Global Flower Box Market Size, Share, Growth Analysis By Material (Paper & Paperboard, Plastic, Fabrics, Wooden, Bamboo, Recycled Plastic, Others), By Finish (Matte Lamination, Gloss Lamination, Varnishing, Embossing, Hot Stamping), By End Use (Institutional, Residential, Commercial), By Distribution Channel (Retail Stores, Supermarkets, Florist, Online Sales, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166522

- Number of Pages: 235

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

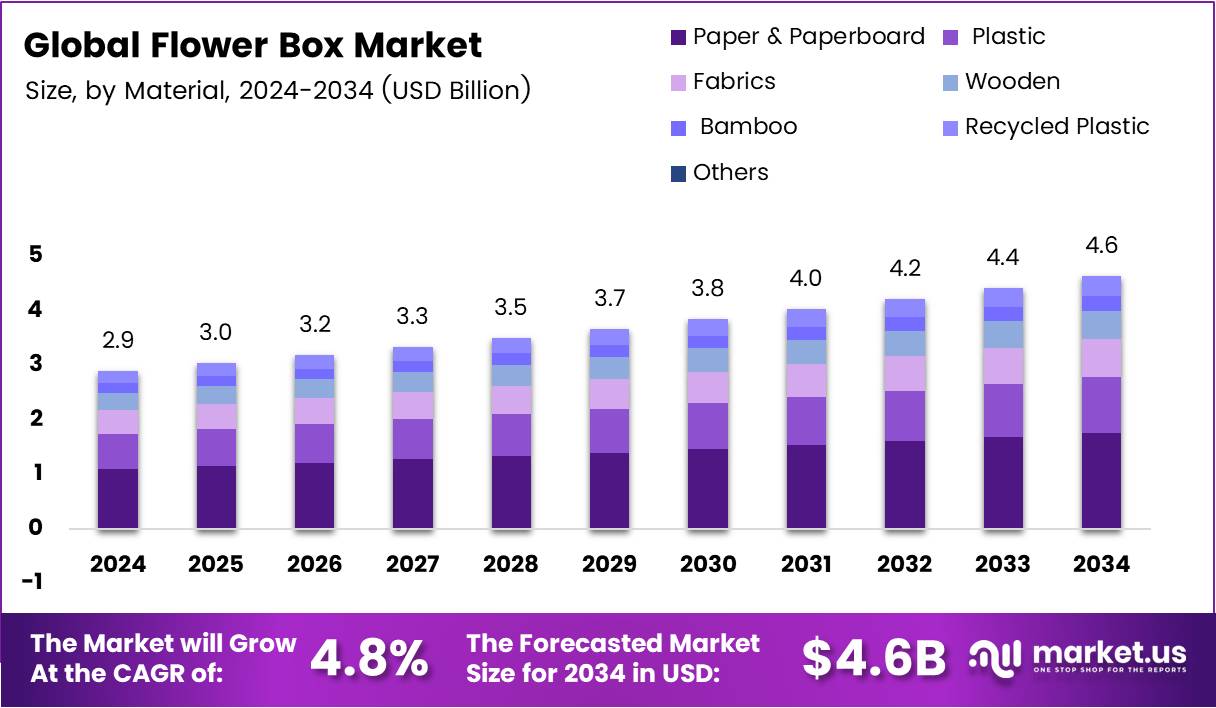

The Global Flower Box Market size is expected to be worth around USD 4.6 Billion by 2034, from USD 2.9 Billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034.

The Flower Box Market represents a growing niche within floral gifting, combining curated arrangements with premium packaging to elevate consumer experience. Moreover, rising demand for personalized décor and sustainable packaging solutions encourages brands to innovate. Consequently, businesses increasingly adopt flower boxes to enhance gifting value, aesthetic appeal, and market differentiation.

A Flower Box is a modern floral presentation format that uses rigid, decorative containers to maintain freshness and visual elegance. Additionally, it appeals to consumers seeking convenience and luxury. Therefore, retailers leverage flower boxes to expand product lines, attract younger buyers, and support premium pricing in competitive floral markets.

Analysts observe consistent growth as consumers shift toward experiential and visually appealing gifts. Furthermore, digitalization boosts online floral subscriptions and curated box delivery services. As a result, the Flower Box Market benefits from lifestyle trends emphasizing home décor enhancement, personalized gifting, and eco-friendly packaging made from recycled materials or biodegradable options.

Market opportunities continue expanding as businesses introduce smart watering systems, keepsake containers, and long-lasting preserved flowers. Additionally, demand strengthens in corporate gifting, hospitality décor, and event styling. Consequently, vendors that adopt unique textures, seasonal assortments, and customization features capture higher engagement, strengthening brand loyalty and increasing repeat purchase potential.

Government investment in agriculture, sustainability, and logistics infrastructure indirectly supports flower box suppliers by stabilizing supply chains. Moreover, regulations promoting environmentally friendly packaging encourage producers to adopt recyclable materials. Thus, companies aligning with green compliance strengthen market positioning while meeting consumer expectations for ethical sourcing and responsible product development.

Growth prospects further improve due to rising urban gifting culture and e-commerce expansion. Additionally, improved cold-chain networks support freshness retention within flower boxes, enhancing product quality. Therefore, manufacturers and retailers gain room to scale operations, optimize distribution efficiency, and serve increasing demand across metropolitan and emerging suburban markets.

According to a national consumer survey, 60% of Americans believe a flower gift carries special meaning unlike other gifts, reinforcing emotional value within the Flower Box Market. Similarly, according to another survey, Americans purchase 10 million cut flowers daily, generating US$6.43 billion in floriculture sales and US$171 per-capita spending in 2021.

Key Takeaways

- The Global Flower Box Market is projected to reach USD 4.6 Billion by 2034, up from USD 2.9 Billion in 2024, at a 4.8% CAGR.

- Paper & Paperboard leads the material segment with a 38.1% market share in 2024.

- Matte Lamination dominates the finish segment with a 32.8% share in 2024.

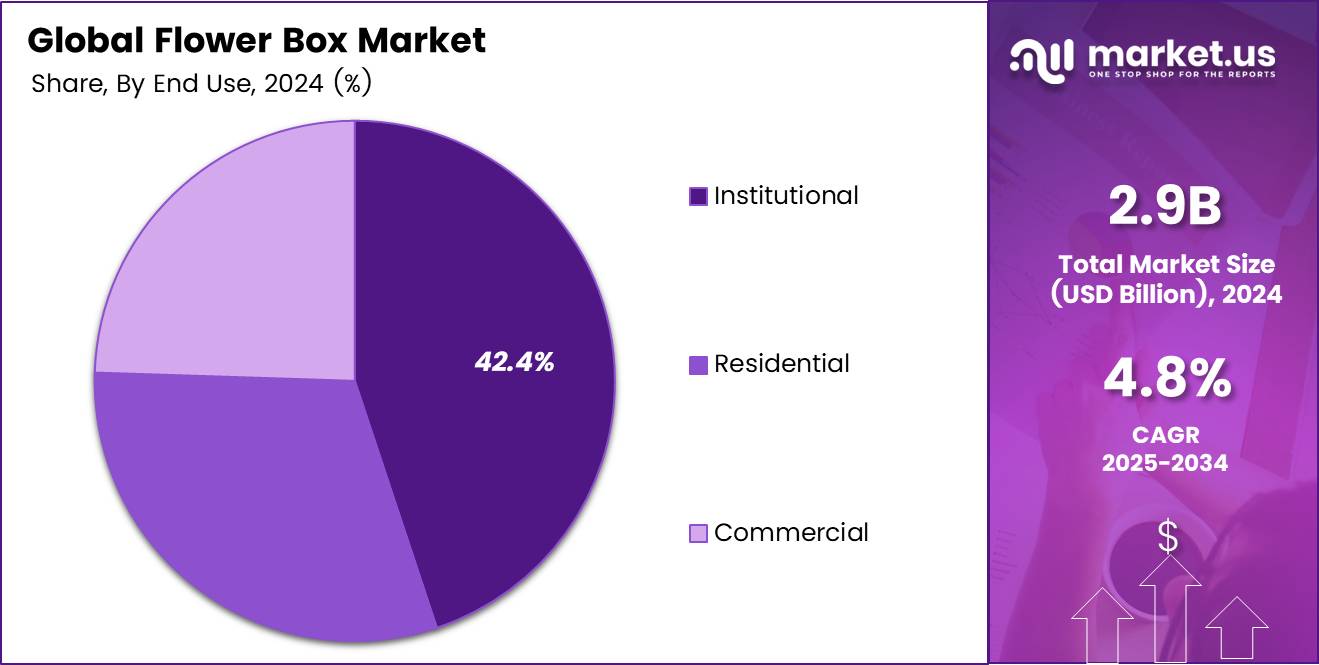

- The Institutional end-use segment holds the largest share at 42.4% in 2024.

- Retail Stores lead the distribution channel with a 32.2% market share in 2024.

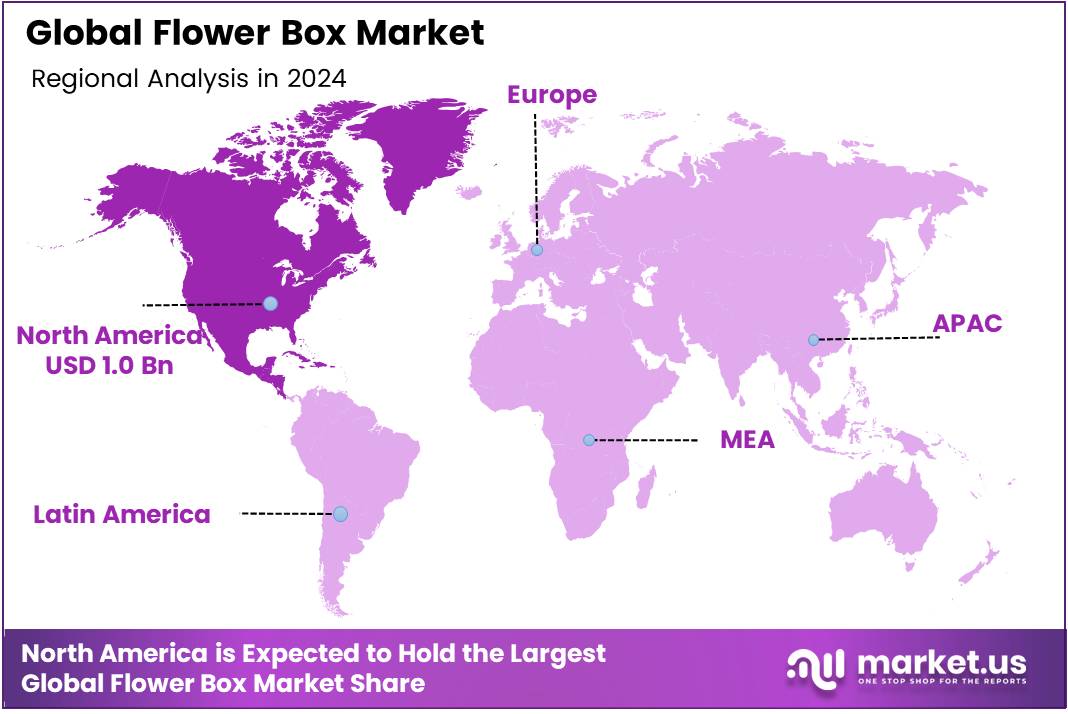

- North America holds the highest regional share at 34.9%, valued at USD 1.0 Billion.

By Material Analysis

Paper & Paperboard dominates with 38.1% due to its eco-friendly appeal and versatile structural strength.

In 2024, Paper & Paperboard held a dominant market position in the By Material segment of the Flower Box Market, with a 38.1% share. This segment advances sustainability goals, supports lightweight packaging, and attracts brands seeking recyclable solutions. Its durability and printability further elevate its preference across gifting applications.

Plastic flower boxes continue to grow as they offer strong protection and long-lasting clarity. They transition well into premium floral packaging where transparency, moisture resistance, and structural rigidity are essential, making them reliable for decorative displays and long-distance transport.

Fabrics gain attention as they introduce a premium, handcrafted appearance. They enhance perceived value and support reusable packaging trends. Fabric-based boxes also transition into luxury gifting channels, aligning well with artisanal design preferences.

Wooden options expand steadily as consumers seek rustic aesthetics. Wooden boxes transition into high-end gifts and durable storage uses, providing long-term reusability and strong visual appeal that elevates brand presentation.

Bamboo flower boxes grow as eco-conscious choices rise. Their biodegradable properties and natural texture help brands shift toward renewable materials, strengthening their sustainable identity and consumer trust.

Recycled Plastic advances sustainability goals by reducing waste. These boxes transition into mainstream packaging as recycling technologies improve, helping brands maintain durability while lowering environmental impact.

Others include mixed materials that address niche needs. These options transition into flexible applications, offering customized textures, finishes, and structural variations to meet diverse market preferences.

By Finish Analysis

Matte Lamination dominates with 32.8% due to its elegant texture and premium appearance.

In 2024, Matte Lamination held a dominant market position in the By Finish segment of the Flower Box Market, with a 32.8% share. This finish transitions brands toward sophisticated aesthetics, offering a smooth and refined look that enhances premium floral presentations and gifting experiences.

Gloss Lamination remains popular for its shiny appearance and enhanced vibrancy. It transitions floral packaging into eye-catching retail displays, offering visual depth and improved resistance to scratches while maintaining affordability.

Varnishing grows as a protective and decorative option. It transitions boxes into durable forms by preventing moisture damage and wear. Its flexible application helps brands choose subtle or high-gloss results depending on the design intent.

Embossing strengthens tactile appeal and transitions flower boxes into luxury gift categories. Raised patterns enhance brand recognition and create a distinctive, textured finish that increases perceived value.

Hot Stamping adds metallic brilliance and transitions packaging into premium gifting environments. Gold, silver, and foil accents help elevate brand messaging and deliver an upscale visual identity.

By End Use Analysis

Institutional dominates with 42.4% due to large-scale decorative and event-based demand.

In 2024, Institutional held a dominant market position in the By End Use segment of the Flower Box Market, with a 42.4% share. Institutions transition toward coordinated floral themes for events, hotels, and offices, driving strong demand for elegant, durable, and customizable packaging.

Residential users continue adopting flower boxes for décor and gifting. This segment transitions into lifestyle-driven purchases, where aesthetics, affordability, and ease of handling play crucial roles in consumer decision-making.

Commercial buyers—such as florists and gift boutiques—expand their use of flower boxes for branding. These businesses transition into curated packaging solutions that enhance product value, improve customer experience, and support retail display requirements.

By Distribution Channel Analysis

Retail Stores dominate with 32.2% due to easy accessibility and diverse product displays.

In 2024, Retail Stores held a dominant market position in the By Distribution Channel segment of the Flower Box Market, with a 32.2% share. This channel transitions customer engagement through immediate product visibility, physical evaluation, and impulse purchasing behavior.

Supermarkets expand flower box sales by integrating packaging near floral sections. They transition convenience-based purchases and offer cost-effective options for everyday gifting and décor.

Florists remain a specialized channel. They transition premium designs and customized packaging solutions, helping customers pair flower arrangements with suitable decorative boxes for occasions.

Online Sales grow rapidly by offering wide variety and doorstep convenience. This channel transitions consumer buying habits toward digital exploration, personalized options, and easy price comparisons.

Others include boutiques and pop-up stores. They transition niche customer segments by offering unique designs catering to seasonal or themed events.

Key Market Segments

By Material

- Paper & Paperboard

- Plastic

- Fabrics

- Wooden

- Bamboo

- Recycled Plastic

- Others

By Finish

- Matte Lamination

- Gloss Lamination

- Varnishing

- Embossing

- Hot Stamping

By End Use

- Institutional

- Residential

- Commercial

By Distribution Channel

- Retail Stores

- Supermarkets

- Florist

- Online Sales

- Others

Drivers

Expanding E-Commerce Platforms Enhancing Flower Box Accessibility

The growth of online shopping platforms is making flower boxes easier to buy, helping the market reach more customers. As e-commerce becomes stronger, consumers can compare designs, prices, and delivery options quickly, which boosts overall demand. This wider accessibility also encourages brands to offer more unique and premium flower boxes to attract online shoppers.

Premium aesthetic décor is becoming more popular in homes and events, and flower boxes are benefiting from this trend. People want products that look modern and elegant, and premium floral boxes meet this need with stylish arrangements and high-quality materials. Social media trends also help drive this interest, as customers seek visually appealing décor for celebrations and interior spaces.

Corporations are increasingly using luxury floral arrangements to enhance branding and create a refined impression. Flower boxes used in offices, reception areas, and corporate events add a premium touch to their image. This growing business demand is supporting market expansion and motivating suppliers to offer customized corporate flower box solutions.

Restraints

Limited Shelf Life of Fresh Flowers Reducing Inventory Flexibility

The short life span of fresh flowers creates major challenges for flower box sellers. Because flowers must be used quickly, companies have limited flexibility in managing stock, often leading to higher storage and handling costs. This makes it difficult for businesses to plan inventory efficiently and increases the risk of product losses.

Seasonal supply changes also affect flower availability throughout the year. Certain flowers may be abundant during specific seasons but hard to source during others, leading to inconsistent product options. These fluctuations can make it harder for sellers to maintain stable pricing and fulfill customer expectations. For buyers, this can reduce the reliability of flower box offerings, especially when they seek specific varieties.

Together, short shelf life and seasonal variability create operational constraints for market players. These limitations slow down continuous product availability and force companies to develop better sourcing and stocking strategies to stay competitive.

Growth Factors

Integration of Smart Packaging and Temperature-Control Innovations

The flower box market is gaining new opportunities through the use of smart packaging and temperature-control technologies. These innovations help maintain freshness and extend the life of floral arrangements, making products more appealing to customers. Brands that adopt such solutions can offer higher-quality flower boxes with improved durability, strengthening their competitive position.

Subscription-based flower box services are also emerging as a strong growth area. Consumers enjoy curated monthly or weekly floral deliveries, and this model creates steady revenue for providers. Personalized and themed subscription boxes can further enhance customer loyalty.

Collaborations with event planners present additional opportunities. Exclusive partnerships allow flower box companies to supply décor for weddings, corporate events, and luxury gatherings. These partnerships expand visibility and open doors to new customer groups.

Sustainable packaging is becoming essential as consumers prefer eco-friendly choices. Using recyclable or biodegradable box materials can attract environmentally conscious buyers and support long-term market growth.

Emerging Trends

Increasing Popularity of Preserved and Forever-Flower Box Collections

Preserved and forever-flower boxes are becoming trendy because they last much longer than fresh flowers. Customers value their durability, low maintenance, and premium appearance. These long-lasting arrangements also make flower boxes more suitable for gifting and décor, which increases overall market demand.

Customizable themes and limited-edition designer boxes are further shaping market trends. Consumers enjoy personalizing colors, styles, and packaging to fit special occasions. Designer collaborations add exclusivity and help brands stand out in a competitive marketplace.

Urban customers now expect faster delivery, including same-day or hyperlocal services. This demand pushes flower box companies to improve logistics and partner with rapid-delivery providers. Faster service increases customer satisfaction and encourages impulse purchases.

Together, these trends reflect shifting consumer preferences toward long-lasting, customizable, and fast-delivered flower box solutions, driving continuous market evolution.

Regional Analysis

North America Dominates the Flower Box Market with a Market Share of 34.9%, Valued at USD 1.0 Billion

North America leads the global flower box market, capturing 34.9% of the total share with a valuation of USD 1.0 Billion. The region benefits from high consumer spending on premium floral décor, strong demand in gifting applications, and the rapid adoption of sustainable packaging formats. Additionally, well-established e-commerce channels and customization trends support continued growth across residential and commercial users.

Europe Flower Box Market Trends

Europe exhibits steady growth driven by rising interest in eco-friendly and artisanal floral presentation solutions. Increasing urbanization and a robust hospitality sector contribute to consistent demand for decorative and luxury flower boxes. The region also benefits from a strong culture of floral gifting, particularly during seasonal and cultural celebrations.

Asia Pacific Flower Box Market Trends

Asia Pacific is one of the fastest-growing regions, supported by expanding retail landscapes and rising disposable incomes. Growing popularity of event decoration, premium gifting, and lifestyle-driven floral purchases fuels market expansion. Increased online retail penetration and innovative packaging formats further enhance regional opportunities.

Middle East & Africa Flower Box Market Trends

The Middle East & Africa market shows gradual growth, driven by rising consumer inclination toward luxury floral arrangements and premium presentation formats. The region’s flourishing hospitality and event-management industries boost demand for high-end flower boxes. Moreover, increasing adoption of modern gifting trends supports market development across urban centers.

Latin America Flower Box Market Trends

Latin America experiences moderate growth as consumer appreciation for stylish and durable floral packaging continues to increase. Expanding floral export activities and the rise of boutique floral studios drive the adoption of decorative flower boxes. Moreover, growing digital retail platforms are making premium floral products more accessible across the region.

U.S. Flower Box Market Trends

The U.S. market remains a key contributor within North America, driven by strong demand for premium gifting, event décor, and personalized floral presentations. High consumer preference for sustainable and customizable packaging formats fuels innovation among manufacturers. The presence of a well-developed e-commerce ecosystem further supports sustained market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Flower Box Company Insights

DS Smith plc continues to strengthen its position in the flower box market through its focus on sustainable, fiber-based packaging solutions. Its broad global presence and commitment to recyclable materials support rising demand for eco-friendly floral packaging, especially in e-commerce and premium gifting applications. The company’s design capabilities and innovation pipeline further reinforce its competitive edge.

Smurfit Kappa Group plc brings strong technical expertise to the flower box segment with durable, customizable, and fully paper-based packaging solutions. Their emphasis on high-quality structural design and enhanced unboxing experiences aligns with the growing preference for value-added floral packaging. With significant global reach and advanced production capabilities, the company is well positioned to influence market direction in 2024.

the Packaging Pro. offers tailored premium packaging, making it a notable participant in the niche luxury flower-box segment. Their strength lies in rapid customization, premium finishes, and brand-focused packaging solutions that appeal to boutique florists and high-end gifting brands. This specialization allows them to capture a distinct share of customers seeking elevated presentation.

Fleur Box focuses specifically on bespoke flower boxes, delivering high levels of customization and aesthetic appeal. Their product offerings cater to customers prioritizing design, material quality, and presentation, particularly within the luxury floral gifting segment. Although smaller in scale, their targeted strategy positions them well within a market where personalization and premium quality drive purchasing decisions.

Top Key Players in the Market

- DS Smith plc

- Smurfit Kappa Group plc

- the Packaging Pro.

- Fleur Box

- Packman Packaging Private Limited

- ZEE Packaging

- Packtek

- Guangzhou Huaisheng Packaging Inc., Ltd.

- Dongguan Changfa Craft Packing Product Co., Ltd

- Oyeboxes

Recent Developments

- In March 2024, Family Flowers acquired Colorado-based Palmer Flowers and Paul Wood Florist. This acquisition expanded Family Flowers’ presence and strengthened its portfolio in the Colorado floral market.

- In June 2024, Family Flowers acquired Flowers by Edith in the United States. This move further broadened the company’s retail footprint and enhanced its national floral service offerings.

- In July 2024, MM Flowers acquired Dutch horticultural business Moolenaar. The acquisition strengthened MM Flowers’ supply chain capabilities and expanded its operations within the European horticulture sector.

- In October 2024, Delaware Valley Floral Group acquired wholesale distributor Zieger & Sons. This acquisition increased the group’s distribution network and boosted its wholesale floral operations across key markets.

Report Scope

Report Features Description Market Value (2024) USD 2.9 Billion Forecast Revenue (2034) USD 4.6 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Paper & Paperboard, Plastic, Fabrics, Wooden, Bamboo, Recycled Plastic, Others), By Finish (Matte Lamination, Gloss Lamination, Varnishing, Embossing, Hot Stamping), By End Use (Institutional, Residential, Commercial), By Distribution Channel (Retail Stores, Supermarkets, Florist, Online Sales, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape DS Smith plc, Smurfit Kappa Group plc, the Packaging Pro., Fleur Box, Packman Packaging Private Limited, ZEE Packaging, Packtek, Guangzhou Huaisheng Packaging Inc., Ltd., Dongguan Changfa Craft Packing Product Co., Ltd, Oyeboxes Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- DS Smith plc

- Smurfit Kappa Group plc

- the Packaging Pro.

- Fleur Box

- Packman Packaging Private Limited

- ZEE Packaging

- Packtek

- Guangzhou Huaisheng Packaging Inc., Ltd.

- Dongguan Changfa Craft Packing Product Co., Ltd

- Oyeboxes