Global Gas Sensors Market By Product Type (Wired and Wireless), By Gas Type (Oxygen, Carbon Monoxide, Carbon Dioxide, Hydrogen Sulphide, Nitrogen Oxide, Hydrogen, and Others), By Technology, By End-Use, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Nov. 2023

- Report ID: 55472

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

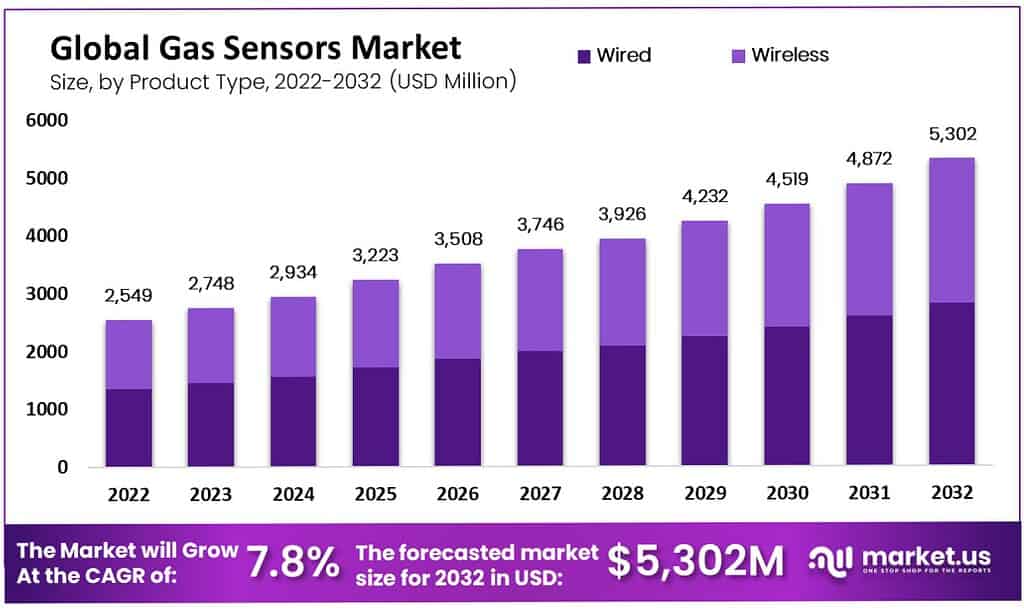

The Global Gas Sensors Market size is expected to be worth around USD 5,302 Million by 2032 from USD 2,748 Million in 2023, growing at a CAGR of 7.80% during the forecast period from 2023 to 2032.

Gas sensors are devices that can detect the presence or concentration of various hazardous gases and vapors such as explosive gases, odors, humidity, and volatile organic compounds (VOCs). Based on the concentration of gas in the environment, gas sensors indicate changes in the opposition of the materials used in the sensor which are used to measure the output voltage.

Changes in this voltage value are used to record the gas type and concentration. The development of wireless and miniaturized gas sensors, along with improved communication technologies, is the main driver for the global market. This allows them to be integrated into other devices and machines that detect toxic gases safely.

Analyst Viewpoint

The gas sensor market is currently experiencing a robust expansion, primarily driven by factors such as heightened safety regulations, technological advancements, and increasing demand for gas detection in various industries. The integration of IoT and advancements in wireless technology have significantly improved gas sensor capabilities, leading to wider applications and more efficient monitoring systems. The adoption of these sensors is especially pronounced in sectors like oil and gas, automotive, environmental monitoring, and industrial safety. In January 2023, Honeywell International Inc. expanded its collaboration with Nexceris, a developer of Li-ion Tamer lithium-ion gas detection solutions.

In terms of opportunities, the market is poised to benefit from the growing emphasis on air quality monitoring in both indoor and outdoor environments. This trend is further accelerated by the rising awareness of the health impacts of poor air quality, driving the demand for sophisticated gas detection solutions in residential, commercial, and public spaces. Additionally, the trend towards miniaturization and cost reduction of sensors opens up new application areas, including wearable devices and smart home systems.

Furthermore, stringent government regulations and standards globally to ensure workplace safety and environmental protection are acting as a catalyst for market growth. There is a growing trend towards adopting smart and wireless gas sensors, which offer real-time monitoring and data analytics capabilities. These technological advancements not only enhance safety and efficiency but also provide valuable data insights for predictive maintenance and risk assessment.

Key Takeaways

- Market Size Projection: The Gas Sensor Market is projected to be worth around USD 5.302 Million by 2032, growing at a CAGR of 7.80% from 2023 to 2032.

- Overview of Gas Sensors: Gas sensors are devices used to detect the presence or concentration of various hazardous gases and vapors such as explosive gases, odors, humidity, and volatile organic compounds (VOCs). They operate by measuring the changes in the materials used in the sensor based on gas concentration.

- Driving Factors: The market growth is driven by the increasing demand in various industries to control harmful gas emissions and strict government regulations aimed at lowering harmful gas emissions.

- Restraints Factors: High initial costs and accuracy issues are some of the factors restraining the growth of the Gas Sensors Market.

- Product Type: Wired gas sensors dominate the market with a share of 53% in 2022.

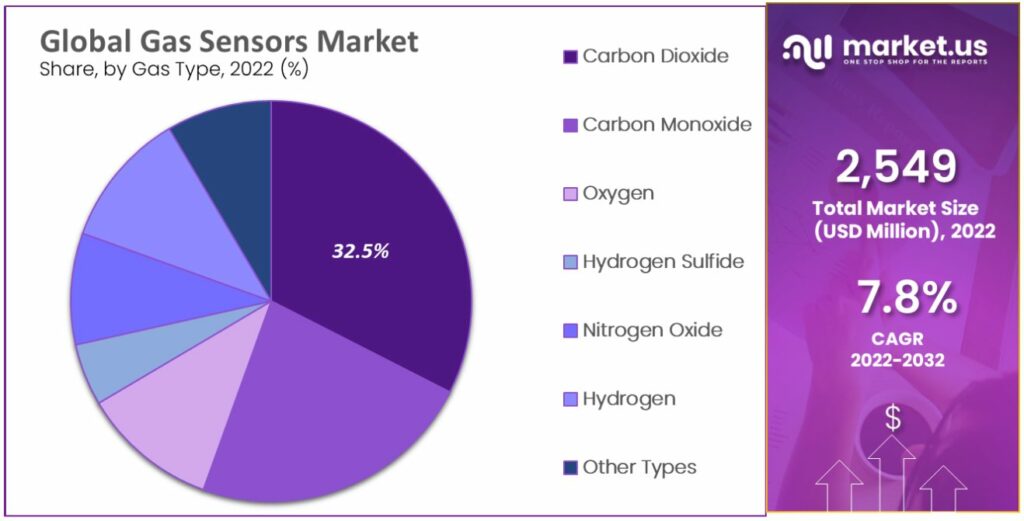

- Gas Type: Carbon Dioxide Gas Sensors lead the market, accounting for more than 32.5% of global revenue in 2022.

- Technology: Electrochemical Gas Sensors hold the largest market share, accounting for more than 23% of the global share.

- End-Use: The industrial sector dominates the Gas Sensor market, accounting for more than 23% of worldwide sales in 2022.

- Opportunity: The increasing demand for gas sensors in manufacturing industries creates lucrative opportunities in the market.

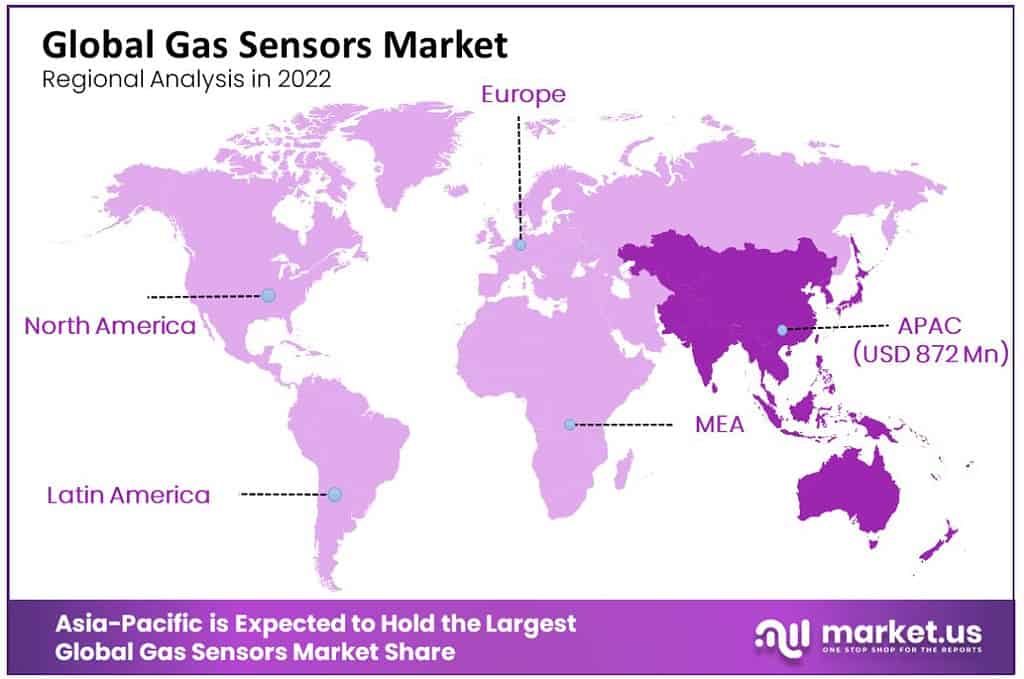

- Regional Analysis: The Asia Pacific region dominates the Gas Sensors Market, accounting for more than 34.2% of global revenue in 2022. Europe is anticipated to experience steady growth due to strict emission norms and the need for monitoring.

- Key Players: Key players in the market include ABB, AlphaSense Inc., Senseair AB, Trolex Ltd., Aeroqual Ltd., Emerson Electric Co., City Technology Ltd., Dynament Ltd., Figaro Engineering Inc., Membrapor, Nemoto & Co. Ltd., and Robert Bosch LLC, among others.

Product Type Analysis

Wired Segment is Dominant

Based on product type, the market for gas sensors is classified into wired, and wireless gas sensors. The wired gas sensor is dominant in the gas sensor market with the largest market share of 53% in 2022. Wired gas sensors provide significant benefits such as compact size, high accuracy, low maintenance, and low cost. In many conditions, wired sensors are one of the most consistent methods as they connect the sensor directly to the device receiving input, making them proper for use in mines, oil rigs and nuclear power plants.

Furthermore, the increasing use of wired gas sensors in civil applications is a key factor responsible for the growth of this segment. Wireless sensors provide high scalability, cost-effectiveness, and high flexibility, due to this wireless segment expected to show growth in forecast period. Wireless sensors are used in various industries including manufacturing, petrochemical, oil & gas.

Gas Type Analysis

Carbon Dioxide Gas Sensor Segment is Dominant

By gas type market for gas sensors is segmented into oxygen, carbon monoxide, carbon dioxide, hydrogen sulphide, nitrogen oxide, hydrogen, and others. In 2022, the carbon dioxide gas sensor market dominated and accounted for more than 32.5% of the global revenue share. The main purpose of carbon dioxide sensors is to monitor indoor air quality in buildings, homes, offices, automobiles, healthcare facilities, and other applications. Many companies are working to develop MEMS-based carbon dioxide sensors for various applications.

TDK Corporation, for example, introduced the TCE-11101 MEMS gas sensor platform in January 2021. It is a small, lightweight, low-power, miniaturized device that measures carbon dioxide in homes, hospitals, automobiles, IoT, and other settings. These initiatives are positive for the segment’s growth. In the coming years, significant growth is expected in the carbon monoxide sensor market. Carbon monoxide sensors are needed to prevent fatalities from carbon monoxide poisoning.

The carbon monoxide sensor market is growing due to government regulations that ensure workplace safety. In the U.S., for example, carbon monoxide poisoning has led the government to install carbon monoxide detection devices in various states.

Technology Analysis

Electrochemical Gas Sensor Segment is Dominant

Based on technology market is segmented into electrochemical gas sensor, semiconductor gas sensor, solid state/MOS gas sensor, photo-ionization detector sensor, catalyst gas sensor, infrared gas sensor, laser gas sensor, and other gas sensors. The electrochemical gas sensor segment is dominant in market with largest market share more than 23% of global share.

The demand for electrochemical gas sensors is increasing as electrochemical sensors consumes less power, offers specificity to target gas among the other gas sensors. Electrochemical technology easily detects toxic gas and vapors concentration with oxidation of target gas. Such aspects are anticipated to drive growth of this segment in forecast period.

Also infrared segment predicted to hold significant market share during forecast period as infrared gas sensors identify numerous gases like carbon monoxide, acetylene, benzene, volatile organic compounds(VOCs), and others. Infrared gas sensors play important role in monitoring oxygen levels in ventilators and incubators. Photo-Ionization gas sensors are important in detection of natural gases. Catalytic gas sensors are most common gas detector sensor which are widely used in portable gas monitors.

By End-Use Analysis

Industrial Segment is Dominant

Based on end-use gas sensors are classified into medical, building automation & domestic appliances, environmental, petrochemical, automotive & transportation, industrial, agriculture, food & beverages, waste water treatment, aerospace & defense, and other end-use. The industrial sector dominated the Gas Sensor market in 2022 and accounted for more than 23% of worldwide sales.

Hazardous gases and vapors can be detected and monitored using industrial gas sensors, which can also set off visual and audio warnings. Now, a lot of gas sensor producers are concentrating on making tiny industrial gas sensors. In October 2020, sensor company DD-Scientific unveiled its newest line of high-performance industrial gases sensors. It provides the same durability and dependability as a bigger sensor in a more compact form.

The petrochemicals industry will experience significant expansion during the forecast period. Gas sensors are being rapidly deployed by the LPG and LNG sector verticals since these verticals need to monitor the storage, production, and transportation of gas at every stage. As natural gas output increases, the processing facilities’ emphasis on safety and security has increased. As natural gas goods continue to rise in popularity, this Gas Sensor market is anticipated to grow further.

Key Market Segments

Based on Product Type

- Wired

- Wireless

Based on Gas Type

- Oxygen

- Carbon monoxide

- Carbon dioxide

- Hydrogen sulphide

- Nitrogen oxide

- Hydrogen

- Others

Based on Technology

- Electrochemical gas sensor

- Semiconductor gas sensor

- Solid state/MOS gas sensor

- Photo-ionization detector sensor

- Catalyst gas sensor

- Infrared gas sensor

- Laser gas sensor

- Other gas sensors

Based on End-Use

- Medical

- Building automation & domestic appliances

- Environmental, petrochemical

- Automotive & transportation

- Industrial

- Agriculture

- Food & Beverages

- Waste Water Treatment

- Aerospace & Defense

- Other End-Use.

Drivers

Rising Demand in Critical Industries

The gas sensor market is experiencing significant growth, primarily driven by escalating demand within crucial industries. These sectors include oil and gas, chemicals, healthcare, and environmental monitoring, where gas sensors play a vital role in ensuring safety, operational efficiency, and regulatory compliance.

The need for constant monitoring of various gases, such as carbon dioxide, methane, and volatile organic compounds, has been identified as a key factor bolstering this demand. This growth can be attributed to the increasing awareness of occupational health and safety standards, coupled with stringent governmental regulations concerning environmental protection.

Restraint

Development Complexities for Industry-Specific Gas Sensors

However, the market faces notable restraints, primarily the complexities involved in the development of industry-specific gas sensors. Tailoring these sensors to meet the unique requirements of different industries poses significant challenges. These include the need for high sensitivity, selectivity, and reliability in diverse and often harsh environmental conditions. Additionally, the requirement for gas sensors to be compatible with various control systems and platforms adds to the development complexity, potentially impeding market growth.

Opportunity

Integration of IoT, Cloud Computing, and Big Data

Conversely, a substantial opportunity is presented by the rising deployment of advanced technologies such as the Internet of Things (IoT), cloud computing, and big data analytics in the gas sensor market. The integration of these technologies enhances the functionality and application scope of gas sensors, enabling real-time monitoring, remote control, and predictive maintenance. This integration facilitates better data management and analysis, leading to improved decision-making processes in safety operations and environmental monitoring, thus broadening the market’s horizons.

Challenge

Technical Issues Including High Energy Consumption

The gas sensor market, while poised for growth, faces significant challenges, notably technical issues related to high energy consumption. This concern is particularly acute in the context of portable and wearable gas sensors, where prolonged battery life is crucial. Additionally, maintaining sensor accuracy and stability over time, especially in variable environmental conditions, remains a challenge. Addressing these technical issues is essential for the continued advancement and adoption of gas sensor technology across various industries.

Trends

Competitive Landscape of Manufacturers

Manufacturers are now more inclined toward competitive pricing. Some independent manufacturers hire third-party suppliers to sell their products. Gas sensors manufacturers are increasingly focused on product innovation and differentiation as they are steadily moving toward consolidation through mergers & acquisitions, joint ventures, and collaborative partnerships. Such trends are currently being witnessed in this market, thereby bolstering the demand for gas sensors in the process.

Regional Analysis

Asia Pacific Region is Dominant in Global Gas Sensors Market

The Gas Sensors market was dominated by the Asia Pacific in 2022, accounting for more than 34.2% of global revenue. Gas sensors are being used to monitor air quality and increase awareness of the health effects of air pollutants. The region’s continued urbanization is contributing to the increasing demand for gas sensors. Smart sensor devices are also in high demand as the governments of the Asia Pacific region invest heavily in smart city projects. These factors are positive for regional market growth.

Europe is anticipated to experience steady growth over the forecast period. The regional Gas Sensor market will grow due to strict emission norms and the need to monitor them. All European vehicle OEMs must include gas sensor technology in their offerings due to safety regulations. The popularity of gas sensors to reduce pollution in the automotive industry is expected to grow as stricter pollution regulations are implemented.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Major players are focused on a variety of strategic policies to develop their respective businesses in foreign markets. Several gas sensor market companies are concentrating on expanding their existing operations and R&D facilities. Furthermore, businesses in the gas sensors market are developing new products and portfolio expansion strategies through investments and mergers, and acquisitions. Market players are increasingly focusing on wireless gas sensors because of the many benefits associated with wireless devices.

Top Key Players

- ABB

- AlphaSense Inc.

- Senseair AB

- Trolex Ltd.

- Aeroqual Ltd.

- Emerson Electric Co.

- City Technology Ltd.

- Dynament Ltd.

- Figaro Engineering Inc.

- Membrapor

- Nemoto & Co. Ltd.

- Robert Bosch LLC

- Other key Players

Recent Developments

- In 2023, ABB launched its Multigas Detector Xpert 8000 in June 2023. This detector is designed for harsh environments and can measure various gases, including hydrocarbons, ammonia, and hydrogen sulfide. It features advanced safety features and remote access capabilities.

- In 2023, AlphaSense launched its new A5000 Series gas sensors in March 2023. These sensors are designed for high-performance applications and offer low power consumption, fast response times, and high accuracy.

- In 2023, Senseair AB launched its new Nova Lite gas sensor in May 2023. This sensor is designed for portable and battery-powered applications and is ideal for measuring carbon dioxide and other indoor air quality parameters.

- In 2023, Trolex launched its new T7000 Series gas sensors in February 2023. These sensors are designed for industrial applications and offer high sensitivity and accuracy for a wide range of gases.

Report Scope

Report Features Description Market Value (2023) US$ 2,748 Mn Forecast Revenue (2032) US$ 5,302 Mn CAGR (2023-2032) 7.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type- Wired, and Wireless; By Gas Type- Oxygen, Carbon Monoxide, Carbon Dioxide, Hydrogen Sulphide, Nitrogen Oxide, Hydrogen, and Others; By Technology- Electrochemical Gas Sensor, Semiconductor Gas sensor, Solid state/MOS Gas Sensor, Photo-Ionization Detector Sensor, Catalyst Gas Sensor, Infrared Gas Sensor, Laser Gas Sensor, and Other Gas Sensors; By End-Use- Medical, Building Automation & Domestic Appliances, Environmental, Petrochemical, Automotive & Transportation, Industrial, Agriculture, Food & Beverages, Waste Water Treatment, Aerospace & Defense, and Other End-Use Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape ABB, AlphaSense Inc., Senseair AB, Trolex Ltd., Aeroqual Ltd., Emerson Electric Co., City Technology Ltd., Dynament Ltd., Figaro Engineering Inc., Membrapor, Nemoto & Co. Ltd., Robert Bosch LLC, and Other key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How big is the gas sensor industry?The Global Gas Sensors Market size is expected to be worth around USD 5,302 Million by 2032 from USD 2,748 Million in 2023, growing at a CAGR of 7.80% during the forecast period from 2023 to 2032.

What is the current Gas Sensors Market size?In 2024, the Gas Sensors Market size is expected to reach USD 2,934.0 Mn.

Who are the key companies/players in the gas sensor market?Some key players operating in the gas sensor market include ABB, AlphaSense Inc., Senseair AB, Trolex Ltd., Aeroqual Ltd., Emerson Electric Co., City Technology Ltd., Dynament Ltd., Figaro Engineering Inc., Membrapor, Nemoto & Co. Ltd., Robert Bosch LLC, and Other key Players

What application dominates the gas sensor market?Industrial segment is expected to dominate the gas sensor market.

Which gas type dominates the gas sensor market?Carbon Dioxide Gas Sensor Segment is expected to have the largest market size during the forecast period.

-

-

- ABB

- AlphaSense Inc.

- Senseair AB

- Trolex Ltd.

- Aeroqual Ltd.

- Emerson Electric Co.

- City Technology Ltd.

- Dynament Ltd.

- Figaro Engineering Inc.

- Membrapor

- Nemoto & Co. Ltd.

- Robert Bosch LLC

- Other key Players