The Global Fresh Berries Market Size, Share, And Business Benefits By Type (Strawberries, Blueberries, Raspberries, Blackberries, Others), By Category (Conventional, Organic), By Distribution Channel (Direct Sales, Indirect Sales, Supermarkets/Hypermarkets (Specialty Stores, Online Retail, Others)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153317

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

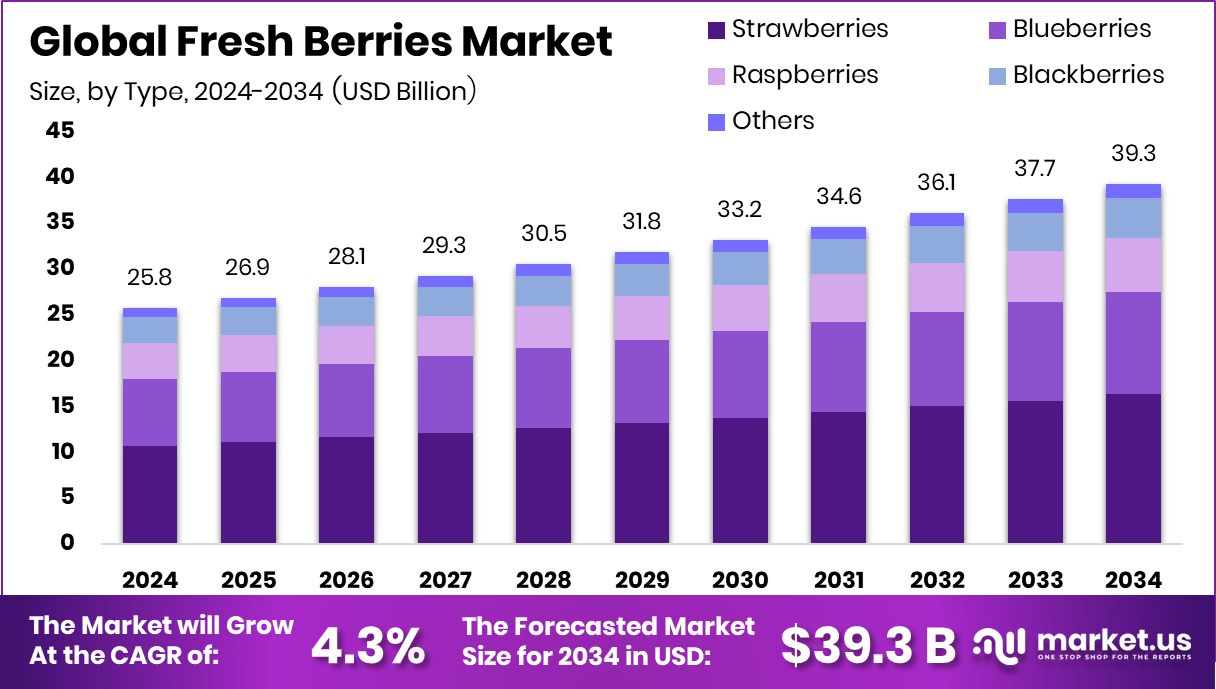

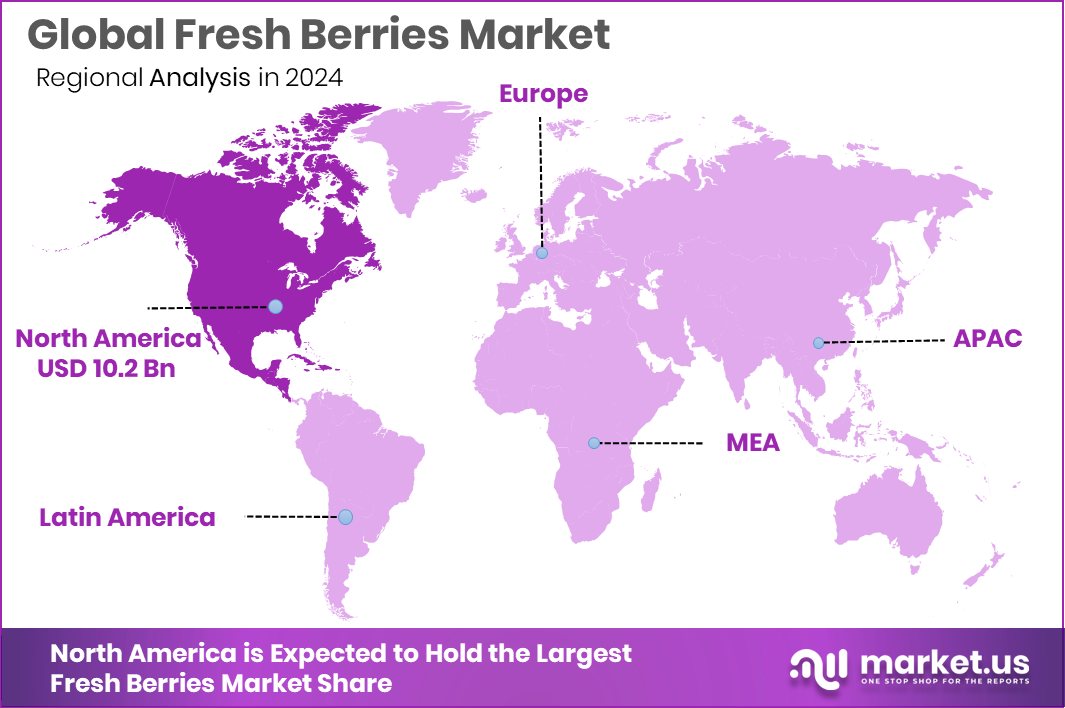

The Global Fresh Berries Market is expected to be worth around USD 39.3 billion by 2034, up from USD 25.8 billion in 2024, and is projected to grow at a CAGR of 4.3% from 2025 to 2034. High demand for healthy fruits supported North America’s USD 10.2 billion market value.

Fresh berries are small, pulpy, and brightly colored fruits that are typically eaten raw and known for their sweet-tart flavor and high nutritional value. Common varieties include strawberries, blueberries, raspberries, and blackberries. These fruits are rich in antioxidants, vitamins, fiber, and natural sugars, making them a popular choice among health-conscious consumers.

Recent investments have highlighted this appeal, with Oishii securing an additional $16 million to expand its premium strawberries globally, and also raising $50 million to grow eco-friendly, bee-pollinated strawberries using vertical farming techniques.

The fresh berries market refers to the global trade, production, distribution, and consumption of these berries in their natural, unprocessed form. This market involves a network of growers, suppliers, distributors, and retailers who manage the seasonal supply chain to deliver berries to consumers across regions. It is influenced by agricultural practices, climate conditions, consumer trends, and logistics infrastructure.

The growth of the fresh berries market is primarily supported by increasing awareness of healthy eating and rising demand for natural and nutrient-rich foods. Consumers are actively seeking foods that offer immunity-boosting and disease-preventing properties, which berries are widely known for. This trend has led to greater inclusion of berries in daily diets, especially among urban populations.

Demand for fresh berries is expanding due to rising disposable incomes and the growing popularity of plant-based and low-calorie diets. Year-round availability through improved cold-chain logistics and greenhouse cultivation has also fueled consistent demand even in non-harvest seasons.

Key Takeaways

- The Global Fresh Berries Market is expected to be worth around USD 39.3 billion by 2034, up from USD 25.8 billion in 2024, and is projected to grow at a CAGR of 4.3% from 2025 to 2034.

- Strawberries dominate the Fresh Berries Market by type, accounting for a significant 41.6% global share.

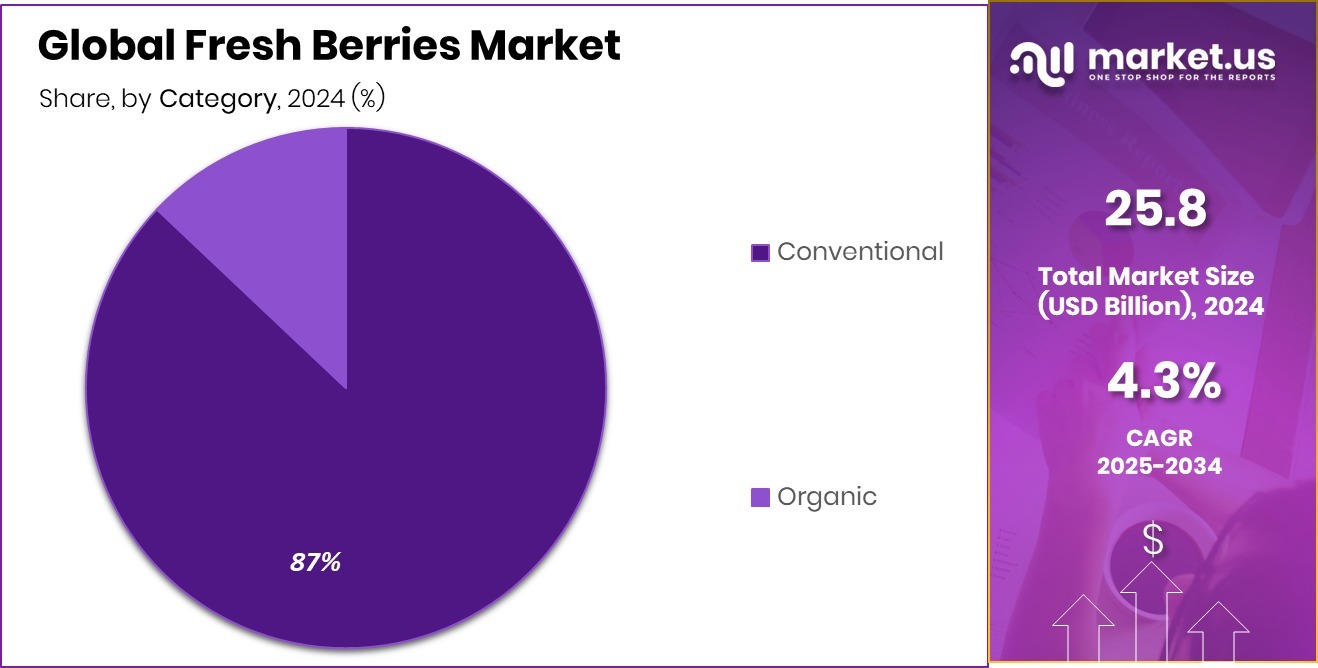

- Conventional berries lead the category segment, contributing to 87.4% of total Fresh Berries Market volume.

- Direct sales serve as the main distribution channel, capturing 56.8% share in the Fresh Berries Market.

- North America reached a market value of USD 10.2 billion in 2024.

By Type Analysis

Strawberries dominate the Fresh Berries Market with 41.6% share.

In 2024, Strawberries held a dominant market position in the By Type segment of the Fresh Berries Market, with a 41.6% share. This dominance can be attributed to their widespread consumer preference, versatile usage in culinary applications, and year-round demand across global markets.

Strawberries continue to be a leading choice due to their appealing taste, visual appeal, and rich nutritional profile, which includes vitamins, fiber, and antioxidants. Their dominance reflects strong production volumes and consistent availability through improved agricultural practices and controlled-environment farming techniques.

Within the By Category segment, Conventional berries accounted for a significant 87.4% share in 2024. This strong presence is largely due to established cultivation methods, lower production costs, and widespread retail accessibility.

Conventional farming continues to meet the bulk of market demand, especially in regions where price sensitivity influences purchasing decisions. The segment’s performance also reflects the existing supply chain efficiency and availability at large-scale supermarkets and grocery outlets.

By Category Analysis

Conventional farming leads the market, covering 87.4% of production.

In 2024, Conventional held a dominant market position in the By Category segment of the Fresh Berries Market, with an 87.4% share. This overwhelming share highlights the widespread adoption of conventional farming methods for berry cultivation.

The conventional approach remains the preferred choice among growers due to its cost-effectiveness, scalability, and well-established supply chain mechanisms. It allows for higher yield production, supporting the steady and large-scale supply required to meet growing consumer demand across various regions.

The dominance of the conventional segment also reflects its strong presence in retail and wholesale markets, where price competitiveness and availability play a crucial role in influencing purchase decisions. Conventional berries continue to maintain market traction owing to their accessibility in mainstream grocery outlets, local stores, and foodservice supply chains.

By Distribution Channel Analysis

Direct sales channel accounts for 56.8% in the berries market distribution.

In 2024, Direct Sales held a dominant market position in the By Distribution Channel segment of the Fresh Berries Market, with a 56.8% share. This leadership highlights the growing preference for direct-to-consumer models, where producers sell fresh berries without intermediaries. The 56.8% share reflects the effectiveness of farm-level sales, local markets, and subscription-based delivery systems in meeting consumer demand for freshness, quality assurance, and product traceability.

The strong performance of the direct sales segment is supported by increasing consumer interest in locally sourced produce and the transparency offered through direct purchase. It allows producers to maintain better control over pricing, quality standards, and supply consistency, while consumers benefit from receiving freshly harvested berries. This model has also been reinforced by the rise in community-supported agriculture (CSA) and farm-to-table practices, which emphasize the value of fresh and minimally handled food products.

The 2024 dominance of direct sales in the distribution channel mix underlines the trust consumers place in face-to-face or source-based buying experiences. It also reflects an evolving retail landscape where personalized service and origin transparency are becoming key decision-making factors.

Key Market Segments

By Type

- Strawberries

- Blueberries

- Raspberries

- Blackberries

- Others

By Category

- Conventional

- Organic

By Distribution Channel

- Direct Sales

- Indirect Sales

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Others

Driving Factors

Health Awareness Driving Demand for Fresh Berries

One of the top driving factors in the Fresh Berries Market is the growing awareness about health and nutrition. People are choosing foods that are rich in vitamins, antioxidants, and fiber, and fresh berries offer all these benefits in one small fruit. Berries such as strawberries, blueberries, and raspberries are known to support heart health, boost immunity, and improve digestion.

As more individuals shift toward natural and plant-based diets, the demand for fresh, nutrient-rich fruits like berries continues to grow. Doctors and health experts often recommend berries as part of a balanced diet, which further boosts consumer confidence.

Restraining Factors

Short Shelf Life Limits Market Growth Potential

One of the key restraining factors in the Fresh Berries Market is their short shelf life. Berries are delicate fruits that spoil quickly if not stored properly, especially in warm or humid conditions. This creates a big challenge for farmers, distributors, and retailers, as they must ensure fast delivery and refrigerated storage throughout the supply chain.

If berries are not sold or consumed quickly, they lose freshness and become unsuitable for sale. This leads to high post-harvest losses and reduced profitability. For consumers, the fear of quick spoilage may discourage bulk purchases.

Growth Opportunity

Expanding Online Grocery Platforms Boost Berry Sales

A major growth opportunity in the Fresh Berries Market lies in the rapid expansion of online grocery platforms. With more people shopping for fruits and vegetables online, fresh berries are now reaching consumers through convenient home delivery services. E-commerce allows farmers and suppliers to connect directly with customers, cutting out middlemen and ensuring fresher produce.

This trend is especially growing in urban areas, where busy lifestyles make online shopping more attractive. Cold-chain logistics and better packaging are also helping maintain berry freshness during transit. As digital grocery platforms become more trusted and widely used, fresh berries are likely to see higher sales and wider distribution.

Latest Trends

Growing Demand for Organic and Pesticide-Free Berries

One of the latest trends in the Fresh Berries Market is the rising demand for organic and pesticide-free berries. Consumers are becoming more careful about what they eat and are choosing berries grown without synthetic chemicals or harmful sprays. Organic berries are seen as safer, healthier, and better for the environment.

This trend is especially strong among families, health-conscious individuals, and people following clean-label diets. As awareness of food safety and sustainability increases, shoppers are willing to pay more for certified organic produce. Farmers are also responding by switching to organic farming methods.

Regional Analysis

In 2024, North America led the Fresh Berries Market with 39.70% share.

In 2024, North America emerged as the dominant region in the global Fresh Berries Market, capturing a significant 39.70% share, valued at USD 10.2 billion. This leadership is largely attributed to high per capita consumption of fresh fruits, widespread adoption of health-conscious diets, and strong retail infrastructure supporting year-round availability of berries.

Europe remains a key regional market, supported by consumer preference for locally grown, seasonal produce and an increasing shift toward organic food consumption. Asia Pacific is showing steady growth, driven by rising disposable incomes, urbanization, and growing interest in healthy dietary habits across developing economies.

Meanwhile, Latin America contributes as a significant supplier, with favorable climates and growing export capabilities. The Middle East & Africa region, although smaller in size, is witnessing gradual growth due to expanding food retail sectors and increasing awareness of nutritional benefits.

However, North America’s commanding share of 39.70% and a market value of USD 10.2 billion position it as the leading contributor in the global Fresh Berries Market in 2024, reflecting its well-established supply chain and strong consumer demand for fresh and nutritious fruits.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Fresh Berries Market was notably shaped by the strategic positioning and operational excellence of four key companies: Driscoll’s Inc., Naturipe Farms LLC, Hortifrut S.A., and Berry Fresh Group. Collectively, these players have sustained significant influence through innovation, quality control, and responsive supply chain practices.

Driscoll’s Inc. continued to reinforce its market leadership by leveraging proprietary breeding programs and extensive quality standards. Its focus on developing berry varieties with improved taste, shelf life, and disease resistance has enabled consistent year‑round supply and consumer loyalty. Strategic investments in global production sites and cold‑chain infrastructure have ensured that international demand is met with minimal post‑harvest losses.

Naturipe Farms LLC maintained its competitive edge through vertically integrated farming operations and a strong emphasis on traceability. By managing cultivation, packing, and distribution internally, Naturipe has enhanced efficiency, reduced costs, and strengthened consumer trust in produce origin and safety.

Hortifrut S.A. established itself as a leading exporter by consolidating production across favorable climates in South America and Europe. The company’s specialization in frozen and IQF (individually quick‑frozen) berries has diversified its market offerings, catering to both fresh consumption and industrial use. This product range has extended Hortifrut’s reach beyond traditional fresh berry markets into food processing sectors.

Berry Fresh Group capitalized on regional strengths and nimble logistics to serve premium markets. By collaborating closely with local growers and focusing on rapid distribution within high‑end retail and hospitality segments, the company has built a reputation for consistent quality and freshness. Its targeted regional strategies have enabled swift responses to seasonal demand variations.

Top Key Players in the Market

- Driscoll’s Inc.

- Naturipe Farms LLC

- Hortifrut S.A.

- Berry Fresh Group

- Wish Farms

- SunOpta Inc.

- Berryworld Ltd.

- Agrana Beteiligungs AG

- Costa Group Holdings Limited

- Del Monte Fresh Produce N.A. Inc.

- T&G Global Limited

- The Kraft Heinz Company

- Giddings Fruit

- Planasa

- North Bay Produce

Recent Developments

- In August 2024, Naturipe introduced Berry Buddies, a pre-packaged, fresh-berry-based snack designed for children and families. The product line includes combinations like berries with pancakes, cookies, cheese, or pretzels—each under 160 calories and in a portable container. This launch reflects Naturipe’s ability to innovate and reach younger consumers through convenient, healthy snacking options using fresh berries.

- In February 2024, Driscoll’s acquired Costa Group, Australia’s top grower, packer, and marketer of blueberries and other produce. This acquisition extended Driscoll’s global reach and expanded its production footprint across Australia, China, Morocco, and southern Africa, enhancing access to new genetics for berry cultivation.

Report Scope

Report Features Description Market Value (2024) USD 25.8 Billion Forecast Revenue (2034) USD 39.3 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Strawberries, Blueberries, Raspberries, Blackberries, Others), By Category (Conventional, Organic), By Distribution Channel (Direct Sales, Indirect Sales, Supermarkets/Hypermarkets (Specialty Stores, Online Retail, Others)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Driscoll’s Inc., Naturipe Farms LLC, Hortifrut S.A., Berry Fresh Group, Wish Farms, SunOpta Inc., Berryworld Ltd., Agrana Beteiligungs AG, Costa Group Holdings Limited, Del Monte Fresh Produce N.A. Inc., T&G Global Limited, The Kraft Heinz Company, Giddings Fruit, Planasa, North Bay Produce Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Driscoll's Inc.

- Naturipe Farms LLC

- Hortifrut S.A.

- Berry Fresh Group

- Wish Farms

- SunOpta Inc.

- Berryworld Ltd.

- Agrana Beteiligungs AG

- Costa Group Holdings Limited

- Del Monte Fresh Produce N.A. Inc.

- T&G Global Limited

- The Kraft Heinz Company

- Giddings Fruit

- Planasa

- North Bay Produce