Global Game Engines Market Size, Share Analysis Report By Component (Solution, Services), By Type (2D Game Engines, 3D Game Engines, Others), By Platform (Mobile, Console, Computer, Others), By Genre (Action & Adventure, Multiplayer online battle arena (MOBA), Real-time strategy (RTS), Role-playing games (RPG, ARPG, CRPG, MMORPG, TRPG, etc.), Sandbox, Shooter (FPS & TPS), Simulation and Sports, Others (Puzzlers, Gamers, Survival & Horror Games, etc.)), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151133

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

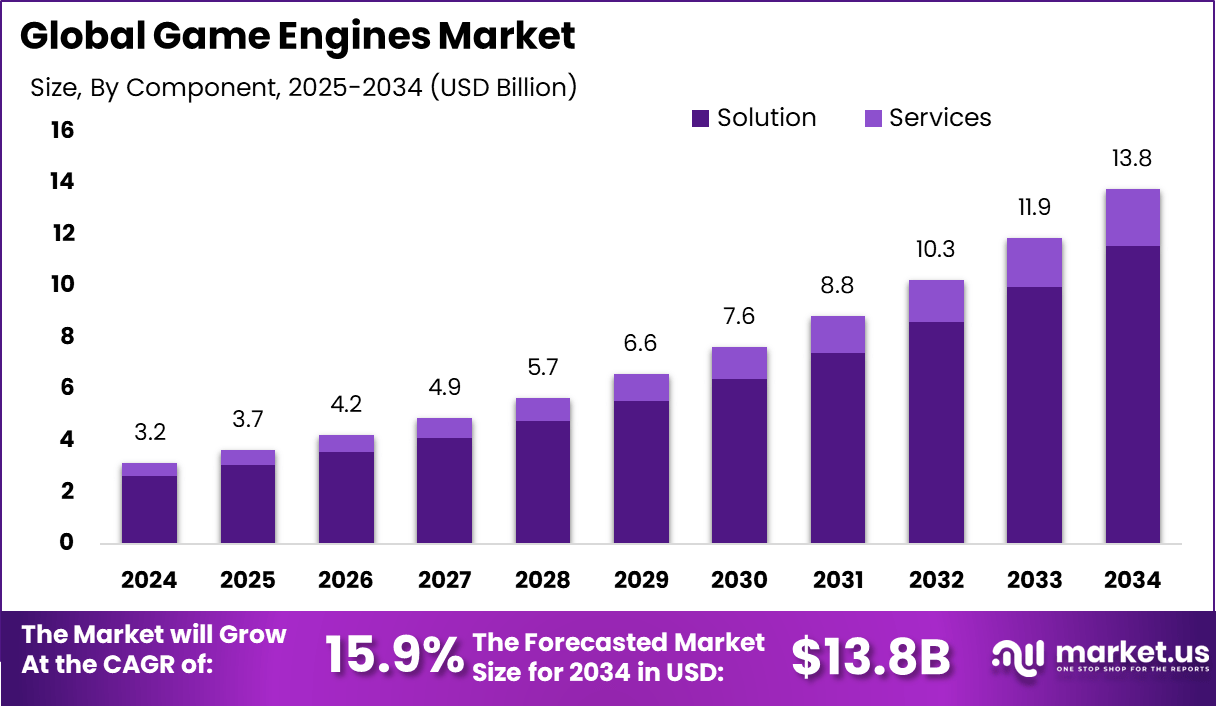

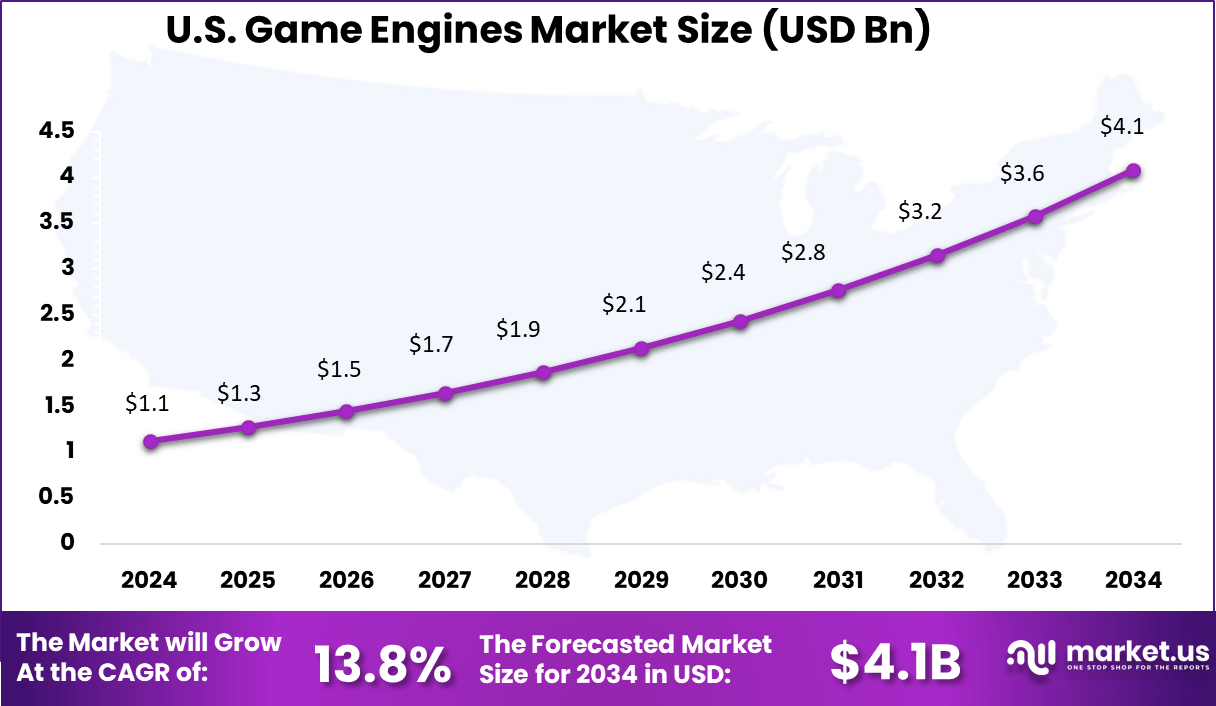

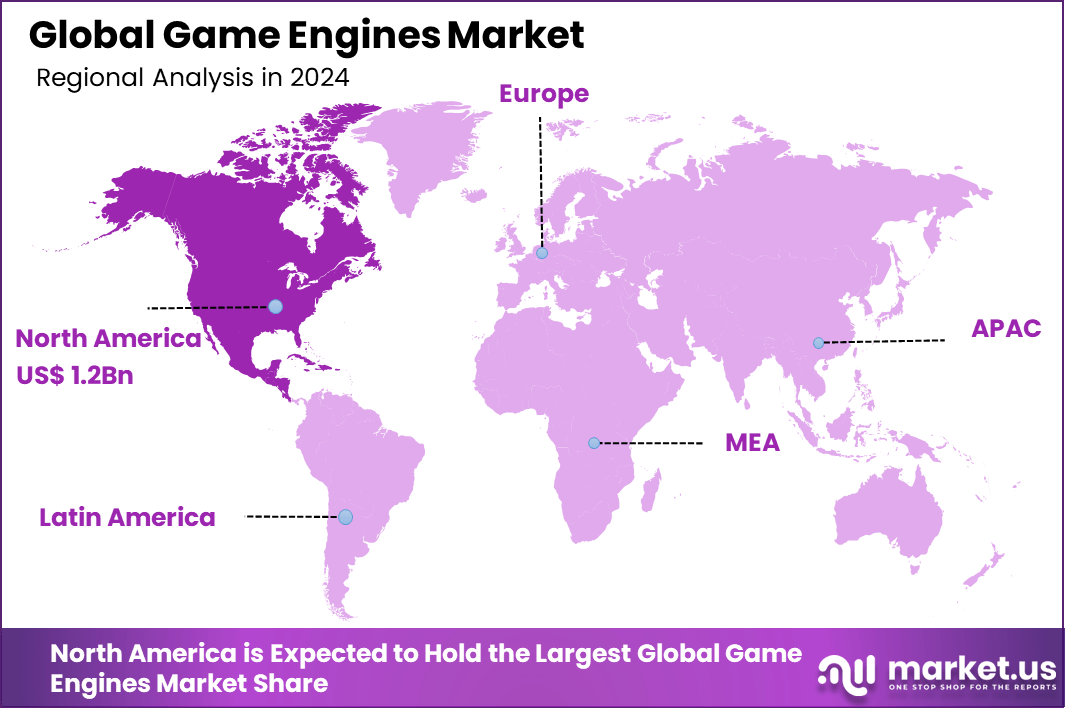

The Global Game Engines Market size is expected to be worth around USD 13.8 Billion By 2034, from USD 3.2 billion in 2024, growing at a CAGR of 15.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38% share, holding USD 1.2 Billion revenue. US Game Engines Market recorded a value of USD 1.12 billion, growing at a 13.8% CAGR.

The Game Engine market is undergoing a period of robust transformation, propelled by rising consumer expectations, technological innovation, and expanding industry applications. The increasing prevalence of mobile gaming, immersive content, and cloud-powered experiences has solidified game engines as essential infrastructure in the digital ecosystem.

The primary drivers for the growth of the game engine market are rooted in continuous technical innovation and rising consumer expectations. Improvements in rendering systems, physics engines, and support for high-definition graphics have contributed to the ability of developers to build visually stunning and interactive environments.

Moreover, the expansion of mobile gaming has increased the demand for engines that are lightweight and efficient, while still capable of delivering high-performance graphics. Simultaneously, the adoption of engines by non-gaming sectors has opened new growth avenues, driving greater demand for customized and industry-specific features.

For instance, in 2024, Unity maintained its position as the most widely used engine on Steam, powering 51% of released games. However, Unreal Engine games achieved greater commercial success, securing 31% of total units sold, ahead of Unity’s 26%, reflecting a difference in user purchase behavior versus development preference.

Adoption of game engines is broadening into non‑gaming sectors such as film production, automotive simulation, and architectural visualization. Unity, for instance, has expanded into these markets and supports over 25 platforms, with its applications reaching 2 billion monthly active users. Concurrently, the indie developer community is growing, driving demand for accessible yet feature-rich engine solutions.

Key Takeaways

- The Game Engines Market is projected to grow from USD 3.2 Bn in 2024 to approximately USD 13.8 Bn by 2034, registering a strong CAGR of 15.9% during the forecast period.

- North America led the global market with over 38% share, generating USD 1.2 Bn, driven by strong developer ecosystems and gaming studios across the region.

- The U.S. market alone contributed USD 1.12 Bn, expanding at a CAGR of 13.8%, supported by increasing investments in immersive game content.

- The Solution segment dominated by accounting for 84% share, as developers prioritized integrated engine capabilities over standalone tools.

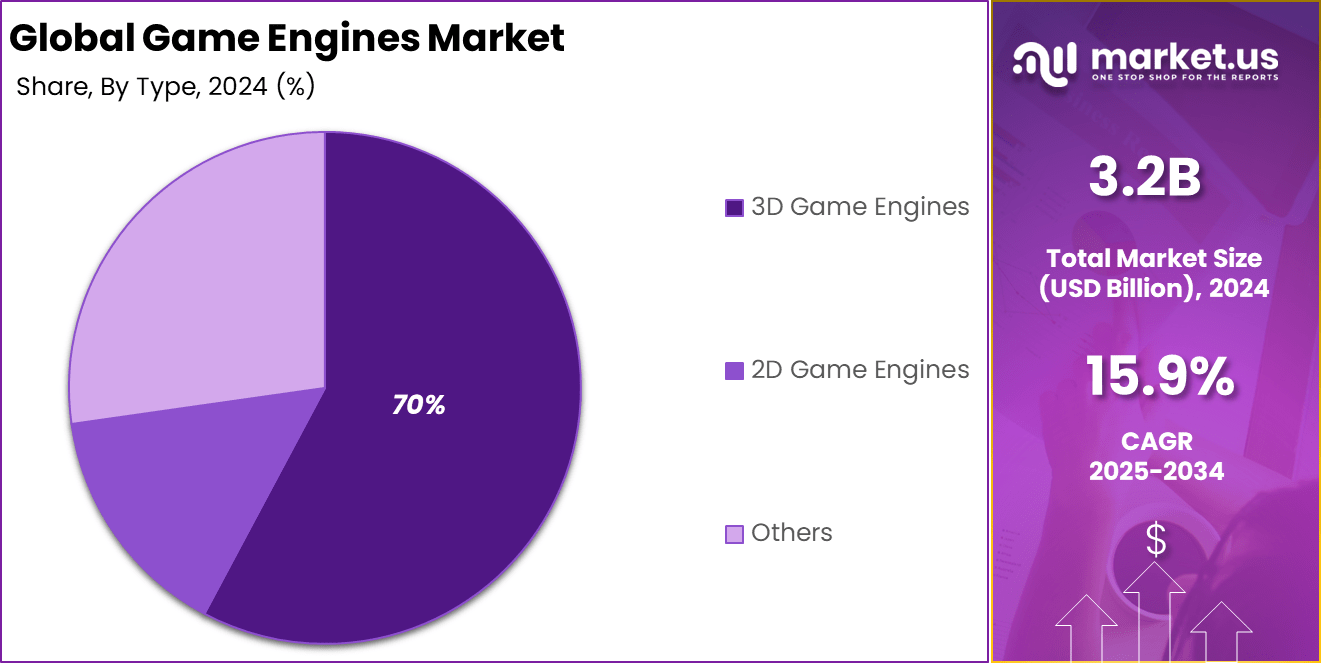

- 3D Game Engines captured a commanding 70% share, reflecting the rising demand for high-fidelity graphics in immersive gameplay.

- Mobile platforms held the largest platform share at 47%, driven by the growing popularity of mobile gaming across global audiences.

- The Action & Adventure genre led all game categories, contributing 26% share, fueled by strong consumer engagement and story-rich experiences.

Impact of Generative AI

Generative AI’s most visible impact lies in automated procedural content generation (PCG). Engine-integrated tools can now generate entire environments, textures, audio, animations, and even NPC dialogue based on structured prompts or learned player profiles. This capability greatly reduces manual workload and opens new avenues for dynamic, replayable world-building.

Recent industry surveys indicate that approximately 40% of developers are already leveraging such tools to produce varied game worlds more quickly. Another major area of transformation lies in non-playable character (NPC) behavior. Generative AI enables game engines to support adaptive dialogue systems that respond to players in natural, unscripted ways.

This shift introduces context-aware interactions, making characters feel more human and emotionally responsive. Prototypes developed by leading gaming firms have shown that AI-driven characters can sustain meaningful, story-aligned conversations with players, increasing immersion and personalization.

For instance, In August 2024, NVIDIA launched NVIDIA ACE, a generative AI-powered tool designed to enhance interactions with digital humans. Mecha BREAK became the first game to integrate this technology, marking a significant step in AI-driven gaming experiences.

US Market Dominance

The US Game Engines Market is valued at USD 1.1 Billion in 2024 and is predicted to increase from USD 2.1 Billion in 2029 to approximately USD 4.1 Billion by 2034, projected at a CAGR of 13.8% from 2025 to 2034.

The presence of a large base of AAA game studios, indie developers, and tech-forward educational institutions has created a constant demand for robust, high-performance game engines. Additionally, the U.S. market benefits from early adoption of emerging technologies such as generative AI, real-time ray tracing, and immersive VR/AR, which are increasingly being embedded within modern game engines.

In 2024, North America held a dominant market position, capturing more than a 38% share, holding USD 1.2 Billion in revenue. This regional dominance can be primarily attributed to the high concentration of game development studios across the United States and Canada, including a large presence of indie developers.

The region also benefits from the early adoption of advanced technologies such as real-time ray tracing, cloud gaming infrastructure, and AI-driven game design, which has boosted the demand for high-performance game engines. Furthermore, major tech companies headquartered in North America continue to invest heavily in immersive technologies like AR and VR, fueling innovation within the game engine ecosystem.

Another factor contributing to North America’s dominance is the region’s high spending power and strong penetration of high-performance gaming hardware, which fuels demand for sophisticated game content powered by next-generation engines. The presence of prominent universities offering game design programs, along with a thriving ecosystem of AR/VR startups, has further pushed innovation in engine design and integration.

Component Analysis

In 2024, the Solution segment held a dominant market position, capturing more than an 84 % share of the global game engines market. This commanding lead can be attributed to the strong demand for comprehensive development tools that enable cross-platform deployment, real-time rendering, and immersive experiences.

Such all‑in‑one solutions significantly reduce development time and costs by integrating physics engines, advanced graphics pipelines, asset management, and debugging tools into singular frameworks. Platforms like Unity and Unreal Engine maintain their lead due to their scalability, strong community support, and rich asset ecosystems preferred by both indie and major studios.

Comparison Summary – Component Analysis

Segment Key Drivers Solution Cross-platform engines, integrated toolsets, dominant platforms Services Customisation, technical consultancy, enterprise-grade integrations The Solution segment’s prominence is further underpinned by rapid innovation in support for emerging technologies – such as AI-driven animation, AR/VR capabilities, cloud-based collaboration, and multiplatform compatibility – meeting today’s gaming industry needs.

Developers are increasingly prioritizing engines that streamline seamless deployment across PC, console, and mobile devices. This has driven a shift toward solution-centric offerings that eliminate the need for separate tools or custom integrations, contributing to the sustained share dominance of the Solution segment.

Type Analysis

In 2024, the 3D Game Engines segment held a dominant market position, capturing more than a 70 % share of the global game engines market. This leading share is driven by the growing demand for high-fidelity, immersive gaming experiences across PC, console, and increasingly, mobile platforms.

Advanced rendering capabilities such as real-time ray tracing and dynamic lighting – featured prominently in engines like Unreal Engine and Unity – have elevated user expectations and propelled 3D engines into mainstream adoption. Additionally, the rapid expansion of AR/VR applications, simulations, and interactive visualizations in industries outside gaming has further expanded the addressable market for 3D engines.

Comparison Summary – Type Analysis

Segment Key Drivers 3D Game Engines Real-time rendering, AR/VR adoption, photogrammetry, dominance in AAA & simulation applications 2D Game Engines Lightweight assets, lower development costs, mobile and indie appeal Others (2.5D/Hybrid) Niche genres, cost-effective cross-genre development The sustained dominance of the 3D segment is further explained by its continuous integration of cutting-edge technologies. Notably, many 3D engines now support AI-driven asset generation, photogrammetry, physics simulation, and cross-platform deployment. These features streamline workflows and enable developers to create richly detailed environments at scale.

For instance, photogrammetry tools seamlessly integrate with leading 3D engines to produce realistic assets for VR and game scenarios. Moreover, the prevalence of 3D engines in AAA game titles, eSports, and blockbuster media underscores their strategic value in delivering top-tier visual experiences

Platform Analysis

In 2024, the Mobile segment held a dominant market position, capturing more than 47% of the game engines market. This dominance was largely driven by the rapid rise in smartphone gaming, especially in regions with high mobile internet penetration. Developers are increasingly favoring mobile platforms due to the lower development costs, quicker deployment cycles, and widespread reach across both emerging and developed markets.

Mobile game engines offer ease of integration with in-app purchases, social sharing features, and advertisement networks, which are essential for monetization in the free-to-play gaming model. Additionally, the availability of cross-platform tools and lightweight engine architectures has simplified the process for indie developers to enter the mobile gaming space, further boosting adoption.

Another factor contributing to the mobile segment’s leadership is the advancement of mobile hardware and network infrastructure. Devices today are capable of handling complex graphics, immersive physics, and multiplayer functionalities that were previously limited to console or PC. The growth of 5G and edge computing has lowered latency and enhanced gaming quality, pushing more developers to create high-performance mobile games.

Comparison Summary – Platform Analysis

Segment Key Drivers Mobile Widespread smartphone use, freemium models, cross-platform tools, AR/VR/AI integrations Console High-performance engine features, exclusive titles, immersive gameplay Computer Complex simulation support, enterprise & AAA gaming, hardware scalability Others Cloud streaming, web adaptations, emerging platforms Genre Analysis

In 2024, the Action & Adventure segment held a dominant market position, capturing more than 26% of the game engines market. This leadership arises from the genre’s extensive popularity across both console and PC platforms, where deep narrative, exploration, and puzzle-solving are highly valued.

High-quality engines that support storytelling, dynamic world-building, and advanced physics have favored developers in this segment, contributing to its strong adoption rate. The genre remains appealing to both AAA and independent studios, producing titles that resonate with broad audiences for their immersive experiences.

Further reinforcing this dominance, the engine ecosystem has become more accessible to independent developers, enabling the segment’s expansion beyond AAA studios. User-friendly engines such as Unity, Unreal, and Godot provide modular workflows, extensive asset libraries, and cross-platform deployment, allowing indie teams to produce visually compelling action-adventure titles without prohibitive costs.

Comparison Summary -Genre Analysis

Genre Key Drivers Action & Adventure Open-world demand, cinematic toolkits, rich asset ecosystems, and indie creativity MOBA Esports popularity, team gameplay, cross-platform support RTS Strategic depth, map design tools, simulation features RPG (incl. MMORPG etc.) Narrative complexity, character progression systems, dialogue engines Sandbox User-generated content frameworks, procedural tools, creative freedom Shooter (FPS & TPS) Real-time physics, networking, optimized performance for fast-paced combat Simulation and Sports Real-world physics, AI behaviours, training applications Key Market Segments

By Component

- Solution

- Services

By Type

- 2D Game Engines

- 3D Game Engines

- Others

By Platform

- Mobile

- Console

- Computer

- Others

By Genre

- Action & Adventure

- Multiplayer online battle arena (MOBA)

- Real-time strategy (RTS)

- Role-playing games (RPG, ARPG, CRPG, MMORPG, TRPG, etc.)

- Sandbox

- Shooter (FPS & TPS)

- Simulation and Sports

- Others (Puzzlers, Gamers, Survival & Horror Games, etc.)

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

Generative AI–Powered Engine Components

Game engines are undergoing a transformative shift with the integration of generative AI, enabling real-time creation of characters, environments, and animations. These tools are redefining development cycles by reducing manual design processes and enhancing creativity.

Generative AI not only accelerates asset creation but also offers dynamic storytelling capabilities, where game narratives evolve based on player input. Startups and major studios are experimenting with generative frameworks that allow even small teams to produce expansive, open-world content.

For example, Xbox and Unity have both launched initiatives to embed AI into core engine pipelines. These advancements mark a new phase where AI becomes a co-developer, shaping not just visual outputs but gameplay logic as well.

Driver

Demand for Cross-Platform Development Efficiency

Game developers are increasingly driven by the need to launch games across multiple platforms simultaneously – including consoles, PCs, mobile devices, and cloud. This has created strong demand for engines that provide unified development environments with tools for asset sharing, code reuse, and multi-platform optimization.

Features such as integrated rendering pipelines, visual scripting, and adaptive performance tuning are central to these engines, allowing developers to reduce costs and time-to-market. This trend is also linked to rising consumer expectations for cross-play and cross-save functionalities. Engines that support seamless transitions between platforms gain clear preference among studios.

Additionally, cloud-based version control, real-time collaboration tools, and live update deployment capabilities are becoming standard in leading engines to support these workflows. These developments ensure that developers can deliver consistent experiences, regardless of hardware or device ecosystem.

Restraint

Security and Source Code Vulnerabilities

As game engines become more connected to cloud services, online stores, and multiplayer platforms, their attack surfaces are expanding significantly. A notable example occurred in 2024 when open-source engine Godot was exploited via GitHub for malware distribution, impacting numerous developer systems.

These events highlight how compromised plugins or modules can infect engine pipelines, causing financial damage and reputational harm to developers. In addition, code theft and engine manipulation have emerged as major threats.

Recent incidents involving source code leaks from major studios have shown that compromised engines can be reverse-engineered for cheating, piracy, and unauthorized modding. These vulnerabilities require engine developers to invest in encrypted frameworks, secure APIs, and regular codebase audits – raising development overhead and complicating open-source engine use.

Opportunity

Rise of Cloud Gaming and Engine-as-a-Service

Cloud gaming is reshaping how games are built, hosted, and streamed. Game engines now face opportunities to evolve into cloud-native platforms that support real-time streaming, distributed processing, and persistent world generation. By shifting heavy computations to remote servers, developers can deliver graphically intensive games to lower-end devices, expanding their audience base.

This cloud-native transition also aligns with new monetization models such as subscription-based game access and live content updates. Game engines are now being offered as modular platforms on the cloud – commonly referred to as Engine-as-a-Service. These allow developers to access rendering power, physics simulation, and AI capabilities through scalable APIs.

This model not only reduces upfront costs but also enables smaller studios to compete with large developers. Providers who can deliver flexible deployment, real-time support, and AI integration at scale are poised to lead the next phase of game development.

Challenge

Talent Gap and Toolchain Fragmentation

Despite growing innovation, the game engine sector faces a shortage of skilled developers capable of handling the complexities of cross-platform, AI-enhanced, and cloud-integrated engines. Advanced game engines now require expertise in real-time physics, machine learning, shader programming, and multiplayer architecture.

Unfortunately, universities and training programs are still catching up with these evolving demands, leading to delayed hiring and limited innovation pipelines across studios. Compounding the issue is the fragmentation of tools and workflows.

Many studios are locked into proprietary engines or outdated toolchains, which hinders modular upgrades or platform scalability. Internal restructuring at major engine developers has also disrupted developer trust, with layoffs and monetization missteps making studios wary of long-term engine dependencies.

Key Player Analysis

Leading companies in the game engines industry are adopting a range of strategic initiatives to enhance their market presence and respond to shifting developer demands. Unity Software, Epic Games (Unreal Engine), Crytek GmbH (CryEngine), YoYo Games (GameMaker Studio 2), Scirra Ltd. (Construct 3), and Cocos are among the key players actively strengthening their position through continuous innovation and global expansion efforts.

These companies are increasingly focusing on product differentiation, cross-platform support, and visual performance upgrades to meet the growing expectations of indie developers and AAA studios alike. Strategic moves such as partnerships, acquisitions, and cross-industry collaborations are being pursued to enhance ecosystem value.

Moreover, a strong emphasis is being placed on developer community engagement and monetization tools, which are becoming essential in an industry where content creation is decentralizing. By investing in flexible licensing models, enhanced toolkits, and AI-driven development assistance, these companies are not only improving usability but also future-proofing their offerings against rapidly changing game development workflows

Top Key Players Covered

- Unity Technologies

- Epic Games

- Crytek GmbH

- Amazon Lumberyard

- Cocos

- GameMaker Studio

- PhyreEngine

- Clickteam

- Stencyl LLC

- The Game Creators Ltd.

- Marmalade Technologies Ltd.

- Photon Storm Ltd.

- Stride

- Godot Engine

- Scirra Ltd.

- Corona Labs Inc.

- GarageGames

- Leadwerks Software

- Silicon Studio Corporation

- Other Key Players

Recent Developments

- In October 2024, Unity Technologies released Unity 6 at its Unite Developer Conference. The update focused on improving performance and engine stability, which had been a key concern for many developers. Unity also promised a more transparent pricing policy going forward, ensuring that any future fee changes would be communicated in advance.

- In November 2024, Webster University formed a partnership with Epic Games to strengthen its academic programs in Games & Game Design and Film, Television, and Video Production. This collaboration aims to provide students with direct access to Unreal Engine’s cutting-edge tools and workflows, creating new pathways for talent development and curriculum innovation.

- On April 5, 2024, Godot merged with the Blender Foundation to form a combined open-source platform for game development and 3D modeling. Godot is known for supporting both 2D and 3D games, while Blender is a powerful tool for animation and design. This merger brings together two developer-friendly platforms and is expected to attract more creators looking for a free and flexible development environment.

- In February 2024, Epic Games entered into a high-value strategic partnership with The Walt Disney Company, which involved an estimated investment of ~USD 1.6 billion. As part of this collaboration, Disney acquired a minority equity stake in Epic Games and committed to co-developing open, immersive game experiences.

Report Scope

Report Features Description Market Value (2024) USD 3.2 Bn Forecast Revenue (2034) USD 13.8 Bn CAGR (2025-2034) 15.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solution, Services), By Type (2D Game Engines, 3D Game Engines, Others), By Platform (Mobile, Console, Computer, Others), By Genre (Action & Adventure, Multiplayer online battle arena (MOBA), Real-time strategy (RTS), Role-playing games (RPG, ARPG, CRPG, MMORPG, TRPG, etc.), Sandbox, Shooter (FPS & TPS), Simulation and Sports, Others (Puzzlers, Gamers, Survival & Horror Games, etc.)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Unity Technologies, Epic Games, Crytek GmbH, Amazon Lumberyard, Cocos , GameMaker Studio, PhyreEngine , Clickteam, Stencyl LLC , The Game Creators Ltd., Marmalade Technologies Ltd., Photon Storm Ltd. , Stride, Godot Engine, Scirra Ltd. , Corona Labs Inc., GarageGames, Leadwerks Software, Silicon Studio Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Unity Technologies

- Epic Games

- Crytek GmbH

- Amazon Lumberyard

- Cocos

- GameMaker Studio

- PhyreEngine

- Clickteam

- Stencyl LLC

- The Game Creators Ltd.

- Marmalade Technologies Ltd.

- Photon Storm Ltd.

- Stride

- Godot Engine

- Scirra Ltd.

- Corona Labs Inc.

- GarageGames

- Leadwerks Software

- Silicon Studio Corporation

- Other Key Players