Global Generative AI in Corporate Tax Management Market Report By Component (Solution, Services), By Deployment Mode (Cloud-Based, On-Premise), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (BFSI, IT and Telecommunications, Healthcare, Manufacturing, Retail and E-commerce, Energy and Utilities, Other Industry Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: August 2024

- Report ID: 127612

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

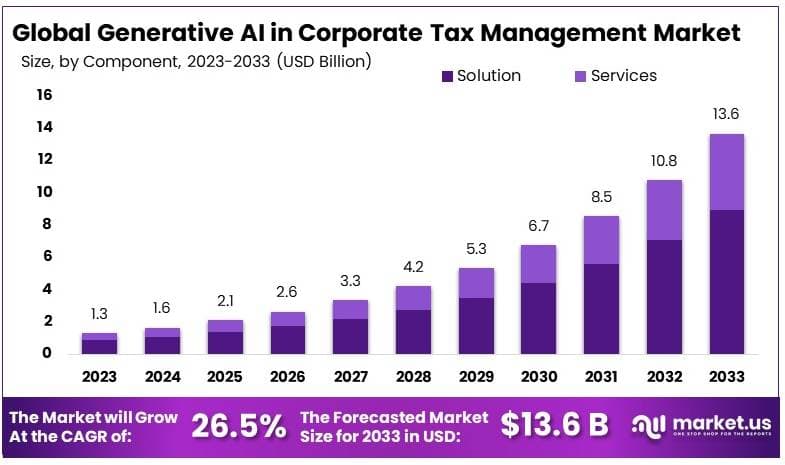

The Global Generative AI in Corporate Tax Management Market size is expected to be worth around USD 13.6 Billion by 2033, from USD 1.3 Billion in 2023, growing at a CAGR of 26.5% during the forecast period from 2024 to 2033.

The Generative AI in Corporate Tax Management Market is revolutionizing how businesses handle their tax obligations. Generative AI uses advanced algorithms to automate complex tax calculations, identify tax-saving opportunities, and ensure compliance with ever-changing regulations.

For corporations, this technology reduces the time and resources spent on tax management while minimizing the risk of errors. It also offers predictive insights that help companies plan more effectively for future tax liabilities.

The market is expanding as more firms recognize the value of AI-driven tax solutions in improving accuracy and efficiency. This sector is particularly relevant for large enterprises that deal with complex tax structures and need robust tools to manage their tax processes.

The integration of generative AI in corporate tax management is emerging as a transformative force, offering significant potential to enhance efficiency, compliance, and decision-making processes within the sector. As businesses grapple with increasingly complex tax regulations and the growing scrutiny from tax authorities, the adoption of AI-driven solutions is becoming more critical.

The IRS, which collected approximately $4.7 trillion in revenue in 2023, representing 96% of the federal government’s total funding, has been at the forefront of leveraging AI to close the tax gap. This gap, estimated to be $496 billion annually for 2014-2016 and projected to rise to $688 billion in 2021, highlights the challenges in tax compliance that AI tools are well-positioned to address.

For instance, AI-driven audits in 2023 targeted 76 of the largest U.S. partnerships, each managing over $10 billion in assets, underscoring the technology’s capability to manage and analyze complex financial structures.

Generative AI, in particular, is set to revolutionize corporate tax management by automating routine tasks such as data entry, tax filing, and report generation. This allows tax professionals to focus on higher-value activities like strategic tax planning and compliance risk management.

With the IRS significantly improving its customer service capabilities—evidenced by reducing call wait times to an average of three minutes during the 2024 filing season—there is a clear push towards modernizing tax processes through AI.

Moreover, federal spending on AI has seen a sharp increase, with a 150% rise in obligated funding from $261 million to $675 million between 2022 and 2023. This surge, primarily driven by the Department of Defense, indicates a broader government commitment to AI, which is likely to spill over into tax management and compliance sectors.

The adoption of generative AI in corporate tax management is poised for growth. With increasing government investment in AI and the IRS’s focus on closing the tax gap, businesses are likely to see significant benefits from these technologies in terms of efficiency, accuracy, and compliance.

Key Takeaways

- The Generative AI in Corporate Tax Management Market was valued at USD 1.3 billion in 2023, and is expected to reach USD 13.6 billion by 2033, with a CAGR of 26.5%.

- In 2023, Solution dominated the component segment with 65.4% due to the increasing need for automated tax solutions.

- In 2023, Cloud-Based deployment led with 67.1%, reflecting its scalability and accessibility for enterprises.

- In 2023, Large Enterprises dominated with 64.8%, driven by the complex tax management needs of large organizations.

- In 2023, North America was the dominant region with 39.0% market share, supported by a strong corporate sector.

Component Analysis

Solution dominates with 65.4% due to its comprehensive integration capabilities and scalability.

In the market for Generative AI in corporate tax management, the Solution component is notably dominant, accounting for 65.4% of the segment. This prominence is largely due to the critical need for robust, scalable AI frameworks that can seamlessly integrate with existing corporate systems to automate and enhance tax processes.

Solutions in this context refer to the software platforms that employ generative AI to create, simulate, and optimize tax scenarios, thus enabling companies to improve compliance and efficiency in tax management.

The Services segment, although essential, primarily supports the implementation, maintenance, and updating of these solutions but does not drive the market to the same extent as the solutions themselves. Services include consulting, training, and after-sales support which are vital for maximizing the functionality and impact of generative AI solutions in corporate environments.

The significance of solutions in the Generative AI market for corporate tax management is set to increase as more companies recognize the potential of AI to automate complex and time-consuming tax operations. This recognition is expected to lead to greater investment in advanced AI solutions, thereby maintaining their dominance in the market.

Deployment Mode Analysis

Cloud-Based dominates with 67.1% due to its flexibility, scalability, and cost-effectiveness.

Cloud-Based deployment holds the largest share in the deployment mode category for Generative AI in corporate tax management, with a significant 67.1% market dominance. This deployment mode’s popularity stems from its flexibility, scalability, and cost-effectiveness, which are particularly advantageous for managing corporate tax operations.

The cloud offers companies the ability to scale their artificial intelligence solutions up or down based on real-time demands and access advanced computing power without a hefty initial investment, making it a preferred choice for many businesses.

On-Premise solutions, while providing control and security, often involve higher upfront costs and require continuous maintenance and upgrades. In contrast, cloud-based services reduce the need for physical infrastructure and upfront investments, which is particularly appealing for companies aiming to reduce operational costs and increase efficiency.

As more companies move towards digital transformations, cloud-based Generative AI solutions are expected to become even more entrenched as the standard for deploying advanced technologies in corporate tax management, primarily due to their cost efficiency and adaptability to changing business environments.

Organization Size Analysis

Large Enterprises dominate with 64.8% due to their capacity to invest in advanced technologies and drive innovation.

Large Enterprises hold a dominant position in the application of Generative AI in corporate tax management, with a market share of 64.8%. This dominance is due to their substantial resources, which allow for significant investments in advanced technology and innovative practices to streamline tax operations.

Small and Medium-Sized Enterprises (SMEs), while increasingly adopting AI solutions, still lag behind in their ability to invest at scale, which is necessary for full-scale implementation of sophisticated AI technologies. However, as solutions become more cost-effective and the benefits of AI in enhancing compliance and efficiency become clearer, SMEs are expected to increase their adoption rates.

The continued dominance of large enterprises in utilizing Generative AI for corporate tax management is likely to persist as these organizations continue to lead in technological adoption, benefiting from the efficiency and scalability that AI solutions provide.

Industry Vertical Analysis

BFSI dominates with 22.5% due to stringent regulatory requirements and high transaction volumes.

In the industry verticals for Generative AI in corporate tax management, the Banking, Financial Services, and Insurance (BFSI) sector leads with a 22.5% market share. The BFSI sector faces some of the most stringent regulatory requirements and manages high volumes of complex transactions that are ideally suited for automation through Generative AI.

Other industry verticals such as IT and Telecommunications, Healthcare, Manufacturing, Retail and E-commerce, Energy and Utilities also integrate Generative AI into their tax functions but not to the extent seen in the BFSI sector. Each of these sectors has unique challenges and demands for AI in tax management, contributing to the overall growth of the market.

The BFSI sector’s role as a leader in the adoption of Generative AI for tax management is expected to continue, driven by the need for compliance, efficiency, and the handling of complex financial data, which are highly compatible with the capabilities of AI solutions. As regulatory pressures increase and technological advancements continue, the BFSI sector will likely maintain its leading position in adopting these innovations.

Key Market Segments

By Component

- Solution

- Services

By Deployment Mode

- Cloud-Based

- On-Premise

By Organization Size

- Small and Medium-Sized Enterprises

- Large Enterprises

By Industry Vertical

- BFSI

- IT and Telecommunications

- Healthcare

- Manufacturing

- Retail and E-commerce

- Energy and Utilities

- Other Industry Verticals

Driver

Technology Advancements and Regulatory Compliance Drive Market Growth

The adoption of generative AI in corporate tax management is significantly driven by advancements in technology and the growing emphasis on regulatory compliance. With over 14,000 regulatory changes occurring monthly across approximately 19,000 tax jurisdictions globally, the need for real-time updates and accurate compliance tracking has never been more critical.

Generative AI offers substantial support by automating the monitoring of these changes, enabling companies to remain compliant more efficiently. This technology also facilitates the automation of repetitive tasks, such as data entry and document management, allowing tax professionals to focus on strategic decision-making.

Furthermore, the Indian government’s initiatives, like the push for comprehensive reconciliations through platforms such as the Annual Information Statement (AIS), underscore the importance of leveraging AI to enhance accuracy in tax reporting. The integration of AI tools into tax departments is not just about improving efficiency; it also directly impacts the bottom line by reducing errors and optimizing resource allocation.

Restraint

Data Privacy, Integration Costs, and Skill Gaps Restrain Market Growth

Data privacy concerns, integration costs, and skill gaps are significant factors restraining the growth of the Generative AI in Corporate Tax Management Market. The need to safeguard sensitive financial information creates hesitation among companies to fully adopt AI technologies. This concern is compounded by strict regulatory requirements, making it difficult for businesses to trust AI systems with critical data.

Integration challenges further complicate adoption. Many organizations rely on legacy systems that are not easily compatible with advanced AI technologies. The cost and complexity of integrating AI into these existing infrastructures can be prohibitive, especially for smaller firms. This often results in delayed implementation or the need for substantial investment in new systems, which many companies are reluctant to make.

Moreover, the skill gap in the workforce presents another barrier. The successful deployment and operation of AI in tax management require specialized knowledge, which is currently in short supply. Companies struggle to find professionals with the necessary expertise, slowing down AI adoption and limiting its potential benefits.

Opportunity

Strategic Adoption and Innovation Provide Opportunities for Market Growth

The Generative AI in Corporate Tax Management Market presents significant opportunities for companies to innovate and differentiate their services. The increasing complexity of global tax regulations creates a demand for advanced AI solutions that can efficiently manage and interpret vast amounts of data.

Moreover, the rising trend of digital transformation in corporate finance opens doors for companies to offer AI-powered solutions that integrate seamlessly with existing financial systems. This allows businesses to streamline their operations and improve decision-making processes.

Additionally, partnerships between technology firms and tax service providers can accelerate the development of tailored AI solutions, offering a competitive edge in the market.

Another opportunity lies in the ability to capitalize on government initiatives aimed at enhancing digital infrastructure and encouraging AI adoption. By aligning their offerings with these initiatives, companies can gain favorable positions in the market. Furthermore, investing in research and development to create more advanced, secure, and user-friendly AI tools will cater to the growing demand for AI-driven tax management solutions.

Challenge

High Costs, Regulatory Uncertainty, and Ethical Concerns Challenge Market Growth

The growth of Generative AI in Corporate Tax Management faces significant challenges, particularly due to high implementation costs, regulatory uncertainty, and ethical concerns. High costs associated with developing and deploying AI systems are a major obstacle. Small to medium-sized enterprises often find it difficult to justify the investment required for AI infrastructure, which includes both the initial setup and ongoing maintenance.

Regulatory uncertainty adds another layer of complexity. As AI technologies evolve, governments and regulatory bodies struggle to keep pace, leading to unclear guidelines and potential legal risks. Companies are often hesitant to fully integrate AI into their tax processes without clear regulations, fearing future compliance issues or penalties.

Ethical concerns related to AI decision-making also pose a challenge. The use of AI in sensitive areas like tax management raises questions about transparency, accountability, and fairness. Companies worry about the potential for biased algorithms or the lack of human oversight, which could lead to incorrect tax filings or disputes with authorities.

Growth Factors

Technological Advancements and Compliance Needs Are Growth Factors

Technological advancements, the increasing complexity of tax regulations, and the demand for efficiency in tax processes are significant growth factors for the Generative AI in Corporate Tax Management Market. As technology rapidly evolves, businesses are compelled to adopt AI-driven solutions to streamline and automate complex tax operations.

The increasing complexity of tax regulations worldwide has created a demand for advanced tools that can navigate these intricate rules. Generative AI provides tax professionals with the ability to analyze and interpret vast amounts of regulatory data, ensuring that companies remain compliant with local and international laws.

Moreover, the need for efficiency in corporate tax management is driving the adoption of AI. Traditional tax processes are often time-consuming and prone to errors, which can lead to costly penalties and reputational damage. AI tools help automate these processes, freeing up resources and allowing tax professionals to focus on more strategic tasks.

Emerging Trends

AI-Driven Automation and Data Analytics Are Latest Trending Factors

AI-driven automation, enhanced data analytics, and the push for real-time insights are the latest trending factors driving the growth of the Generative AI in Corporate Tax Management Market. The trend toward AI-driven automation is transforming tax management by reducing manual intervention and enabling companies to handle complex tax computations with greater speed and accuracy.

Enhanced AI in data analytics is another key trend. As tax data becomes more complex and voluminous, companies are increasingly relying on advanced AI tools to analyze and interpret this data. AI’s ability to process large datasets quickly and provide actionable insights is helping tax departments to identify patterns, detect anomalies, and optimize tax strategies.

The push for real-time insights is also trending, as companies demand up-to-the-minute data to make informed decisions. Generative AI is playing a crucial role in providing these insights by continuously analyzing data and updating tax strategies accordingly.

Regional Analysis

North America Dominates with 39.0% Market Share

North America leads the Generative AI in Corporate Tax Management market with a 39.0% share, generating USD 0.51 billion. This region’s dominance is supported by a highly developed technological infrastructure, a robust regulatory environment that necessitates advanced tax management solutions, and significant investments in AI and machine learning technologies.

The presence of major technology and financial corporations that readily invest in AI to optimize tax processes significantly contributes to this dominance. Moreover, the region’s focus on compliance and transparency in financial operations drives the adoption of advanced AI tools for corporate tax management.

Given the ongoing technological advancements and regulatory complexities, North America is expected to continue leading in this sector. The growing need for efficient and accurate tax processing systems will likely fuel further investments and innovations in Generative AI, enhancing its impact on the market.

Regional Overview for Other Regions

- Europe: Europe is a strong player in this market, with a focus on enhancing regulatory compliance through technology. The adoption of Generative AI in corporate tax management is growing, driven by the need to manage diverse and complex tax regulations efficiently.

- Asia Pacific: Asia Pacific shows significant growth potential, driven by rapid economic development and digital transformation initiatives. Increasing corporate investments in AI for business process automation, including tax management, are pivotal to this growth.

- Middle East & Africa: The Middle East & Africa region is gradually embracing Generative AI for tax management, particularly in economically diversified countries looking to streamline corporate financial processes and improve compliance.

- Latin America: In Latin America, adoption is on the rise, with countries like Brazil leading the way in implementing AI solutions to address corporate tax management challenges. Economic reforms and digital transformation efforts are key drivers for this technology’s adoption.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The Generative AI in Corporate Tax Management market is influenced by a few leading companies that shape its growth and development. The top three key players in this market are Thomson Reuters Corporation, Deloitte Touche Tohmatsu Limited, and KPMG International Limited.

Thomson Reuters Corporation is a dominant force, leveraging its deep expertise in tax and accounting to integrate generative AI into corporate tax management. The company’s ONESOURCE platform uses AI to automate complex tax processes, making it a leader in the market. Thomson Reuters’ strong brand and innovative solutions give it significant influence and strategic advantage.

Deloitte Touche Tohmatsu Limited is another key player, utilizing generative AI to enhance its tax advisory services. Deloitte’s extensive global network and deep industry knowledge allow it to offer customized AI-driven tax solutions. Its strategic positioning as a leader in professional services strengthens its impact on the market.

KPMG International Limited is also a major player, integrating AI into its tax management services to offer advanced analytics and compliance solutions. KPMG’s focus on innovation and its robust client base in corporate tax management make it a key influencer in this space. Its strategic investments in AI technology ensure its strong market presence.

These companies drive the adoption of generative AI in corporate tax management, setting standards and leading innovation. Their strategic positioning, advanced technology, and market influence make them the leading players in this emerging market.

Top Key Players in the Market

- Thomson Reuters Corporation

- Vertex, Inc.

- KPMG International Limited

- Deloitte Touche Tohmatsu Limited

- Avalara, Inc.

- Wolters Kluwer N.V.

- Blue dot VATBox Ltd.

- Blue J Legal Inc.

- Other Key Players

Recent Developments

- Thomson Reuters: Thomson Reuters announced updates to its tax, accounting, and audit products at the SYNERGY 2023 event, including the integration of generative AI into products like Checkpoint Edge and ONESOURCE Global Trade Management. These updates aim to automate tax preparation, streamline audits, and improve compliance.

- KPMG: KPMG’s survey revealed that 83% of senior business leaders plan to increase investments in generative AI over the next three years. Many executives are already integrating AI into their tax functions, expecting it to drive revenue growth and improve productivity in tax compliance and risk management.

- Deloitte: Deloitte has expanded its portfolio of AI-powered tax solutions, focusing on automating tax compliance and optimizing tax strategies for large enterprises. By leveraging generative AI, Deloitte aims to provide real-time insights and support strategic decision-making in tax planning.

Report Scope

Report Features Description Market Value (2023) USD 1.3 Billion Forecast Revenue (2033) USD 13.6 Billion CAGR (2024-2033) 26.5% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By Deployment Mode (Cloud-Based, On-Premise), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By Industry Vertical (BFSI, IT and Telecommunications, Healthcare, Manufacturing, Retail and E-commerce, Energy and Utilities, Other Industry Verticals) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Thomson Reuters Corporation, Vertex, Inc., KPMG International Limited, Deloitte Touche Tohmatsu Limited, Avalara, Inc., Wolters Kluwer N.V., Blue dot VATBox Ltd., Blue J Legal Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Generative AI in Corporate Tax Management Market?The Generative AI in Corporate Tax Management Market focuses on the use of generative artificial intelligence technologies to automate and optimize corporate tax management processes, including compliance, reporting, and planning.

How big is the Generative AI in Corporate Tax Management Market?The Generative AI in Corporate Tax Management Market was valued at USD 1.3 billion and is expected to grow to USD 13.6 billion, with a CAGR of 26.5% during the forecast period.

What are the key factors driving the growth of the Generative AI in Corporate Tax Management Market?The growth is driven by the need for efficient tax compliance and reporting, the adoption of AI to reduce manual processes and errors, and the increasing complexity of global tax regulations.

What are the current trends and advancements in the Generative AI in Corporate Tax Management Market?Trends include the integration of AI for predictive tax analytics, automation of tax calculations and reporting, and the development of AI-driven solutions to handle complex tax scenarios.

What are the major challenges and opportunities in the Generative AI in Corporate Tax Management Market?Challenges include data security and the need for compliance with regulatory standards. Opportunities lie in the development of advanced AI solutions that can enhance accuracy and efficiency in tax management.

Who are the leading players in the Generative AI in Corporate Tax Management Market?Leading players include Thomson Reuters Corporation, Vertex, Inc., KPMG International Limited, Deloitte Touche Tohmatsu Limited, Avalara, Inc., Wolters Kluwer N.V., Blue dot VATBox Ltd., Blue J Legal Inc., and other key players.

Generative AI in Corporate Tax Management MarketPublished date: August 2024add_shopping_cartBuy Now get_appDownload Sample

Generative AI in Corporate Tax Management MarketPublished date: August 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Thomson Reuters Corporation

- Vertex, Inc.

- KPMG International Limited

- Deloitte Touche Tohmatsu Limited

- Avalara, Inc.

- Wolters Kluwer N.V.

- Blue dot VATBox Ltd.

- Blue J Legal Inc.

- Other Key Players