Global Fructo-Oligosaccharides Market Size, Share Analysis Report By Source (Sucrose, Chicory), By Form (Liquid, Powder), By Application (Infant Formulation, Food & Beverages, Dietary Supplements, Pet/Animal Feed, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173974

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

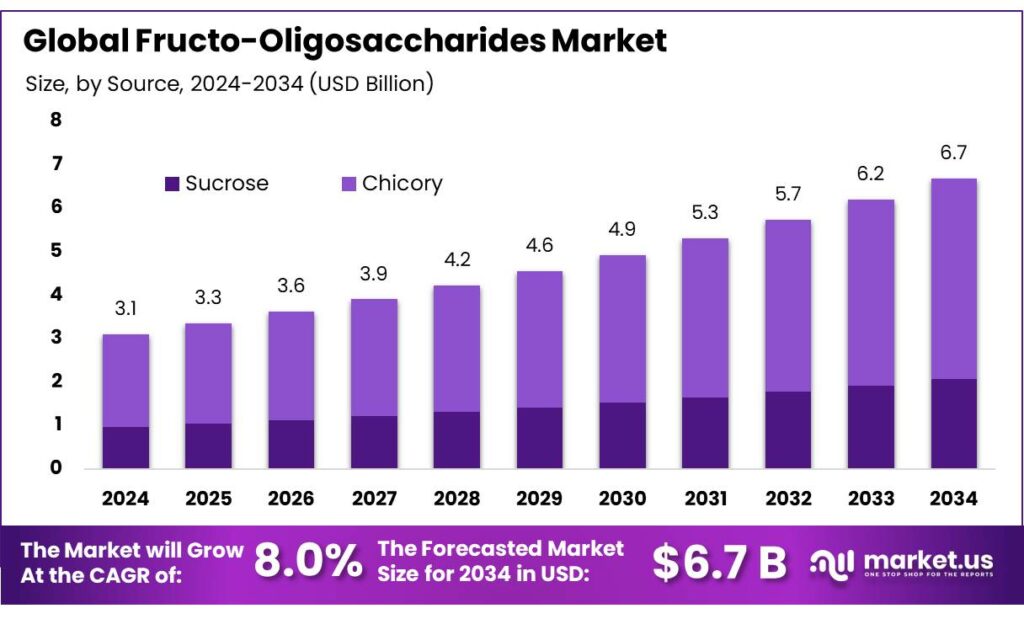

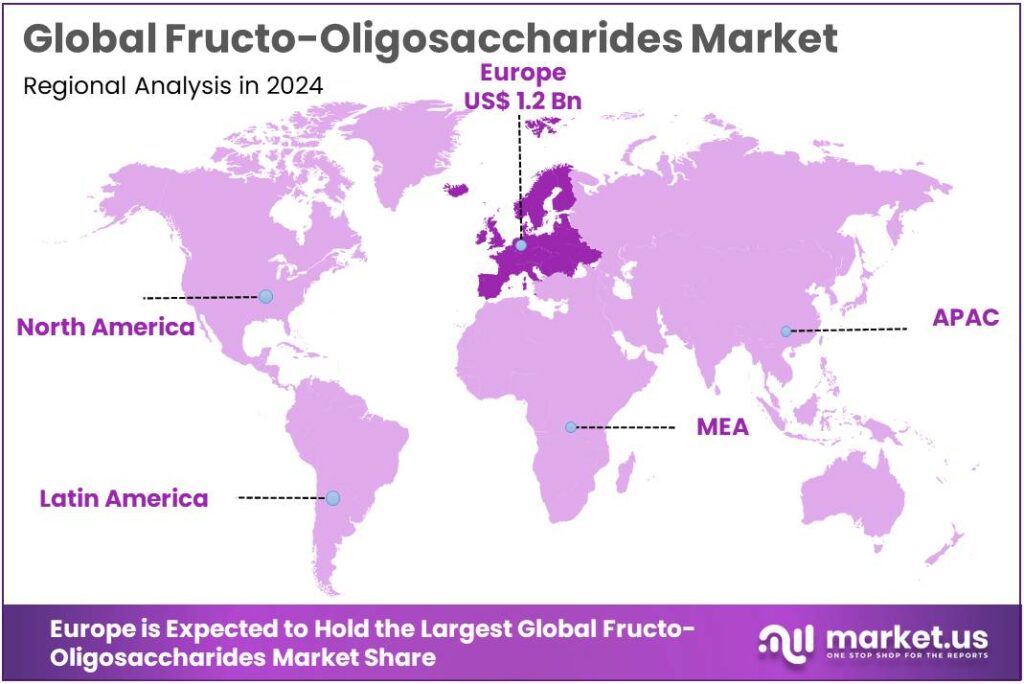

Global Fructo-Oligosaccharides Market size is expected to be worth around USD 6.7 Billion by 2034, from USD 3.1 Billion in 2024, growing at a CAGR of 8.0% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 39.9% share, holding USD 1.2 Million in revenue.

Fructo-oligosaccharides (FOS) sit in the “functional carbohydrate” space, positioned between sweeteners and dietary fibers. Industrially, they are valued because they add mild sweetness while behaving like a prebiotic fiber in the gut, so formulators can support digestive-wellness claims without relying on high sugar loads. Human digestion studies also support why the ingredient is marketed as “low energy”: one classic metabolic study estimated an average energy value of 9.5 kJ/g for FOS because most of it reaches the colon and is fermented rather than absorbed like table sugar.

Industrially, FOS sits inside the larger “functional carbohydrates” ecosystem, with supply chains that start either from plant feedstocks or from enzymatic conversion routes that create targeted chain lengths for performance. Capacity expansion activity signals that buyers want reliable, scalable supply: BENEO reported a €90 million investment to increase chicory-fibre capacity by 30% at its Chile plant, while also targeting a 35% reduction in specific energy consumption—an unusually direct link between scale-up and sustainability efficiency.

Demand fundamentals are strongly tied to fibre shortfalls and sugar-reduction pressure in mainstream diets. EFSA notes average adult fibre intakes of roughly 16–29 g/day, while also stating 25 g/day as adequate for normal laxation—creating a clear nutritional “gap” that functional fibres like FOS can help brands address through everyday foods, not just supplements. At the same time, public-health guidance continues to push manufacturers toward reformulation: WHO recommends keeping “free sugars” below 10% of total energy intake, with additional benefits suggested below 5%.

Public health guidance reinforces that direction: the Dietary Guidelines framework commonly used in the U.S. encourages about 14 g of fiber per 1,000 calories—creating a measurable benchmark that many packaged-food portfolios struggle to meet using whole-food ingredients alone.

Commercial adoption is also supported by practical intake/tolerance data used by industry and regulators. FDA GRAS documentation notes FOS is sold in the U.S. as a supplement at recommended doses of 4–8 g/day to promote beneficial gut bacteria, while more recent GRAS materials also discuss high-end consumer exposure estimates up to 20 g/day at the 90th percentile for ages 2+ in the general population.This type of quantified safety-and-use framing reduces formulation risk for large-scale rollouts in yoghurt, beverages, cereals, bars, and dairy alternatives.

Key Takeaways

- Fructo-Oligosaccharides Market size is expected to be worth around USD 6.7 Billion by 2034, from USD 3.1 Billion in 2024, growing at a CAGR of 8.0%.

- Chicory held a dominant market position, capturing more than a 69.7% share.

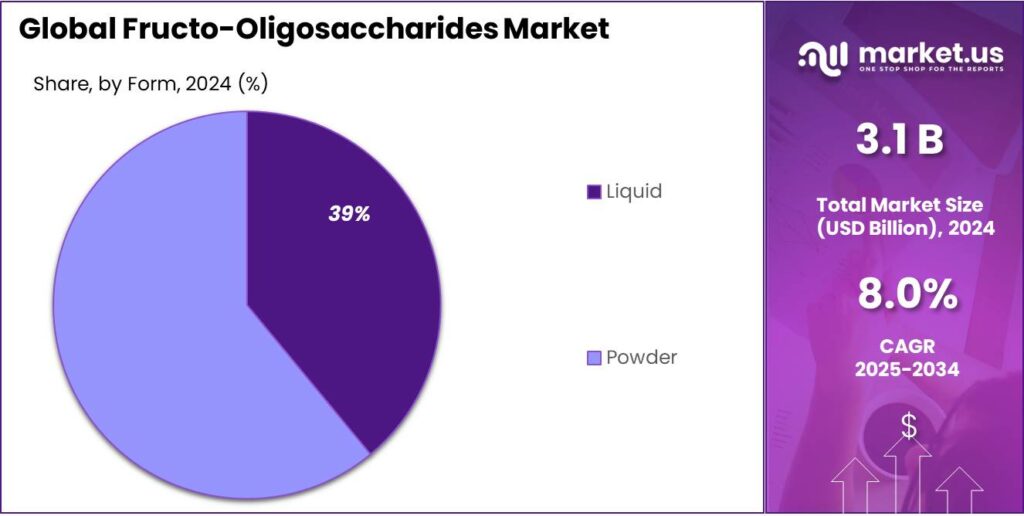

- Powder held a dominant market position, capturing more than a 61.4% share.

- Food & Beverages held a dominant market position, capturing more than a 51.8% share.

- Europe holds the dominant position in the Fructo-Oligosaccharides (FOS) market, In this region, Europe leads with a market share of 39.9%, valued at USD 1.2 Bn.

By Source Analysis

Chicory dominates with 69.7% due to its natural richness and clean-label appeal

In 2024, Chicory held a dominant market position, capturing more than a 69.7% share in the fructo-oligosaccharides market by source. This strong position was mainly supported by the high natural concentration of fructo-oligosaccharides in chicory roots, making them an efficient and reliable raw material for large-scale extraction.

In 2024, food and beverage producers widely preferred chicory-based sources due to their plant-based origin, neutral taste, and strong alignment with clean-label and digestive health trends. The source was also favored for its consistent quality and suitability for use in functional foods, dietary supplements, and infant nutrition. In 2025, demand continued to remain firm as consumer awareness around gut health increased and manufacturers focused on natural prebiotic ingredients with proven functionality, reinforcing chicory’s leading role in the market.

By Form Analysis

Powder leads with 61.4% due to ease of use and longer shelf stability

In 2024, Powder held a dominant market position, capturing more than a 61.4% share in the fructo-oligosaccharides market by form. This leadership was mainly driven by its ease of handling, accurate dosing, and better shelf life compared to liquid alternatives.

In 2024, powder form was widely used across functional foods, dietary supplements, and infant nutrition products, as it blended easily with dry formulations and maintained stability during processing and storage. Manufacturers favored this form for its flexibility in transportation and cost-effective packaging. In 2025, demand continued to grow as clean-label and gut-health focused products expanded, with powder remaining the preferred choice for large-scale production and consistent product quality across applications.

By Application Analysis

Food & Beverages leads with 51.8% driven by rising demand for gut-friendly foods

In 2024, Food & Beverages held a dominant market position, capturing more than a 51.8% share in the fructo-oligosaccharides market by application. This dominance was supported by the growing use of fructo-oligosaccharides as a natural prebiotic ingredient in functional foods and beverages aimed at improving digestive health.

In 2024, manufacturers increasingly added these ingredients to dairy products, bakery items, nutrition bars, and health drinks to meet consumer demand for fiber-enriched and low-sugar formulations. The ingredient’s ability to improve texture while maintaining a mild sweetness also supported wider adoption. In 2025, demand remained strong as clean-label trends and awareness of gut health continued to influence food choices, keeping food and beverages as the leading application segment.

Key Market Segments

By Source

- Sucrose

- Chicory

By Form

- Liquid

- Powder

By Application

- Infant Formulation

- Food & Beverages

- Dietary Supplements

- Pet/Animal Feed

- Others

Emerging Trends

Prebiotic Fiber Fortification Moves Into Everyday Foods (and Labels Are Getting Stricter)

One clear, latest trend for fructo-oligosaccharides (FOS) is how fast they are moving from “specialty gut-health” products into everyday foods as a practical way to add prebiotic fiber while keeping taste familiar. The push is simple: many people still fall short on fiber. U.S. dietary intake data show the mean fiber intake is 16 g/day for people 2 years and older. At the same time, widely used U.S. dietary guidance encourages about 14 g of fiber per 1,000 calories, which sets a clear “gap” that food makers try to close through smarter formulations.

Because of that gap, product developers are using FOS as a dual-purpose ingredient—it can contribute to fiber positioning while also helping with sweetness and texture in cereals, bars, dairy, beverages, and snacks. FDA’s GRAS notice inventory for FOS describes use across many conventional-food categories and lists typical inclusion levels in the range of 0.4% to 6.7% depending on the food.

Finally, brands are getting more careful about how much FOS they add, because tolerance and consumer comfort shape repeat purchase. A 2022 human study on short-chain FOS assessed gastrointestinal tolerance at doses up to 40 g/day in 116 healthy volunteers, giving industry a useful reference point for formulation guardrails.Older human evidence also shows functional “prebiotic activity” at practical intakes; one classic study reported that 10 g/day of short-chain FOS was well tolerated and increased fecal bifidobacteria in healthy volunteers.

Drivers

Low Fiber Intake Drives Demand for Prebiotic Fibers Like Fructo-Oligosaccharides

A major growth driver for fructo-oligosaccharides (FOS) is the everyday “fiber gap” in modern diets. Many people want better digestion and steadier energy, but they simply don’t eat enough naturally high-fiber foods. The World Health Organization (WHO) recommends adults get at least 25 g of naturally occurring dietary fibre per day, alongside at least 400 g of fruits and vegetables.

In reality, average intake often sits far below those targets, especially in urban, convenience-driven eating patterns. A U.S. dietary data brief (based on national intake data) highlights that the average daily dietary fiber intake was about 16 g/day—roughly “halfway” to the kind of levels most guidelines aim for.This gap creates a practical need for foods that can add fiber without changing taste too much—exactly where FOS fits, because it is mildly sweet, blends well, and works in products people already buy (yogurt, drinks, cereals, nutrition bars, and bakery items).

Government nutrition guidance also reinforces this direction by putting a clear number on what “enough fiber” looks like. The U.S. Dietary Guidelines use a simple benchmark of 14 g of fiber per 1,000 calories (so roughly 28 g for a 2,000-calorie pattern). When consumers see targets like this, it pushes everyday shopping behavior toward “higher fiber” choices—especially in packaged foods where labels make comparison easy.

Another key boost is regulatory clarity on fiber labeling, which matters a lot for manufacturers. The U.S. FDA has issued guidance on which isolated or synthetic non-digestible carbohydrates can be counted as “dietary fiber” on Nutrition Facts labels. In that guidance, the FDA lists inulin and inulin-type fructans—a group that includes FOS—as eligible for fiber declaration under enforcement discretion while rulemaking proceeds.

Restraints

Digestive Tolerance Limits Can Restrict Wider FOS Use

One major restraining factor for fructo-oligosaccharides (FOS) is simple: not everyone tolerates fermentable fibers well, especially when brands push higher “added fiber” doses in a single serving. FOS belongs to the fructans family, and fructans are poorly absorbed in the small intestine because humans do not have the enzymes to digest them. When they reach the large bowel, they ferment and can pull in water—two effects that can trigger bloating, gas, cramps, or loose stools in sensitive consumers.

This matters because the sensitive group is not small. UK clinical guidance from NICE estimates IBS prevalence at 10%–20% in the general population. A 2025 meta-analysis also reports global IBS prevalence estimates that vary by diagnostic criteria, including about 13.21% (Rome III) and 17.14% (Rome IV). Since many IBS dietary approaches reduce FODMAPs (a group that includes fructans/FOS), manufacturers have to assume that a meaningful slice of shoppers may react badly to high-FOS products, even if the ingredient is “healthy” in principle.

Clinical and industry-relevant evidence shows how dose can become a practical ceiling. A dose-ranging study in healthy volunteers tested short-chain FOS at 15 g/day, 20 g/day, and then doubled doses up to 40 g/day, reporting that symptoms remained “very mild” overall in that population. However, the same paper highlights why product developers still worry: tolerance differs across inulin-type fructans, and at higher intakes some people report painful symptoms. It specifically cites evidence where a higher inulin dose of 16.25 g/day was associated with abdominal cramps along with bloating and flatulence, and where 20 g inulin was significantly less well tolerated than 10 g.

Healthcare guidance also reinforces that fructans can be symptom triggers and that restriction can help many symptomatic people. An NHS low-FODMAP patient sheet explains that fructans (also called FOS) are poorly absorbed in everyone, and that reducing high-FODMAP intake has been shown to improve gut symptoms for many people with IBS-like symptoms—typically assessed over 4–6 weeks.

Opportunity

Sugar-Reduction Reformulation Creates a Big FOS Opportunity

A major growth opportunity for fructo-oligosaccharides (FOS) is the global push to cut added/free sugars without making foods taste “thin” or less satisfying. Public-health guidance is moving in one clear direction: WHO recommends reducing free sugars to less than 10% of total energy intake, and suggests aiming below 5% for extra health benefits. When brands reformulate to meet these expectations, they usually face a trade-off—remove sugar and you lose sweetness, mouthfeel, and overall consumer liking.

This opportunity becomes more concrete when governments set measurable reformulation targets. In the UK, the government’s sugar reduction programme challenged the food industry to cut sugar by 20% by 2020 in categories that contribute most to children’s sugar intakes. Even when progress is mixed, the direction is set: manufacturers keep investing in practical tools that reduce sugar while protecting texture and taste.

A second layer of opportunity is fiber fortification, which often goes hand-in-hand with sugar reformulation. WHO’s broader carbohydrate guidance highlights diet quality and recommends adults consume at least 400 g of fruits and vegetables per day and 25 g of naturally occurring dietary fibre daily. Those targets are hard to meet consistently with busy lifestyles, so manufacturers increasingly build “better-for-you” versions of everyday foods.

In the United States, there is also a practical labeling advantage that can accelerate product launches. The FDA’s dietary fiber Q&A and guidance on isolated or synthetic non-digestible carbohydrates lists inulin and inulin-type fructans (the family that includes many FOS ingredients) among fibers that can be declared as dietary fiber under FDA’s approach to enforcement discretion guidance.

Regional Insights

Europe Dominates the Fructo-Oligosaccharides Market with a Share of 39.9%, Valued at USD 1.2 Bn

Europe holds the dominant position in the Fructo-Oligosaccharides (FOS) market, supported by strong consumer demand for digestive wellness, clean-label reformulation, and mature functional food manufacturing. In this region, Europe leads with a market share of 39.9%, valued at USD 1.2 Bn, reflecting the scale of adoption of prebiotic fibers across mainstream categories such as dairy alternatives, yogurts, nutrition bars, infant and toddler foods, and dietary supplements.

Manufacturers across Europe increasingly treat FOS as a practical formulation tool because it can support fiber enrichment while helping maintain taste and texture in reduced-sugar product upgrades. This positioning aligns with the region’s long-standing focus on gut health, especially in foods marketed for everyday digestive comfort rather than niche clinical nutrition.

From an industry scenario perspective, Europe’s dominance is reinforced by advanced ingredient supply chains and high penetration of fortified foods across retail channels, including supermarkets and pharmacy-led wellness formats. In addition, European food brands often prioritize science-backed functional claims and ingredient traceability, which supports sustained FOS usage in product renovation cycles. The region also benefits from a well-established regulatory and labeling environment for functional ingredients, encouraging companies to invest in formulation consistency, evidence-based messaging, and stable prebiotic performance across processing conditions.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Top Key Players Outlook

- Beneo

- Biosynth

- Cargill, Incorporated

- Galam

- Ingredion

- Meiji Holdings Co., Ltd.

- Tata Chemicals

- Tereos Group

Recent Industry Developments

In 2024, Beneo recorded approximately USD 0.95 billion in revenue from its prebiotic and ingredient portfolio, serving customers in 80+ countries with products such as Orafti® inulin and oligofructose that improve gut health and reduce sugar content in formulations.

In 2024, Ingredion reported annual net sales of ~USD 7.4 billion, with its Texture & Healthful Solutions segment—which includes digestive wellness ingredients—showing steady growth as manufacturers sought clean‑label fibers that enhance gut health and product functionality.

Report Scope

Report Features Description Market Value (2024) USD 3.1 Bn Forecast Revenue (2034) USD 6.7 Bn CAGR (2025-2034) 8.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Sucrose, Chicory), By Form (Liquid, Powder), By Application (Infant Formulation, Food & Beverages, Dietary Supplements, Pet/Animal Feed, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Beneo, Biosynth, Cargill, Incorporated, Galam, Ingredion, Meiji Holdings Co., Ltd., Tata Chemicals, Tereos Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fructo-Oligosaccharides MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Fructo-Oligosaccharides MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Beneo

- Biosynth

- Cargill, Incorporated

- Galam

- Ingredion

- Meiji Holdings Co., Ltd.

- Tata Chemicals

- Tereos Group