Global Fluoroelastomer Market Size, Share, And Business Benefits By Type (Fluorocarbon, Fluorosilicone, Perfluoroelastomers), By Product (O-Rings, Seals and Hoses, Gaskets, Others), By End-use (Automotive, Aerospace, Chemicals, Oil and Gas, Energy and Power, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 159093

- Number of Pages: 256

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

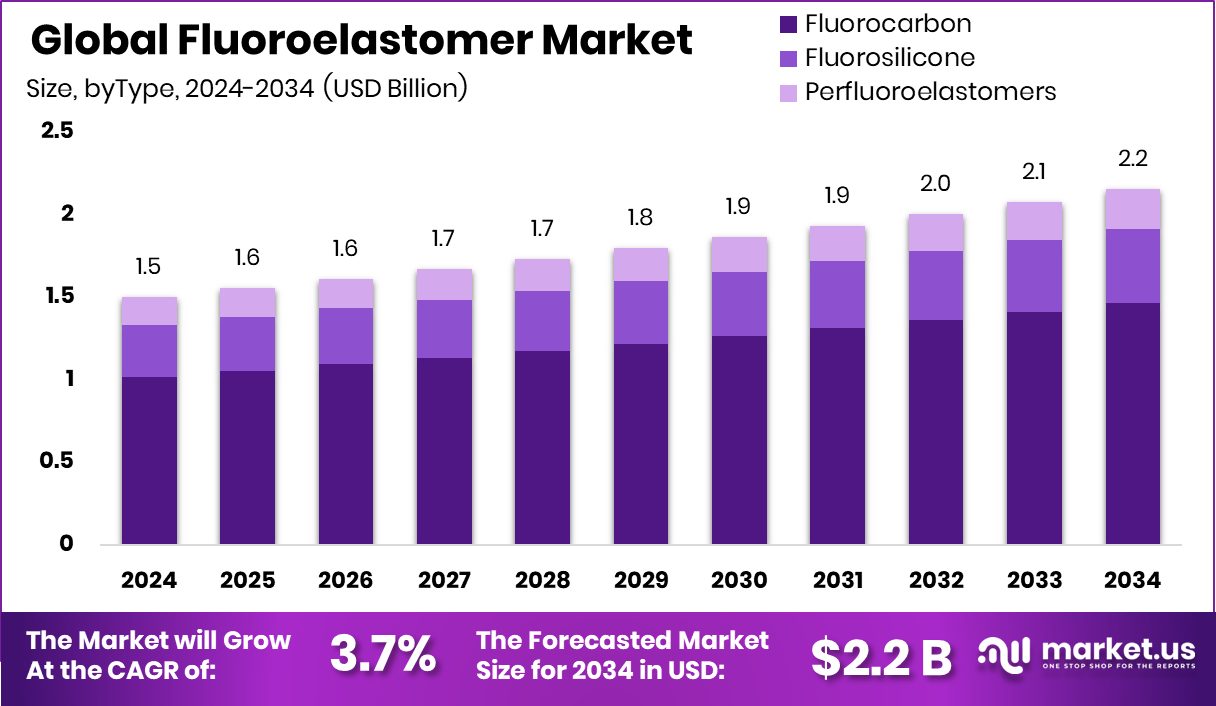

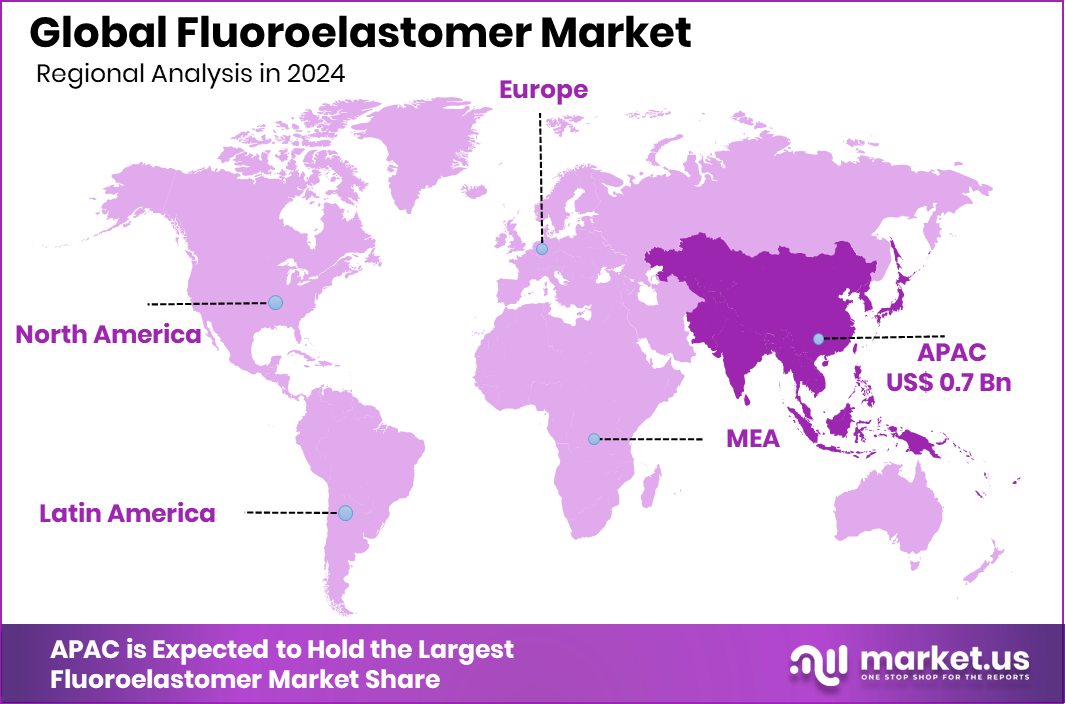

The Global Fluoroelastomer Market is expected to be worth around USD 2.2 billion by 2034, up from USD 1.5 billion in 2024, and is projected to grow at a CAGR of 3.7% from 2025 to 2034. Rising industrial applications in the Asia Pacific supported growth, capturing 46.90% of the USD 0.7 Bn market.

Fluoroelastomer is a type of synthetic rubber designed to withstand extreme conditions such as high temperatures, aggressive chemicals, and fuels. It is widely used in sealing applications, gaskets, O-rings, and hoses across industries like automotive, aerospace, oil & gas, and chemical processing due to its excellent resistance to heat, oils, and corrosive substances. This material provides durability and reliability where conventional rubbers fail, making it a critical choice for high-performance environments.

The fluoroelastomer market represents the global trade and usage of these advanced rubber materials across multiple sectors. Its demand is directly linked to industrial applications that require long-lasting sealing performance and safety standards. Growth in automobile production, aerospace advancements, and expansion in chemical industries are some of the major factors that keep this market strong and steadily expanding.

One of the key growth factors is the rising need for heat- and chemical-resistant sealing materials in the automotive sector, especially as engines and fuel systems become more advanced and operate at higher temperatures. This has pushed manufacturers to adopt fluoroelastomers to ensure performance and safety.

Demand is further fueled by industries such as oil & gas and chemical processing, where equipment is constantly exposed to harsh fluids and extreme pressure. The ability of fluoroelastomers to extend equipment life and reduce downtime drives steady adoption. Oura, the sleep-tracking smart ring company, has crossed the milestone of raising over $20 million in funding. Meanwhile, Sky Labs, known for developing ring-shaped blood pressure monitoring devices, secured $15 million through its Series C funding round.

Key Takeaways

- The Global Fluoroelastomer Market is expected to be worth around USD 2.2 billion by 2034, up from USD 1.5 billion in 2024, and is projected to grow at a CAGR of 3.7% from 2025 to 2034.

- By type, the fluoroelastomer market is dominated by fluorocarbon, holding 67.8% global share.

- By product, O-rings lead the fluoroelastomer market, accounting for 44.3% of total demand.

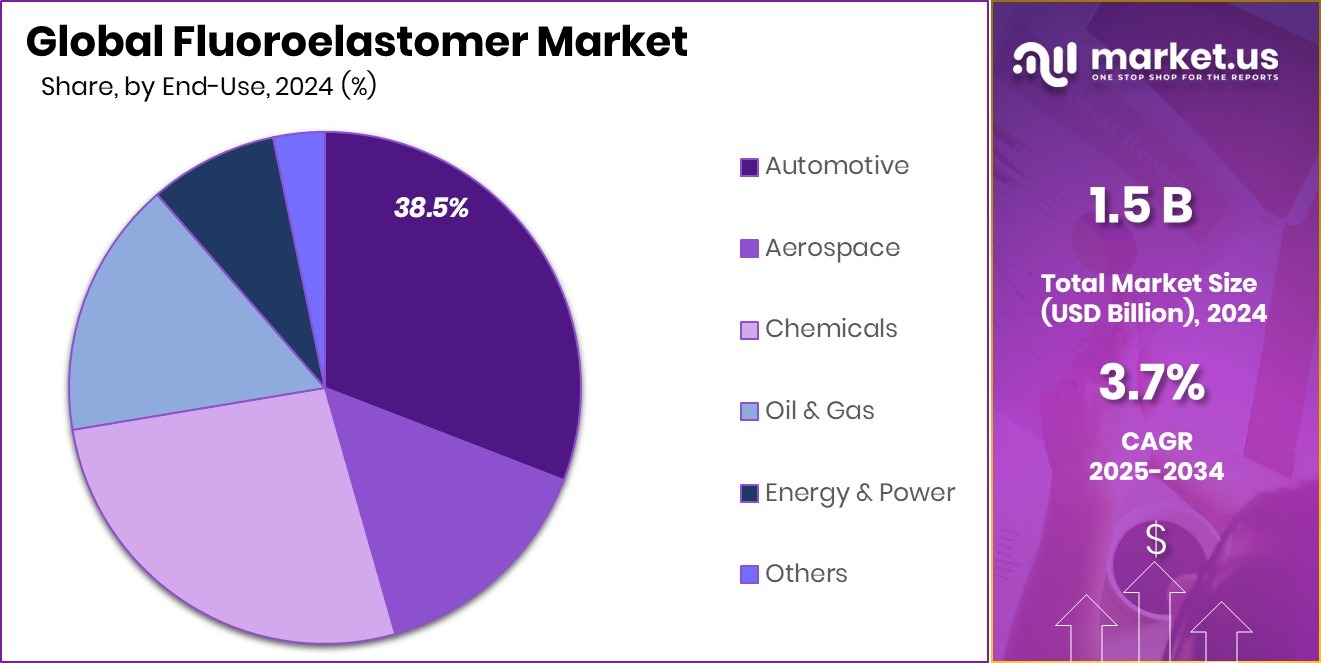

- By end-use, the automotive sector drives the fluoroelastomer market, contributing 38.5% of overall consumption.

- Asia Pacific’s strong demand contributed significantly, with the Fluoroelastomer Market reaching USD 0.7 Bn.

By Type Analysis

By type, fluorocarbon dominates the fluoroelastomer market with a 67.8% share.

In 2024, Fluorocarbon held a dominant market position in the By Type segment of the Fluoroelastomer Market, with a 67.8% share. This segment’s strong presence is driven by its exceptional resistance to high temperatures, fuels, and aggressive chemicals, making it the preferred choice for critical sealing applications across industries such as automotive, aerospace, and chemical processing. The widespread adoption of fluorocarbons is supported by their durability and reliability, which help reduce maintenance costs and equipment downtime.

Growing industrialization and rising demand for high-performance sealing solutions further strengthen this segment’s market position, positioning Fluorocarbon as a key contributor to the overall growth of the Fluoroelastomer Market.

By Product Analysis

O-rings lead the fluoroelastomer market by product segment at 44.3%.

In 2024, O-Rings held a dominant market position in the By Product segment of the Fluoroelastomer Market, with a 44.3% share. This strong performance is attributed to their critical role in providing reliable sealing solutions in high-temperature and chemically aggressive environments, particularly in automotive, aerospace, and industrial machinery applications.

O-rings made from fluoroelastomer materials offer excellent resistance to fuels, oils, and corrosive chemicals, ensuring long-term durability and reducing maintenance requirements. The rising need for efficient and leak-proof sealing components across various industries continues to drive the adoption of O-rings. Their versatility and high-performance characteristics make them a cornerstone product within the Fluoroelastomer Market, contributing significantly to overall market growth.

By End-use Analysis

Automotive is the top end-use in the fluoroelastomer market at 38.5%.

In 2024, Automotive held a dominant market position in the by-end-use segment of the Fluoroelastomer Market, with a 38.5% share. The segment’s leadership is driven by the growing demand for high-performance sealing solutions in engines, fuel systems, and transmission components that operate under extreme temperatures and chemical exposure.

Fluoroelastomer materials offer exceptional resistance to oils, fuels, and harsh environmental conditions, making them ideal for critical automotive applications. Increasing vehicle production, stricter emission regulations, and the push for enhanced engine efficiency are further boosting the adoption of fluoroelastomer-based components. The automotive sector’s continuous need for durable and reliable sealing solutions reinforces its dominant position and sustains significant growth in the overall Fluoroelastomer Market.

Key Market Segments

By Type

- Fluorocarbon

- Fluorosilicone

- Perfluoroelastomers

By Product

- O-Rings

- Seals and Hoses

- Gaskets

- Others

By End-use

- Automotive

- Aerospace

- Chemicals

- Oil and Gas

- Energy and Power

- Others

Driving Factors

Government Funding Accelerates Fluoroelastomer Innovation

Government funding plays a pivotal role in advancing the development and application of fluoroelastomers. In the United States, agencies like the Department of Energy (DOE) and the Environmental Protection Agency (EPA) have allocated substantial resources to support research in advanced materials, including fluoroelastomers. For instance, the DOE’s Advanced Materials and Manufacturing Technologies Office (AMMTO) has invested in projects aimed at enhancing the performance and sustainability of materials used in various industries.

Similarly, the EPA has provided research grants focused on understanding and mitigating the environmental impact of per- and polyfluoroalkyl substances (PFAS), which are integral components of fluoroelastomers. These funding initiatives not only foster innovation but also ensure that fluoroelastomers meet stringent environmental and performance standards, thereby driving their adoption across sectors such as automotive, aerospace, and chemical processing.

Restraining Factors

High Production Costs Limit Fluoroelastomer Adoption

A significant challenge facing the fluoroelastomer market is the high production costs associated with these materials. The complex manufacturing processes, specialized equipment, and the need for fluorine-based raw materials contribute to the elevated expenses. These high costs can limit the adoption of fluoroelastomers, particularly in industries where cost-efficiency is a priority.

While government funding has been directed towards research and development to improve the performance and environmental footprint of fluoroelastomers, it has not substantially addressed the underlying cost issues. This financial barrier hinders the widespread use of fluoroelastomers in applications where alternative materials might offer more economical solutions. Therefore, overcoming these high production costs is essential for expanding the market reach of fluoroelastomers.

Growth Opportunity

Government Funding Fuels Fluoroelastomer Research Advancements

Government funding significantly drives innovation in the fluoroelastomer market, particularly in research and development. In the United States, agencies like the Environmental Protection Agency (EPA) and the National Institute of Environmental Health Sciences (NIEHS) have allocated substantial resources to study per- and polyfluoroalkyl substances (PFAS), which are integral components of fluoroelastomers. For instance, the EPA has awarded over $15 million in grants to institutions researching PFAS exposure reduction in agriculture.

Similarly, the NIEHS funds PFAS research through its Superfund Research Program, supporting universities and small businesses. These funding initiatives not only enhance the performance and environmental safety of fluoroelastomers but also open new avenues for their application in various industries. As governments continue to invest in such research, the fluoroelastomer market is poised for growth, driven by innovations that meet both industrial demands and environmental standards.

Latest Trends

Government Funding Accelerates Fluoroelastomer Innovation

Government funding plays a pivotal role in advancing the development and application of fluoroelastomers. In the United States, agencies like the Department of Energy (DOE) and the Environmental Protection Agency (EPA) have allocated substantial resources to support research in advanced materials, including fluoroelastomers. For instance, the DOE’s Advanced Materials and Manufacturing Technologies Office (AMMTO) has invested in projects aimed at enhancing the performance and sustainability of materials used in various industries.

Similarly, the EPA has provided research grants focused on understanding and mitigating the environmental impact of per- and polyfluoroalkyl substances (PFAS), which are integral components of fluoroelastomers. These funding initiatives not only foster innovation but also ensure that fluoroelastomers meet stringent environmental and performance standards, thereby driving their adoption across sectors such as automotive, aerospace, and chemical processing.

Regional Analysis

In 2024, the Asia Pacific held 46.90% of the Fluoroelastomer Market, valued at USD 0.7 Bn.

In 2024, the Fluoroelastomer Market in the Asia Pacific emerged as the dominant region, capturing a 46.90% share, valued at USD 0.7 Bn. The region’s leadership is primarily driven by rapid industrialization, expansion in automotive manufacturing, and increasing demand for high-performance sealing solutions in the chemical and oil & gas industries.

Countries like China, Japan, and India are investing heavily in advanced material technologies, further boosting the adoption of fluoroelastomers for critical applications such as O-rings, gaskets, and hoses. Government initiatives supporting advanced manufacturing and industrial innovation have also encouraged the development and use of fluoroelastomer-based components, ensuring improved durability and performance in extreme operating conditions.

Meanwhile, other regions including North America, Europe, the Middle East & Africa, and Latin America are showing steady growth as industries increasingly require heat- and chemical-resistant sealing solutions. While these regions are yet to surpass the Asia Pacific in market share, they are gradually expanding their production and application capacities, especially in the automotive and chemical processing sectors.

Overall, Asia Pacific’s strong industrial base, technological advancements, and supportive government policies reinforce its dominant position in the global Fluoroelastomer Market, driving both current growth and long-term opportunities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, The Chemours Company reported annual revenue of $5.78 billion, a decrease from $6.08 billion in 2023. Despite this decline, Chemours remains a significant player in the fluoroelastomer market, particularly known for its Viton™ brand of fluoroelastomers. The company continues to focus on innovation and expanding its product offerings to meet the evolving demands of industries such as automotive, aerospace, and chemical processing.

DAIKIN INDUSTRIES, Ltd. achieved record net sales and operating profits in fiscal year 2024, surpassing the previous year’s performance. Solvay reported underlying net sales of €4.686 billion in 2024, a 4.0% decrease compared to 2023. This growth underscores Daikin’s strong position in the fluoroelastomer market, driven by its advanced manufacturing capabilities and a robust portfolio of high-performance materials. The company’s commitment to research and development ensures its continued leadership in providing innovative solutions to meet the stringent requirements of various industries.

Solvay reported underlying net sales of €4.686 billion in 2024, a 4.0% decrease compared to 2023. Despite this decline, Solvay remains a key player in the fluoroelastomer market, focusing on cost-saving initiatives and operational efficiencies to maintain competitiveness. The company’s strategic investments in research and development aim to enhance its product offerings and cater to the growing demand for high-performance materials across various sectors.

Top Key Players in the Market

- The Chemours Company

- DAIKIN INDUSTRIES, Ltd.

- Solvay

- 3M

- Shin-Etsu Chemical Co., Ltd.

- AGC Inc.

- Gujarat Fluorochemicals Limited (GFL)

- DuPont

- Swastik

- Eagle Elastomer Inc

- Zhejiang Funolin Chemical New Materials Co., Ltd.

Recent Developments

- In April 2025, Shin-Etsu Chemical revealed an investment of approximately ¥83 billion (about $545 million) in a new factory located in Gunma Prefecture, Japan. The facility will focus on producing lithography materials essential for semiconductor manufacturing, including photoresists and photomask blanks. This investment underscores Shin-Etsu’s commitment to strengthening its position in the semiconductor materials market and supporting the growing demand for advanced chip technologies

- In April 2024, Chemours announced the launch of Viton™ FWRD APA fluoroelastomers, a new grade produced using a non-fluorinated surfactant. This innovation aligns with evolving environmental regulations while maintaining the high-performance characteristics essential for demanding applications in automotive, aerospace, oil & gas, and semiconductor industries.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Billion Forecast Revenue (2034) USD 2.2 Billion CAGR (2025-2034) 3.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Fluorocarbon, Fluorosilicone, Perfluoroelastomers), By Product (O-Rings, Seals and Hoses, Gaskets, Others), By End-use (Automotive, Aerospace, Chemicals, Oil and Gas, Energy and Power, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape The Chemours Company, DAIKIN INDUSTRIES, Ltd., Solvay, 3M, Shin-Etsu Chemical Co., Ltd., AGC Inc., Gujarat Fluorochemicals Limited (GFL), DuPont, Swastik, Eagle Elastomer Inc, Zhejiang Funolin Chemical New Materials Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fluoroelastomer MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Fluoroelastomer MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- The Chemours Company

- DAIKIN INDUSTRIES, Ltd.

- Solvay

- 3M

- Shin-Etsu Chemical Co., Ltd.

- AGC Inc.

- Gujarat Fluorochemicals Limited (GFL)

- DuPont

- Swastik

- Eagle Elastomer Inc

- Zhejiang Funolin Chemical New Materials Co., Ltd.