Generative AI In Financial Services Market Size, Share, Statistics Analysis Report By Type (Solutions And Services), By Application (Credit Scoring, Fraud Detection, Risk Management, Forecasting & Reporting, Other Applications), By Deployment Mode (Cloud And On-Premises), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: Nov. 2024

- Report ID: 116329

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

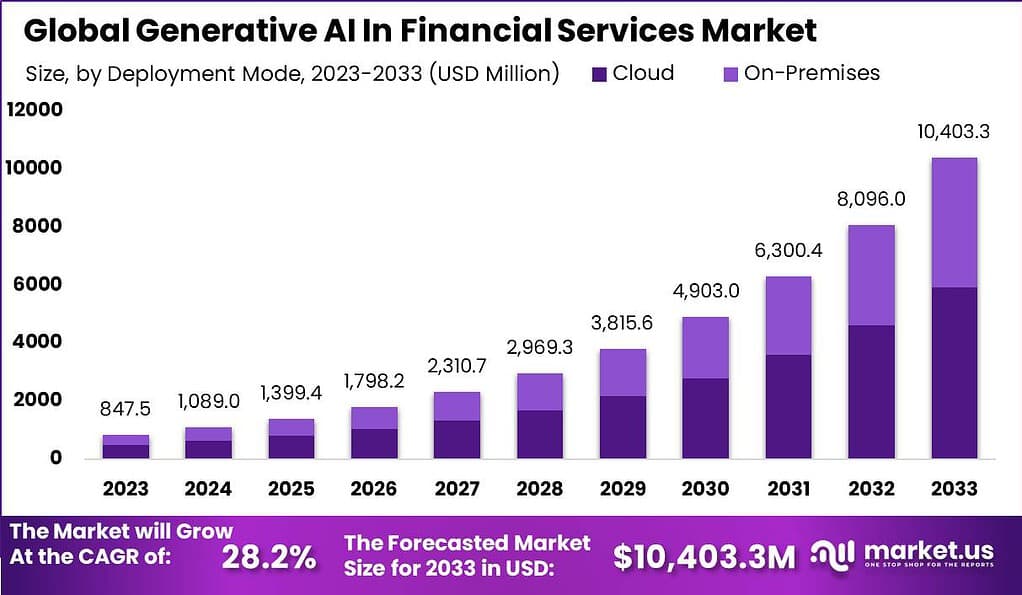

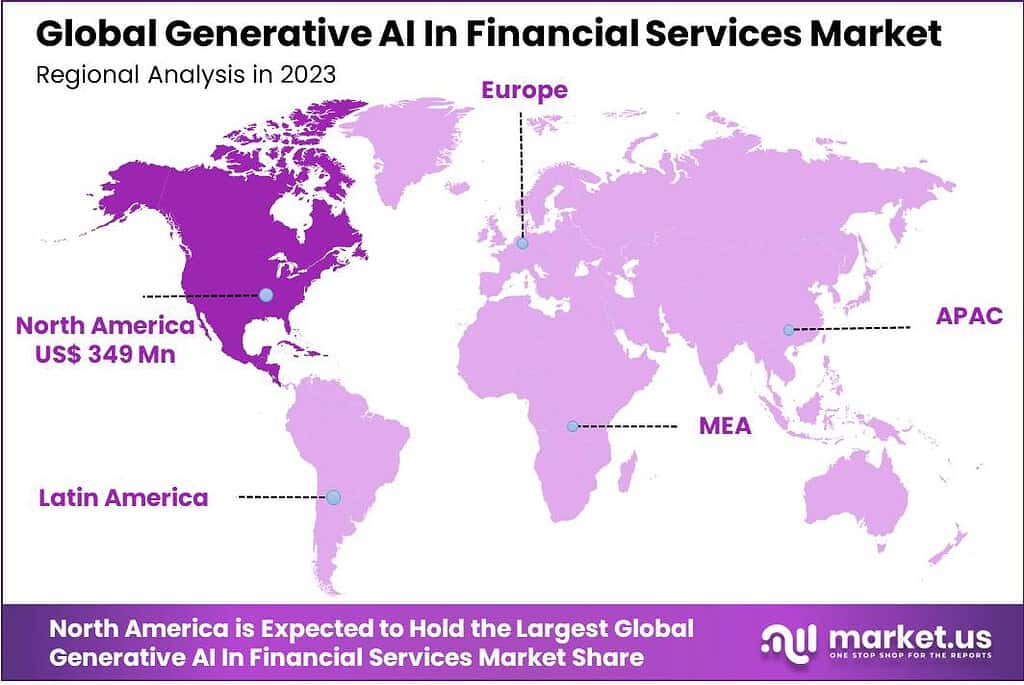

The Global Generative AI in Financial Services Market size is expected to be worth around USD 10,403.3 Million by 2033, from USD 847.5 Million in 2023, growing at a CAGR of 28.2% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 40% share, holding USD 349 Million revenue.

Generative AI (GenAI) has rapidly emerged as a pivotal technology in the financial services sector, revolutionizing how institutions operate from core functions to customer interactions. This technology enables the creation of new, original content, insights, and solutions across various applications. In banking and financial services, GenAI is deployed in areas such as customer service through chatbots, risk assessment, fraud detection, and financial advising.

The integration of Generative AI into financial services is rapidly evolving, driven by the technology’s ability to generate valuable insights and automate complex processes. As financial institutions continue to explore and adopt these technologies, the market for Generative AI in finance is seeing significant growth. This market is characterized by increasing investment in AI infrastructure and a strong focus on developing AI capabilities that can enhance customer interactions, risk assessment, compliance, and overall operational efficiency.

The primary drivers of Generative AI in financial services include the need to enhance operational efficiency, improve customer experience, and manage risk more effectively. Financial institutions are leveraging Generative AI to automate routine and complex tasks alike, which helps reduce costs and improve accuracy.

Moreover, the ability to process and analyze large volumes of data at unprecedented speeds allows for better decision-making and can significantly enhance the responsiveness of financial services to market changes and customer needs.

Market demand for Generative AI in financial services is growing as more organizations recognize its potential to drive innovation and competitiveness. This demand is reflected in the increasing adoption of AI tools for customer service automation, personalized financial advice, and advanced risk management solutions. Financial institutions are not only looking to streamline existing processes but also to create new products and services that can differentiate them in a competitive market.

Technological advancements are continually shaping the landscape of Generative AI in financial services. These advancements include improvements in AI models that enhance learning capabilities and accuracy, as well as developments in data processing and analysis. Financial institutions are increasingly investing in AI infrastructure that supports robust, scalable AI applications, enabling them to integrate these technologies more deeply into their core operations.

The market opportunities for Generative AI in financial services are vast, ranging from fraud detection and cybersecurity to compliance and customer relationship management. By automating these areas, financial institutions can allocate more resources to strategic activities and innovation. Additionally, Generative AI enables the personalization of customer interactions, offering a richer, more engaging customer experience that can lead to higher satisfaction and loyalty.

Key Takeaways

- The Generative AI in Financial Services market is forecasted to reach a value of USD 10,403.3 million by 2033, experiencing a robust CAGR of 28.2% from 2024 to 2033.

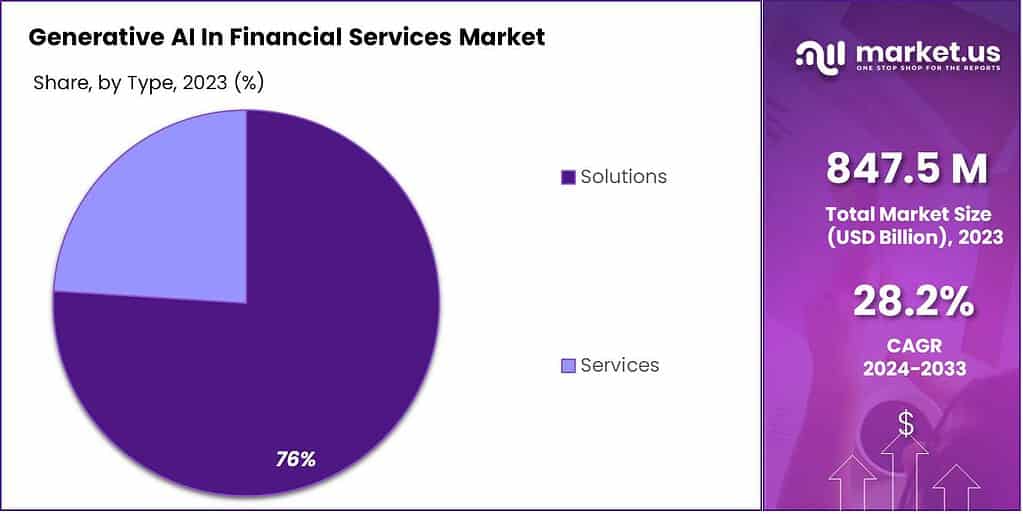

- In 2023, the Solutions segment held a dominant market position in the Generative AI in Financial Services market, capturing more than a ~76.4% share.

- In 2023, the Forecasting & Reporting segment held a dominant market position within the Generative AI in Financial Services market, capturing more than a 30% share.

- In 2023, the On-Premises segment held a dominant market position in the Generative AI in Financial Services market, capturing more than a 57% share.

- ~70% of financial institutions are set to embrace Generative AI by the end of 2024, indicating a widespread recognition of its value across the sector.

- The market size for Generative AI is projected to surge to USD 255.8 Billion by 2033, up from USD 13.5 Billion in 2023, demonstrating a robust CAGR of ~34.2% during the forecast period from 2024 to 2033. This growth underscores the expanding role of Generative AI in various industries.

- Specifically, within the Fintech sector, the Generative AI market is expected to reach USD 6,256 Million by 2033, growing from USD 865 Million in 2023. This growth, at a CAGR of 22.5% from 2024 to 2033, highlights the technology’s increasing adoption in financial services.

- Financial institutions utilizing Generative AI for fraud detection and anti-money laundering have seen a 25% increase in accuracy rates. This improvement underscores the technology’s effectiveness in enhancing security measures.

- ~48% of financial services executives have identified Generative AI as a crucial element of their digital transformation initiatives in 2023, reflecting its strategic importance.

- The adoption of Generative AI for compliance and regulatory reporting tasks has resulted in a 20% reduction in operational costs for financial institutions. This cost efficiency highlights Generative AI’s role in streamlining operations and improving financial performance.

- ~68% of financial services executives believe Generative AI will significantly impact the industry by 2025, signifying broad consensus on its potential to drive industry-wide transformations.

Type Analysis

In 2023, the Solutions segment held a dominant market position within the Generative AI in Financial Services market, capturing more than a 76.4% share. This substantial market share is primarily driven by the segment’s critical role in enhancing operational efficiencies and decision-making capabilities within financial institutions.

Solutions leveraging Generative AI include automated financial advising systems, advanced risk assessment models, and sophisticated fraud detection systems. These technologies are crucial for analyzing vast amounts of data, generating actionable insights, and improving service delivery across the financial sector.

The prominence of the Solutions segment can also be attributed to the increasing complexity and volume of data handled by financial services. Financial entities utilize Generative AI to develop personalized products and services, which requires the ability to predict market trends and customer behavior with high accuracy.

This need has propelled the adoption of Generative AI solutions, as they are integral in transforming data into strategic opportunities, thereby enhancing the institutions’ competitiveness and responsiveness to market dynamics. Furthermore, the integration of Generative AI in these solutions significantly aids in regulatory compliance and risk management, which are top priorities for financial institutions.

The ability of GenAI solutions to streamline compliance processes and enhance the detection of financial anomalies offers considerable advantages. This not only mitigates risks but also reduces operational costs, making the Solutions segment a valuable asset for the financial services industry.

Overall, the Solutions segment’s dominance is indicative of its indispensable role in the current and future landscape of financial services. As the market continues to evolve, the demand for advanced Generative AI solutions is expected to grow, driven by their ability to provide significant operational advantages and support strategic decision-making processes.

Application Analysis

In 2023, the Forecasting & Reporting segment held a dominant market position in the Generative AI in Financial Services market, capturing more than a 30% share. This leadership can be attributed to the critical role these technologies play in enhancing the accuracy and timeliness of financial analysis and decision-making processes.

Financial institutions are increasingly relying on Generative AI for precise forecasting and detailed reporting capabilities that allow them to make informed strategic decisions, manage risks effectively, and optimize performance across their operations. The substantial impact of the Forecasting & Reporting segment is further bolstered by the financial sector’s need for robust predictive analytics to navigate the complexities of global markets.

As markets become more volatile and data-driven, the ability to forecast economic shifts and customer behavior becomes a competitive advantage. Generative AI excels in sifting through vast datasets to identify patterns, trends, and potential anomalies, which is indispensable for predicting market movements and financial outcomes.

Moreover, the adoption of Generative AI in forecasting and reporting not only facilitates real-time data analysis but also enables financial institutions to dynamically adjust their strategies in response to emerging market conditions.

This agility is crucial in the fast-paced financial sector, where timely and accurate information can be the difference between capitalizing on opportunities and missing them. Thus, the dominance of this segment is expected to continue as the demand for sophisticated, data-driven decision-making tools increases.

Deployment Mode Analysis

In 2023, the On-Premises segment held a dominant market position in the Generative AI in Financial Services market, capturing more than a 57% share. This significant market dominance is primarily due to financial institutions prioritizing data security, regulatory compliance, and customized control over their AI systems.

On-premises deployment allows these institutions to maintain strict oversight of their AI infrastructure and data, which is crucial given the sensitive nature of financial information. This model ensures that data handling complies with stringent industry regulations and internal protocols, enhancing the security and integrity of financial data.

The preference for on-premises deployment also stems from the need for high-performance computing capabilities that integrate seamlessly with existing IT environments. Financial institutions often require sophisticated AI models that can process large volumes of data with minimal latency.

Hosting these solutions on-premises allows organizations to utilize their robust hardware and network infrastructure, which supports the efficient and secure operation of generative AI applications without the potential vulnerabilities associated with cloud-based solutions.

Moreover, the on-premises model offers financial institutions the flexibility to tailor generative AI solutions to specific operational needs and regulatory standards. This customization is vital for adapting to the complex and ever-changing landscape of financial regulations.

By maintaining control over the deployment and management of these AI systems, institutions can ensure that they are not only compliant but also optimally configured to support unique business processes and strategies.

Overall, the dominance of the On-Premises segment reflects its critical role in providing financial institutions with the security, performance, and customization needed to effectively leverage Generative AI technologies within a regulated industry. As data privacy concerns and regulatory requirements continue to escalate, the value of on-premises deployment in ensuring compliance and operational integrity is expected to sustain its preference in the market.

Key Market Segments

Based on Type

- Solutions

- Services

Based on Application

- Credit Scoring

- Fraud Detection

- Risk Management

- Forecasting & Reporting

- Other Applications

Based on the Deployment Mode

- Cloud

- On-premises

Driver

Enhanced Decision-Making Capabilities

The integration of generative AI into financial services significantly enhances decision-making capabilities, acting as a primary driver for its adoption. By leveraging advanced algorithms and machine learning, financial institutions can analyze large volumes of data to identify trends, assess risks, and uncover investment opportunities with unprecedented accuracy. This AI-driven approach enables more informed and timely decisions, optimizing financial performance and competitive advantage.

As a result, the demand for generative AI solutions in financial services is accelerating, driven by the need for deeper insights into market dynamics, customer behavior, and financial risk management. This technological advancement facilitates a shift towards data-driven strategies, improving overall operational efficiency and fostering innovation within the sector.

Restraint

High Implementation Costs

One significant restraint in the adoption of generative AI within financial services is the high implementation costs associated with these technologies. Deploying advanced AI systems requires substantial investment in infrastructure, software, and skilled personnel to develop, manage, and maintain these complex systems.

Additionally, the transition to AI-driven operations can entail significant upfront costs, including training for staff and integration with existing IT systems. For many financial institutions, especially smaller firms with limited budgets, these initial costs pose a considerable barrier to entry. This challenge is compounded by the ongoing expenses related to updating and securing AI systems against evolving cybersecurity threats, further straining financial resources and impacting the pace of adoption across the industry.

Opportunity

Personalized Financial Services

Generative AI opens up vast opportunities for delivering personalized financial services, transforming how institutions interact with their customers. By analyzing customer data in real-time, AI can generate personalized insights, recommendations, and financial products tailored to individual needs and preferences. This level of personalization enhances customer engagement and satisfaction, leading to increased loyalty and retention rates.

Moreover, the ability to offer customized solutions allows financial institutions to differentiate themselves in a competitive market, creating new revenue streams and expanding their customer base. As consumer expectations continue to evolve towards more personalized experiences, the demand for AI-enabled customization in financial services presents a significant growth opportunity for the sector.

Challenge

Data Privacy and Security Concerns

As generative AI relies heavily on the use and analysis of vast amounts of data, data privacy and security emerge as major challenges. Financial institutions must navigate complex regulatory landscapes designed to protect consumer information while leveraging AI technologies. Ensuring compliance with these regulations, such as GDPR in Europe or CCPA in California, requires rigorous data management practices and robust security protocols.

Additionally, the potential for AI systems to be exploited in data breaches or for malicious purposes raises significant concerns. Building and maintaining trust with customers while harnessing the benefits of AI demands a delicate balance, necessitating ongoing investment in cybersecurity measures and privacy-compliant technologies. This challenge underscores the need for financial services to prioritize data protection as they advance in their AI journey.

Growth Factors

The growth of generative AI (GenAI) in the financial services sector is driven by its potential to enhance efficiency, accuracy, and personalized customer experiences. Financial institutions are leveraging GenAI to automate complex tasks such as data analysis, risk assessment, and regulatory compliance, which traditionally require significant manpower and time. These advancements not only streamline operations but also reduce costs and improve service delivery.

Additionally, the demand for real-time data processing and insights in the financial sector boosts the adoption of GenAI. These technologies enable institutions to quickly analyze vast arrays of information, aiding in decision-making processes that are critical in today’s fast-paced market environments. The ability to generate predictive insights and personalized financial advice based on comprehensive data analysis is particularly valuable, driving further investment in GenAI technologies.

Emerging Trends

One of the key trends in the adoption of GenAI within financial services is the increasing use of AI to create more sophisticated customer interaction systems, such as chatbots and virtual assistants. These systems are being designed to handle a broader range of customer inquiries with greater precision, enhancing the customer service experience and operational efficiency.

Another emerging trend is the use of GenAI for risk management and compliance tasks. Financial institutions are employing these technologies to simulate different risk scenarios and stress-test investment strategies, which is crucial for maintaining financial stability and adhering to regulatory standards. Additionally, GenAI is being used to automate and enhance the accuracy of financial reporting and fraud detection processes, further embedding AI into critical financial operations.

Business Benefits

The business benefits of implementing GenAI in financial services are significant. By automating routine and complex tasks, GenAI allows financial institutions to focus more on strategic activities and innovation. This shift not only boosts operational efficiency but also enhances employee satisfaction by reducing mundane tasks and enabling a focus on more engaging and value-added activities.

Furthermore, GenAI aids in the customization of financial products and services to meet individual customer needs more effectively. Through detailed analysis of customer data, financial institutions can offer tailored advice, predict customer needs, and proactively address them, leading to improved customer retention and satisfaction.

Overall, the integration of GenAI into financial services is transforming the industry by enhancing operational efficiencies, improving customer engagement, and ensuring more robust compliance and risk management. As the technology continues to evolve, it is expected to unlock even more innovative applications and drive significant changes in the sector.

Regional Analysis

In 2023, North America held a dominant market position in the Generative AI in Financial Services market, capturing more than a 40% share. This leading position is largely attributable to the region’s robust financial sector, high technological adoption rates, and significant investments in AI research and development. The demand for Generative AI In Financial Services in North America was valued at USD 349 Million in 2023 and is anticipated to grow significantly in the forecast period.

North America, particularly the United States, is home to a large number of pioneering tech companies and financial institutions that are at the forefront of integrating AI technologies into their operations. These entities recognize the transformative potential of generative AI for enhancing decision-making processes, improving customer experiences, and increasing operational efficiency.

The region’s regulatory environment also plays a critical role in fostering the growth of generative AI in financial services. Regulatory bodies in North America have been proactive in establishing frameworks that encourage innovation while ensuring the responsible use of AI technologies. This has provided a conducive environment for financial institutions to experiment with and deploy generative AI solutions, further driving the market’s growth.

Moreover, the presence of a highly skilled workforce specializing in AI and machine learning, combined with world-class academic and research institutions, supports the continuous advancement of AI technologies in North America. These factors contribute to the region’s leadership in the generative AI market, enabling North American financial services companies to leverage cutting-edge AI solutions to maintain a competitive edge in the global marketplace.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the rapidly evolving Generative AI in Financial Services market, several key players have established themselves as leaders through innovative solutions, strategic partnerships, and extensive research and development efforts. These companies are at the forefront of integrating AI technologies to transform financial services, offering solutions that enhance efficiency, security, and customer experience.

Top Market Leaders

- IBM Corporation

- Intel Corporation

- Narrative Science

- Amazon Web Services, Inc.

- Microsoft

- Google LLC

- Salesforce, Inc.

- Other Key Players

Recent Developments

- Salesforce Expansion: In February 2023, Salesforce enhanced its Einstein platform with generative AI, offering personalized customer experiences and automated financial reporting for institutions.

- AWS SageMaker Autopilot: March 2023 saw AWS introducing Amazon SageMaker Autopilot, streamlining the creation and deployment of machine learning and generative AI models for financial applications.

- Microsoft and S&P Global Partnership: June 2023 marked a collaboration between Microsoft and S&P Global Market Intelligence, aiming to develop a generative AI solution for generating insightful financial reports.

- IBM Acquires ENI: In August 2023, IBM acquired ENI, a startup focusing on explainable AI, to improve the transparency and trustworthiness of its financial services generative AI models.

- Narrative Science’s Quill for Finance: October 2023 witnessed the release of Quill for Finance by Narrative Science, a platform designed to generate financial narratives and reports through generative AI.

Report Scope

Report Features Description Market Value (2023) USD 847.5 Mn Forecast Revenue (2033) USD 10,403.3 Mn CAGR (2024-2033) 28.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Solutions And Services), By Application (Credit Scoring, Fraud Detection, Risk Management, Forecasting & Reporting, Other Applications), By Deployment Mode (Cloud And On-Premises) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape IBM Corporation, Intel Corporation, Narrative Science, Amazon Web Services Inc., Microsoft, Google LLC, Salesforce Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Generative AI in the context of Financial Services?Generative AI refers to a subset of artificial intelligence that involves machines generating new content, such as text, images, or even financial data, based on patterns from existing data. In the Financial Services market, it can be used for tasks such as generating synthetic financial data, creating investment strategies, or automating customer service interactions.

How big is Generative AI in Financial Services Market?The Global Generative AI in Financial Services Market size is expected to be worth around USD 10,403.3 Million by 2033, from USD 847.5 Million in 2023, growing at a CAGR of 28.2% during the forecast period from 2024 to 2033.

How is Generative AI transforming the Financial Services industry?Generative AI is revolutionizing the Financial Services industry by enabling organizations to automate processes, generate insights, and develop innovative solutions. It enhances risk management, fraud detection, customer service, and investment decision-making, leading to increased efficiency, accuracy, and competitiveness.

What are the challenges associated with implementing Generative AI in the Financial Services sector?Challenges may include:

- Data privacy and regulatory compliance

- Ensuring algorithm transparency and interpretability

- Addressing bias and fairness in AI models

- Integration with legacy systems and infrastructure

- Security concerns related to sensitive financial data

Who are the key players in the Generative AI in Financial Services market?IBM Corporation, Intel Corporation, Narrative Science, Amazon Web Services Inc., Microsoft, Google LLC, Salesforce Inc., Other Key Players

Generative AI In Financial Services MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample

Generative AI In Financial Services MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Intel Corporation

- Narrative Science

- Amazon Web Services, Inc.

- Microsoft

- Google LLC

- Salesforce, Inc.

- Other Key Players