Global Gas To Liquid (GTL) Market By Technology(Fischer-Tropsch Synthesis, Syngas to Methanol, Methanol-to-Gasoline, Methanol-to-Olefins , Others), By Product(Diesel, Naphtha, Lubricants, Others), By Application(Fuel Oil, Lubricating Oil, Process Oil, Others), By End-Use (Transportation, Chemicals and Petrochemicals, Power Generation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 122216

- Number of Pages: 336

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

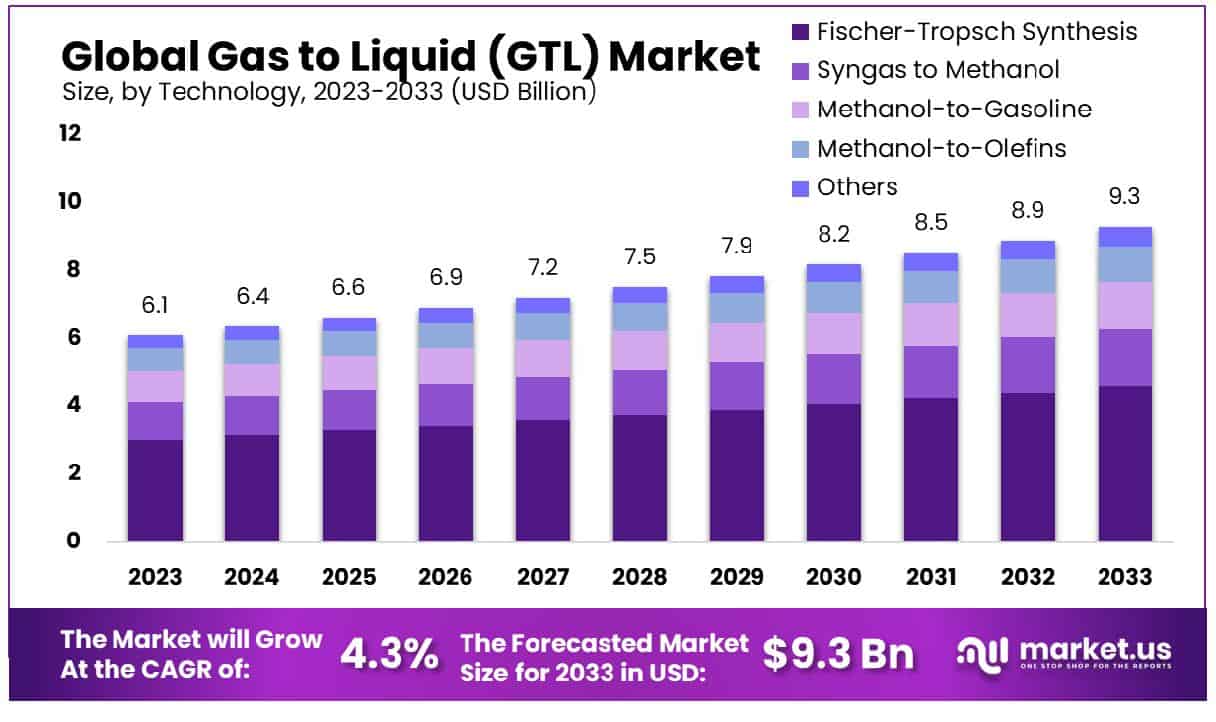

The Global Gas To Liquid (GTL) Market size is expected to be worth around USD 9.3 Billion by 2033, From USD 6.1 Billion by 2023, growing at a CAGR of 4.3% during the forecast period from 2024 to 2033.

The Gas to Liquid (GTL) Market refers to the industry focused on converting natural gas into liquid fuels and chemicals. This technology facilitates the production of cleaner, high-quality products such as diesel, kerosene, and lubricants from natural gas. GTL processes enhance fuel performance, reduce emissions, and offer an alternative to crude oil-derived products.

Key players leverage advanced catalysts and reactors to optimize conversion efficiency and product yield. This market is driven by the demand for sustainable energy solutions and the abundance of natural gas reserves, providing a significant growth opportunity for energy and chemical companies worldwide.

The Gas to Liquid (GTL) market, characterized by its ability to convert natural gas into high-quality liquid fuels, is positioned for significant growth due to the increasing global demand for cleaner energy solutions. The market’s expansion is driven by advancements in GTL technology, which enhance efficiency and cost-effectiveness.

Furthermore, the stable production of natural gas globally underscores the potential for sustained GTL growth. Notably, global natural gas production remained stable in 2022, with a 12% decline in Russia’s production offset by increases in North America, the Middle East, China, and Australia. U.S. natural gas production alone grew by 4% in 2023, reaching an average of 125.0 billion cubic feet per day (Bcf/d).

Despite the anticipated modest contraction in U.S. natural gas production in 2024, projected to be around 103 Bcf/d due to low natural gas prices and a relatively stable rig count, the GTL market is expected to maintain resilience. This is largely because GTL processes can utilize natural gas from various global sources, ensuring a steady feedstock supply.

Additionally, the environmental benefits of GTL fuels, which produce fewer emissions compared to traditional fossil fuels, align with the global shift towards greener energy policies. This alignment with environmental goals is likely to spur investments in GTL projects.

Key Takeaways

- Market Growth: The Global Gas To Liquid (GTL) Market size is expected to be worth around USD 9.3 Billion by 2033, From USD 6.1 Billion by 2023, growing at a CAGR of 4.3% during the forecast period from 2024 to 2033.

- Regional Dominance: The GTL market in the Middle East & Africa holds 48.5%, USD 2.9 billion.

- Segmentation Insights:

- By Technology: Fischer-Tropsch Synthesis technology dominates with a share of 49.7%.

By Product: Product-wise, fuel oil accounts for a substantial 42.6% market share.

By Application: Fuel oil application leads with a commanding 80.4% market presence.

By End-Use: Transportation sector holds the majority share at 51.6% in end-use.

- By Technology: Fischer-Tropsch Synthesis technology dominates with a share of 49.7%.

- Growth Opportunities: In 2023, the GTL market is poised for growth with the expansion of plants in emerging markets and advancements in small-scale GTL technologies enhancing accessibility and economic viability.

Driving Factors

Abundance of Natural Gas Reserves

The Gas To Liquid (GTL) market is significantly propelled by the abundance of natural gas reserves globally. With major reserves located in regions such as the Middle East, the United States, and Russia, the accessibility of natural gas provides a robust foundation for the GTL industry.

This abundance ensures a steady and scalable supply of raw materials for GTL processes, which convert natural gas into liquid fuels such as diesel and naphtha. The assurance of raw material availability helps in stabilizing GTL production costs and enhances market growth potential, facilitating long-term planning and investment in GTL facilities.

Increasing Demand for Cleaner Fuels

Environmental concerns and stringent global regulations on emissions are driving the demand for cleaner fuel alternatives, positioning the GTL market for substantial growth. GTL fuels are particularly appealing because they burn cleaner than conventional crude oil-based fuels, producing fewer pollutants such as sulfur oxides and particulates.

This factor aligns with global sustainability goals and the increasing consumer and governmental push toward reducing environmental footprints. As nations commit to greener policies, the demand for GTL-produced liquid fuels is expected to rise, further stimulated by the ongoing shift in public and corporate transport sectors towards more eco-friendly solutions.

Technological Advancements in GTL Processes

Technological innovations in GTL technology are crucial in enhancing the efficiency and economic viability of the GTL market. Recent advancements have focused on improving conversion efficiency, reducing operational costs, and minimizing environmental impacts. For instance, the development of more efficient catalysts and process integration techniques has allowed GTL plants to achieve higher yields with lower energy inputs.

These technological improvements not only enhance the competitiveness of GTL fuels in the energy market but also attract investments by reducing the financial risks associated with GTL projects. As these technologies continue to evolve, they will further drive down costs and increase the adoption of GTL solutions in the global market.

Restraining Factors

High Capital Investment Costs

The growth of the Gas to Liquid (GTL) market is significantly hindered by the high capital investment required for GTL projects. Establishing a GTL plant involves substantial upfront costs related to construction, technological implementation, and securing a skilled workforce, which can deter new entrants and limit market expansion. For example, large-scale GTL facilities often require investments in the range of several billion dollars.

This financial barrier not only affects the pace of new installations but also impacts the decision-making of smaller companies with limited capital, thereby restricting the overall growth rate of the market. Furthermore, the economic feasibility of GTL processes is heavily dependent on the volatile prices of crude oil; lower oil prices can make GTL products less competitive, thereby exacerbating the impact of high initial costs.

Complex and Lengthy Regulatory Approvals

The GTL market’s development is also impeded by complex and lengthy regulatory approval processes. GTL technology involves converting natural gas into liquid fuels, which necessitates stringent compliance with environmental regulations. The approval process can be protracted, involving detailed assessments of environmental impact, emissions, and sustainability practices. This not only slows down the project timelines but also increases the uncertainty associated with GTL investments.

The necessity for multiple approvals from various governmental and environmental bodies adds another layer of complexity, which can discourage potential investors and delay the commencement of new projects. Collectively, these regulatory challenges contribute to the slower adoption and diffusion of GTL technology across potential markets, further restraining the industry’s growth.

By Technology Analysis

Fischer-Tropsch Synthesis holds a significant share, accounting for 49.7% of the market by technology.

In 2023, Fischer-Tropsch Synthesis held a dominant market position in the Gas To Liquid (GTL) Market’s By Technology segment, capturing more than a 49.7% share. Fischer-Tropsch Synthesis technology remains pivotal in converting syngas derived from natural gas, biomass, or coal into liquid hydrocarbons, including diesel and other high-value products. This technology’s robust market dominance is underpinned by its efficiency in producing clean fuels with lower sulfur content, meeting stringent environmental regulations globally.

Following Fischer-Tropsch Synthesis, the Syngas to Methanol technology segment emerged as another significant player in the GTL market landscape. This process involves converting syngas into methanol, a versatile chemical feedstock used in various industries, including automotive, construction, and chemical manufacturing. The segment’s growth is fueled by increasing demand for cleaner-burning fuels and chemical intermediates across diverse applications.

Moreover, the Methanol-to-Gasoline technology segment also exhibited notable growth, driven by its capability to convert methanol into high-octane gasoline, thereby addressing the demand for sustainable transportation fuels. This technology’s advancement aligns with global efforts to reduce greenhouse gas emissions and dependence on fossil fuels.

Additionally, the Methanol-to-Olefins technology segment contributed significantly to the GTL market, leveraging methanol as a feedstock to produce ethylene and propylene, crucial building blocks for plastics and other petrochemical products. This segment’s growth underscores the market’s shift towards sustainable and economically viable alternatives in the petrochemical industry.

Lastly, other innovative technologies within the GTL market continue to explore new avenues, including direct conversion processes and hybrid approaches, aiming to further enhance efficiency, reduce costs, and broaden the market’s scope. These developments highlight a dynamic landscape where technological innovation and environmental sustainability converge to reshape the future of liquid fuel and chemical production.

By Product Analysis

The product segment contributes notably, representing 42.6% of the total market composition.

In 2023, in the Gas To Liquid (GTL) Market’s By Product segment, Diesel emerged as the dominant product, capturing more than a 42.6% share. GTL-derived diesel stands out for its high cetane number, low sulfur content, and excellent lubricity, making it a preferred fuel choice in transportation and industrial applications where stringent emissions standards and operational efficiency are crucial. The segment’s prominence reflects GTL technology’s capability to produce cleaner-burning fuels that meet environmental regulations while enhancing engine performance and longevity.

Following Diesel, Naphtha also played a significant role in the GTL market, catering primarily to the petrochemical industry. GTL-derived naphtha offers advantages such as consistent quality and purity, essential for manufacturing plastics, chemicals, and other downstream petrochemical products. This segment’s growth is driven by increasing demand for reliable feedstocks that support sustainable and efficient manufacturing processes.

Moreover, the Lubricants segment witnessed notable expansion, leveraging GTL technology’s ability to produce high-performance oils with superior thermal stability and oxidative resistance. These lubricants find application across automotive, industrial, and specialty sectors, where reliability and efficiency are critical for equipment performance and maintenance cost savings.

Additionally, the GTL market’s Other products category continues to explore new opportunities in specialty chemicals, solvents, and additives, reflecting the versatility and innovation within the industry. These segments collectively highlight GTL technology’s role in providing sustainable, high-value solutions to meet diverse market demands while addressing environmental and operational challenges.

By Application Analysis

Fuel oil dominates the application category, comprising 80.4% of the market by application.

In 2023, Fuel Oil held a dominant market position in the Gas To Liquid (GTL) Market’s By Application segment, capturing more than an 80.4% share. Fuel Oil remains integral in the energy sector, particularly for marine and industrial applications, due to its cleaner burning properties and compliance with stringent emissions regulations worldwide. The segment’s dominance underscores its critical role in reducing sulfur emissions and improving overall environmental sustainability in the transportation and industrial sectors.

Following Fuel Oil, the Lubricating Oil segment emerged as another significant application within the GTL market. Lubricating oils derived from GTL technology offer superior performance characteristics, including enhanced thermal stability and oxidative stability, making them ideal for use in automotive engines, industrial machinery, and other high-performance applications. This segment’s growth is driven by increasing demand for high-quality lubricants that contribute to equipment longevity and operational efficiency.

Moreover, the Process Oil segment also exhibited substantial growth, supported by GTL-derived oils’ excellent solvency and thermal stability properties. These oils find extensive applications in various industrial processes, such as rubber and polymer processing, where consistent performance and environmental compliance are paramount.

Additionally, other applications within the GTL market continue to evolve, exploring new opportunities in niche sectors such as specialty chemicals and additives. These innovations highlight the versatility and adaptability of GTL-derived products in meeting diverse market demands while advancing sustainability goals.

By End-Use Analysis

In the transportation sector, a substantial 51.6% share illustrates its prominence in market end-use.

In 2023, Transportation held a dominant market position in the Gas To Liquid (GTL) Market’s By End-Use segment, capturing more than a 51.6% share. GTL-derived fuels have gained significant traction in the transportation sector due to their cleaner combustion characteristics and compliance with stringent emissions regulations. This segment’s leadership is driven by the increasing adoption of GTL fuels as a sustainable alternative to conventional diesel, particularly in commercial fleets, aviation, and heavy-duty transportation.

Following Transportation, the Chemicals and Petrochemicals segment emerged as another key driver within the GTL market. GTL technology enables the production of high-purity liquid hydrocarbons that serve as essential feedstocks for the chemical industry, supporting the manufacturing of plastics, solvents, and other petrochemical products. The segment’s growth is fueled by the demand for reliable and environmentally friendly raw materials across diverse industrial applications.

Moreover, the Power Generation segment also witnessed significant growth, leveraging GTL-derived fuels to generate electricity with lower emissions and improved efficiency compared to traditional fossil fuels. This application is crucial in regions striving to enhance energy security and reduce environmental impact through cleaner energy sources.

Additionally, other end-use applications within the GTL market continue to expand, exploring new opportunities in sectors such as marine propulsion, where GTL fuels offer advantages in terms of fuel stability and reduced particulate emissions.

Key Market Segments

By Technology

- Fischer-Tropsch Synthesis

- Syngas to Methanol

- Methanol-to-Gasoline

- Methanol-to-Olefins

- Others

By Product

- Diesel

- Naphtha

- Lubricants

- Others

By Application

- Fuel Oil

- Lubricating Oil

- Process Oil

- Others

By End-Use

- Transportation

- Chemicals and Petrochemicals

- Power Generation

- Others

Growth Opportunities

Expansion of GTL Plants in Emerging Markets

The expansion of Gas to Liquid (GTL) plants in emerging markets presents significant growth opportunities for the GTL industry in 2023. Emerging economies are increasingly focusing on diversifying their energy sources and reducing reliance on crude oil, which positions GTL technology as a strategic alternative. The establishment of GTL plants in these regions can help leverage abundant natural gas reserves, transforming them into higher-value liquid fuels and chemicals.

This expansion is anticipated to drive local economic growth by creating jobs, enhancing energy security, and fostering technological advancements. Furthermore, the presence of GTL plants can lead to infrastructural development and attract foreign direct investment, catalyzing broader economic benefits. The strategic positioning of GTL plants in these markets is expected to significantly contribute to the global scaling of the GTL industry.

Development of Small-Scale GTL Technologies

The development of small-scale GTL technologies is another crucial growth opportunity for the GTL market in 2023. Small-scale GTL plants offer the flexibility to monetize smaller and more remote natural gas reserves that are otherwise not viable through large-scale operations. These technologies are particularly transformative as they enable the economic processing of gas resources at the source, reducing the need for extensive pipeline infrastructure.

The advancement in modular and scalable GTL solutions is expected to lower capital costs and operational complexities, making GTL technology accessible to a broader range of industry players. Additionally, these developments support the decentralization of fuel production, potentially leading to more stable energy supplies in remote areas. The progression of small-scale GTL technologies is set to enhance the overall market dynamics by opening up new avenues for growth and innovation within the sector.

Latest Trends

Integration of GTL Technology with Renewable Energy Sources

In 2023, a significant trend in the global Gas to Liquid (GTL) market is the integration of GTL technology with renewable energy sources. This trend is driven by the increasing global emphasis on sustainable energy practices and the reduction of carbon footprints across industries.

Integrating renewable energy sources with GTL processes can significantly enhance the environmental credentials of GTL fuels, as it reduces the overall carbon emissions associated with their production. This integration involves using renewable energy to power the various stages of the GTL process, from gasification to the final conversion into liquids.

Such initiatives not only align with global sustainability targets but also improve the market appeal of GTL products among environmentally conscious consumers and industries. As renewable energy technologies continue to advance and decrease in cost, their incorporation into GTL processes is expected to become more prevalent, positioning GTL as a key player in the eco-friendly fuel market.

Adoption of Advanced Catalysts to Improve Conversion Efficiency

Another notable trend in the GTL market is the adoption of advanced catalysts aimed at improving the efficiency of the conversion process. Catalysts play a pivotal role in the GTL technology, influencing both the efficiency and the cost-effectiveness of converting natural gas into liquid fuels.

Recent advancements in catalyst technology have focused on enhancing conversion rates, thereby reducing energy consumption and operational costs. High-performance catalysts are being developed to withstand higher temperatures and pressures, increase the yield of liquid products, and minimize by-products that require further processing.

This not only optimizes the GTL process but also boosts the economic viability of GTL facilities. The ongoing innovation in catalyst technologies is crucial for the competitiveness of the GTL industry, as it allows for more robust and efficient operations, meeting the market’s growing demand for cleaner and more efficient fuel solutions.

Regional Analysis

In the Middle East & Africa, the Gas to Liquid (GTL) market comprises 48.5% and is valued at USD 2.9 billion.

The Gas to Liquid (GTL) market exhibits varied regional dynamics, with distinct growth drivers and market sizes. In North America, the GTL market is progressively expanding, influenced by increasing shale gas production and technological advancements in GTL processes. Although the market size is smaller compared to other regions, it is expected to grow as energy companies invest in cleaner technology solutions.

Europe’s GTL market is driven by stringent environmental regulations that encourage the adoption of cleaner fuels. The region sees moderate growth, with key developments focused on integrating GTL within existing energy infrastructures to reduce carbon emissions effectively.

Asia Pacific presents a rapidly growing GTL market, buoyed by rising energy demand and industrial growth, particularly in emerging economies such as China and India. This region benefits from substantial investments in infrastructure and technological innovation, making it a significant player in the global GTL landscape.

Middle East & Africa dominate the global GTL market, holding a substantial share of 48.5% and valued at USD 2.9 billion. This region’s dominance is attributed to its vast natural gas reserves and established gas processing infrastructure. Countries like Qatar and South Africa have heavily invested in GTL technology, leveraging their natural gas endowments to meet both regional and global energy demands.

Lastly, Latin America’s GTL market is in the nascent stages, with potential growth expected as countries like Brazil and Venezuela explore GTL technologies to capitalize on their large natural gas reserves. The market’s development is contingent on political stability and investment in gas infrastructure.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

Key Players Analysis

The Global Gas to Liquid (GTL) Market in 2023 is characterized by significant contributions from key players, each bringing unique capabilities and strategic advancements to the industry. Among these, Shell plc stands out with its robust technological expertise and large-scale GTL plants, particularly in Qatar, which continue to drive innovation and market leadership.

Chevron Corporation leverages its extensive energy portfolio and advanced processing technologies to enhance GTL efficiency and output. Sasol Limited, a pioneer in the GTL market, remains instrumental due to its proprietary Fischer-Tropsch technology, enabling the production of high-quality liquid fuels from natural gas.

PetroSA, the national oil company of South Africa, adds value through its integrated GTL operations, while Velocys focuses on small-scale, modular GTL solutions, offering flexibility and reduced capital expenditure. ORYX GTL, a joint venture between Qatar Petroleum and Sasol, exemplifies successful international collaborations, emphasizing operational excellence. Oltin Yol GTL and Linc Energy continue to expand their footprint in emerging markets, bolstering regional GTL production capacities.

CompactGTL and Primus Green Energy innovate with their compact and scalable GTL technologies, catering to niche markets and remote locations. Gas Technologies LLC and NRG Energy Inc. are notable for their environmentally friendly approaches and renewable energy integration in GTL processes.

Petróleo Brasileiro S.A. (Petrobras) and ExxonMobil Corporation leverage their extensive oil and gas expertise to optimize GTL production, ensuring high output and market reach. Lastly, Linde plc’s contributions lie in its advanced gas processing and engineering solutions, which are critical to the GTL value chain.

Market Key Players

- Shell plc

- Chevron Corporation

- Sasol Limited

- PetroSA

- Velocys

- ORYX GTL

- Oltin Yol GTL

- Linc Energy

- CompactGTL

- Primus Green Energy

- Gas Technologies LLC

- NRG Energy Inc.

- Petróleo Brasileiro S A

- ExxonMobil Corporation

- Linde plc

Recent Development

- In June 2024, Cerilon Inc. advances its Gas-to-Liquids (GTL) facility in North Dakota, entering the FEED phase with plans for operational start in 2028. The project aims to produce high-quality synthetic products and achieve low-carbon emissions through carbon capture.

- In February 2014, Chinese firm Beijing Zhongmin Xinjunlong New Energy Technology Company Ltd. and Nigerian firm NIGUS International signed $1 billion pact to develop gas flaring solutions in Nigeria, aiming for sustainable energy production and economic growth.

Report Scope

Report Features Description Market Value (2023) USD 6.1 Billion Forecast Revenue (2033) USD 9.3 Billion CAGR (2024-2033) 4.3% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology(Fischer-Tropsch Synthesis, Syngas to Methanol, Methanol-to-Gasoline, Methanol-to-Olefins , Others), By Product(Diesel, Naphtha, Lubricants, Others), By Application(Fuel Oil, Lubricating Oil, Process Oil, Others), By End-Use (Transportation, Chemicals and Petrochemicals, Power Generation, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Shell plc, Chevron Corporation, Sasol Limited, PetroSA, Velocys, ORYX GTL, Oltin Yol GTL, Linc Energy, CompactGTL, Primus Green Energy, Gas Technologies LLC, NRG Energy Inc., Petróleo Brasileiro S A, ExxonMobil Corporation, Linde plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Gas To Liquid (GTL) Market Size in 2023?The Global Gas To Liquid (GTL) Market Size is USD 6.1 Billion in 2023.

What is the projected CAGR at which the Global Gas To Liquid (GTL) Market is expected to grow at?The Global Gas To Liquid (GTL) Market is expected to grow at a CAGR of 4.3% (2024-2033).

List the segments encompassed in this report on the Global Gas To Liquid (GTL) Market?Market.US has segmented the Global Gas To Liquid (GTL) Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Technology(Fischer-Tropsch Synthesis, Syngas to Methanol, Methanol-to-Gasoline, Methanol-to-Olefins , Others), By Product(Diesel, Naphtha, Lubricants, Others), By Application(Fuel Oil, Lubricating Oil, Process Oil, Others), By End-Use (Transportation, Chemicals and Petrochemicals, Power Generation, Others)

List the key industry players of the Global Gas To Liquid (GTL) Market?Shell plc, Chevron Corporation, Sasol Limited, PetroSA, Velocys, ORYX GTL, Oltin Yol GTL, Linc Energy, CompactGTL, Primus Green Energy, Gas Technologies LLC, NRG Energy Inc., Petróleo Brasileiro S A, ExxonMobil Corporation, Linde plc

Name the key areas of business for Global Gas To Liquid (GTL) Market?The Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates are leading key areas of operation for Global Gas To Liquid (GTL) Market.

Gas To Liquid (GTL) MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Gas To Liquid (GTL) MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample - Market Growth: The Global Gas To Liquid (GTL) Market size is expected to be worth around USD 9.3 Billion by 2033, From USD 6.1 Billion by 2023, growing at a CAGR of 4.3% during the forecast period from 2024 to 2033.

-

-

- Shell plc

- Chevron Corporation

- Sasol Limited

- PetroSA

- Velocys

- ORYX GTL

- Oltin Yol GTL

- Linc Energy

- CompactGTL

- Primus Green Energy

- Gas Technologies LLC

- NRG Energy Inc.

- Petróleo Brasileiro S A

- ExxonMobil Corporation

- Linde plc