Global Full-Stack Observability Services Market Size, Share Report Analysis By Component (Solutions/Software, Services), By Deployment Mode (Cloud/SaaS, On-Premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Application Performance Management, Infrastructure & Network Management, Security & Compliance Management, Database Performance Monitoring, Business Analytics & Optimization), By End-User Vertical ( IT & ITeS, BFSI, Retail & E-commerce, Healthcare & Life Sciences, Manufacturing, Telecommunications, Media & Entertainment, Government & Public Sector ), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 169823

- Number of Pages: 313

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Quick Market Facts

- By Component

- By Deployment Mode

- By Organization Size

- By Application

- By End User Vertical

- Regional Analysis

- Emerging Trends Analysis

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

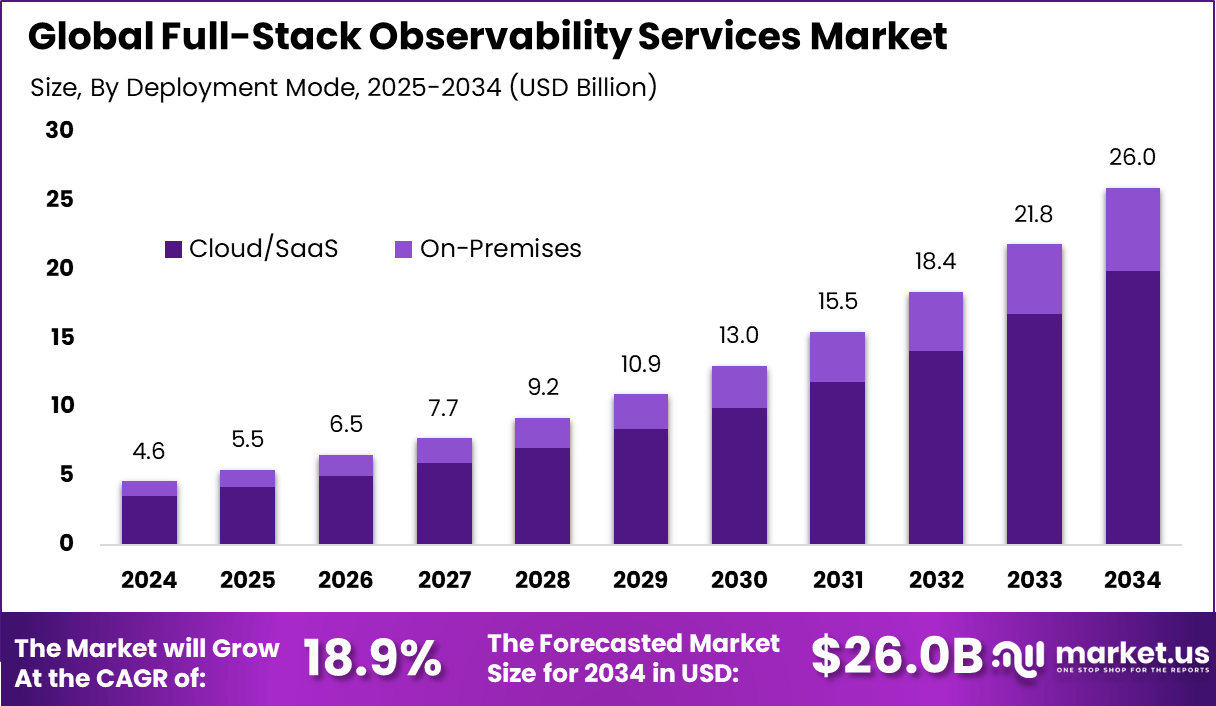

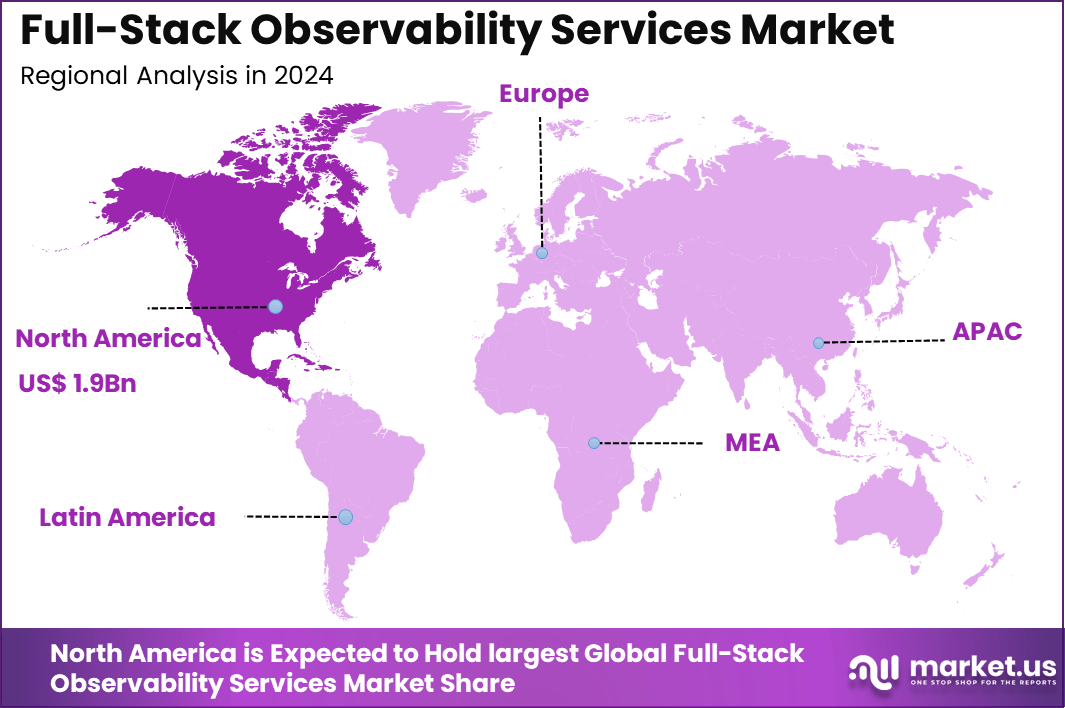

The Global Full-Stack Observability Services Market generated USD 4.6 billion in 2024 and is predicted to register growth from USD 5.5 billion in 2025 to about USD 26 billion by 2034, recording a CAGR of 18.9% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 41.7% share, holding USD 1.9 Billion revenue.

The full stack observability services market has grown as organisations manage complex digital systems that span applications, servers, networks and cloud environments. Growth is linked to rising use of distributed systems, cloud platforms and digital services that require continuous performance tracking. Full stack observability services provide a single view of system health across all technology layers.

The market has continued to gain traction as enterprises prioritize real time visibility and data driven operations. The adoption of DevOps and Site Reliability Engineering practices has further increased demand for observability tools that provide actionable insights rather than isolated metrics. As digital services become central to revenue generation, observability platforms are increasingly viewed as core operational systems rather than optional monitoring tools.

The growth of the market can be attributed to increasing application complexity, wider cloud adoption and higher business dependence on uptime. Digital services must remain available at all times, and even small system failures can cause service disruption. Organisations rely on observability services to detect issues early and maintain stable operations.

Demand is rising across banking, retail, healthcare, telecom, manufacturing, logistics and software service providers. Businesses that operate customer facing digital platforms depend on observability to track performance across servers, databases, applications and user devices. Demand is strongest in environments where system downtime directly affects revenue and customer trust.

Top Market Takeaways

- Solutions and software dominated with 71.7%, showing that enterprises prefer complete observability platforms over isolated monitoring tools.

- Cloud and SaaS deployment led with 76.8%, reflecting strong demand for scalable, remotely managed observability environments.

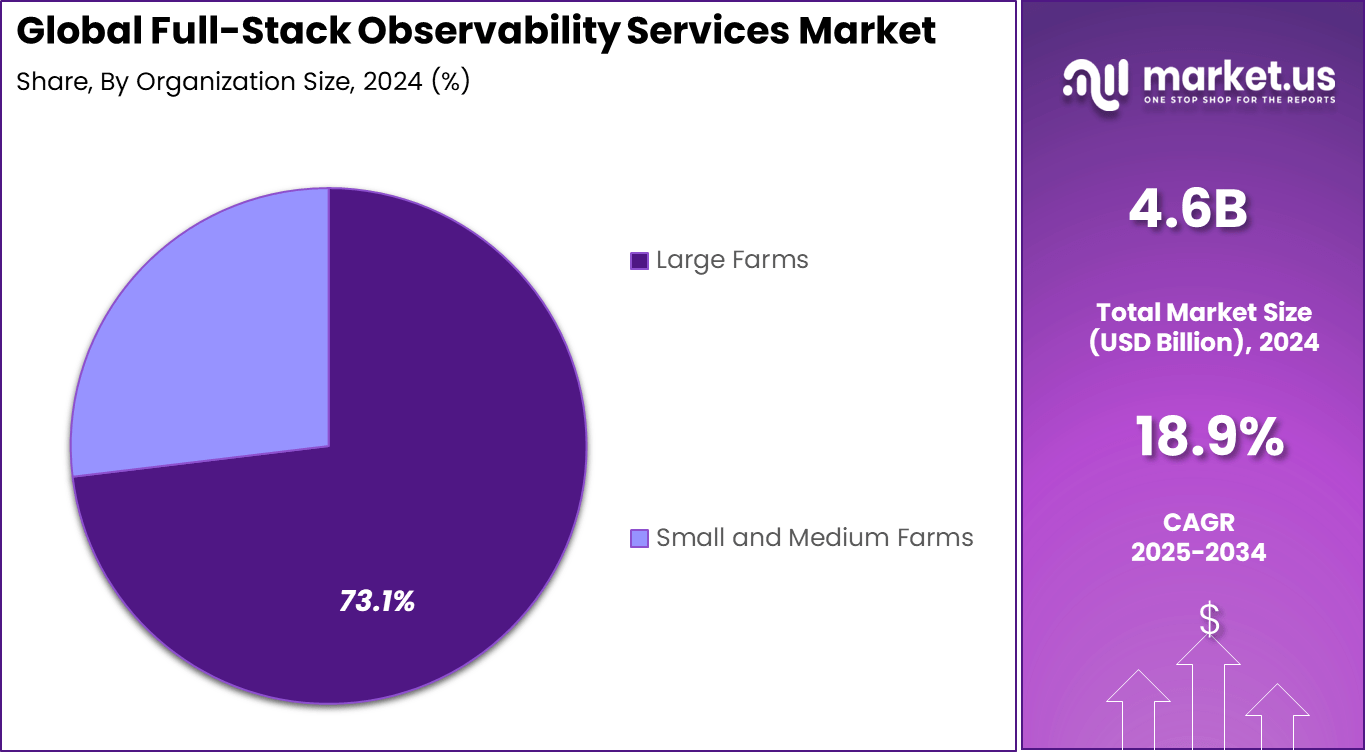

- Large enterprises accounted for 73.1%, driven by complex application ecosystems and high data visibility needs.

- Application performance management captured 33.6%, confirming that real-time app speed, uptime, and error tracking remain the top use cases.

- The IT and IT-enabled services sector held 27.2%, supported by continuous digital operations and strict service-level requirements.

- North America recorded 41.7%, backed by early adoption of DevOps, cloud-native applications, and advanced monitoring frameworks.

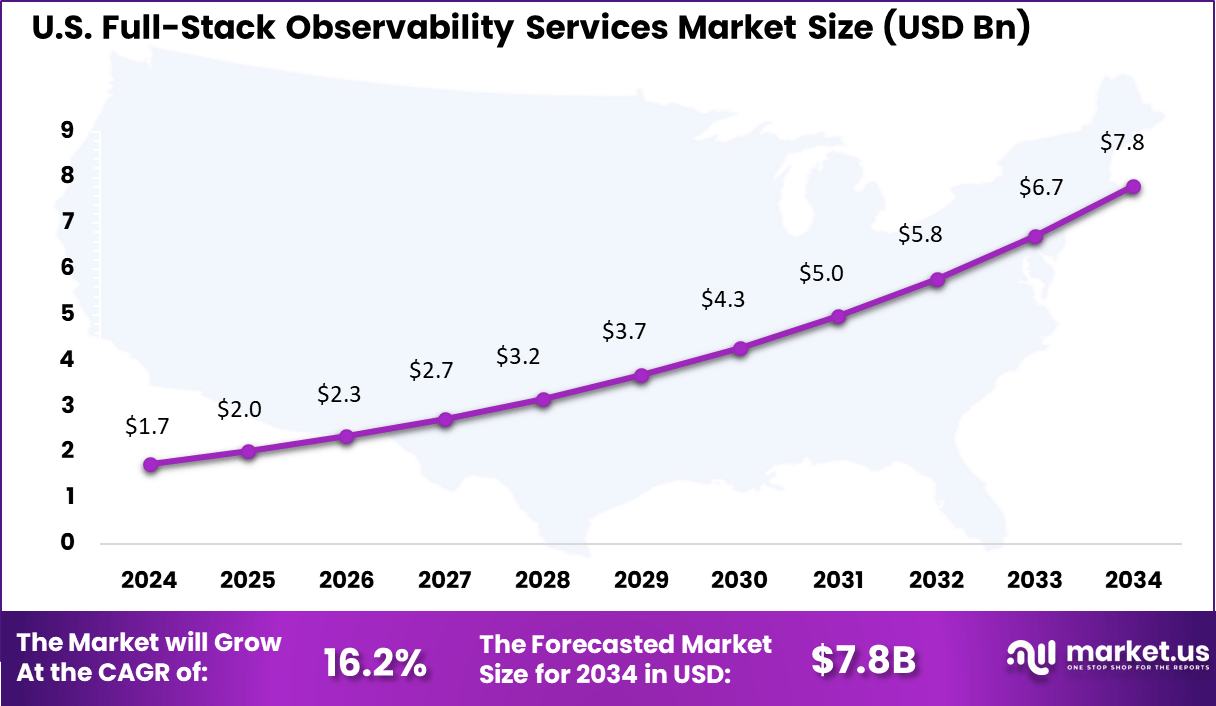

- The U.S. market reached USD 1.74 billion and is expanding at 16.2%, indicating strong investment in full-stack observability across large enterprises.

Quick Market Facts

- Faster problem resolution is achieved as AI-driven anomaly detection and root cause analysis sharply reduce Mean Time to Detect and Mean Time to Resolution.

- System reliability and performance improve through proactive monitoring that identifies bottlenecks and failures before they impact users.

- User experience is enhanced using Real User Monitoring and Synthetic Monitoring, which provide deep visibility into actual digital journeys.

- Operational efficiency increases as automated monitoring breaks down silos between IT, DevOps, and SecOps teams and strengthens cross-functional coordination.

By Component

The solutions and software segment leads the market with a strong 71.7% share, showing that most full-stack observability platforms are delivered through integrated software products. These solutions collect, process, and analyze data across infrastructure, applications, networks, and user layers within one unified system.

High adoption is driven by the need for centralized visibility and faster issue detection. Enterprises prefer software-based observability tools because they reduce manual monitoring effort and allow automated performance tracking across complex digital environments.

By Deployment Mode

Cloud and SaaS deployment dominates with a 76.8% share, reflecting the rapid movement of enterprise workloads to cloud platforms. Cloud-based observability services allow real-time monitoring, remote access, and faster scaling without heavy on-site infrastructure.

The strong demand for cloud deployment is supported by growth in multi-cloud strategies and remote operations. Organizations rely on cloud observability tools to monitor dynamic workloads and ensure stable performance across distributed systems.

By Organization Size

Large enterprises hold a dominant 73.1% share, confirming that observability adoption is strongest among organizations with complex digital ecosystems. These enterprises manage large volumes of applications, servers, and network assets that require continuous performance tracking.

Their leadership in this segment is linked to higher IT budgets, strict uptime requirements, and strong digital dependency. Large organizations also face higher business risk from system failure, which makes observability a critical operational requirement.

By Application

Application performance management represents 33.6% of total application demand, making it the largest use case for full-stack observability services. Enterprises use these tools to track application speed, error rates, transaction flows, and user response times.

Strong demand in this segment is driven by rising use of digital platforms, mobile apps, and cloud-native software. Performance monitoring helps businesses prevent service outages and improve user experience across high-traffic systems.

By End User Vertical

The IT and ITeS sector accounts for 27.2% of total end-user demand. This sector depends heavily on application stability, data flow accuracy, and continuous system availability for service delivery.

IT service providers use observability platforms to manage large customer workloads, meet service-level agreements, and reduce fault resolution time. The strong digital dependency of this sector continues to support steady demand.

Regional Analysis

North America holds a leading 41.7% regional share, supported by high cloud adoption, strong digital infrastructure, and early use of advanced monitoring tools. Enterprises across the region focus strongly on system uptime, cybersecurity, and digital service reliability.

The United States alone reached USD 1.74 Billion with a healthy CAGR of 16.2%, reflecting rapid expansion of cloud services, digital platforms, and enterprise software usage. Growth is supported by rising investments in DevOps, cloud migration, and real-time system monitoring.

Large technology firms, data centers, and digital service providers continue to increase their spending on observability platforms to manage growing system complexity. This trend is expected to keep North America at the front of global adoption.

Emerging Trends Analysis

The integration of AI driven analytics into observability platforms has emerged as a major trend. AI and machine learning models are increasingly used to detect anomalies, predict failures, and automate root cause analysis. Industry surveys indicate that over 65% of enterprises are prioritizing AI enabled observability to reduce manual troubleshooting and operational downtime.

Another notable trend is the convergence of security and observability. Organizations are increasingly correlating performance metrics with security telemetry to improve threat detection and system resilience. This unified approach is becoming essential as attack surfaces expand across cloud and distributed environments.

Key Market Segments

By Component

- Solutions/Software

- Application Performance Monitoring (APM)

- Infrastructure Monitoring

- Network Performance Monitoring and Diagnostics (NPMD)

- Log Management

- Digital Experience Monitoring (DEM)

- AIOps Platforms

- Security Observability (SecOps)

- Services

- Professional Services

- Consulting & Implementation

- Training & Development

- Managed Services

- Professional Services

By Deployment Mode

- Cloud/SaaS

- On-Premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Application

- Application Performance Management

- Infrastructure & Network Management

- Security & Compliance Management

- Database Performance Monitoring

- Business Analytics & Optimization

By End-User Vertical

- IT & ITeS

- BFSI

- Retail & E-commerce

- Healthcare & Life Sciences

- Manufacturing

- Telecommunications

- Media & Entertainment

- Government & Public Sector

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Increasing Complexity of Distributed Systems

The growth of microservices, containers, and multi cloud architectures has increased system interdependencies. Traditional monitoring tools struggle to provide context across these environments, driving demand for full stack observability platforms. Enterprises require end to end visibility to maintain performance and service continuity.

Downtime and latency issues have direct financial impact, making observability a strategic investment. As digital services scale, observability tools are increasingly adopted to ensure operational stability and customer satisfaction.

Restraint Analysis

High Cost of Implementation and Skill Gaps

The deployment of full stack observability systems requires investment in advanced tools, training, and skilled personnel. Many organizations face difficulties integrating multiple telemetry sources into unified analytics pipelines, which results in high operational overhead. Smaller enterprises often struggle with the cost of licensing, data ingestion, and long term maintenance.

Skill shortages have been another limiting factor, as observability platforms require expertise in data engineering, DevOps practices, and distributed system analysis. This has slowed adoption in segments with limited technical capacity, reducing market growth potential despite strong demand.

Opportunity Analysis

Growth of Cloud Native and AI Driven Operations

As enterprises adopt cloud native architectures, new opportunities have emerged to deliver real time monitoring solutions with stronger automation. AI powered observability platforms enable faster diagnostics and reduce reliance on manual analysis. The increasing volume of data generated by digital systems has created opportunities for vendors to introduce advanced analytics features.

Industry studies show that more than 70% of organizations plan to increase observability investments as part of cloud optimization efforts. The expansion of zero trust security, API driven businesses, and large scale digital transformation programs provides a favorable environment for observability vendors to scale new service offerings.

Challenge Analysis

Data Overload and Telemetry Management

The continuous flow of logs, traces, metrics, and security telemetry poses challenges for organizations struggling with storage, indexing, and analysis. Large enterprises generate petabytes of operational data, and managing this volume can create bottlenecks in performance and cost.

This challenge becomes more significant when observability platforms are deployed across hybrid cloud setups where data structures differ. Without effective filtering and prioritization, enterprises face alert fatigue and reduced visibility into true incidents. Improving data governance and adaptive sampling methods has become essential for sustaining observability effectiveness at scale.

Competitive Analysis

Datadog, New Relic, and Dynatrace lead the full-stack observability services market with unified platforms that combine metrics, logs, traces, and real-time application performance monitoring. Their solutions help enterprises detect outages, analyze root causes, and optimize system reliability across cloud and hybrid environments. These companies focus on automation, AI-driven anomaly detection, and scalable data ingestion.

Splunk, Elastic, and AppDynamics strengthen the competitive landscape with deep visibility into infrastructure, networks, and application layers. Their platforms support security analytics, business transaction monitoring, and compliance reporting. These providers emphasize real-time search, correlation across data sources, and strong enterprise integration.

Grafana Labs, Honeycomb, Lightstep, Sumo Logic, and Sentry expand the market with developer-focused observability, distributed tracing, and real-time error monitoring. Their tools help engineering teams improve software performance and user experience. These companies focus on fast deployment, flexible dashboards, and cloud-first delivery.

Top Key Players in the Market

- Datadog, Inc.

- New Relic, Inc.

- Dynatrace, Inc.

- Splunk Inc.

- Elastic N.V.

- AppDynamics (Cisco Systems)

- Grafana Labs

- Honeycomb.io

- Lightstep (ServiceNow)

- Sumo Logic

- Sentry

- Others

Recent Developments

- February, 2025 – Dynatrace used its Perform 2025 conference to introduce preventive operations across its full‑stack observability platform, combining Davis AI with deeper log, metric and trace analytics so teams can predict incidents and debug live production without taking services down.

- February, 2025 – New Relic’s first New Relic Now+ event brought more than 20 new features, including AI-powered anomaly prediction, RAG-based insights, and integrated OpenTelemetry pipelines to give a single view across applications, infrastructure and user experience.

Report Scope

Report Features Description Market Value (2024) USD 4.6 Bn Forecast Revenue (2034) USD 26.0 Bn CAGR(2025-2034) 18.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions/Software, Services), By Deployment Mode (Cloud/SaaS, On-Premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Application Performance Management, Infrastructure & Network Management, Security & Compliance Management, Database Performance Monitoring, Business Analytics & Optimization), By End-User Vertical ( IT & ITeS, BFSI, Retail & E-commerce, Healthcare & Life Sciences, Manufacturing, Telecommunications, Media & Entertainment, Government & Public Sector) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Datadog, Inc., New Relic, Inc., Dynatrace, Inc., Splunk Inc., Elastic N.V., AppDynamics (Cisco Systems), Grafana Labs, Honeycomb.io, Lightstep (ServiceNow), Sumo Logic, Sentry, Others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Full-Stack Observability Services MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Full-Stack Observability Services MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Datadog, Inc.

- New Relic, Inc.

- Dynatrace, Inc.

- Splunk Inc.

- Elastic N.V.

- AppDynamics (Cisco Systems)

- Grafana Labs

- Honeycomb.io

- Lightstep (ServiceNow)

- Sumo Logic

- Sentry

- Others