Global Generative AI In Agriculture Market Size, Share Report By Technology (Machine Learning, Natural Language Processing, Computer Vision, Generative Adversarial Networks (GANs)), By Application (Precision Farming, Livestock Management, Agricultural Robotics & Automation, Weather Forecasting), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153758

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

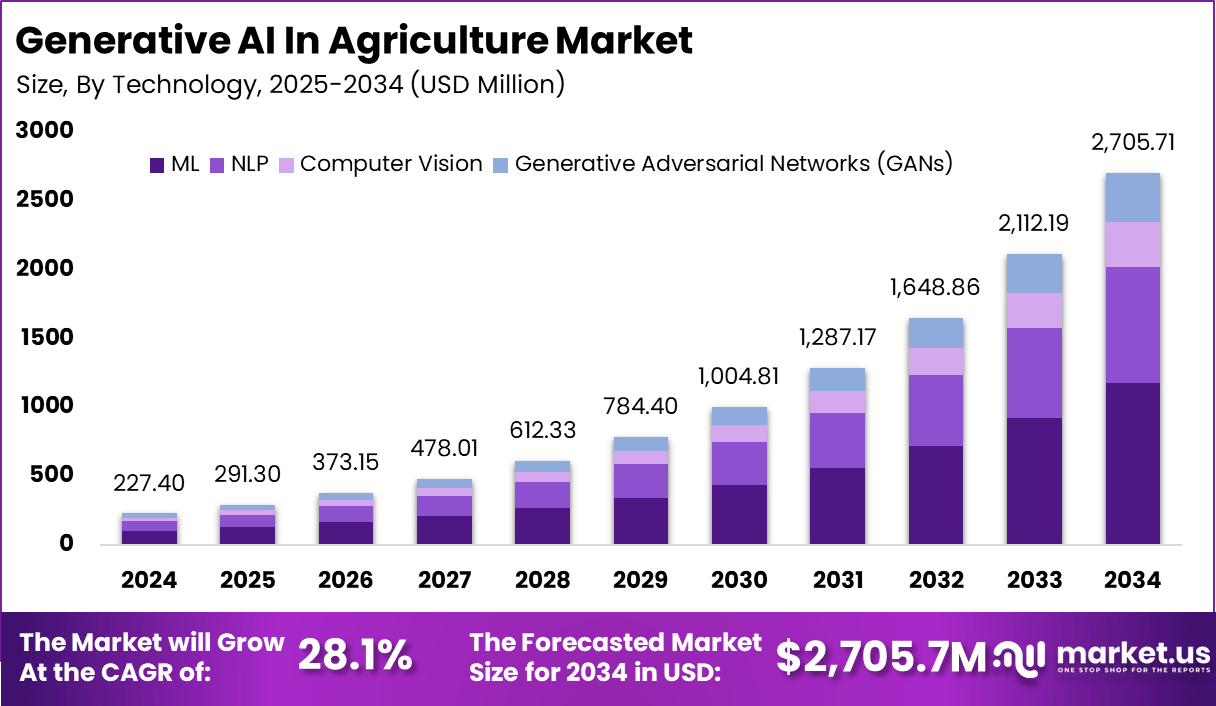

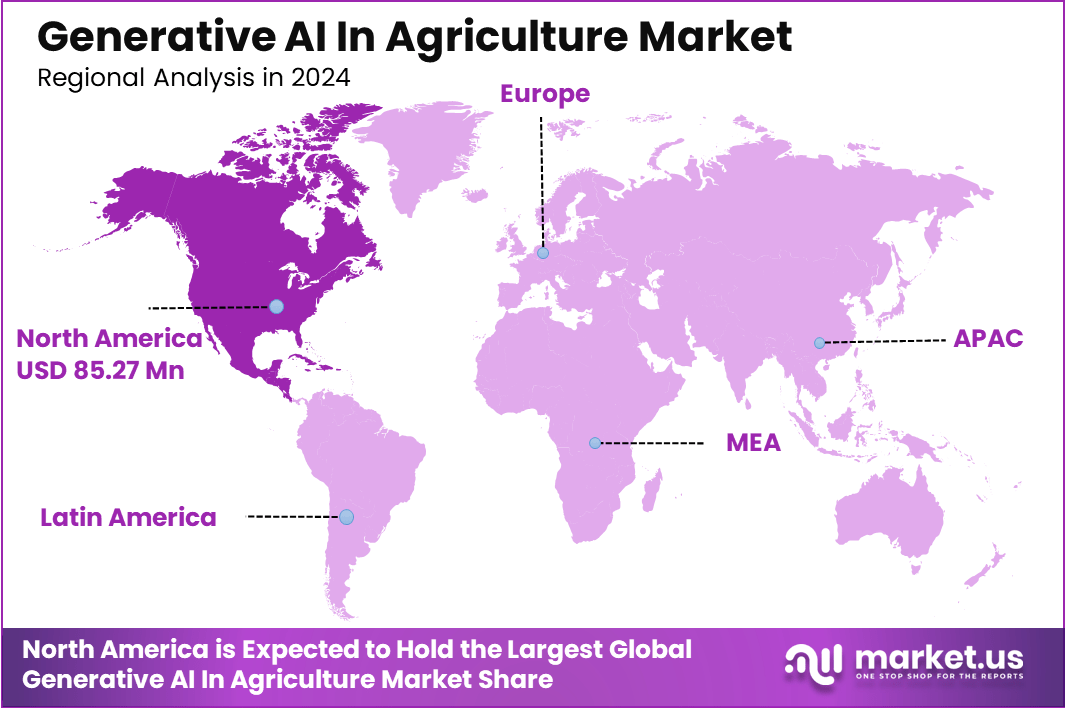

The Generative AI In Agriculture Market size is expected to be worth around USD 2,705.7 Million By 2034, from USD 227.40 Million in 2024, growing at a CAGR of 28.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.5% share, holding USD 85.27 Million revenue.

The Generative AI in Agriculture market can be characterized as an emerging segment within the broader digital agriculture domain. It centers on the use of generative artificial intelligence models to simulate new data, inform predictions, and deliver adaptive advisory for farm operations. These systems are layered upon established analytical AI, satellite imagery, drone‐based sensing, and IoT infrastructure to drive precision farming, autonomous robotics, yield forecasting, and climate‑sensitive planning.

One of the top driving factors accelerating the use of generative AI in agriculture is the urgent need for food security in the face of climate change, population growth, and depleting natural resources. Farmers and agribusinesses seek solutions that optimize yields, adapt to unpredictable weather, and use water and fertilizers more efficiently. The drive for sustainable farming and efficiency has made generative AI a key tool in achieving these goals.

According to Market.us research, The Global Generative AI Market is projected to reach approximately USD 255.8 Billion by 2033, rising sharply from around USD 13.5 Billion in 2023. This growth reflects a robust compound annual growth rate of 34.2% between 2024 and 2033. The increasing demand for creative automation, personalized content generation, and AI-driven productivity tools continues to drive this expansion across multiple industries.

Scope and Forecast

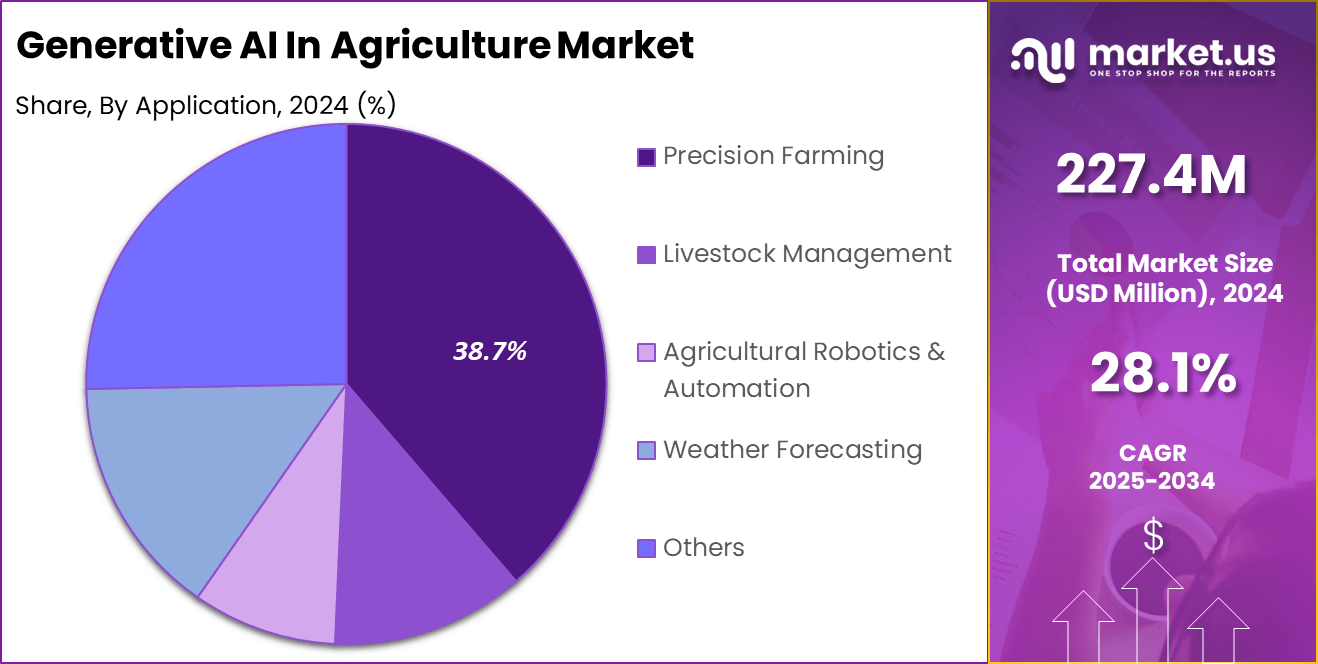

Report Features Description Market Value (2024) USD 227.40 Mn Forecast Revenue (2034) USD 2,705.7 Mn Significant CAGR(2025-2034) 28.1% Leading Segment Machine Learning segment [43.5%] Largest Market North America [37.5% Market Share] Fastest growing market Asia Pacific Key Insight Summary

- In 2024, the generative AI in agriculture market was valued at USD 227.40 million and is projected to reach USD 2,705.7 million by 2034, growing at a CAGR of 28.1% from 2025 to 2034.

- North America held a dominant position with a 37.5% market share in 2024, generating USD 85.27 million in revenue.

- By technology, the machine learning segment led the market with a 43.5% revenue share in 2024.

- By application, agricultural robotics & automation driving segment dominated with a 38.7% revenue share in 2024.

Analysts’ Viewpoint

Investment opportunities in generative AI for agriculture are expanding rapidly as the industry recognizes the need for next-generation solutions. From start-ups developing AI-driven sensors and platforms to established technology firms targeting digital agtech, investors are responding to growing demand for scalable, localized, and sustainable agricultural solutions.

The business benefits are felt across the value chain. Generative AI speeds up workflows, cuts down on manual labor, and automates documentation and compliance tasks. By enabling smarter, data-driven decisions, it not only improves productivity and profits but also helps with supply chain planning and reduces food waste.

The regulatory environment for generative AI in agriculture is still evolving. Governments and international organizations are working to ensure that AI-powered solutions are accessible, safe, and equitable. Key concerns around data privacy, content quality, ethical AI usage, and safe, context-appropriate recommendations are addressed through new frameworks and pilot programs.

Regional Insight

In 2024, North America held a dominant market position, capturing more than a 37.5% share, holding USD 85.27 Million in revenue. The region’s leadership in the generative AI in agriculture market is deeply rooted in its advanced digital infrastructure, robust research ecosystem, and rapid integration of AI into precision farming.

The presence of technologically enabled farms, strong broadband penetration in rural areas, and early government and private sector support for AI deployment have accelerated adoption. U.S. growers, in particular, have demonstrated strong interest in AI-driven tools that predict crop diseases, optimize inputs, and automate labor-intensive tasks.

The dominance of North America is further supported by the widespread availability of agritech funding and innovation partnerships between AI developers, universities, and large-scale agribusinesses. The region’s focus on sustainability, especially in reducing fertilizer and water wastage, has led to faster adoption of AI models trained on multi-year, multimodal farm data.

Technology Analysis

In 2024, the machine learning segment held a dominant market position in the generative AI in agriculture sphere, capturing more than a 43.5% share.

This reflects the segment’s critical importance across farming operations. Machine learning methodologies remain the preferred technology due to their flexibility, maturity, and capacity to process large volumes of heterogeneous agricultural data.

These models are able to integrate inputs such as sensor readings, satellite imagery, yield records, and weather patterns to deliver predictive insights that support decisions at field level. Their reliability and ease of calibration to local contexts reinforce their leadership position. As a result, machine learning continues to be widely adopted for tasks such as yield forecasting, soil mapping, and resource optimisation.

The predominance of the machine learning segment can be attributed to its foundational role in supporting generative AI use cases. Unlike newer technologies such as natural language processing or GANs, machine learning tools have been refined through large-scale deployment in agriculture, and their output is trusted by agronomists and producers.

Machine learning supports the generation of synthetic datasets for plant breeding, modelling of growth scenarios under varying climate conditions, and optimization of input usage such as water or fertilizer. These applications offer tangible operational value and lower barriers to adoption for agricultural stakeholders

By Application Analysis

In 2024, agricultural robotics and automation segment held a dominant market position, capturing more than a 38.7% share of the generative AI in agriculture applications.

This dominance is indicative of the segment’s strategic importance in transforming farm operations globally. Automated platforms powered by generative AI – such as autonomous tractors, robotic weeders, and drone-based field machines – have become essential in addressing labor shortages and optimizing resource usage.

These tools deliver precise intervention from planting to harvesting, reducing manual effort while enhancing productivity and sustainability. The generative AI capabilities embedded in these systems enable adaptive planning and decision-making in real time, which reinforces their leadership position among other application areas such as precision farming or livestock management.

The pre‑eminence of the robotics and automation application segment can be attributed to its direct operational impact and scalability across diverse cropping systems. Generative AI empowers robots to interpret sensor input, satellite imagery, and environmental data to respond dynamically – for instance, adjusting spraying patterns, guiding autonomous feeders, or managing irrigation schedules.

Key Drivers

Driver Details Crop yield optimization Increasing demand to optimize yields with data-driven insights, scenario analysis, and precision farming. Labor shortages Need for automation and robotics (e.g., autonomous tractors, drones) to address workforce gaps. Climate adaptation Pressure to adapt to extreme weather and climate uncertainty, using AI for prediction and planning. Integration with digital agriculture AI models combined with IoT, satellite/drone imagery, and management systems for improved decisions. Smallholder farmer inclusion Move toward localized, low-resource, and multilingual AI tools for underserved regions. Demand for sustainability Industry and societal push for more resource-efficient, sustainable farming practices. Technological advancement Fast progress in machine learning, computer vision, GANs, and cloud infrastructure. Key Features & Trends

Feature/Trend Details Precision agriculture Real-time, data-driven management and recommendation systems for irrigation, fertilization, etc. Predictive analytics AI models forecast yields, pest outbreaks, and environmental impacts, helping minimize losses. Computer vision integration Enhanced image analysis automates crop health monitoring and disease detection via drones/satellites. Generative models (GANs) Creation of synthetic data for training robust AI models, especially where real data is scarce. Edge computing Use of on-device or field-level AI to reduce latency and reliance on connectivity/cloud. Robotics & automation AI-driven machines for planting, spraying, harvesting, and weeding, enhancing operational efficiency. Multilingual, adaptive tools Development of AI solutions tailored for local contexts, smallholder needs, and various languages. Cloud-based collaboration Cloud platforms enhance data sharing, processing, and value-chain partnerships. Power/battery optimization Generative AI optimizes resource use, leading to improved energy and input efficiencies. Challenge Analysis

Challenge Details High implementation cost Upfront investment for hardware, software, sensors, and connectivity can be prohibitive for some farmers. Data quality and compatibility Fragmented, variable, or inaccessible agricultural data limits AI performance and scalability. Connectivity gaps Lack of reliable internet in rural areas hinders adoption of cloud/AI-powered services. Privacy and data ownership Concerns about data sharing, security, and ownership among farmers and stakeholders. Resistance to change Hesitation or lack of trust among farmers to adopt new technologies and change traditional practices. Shortage of skilled workforce Need for AI/data science expertise in agriculture for development and operation of AI systems. Model generalizability Diverse microclimates and farm contexts challenge the transferability of AI models across regions/crops. Ethical and regulatory concerns Issues around fair access, transparency, job displacement, and data governance. Key Market Segments

By Technology

- Machine Learning

- Natural Language Processing

- Computer Vision

- Generative Adversarial Networks (GANs)

By Application

- Precision Farming

- Livestock Management

- Agricultural Robotics & Automation

- Weather For ecasting

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the Generative AI in Agriculture Market, key players such as Bayer AG, Syngenta Group, and Deere & Company have been pivotal in integrating AI into crop management and precision agriculture. Their efforts are focused on boosting productivity, improving seed traits, and reducing resource usage.

Bayer’s digital farming tools and Syngenta’s crop intelligence systems have allowed farmers to make faster and data-driven decisions. Meanwhile, John Deere’s investments in autonomous tractors and AI-powered equipment have positioned it as a leader in agricultural automation. Technology firms like Microsoft, IBM Corporation, and Agmatix are enhancing AI capabilities across agricultural workflows.

Microsoft’s cloud platforms are being used to analyze field data in real time, while IBM’s Watson Decision Platform supports pest prediction and weather forecasting. Agmatix has focused on harmonizing agronomic data for better insight generation. These companies are enabling smarter farming practices through scalable digital infrastructure and AI-powered platforms that reduce the complexity of agricultural data.

Startups such as Carbon Robotics, DeepAgro, KissanAI, and AgroScout are driving innovation at the ground level. Carbon Robotics uses AI-guided lasers for weed control, reducing the need for herbicides. DeepAgro applies computer vision to detect crop health. KissanAI focuses on Indian farming challenges using localized generative models, and AgroScout offers remote field scouting using drone technology.

Major players

Leading companies in the Generative AI In Agriculture market include:

- AgroScout

- Bayer AG

- Carbon Robotics

- Deere & Company (John Deere)

- DeepAgro

- IBM Corporation

- KissanAI

- Microsoft

- Agmatix

- Syngenta Group

Recent Developments

- In March 2025, Agmatix partnered with BASF through the AgroStart platform to create a digital tool for detecting and predicting Soybean Cyst Nematode (SCN) risks. By combining Agmatix’s AI engine Axiom with BASF’s agronomic knowledge, the solution delivers real-time, scalable forecasts tailored to growers’ needs.

- In April 2024, ITC Limited and Microsoft introduced the Krishi Mitra app using Microsoft Copilot. The AI tool aims to offer personalized agricultural insights to farmers. Initially launched for 300,000 users, it targets a wider rollout to 10.1 million farmers across India, enhancing access to timely crop guidance.

- In September 2024, Syngenta Group launched Cropwise AI, a generative AI system built on 20 years of agronomic data. It provides natural-language crop recommendations to improve yields and sustainability. Available in the U.S. and Brazil, the platform supports multilingual use, with plans to expand into Europe.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Technology (Machine Learning, Natural Language Processing, Computer Vision, Generative Adversarial Networks (GANs)), By Application (Precision Farming, Livestock Management, Agricultural Robotics & Automation, Weather Forecasting) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AgroScout, Bayer AG, Carbon Robotics, Deere & Company (John Deere), DeepAgro, IBM Corporation, KissanAI, Microsoft, Agmatix, Syngenta Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Generative AI In Agriculture MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Generative AI In Agriculture MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AgroScout

- Bayer AG

- Carbon Robotics

- Deere & Company (John Deere)

- DeepAgro

- IBM Corporation

- KissanAI

- Microsoft

- Agmatix

- Syngenta Group