Global Freshness Prediction AI Market Size, Share and Analysis Report By Component (Solutions, Services), By Deployment Mode (Cloud-based/SaaS, On-premises/Edge), By Application (Retail & Grocery, Dynamic Pricing & Markdown Optimization, Inventory Rotation & Stock Replenishment, Food Service & Hospitality, Kitchen & Menu Management, Prep Schedule Optimization, Logistics & Supply Chain, Others), By Technology Input (IoT Sensor Data, Visual Data, Historical Sales & Supply Chain Data, Multi-modal Data Fusion), By End-User (Supermarkets & Grocery Chains, Food & Beverage Manufacturers, Restaurants & Catering Services, Third-party Logistics Providers, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 176196

- Number of Pages: 313

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Insights Summary

- Drivers Impact Analysis

- Restraint Impact Analysis

- Component Analysis

- Deployment Mode Analysis

- Application Analysis

- Technology Input Analysis

- End-User Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- U.S. Market Size

- Emerging Trend Analysis

- Opportunity Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

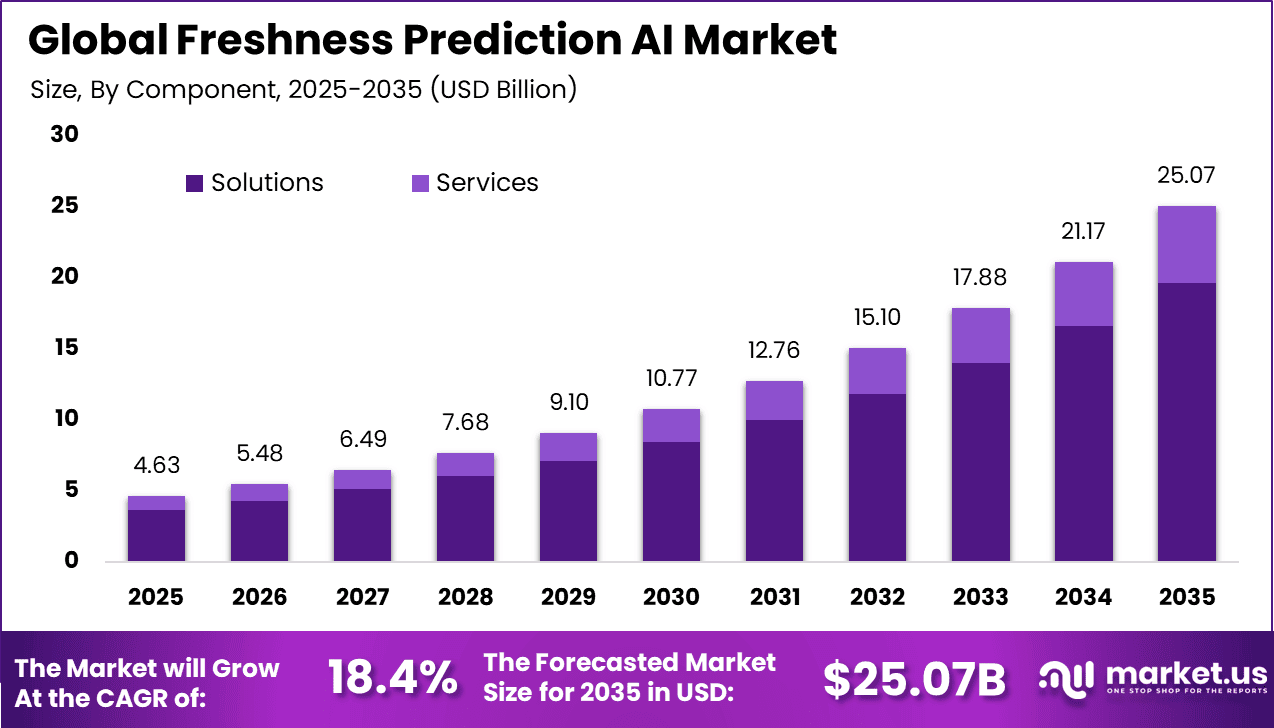

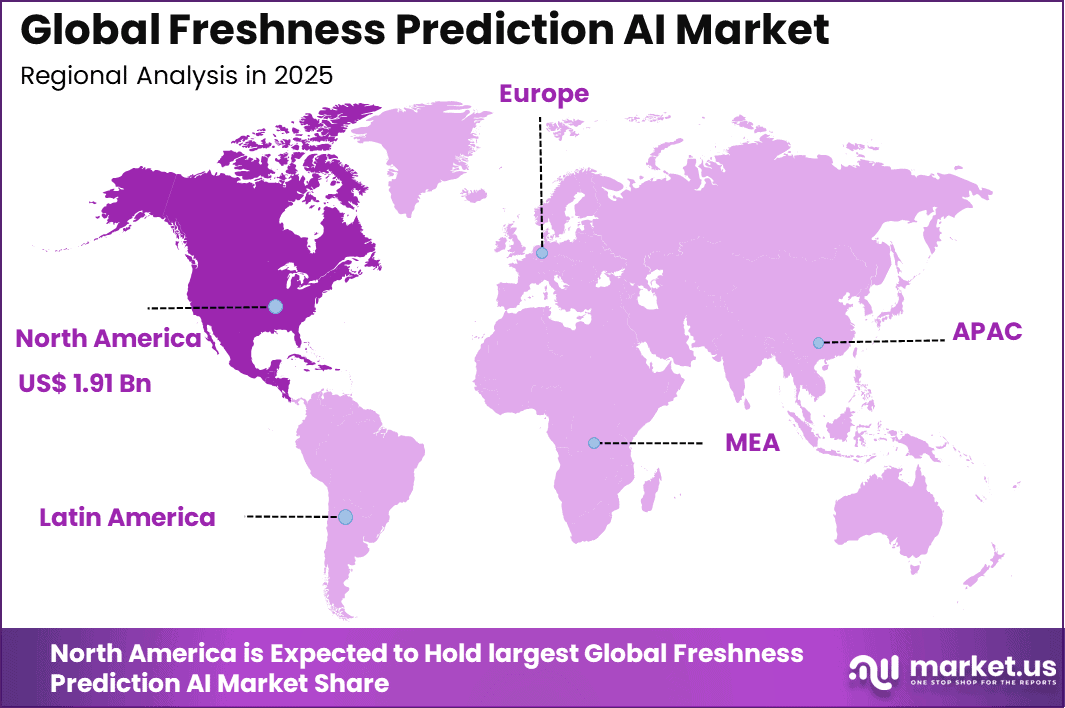

The Global Freshness Prediction AI Market size is expected to be worth around USD 25.07 billion by 2035, from USD 4.63 billion in 2025, growing at a CAGR of 18.4% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 41.26% share, holding USD 1.91 billion in revenue.

The freshness prediction artificial intelligence market refers to technology solutions that apply machine learning models, computer vision, and predictive analytics to assess the quality or spoilage status of perishable products. This market is influenced by the increasing need for accurate freshness assessment across the food supply chain, from harvesting and processing to retail and consumption.

AI-enabled systems analyse real time data from sensors, images, environmental conditions, and historical patterns to determine freshness levels and forecast spoilage. Adoption is driven by operational needs to reduce food waste, enhance food safety, and optimise inventory management within complex distribution networks. Technological innovation in this field supports more reliable quality assurance processes and contributes to sustainability goals in the food ecosystem.

One major driving factor of the freshness prediction AI market is the need to reduce food and product waste. Retailers and distributors face losses due to spoilage and overstocking. AI models provide more accurate freshness estimates than static expiry dates. Better predictions support timely sales and redistribution. Waste reduction strongly drives adoption.

For instance, in September 2025, Zest Labs, Inc. earned Fast Company recognition for innovative AI in freshness management. Their Zest Fresh platform now tackles proteins like beef and seafood, offering pallet-level shelf-life predictions and blockchain traceability.

Demand for freshness prediction AI is influenced by expansion of cold chain and fresh product distribution. Perishable goods require careful handling and monitoring. AI systems provide continuous freshness insights across logistics stages. Real-time predictions improve decision-making. Distribution growth increases demand.

Key Takeaway

- The solutions segment led the global freshness prediction AI market with a 78.4% share, driven by demand for end to end platforms that combine analytics, modeling, and decision support.

- The cloud based and SaaS segment captured 68.7%, reflecting preference for scalable deployment, centralized updates, and easier integration with retail and supply chain systems.

- The retail and grocery segment dominated applications with 52.8%, supported by the need to reduce food waste, improve shelf life management, and optimize inventory turnover.

- IoT sensor data accounted for 41.6%, highlighting the importance of real time temperature, humidity, and handling data in freshness prediction models.

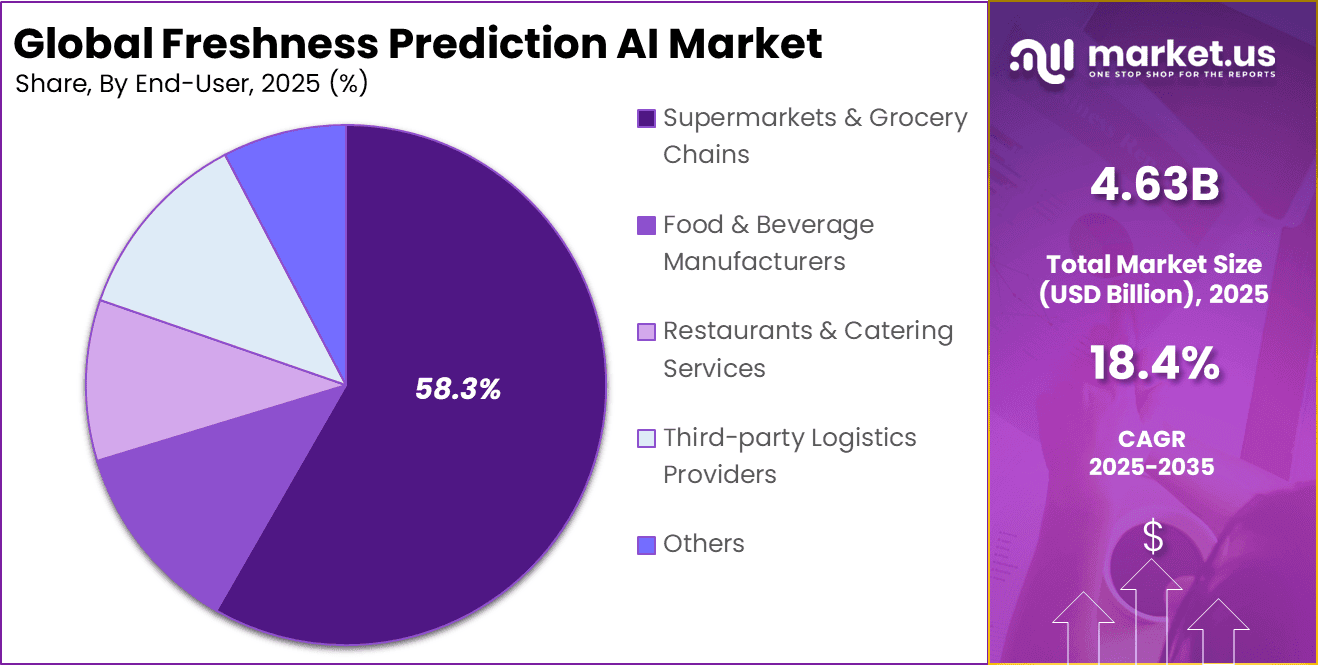

- Supermarkets and grocery chains held 58.3% share among end users, as large store networks benefit most from automated freshness monitoring at scale.

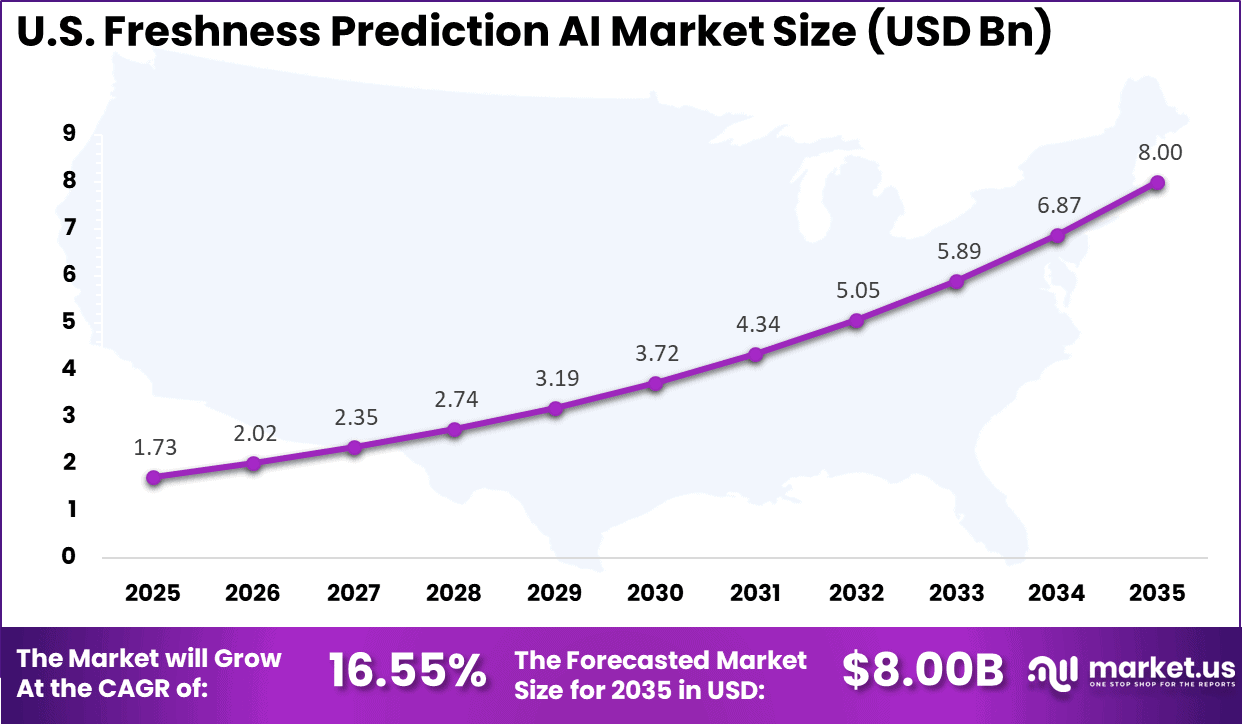

- The US freshness prediction AI market was valued at USD 1.73 billion in 2025 and is growing at a 16.55% CAGR, supported by advanced retail analytics adoption.

- North America led globally with more than 41.26% share, driven by strong AI adoption in retail, mature cold chain infrastructure, and focus on food quality compliance.

Key Insights Summary

Accuracy Rates

- Produce (fruits and vegetables): Accuracy ranges from 97% using VGG16 models to as high as 99.95% with SVM for specific items such as bananas and strawberries.

- Leafy greens: Lettuce freshness classification achieved 99.74% accuracy using ConvNeXt models.

- Meat and fish: Deep learning models combined with sensor arrays report accuracy levels above 95%, reaching up to 97.1%.

- Overall systems: End to end freshness prediction systems based on Inception V3 show around 94% accuracy across mixed food categories.

Key Performance Indicators

- Precision and recall: Frequently exceed 95% in high performing models, with CNN BiLSTM systems reporting 96% to 98%.

- F1 score: Typically ranges between 0.90 and 1.00 for most fruit and vegetable freshness classification tasks.

- CNN BiLSTM models: Achieved 98.46% accuracy for capsicum freshness and 98.25% for bananas.

- Swin Transformer models: Reported 100% accuracy for apple freshness classification under controlled conditions.

- MobileNetV3: Widely preferred for mobile and edge applications due to strong accuracy combined with lower computational requirements.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline Rising food waste reduction initiatives across supply chains +4.8% North America, Europe Short to medium term Growing adoption of AI in food quality and safety monitoring +4.2% North America, Asia Pacific Medium term Expansion of cold chain logistics and smart warehousing +3.6% North America, Europe, Asia Pacific Medium term Increased demand for real-time freshness visibility by retailers +3.1% North America, Europe Medium to long term Regulatory pressure on food safety and traceability +2.7% North America, Europe Long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline High deployment costs for AI sensors and analytics platforms -3.1% Emerging Markets Short to medium term Integration challenges with legacy supply chain systems -2.6% Global Medium term Limited AI expertise among small food producers -2.2% Asia Pacific, Latin America Medium term Data accuracy dependency on sensor quality -1.8% Global Short term Concerns around data ownership and sharing -1.5% Europe, North America Medium to long term Component Analysis

In 2025, The Solutions segment held a dominant market position, capturing a 78.4% share of the Global Freshness Prediction AI Market. Solutions are growing strongly because food retailers and supply chain operators want complete systems rather than fragmented tools. A single solution that combines data collection, analysis, and alerts makes it easier to manage freshness across storage, transport, and shelves.

This reduces manual checks and improves daily decision making for staff. Growth is also supported by the need to cut food waste and protect margins. Freshness prediction solutions help businesses act before products spoil, adjust pricing at the right time, and maintain consistent quality. As operations become more data-driven, demand for integrated solutions continues to rise.

For Instance, in November 2025, Afresh Technologies launched its AI-powered Fresh Buying solution with Wakefern. This tool uses smart algorithms to forecast demand and pick vendors for produce and meat. It streamlines workflows to cut waste and ensure fresh stock reaches stores fast. Buyers get real-time insights, making daily decisions easier in the fast, fresh supply chain.

Deployment Mode Analysis

In 2025, the Cloud-based/SaaS segment held a dominant market position, capturing a 68.7% share of the Global Freshness Prediction AI Market. Cloud based and SaaS platforms are expanding because they are easy to deploy and manage across multiple locations. Businesses can access freshness insights in real time without investing heavily in IT infrastructure.

This flexibility is especially valuable for grocery chains and distributors with wide networks. Cloud platforms allow users to add new stores, sensors, or data sources quickly as operations expand. Regular software updates and remote access also help companies keep systems current and reliable, supporting long term adoption.

For instance, in March 2025, Crisp acquired Shelf Engine’s AI demand planning tech. This boosts Crisp’s cloud platform for real-time inventory forecasts in fresh goods. Retailers now automate orders via SaaS to match demand and slash spoilage. The move expands data sharing across supply chains for better perishables handling. Easy integration drives wider use.

Application Analysis

In 2025, The Retail & Grocery segment held a dominant market position, capturing a 52.8% share of the Global Freshness Prediction AI Market. Retail and grocery applications are growing as stores face constant pressure to keep products fresh while reducing waste.

Freshness prediction tools help retailers plan replenishment more accurately and avoid overstocking items with short shelf lives. This improves inventory efficiency and customer satisfaction. Shoppers increasingly demand fresh and safe food, especially for produce, meat, and dairy. Retailers use freshness insights to maintain quality standards and build trust, which drives continued investment in this application area.

For Instance, in January 2026, OneThird rolled out AI-driven Visual Inspection in its Digital Quality Platform. The tool scans soft fruits like berries for defects and shelf life in stores. It speeds quality checks up to 10 times, helping grocers pick fresher stock and reduce waste at retail. Cloud reports aid smart stocking decisions.

Technology Input Analysis

In 2025, The IoT Sensor Data segment held a dominant market position, capturing a 41.6% share of the Global Freshness Prediction AI Market. IoT sensor data is growing in importance because it provides continuous and accurate information on product conditions. Sensors track temperature, humidity, and handling across the supply chain, which improves freshness prediction accuracy compared to manual inspections.

Growth is further supported by better connectivity and lower sensor costs. As sensors become easier to install and maintain, more businesses rely on real time data to monitor freshness. This makes IoT a core input for AI-driven freshness systems.

For Instance, in June 2022, Strella Biotechnology raised $8M to scale its IoT biosensors for fruit ripeness. Sensors track maturity from harvest to shelf, streaming data for precise freshness predictions. This cuts produce waste by optimizing routes and inventory. Growers gain actionable insights to boost quality across the chain.

End-User Analysis

In 2025, The Supermarkets & Grocery Chains segment held a dominant market position, capturing a 58.3% share of the Global Freshness Prediction AI Market. Supermarkets and grocery chains are driving growth due to their high exposure to spoilage losses. Managing large volumes of perishable goods across many stores creates a strong need for predictive tools that support timely decisions and reduce waste.

These organizations also have the scale and digital readiness to adopt AI solutions. Centralized data systems and standardized processes make it easier to roll out freshness prediction across locations, supporting steady growth in this end-user segment.

For Instance, in September 2025, Afresh introduced Fresh Store Suite for grocery inventory and production planning. AI handles end-of-period counts and fresh prep for chains. It unifies data to minimize overstock in supermarkets. Partners report less waste and smoother ops in high-volume stores. Scalable for big retail networks.

Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Food technology companies Very High Medium North America, Europe Strong alignment with sustainability goals AI and analytics platform investors High Medium Global Scalable software-driven returns Logistics and cold chain operators Medium Low to Medium North America, Asia Pacific Efficiency-led strategic investments Private equity firms Medium Medium North America, Europe Platform expansion and consolidation Venture capital investors Very High High North America Early-stage innovation upside Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~)% Primary Function Geographic Relevance Adoption Timeline Machine learning-based freshness prediction models +5.0% Shelf-life estimation accuracy Global Short to medium term IoT sensors for temperature and humidity monitoring +4.3% Real-time data capture North America, Europe Medium term Computer vision for visual quality assessment +3.6% Non-invasive inspection Global Medium term Cloud-based analytics and dashboards +3.1% Scalability and remote access Global Medium to long term Edge AI for on-site freshness analysis +2.4% Low-latency decision making North America Long term U.S. Market Size

The market for Freshness Prediction AI within the U.S. is growing tremendously and is currently valued at USD 1.73 billion, the market has a projected CAGR of 16.55%. The market is growing due to rising demand for food safety, waste reduction, and real time quality monitoring across retail, foodservice, and supply chain operations.

Grocery chains and distributors increasingly adopt AI-driven analytics to predict spoilage, optimize inventory turnover, and extend shelf life. Growth in e-commerce grocery, stricter food safety regulations, and higher consumer expectations for fresh produce further accelerate adoption, making AI-based freshness solutions a strategic priority across the US food ecosystem.

For instance, in November 2025, Afresh Technologies, Inc. launched the industry’s first AI-powered Fresh Buying solution with Wakefern Food Corp., enabling real-time visibility, coordination, and intelligent decision-making for fresh produce distribution centers. This innovation optimizes supply chains, reduces waste, and maximizes freshness and profits, reinforcing U.S. leadership in AI-driven freshness prediction.

In 2025, North America held a dominant market position in the Global Freshness Prediction AI Market, capturing more than a 41.26% share, holding USD 1.91 billion in revenue. This dominance is due to early adoption of advanced AI technologies across food retail, logistics, and cold chain infrastructure.

The region benefits from a strong presence of large grocery chains, advanced supply chain digitization, and high investment in AI driven analytics. Strict food safety regulations, rising focus on food waste reduction, and widespread use of smart sensors and IoT further support adoption, enabling consistent deployment of freshness prediction solutions at scale.

For instance, in April 2025, Shelf Engine, Inc. was acquired by Crisp, enhancing AI demand forecasting and automated ordering for fresh goods. The integration bolsters food waste reduction and inventory optimization in grocery retail, showcasing North American dominance in predictive freshness technologies.

Emerging Trend Analysis

A significant emerging trend within the Freshness Prediction AI market is the integration of real time sensor data and machine learning to dynamically assess product quality throughout the supply chain. AI models are being trained with environmental, visual, and biochemical data to predict how long perishable items will remain fresh and safe for consumption, which supports faster decision making for producers, retailers, and consumers.

Recent research illustrates that devices using smartphone imaging and advanced algorithms can classify produce freshness directly from RGB images, enabling real time predictions even at retail or household levels. Another trend is the adoption of intelligent freshness indicators that adjust estimates based on actual storage conditions rather than static expiry dates.

These AI frameworks combine temperature, humidity, and handling variables to refine spoilage projections and reduce waste. The shift from traditional static labeling toward predictive AI driven expiration estimations is gaining traction in efforts to improve food safety and supply chain transparency across food and beverage industries.

Opportunity Analysis

An opportunity in the Freshness Prediction AI market exists in tailoring AI models for specific food categories and localized conditions. By training algorithms on diverse datasets that reflect different climates, storage methods, and product characteristics, solutions can offer more precise and location sensitive freshness estimates.

This customisation enhances predictive relevance for producers and retailers operating in varied environments, expanding applicability across global markets. Expansion of mobile and edge computing applications also presents an opportunity.

AI models deployed on smartphones or handheld scanners enable on the spot freshness assessments without the need for complex infrastructure. These portable solutions can empower smaller retailers, farmers, and even consumers to access predictive freshness insights, opening new channels for adoption and scaling.

Key Market Segments

By Component

- Solutions

- Shelf-life & Expiry Date Prediction Models

- Real-time Sensor Data Integration Platforms

- Demand & Waste Forecasting Engines

- Supply Chain Optimization Dashboards

- Others

- Services

- Professional Services

- Managed Analytics Services

- Others

By Deployment Mode

- Cloud-based/SaaS

- On-premises/Edge

By Application

- Retail & Grocery

- Dynamic Pricing & Markdown Optimization

- Inventory Rotation & Stock Replenishment

- Food Service & Hospitality

- Kitchen & Menu Management

- Prep Schedule Optimization

- Logistics & Supply Chain

- Others

By Technology Input

- IoT Sensor Data

- Visual Data

- Historical Sales & Supply Chain Data

- Multi-modal Data Fusion

By End-User

- Supermarkets & Grocery Chains

- Food & Beverage Manufacturers

- Restaurants & Catering Services

- Third-party Logistics Providers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Key Players Analysis

Specialized food retail and supply chain technology providers such as Afresh Technologies, Inc., Shelf Engine, Inc., and Crisp focus on AI-driven demand sensing and freshness prediction. Their platforms analyze sales patterns, inventory age, and supplier data to reduce spoilage. These solutions are widely adopted by grocery retailers and distributors. The value proposition centers on waste reduction and improved product availability.

Post-harvest and produce-focused innovators such as Zest Labs, Inc., OneThird, and Strella Biotechnology, Inc. emphasize real-time quality assessment. ImpactVision and AgShift, Inc. apply computer vision and sensor data to predict remaining shelf life. These players support growers, packers, and retailers. Their tools improve pricing decisions and cold chain efficiency across fresh produce categories.

Food preservation and enterprise platform providers such as Apeel Sciences, Hazel Technologies, Inc., and Wasteless, Ltd. complement AI prediction with shelf-life extension and pricing optimization. IBM Corporation and Microsoft Corporation support scalable deployment through cloud analytics and IoT integration. Other vendors expand niche use cases.

Top Key Players in the Market

- Afresh Technologies, Inc.

- Shelf Engine, Inc.

- Crisp

- Zest Labs, Inc.

- ImpactVision

- OneThird

- Strella Biotechnology, Inc.

- Mori

- Wasteless, Ltd.

- Food Forensics

- AgShift, Inc.

- Apeel Sciences

- Hazel Technologies, Inc.

- IBM Corporation

- Microsoft Corporation

- Others

Recent Developments

- In March 2025, Crisp acquired Shelf Engine’s AI demand planning tech, boosting its food waste analytics for fresh goods. The move adds precise forecasting and auto-ordering, tackling perishable inventory challenges. Retailers can cut out-of-stocks while minimizing excess, especially in high-margin fresh categories. It’s a smart consolidation play in the vertical AI space for grocery.

- In June 2025, Apeel Sciences earned Food & Wine’s 2025 Game Changer nod for its plant-based coatings that extend produce freshness sans refrigeration. The tech cuts spoilage across the chain, with RipeTrack AI adding ripeness predictions. It’s gaining traction with suppliers for waste cuts and quality boosts, positioning Apeel as a sustainability leader in perishables.

Report Scope

Report Features Description Market Value (2025) USD 4.6 Bn Forecast Revenue (2035) USD 25 Bn CAGR(2026-2035) 18.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions, Services), By Deployment Mode (Cloud-based/SaaS, On-premises/Edge), By Application (Retail & Grocery, Dynamic Pricing & Markdown Optimization, Inventory Rotation & Stock Replenishment, Food Service & Hospitality, Kitchen & Menu Management, Prep Schedule Optimization, Logistics & Supply Chain, Others), By Technology Input (IoT Sensor Data, Visual Data, Historical Sales & Supply Chain Data, Multi-modal Data Fusion), By End-User (Supermarkets & Grocery Chains, Food & Beverage Manufacturers, Restaurants & Catering Services, Third-party Logistics Providers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Afresh Technologies, Inc., Shelf Engine, Inc., Crisp, Zest Labs, Inc., ImpactVision, OneThird, Strella Biotechnology, Inc., Mori, Wasteless, Ltd., Food Forensics, AgShift, Inc., Apeel Sciences, Hazel Technologies, Inc., IBM Corporation, Microsoft Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Freshness Prediction AI MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Freshness Prediction AI MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Afresh Technologies, Inc.

- Shelf Engine, Inc.

- Crisp

- Zest Labs, Inc.

- ImpactVision

- OneThird

- Strella Biotechnology, Inc.

- Mori

- Wasteless, Ltd.

- Food Forensics

- AgShift, Inc.

- Apeel Sciences

- Hazel Technologies, Inc.

- IBM Corporation

- Microsoft Corporation

- Others