Global Foot Hydrating Socks Market Market Size, Share, Growth Analysis By Product Type (Non-Medical, Medical), By Socks Length (Full Length/Knee Length, Ankle Length, Others), By End User (Women, Men), By Distribution Channel (Retail Stores/Specialty Stores, Supermarkets/Hypermarkets, Pharmacies & Clinics, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171863

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

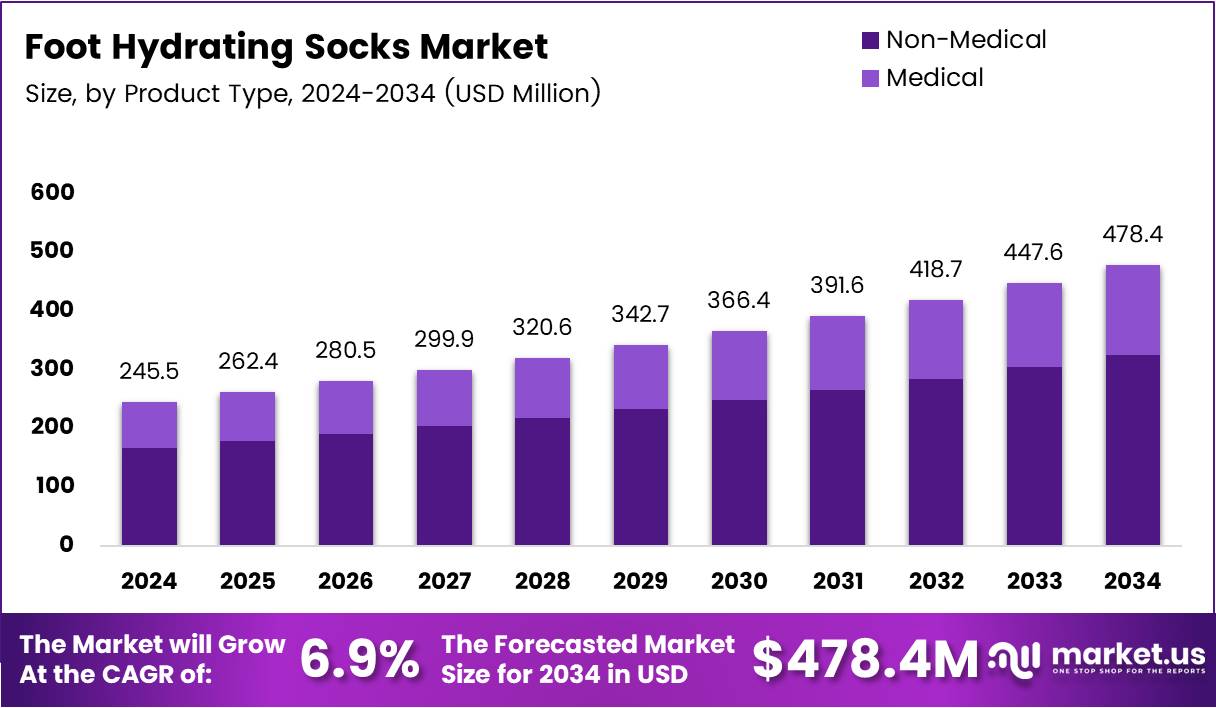

The Foot Hydrating Socks Market is projected to reach USD 478.4 Million by 2034, expanding from USD 245.5 Million in 2024, demonstrating a compound annual growth rate of 6.9% during the forecast period from 2025 to 2034. This specialized personal care segment addresses common foot concerns including dryness, cracking, and skin barrier dysfunction through topical moisturizing textile solutions.

Foot hydrating socks represent an innovative intersection between skincare and functional textiles. These products typically feature gel-lined or serum-infused fabrics designed to deliver intensive moisture therapy. They target consumers seeking convenient at-home treatments for heel fissures, calluses, and overall foot skin health maintenance.

Market expansion stems from shifting consumer preferences toward preventive self-care routines. The convenience factor drives adoption, as users can wear these socks overnight or during relaxation periods. This aligns with broader wellness trends emphasizing holistic personal care beyond traditional facial skincare regimens.

Growing awareness of foot health among diabetic patients significantly influences market dynamics. Healthcare professionals increasingly recommend preventive foot care products to manage complications. Simultaneously, aging populations worldwide prioritize mobility and comfort, recognizing proper foot maintenance as essential to quality of life.

E-commerce transformation has democratized access to specialized foot care solutions. Direct-to-consumer brands leverage digital marketing and influencer partnerships to educate consumers about foot hydration benefits. Online platforms provide detailed product information, user reviews, and subscription models that traditional retail channels cannot match.

Product innovation continues reshaping the competitive landscape. Manufacturers incorporate botanical extracts, hyaluronic acid, and ceramides into textile formulations. Medical-grade variants target therapeutic applications, while premium offerings emphasize spa-quality experiences. Sustainability concerns drive development of reusable and biodegegradable alternatives to disposable formats.

According to Beauty Matter, 82% of Americans consider wellness a top priority in their daily routines, highlighting growth momentum for wellness-oriented products. Additionally, research from Bread Financial indicates that 74% of US consumers prioritize self-care and wellness in their beauty routines, indicating strong consumer interest in personal care products that include foot care practices.

Furthermore, consumer behavior research reveals significant psychological dimensions influencing market potential. A US survey of 2,000 respondents found that 44% reported being self-conscious about their feet, with many avoiding open-toed shoes due to appearance concerns such as dryness, nails, and odor, according to New York Post. This widespread self-consciousness creates substantial demand for corrective foot care solutions.

Key Takeaways

- Global Foot Hydrating Socks Market projected to reach USD 478.4 Million by 2034 from USD 245.5 Million in 2024, growing at 6.9% CAGR

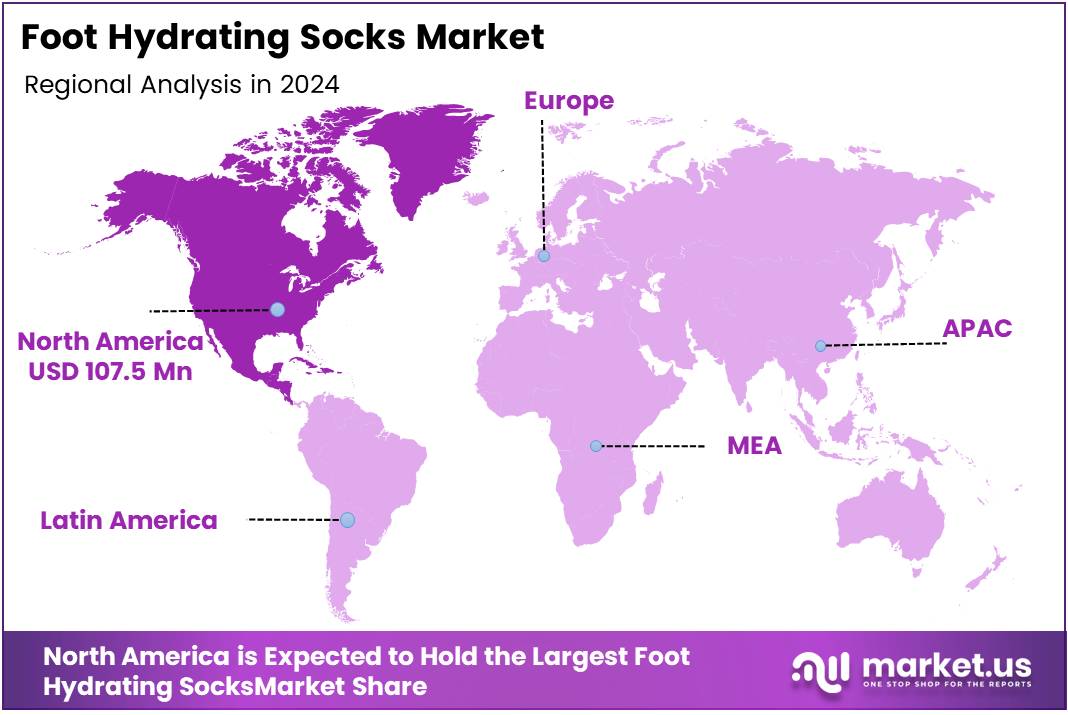

- North America dominates with 43.80% market share, valued at USD 107.5 Million

- Non-Medical segment holds 74.7% market share in Product Type category

- Full Length/Knee Length socks account for 49.9% of market by Socks Length

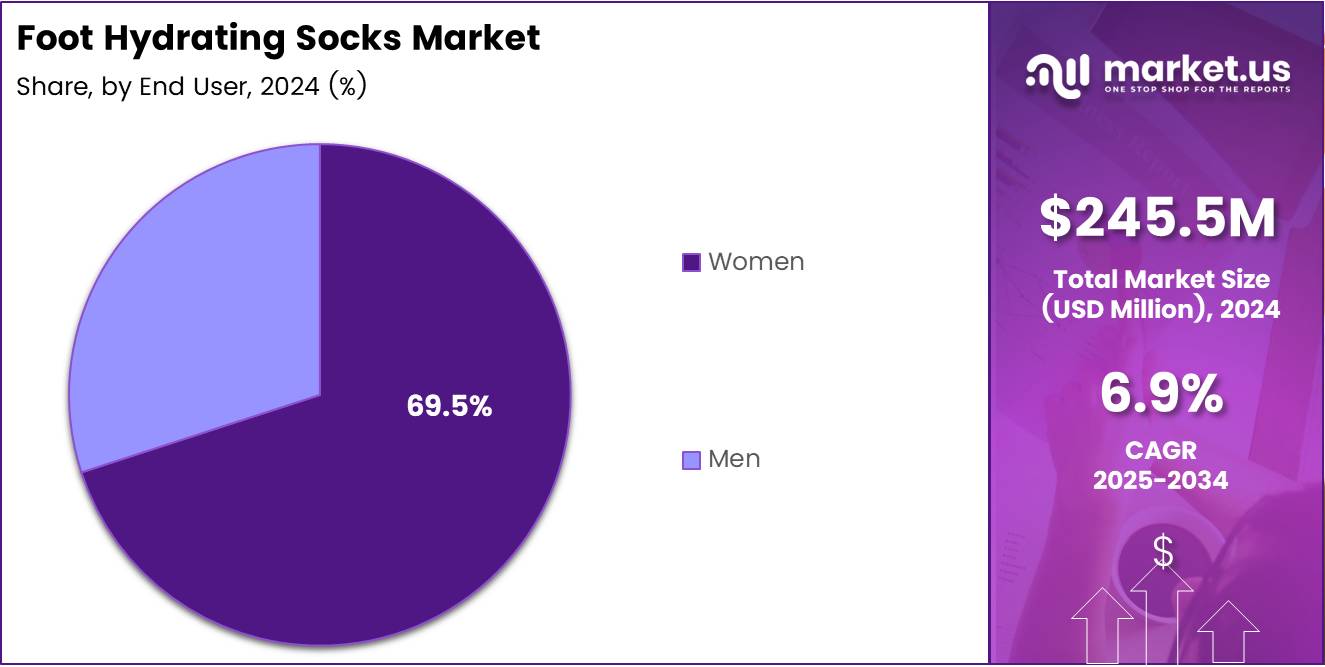

- Women represent 69.5% of End User segment

- Retail Stores/Specialty Stores lead Distribution Channel with 32.6% share

By Product Type

Non-Medical segment dominates with 74.7% market share due to widespread consumer adoption for cosmetic and preventive foot care applications.

In 2024, Non-Medical held a dominant market position in the By Product Type segment of Foot Hydrating Socks Market, with a 74.7% share. This segment encompasses consumer-oriented foot care products marketed primarily for cosmetic benefits and general skin hydration. These products are readily accessible through multiple retail channels without requiring medical prescriptions or professional recommendations.

Non-medical variants appeal to health-conscious consumers seeking preventive care solutions. They feature moisturizing ingredients like shea butter, vitamin E, and essential oils infused into textile structures. Marketing strategies emphasize relaxation, self-pampering, and aesthetic foot appearance improvements rather than therapeutic claims.

The Medical segment serves clinical applications targeting specific dermatological conditions and diabetic foot complications. These products undergo rigorous testing and often require healthcare provider recommendations. Medical-grade formulations incorporate pharmaceutical ingredients designed to treat severe dryness, ulcer prevention, and compromised skin barrier restoration.

Healthcare institutions increasingly adopt medical variants as complementary therapies for patients with circulation issues. Reimbursement policies in certain markets support medical foot care product usage. However, higher price points and distribution limitations through pharmacies and clinics constrain mass market penetration compared to non-medical alternatives.

By Socks Length

Full Length/Knee Length socks capture 49.9% market share due to comprehensive coverage and enhanced moisture retention capabilities.

In 2024, Full Length/Knee Length held a dominant market position in the By Socks Length segment of Foot Hydrating Socks Market, with a 49.9% share. These extended designs provide complete foot and lower leg coverage, maximizing treatment surface area. The additional length prevents moisture loss and maintains consistent skin contact throughout wear duration.

Consumers prefer full-length options for overnight treatments when extended wear maximizes ingredient absorption. The design prevents slipping during sleep and protects bedding from residual moisturizers. Cold weather markets particularly favor longer lengths as they combine hydration benefits with thermal comfort properties.

Ankle Length variants offer convenient alternatives for daytime use and warmer climates. These shorter designs accommodate various footwear types and appeal to consumers seeking targeted heel and sole treatment. The compact format suits travel scenarios and enables discreet wear under regular clothing.

Others category includes specialized formats like toe separators, heel-only sleeves, and open-toe designs. These niche products address specific foot concerns such as bunions, heel fissures, or toe spacing issues. Innovation within this segment drives product differentiation as manufacturers develop anatomically targeted solutions.

By End User

Women dominate with 69.5% market share driven by higher beauty and personal care product engagement.

In 2024, Women held a dominant market position in the By End User segment of Foot Hydrating Socks Market, with a 69.5% share. Female consumers demonstrate greater propensity toward skincare routines extending beyond facial applications. Cultural norms around appearance standards and footwear choices motivate proactive foot care maintenance among women.

Women’s market dominance reflects higher beauty product expenditure patterns and receptiveness to self-care innovations. Marketing campaigns predominantly target female demographics through beauty influencers and wellness platforms. Seasonal factors like sandal season drive purchase spikes as women prepare for open-toed footwear visibility.

Men represent an emerging growth segment as male grooming attitudes evolve globally. Athletic men prioritize foot health for sports performance and recovery. Professional men in formal footwear recognize foot care importance for comfort and hygiene. However, traditional masculinity norms and limited product awareness constrain faster adoption rates.

Male-focused product development remains nascent, with most offerings utilizing gender-neutral packaging and marketing. Brands increasingly recognize untapped potential in men’s segment through targeted messaging emphasizing performance, functionality, and preventive health rather than cosmetic benefits.

By Distribution Channel

Retail Stores/Specialty Stores lead with 32.6% share through personalized service and product education advantages.

In 2024, Retail Stores/Specialty Stores held a dominant market position in the By Distribution Channel segment of Foot Hydrating Socks Market, with a 32.6% share. These establishments offer curated product selections with knowledgeable staff providing application guidance. Beauty specialty retailers and foot care boutiques create experiential shopping environments that build consumer confidence in product efficacy.

Specialty channels excel at demonstrating product features and recommending appropriate variants for specific conditions. In-store promotions and sampling programs enable trial before purchase. Premium positioning in specialty retail validates product quality perceptions and justifies higher price points compared to mass-market alternatives.

Supermarkets/Hypermarkets provide mass-market accessibility and convenience for impulse purchases. These channels stock entry-level products at competitive prices, capturing price-sensitive consumers. High foot traffic and strategic placement near hosiery or personal care sections drive visibility and trial among mainstream shoppers.

Pharmacies & Clinics serve health-conscious consumers seeking trusted recommendations for therapeutic applications. Pharmacist consultations add credibility, particularly for medical-grade variants. Proximity to healthcare settings positions these products as preventive care solutions rather than purely cosmetic items.

Online channels experience rapid growth through digital-first brands and subscription models. E-commerce eliminates geographic barriers and enables discrete purchasing for self-conscious consumers. Detailed product information, user reviews, and educational content support informed decision-making. Direct-to-consumer models offer better margins and customer relationship management.

Others category includes direct sales, television shopping networks, and institutional bulk purchases. Corporate wellness programs and spa facilities represent emerging distribution opportunities. Hotel amenity kits and travel retail provide category exposure to new consumer segments.

Key Market Segments

By Product Type

- Non-Medical

- Medical

By Socks Length

- Full Length/Knee Length

- Ankle Length

- Others

By End User

- Women

- Men

By Distribution Channel

- Retail Stores/Specialty Stores

- Supermarkets/Hypermarkets

- Pharmacies & Clinics

- Online

- Others

Drivers

Rising Consumer Focus on At-Home Wellness and Preventive Foot Care Drives Market Expansion

Growing prevalence of cracked heels, dry feet, and skin barrier disorders affects consumers across all demographic groups. Modern lifestyles involving prolonged standing, restrictive footwear, and environmental stressors compromise foot skin integrity. Consequently, consumers increasingly seek accessible solutions addressing these widespread concerns without requiring professional intervention.

The consumer shift toward at-home foot care and spa-style personal wellness routines fundamentally transforms purchase behavior. Busy professionals value convenient treatments fitting seamlessly into daily schedules. Home-based foot care eliminates appointment scheduling and travel time while delivering comparable results to salon services at reduced costs.

Heightened awareness of foot hygiene among diabetic and elderly populations creates sustained demand for preventive care products. Healthcare providers recommend regular foot maintenance to prevent complications like ulcers and infections. Aging demographics prioritize mobility preservation through proactive foot health management.

E-commerce and direct-to-consumer beauty platform expansion dramatically improves product accessibility across geographic markets. Digital channels provide extensive product information, usage tutorials, and peer reviews that traditional retail cannot match. Subscription models ensure consistent usage patterns while offering convenience and cost savings.

Restraints

Limited Reusability and Alternative Product Availability Constrain Market Growth

Short product lifespan and limited reusability significantly impact consumer perceived value propositions. Most hydrating socks function as single-use or limited-use items requiring frequent replacement. This consumption pattern creates higher long-term costs compared to conventional moisturizers, potentially deterring budget-conscious consumers from sustained purchasing.

Disposable format concerns align with growing environmental consciousness among consumers globally. Single-use personal care products face increasing scrutiny regarding sustainability and waste generation. While some manufacturers develop reusable alternatives, many consumers remain unaware of these options or perceive them as less effective.

Extensive availability of alternative foot care solutions creates competitive pressure on hydrating sock adoption. Traditional moisturizing creams, foot masks, and professional pedicure services offer established approaches to foot care. Many consumers default to familiar products rather than experimenting with newer textile-based delivery systems.

Professional salon treatments provide comprehensive foot care addressing multiple concerns simultaneously. Pedicures combine exfoliation, moisturizing, and aesthetic enhancements through experienced practitioners. The experiential and social aspects of salon visits appeal to consumers seeking indulgent self-care occasions beyond functional product application.

Growth Factors

Innovation and Demographic Expansion Create Significant Growth Opportunities

Product innovation incorporating infused botanicals, CBD, and dermatologically tested formulations attracts quality-conscious consumers. Advanced ingredient science delivers enhanced efficacy while addressing safety concerns through clinical validation. Premium positioning enables margin expansion as consumers willingly pay higher prices for proven performance and sophisticated formulations.

Rising demand for eco-friendly, reusable, and biodegradable foot care textiles aligns with sustainability megatrends. Manufacturers developing washable, multi-use designs reduce environmental impact while improving cost-effectiveness. Sustainable material sourcing and packaging innovations appeal to environmentally conscious demographics driving purchase decisions.

Increasing male grooming adoption substantially expands addressable consumer bases beyond traditional female demographics. Younger men particularly embrace comprehensive personal care routines including specialized foot treatments. Sports enthusiasts and professionals recognize foot health importance for performance and comfort, creating distinct male-oriented market segments.

Growth of private-label foot care brands through online and pharmacy channels intensifies competition while expanding category awareness. Retailer-branded products offer value-oriented alternatives increasing trial rates among price-sensitive consumers. Private-label success validates market potential, encouraging additional investment and innovation across the competitive landscape.

Emerging Trends

Technology Integration and Premium Positioning Shape Market Evolution

Integration of gel-lined and silicone-based moisture-locking sock technologies represents significant technical advancement. These materials create occlusive barriers preventing moisture evaporation while maintaining skin comfort during extended wear. Enhanced efficacy through technology integration justifies premium pricing and differentiates products in crowded marketplaces.

Rising popularity of overnight and intensive repair foot treatment formats addresses consumer demand for time-efficient solutions. Sleep-time application maximizes ingredient absorption without interfering with daily activities. Intensive treatment positioning appeals to consumers seeking rapid results for special occasions or persistent conditions.

Influencer-driven marketing and social media visibility dramatically increase foot care routine awareness among younger demographics. Beauty influencers demonstrate application techniques and share before-after results, building credibility through authentic user experiences. Viral content creation drives discovery and trial among digitally native consumer segments.

Premiumization through spa-grade, anti-aging, and medical-grade positioning elevates category perceptions beyond basic moisturizing. High-end formulations incorporate advanced peptides, retinol, and professional-strength ingredients. Luxury packaging and limited-edition collaborations create aspirational appeal while expanding price tier options across diverse consumer segments.

Regional Analysis

North America Dominates the Foot Hydrating Socks Market with 43.80% Market Share, Valued at USD 107.5 Million

North America leads the global market with a commanding 43.80% share, representing USD 107.5 Million in revenue. This dominance stems from high disposable incomes, strong self-care culture, and mature beauty retail infrastructure. American consumers demonstrate early adoption of innovative personal care products, driving demand for specialized foot treatments. Extensive e-commerce penetration and influencer marketing reach accelerate product awareness and trial rates across diverse demographics.

Europe Foot Hydrating Socks Market Trends

Europe represents a significant market characterized by premium product preferences and sustainability consciousness. Western European consumers prioritize dermatologically tested formulations and eco-friendly packaging. Pharmacy channels play crucial distribution roles, particularly in markets with strong natural health traditions. Aging populations drive demand for therapeutic variants addressing age-related foot concerns.

Asia Pacific Foot Hydrating Socks Market Trends

Asia Pacific demonstrates fastest growth potential fueled by rising middle-class affluence and K-beauty influence. Korean and Japanese innovations in textile technology and ingredient formulations lead regional development. Growing awareness of foot aesthetics and increasing adoption of Western beauty routines expand market opportunities. E-commerce dominance in China and India enables rapid brand scaling and consumer education.

Latin America Foot Hydrating Socks Market Trends

Latin America shows emerging interest driven by beauty consciousness and expanding middle classes. Brazil leads regional consumption with strong personal care engagement across all categories. Distribution challenges in rural areas limit penetration, while urban centers demonstrate growing acceptance. Price sensitivity requires value-oriented positioning and smaller pack sizes.

Middle East and Africa Foot Hydrating Socks Market Trends

Middle East and Africa represent nascent markets with untapped potential in affluent urban segments. Gulf countries show receptiveness to premium international brands through modern retail channels. Africa faces infrastructure and affordability barriers limiting mass-market penetration. Cultural factors and climate considerations influence product format preferences and seasonal demand patterns.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Foot Hydrating Socks Company Insights

The global Foot Hydrating Socks Market in 2024 features diverse players ranging from established personal care brands to specialized foot care innovators. Market leadership reflects capabilities in formulation science, distribution reach, and brand building across consumer segments.

Beauty Pro leverages its sheet mask expertise to develop textile-based foot treatments with proven skincare ingredient delivery systems. The company’s Asian heritage and beauty technology focus position it competitively in premium segments seeking effective, spa-quality solutions.

Bliss brings established spa brand credentials and beauty retail relationships to the foot care category. Its wellness-oriented positioning and accessible premium pricing attract mainstream consumers seeking elevated self-care experiences at home.

Cariloha differentiates through bamboo textile innovation, appealing to eco-conscious consumers prioritizing sustainable materials. The brand’s natural fiber focus and comfort-oriented messaging create distinct positioning in environmentally aware market segments.

Dr. Scholl’s commands significant market presence through foot care category expertise and medical credibility spanning decades. Its pharmacy distribution strength and therapeutic positioning particularly resonate with health-focused consumers and aging demographics seeking trusted solutions.

These leading players invest continuously in product innovation, incorporating advanced moisturizing technologies and addressing evolving consumer preferences. Strategic partnerships with retailers and influencers expand market reach while educational initiatives build category awareness. The competitive landscape remains dynamic as new entrants introduce novel formulations and direct-to-consumer brands disrupt traditional distribution models. Established companies leverage brand recognition and distribution scale, while emerging players compete through innovation, sustainability positioning, and digital marketing prowess.

Key Companies

- Beauty Pro

- Bliss

- Cariloha

- Dr. Scholl’s

- Earth Therapeutics

- Moisture Jamzz

- NatraCure

- Others

Recent Developments

- In October 2025, Curél (Kao Corporation) announced the launch of “Curel Boosting Heel Care Socks, expanding its dermatological skincare portfolio into specialized foot care textile solutions addressing dry and compromised heel skin conditions.

- In January 2025, Siren, a US medical tech company, secured USD 9.5 million in funding, led by an USD 8 million strategic investment from Mölnlycke Health Care to further development and adoption of its temperature-sensing diabetic foot ulcer prevention socks and associated care solutions.

- In November 2025, ZenToes Moisturizing Socks were featured in a retail promotion where clinical trial data showed 93% of users reported improvement in dry heels, highlighting consumer traction and product performance in foot hydration and cracked heel relief.

- In June 2025, ZenToes introduced next-generation compression socks in multiple styles including Basic, Anti-Slip, and Gel versions, representing product innovation in the foot care and comfort sock segment.

Report Scope

Report Features Description Market Value (2024) USD 245.5 Million Forecast Revenue (2034) USD 478.4 Million CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Non-Medical, Medical), By Socks Length (Full Length/Knee Length, Ankle Length, Others), By End User (Women, Men), By Distribution Channel (Retail Stores/Specialty Stores, Supermarkets/Hypermarkets, Pharmacies & Clinics, Online, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Beauty Pro, Bliss, Cariloha, Dr. Scholl’s, Earth Therapeutics, Moisture Jamzz, NatraCure, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Foot Hydrating Socks MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Foot Hydrating Socks MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Beauty Pro

- Bliss

- Cariloha

- Dr. Scholl's

- Earth Therapeutics

- Moisture Jamzz

- NatraCure

- Others