Global Genetic Engineering Market By Product Type (Genetic Markers and Biochemical), By Technology (Artificial Selection and Gene Splicing), By Application (Agriculture and Medical Industry), By Device (PCR, Gel Assemblies, and Gene Gun), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148863

- Number of Pages: 228

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

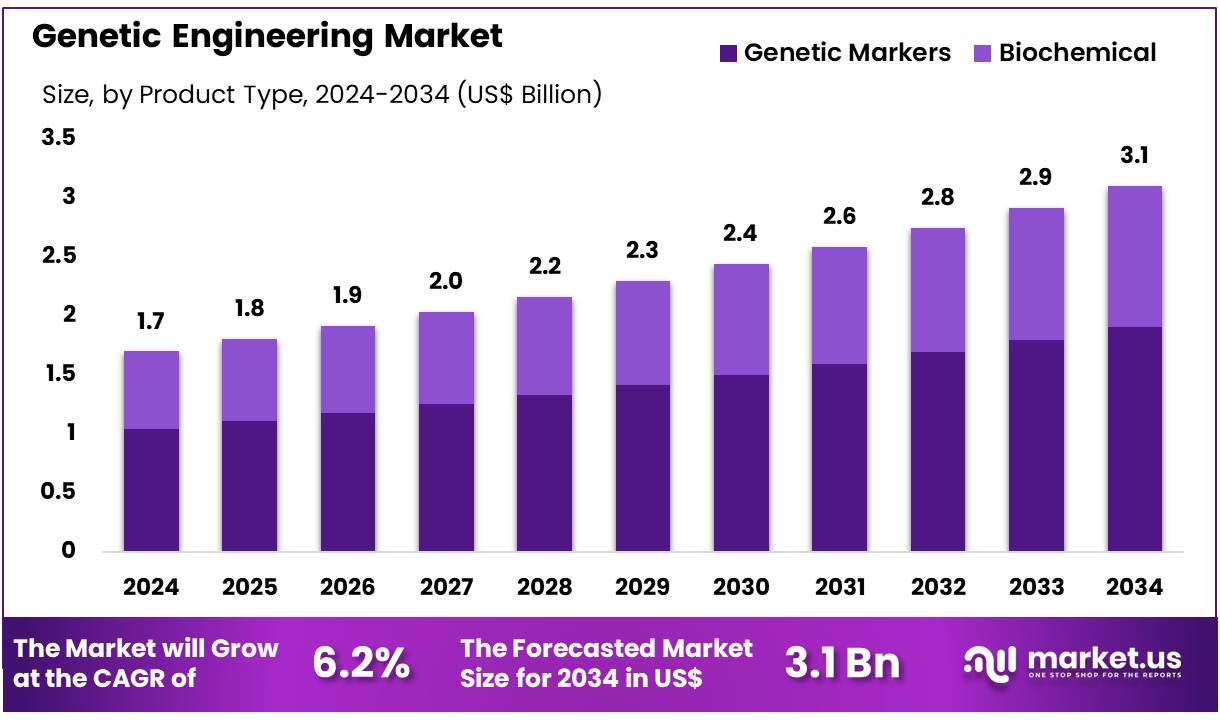

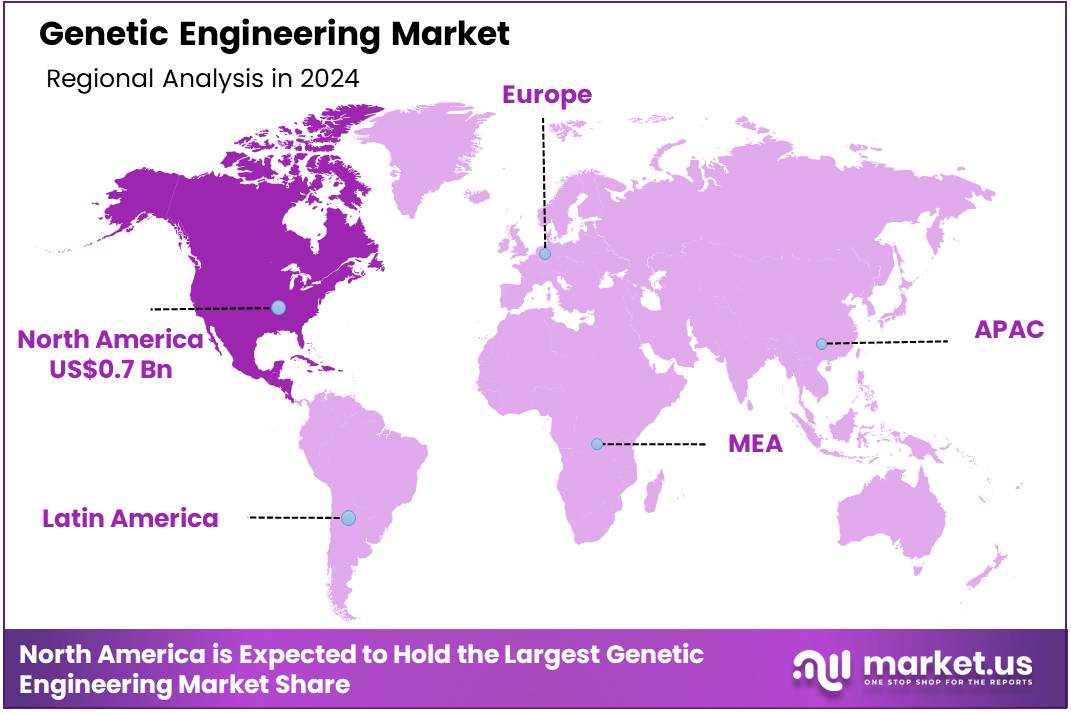

The Global Genetic Engineering Market size is expected to be worth around US$ 3.1 Billion by 2034 from US$ 1.7 Billion in 2024, growing at a CAGR of 6.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.1% share with a revenue of US$ 0.7 Billion.

Growing advancements in gene editing tools and molecular biology continue to accelerate the expansion of the genetic engineering market. Researchers and biotechnology firms increasingly apply genetic engineering across a wide spectrum of fields, including drug discovery, personalized medicine, agricultural biotechnology, synthetic biology, and functional genomics. In January 2025, EditCo Bio unveiled XDel Knockout Cells, a breakthrough product designed to enhance the accuracy and reproducibility of CRISPR-based gene knockout experiments.

This innovation uses a proprietary guide RNA configuration to optimize genome editing workflows, supporting high-throughput screening in drug development and disease modeling. Rising demand for efficient tools in cell line engineering and therapeutic target validation fuels innovation in genome manipulation techniques. Gene therapies, engineered cell lines, and genetically modified organisms (GMOs) continue to gain regulatory and commercial momentum, creating lucrative opportunities for companies in the sector.

The convergence of AI with gene editing platforms also enables predictive analytics and design optimization for genetic constructs. Growing interest in developing gene-based diagnostics and treatments for rare and chronic conditions has encouraged strategic collaborations among research institutes, biotech companies, and pharmaceutical manufacturers. As stakeholders focus on improving therapeutic precision, safety, and delivery mechanisms, the genetic engineering market remains well-positioned for sustained growth.

Key Takeaways

- In 2024, the market for genetic engineering generated a revenue of US$ 1.7 billion, with a CAGR of 6.2%, and is expected to reach US$ 3.1 billion by the year 2033.

- The product type segment is divided into genetic markers and biochemical, with genetic markers taking the lead in 2024 with a market share of 61.5%.

- Considering technology, the market is divided into artificial selection and gene splicing. Among these, gene splicing held a significant share of 54.7%.

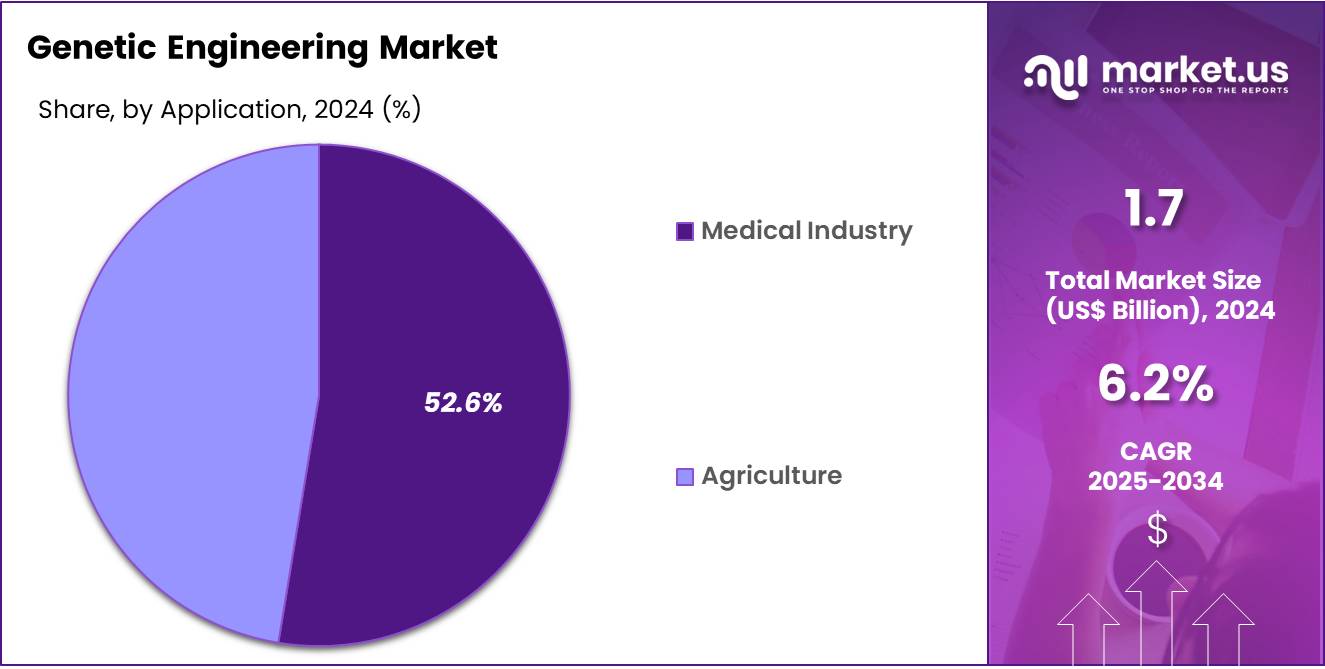

- Furthermore, concerning the application segment, the market is segregated into agriculture and medical industry. The medical industry sector stands out as the dominant player, holding the largest revenue share of 52.6% in the genetic engineering market.

- The device segment is segregated into PCR, gel assemblies, and gene gun, with the PCR segment leading the market, holding a revenue share of 53.2%.

- North America led the market by securing a market share of 42.1% in 2024.

Product Type Analysis

The genetic markers segment claimed a market share of 61.5% owing to its critical role in identifying gene-trait associations and enhancing precision breeding. Researchers increasingly utilize these markers for mapping genetic diseases, improving crop yields, and advancing personalized medicine. The demand for advanced molecular diagnostic tools is anticipated to rise, especially in oncology, where genetic markers assist in predicting disease susceptibility and therapy response.

The segment benefits from growing investments in genomics and expanding applications in forensic science, pharmacogenomics, and biodiversity conservation. Widespread adoption of next-generation sequencing has made marker identification faster and more accurate, thereby supporting market expansion. Academic institutions and biotechnology firms are likely to drive growth through collaborative research projects and commercial applications.

Additionally, regulatory support for biomarker-based diagnostic approvals is expected to increase product utilization. The segment’s ability to facilitate early disease detection and targeted therapies adds to its value proposition. Continuous technological innovation and reduced genotyping costs are anticipated to further accelerate adoption. These factors collectively position genetic markers for strong market growth in the coming years.

Technology Analysis

The gene splicing held a significant share of 54.7% due to its increasing application in correcting genetic disorders and developing transgenic organisms. Scientists use this technique to modify or insert genes in living cells, enabling the production of therapeutic proteins, vaccines, and genetically modified crops. Advancements in CRISPR-Cas9 and other genome-editing tools have significantly improved the precision and efficiency of gene splicing, making it a preferred approach in research and commercial biotechnology.

The rising prevalence of inherited diseases and the demand for novel gene therapies are anticipated to fuel this segment. Pharmaceutical companies are projected to invest heavily in splicing technologies to enhance drug development pipelines. Additionally, the agricultural sector increasingly adopts gene splicing to engineer pest-resistant and high-yield crops.

Regulatory bodies’ growing openness to approving genetically edited products further supports market expansion. Academic and industrial collaborations are likely to accelerate innovation in this space. These dynamics suggest that gene splicing will remain a key driver in shaping the future of genetic technologies.

Application Analysis

The medical industry segment had a tremendous growth rate, with a revenue share of 52.6% owing to rising demand for advanced therapies and diagnostic tools based on genomic information. Hospitals and research institutions increasingly rely on engineered genes to develop personalized medicine approaches, gene therapies, and regenerative treatments. The growing burden of genetic and chronic diseases such as cancer, rare disorders, and cardiovascular conditions is projected to stimulate innovation and product adoption across healthcare settings.

Biotechnology firms continue to invest in the development of recombinant proteins, monoclonal antibodies, and cell-based therapies, reinforcing segment growth. In parallel, rising awareness and adoption of precision medicine among clinicians are expected to fuel the use of engineered genes in clinical practice. The expansion of clinical trials and FDA approvals for gene-based therapies reflects rising confidence in their efficacy and safety.

Furthermore, the integration of AI and bioinformatics enhances the efficiency and accuracy of genomic analysis, accelerating medical applications. Increased funding from governments and private investors supports sustained innovation in this space. Collectively, these factors strongly position the medical industry as a leading force in the adoption of advanced genomic tools.

Device Analysis

The PCR segment grew at a substantial rate, generating a revenue portion of 53.2% due to its central role in amplifying DNA for a wide range of genetic engineering applications. Laboratories and research centers prefer polymerase chain reaction technology due to its speed, accuracy, and versatility in detecting genetic variations, mutations, and pathogen DNA. Continuous technological advancements, such as digital PCR and real-time PCR, are anticipated to improve analytical sensitivity and broaden application scope.

Researchers use PCR in gene cloning, sequencing, and diagnostics, which strengthens its importance across both clinical and agricultural domains. The rising demand for rapid testing solutions in infectious disease diagnosis, including COVID-19, further reinforces the segment’s relevance. Pharmaceutical and biotech companies increasingly integrate PCR into their R&D workflows, especially in biomarker discovery and vaccine development.

Educational institutions also rely on PCR for molecular biology training, thereby expanding its user base. The affordability and miniaturization of PCR systems are likely to drive wider adoption in resource-limited settings. These combined factors indicate strong and sustained growth for the PCR segment in the global genomic technologies landscape.

Key Market Segments

By Product Type

- Genetic Markers

- Biochemical

By Technology

- Artificial Selection

- Gene Splicing

By Application

- Agriculture

- Medical Industry

By Device

- PCR

- Gel Assemblies

- Gene Gun

Drivers

Increased funding for research and development is driving the market

Increased funding for research and development in life sciences and biotechnology is a primary driver for the genetic engineering market. Significant investment from both government bodies and private sector companies fuels advancements in gene editing technologies, synthetic biology, and gene therapy development. This financial support accelerates the discovery of new genetic targets, the refinement of engineering techniques, and the translation of laboratory research into potential clinical and commercial applications.

Higher R&D spending allows for larger and more complex projects, pushing the boundaries of what is possible in manipulating genetic material. For example, the National Institutes of Health (NIH), a key US government funding body for health research which includes genetic research, had a total estimated budget of approximately US$47.08 billion in fiscal year 2023, reflecting substantial ongoing federal investment in areas critical to advancing genetic engineering capabilities in healthcare.

Restraints

High development costs and lengthy approval processes are restraining the market

High development costs and lengthy regulatory approval processes pose a significant restraint on the genetic engineering market, particularly for therapeutic applications. Bringing a novel gene-based therapy or genetically modified product from initial research through preclinical testing and multiple phases of clinical trials to regulatory approval requires substantial financial investment and can take many years.

The complexity of these advanced technologies necessitates rigorous safety and efficacy evaluations by regulatory bodies like the FDA. These stringent review processes, while essential for public safety, contribute to high development costs and can delay market entry, presenting a significant barrier, especially for smaller biotechnology firms.

Opportunities

The growing number of clinical trials for gene therapies is creating growth opportunities

The growing number of clinical trials for gene therapies is creating significant growth opportunities in the market. Advances in genetic engineering techniques are directly translating into a robust pipeline of potential new treatments for a wide range of diseases, including rare genetic disorders, various cancers, and chronic conditions. The increasing number of these experimental therapies advancing through different phases of clinical testing demonstrates the tangible progress in applying genetic engineering to address unmet medical needs.

This clinical activity signals potential future product approvals and market expansion as more gene therapies become available to patients. For instance, data shows that in 2023, there were 371 new gene therapy investigational new drug (IND) submissions received by the FDA’s Center for Biologics Evaluation and Research (CBER), indicating a strong pipeline of novel gene therapy candidates entering clinical development in the US.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors influence the genetic engineering market. Economic conditions impact the availability of funding for research institutions and biotechnology companies, affecting the pace of discovery and development in genetic engineering; during periods of economic growth, there is typically increased investment in R&D and venture capital funding for biotech startups, while economic downturns can lead to budget cuts and reduced investment.

Geopolitical tensions and international relations can affect cross-border research collaborations, the global supply chain for specialized reagents and equipment used in genetic engineering, and regulatory harmonization efforts. Reports in early 2025 indicated that geopolitical risks were contributing to volatility across various global supply chains, impacting sectors including biotechnology.

Despite potential negative impacts from economic uncertainties and geopolitical friction, the transformative potential of genetic engineering to address major global challenges, such as developing new cures for diseases or improving food security, maintains strong underlying drivers for continued investment and innovation in the field.

Current US tariff policies can indirectly impact the genetic engineering market by affecting the cost of imported research reagents, enzymes, and specialized laboratory equipment. Genetic engineering laboratories rely heavily on a global supply chain for high-purity chemicals, biological enzymes, vectors, and advanced instrumentation used in gene editing, sequencing, and cell culture; tariffs imposed on these imported products can increase operational costs for research institutions and biotech companies in the US.

According to the US International Trade Commission DataWeb, US imports of enzymes under HTS 3507, which includes enzymes used in genetic engineering, had a customs value significantly lower than US$2.48 billion in 2023, with calculated duties also below US$8.6 million, indicating the volume and associated tariff costs for these crucial inputs. These increased costs present a financial challenge for organizations engaged in genetic engineering research and development, potentially impacting the speed and cost of bringing new technologies and therapies to market.

However, the significant scientific and medical advancements enabled by genetic engineering provide a strong impetus for continued research and development, encouraging stakeholders to explore strategies to mitigate cost pressures and ensure progress in this vital field.

Latest Trends

Advancements in gene editing technologies is a recent trend

Advancements in gene editing technologies, particularly the continued evolution of CRISPR-based systems and the emergence of new tools like prime editing and base editing, represent a significant recent trend in the market. Researchers and companies are developing more precise, efficient, and safer methods for making targeted changes to DNA and RNA sequences. These technological improvements are broadening the scope of potential applications for genetic engineering, from correcting single-gene mutations to developing more sophisticated cell and gene therapies and creating improved agricultural products.

The rapid pace of innovation in this area is reflected in the continued significant investment by companies at the forefront of this technology. For example, Vertex Pharmaceuticals, a company with a focus on genetic diseases and therapies developed in part through genetic engineering approaches, reported GAAP research and development expenses of US$5.1 billion in fiscal year 2024, reflecting substantial ongoing investment in discovering and developing advanced treatments, including gene-based therapies.

Regional Analysis

North America is leading the Genetic Engineering Market

North America dominated the market with the highest revenue share of 42.1% owing to the increasing investment in research and development, supported by substantial funding from organizations like the National Institutes of Health (NIH). While specific overall funding figures for genetic engineering from NIH are broad, the agency consistently supports projects advancing gene editing and gene therapy.

Furthermore, the US Food and Drug Administration (FDA) has shown a growing trend in approving gene therapies, with several novel therapies receiving the green light between 2022 and 2024. This regulatory progress signals a maturing field and facilitates the translation of research into clinical applications. The focus on developing personalized medicines for various diseases, including genetic disorders and cancer, further fuels the demand for advanced genetic modification techniques.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing government support for biotechnology and genomics research across the region. For example, India’s Department of Biotechnology (DBT) actively funds and promotes genetic engineering research and its applications in various sectors, as highlighted by the establishment of facilities like the DST-ICGEB Bio-Foundry.

Furthermore, precision medicine initiatives, such as Singapore’s National Precision Medicine Program aiming to sequence a large number of Asian genomes, are expected to drive the adoption of genetic modification technologies for diagnostics and therapeutics. The increasing prevalence of genetic disorders and the growing emphasis on agricultural biotechnology to enhance crop yields will also likely contribute to the market’s growth in this region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the genetic engineering market drive growth by advancing gene-editing platforms like CRISPR, expanding their research collaborations, and targeting regulatory milestones for clinical therapies. They focus on developing precise, scalable solutions for treating genetic disorders and improving crop traits in agriculture.

Strategic alliances with academic institutions and biotech companies help accelerate innovation and shorten development timelines. Many companies also increase their footprint in emerging markets to meet rising global demand for gene-based technologies. Robust investment in R&D ensures a continuous flow of cutting-edge tools and therapies into the market.

CRISPR Therapeutics stands out as a key player, leveraging its proprietary CRISPR/Cas9 technology to develop next-generation genetic medicines. The company focuses on treating serious conditions such as sickle cell disease, beta-thalassemia, and certain cancers through targeted gene modification.

Its pipeline includes both in vivo and ex vivo therapies aimed at delivering long-term clinical benefits. CRISPR Therapeutics collaborates with major pharmaceutical firms and research institutions to strengthen its scientific capabilities. With a commitment to innovation and therapeutic impact, the company plays a pivotal role in shaping the future of gene-based healthcare.

Top Key Players

- Lonza

- Cibus

- EditCo Bio

- MaxCyte, Inc

- Genethon

- Sangamo

- Merck KGaA

- Precision Biosciences

Recent Developments

- In January 2025, MaxCyte, Inc., a prominent innovator in cell engineering technologies, disclosed its acquisition of SeQure Dx. The acquisition strengthens MaxCyte’s capabilities in the gene editing sector by incorporating SeQure Dx’s specialized tools for evaluating both on-target and off-target gene modifications in cell and gene therapy applications.

- In January 2025, Genethon, known for its leadership in gene therapy for rare disorders, announced a strategic alliance with Eukarÿs, a biotech firm that has developed a high-yield mRNA expression platform. The partnership aims to make gene therapy production more cost-efficient by utilizing Eukarÿs’ proprietary C3P3 system, which boosts protein expression in mammalian cells.

Report Scope

Report Features Description Market Value (2024) US$ 1.7 Billion Forecast Revenue (2034) US$ 3.1 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Genetic Markers and Biochemical), By Technology (Artificial Selection and Gene Splicing), By Application (Agriculture and Medical Industry), By Device (PCR, Gel Assemblies, and Gene Gun) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Lonza, Cibus, EditCo Bio , MaxCyte, Inc, Genethon, Sangamo, Merck KGaA, and Precision Biosciences. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Lonza

- Cibus

- EditCo Bio

- MaxCyte, Inc

- Genethon

- Sangamo

- Merck KGaA

- Precision Biosciences