Global Full Platform Gamepad Market Size, Share, Growth Analysis By Platform Compatibility (Console, Mobile, PC), By Connectivity Type (Wired, Wireless [Bluetooth, Rf Wireless], By Distribution Channel (Offline Retail [Electronics Retailers, Specialty Stores], Online Retail [E-Commerce Platforms, Manufacturer Websites]), By Price Range (Entry Level, Mid Range, Premium), By End User (Casual Gamers, Esports Organizations, Professional Gamers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163467

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Consumer Demand

- AI Industry Adoption

- Analysts’ Viewpoint

- China Market Size

- By Platform Compatibility

- By Connectivity Type

- By Distribution Channel

- By Price Range

- By End User

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint Factors

- Growth Opportunities

- Challenging Factors

- Competitive Analysis

- Major Developments

- Report Scope

Report Overview

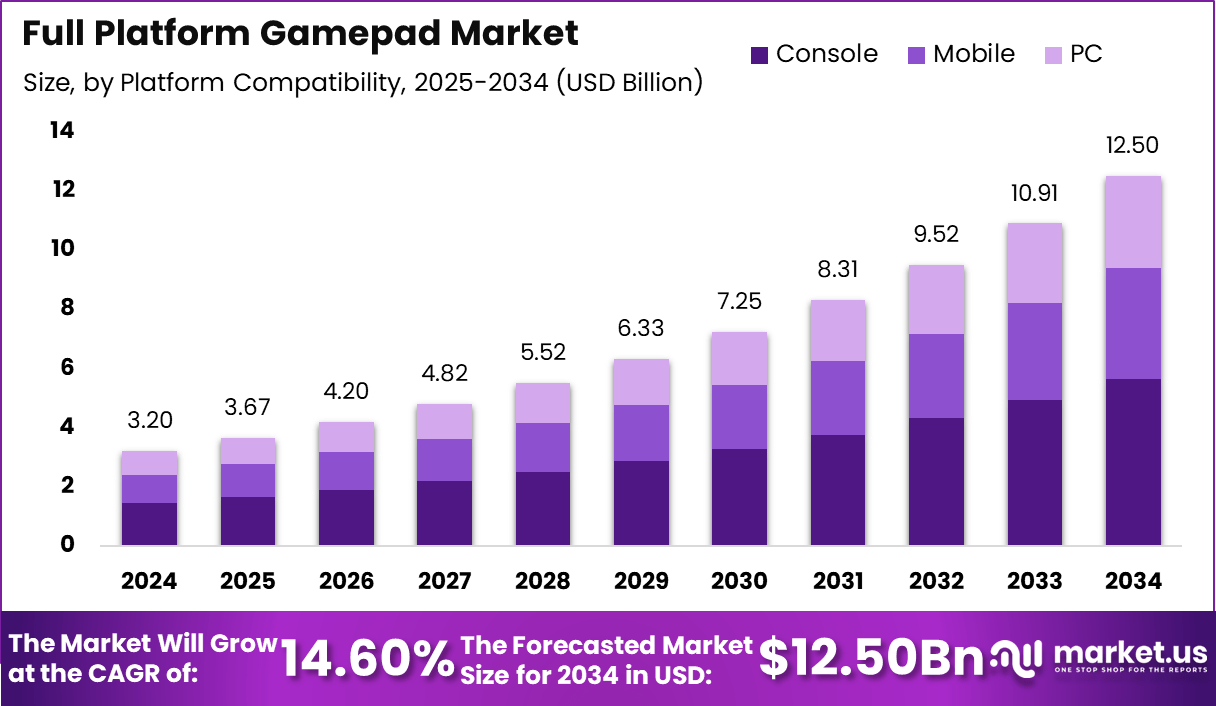

The global Full Platform Gamepad Market, valued at USD 3.2 billion in 2024, is projected to reach USD 12.5 billion by 2034, expanding at a CAGR of 14.6%. The market growth is driven by rising demand for immersive gaming experiences, increasing penetration of cloud gaming platforms, and growing adoption of multi-device compatibility among gamers. Advancements in haptic feedback, ergonomic design, and cross-platform connectivity are further enhancing user engagement across PC, console, and mobile gaming ecosystems.

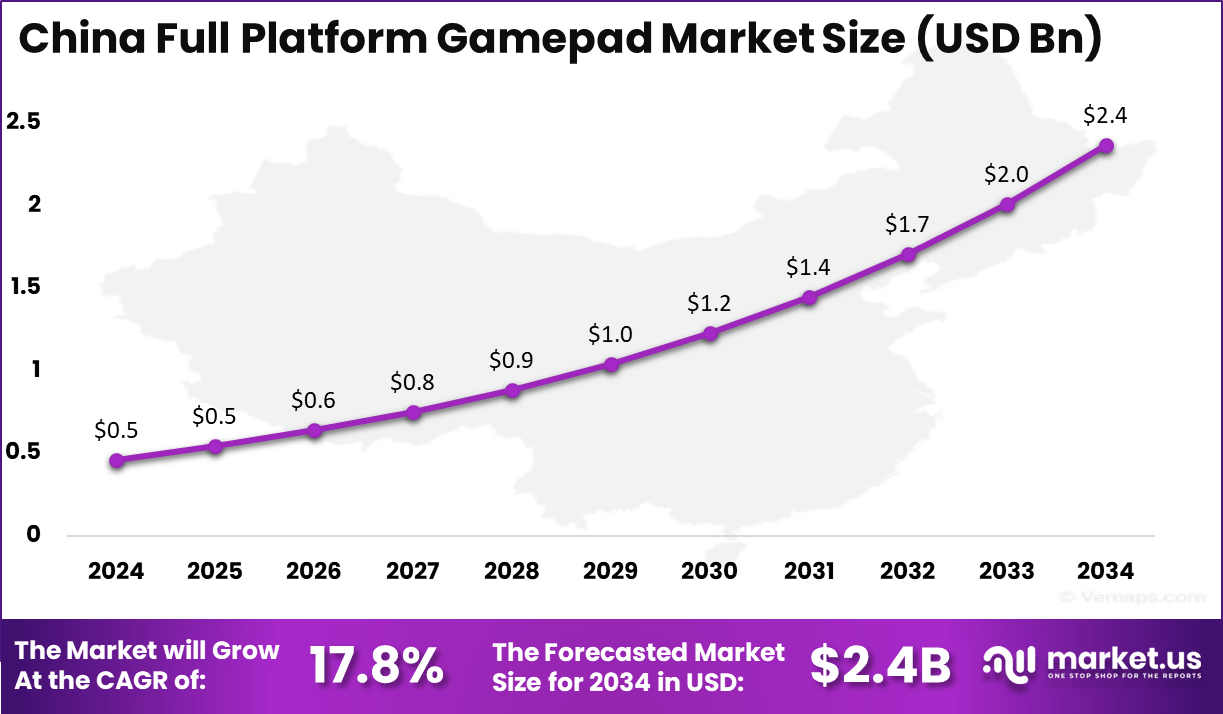

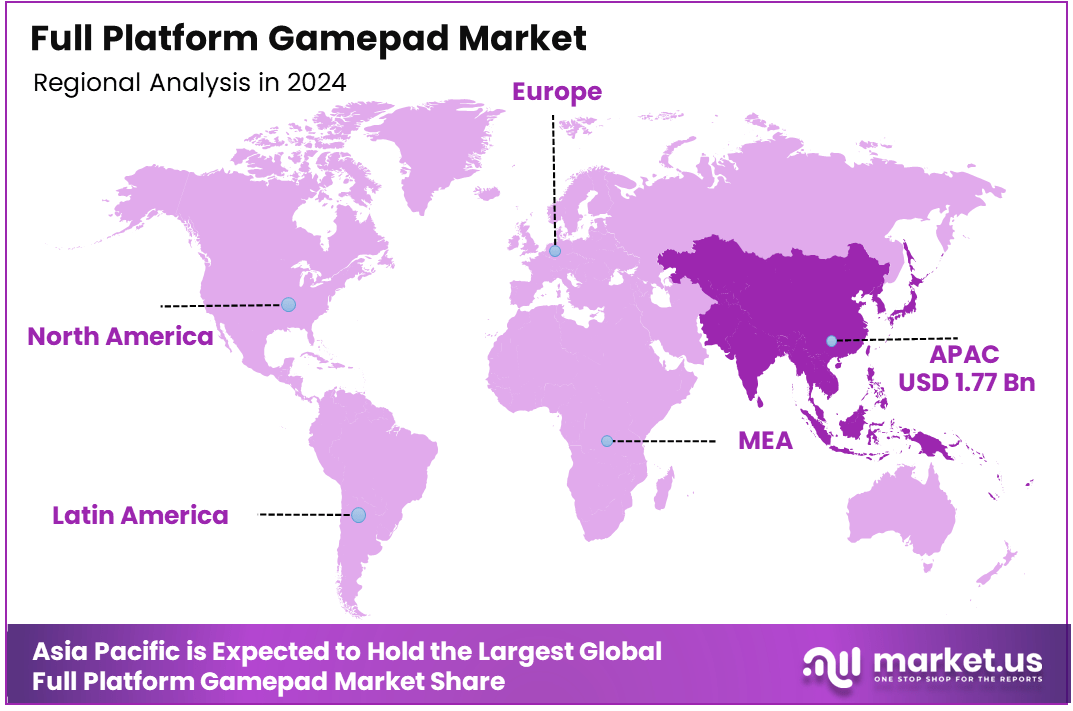

Asia-Pacific accounted for 37.2% of the global share in 2024, amounting to USD 1.19 billion, reflecting the region’s strong gaming culture, expanding esports ecosystem, and growing number of gaming hardware manufacturers. China alone contributed USD 0.46 billion in 2024 and is anticipated to reach USD 2.4 billion by 2034, registering a robust CAGR of 17.8%, supported by its rapidly evolving digital entertainment infrastructure and surge in professional gaming participation.

The global Full Platform Gamepad Market is experiencing strong growth driven by the rapid evolution of gaming ecosystems and the rising demand for cross-platform compatibility. As gaming expands across consoles, PCs, and mobile devices, players increasingly seek versatile controllers that deliver consistent performance and comfort across multiple systems. The surge in online multiplayer gaming, cloud-based gaming platforms, and the popularity of competitive esports are further fueling the adoption of full platform gamepads among both casual and professional gamers.

Technological advancements such as improved haptic feedback, adaptive triggers, customizable layouts, and wireless connectivity are redefining the user experience, allowing gamers to enjoy more immersive and responsive gameplay. Additionally, the growing integration of AI-driven features, motion sensors, and ergonomic design improvements is enhancing precision and comfort during extended gaming sessions.

Asia-Pacific continues to be a leading region due to its vibrant gaming culture, expanding esports ecosystem, and increasing investment in gaming hardware innovation. With major manufacturers focusing on design efficiency, connectivity, and user adaptability, the full platform gamepad market is poised for sustained expansion, transforming how players interact across gaming platforms and solidifying its role as a key accessory in the modern digital entertainment landscape.

Recent developments in the full platform gamepad market in 2025 show significant growth fueled by technological advancements, rising demand, and active investments. The global gamepad market size is valued between $0.75 billion to over $5 billion, depending on market segmentation, with an expected compound annual growth rate (CAGR) ranging from 5.4% to 8% through 2033. Key factors driving this growth include wireless technology adoption, customizable controllers, AI-driven personalization, and expanding gaming ecosystems like esports and cloud gaming.

Notable product launches include GuliKit’s new high-performance controllers and the Hyperlink 2 wireless controller adapter, which claims ultra-low latency of 2.95ms and supports multiple platforms such as PC, Switch, and Android. GameSir introduced the T4 Kaleid multi-platform controller compatible with PC and mobile devices.

In funding and investment, GamePad.co, a decentralized accelerator for crypto gaming and metaverse projects, raised $2.5 million in a seed round led by Enjin and OKX Blockdream Ventures. This platform aims to nurture new blockchain-based gaming projects, signaling growth in gamepad-related blockchain and metaverse investments.

Venture capital activity in gaming overall rose 35% to $373 million in Q1 2025, with continued interest in growth-stage funding and innovation linked to gamepads and gaming peripherals.

Market consolidation through mergers and acquisitions is also expected as companies seek to boost technology capabilities and increase market share, with increasing competition driving price adjustments and new technological integrations like AI customization and haptic feedback.

Overall, the full platform gamepad market is expanding robustly, supported by advancing technologies, diversified product portfolios, substantial funding rounds like the $2.5 million seed for GamePad.co, and a $2.5 billion multi-platform gamepad market size projected for 2025, indicating a promising and competitive landscape ahead.

Key Takeaways

- The global Full Platform Gamepad Market was valued at USD 3.2 billion in 2024.

- The market is projected to grow at a CAGR of 14.6% during the forecast period.

- The total market value is expected to reach USD 12.5 billion by 2034.

- Asia-Pacific accounted for 37.2% of the global market in 2024, valued at USD 1.19 billion.

- China contributed USD 0.46 billion in 2024 and is projected to reach USD 2.4 billion by 2034, registering a CAGR of 17.8%.

- By Platform Compatibility, PC accounted for the largest share at 45.3%.

- By Connectivity Type, Wireless dominated the market with an 80.4% share.

- By Distribution Channel, Online Retail led with a 70.8% contribution.

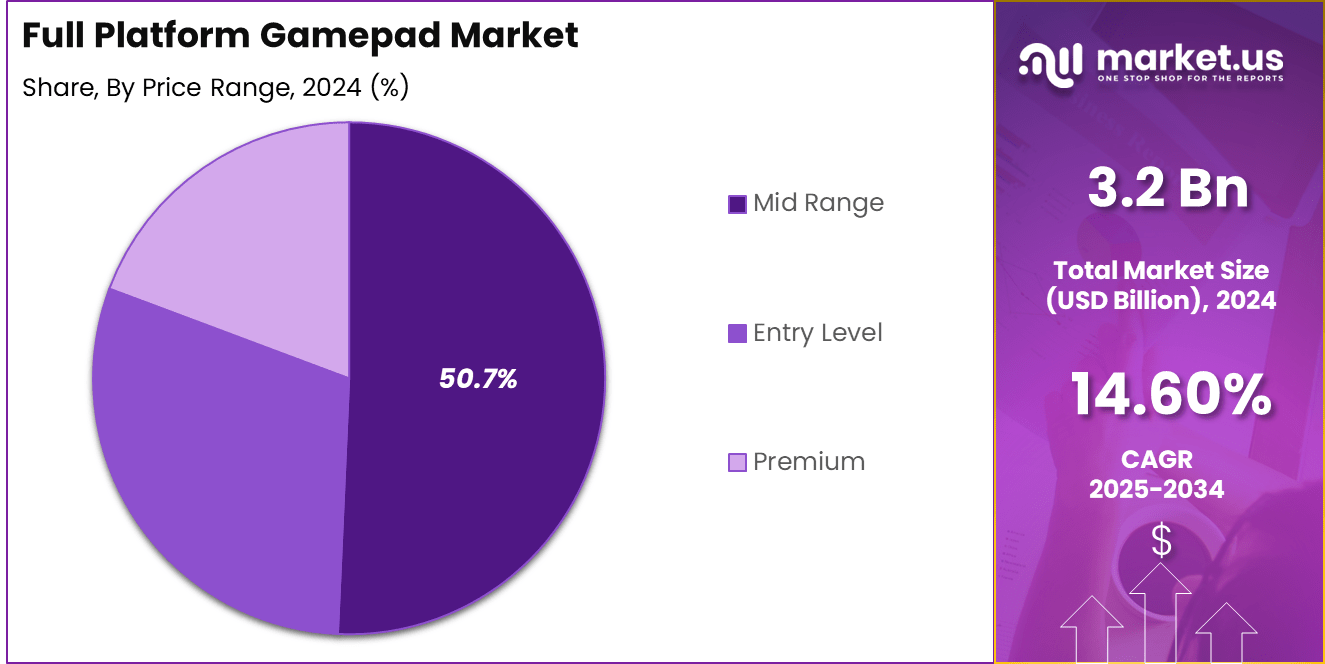

- By Price Range, the Mid-Range segment (USD 40–100) represented 50.7% of the market.

- By End-User, Casual Gamers constituted the dominant segment with a 75.5% share.

Consumer Demand

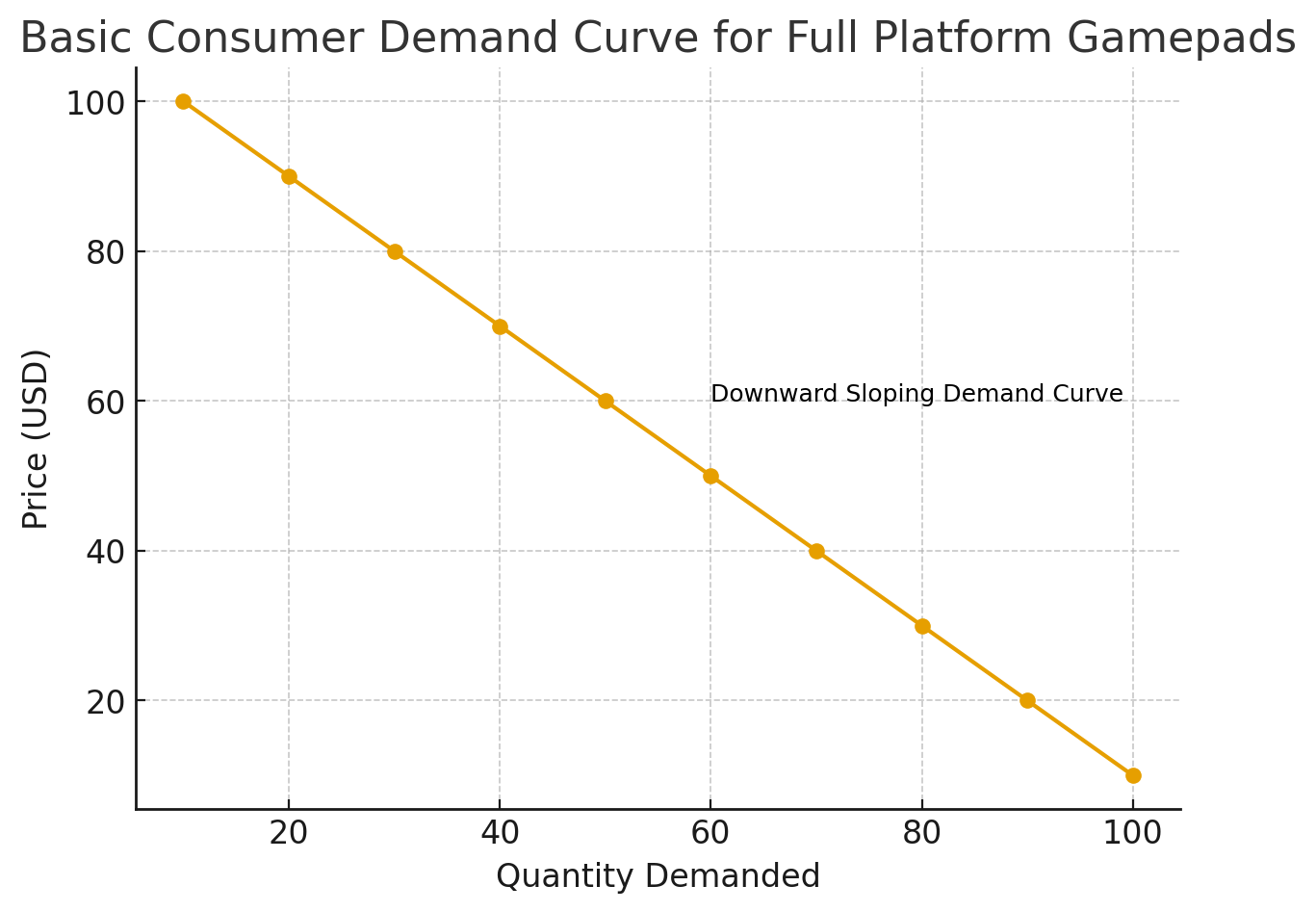

Consumer demand for full-platform gamepads is being driven by several converging forces. The largest contributor is the continuing expansion of cross-platform gaming — as players move seamlessly between PC, console, and mobile environments, demand is growing for controllers capable of delivering consistent performance across all platforms.

Consumers increasingly expect gamepads that provide advanced ergonomics, responsive input, wireless connectivity, and seamless switching between devices. Wireless technology in gamepads is particularly in demand because it removes cable constraints, enabling relaxed posture and better immersion. In mobile and cloud gaming alike, gamers are looking for compact, high-precision controllers that transform smartphone play into a console-like experience.

The rise of competitive gaming and the growth of the esports ecosystem are also influencing consumer expectations: even casual gamers are showing a preference for high-performance features (such as haptic feedback or customisable triggers) previously reserved for pro-grade models.

At the same time, price sensitivity remains relevant: many consumers balance premium‐feature wish-lists with accessible price points, meaning mid-range controllers with “good enough” advanced features are finding strong uptake. Overall, consumer demand is shifting from basic utility controllers towards feature-rich, comfortable, multi-device controllers that align with broader gaming habits and ecosystem fluidity.

AI Industry Adoption

The integration of AI-enabled features in gamepads is emerging as a key differentiator and growth driver. According to industry commentary, “AI-powered features: intelligent features enhancing gameplay experience” are listed among the emerging trends in the gamepad market. While most AI adoption to date has been focused on game development rather than peripherals, the spill-over into gamepad design is becoming more pronounced.

Gamepad manufacturers are increasingly incorporating adaptive algorithms, predictive input modelling, and motion-sensor analytics to enhance user experience through gamepads. While precise adoption rates in gamepads are scarce, broader gaming-industry data indicate that 96% of game developers were planning to employ AI in workflows by 2025, and 68% were actively implementing it. This suggests that hardware accessory providers are under growing pressure to support AI-driven experiences via controllers.

From a strategic perspective, AI adoption in full-platform gamepads supports three major value levers: personalization (tailoring haptics/trigger feedback based on user skill or game genre), performance optimisation (reducing latency, adapting control mapping dynamically), and content extension (enabling controllers to interface with cloud/AI-based game services).

These capabilities align with the broader shift in gaming accessories toward higher-end features, including modular design and immersive feedback. However, challenges remain: gamepad makers must ensure low-latency AI functions, robust data collection/processing pipelines, and compatibility across platforms and titles.

Analysts’ Viewpoint

Analysts view the full-platform gamepad market as entering a phase of sustained growth driven by three core dynamics. First, increasing demand from the competitive gaming and esports segments is expected to fuel uptake of advanced controllers featuring low latency, wireless connectivity, and ergonomic designs.

Second, the shift toward multi-platform gaming — across PC, console, and mobile — is projected to broaden the addressable base for versatile gamepads, thereby elevating average selling prices and market volumes. Third, technological convergence, such as haptic feedback, adaptive triggers, and integration with cloud gaming ecosystems, is anticipated to deepen differentiation among vendors and drive premiumisation.

Analysts also highlight important challenges to execution: the high cost of advanced controllers may limit adoption in price-sensitive markets; the need for broad platform compatibility and rapid innovation cycles increases R&D pressure; and the presence of substitute input devices (touch, motion, gesture-based controllers) remains a competitive risk.

Analysts therefore advise market participants to prioritise product road-mapping, cross-platform firmware support, and partnerships with game developers to secure hardware relevance. In sum, the gamepad segment is expected to outperform the broader controller market thanks to cross-platform tailwinds and esports momentum, provided manufacturers navigate cost and substitution risks effectively.

China Market Size

The China market for full platform gamepads is projected to expand significantly over the forecast period. In 2024 the market value stood at approximately USD 0.46 billion. With a CAGR of 17.8 %, the value is expected to reach around USD 2.4 billion by 2034.

This robust growth is underpinned by rising multi-platform gaming adoption—encompassing PC, console and mobile devices—and growing demand for wireless, ergonomic and feature-rich gamepads that cater to both casual and competitive gamers.

Further drivers include the increasing penetration of high-speed broadband and cloud gaming platforms in China, alongside strong consumer uptake of esports and streaming content. Local manufacturers’ investment in innovation and supply chain scale is also contributing to improved availability and competitive pricing of advanced controllers.

As players in China continue to seek seamless cross-device gaming experiences and premium accessory support, the full platform gamepad market is expected to remain one of the fastest-growing regional segments globally.

By Platform Compatibility

The PC segment holds 45.3% of the compatibility-based share in the full-platform gamepad market, making it the dominant platform. This is expected to stem from the broad ecosystem of PC gaming—ranging from AAA titles to indie games to emulators—where gamepads are increasingly used for genre types traditionally dominated by keyboard/mouse (for example, racing, fighting, and platform games). The shift is further supported by the growing adoption of cloud-gaming services and remote-play functionality on PC, increasing the need for console-style controllers.

The console segment is anticipated to occupy the next largest share. Since most console titles already include gamepad support and gamers expect seamless compatibility across console and PC using the same controller, manufacturers are prioritising console-PC hybrid controllers.

The mobile segment is projected to show rapid growth despite a smaller current share due to the proliferation of smartphones, mobile-cloud gaming, and the rising use of external controllers with mobile devices. The trend of dedicated mobile gamepads and multi-device controllers that bridge mobile and PC/console suggests the mobile segment will gain share and contribute meaningfully to overall market expansion.

By Connectivity Type

The wireless connectivity segment is dominating, accounting for 80.4% of the market share. Wireless gamepads—spanning Bluetooth and RF technologies—are benefiting from the strong consumer demand for freedom of movement, convenience, and multi-device usability. These controllers appeal strongly in casual and lifestyle gaming settings where cable-free interaction enhances comfort and immersion.

The wired segment remains relevant, especially among competitive and professional gamers who prioritise minimal latency, consistent input, and reliability during high-stakes play. Wired gamepads retain a niche position because they avoid the battery-life and connectivity variability issues associated with wireless units.

Within wireless connectivity, Bluetooth and RF sub-segments are key. Bluetooth gamepads provide broad compatibility across PCs, consoles, and mobile devices, supporting cross-platform integration. RF wireless controllers often offer proprietary low-latency links and dedicated receivers, making them attractive in premium and competitive segments. Manufacturers focusing on wireless innovations—including dual-mode (wired + wireless) controllers—are expected to lead as the ecosystem evolves.

In summary, the 80.4% wireless share highlights how mobility, convenience, and multi-device integration are primary drivers in the gamepad connectivity space, while wired connectivity retains a strong, performance-oriented foothold.

By Distribution Channel

Online retail accounted for 70.8% of the global full platform gamepad market, making it the leading distribution channel. The rise of e-commerce platforms and direct manufacturer websites has transformed how consumers purchase gaming accessories. E-commerce platforms such as Amazon, JD.com, and

Flipkart provide extensive product ranges, competitive pricing, and user reviews, enabling buyers to compare options and make informed decisions easily. Manufacturer websites, on the other hand, allow brands to engage directly with customers through personalized offers, product customization, and exclusive releases, which strengthens brand loyalty and margins.

Offline retail, including electronics retailers and specialty gaming stores, continues to play a supporting role in the market. These outlets offer hands-on product experiences and immediate availability, which appeal to consumers seeking to test controllers before purchase or those prioritizing instant fulfillment. However, the convenience, accessibility, and promotional flexibility of online retail remain unmatched, especially in regions with expanding internet penetration and digital payment systems.

As a result, major manufacturers are investing in omnichannel strategies—combining strong online presence with selective offline partnerships—to enhance market reach and maintain customer engagement. The growing dominance of online retail underscores the broader digital shift in consumer purchasing behavior across the gaming ecosystem.

By Price Range

The mid-range price segment (USD 40 – 100) represents 50.7% of the global full-platform gamepad market, indicating that over half of all units and value fall into this category. This segment is expected to expand as consumers seek controllers that balance advanced features (such as wireless connectivity, cross-platform compatibility, and enhanced ergonomics) with accessible pricing.

Its dominance stems from the growing casual gamer base and “prosumer” users who prioritise value rather than ultra-premium customization. While the entry-level segment appeals through the lowest price points, and the premium segment targets high-end enthusiasts with modular designs and elite features, the mid-range segment offers the largest reach and scale.

Suppliers focusing on this segment are anticipated to benefit from economies of scale, broader distribution (especially online retail), and higher turnover compared to niche premium models. As the industry evolves, product differentiation within the mid-range — through improved haptics, firmware updates, and brand ecosystems — is projected to become a key competitive lever and drive further adoption in this segment.

By End User

Casual gamers accounted for 75.5% of the global full platform gamepad market, representing the largest end-user segment. The dominance of this group is attributed to the rapid expansion of the global gaming population and the growing accessibility of gaming across PCs, consoles, and mobile devices.

Casual gamers typically prioritize comfort, affordability, and ease of use over professional-grade performance, driving demand for mid-range, wireless, and multi-platform compatible gamepads. The increasing popularity of mobile and cloud gaming has also made it easier for this segment to engage in gaming anytime and anywhere, further boosting adoption rates.

Esports organizations and professional gamers form smaller but high-value market segments. Esports teams demand advanced, low-latency controllers with customizable triggers, adaptive feedback, and high durability to meet competitive standards. These requirements have encouraged manufacturers to develop high-precision gamepads integrated with AI-based performance analytics and adaptive firmware.

Professional gamers, though a niche group, influence broader purchasing trends through endorsements, streaming, and content creation, thereby elevating brand recognition among casual players. However, the bulk of sales continues to stem from casual gamers who increasingly seek immersive and connected gaming experiences. This segment’s mass-market appeal ensures steady revenue generation and positions it as the backbone of the global gamepad industry.

Key Market Segments

By Platform Compatibility

- Console

- Mobile

- PC

By Connectivity Type

- Wired

- Wireless

- Bluetooth

- Rf Wireless

By Distribution Channel

- Offline Retail

- Electronics Retailers

- Specialty Stores

- Online Retail

- E-Commerce Platforms

- Manufacturer Websites

By Price Range

- Entry Level

- Mid Range

- Premium

By End User

- Casual Gamers

- Esports Organizations

- Professional Gamers

Regional Analysis

The Asia-Pacific region accounted for 37.2% of the global full platform gamepad market in 2024, reflecting its role as the largest regional contributor. The strong regional performance is driven by rising gaming participation across PCs, consoles, and mobile devices, supported by rapid internet penetration, expanding esports ecosystems, and a growing middle-class consumer base that prioritises gaming hardware upgrades.

Local manufacturers and regional online retail platforms are further easing access to full platform gamepads, while innovations in wireless connectivity and ergonomic design resonate with consumer preferences in this region.

Within Asia-Pacific region, key markets such as China, India, and Southeast Asia are showing particularly strong momentum. For example, the gaming community in China is considered one of the largest globally, with the demand for quality peripherals increasing in tandem with mobile and console gaming.

In addition, the region’s scenario of multi-device gaming (mobile plus console/PC) fosters demand for controllers that provide seamless cross-platform compatibility—a defining characteristic of the full platform gamepad segment. Given these structural drivers, the Asia-Pacific is expected to remain a focal market for manufacturers and investors seeking scale and growth in the gaming accessories domain.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

Rapid expansion of online and mobile gaming platforms is expected to significantly raise demand for full-platform gamepads. Innovation in gamepad technology—especially wireless connectivity, ergonomic design, and advanced features such as haptic feedback—is anticipated to enhance user experience and drive adoption.

The growth of esports and streaming communities is projected to elevate the importance of high-performance controllers, thereby supporting market expansion. Further, the shift toward multi-platform gaming (PC, console, and mobile) is expected to increase the addressable market, as consumers look for controllers that seamlessly move across devices. The wide availability of online retail channels and increased internet penetration, particularly in the Asia-Pacific region, are projected to lower barriers and expand reach.

Restraint Factors

High cost of advanced gamepads with premium features may restrict adoption in price-sensitive markets, limiting growth velocity. Fragmented compatibility across multiple devices and platforms adds complexity for manufacturers and can slow uptake among consumers who prefer plug-and-play simplicity.

Rapid product obsolescence caused by fast-paced technology cycles and the presence of alternative input solutions (such as touch screens, motion controllers or VR-specific devices) is anticipated to constrain the market. Supply-chain disruptions and the need to maintain margins in a competitive market may clip growth potential for smaller players.

Growth Opportunities

There is significant potential in offering mid-range and premium controllers that combine performance and affordability to capture a broader gamer base. Manufacturers can leverage emerging gaming segments such as cloud gaming, virtual reality and mobile-first devices to create specialised full-platform gamepads tailored to new use-cases.

Expansion into developing regions with rising gaming participation—especially in the Asia-Pacific—offers geographic growth opportunities. Customisation features (button mapping, modular design, aesthetic options), collaborations with developers/streamers and direct-to-consumer online models represent avenues to differentiate and enhance brand value.

Challenging Factors

Maintaining seamless compatibility across a wide spectrum of platforms and devices remains technically demanding and costly for manufacturers. The rapid innovation cycle demands continual R&D investment and short product life-cycles, which may compress profitability. Intense competition—both from established brands and new entrants—puts pressure on pricing, margins and brand loyalty.

Moreover, consumer education and awareness are required to demonstrate the value of upgraded controllers versus standard peripherals, especially for casual gamers who may consider gamepads optional rather than essential.

Competitive Analysis

In the competitive landscape of the full platform gamepad market, several major players dominate, each leveraging distinct strengths and strategies to build market share. Key firms such as Sony Interactive Entertainment, Microsoft Corporation, Nintendo Co., Ltd., Logitech International SA, and Razer Inc. are frequently cited as leading in global game controller markets.

Sony’s DualSense and DualShock lines offer high brand recognition, advanced haptics, and strong ecosystem integration with PlayStation consoles. Microsoft’s Xbox controllers emphasise ergonomic design, accessibility options, and extensive platform compatibility.

Nintendo’s approach is differentiated by motion controls and unique form factors (such as the Switch Joy-Con) that appeal to both casual and family gamers. Logitech and Razer focus on PC and multi-platform peripherals, leveraging customisation, high-performance specs, and competitive gamer appeal.

Smaller niche players and third-party manufacturers such as SCUF Gaming, GameSir and BETOP Rumble fill market gaps with premium, modular controllers or value-driven offerings, especially in rapidly-growing regions. The competitive dynamic is shaped by continuous innovation (adaptive triggers, dual-wireless modes, firmware upgrades), global supply-chain optimisation and rising consumer expectations for seamless cross-device compatibility.

For businesses entering or expanding within this market segment, the key differentiator is the ability to offer both premium feature-sets and broad compatibility at scale, while managing cost pressures and aligning with platform ecosystems (PC, console, mobile).

Top Key Players in the Market

- Sony Interactive Entertainment LLC

- Microsoft Corporation

- Nintendo Co., Ltd.

- Razer Inc.

- Logitech International S.A.

- PowerA Inc.

- Performance Designed Products, Inc.

- MCW Creative SAS

- HORI Co., Ltd.

- Guillemot Corporation

- 8Bitdo

- Scuf

- Others

Major Developments

- September 22, 2025: Nintendo Co., Ltd. announced a new Joy-Con Pro variant compatible with non-Nintendo devices, expanding its reach into the multi-platform accessory segment.

- October 8, 2025: GameSir released its next-gen AI-enabled controller featuring motion-sensing algorithms and predictive input correction to support cloud and mobile gaming experiences.

- October 25, 2025: SCUF Gaming revealed a partnership with major esports organizations to supply tournament-grade, fully customizable gamepads integrated with adaptive trigger systems and improved battery efficiency.

Report Scope

Report Features Description Market Value (2024) USD 3.2 Billion Forecast Revenue (2034) USD 12.50 Billion CAGR(2025-2034) 14.60% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Platform Compatibility (Console, Mobile, PC), By Connectivity Type (Wired, Wireless [Bluetooth, Rf Wireless], By Distribution Channel (Offline Retail [Electronics Retailers, Specialty Stores], Online Retail [E-Commerce Platforms, Manufacturer Websites]), By Price Range (Entry Level, Mid Range, Premium), By End User (Casual Gamers, Esports Organizations, Professional Gamers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sony Interactive Entertainment LLC, Microsoft Corporation, Nintendo Co., Ltd., Razer Inc., Logitech International S.A., PowerA Inc., Performance Designed Products, Inc., MCW Creative SAS, HORI Co., Ltd., Guillemot Corporation, 8Bitdo, Scuf, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Full Platform Gamepad MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Full Platform Gamepad MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sony Interactive Entertainment LLC

- Microsoft Corporation

- Nintendo Co., Ltd.

- Razer Inc.

- Logitech International S.A.

- PowerA Inc.

- Performance Designed Products, Inc.

- MCW Creative SAS

- HORI Co., Ltd.

- Guillemot Corporation

- 8Bitdo

- Scuf

- Others