Global Generative AI Software Platforms Market Size, Share Analysis By Technology (Machine Learning Platforms, Natural Language Processing (NLP), Computer Vision, Speech Recognition & Voice Processing, Deep Learning Platforms, Reinforcement Learning, Others), By Deployment Mode (Cloud-Based, On-Premise), By Component (Solution, Services), By Functionality (Model Development (Training & Validation), Model Deployment & Inference, Data Engineering & ETL, Model Monitoring & Governance, AutoML / No-code AI Builders, Others), By Application (Predictive Analytics, Natural Language Understanding (Chatbots, Virtual Assistants), Image/Video Analysis, Speech Analytics, Fraud Detection, Recommendation Engines, Others), By End Use Industry (Healthcare & Life Sciences, Banking, Financial Services & Insurance (BFSI), Retail & E-Commerce, Manufacturing, Others), By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155316

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of AI and Advanced Technology

- U.S. Market Size

- Technology Analysis

- Deployment Mode Analysis

- Component Analysis

- Functionality Analysis

- Application Analysis

- End Use Industry Analysis

- Enterprise Size Analysis

- Top Growth Drivers

- Key Trends

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

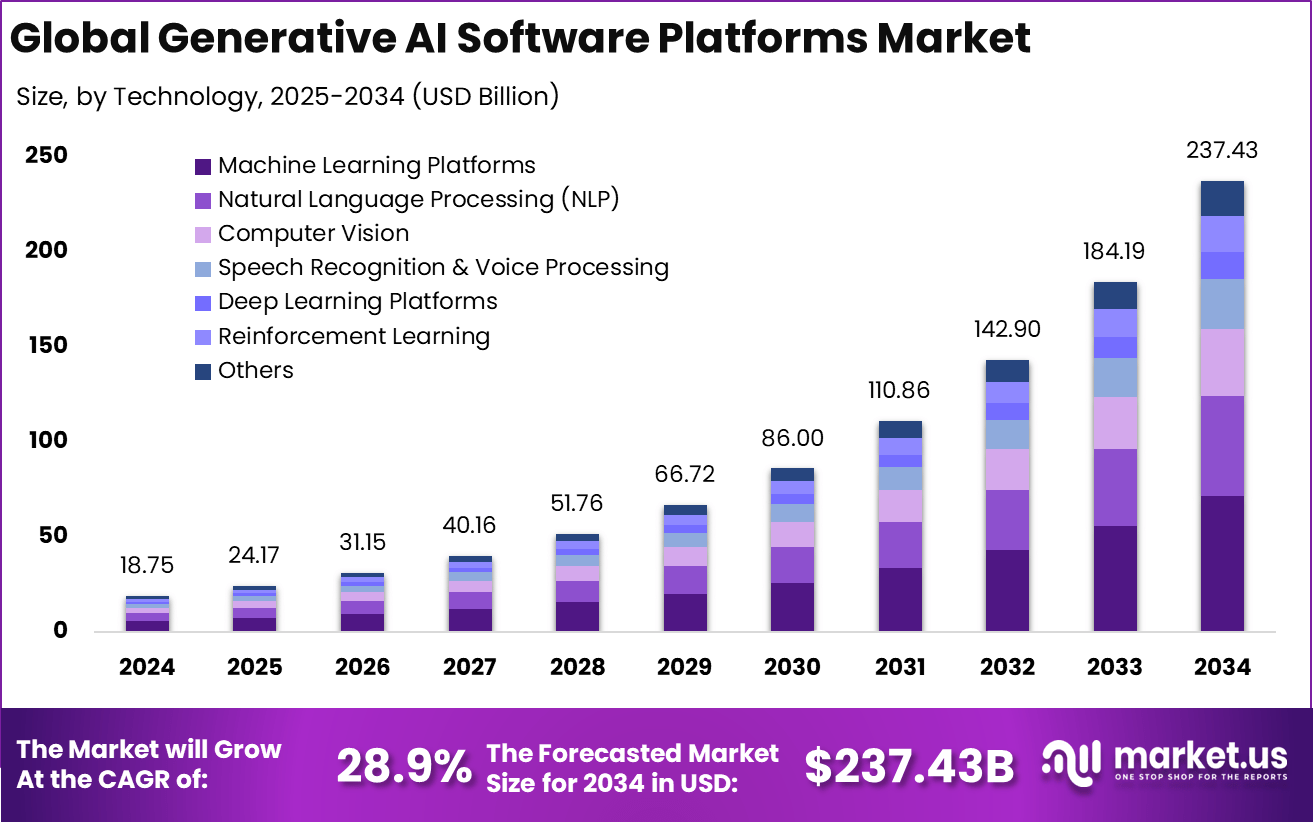

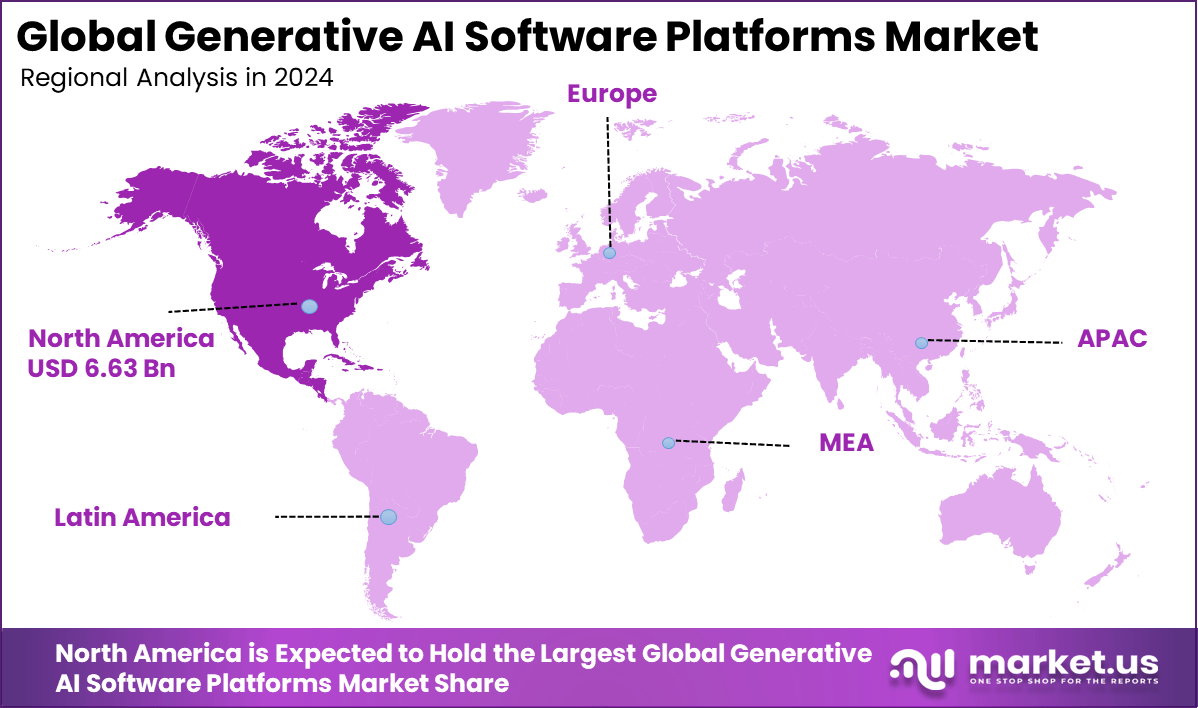

The Global Generative AI Software Platforms Market size is expected to be worth around USD 237.43 billion by 2034, from USD 18.75 billion in 2024, growing at a CAGR of 28.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 35.4% share, holding USD 6.63 billion in revenue.

The Generative AI software platforms market is experiencing robust growth as businesses across industries integrate AI-driven content creation, automation, and decision-making capabilities into their core workflows. Generative AI refers to advanced machine learning technology capable of producing original content – including text, images, audio, and video – by learning patterns from existing data.

For instance, in October 2024, Adobe unveiled a range of AI-powered tools at its MAX 2024 conference, further enhancing its Creative Cloud platform. The new tools, which include expanded capabilities for Firefly- Adobe’s generative AI model – aim to streamline creative workflows by enabling faster content generation, image editing, and video production.

Market Size and Growth

Metric Statistic / Value Market Value (2024) USD 18.75 Bn Forecast Revenue (2034) USD 237.43 Bn CAGR(2025-2034) 28.9% Leading Segment By Enterprise Size – Large Enterprises: 70.5% Key Takeaway

- By platform type, Machine Learning Platforms led with a 30.2% share, reflecting their central role in building, training, and deploying generative AI models.

- On-Premise deployment dominated with a 64.6% share, as many enterprises prefer local control for data privacy, security, and compliance in AI model management.

- The Solution segment accounted for 60.6%, driven by demand for end-to-end AI software packages that streamline development and deployment workflows.

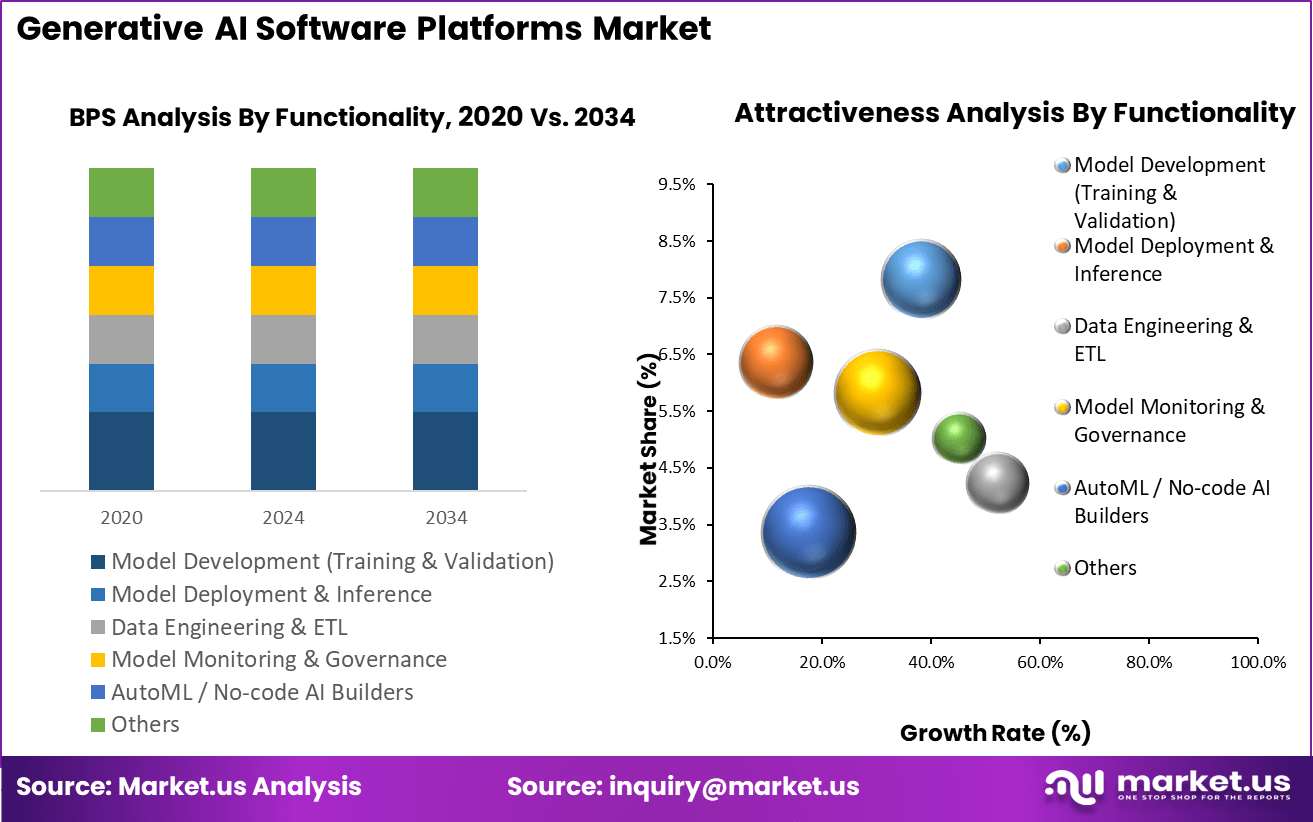

- By function, Model Development (Training & Validation) held a 32.4% share, indicating strong enterprise focus on creating tailored AI models for specialized applications.

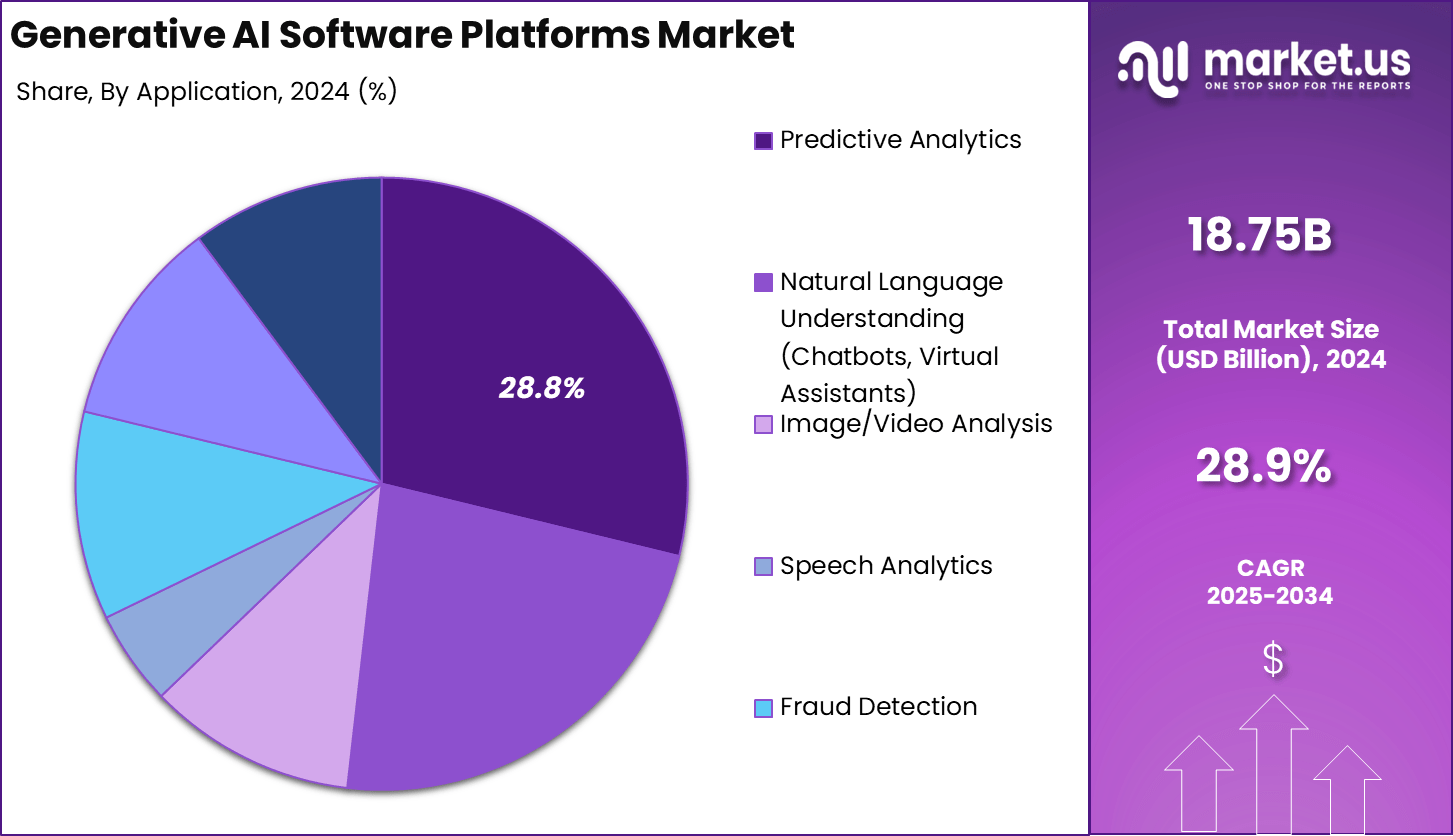

- Predictive Analytics led application areas with a 28.8% share, showcasing the use of generative AI in forecasting, decision support, and strategic insights.

- The Banking, Financial Services & Insurance (BFSI) sector represented 30.6% of demand, leveraging generative AI for risk assessment, fraud detection, and personalized financial services.

- Large enterprises dominated with 70.5%, reflecting greater investment capacity, advanced infrastructure, and complex AI use cases.

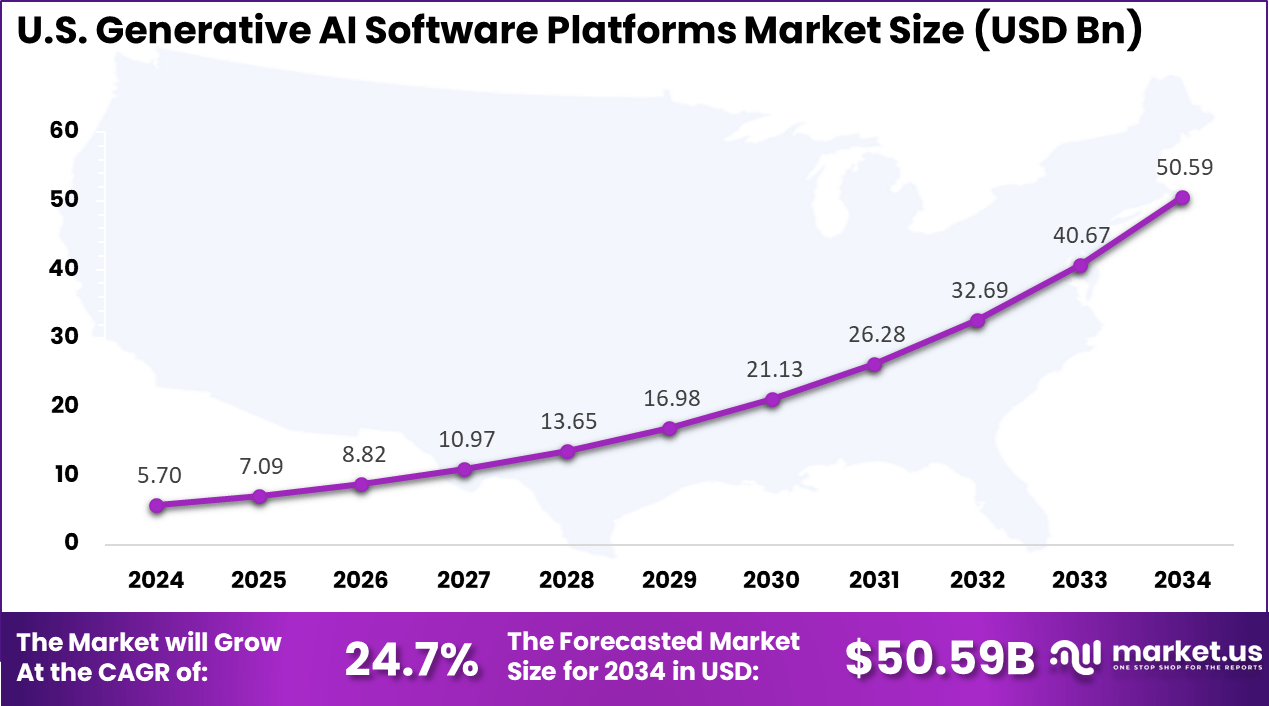

- The U.S. market reached USD 5.70 billion in 2024, with a CAGR of 24.7%, supported by strong innovation ecosystems and early adoption across industries.

- North America led globally with a 35.4% share, driven by AI maturity, skilled talent pools, and high R&D investment.

Top driving factors for this market include the embedding of generative AI into widely used enterprise software such as collaboration suites, CRM systems, and design platforms. This integration eliminates friction in adoption and enables immediate productivity gains, with users reporting significant improvements early in deployment.

The rapid advancements in foundational AI models, increased computing power, and widespread cloud adoption further fuel demand. Enterprises value generative AI platforms for their ability to automate repetitive tasks, enhance creativity, and provide data-driven insights that support faster, smarter decision-making. Additionally, the growing interest in agentic AI ecosystems and multi-agent orchestration increases appeal with platforms offering flexible, scalable AI solutions that fit evolving enterprise needs.

Investment opportunities in the generative AI software platforms market are extensive, ranging from foundational model development and domain-specific AI solutions to platform enhancements that improve usability and integration capabilities. Venture capital and corporate funding are flowing into startups offering niche AI capabilities as well as hyperscalers expanding their AI infrastructure and service portfolios.

Innovations such as fine-tuning platforms, prompt engineering frameworks, and multi-modal AI models open new avenues for startup growth and enterprise transformation. Furthermore, investments into AI-enabling infrastructure like high-performance computing, data storage, and thermal management solutions are critical to sustaining platform scaling and performance.

Role of AI and Advanced Technology

Role/Function Description AI/ML Chatbots Automated onboarding, 24/7 customer support, and claims handling for frictionless experience Usage-Based/Personalized Pricing AI analyzes real-time behavior and IoT/telematics data to set premiums and assess risk Automated Underwriting ML reduces manual intervention, allowing near-instant issuance and flexible micro-policies Predictive Analytics Big data and AI enable targeted recommendations and improved risk modeling Blockchain Integration Secur U.S. Market Size

The market for Generative AI Software Platforms within the U.S. is growing tremendously and is currently valued at USD 5.70 billion, the market has a projected CAGR of 24.7%. The market is growing due to the U.S.’s robust technological infrastructure, a dynamic startup ecosystem, and ongoing advancements in AI research.

For instance, in January 2024, Siemens announced a collaboration with Amazon Web Services (AWS) to enhance its generative AI capabilities, showcasing the continued dominance of the U.S. in the AI space. This partnership aims to accelerate the development and deployment of AI-driven solutions across industries like manufacturing and automation.

In 2024, North America held a dominant market position in the Global Generative AI Software Platforms Market, capturing more than a 35.4% share, holding USD 6.63 billion in revenue. This leadership is fueled by North America’s strong presence of major tech companies such as Microsoft, Amazon Web Services, Google, and IBM, combined with advanced cloud infrastructure and a thriving AI research ecosystem.

The region’s significant investments in AI innovation, coupled with growing security concerns and early enterprise adoption, have accelerated market expansion. Additionally, the rising demand for AI-driven automation and security solutions has further boosted the growth of generative AI software platforms in North America.

For instance, in April 2024, Google Cloud introduced new AI-driven tools for its channel partners at the Google Next 2024 conference, reinforcing North America’s leadership in the generative AI market. These innovations are designed to help businesses rapidly deploy AI solutions, from automating processes to enhancing data insights.

Technology Analysis

In 2024, the Machine Learning Platforms segment held a dominant market position, capturing a 30.2% share of the Global Generative AI Software Platforms Market. This dominance is due to the broad use of machine learning for tasks like data analysis, automation, and content creation.

Machine learning platforms streamline processes such as data preparation, model training, and system integration, making it easier for businesses to adopt AI solutions quickly. The continuous improvement of machine learning models, along with advancements in algorithms and infrastructure, has positioned it as a critical technology for businesses across multiple industries, fueling its significant share of the generative AI market.

For instance, in May 2025, IBM was recognized as a leader in Data Science and Machine Learning Platforms for its strong performance in delivering innovative solutions. IBM’s platforms provide robust tools for model development, data preparation, and deployment, enabling businesses to leverage AI across a wide range of applications.

Deployment Mode Analysis

In 2024, the On-Premise segment held a dominant market position, capturing a 64.6% share of the Global Generative AI Software Platforms Market. This dominance is due to businesses’ preference for maintaining full control over their data and AI models.

On-premise deployments offer enhanced security, data privacy, and compliance with regulations, making them particularly attractive for industries like healthcare, finance, and government. Additionally, organizations with sensitive data or legacy infrastructure prefer on-premise solutions for greater customization and integration flexibility.

For instance, in November 2024, Temenos announced the launch of its on-premise generative AI solution, powered by NVIDIA’s accelerated computing for real-time banking. This collaboration enables financial institutions to deploy AI models locally, offering enhanced control, security, and customization. On-premise solutions allow banks to process sensitive data within their infrastructure, ensuring compliance with data privacy regulations.

Component Analysis

In 2024, the Solution segment held a dominant market position, capturing a 60.6% share of the Global Generative AI Software Platforms Market. This dominance is due to the increasing demand for end-to-end AI solutions that encompass model development, deployment, and ongoing management.

Solutions provide businesses with integrated platforms that streamline workflows, reduce operational complexities, and offer customizable tools. Additionally, these comprehensive solutions enable organizations across industries to quickly adopt generative AI, ensuring scalability, efficiency, and innovation in their operations.

For Instance, in September 2024, SLB and NVIDIA announced a collaboration to develop generative AI solutions specifically tailored for the energy sector. By integrating advanced AI technologies with NVIDIA’s powerful computing capabilities, this partnership aims to optimize operations, improve decision-making, and enhance predictive maintenance for energy companies.

Functionality Analysis

In 2024, the Model Development (Training & Validation) segment held a dominant market position, capturing a 32.4% share of the Global Generative AI Software Platforms Market. This dominance is driven by the critical role model development plays in creating efficient generative AI systems. Training and validation are key to enhancing model accuracy, performance, and flexibility.

Businesses across various sectors depend on powerful training and validation tools to ensure their AI models are reliable, scalable, and compliant. This growing reliance on advanced model development processes has led to a strong demand for these components.

For Instance, in October 2024, EXL’s Enterprise AI Platform partnered with NVIDIA AI software to accelerate generative AI development for clients. This collaboration enhances model development by integrating advanced AI tools that streamline training and validation processes, ensuring faster and more efficient creation of high-performing generative AI models.

Application Analysis

In 2024, the Predictive Analytics segment held a dominant market position, capturing a 28.8% share of the Global Generative AI Software Platforms Market. This dominance is due to the increasing reliance on AI-driven predictions to drive business decisions across various industries.

Predictive analytics enables companies to forecast trends, identify opportunities, and mitigate risks by analyzing large datasets. Its application in sectors like finance, healthcare, and retail, where accurate predictions are crucial for optimizing operations and improving customer experiences, has fueled its growth and market share.

For Instance, In August 2025, Dell Technologies introduced enhancements to its AI data platform powered by NVIDIA Elastic, aimed at advancing generative AI capabilities. The upgrades integrate predictive analytics, enabling real-time data analysis and precise forecasting. By combining these capabilities, enterprises can streamline decision-making, automate workflows, and deliver improved customer experiences.

End Use Industry Analysis

In 2024, the Banking, Financial Services & Insurance (BFSI) segment held a dominant market position, capturing a 30.6% share of the Global Generative AI Software Platforms Market. This dominance is due to the growing need for AI solutions in decision-making, fraud detection, risk management, and customer service.

In BFSI, generative AI is used to automate tasks like claims processing, personalized financial advice, and predictive analytics, improving efficiency and reducing costs. The sector also utilizes AI for chatbots, virtual assistants, and real-time analytics, enhancing service delivery. Increased investments, regulatory compliance requirements, and strong AI integration further fuel market growth, driving significant advancements in the BFSI segment.

For Instance, In July 2024, Bengaluru-based OnFinance AI attracted attention in the BFSI sector for its use of generative AI to streamline financial operations. The platform automates functions like fraud detection, risk management, and customer service while delivering real-time insights and personalized financial guidance.

Enterprise Size Analysis

In 2024, the Large Enterprises segment held a dominant market position, capturing a 70.5% share of the Global Generative AI Software Platforms Market. This dominance is driven by the vast resources, infrastructure, and data that large enterprises possess, allowing them to efficiently implement and scale generative AI solutions.

With dedicated AI teams, robust investment capacity, and the need for advanced automation and personalized services, these enterprises are at the forefront of AI adoption. Their strong IT budgets, strategic AI partnerships, and demand for customizable, scalable platforms that meet complex needs in sectors like finance, healthcare, and technology further propel the integration of generative AI.

For Instance, In October 2024, Accenture partnered with NVIDIA to help large enterprises adopt generative AI at scale. Combining NVIDIA’s AI hardware with Accenture’s digital transformation expertise, the collaboration targets sectors like finance, healthcare, and manufacturing, enabling automation, personalized services, and improved decision-making.

Top Growth Drivers

Key Factors Description Rapid AI Adoption Across Enterprises Increasing need to automate workflows, enhance creativity, and improve decision-making drives platform integration Advances in Foundation Models and APIs Development of powerful, large-scale generative models (like GPT-4) and APIs enables scalable deployment and customization Demand for Automation and Hyper-Personalization Enterprises seek to reduce costs, enhance productivity, and deliver tailored customer experiences Cloud Infrastructure and SaaS Enablement Cloud computing and SaaS delivery facilitate flexible, scalable, and cost-effective access to generative AI tools Strong Investment and Innovation Ecosystem Heavy venture capital and developer activity spur rapid innovations and broaden market applications Key Trends

Trend/Innovation Description Embedded Generative AI in Applications Generative AI embedded directly into productivity and creative software like Microsoft 365 Copilot and Adobe Firefly to transform workflows and boost user engagement. Multimodal Generation Support for combined generation of text, images, audio, and video within single platforms, expanding use cases and creativity. Domain-Specific AI Models Customized generative AI tailored for industries such as finance, healthcare, and retail to address specific sector needs and compliance requirements. Foundation Model Proliferation Growth in large and small language models enabling scalable deployment in cloud, on-premises, and edge environments. Privacy and Governance Focus Increased emphasis on data privacy, ethical AI use, transparency, and regulatory compliance integrated into platforms. Key Market Segments

By Technology

- Machine Learning Platforms

- Natural Language Processing (NLP)

- Computer Vision

- Speech Recognition & Voice Processing

- Deep Learning Platforms

- Reinforcement Learning

- Others

By Deployment Mode

- Cloud-Based

- On-Premise

By Component

- Solution

- Software Tools & SDKs

- Application Programming Interfaces (APIs)

- Model Training & Deployment Infrastructure

- Data Preparation & Annotation Tools

- Others

- Services

- Professional Services

- Managed Services

By Functionality

- Model Development (Training & Validation)

- Model Deployment & Inference

- Data Engineering & ETL

- Model Monitoring & Governance

- AutoML / No-code AI Builders

- Others

By Application

- Predictive Analytics

- Natural Language Understanding (Chatbots, Virtual Assistants)

- Image/Video Analysis

- Speech Analytics

- Fraud Detection

- Recommendation Engines

- Others

By End Use Industry

- Healthcare & Life Sciences

- Banking, Financial Services & Insurance (BFSI)

- Retail & E-Commerce

- Manufacturing

- Transportation & Logistics

- IT & Telecom

- Media & Entertainment

- Energy & Utilities

- Government & Defense

- Others

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Demand for Automation and Personalized Content Creation

The expansive demand for automation and hyper-personalized content generation is a key driver propelling the generative AI software platforms market. Businesses across sectors are leveraging generative AI to automate repetitive tasks such as code writing, text generation, image synthesis, and customer interaction, enabling them to save time and reduce costs while improving output quality.

The surge in digital content consumption, coupled with the need for real-time and customized user experiences, fuels the adoption of AI tools that can generate diverse multimedia outputs tailored to specific audiences or individual preferences. Additionally, the availability of powerful large language models and multimodal AI architectures propels innovation in software platforms capable of supporting these capabilities.

For instance, in June 2024, SAP showcased significant advancements in generative AI at its annual Sapphire event. The company announced new AI-powered solutions and strategic partnerships aimed at enhancing automation, personalization, and decision-making across enterprise applications. These innovations enable businesses to leverage AI for tasks like data analysis, process optimization, and content generation.

Restraint

Data Privacy and Security Concerns

As generative AI models rely on large datasets for training, data privacy and security have become major concerns. The use of sensitive and personal data raises issues regarding compliance with privacy regulations like GDPR, which ensures user data protection.

Companies developing AI platforms must prioritize robust security measures and transparent data practices to mitigate privacy risks. Failing to meet these regulatory standards could lead to legal repercussions and erode user trust, hindering the growth of generative AI technologies.

For instance, In January 2025, data privacy and security continued to be major concerns in generative AI development. With AI models relying on large datasets, including sensitive personal information, scrutiny has increased over data collection, storage, and usage. Ensuring strong encryption, data anonymization, and compliance with global regulations like GDPR is essential to protect user information and uphold public trust.

Opportunities

Innovative Applications in Industries

Generative AI offers vast potential across multiple sectors, driving innovation in fields like healthcare, finance, and education. In healthcare, AI aids in drug discovery and medical imaging, enhancing diagnosis accuracy. In finance, it supports risk modeling and financial predictions.

Education benefits from AI’s ability to personalize learning, adapting content to individual needs. These applications create opportunities for businesses to unlock new revenue streams, improve efficiency, and address complex challenges with innovative AI-driven solutions tailored to each industry.

For instance, in April 2025, Waystar, a leading healthcare technology company, launched new generative AI and advanced automation features across its software platform to tackle inefficiencies in healthcare administration. The initiative aims to address billions in administrative waste, which often results from manual tasks like billing, claims processing, and patient interactions.

Challenges

Regulation and Compliance

Generative AI faces significant challenges related to regulation and compliance, as governments are still developing frameworks for its responsible use. In the U.S., regulations like the AI Accountability Act aim to ensure transparency and ethical use of AI technologies, addressing issues like bias and privacy.

Companies must navigate these evolving laws, such as ensuring compliance with data protection standards and mitigating risks of misuse. These uncertainties can slow down innovation and expansion in the generative AI market.

For instance, In February 2025, the European Union’s AI Act, the first comprehensive regulatory framework for artificial intelligence, began shaping the generative AI software landscape. The legislation mandates that AI systems operate safely, ethically, and transparently, with strict requirements for data privacy, transparency, accountability, and bias mitigation.

Key Players Analysis

In the Generative AI Software Platforms Market, several technology leaders are driving innovation through advanced AI model development, cloud integration, and enterprise-focused solutions. Adobe, AWS, Baidu, and C3.ai are at the forefront, offering platforms with strong scalability and domain-specific AI capabilities. DataRobot and Google Cloud AI Platform strengthen market competitiveness through AutoML features and large-scale data processing capabilities.

H2O.ai and HPE continue to enhance open-source frameworks and enterprise AI adoption, enabling faster deployment cycles and customized AI model creation for varied industry needs. IBM Watson Studio, Intel, and Microsoft Azure AI have significantly advanced model training efficiency and inference speed through hardware optimization and integrated development environments.

NVIDIA plays a central role with its GPU-powered AI infrastructure, while Oracle and Palantir deliver robust AI-driven analytics for decision intelligence. Salesforce Einstein and SAP SE integrate generative AI into CRM and ERP systems, improving operational efficiency, predictive insights, and customer engagement for large enterprises.

SAS Institute, TIBCO Software, Veritone, and Zoho’s Zia AI Platform cater to specialized sectors with tailored AI applications, from predictive analytics to cognitive search. These players focus on combining generative models with domain expertise, creating platforms capable of handling diverse use cases such as content generation, automation, and advanced data analytics.

Top Key Players in the Market

- Adobe Inc.

- Amazon Web Services (AWS)

- Baidu Inc.

- C3.ai

- DataRobot

- Google LLC (Google Cloud AI Platform)

- H2O.ai

- Hewlett-Packard Enterprise (HPE)

- IBM Corporation (Watson Studio)

- Intel Corporation

- Microsoft Corporation (Azure AI)

- NVIDIA Corporation

- Oracle Corporation

- Palantir Technologies

- Salesforce Inc. (Einstein Platform)

- SAP SE

- SAS Institute Inc.

- TIBCO Software

- Veritone Inc.

- Zoho Corporation (Zia AI Platform)

- Others

Recent Developments

- C3.ai launched the C3 Generative AI: Standard Edition on the Google Cloud Marketplace in early 2024. This no-code and self-service solution democratizes access to generative AI, enabling enterprise customers to extract insights easily from documents and unstructured data. The company also held its annual AI conference focusing on safe and effective adoption of generative AI across sectors.

- Google Cloud AI has aggressively expanded its AI portfolio with over 1,000 new products and features announced at Google Cloud Next 2024. Google’s Gemini large language models emphasize accuracy, performance, and cost-efficiency in generative AI applications. Google’s strategy centers on providing an open and vertically optimized AI stack, supporting broad developer adoption and digital transformation.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Technology (Machine Learning Platforms, Natural Language Processing (NLP), Computer Vision, Speech Recognition & Voice Processing, Deep Learning Platforms, Reinforcement Learning, Others), By Deployment Mode (Cloud-Based, On-Premise), By Component (Solution, Services), By Functionality (Model Development (Training & Validation), Model Deployment & Inference, Data Engineering & ETL, Model Monitoring & Governance, AutoML / No-code AI Builders, Others), By Application (Predictive Analytics, Natural Language Understanding (Chatbots, Virtual Assistants), Image/Video Analysis, Speech Analytics, Fraud Detection, Recommendation Engines, Others), By End Use Industry (Healthcare & Life Sciences, Banking, Financial Services & Insurance (BFSI), Retail & E-Commerce, Manufacturing, Others), By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Adobe Inc., Amazon Web Services (AWS), Baidu Inc., C3.ai, DataRobot, Google LLC (Google Cloud AI Platform), H2O.ai, Hewlett-Packard Enterprise (HPE), IBM Corporation (Watson Studio), Intel Corporation, Microsoft Corporation (Azure AI), NVIDIA Corporation, Oracle Corporation, Palantir Technologies, Salesforce Inc. (Einstein Platform), SAP SE, SAS Institute Inc., TIBCO Software, Veritone Inc., Zoho Corporation (Zia AI Platform), Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Generative AI Software Platforms MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Generative AI Software Platforms MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Adobe Inc.

- Amazon Web Services (AWS)

- Baidu Inc.

- C3.ai

- DataRobot

- Google LLC (Google Cloud AI Platform)

- H2O.ai

- Hewlett-Packard Enterprise (HPE)

- IBM Corporation (Watson Studio)

- Intel Corporation

- Microsoft Corporation (Azure AI)

- NVIDIA Corporation

- Oracle Corporation

- Palantir Technologies

- Salesforce Inc. (Einstein Platform)

- SAP SE

- SAS Institute Inc.

- TIBCO Software

- Veritone Inc.

- Zoho Corporation (Zia AI Platform)

- Others