Global Flower-Based Essence Market Size, Share and Report Analysis By Product Form (Liquid, Powder), By Source (Chamomile, Cherry Plum, Bleeding Heart, Gentian, Wild Oat, Aspen, Centaury, Chicory, Crab Apple, Willow), By End User (Fragrance Industry, Food And Beverages, Cosmetics, Pharmaceuticals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 176050

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

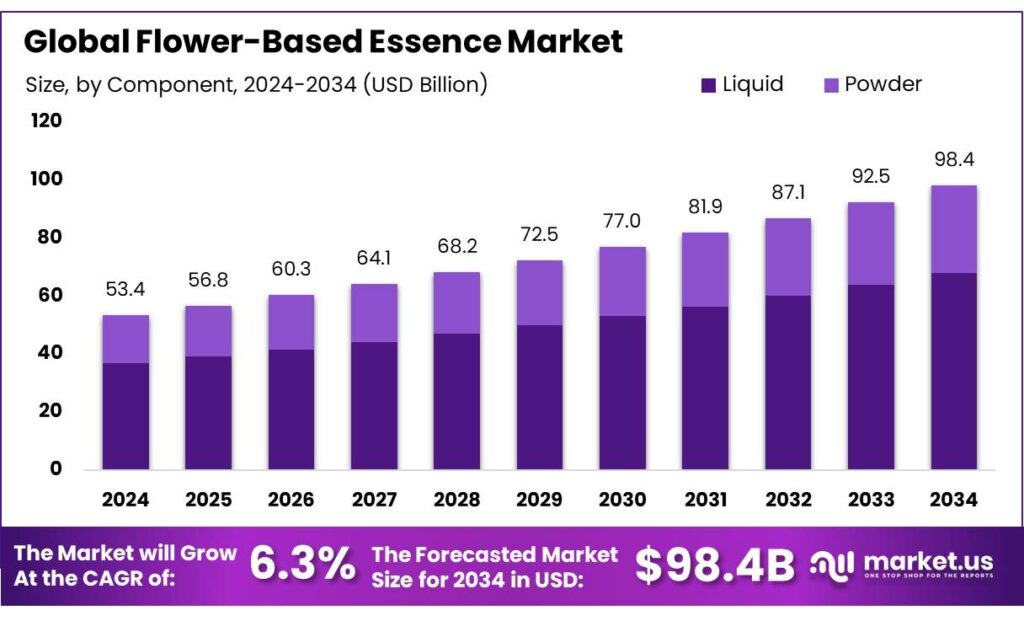

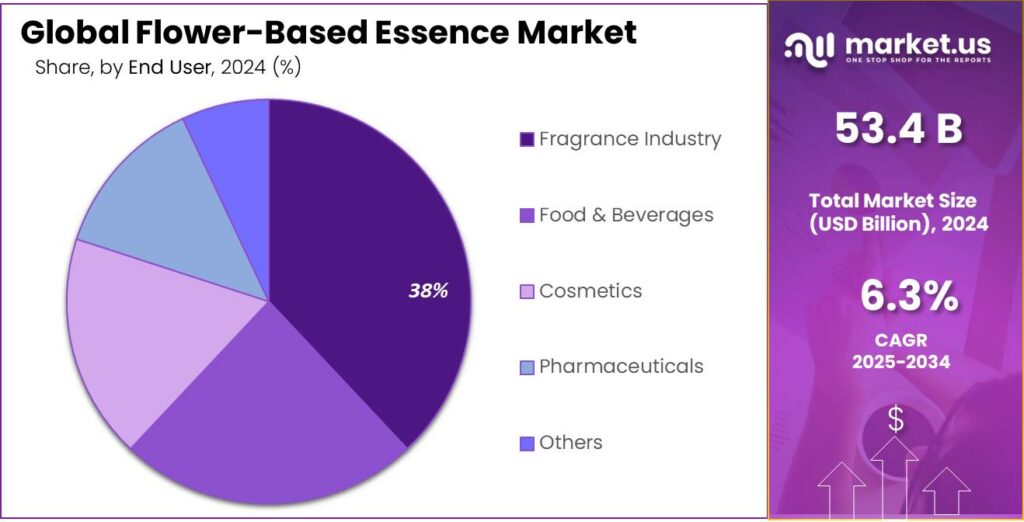

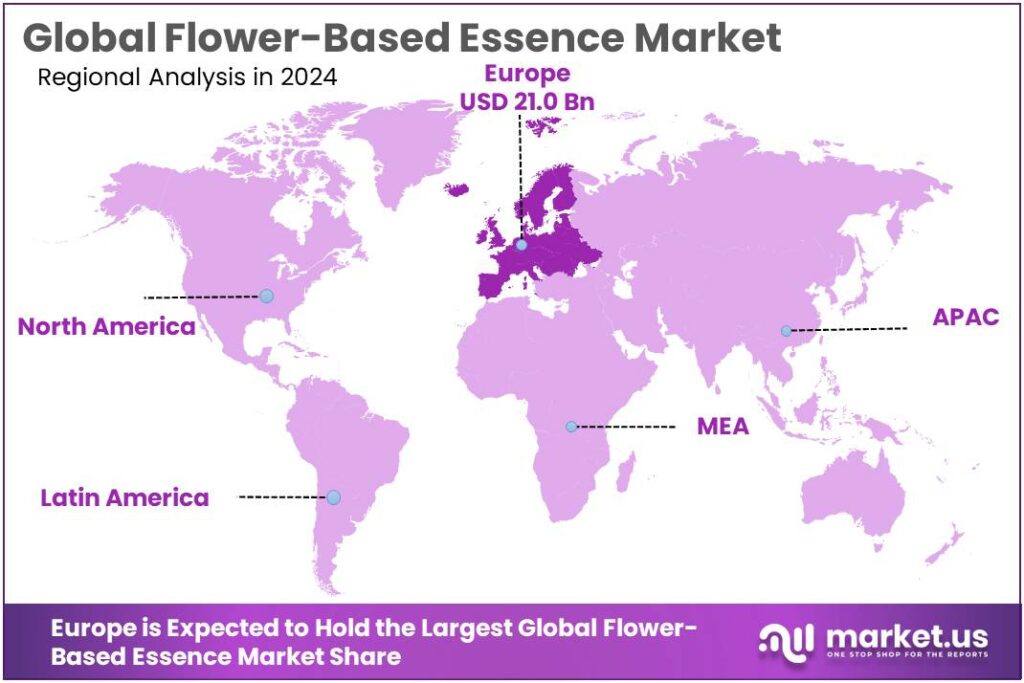

Global Flower-Based Essence Market size is expected to be worth around USD 98.4 Billion by 2034, from USD 53.4 Billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 39.4% share, holding USD 21.0 Billion in revenue.

Flower-based essence in food and beverages refers to edible aromatic concentrates made from flowers such as rose, jasmine, lavender, hibiscus, elderflower, and orange blossom. These essences are used in teas, RTD drinks, dairy, confectionery, bakery, syrups, and “botanical” wellness shots to deliver a recognizable floral top-note without adding bulk ingredients. Regulators also treat them as flavourings/essences: in the U.S., the “natural flavor” definition explicitly includes an “essential oil, oleoresin, essence or extractive” derived from plant materials.

Industrially, flower-based essence demand is supported by the broader essential oils trade and by the professionalization of flavor compliance systems. Global trade in essential oils (HS 3301) reached about $5.75B in 2023, showing that the cross-border supply base for botanical aroma materials is already large and well-established. On the supply side, floriculture remains a sizeable upstream ecosystem; FAO materials have historically estimated world floriculture production value at around $20B, which helps sustain grower networks that can also serve aroma and extraction channels when varieties and quality specs align.

Demand-side drivers are increasingly consumer-led and “ingredient-list visible.” In IFIC’s 2024 Food & Health Survey, 79% of consumers said they consider whether a product is processed when making purchase decisions, signaling why brands lean into recognizable botanical cues and gentle processing narratives. At the category level, the organic market is a strong proxy for willingness to pay for plant-forward positioning: U.S. certified organic sales reached $69.7B in 2023 (up 3.4%), reinforcing a commercial backdrop where natural, botanical flavor systems can command premium placement. In Europe, the EU organic retail market reached €46.5B in 2023, supporting sustained shelf space for “botanical” and “naturally flavored” propositions across beverages and packaged foods.

The operating environment is increasingly compliance-led, which is shaping procurement and documentation. In the EU, Regulation (EC) No 1334/2008 sets the general framework for flavourings used in and on foods, while the Commission notes that the Union list of approved flavouring substances was adopted on 1 October 2012 and is updated over time—pushing suppliers toward stronger traceability and standardized specifications.

Demand pull is closely tied to hot categories where floral notes test well—especially tea, sparkling beverages, and “low/no” alcohol alternatives. Tea is a major volume platform: FAO reports 6.8 million tonnes of world tea production in 2023, with 1.8 million tonnes of total tea imports, showing how large the addressable base is for flower-forward blends. FAO also estimates total tea trade value at around USD 9.2 billion annually, which supports ongoing experimentation in premiumization and differentiated flavour profiles.

Key Takeaways

- Flower-Based Essence Market size is expected to be worth around USD 98.4 Billion by 2034, from USD 53.4 Billion in 2024, growing at a CAGR of 6.3%.

- Liquid flower-based essence held a dominant market position, capturing more than a 69.3% share..

- Chamomile held a dominant market position, capturing more than a 37.9% share in the flower-based essence market.

- Fragrance Industry held a dominant market position, capturing more than a 38.5% share in the flower-based essence market.

- Europe stands out as the dominating region, holding 39.4% of the Flower-Based Essence Market and reaching USD 21.0 Bn.

By Product Form Analysis

Liquid Flower-Based Essence leads with a strong 69.3% market share in 2024, driven by its versatility and wider industrial acceptance.

In 2024, Liquid flower-based essence held a dominant market position, capturing more than a 69.3% share. This strong lead reflects how liquid formats remain the most convenient form for beverage, dairy, confectionery, and bakery manufacturers that require fast-mixing, heat-stable, and dosage-accurate flavour systems. Food processors prefer liquids because they disperse evenly in both hot and cold formulations, allowing consistent aroma release without altering product texture. The year 2024 saw rising adoption across ready-to-drink teas, sparkling botanical beverages, floral syrups, and plant-based yogurts, all of which rely heavily on liquid formats for clean taste and production efficiency.

By Source Analysis

Chamomile leads the category with a strong 37.9% share, supported by its gentle aroma and high consumer trust.

In 2024, Chamomile held a dominant market position, capturing more than a 37.9% share in the flower-based essence market. Its leadership is closely tied to its long-standing use in calming beverages, herbal teas, and soothing wellness formulations. Manufacturers prefer chamomile because it offers a mild, universally accepted floral profile that blends smoothly into drinks, confectionery, and personal-care-inspired food products. The year 2024 saw a noticeable rise in demand as consumers leaned toward natural relaxation ingredients, making chamomile the most trusted and frequently incorporated floral essence across mainstream and premium product lines.

By End User Analysis

Fragrance Industry leads the market with a solid 38.5% share, driven by high demand for natural floral aromatic profiles.

In 2024, the Fragrance Industry held a dominant market position, capturing more than a 38.5% share in the flower-based essence market. This leadership is largely due to the rising consumer preference for nature-inspired scents in perfumes, body mists, personal care products, and premium home fragrances. Flower-based essences such as rose, jasmine, lavender, and chamomile remain foundational ingredients because they deliver authenticity, emotional connection, and clean-label appeal. Throughout 2024, major fragrance houses and artisanal brands alike increased their use of floral essences to meet demand for soft, uplifting, and mood-enhancing scent blends.

Key Market Segments

By Product Form

- Liquid

- Powder

By Source

- Chamomile

- Cherry Plum

- Bleeding Heart

- Gentian

- Wild Oat

- Aspen

- Centaury

- Chicory

- Crab Apple

- Willow

By End User

- Fragrance Industry

- Food & Beverages

- Cosmetics

- Pharmaceuticals

- Others

Emerging Trends

Floral notes are moving into modern RTD teas as brands chase “natural flavor” and lighter taste profiles

One clear latest trend in flower-based essence is the fast shift toward botanical ready-to-drink (RTD) beverages where aroma becomes the main differentiator. Brands are using chamomile, rose, hibiscus, lavender, and elderflower-style notes to create “soft” premium taste in teas, sparkling drinks, and wellness infusions without relying on heavy sugar or artificial flavour systems. This trend is practical for manufacturers: floral essences are easy to dose, they blend well with citrus and honey profiles, and they help a product feel premium even when the ingredient list stays short.

- It is also happening at scale because tea remains a large global base category. FAO reports world tea production at 6.8 million tonnes in 2023, with total tea imports at 1.8 million tonnes, showing how big the pipeline is for new flavour formats that can be rolled out across many markets.

Labelling clarity is another reason floral essences are being used more confidently in new launches. In the U.S., the FDA’s definition of “natural flavor” explicitly includes plant-derived “essential oil, oleoresin, essence or extractive,” which supports the way flower-based essences are positioned in mainstream foods and beverages.

At the same time, the tea and botanical ingredient supply chain has been showing stress signals, which is pushing manufacturers toward more standardized flavour systems to reduce batch-to-batch variation. A Reuters report notes that India’s 2024 tea production fell 7.8% to 1,284.78 million kg, and average prices rose by almost 18% to 198.76 rupees per kg.

Government capacity-building is also shaping the trend by strengthening the upstream botanical ecosystem. In India, a Press Information Bureau release states the National Medicinal Plants Board approved 139 projects for trainings/seminars/workshops during FY 2020–21 to 2024–25, totaling Rs. 1161.96 lakh. While these initiatives are broader than food alone, they support cultivation know-how and organized sourcing—both helpful for floral raw materials that ultimately feed into essences used in beverages and flavours.

Drivers

Health-led demand for herbal tea and “natural flavor” labels is pushing flower-based essences into more products

One major driving factor for flower-based essence is the steady rise in herbal-tea and botanical beverage consumption, paired with a clear industry shift toward “natural” flavour positioning. Flower notes like chamomile, rose, jasmine, hibiscus, and elderflower are easy for consumers to understand, and they signal calm, freshness, and premium taste without adding heavy sweetness. This matters because many brands now compete on simple ingredient stories and familiar plant cues.

The size of the tea platform alone explains why floral profiles keep expanding. The FAO reports that world tea production reached 6.8 million tonnes in 2023, and total tea imports were 1.8 million tonnes in the same year, showing how large and global the tea supply chain is for flavour innovation. Even in mature markets, consumption remains massive; the U.S. Census Bureau notes Americans consumed almost 85 billion servings of tea in 2021, underscoring a high-volume base where new floral variants can scale fast once they work.

Supply-side support is also improving in 2024–2025, which strengthens this demand driver. In India, the National Medicinal Plants Board (Ministry of Ayush) approved 139 projects for trainings, seminars, and workshops during FY 2020–21 to 2024–25, totaling Rs. 1161.96 lakh—a practical push that helps growers and collectors improve cultivation know-how and strengthens the pipeline for botanical inputs. While these programs are broader than food alone, they help normalize organized sourcing and handling practices for many aromatic and medicinal plants that overlap with floral ingredient ecosystems.

Restraints

Limited and inconsistent raw-flower supply creates production instability for manufacturers

One major restraining factor for the flower-based essence market is the inconsistent availability of raw floral biomass. Flowers used for essences—such as chamomile, rose, jasmine, hibiscus, and elderflower—are highly sensitive crops. Their yield depends heavily on temperature, rainfall, soil moisture, and pest pressure. Even a slight shift in climate conditions can change essential-oil content, aroma intensity, or overall harvest volume.

Climate-related disruptions are already visible in broader agricultural trends. The FAO’s global crop assessments show that climate variability continues to affect plant-based supply chains, noting in 2023 that several regions experienced production pressure due to erratic rainfall and higher temperature patterns. For instance, FAO data shows global crop production fluctuations of 1%–3% annually in climate-sensitive categories such as fruits, flowers, and herbs, depending on region and weather cycles.

A second constraint is the cost and labor intensity of flower harvesting. Many flowers used for essences must be picked manually at early dawn, when volatile aromatic compounds are highest. Chamomile, rose petals, and jasmine blossoms all require hand-selection to preserve purity and prevent bruising. Labor shortages can quickly reduce output. According to the International Labour Organization, global agricultural employment has been declining steadily, dropping from 879 million workers in 2000 to around 784 million workers in 2021, a loss of nearly 100 million agricultural laborers over two decades.

Governments do try to strengthen supply systems, but these efforts are uneven across regions. In India, for example, the National Medicinal Plants Board approved 139 projects for grower training and capacity building from FY 2020–21 to 2024–25, with funding of Rs. 1161.96 lakh to support cultivation of aromatic and medicinal crops. Programs like these help stabilize long-term production, but floral crops still remain exposed to weather swings and labor shortages.

Opportunity

Ready-to-drink herbal beverages are opening a bigger runway for floral essences

One major growth opportunity for flower-based essence is the fast expansion of herbal tea and botanical beverage formats—especially ready-to-drink (RTD) teas, infused waters, and light sparkling drinks where aroma does most of the “flavour work.” In these products, floral notes such as chamomile, rose, jasmine, hibiscus, and elderflower help brands create a premium taste without adding sugar or heavy ingredients.

This is a practical advantage for manufacturers: a small dose of essence can lift the aroma, improve the first sip experience, and keep the label simple. The opportunity is not niche, because tea is already a huge global platform. FAO reports that world tea production reached 6.8 million tonnes in 2023, and total tea imports were 1.8 million tonnes in the same year—meaning the base category is large enough for floral variants to scale quickly once consumers accept them.

This opportunity becomes clearer when the economics of the tea and beverage ecosystem are considered. FAO estimates the value of total tea trade at around USD 9.2 billion annually, and notes global tea production value is around USD 17.0 billion annually—both figures that signal a strong, active ingredient and blending market where differentiated flavours matter. In mature consumption markets, the volumes still support new floral formats. The U.S. Census Bureau notes that in 2021, Americans consumed almost 85 billion servings of tea, or more than 3.9 billion gallons—a level of consumption where even small shifts toward floral RTD teas can translate into meaningful industrial demand for essences.

On the supply side, government capacity-building initiatives are improving the long-term pipeline for botanical inputs, which supports scale-up in 2024–2025. In India, the Press Information Bureau reports that the National Medicinal Plants Board approved 139 projects for trainings/seminars/workshops during FY 2020–21 to 2024–25, totaling Rs. 1161.96 lakh, aimed at promoting cultivation and farmer awareness for medicinal and aromatic plants.

Regional Insights

Europe dominates the Flower-Based Essence Market with 39.4% share, valued at USD 21.0 Bn, supported by strong food innovation demand.

Europe stands out as the dominating region, holding 39.4% of the Flower-Based Essence Market and reaching USD 21.0 Bn in 2024. This leadership is strongly linked to Europe’s mature food, beverage, and flavour-manufacturing base, where botanical and floral notes are widely used in teas, confectionery, dairy, bakery, and premium non-alcoholic drinks.

Europe’s scale in food processing also supports industrial pull: Eurostat notes that in 2020 the EU had 291,000 enterprises processing food and beverages, employing 4.6 million people and generating €227 billion of value added—an industrial footprint that naturally absorbs specialised flavour ingredients.

Regulation and standardisation also reinforce Europe’s position because suppliers can scale compliant floral essences across multiple countries with clearer rulebooks. The EU’s Regulation (EC) No 1334/2008 sets the framework for flavourings used in and on foods, and the European Commission highlights that the EU “Union list” of approved flavouring substances was adopted on 1 October 2012, supporting structured evaluation and market access.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Symrise’s 2024 performance reflects resilient demand across fragrances and taste solutions. Group sales increased to €4,998,513,000 and consolidated net income rose to €481,951,000, with earnings per share at €3.42. Management also referenced a market share of around 11% in 2024, supported by a footprint spanning 100+ locations globally.

Robertet continues to lean into naturals-led growth across fragrances, flavors, and health & beauty. In 2024, the company reported turnover of €807 million, representing 12% year-on-year growth, including an organic increase of 10.3%. This momentum was described as being driven by regions such as Southeast Asia, China, Latin America, and the Middle East.

Givaudan remains a scale leader in taste and scent ingredients, backed by strong 2024 execution. The company reported CHF 7.4 billion in sales and CHF 1,765 million EBITDA, lifting EBITDA margin to 23.8%. Net income reached CHF 1,090 million, while free cash flow rose to CHF 1,158 million.

Top Key Players Outlook

- Givaudan

- Firmenich

- Symrise

- International Flavors & Fragrances

- Robertet Group

- Takasago International

- Mane SA

- Sensient Technologies

- Döhler Group

- Kerry Group

Recent Industry Developments

In 2024, Givaudan reported CHF 7,412 million in Group sales and CHF 1,765 million EBITDA, showing the cash strength needed to keep investing in high-quality natural extracts and flavour innovation.

Financially, Robertet Group 2024 results show the scale behind that capability: sales grew 12% to €807.6 million, while net income increased 20% to €90.1 million, indicating solid reinvestment capacity for sourcing, extraction, and new natural launches.

Report Scope

Report Features Description Market Value (2024) USD 53.4 Bn Forecast Revenue (2034) USD 98.4 Bn CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Form (Liquid, Powder), By Source (Chamomile, Cherry Plum, Bleeding Heart, Gentian, Wild Oat, Aspen, Centaury, Chicory, Crab Apple, Willow), By End User (Fragrance Industry, Food And Beverages, Cosmetics, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Givaudan, Firmenich, Symrise, International Flavors & Fragrances, Robertet Group, Takasago International, Mane SA, Sensient Technologies, Döhler Group, Kerry Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Flower-Based Essence MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Flower-Based Essence MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Givaudan

- Firmenich

- Symrise

- International Flavors & Fragrances

- Robertet Group

- Takasago International

- Mane SA

- Sensient Technologies

- Döhler Group

- Kerry Group