recycled content variants supporting sustainability initiatives across the construction industry.

Distribution Channel Analysis

Direct Sales dominates with 63.2% due to technical complexity and customization requirements.

In 2025, Direct Sales held a dominant market position in the By Distribution Channel segment of the Geocells Market, with a 63.2% share. Direct channels enable manufacturers to provide engineering consultation and application-specific design services. Transportation projects require technical support for installation methodology and performance specification development.

Indirect Sales channels serve smaller-scale applications through distributor networks and retail partnerships. Contractors access geocell products via regional distributors for landscaping and residential projects. Additionally, indirect channels expand market reach in emerging regions where manufacturer presence remains limited and local partnerships facilitate market penetration.

Application Analysis

Slope Protection dominates with 43.6% due to global erosion control demands.

In 2025, Slope Protection held a dominant market position in the By Application segment of the Geocells Market, with a 43.6% share. Highway embankments and railway cuttings require effective erosion control systems to maintain structural integrity. Environmental agencies mandate slope stabilization solutions for watershed protection and sediment management programs. Furthermore, geocells reduce maintenance costs while extending infrastructure service life significantly.

Load Support applications enhance bearing capacity for foundations and pavement systems. Transportation infrastructure utilizes load support geocells to distribute vehicle weights across weak subgrade soils. Consequently, engineers reduce pavement thickness requirements and aggregate consumption through cellular confinement technology implementation.

Earth Reinforcement stabilizes retaining walls and embankment structures under lateral loading conditions. Mining operations employ earth reinforcement geocells for tailings dam construction and waste containment facilities. Additionally, reinforcement applications improve seismic performance and reduce settlement in challenging ground conditions.

Channel Protection prevents erosion in drainage systems and waterway infrastructure. Stormwater management projects incorporate channel protection geocells for sustainable urban drainage design. Tree-root and Landscaping applications support urban forestry and green infrastructure development through root protection and soil stabilization systems.

End-user Analysis

Transportation dominates with 47.4% due to infrastructure investment acceleration.

In 2025, Transportation held a dominant market position in the end-user segment of the Geocells Market, with a 47.4% share. Government agencies allocate substantial budgets for highway rehabilitation and railway network expansion projects. Geocells reduce construction timelines and material costs for roadway base reinforcement applications. Transportation infrastructure demands long-term performance under heavy traffic loading and environmental stress conditions.

Environmental and Water sectors utilize geocells for flood control, coastal protection, and watershed management initiatives. Climate adaptation programs integrate geosynthetic solutions into resilience infrastructure development. Additionally, environmental applications address erosion control requirements in sensitive ecological areas and restoration projects.

Industrial and Mining operations employ geocells for haul road construction and site development activities. Mining companies require durable pavement systems supporting heavy equipment loads in harsh operational environments. Furthermore, industrial facilities utilize geocells for temporary access roads and material storage area stabilization.

Defense applications include military base construction and tactical infrastructure deployment systems. Armed forces specify geocells for rapid runway construction and vehicle access route development in remote locations. Other end-users encompass residential development, commercial construction, and recreational facility projects requiring soil stabilization solutions.

Drivers

Accelerating Infrastructure Investment Drives Geocell Adoption Globally

Transportation agencies accelerate highway and railway infrastructure modernization programs worldwide. Governments allocate increased budgets for pavement rehabilitation and subgrade improvement projects. Consequently, geocell technology gains acceptance as a cost-effective reinforcement solution, reducing material consumption and construction timelines.

Soil stabilization requirements expand across weak subgrade conditions and challenging terrain profiles. Engineers specify geocells to enhance bearing capacity while minimizing excavation depth and aggregate importation. Moreover, cellular confinement systems distribute loads efficiently, extending pavement service life and reducing maintenance interventions.

Flood control and erosion protection initiatives integrate geocell systems into resilience infrastructure development. Environmental agencies mandate slope stabilization solutions for watershed management and sediment control programs. Additionally, climate adaptation strategies prioritize sustainable geosynthetic technologies addressing extreme weather event impacts on critical infrastructure assets.

Restraints

High Initial Investment Limits Market Penetration in Price-Sensitive Regions

Material procurement costs create financial barriers for budget-constrained construction projects. Geocell systems require a higher upfront investment compared to conventional aggregate base alternatives. Therefore, decision-makers in developing markets hesitate to adopt advanced geosynthetic solutions despite long-term economic benefits and performance advantages.

- Installation complexity demands specialized equipment and trained personnel for proper deployment procedures. Contractors face learning curves when transitioning from traditional construction methodologies to cellular confinement techniques. Projects report approximately 900,000 square feet of geocell panels installed with recycled concrete infill. The geocell design limited over-excavation by 80,000 cubic yards, demonstrating material efficiency gains.

Technical awareness gaps persist in emerging construction markets regarding geocell applications and performance characteristics. Educational initiatives remain insufficient to communicate lifecycle cost advantages and engineering benefits. Consequently, specification rates lag behind developed regions where geosynthetic knowledge and industry standards achieve broader acceptance among engineering communities.

Growth Factors

Renewable Energy Development Accelerates Geocell Application Expansion

Solar farm construction demands stable foundation systems across diverse soil conditions and terrain profiles. Renewable energy developers utilize geocells for access road stabilization and equipment pad reinforcement. Moreover, wind energy projects employ geosynthetic solutions for turbine foundation support and site infrastructure development.

Smart city initiatives integrate geocell technology into urban resilience and sustainable infrastructure programs. Municipal agencies adopt green infrastructure approaches incorporating permeable surfaces and stormwater management systems. Additionally, urban development projects prioritize cost-effective construction methods, reducing environmental impact and resource consumption.

Mining operations expand haul road networks, requiring durable pavement systems under extreme loading conditions. Industrial facilities demand reliable access routes supporting heavy equipment throughout operational lifecycles. Furthermore, coastal protection programs implement geocell solutions for shoreline stabilization and erosion control, addressing sea-level rise and storm surge impacts.

Emerging Trends

Material Innovation Transforms Geocell Performance and Sustainability Profiles

High-density polyethylene formulations dominate material selection due to superior strength-to-weight ratios and chemical resistance. Manufacturers develop enhanced polymer blends, optimizing tensile properties and environmental durability characteristics. Consequently, HDPE variants achieve market preference across transportation and environmental application segments.

- Industrial jute geocells demonstratean ultimate tensile strength of approximately 15.7 kN/m, comparable to polymer alternatives. Moreover, plate-load tests indicate soil bearing capacity improvements reaching 120% with reduced settlement. Manufacturing cost reductions achieve 80% through mechanized production processes.

Mechanized installation techniques accelerate deployment timelines and reduce labor requirements for large-scale projects. Construction companies invest in specialized equipment enabling rapid geocell placement and infill operations. Recyclable and environmentally friendly geosynthetics gain market traction as sustainability regulations strengthen and corporate environmental commitments intensify across infrastructure development sectors.

Regional Analysis

North America Dominates the Geocells Market with a Market Share of 46.8%, Valued at USD 203.9 Million

North America leads global geocell adoption, driven by extensive highway rehabilitation programs and infrastructure investment initiatives. Transportation agencies across the United States and Canada implement geosynthetic solutions for pavement reinforcement and subgrade stabilization projects. The dominant market position reflects 46.8% share valued at USD 203.9 Million, supported by regulatory frameworks promoting sustainable construction practices.

Europe demonstrates strong geocell demand through environmental protection initiatives and sustainable infrastructure development programs. European Union regulations mandate erosion control and stormwater management systems across member states. Additionally, railway network modernization projects integrate geosynthetic technologies, improving track stability and reducing maintenance requirements throughout regional transportation corridors.

Asia Pacific experiences rapid market expansion fueled by urbanization and transportation infrastructure development across emerging economies. China and India invest heavily in highway construction and railway network expansion, supporting economic growth objectives. Furthermore, mining operations throughout Australia and Southeast Asia adopt geocell solutions for haul road construction and site stabilization applications.

Latin America shows increasing geocell adoption driven by infrastructure modernization and flood control initiatives. Brazil and Mexico implement highway rehabilitation programs addressing transportation network deficiencies and economic development requirements. Moreover, environmental agencies prioritize slope protection solutions for watershed management and erosion control in sensitive ecological regions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Presto Geosystems pioneered geocell technology development and maintains market leadership through continuous innovation and technical expertise. The company offers comprehensive product portfolios, including Neoweb and GEOWEB systems serving transportation, environmental, and industrial applications. Presto provides engineering support and installation training programs, ensuring optimal project performance across diverse geographic markets and application requirements.

PRS Geo-Technologies developed Neoloy geocell material delivering exceptional strength and durability characteristics for demanding applications. The company focuses on polymer technology advancement and proprietary manufacturing processes, optimizing product performance. PRS maintains a strong presence in transportation infrastructure projects through technical consultation services and performance verification programs supporting specification development and quality assurance requirements.

Strata Systems operates as a leading geosynthetic solutions provider offering diverse geocell products for soil stabilization and erosion control. The company emphasizes sustainable construction practices and cost-effective engineering solutions across commercial and government sectors. Strata Geosystems expands market reach through strategic distributor partnerships and regional manufacturing facilities supporting local market needs and project delivery timelines.

Maccaferri S.p.A. leverages global presence and comprehensive geosynthetic product lines serving civil engineering and environmental markets worldwide. The company integrates geocell technology with complementary erosion control and soil reinforcement solutions, providing complete system offerings. Maccaferri achievesa competitive advantage through technical innovation and extensive project experience across transportation, mining, and coastal protection applications.

Top Key Players in the Market

- Presto Geosystems

- PRS Geo-Technologies (Neoloy)

- Strata Systems / Strata Geosystems

- Maccaferri S.p.A.

- HUESKER

- ACE Geosynthetics

- TMP Geosynthetics

- NAUE GmbH and Co. KG

- Terram (Berry Global)

- Geofabrics Australasia

Recent Developments

- In 2025, Strata pioneered large-scale geocell manufacturing in India, introducing solutions for soil stabilization in railways and load support, following RDSO codification by Indian Railways. This includes a majority stake acquisition by Carlyle to boost global expansion.

- In 2025, Maccaferri acquired Synteen to strengthen its geosynthetics presence in North America. It also acquired CPT Group to lead in tunneling technologies and opened a new subsidiary in Australia and New Zealand for direct market support. The company contributed to Saudi Arabia’s King Salman Park and Prince Mohammed Bin Salman Nonprofit City, applying geosynthetics for sustainable urban development under Saudi Vision 2030.

Report Scope

Report Features Description Market Value (2024) USD 435.7 Million Forecast Revenue (2034) USD 923.4 Million CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (HDPE, PP, Polyester, Polymeric Alloys, Others), By Distribution Channel (Direct Sales, Indirect Sales), By Application (Slope Protection, Load Support, Earth Reinforcement, Channel Protection, Tree-root and Landscaping), By End-user (Transportation, Environmental and Water, Industrial and Mining, Defense, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Presto Geosystems, PRS Geo-Technologies (Neoloy), Strata Systems / Strata Geosystems, Maccaferri S.p.A., HUESKER, ACE Geosynthetics, TMP Geosynthetics, NAUE GmbH and Co. KG, Terram (Berry Global), Geofabrics Australasia Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Presto Geosystems

- PRS Geo-Technologies (Neoloy)

- Strata Systems / Strata Geosystems

- Maccaferri S.p.A.

- HUESKER

- ACE Geosynthetics

- TMP Geosynthetics

- NAUE GmbH and Co. KG

- Terram (Berry Global)

- Geofabrics Australasia