Global Food Allergen Testing Market Size, Share Analysis Report By Source (Peanut And Soy, Wheat, Milk, Egg, Tree Nuts, Seafood, Others), By Technology (Polymerase Chain Reaction, Immunoassay-based /ELISA, Others), By Food Tested (Bakery And Confectionery, Infant Food, Processed Foods, Dairy Products And Alternatives, Seafood And Meat Products, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173707

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

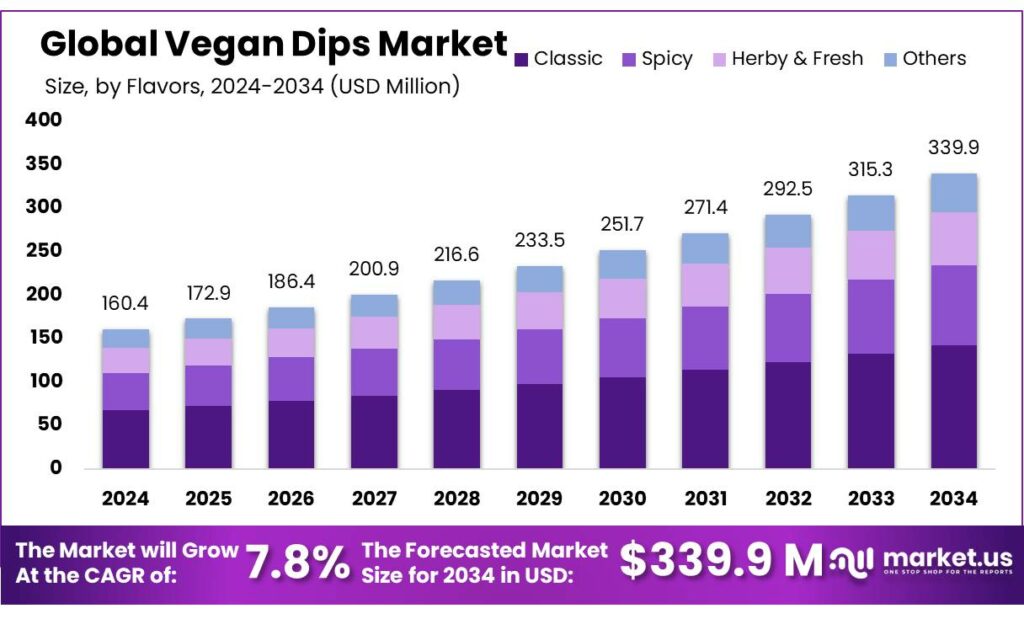

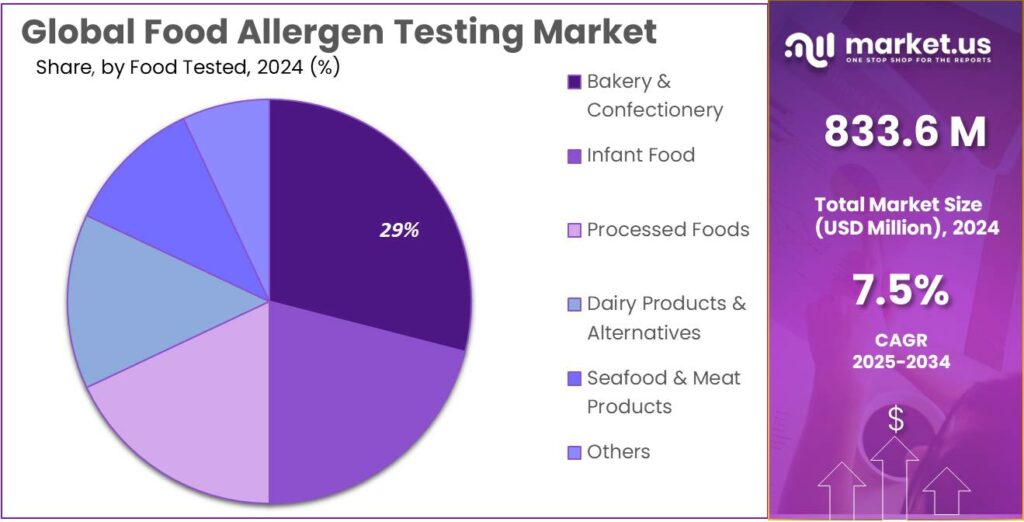

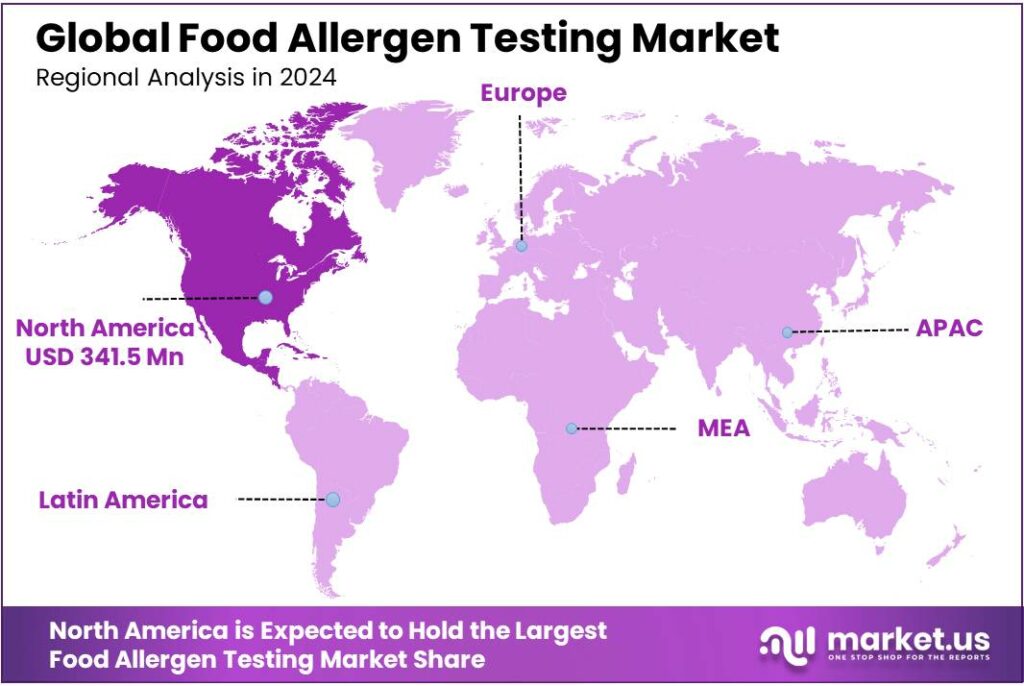

Global Food Allergen Testing Market size is expected to be worth around USD 1717 Million by 2034, from USD 833 Million in 2024, growing at a CAGR of 7.5% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 41.9% share, holding USD 341.5 Million in revenue.

Food allergen testing sits at the intersection of public health risk management and modern food manufacturing controls. Demand is anchored in the scale of food hypersensitivity and the high consequence of labeling errors. In the UK, a Food Standards Agency (FSA) clinical assessment estimated around 6% of adults have a clinically confirmed food allergy—about 2.4 million people—while more than 30% of adults reported some form of adverse reaction to foods before clinical confirmation work narrowed outcomes.

The industrial scenario is shaped heavily by regulation and enforcement. In the United States, the Food Allergen Labeling and Consumer Protection Act (FALCPA) established 8 “major” allergens and states those 8 foods/food groups account for about 90% of food allergies. More recently, the FDA’s implementation of the FASTER Act made sesame the 9th major allergen that must be declared on labels as of January 1, 2023.

A major demand driver is that undeclared allergens remain a persistent compliance risk. FDA notes that, in Reportable Food Registry (RFR) data from September 2009 to September 2014, about one-third of foods reported as serious health risks involved undeclared allergens. In the FDA’s RFR Fifth Annual Report, undeclared allergen reports rose from 30% of reports in Year 1 to 47% in Year 5—evidence that allergen hazards can dominate incident reporting even as companies invest in controls.

Risk and recall dynamics further accelerate adoption. FDA notes that, in reports submitted to its Reportable Food Registry, about one-third of foods reported as serious health risks from September 2009 to September 2014 involved undeclared allergens. Risk and recall dynamics further accelerate adoption. FDA notes that, in reports submitted to its Reportable Food Registry, about one-third of foods reported as serious health risks from September 2009 to September 2014 involved undeclared allergens.

Key Takeaways

- Food Allergen Testing Market size is expected to be worth around USD 1717 Million by 2034, from USD 833 Million in 2024, growing at a CAGR of 7.5%.

- Milk held a dominant market position, capturing more than a 32.7% share.

- Immunoassay-based / ELISA held a dominant market position, capturing more than a 67.8% share.

- Bakery & Confectionery held a dominant market position, capturing more than a 29.4% share.

- North America remained the dominating region in the global food allergen testing market in 2024, capturing approximately 41.9% of total revenue and reaching an estimated USD 341.5 million.

By Source Analysis

Milk leads food allergen testing with a 32.7% share, driven by strict labeling rules and high consumer sensitivity

In 2024, Milk held a dominant market position, capturing more than a 32.7% share, as it remained one of the most common and closely monitored food allergens worldwide. High prevalence of milk allergies, especially among infants and young children, increased routine testing across dairy products, infant formula, bakery items, and processed foods. Regulatory bodies continued to require clear allergen labeling, which supported consistent demand for milk allergen detection in food manufacturing.

In 2025, testing activity related to milk allergens remained strong, supported by growing production of packaged foods and rising awareness of cross-contamination risks during processing. Food producers increasingly relied on regular milk allergen testing to maintain compliance, ensure consumer safety, and protect brand trust. Overall, milk continued to lead this segment due to its widespread use in food formulations and the critical need for accurate allergen control.

By Technology Analysis

Immunoassay-based / ELISA leads food allergen testing with a 67.8% share, supported by accuracy and routine use

In 2024, Immunoassay-based / ELISA held a dominant market position, capturing more than a 67.8% share, as it remained the most widely used technology for detecting food allergens across testing laboratories and food processing facilities. The method was preferred due to its high sensitivity, reliability, and ability to deliver clear results for commonly regulated allergens. ELISA testing was also cost-effective and suitable for routine, large-volume screening, which supported its adoption by food manufacturers of all sizes.

In 2025, demand for ELISA-based allergen testing continued to remain strong, supported by strict food safety regulations and the need for regular compliance testing. The technology also benefited from standardized testing protocols and ease of use, allowing consistent results across different food matrices. Overall, Immunoassay-based / ELISA maintained its leadership position due to its proven performance, wide acceptance, and critical role in ensuring food safety.

By Food Tested Analysis

Bakery and confectionery lead food allergen testing with a 29.4% share, driven by complex ingredient use

In 2024, Bakery & Confectionery held a dominant market position, capturing more than a 29.4% share, as these products commonly contain multiple allergenic ingredients such as milk, eggs, nuts, and gluten. Frequent formulation changes, seasonal product launches, and high production volumes increased the need for regular allergen testing in this segment. Manufacturers focused heavily on preventing cross-contamination during mixing, baking, and packaging stages to meet strict food safety requirements.

In 2025, demand for allergen testing in bakery and confectionery products remained strong, supported by rising consumption of packaged baked goods and premium confectionery items. Clear labeling expectations and consumer sensitivity to allergen risks further reinforced testing frequency. Overall, this segment maintained its leading position due to its complex processing environment and high regulatory scrutiny.

Key Market Segments

By Source

- Peanut & Soy

- Wheat

- Milk

- Egg

- Tree Nuts

- Seafood

- Others

By Technology

- Polymerase Chain Reaction

- Immunoassay-based /ELISA

- Others

By Food Tested

- Bakery & Confectionery

- Infant Food

- Processed Foods

- Dairy Products & Alternatives

- Seafood & Meat Products

- Others

Emerging Trends

Risk-Based Thresholds Are Reshaping Allergen Testing

In September 2024, the World Health Organization published an “In brief” document on food allergen reference doses (RfDs). WHO describes these RfDs as risk-based, derived from global data, and meeting the criterion of “exposure without appreciable health risk.” WHO also links this directly to helping manage unexpected/unintended allergen presence and supporting implementation of the Codex Code of Practice on Food Allergen Management for Food Business Operators (CXC 80-2020).

At the same time, changing allergen rules are increasing the need for routine verification—another part of this trend. In the United States, sesame is now the 9th major food allergen, and the FDA notes that sesame must be labeled on packaged foods and dietary supplements as of January 1, 2023. Adding a new “major allergen” is not just a label change; it forces companies to revisit supplier specifications, label checks, sanitation validation, and finished-product release criteria—especially for bakeries and snack lines where sesame can be common.

This trend is also shaped by the scale of the consumer problem. FAO has reported that food allergies affect about 220 million people worldwide. When that many consumers depend on accurate information, food businesses face pressure to make allergen controls measurable. In the EU, for example, allergen communication is built around a defined list of 14 substances/products that must be declared, which keeps verification and label accuracy high on the factory priority list.

Drivers

Undeclared Allergen Risk Keeps Forcing Testing Adoption

One major driver for food allergen testing is simple: undeclared allergens keep showing up as a serious, repeat problem in real supply chains, and companies cannot afford the health risk or the recall shock. The U.S. FDA points out that, from September 2009 to September 2014, about one-third of foods reported through the Reportable Food Registry (RFR) as serious health risks involved undeclared allergens.

This risk picture is reinforced by the FDA’s own RFR reporting trends. In the FDA’s Reportable Food Registry Fifth Annual Report, undeclared allergen reports grew from 30% of reports in Year 1 to 47% in Year 5. That kind of climb matters to quality teams because it signals that allergen control failures are not rare edge cases. It also tells retailers and auditors that allergen programs need proof, not promises.

Regulation and government-led safety expectations push this driver even harder. Under the U.S. Food Safety Modernization Act, the FDA’s Preventive Controls for Human Food rule became final in September 2015, requiring facilities to have a food safety plan with hazard analysis and risk-based preventive controls. The current federal regulation at 21 CFR Part 117 states that facilities must permit adequate precautions to reduce the potential for allergen cross-contact.

Global trade adds another layer of pressure. In the European Union, food information rules require clear allergen communication for 14 substances/products that must be declared, which raises the bar for label accuracy and cross-contact control across factories and suppliers.

Restraints

Voluntary “May Contain” Labels Limit Clear Testing Decisions

Real-world surveys show why this becomes a practical brake on the value of testing. The UK Food Standards Agency (FSA) ran a survey comparing advisory labels with measured allergen presence in processed foods. It found notable cases where no allergen was detected, yet products still carried an advisory warning: gluten 19% (97/509), milk 18% (77/435), hazelnut 44% (427/959), and peanut 45% (430/948). From an industry viewpoint, this creates a tough commercial reality: if a label is used “just in case,” testing does not always lead to removing that warning, because the decision is often driven by legal caution, supplier uncertainty, or plant complexity rather than the latest test batch.

The same FSA work also flagged the opposite risk: cases where an allergen was detectable even though it was not an intentional ingredient, and the product carried no advisory label—gluten 3.3% (18/542) and milk 2.1% (10/474) were reported, while hazelnut 0% (0/988) and peanut 0% (0/950) in the sampled sets. For food businesses, this points to two expensive problems at once.

Over-warning reduces the usefulness of labels and can shrink the market for allergic consumers; under-warning raises the risk of incidents and recalls. In both situations, quality teams may end up increasing testing frequency, widening allergen panels, or adding confirmatory methods—raising cost and complexity—yet still struggling to make clean, defensible labelling calls.

Government and international bodies are trying to close this gap, but the transition itself is a restraint because it takes time to turn science into widely adopted practice. WHO’s “In brief” publication on food allergen reference doses (published 19 September 2024) describes risk-based “reference doses” intended to help manage unintended allergen presence in a more consistent way. FAO similarly highlights that reference doses and threshold work are part of building better, more reliable precautionary labelling approaches.

Opportunity

Risk-Based Allergen Thresholds Can Make Testing Smarter

In September 2024, the World Health Organization published an “In brief” note on food allergen reference doses (RfDs). These RfDs are described as risk-based values derived from global data, intended to represent exposure “without appreciable health risk,” and they are specifically positioned as tools to help manage unexpected/unintended allergen presence in foods. In the same message, WHO links the idea directly to implementation of the Codex Code of Practice on Food Allergen Management for Food Business Operators (CXC 80-2020).

FAO published its own “In brief” on food allergen reference doses on 18 September 2024, describing how reference doses are recommended through risk assessment for priority allergens. That combination—WHO and FAO both pushing reference dose thinking—creates an opening for laboratories and rapid-test suppliers to design programs that are easier for manufacturers to defend: routine screening plus confirmatory methods, tied to a risk framework that auditors and regulators can understand. In simple terms, factories can move closer to “measure, compare, decide,” instead of “measure, debate, and still keep the warning label.”

This opportunity is amplified by the reality that allergen rules are not identical everywhere. In the European Union, food information law requires clear consumer information for 14 allergen categories listed in Annex II of Regulation (EU) No 1169/2011. In the United States, sesame is now the 9th major food allergen, and the FDA notes it must be labeled on packaged foods and dietary supplements as of January 1, 2023.

As more organizations adopt risk-based thinking, the best growth is likely to come from “right-sized” testing that reduces waste and improves trust. For example, plants can use rapid swab tests during sanitation changeovers to confirm cleaning is working, then use lab methods for periodic verification and investigations. Under a reference-dose approach, the same results can be interpreted with more consistency, helping businesses decide when a precautionary label is truly needed and when controls are strong enough to avoid blanket warnings.

Regional Insights

North America leads the food allergen testing market with a 41.9% share, valued at USD 341.5 million in 2024

North America remained the dominating region in the global food allergen testing market in 2024, capturing approximately 41.9% of total revenue and reaching an estimated USD 341.5 million in market value. The region’s leadership was supported by a combination of strict food safety regulations, heightened consumer awareness of allergen risks, and well-established testing infrastructure across the United States and Canada.

Regulatory frameworks such as the Food Allergen Labeling and Consumer Protection Act (FALCPA) in the U.S. mandated clear identification of major allergens in food products, driving widespread adoption of analytical allergen testing among food manufacturers and third-party laboratories to ensure compliance and consumer safety. Market growth in 2024 was particularly strong across segments such as milk, wheat, peanut and tree nut allergen detection, which are prevalent in a broad range of processed foods and bakery products that require rigorous testing protocols.

Consumer sensitivities and an increasing incidence of diagnosed food allergies further reinforced the demand for reliable detection methods, including immunoassay-based and PCR-based technologies that deliver precise results for routine monitoring. In 2025, the North American market continued its growth trajectory, supported by ongoing updates to regulatory standards and an expanding food processing sector that prioritises allergen risk management.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Eurofins Scientific SE is a global leader in food and bioanalytical testing services, offering allergen detection, quality verification, and safety analysis through an extensive network of laboratories. In 2024, the group employed approximately 63,000 people across over 900 labs in 62 countries, providing more than 200,000 analytical methods used in food safety and allergen testing to support manufacturers and regulators worldwide.

Intertek Group PLC is a UK-based assurance, testing and certification firm with a strong footprint in the food safety and allergen testing market. In 2024, Intertek generated revenue of £3,393.2 million and maintained a global workforce of approximately 40,000 employees, delivering microbiological, chemical, and allergen testing services via more than 1,000 laboratories across nearly 100 countries.

Bureau Veritas SA is a French testing, inspection, and certification group providing comprehensive food safety and allergen testing solutions to global food producers. In 2024, the company reported revenue of about USD 6.34 billion and operated with 79,000 employees across more than 1,500 offices and labs in 140 countries, supporting food quality and compliance initiatives.

Top Key Players Outlook

- Eurofins Scientific SE

- SGS SA

- Intertek Group PLC

- Bureau Veritas SA

- ALS Limited

- Mérieux NutriSciences

- Neogen Corporation

- Microbac Laboratories Inc.

- Romer Labs Division GmbH

- R-Biopharm AG

Recent Industry Developments

Although Bureau Veritas announced the divestment of its food testing business during the transition to 2025, the company’s legacy in allergen and food safety testing contributed significantly to its service portfolio prior to this transition, with the food testing unit generating approximately EUR 133 million in revenue in 2023 before divestment activities continued in 2024 and early 2025.

Intertek, headquartered in London, reported total revenue of £3,393.2 million in 2024, supported by operations in more than 1,000 laboratories and inspection offices worldwide and a global workforce of around 40,000 employees, which underpins its broad service capacity.

Report Scope

Report Features Description Market Value (2024) USD 833 Mn Forecast Revenue (2034) USD 1717 Mn CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Peanut And Soy, Wheat, Milk, Egg, Tree Nuts, Seafood, Others), By Technology (Polymerase Chain Reaction, Immunoassay-based /ELISA, Others), By Food Tested (Bakery And Confectionery, Infant Food, Processed Foods, Dairy Products And Alternatives, Seafood And Meat Products, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Eurofins Scientific SE, SGS SA, Intertek Group PLC, Bureau Veritas SA, ALS Limited, Mérieux NutriSciences, Neogen Corporation, Microbac Laboratories Inc., Romer Labs Division GmbH, R-Biopharm AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Food Allergen Testing MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Food Allergen Testing MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Eurofins Scientific SE

- SGS SA

- Intertek Group PLC

- Bureau Veritas SA

- ALS Limited

- Mérieux NutriSciences

- Neogen Corporation

- Microbac Laboratories Inc.

- Romer Labs Division GmbH

- R-Biopharm AG