Global Flood Barrier Market Size, Share, Growth Analysis By Type (Removable Flood Barriers, Flip-Up Flood Barriers, Self-Closing Flood Barriers, Drop-Down Flood Barriers, Other Types), By Material (Aluminum, Steel, Concrete, Polymer Composites), By End-User (Government and Municipalities, Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 176091

- Number of Pages: 266

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

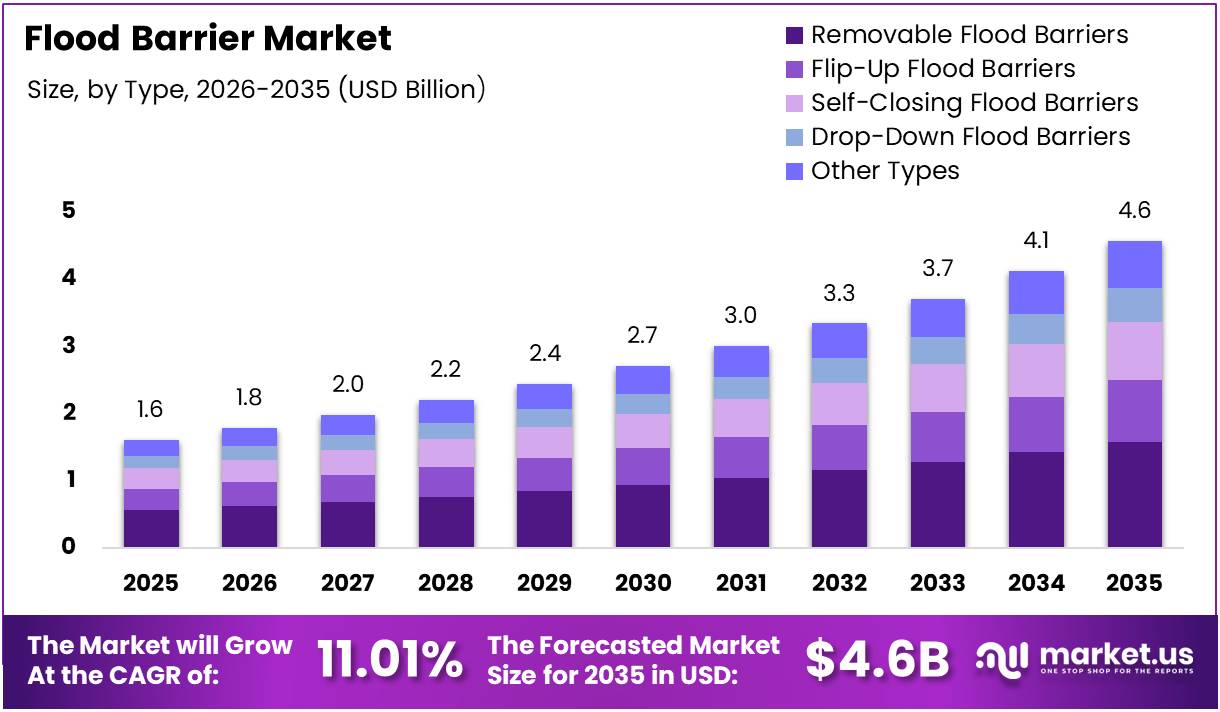

The Global Flood Barrier Market size is expected to be worth around USD 4.6 Billion by 2035 from USD 1.61 Billion in 2025, growing at a CAGR of 11.01% during the forecast period 2026 to 2035.

Flood barriers are engineered protective structures designed to prevent water intrusion during flooding events. These systems include removable, flip-up, self-closing, and drop-down configurations that create temporary or permanent barriers. They serve as critical infrastructure components protecting properties, communities, and urban areas from water damage.

The market encompasses diverse material types including aluminum, steel, concrete, and polymer composites. Each material offers distinct advantages in terms of weight, durability, and deployment speed. Moreover, these barriers cater to multiple end-users ranging from government entities to residential, commercial, and industrial sectors requiring customized flood protection solutions.

Market growth is driven by increasing urbanization and climate-related extreme weather patterns. Consequently, governments worldwide are prioritizing flood defense infrastructure investments to protect vulnerable populations. Additionally, insurance companies are mandating flood mitigation measures in high-risk zones, further accelerating adoption rates across multiple sectors.

Technological advancements are reshaping barrier design and functionality significantly. Lightweight, portable, and reusable systems are gaining traction for emergency response applications. Furthermore, integration with smart city initiatives and urban resilience frameworks is creating new deployment opportunities. Therefore, manufacturers are focusing on environment-friendly and recyclable materials to meet sustainability requirements.

According to Hoverstar, modern flood barriers maintain approximately 92% effectiveness against water flows of 3 m/s or greater in field tests from 2023. However, performance declines to roughly 67% for prolonged floods lasting over 72 hours, highlighting the importance of barrier design optimization.

According to findings from Ahr Valley floods in Germany, commercial areas protected by temporary barriers experienced approximately 42% less structural damage compared to unprotected areas. This demonstrates the tangible economic benefits of deploying flood barrier systems. Consequently, both public and private sectors are increasing investments in these protective infrastructure solutions.

Coastal cities facing sea-level rise represent significant expansion opportunities for barrier manufacturers. Additionally, untapped potential exists in flood-prone rural and semi-urban areas lacking adequate protection infrastructure. Therefore, market participants are developing cost-effective solutions tailored to diverse geographic and economic conditions globally.

Key Takeaways

- Global Flood Barrier Market projected to reach USD 4.6 Billion by 2035 from USD 1.61 Billion in 2025

- Market expected to grow at a CAGR of 11.01% during the forecast period 2026-2035

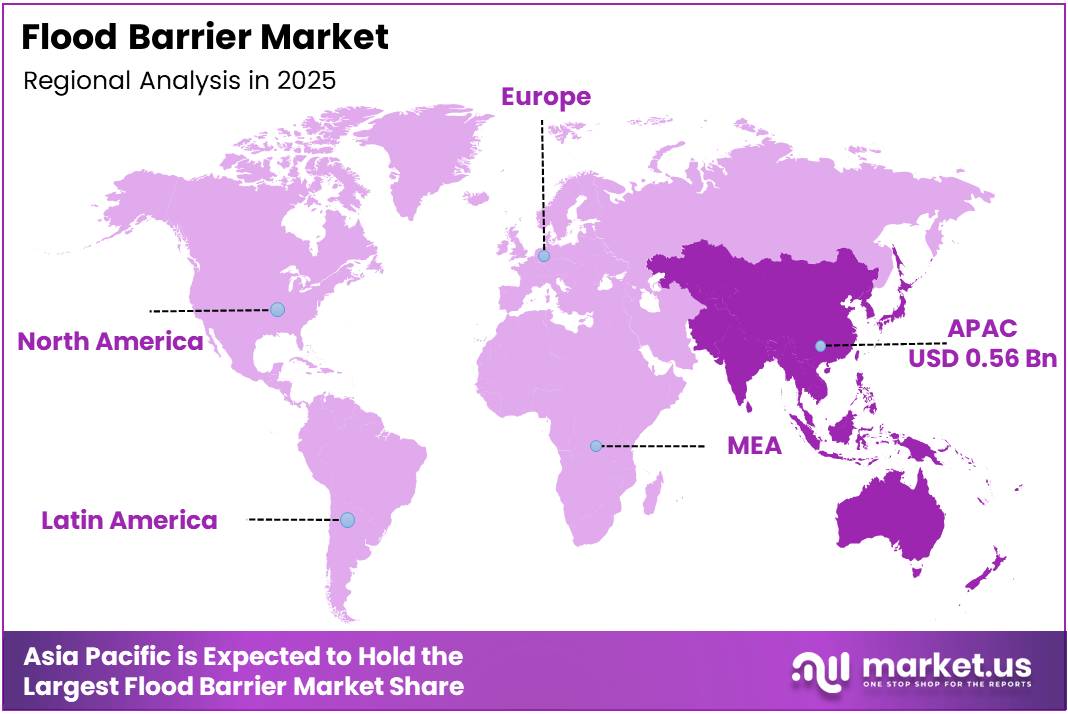

- Asia-Pacific dominates with 34.85% market share, valued at USD 0.56 Billion in 2025

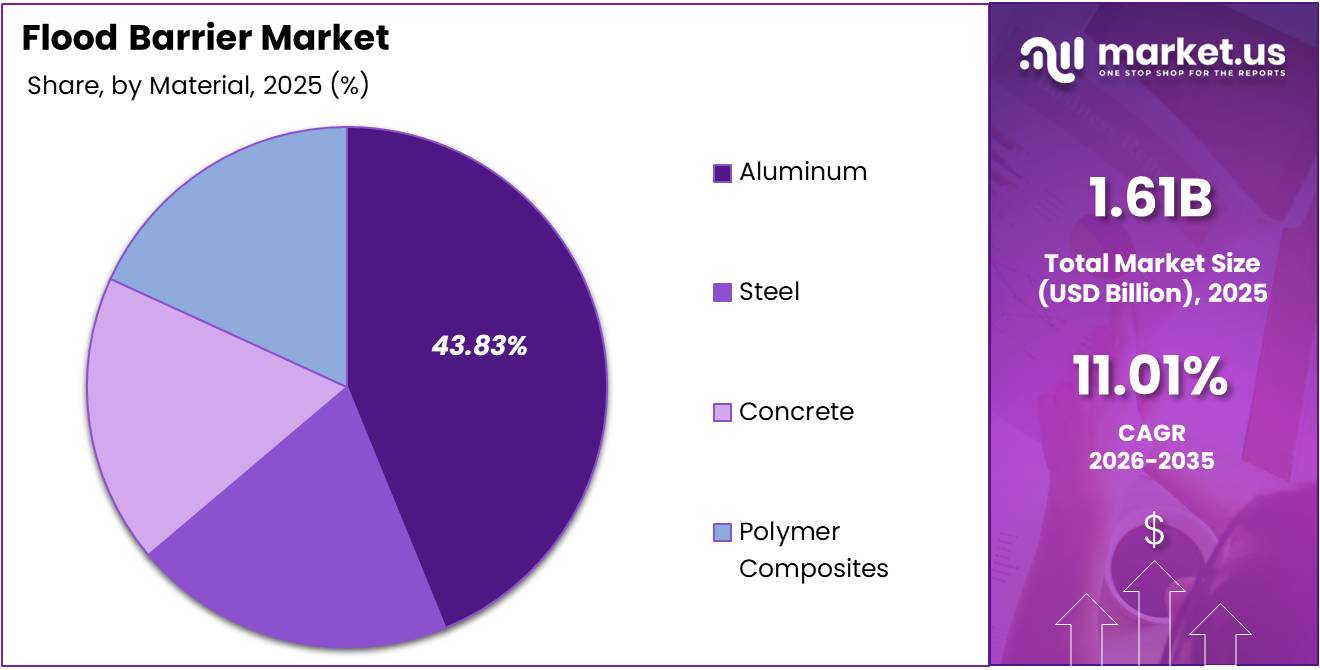

- Aluminum material segment leads with 43.83% share due to lightweight properties and corrosion resistance

- Government and Municipalities end-user segment holds 46.74% share driven by infrastructure investments

- Removable Flood Barriers dominate type segment with 34.60% share owing to deployment flexibility

Type Analysis

Removable Flood Barriers dominate with 34.60% due to flexible deployment and reusability advantages.

In 2025, Removable Flood Barriers held a dominant market position in the By Type segment of Flood Barrier Market, with a 34.60% share. These barriers offer exceptional versatility for temporary deployment during flood events and can be stored when not needed. Their modular design enables rapid installation across various locations, making them ideal for emergency response scenarios and seasonal flood protection requirements.

Flip-Up Flood Barriers provide permanent installation with minimal visual impact during non-flood periods. These systems remain flush with the ground until activated, preserving aesthetic appeal in urban environments. Moreover, they offer quick deployment through mechanical or automated lifting mechanisms, ensuring rapid response capabilities when water levels rise unexpectedly.

Self-Closing Flood Barriers automatically activate when water reaches predetermined levels without human intervention. This autonomous functionality ensures protection even during nighttime or when properties are unoccupied. Additionally, these barriers eliminate deployment delays and human error risks, providing reliable flood defense for residential and commercial properties in high-risk zones.

Drop-Down Flood Barriers feature overhead mounting systems that lower into position when flood threats emerge. These barriers excel in protecting building entrances, doorways, and architectural openings requiring unobstructed access during normal conditions. Furthermore, automated drop-down mechanisms ensure rapid deployment without manual labor requirements during emergency situations.

Other Types encompass specialized barrier configurations addressing unique flood protection challenges across diverse applications. These innovative solutions include inflatable barriers, water-filled barriers, and hybrid systems combining multiple deployment mechanisms. Moreover, custom-engineered barriers serve specific infrastructure requirements where standard configurations prove inadequate for particular geographic or structural conditions.

Material Analysis

Aluminum dominates with 43.83% due to optimal strength-to-weight ratio and superior corrosion resistance properties.

In 2025, Aluminum held a dominant market position in the By Material segment of Flood Barrier Market, with a 43.83% share. Aluminum barriers combine lightweight construction with exceptional durability, enabling easier deployment and transportation. Their natural corrosion resistance ensures longevity in water-exposed environments, reducing maintenance costs while maintaining structural integrity throughout extended service life.

Steel barriers provide maximum structural strength for high-pressure flood scenarios and permanent installations. These robust systems withstand extreme water forces and impact from debris carried by floodwaters. However, steel requires protective coatings to prevent corrosion, increasing maintenance requirements. Nevertheless, its superior load-bearing capacity makes steel essential for critical infrastructure protection applications.

Concrete barriers offer permanent, heavy-duty protection for large-scale flood defense infrastructure projects. Their massive weight provides stability against powerful water currents without additional anchoring systems. Additionally, concrete barriers integrate seamlessly into urban landscapes and waterfront developments. These durable structures deliver long-term protection with minimal maintenance across decades of service.

Polymer Composites represent emerging materials combining lightweight properties with chemical resistance and design flexibility. These advanced materials enable innovative barrier configurations impossible with traditional materials. Moreover, polymer composites offer excellent durability while reducing transportation and installation costs.

End-User Analysis

Government and Municipalities dominate with 46.74% due to large-scale infrastructure investment mandates.

In 2025, Government and Municipalities held a dominant market position in the By End-User segment of Flood Barrier Market, with a 46.74% share. Public sector entities prioritize flood protection infrastructure to safeguard communities and critical facilities. Consequently, substantial budget allocations for disaster prevention and climate adaptation initiatives drive significant barrier procurement across national, regional, and local government levels.

Residential end-users increasingly adopt flood barriers as property protection becomes essential in high-risk zones. Insurance requirements and personal asset protection motivate homeowners to invest in barrier systems. Moreover, growing awareness of climate-related flood risks encourages proactive mitigation measures.

Commercial properties deploy flood barriers to protect valuable inventory, equipment, and business continuity operations. Retail centers, office buildings, and shopping districts utilize barriers to minimize operational disruptions and financial losses. Additionally, commercial establishments face insurance mandates requiring flood protection measures.

Industrial facilities require specialized flood protection for manufacturing equipment, hazardous materials storage, and production infrastructure. These operations face catastrophic risks from flooding including equipment damage, environmental contamination, and prolonged operational shutdowns. Furthermore, regulatory compliance mandates flood protection for facilities handling dangerous substances.

Key Market Segments

By Type

- Removable Flood Barriers

- Flip-Up Flood Barriers

- Self-Closing Flood Barriers

- Drop-Down Flood Barriers

- Other Types

By Material

- Aluminum

- Steel

- Concrete

- Polymer Composites

By End-User

- Government and Municipalities

- Residential

- Commercial

- Industrial

Drivers

Escalating Frequency of Urban Flood Events Drives Infrastructure Investment and Market Expansion

Climate change intensifies extreme rainfall patterns, causing unprecedented flooding in densely populated urban areas worldwide. Consequently, governments allocate substantial resources toward flood defense infrastructure to protect citizens and economic assets. This urgency accelerates procurement of advanced barrier systems capable of rapid deployment during emergency situations, creating sustained market growth momentum.

Rising government spending on permanent and temporary flood defense infrastructure reflects strategic disaster preparedness priorities. National and regional authorities implement comprehensive flood management programs incorporating barrier technologies. Moreover, public-private partnerships facilitate large-scale protection projects across vulnerable communities. Therefore, sustained fiscal commitments ensure consistent demand for diverse barrier solutions meeting varied geographic requirements.

Increased insurance mandates for flood mitigation in high-risk zones compel property owners to implement protective measures. Insurance providers offer premium reductions for properties equipped with certified flood barriers, incentivizing adoption. Additionally, regulatory frameworks increasingly require flood protection infrastructure in new developments. These combined financial and regulatory pressures drive market expansion across residential, commercial, and industrial sectors.

Restraints

Limited Awareness and Regulatory Delays Constrain Market Penetration and Adoption Rates

Limited awareness and technical expertise among residential property owners restrict barrier adoption in vulnerable communities. Many homeowners remain unfamiliar with available flood protection technologies and their effectiveness. Consequently, education gaps prevent proactive mitigation investments despite increasing flood risks. Furthermore, complex installation requirements and perceived costs deter potential buyers lacking technical knowledge about barrier systems.

Inadequate understanding of barrier selection, installation, and maintenance procedures creates hesitation among prospective users. Property owners struggle to evaluate appropriate solutions for their specific flood risk profiles. Moreover, insufficient access to qualified installers and service providers compounds adoption challenges. Therefore, comprehensive education initiatives and simplified installation processes become essential for expanding residential market penetration.

Regulatory delays in approvals for large-scale flood protection installations impede project timelines and market growth. Bureaucratic approval processes for public infrastructure projects extend implementation schedules significantly. Additionally, varying regional standards and certification requirements complicate manufacturer compliance efforts. These administrative obstacles increase project costs and discourage timely deployment of critical flood defense infrastructure across vulnerable regions.

Growth Factors

Coastal Urbanization and Smart City Integration Create Substantial Expansion Opportunities

Expansion of flood barrier deployment in coastal cities facing sea-level rise represents significant growth potential. Rising ocean levels threaten densely populated coastal regions requiring comprehensive flood defense strategies. Consequently, municipalities invest heavily in barrier systems protecting critical infrastructure and residential areas. Moreover, coastal urbanization continues accelerating, creating sustained demand for advanced protection technologies addressing long-term climate adaptation requirements.

Integration of flood barriers into smart city and urban resilience projects unlocks innovative deployment opportunities. Connected barrier systems featuring automated sensors and real-time monitoring enhance emergency response capabilities. Additionally, integration with city-wide disaster management platforms enables coordinated flood protection strategies. Therefore, technology-enabled barriers align with broader smart infrastructure initiatives, attracting substantial public and private investment.

Untapped adoption potential in flood-prone rural and semi-urban areas offers substantial market expansion possibilities. These underserved regions face significant flood risks yet lack adequate protective infrastructure. Furthermore, cost-effective barrier solutions tailored for smaller communities enable broader market penetration. Consequently, manufacturers developing affordable, easy-to-deploy systems can capture emerging demand from previously overlooked geographic markets experiencing increasing climate-related flooding.

Emerging Trends

Innovation in Design and Sustainability Transforms Flood Barrier Technology Landscape

Shift toward lightweight, portable, and reusable flood barrier designs reflects evolving emergency response requirements. Modern barriers prioritize rapid deployment capabilities without compromising structural integrity or protection effectiveness. Consequently, manufacturers develop modular systems enabling quick installation by minimal personnel during critical flood events. Moreover, reusable designs reduce long-term costs while supporting sustainable resource management practices across multiple deployment cycles.

Rising use of environment-friendly and recyclable barrier materials addresses growing sustainability concerns within infrastructure development. Manufacturers increasingly adopt polymer composites and recycled materials minimizing environmental impact throughout product lifecycles. Additionally, eco-conscious design approaches align with corporate sustainability commitments and green building standards. Therefore, environmentally responsible barrier solutions gain competitive advantages in procurement decisions prioritizing ecological considerations.

Growing preference for temporary flood barriers for emergency response demonstrates operational flexibility advantages. Temporary systems enable rapid deployment during unexpected flooding while avoiding permanent landscape alterations. Furthermore, these barriers serve multiple locations sequentially, maximizing asset utilization and cost efficiency. Consequently, emergency management agencies and municipalities increasingly stockpile portable barrier inventories ensuring immediate response capabilities during natural disasters.

Regional Analysis

Asia-Pacific Dominates the Flood Barrier Market with a Market Share of 34.85%, Valued at USD 0.56 Billion

Asia-Pacific leads the global flood barrier market driven by rapid urbanization and frequent monsoon-related flooding across densely populated regions. In 2025, the region held a 34.85% market share, valued at USD 0.56 Billion. Countries like China, India, and Japan prioritize flood infrastructure investments protecting millions from seasonal water damage. Moreover, coastal cities facing typhoon threats accelerate barrier deployment across vulnerable areas.

North America Flood Barrier Market Trends

North America demonstrates strong market growth driven by hurricane preparedness along coastal regions and riverine flooding in interior areas. Government agencies implement comprehensive flood management programs incorporating advanced barrier technologies. Additionally, stringent building codes and insurance requirements mandate flood protection systems in designated high-risk zones. Therefore, sustained infrastructure investments support consistent market expansion throughout the region.

Europe Flood Barrier Market Trends

Europe exhibits mature market characteristics with established flood defense infrastructure across river basins and coastal zones. Countries like the Netherlands, Germany, and the UK maintain sophisticated barrier systems protecting low-lying areas. Moreover, climate adaptation policies drive modernization of existing infrastructure and deployment of innovative protection technologies. Consequently, the region emphasizes sustainable and aesthetically integrated barrier solutions.

Middle East & Africa Flood Barrier Market Trends

Middle East and Africa represent emerging markets with increasing awareness of flood risks in urban development projects. Rapid coastal city expansion necessitates flood protection infrastructure despite historically lower flooding concerns. Additionally, extreme weather events associated with climate change drive infrastructure investments. Therefore, governments increasingly incorporate barrier systems into comprehensive urban planning and disaster preparedness strategies.

Latin America Flood Barrier Market Trends

Latin America experiences growing market activity driven by flooding in major river systems and coastal storm surge events. Countries like Brazil and Mexico invest in protective infrastructure for vulnerable urban populations. Moreover, international development funding supports flood mitigation projects in disaster-prone regions. Consequently, market growth accelerates as climate resilience becomes central to infrastructure development planning.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

FloodBreak LLC maintains a leading position through innovative self-closing barrier technology and extensive North American installations. The company specializes in automatic flood barriers requiring no human intervention, ensuring reliable protection for critical infrastructure. Moreover, FloodBreak’s proven track record includes thousands of installations across government facilities, industrial sites, and commercial properties worldwide.

US Flood Control Corporation excels in providing comprehensive flood protection solutions combining temporary and permanent barrier systems. The company offers diverse product portfolios addressing varied customer requirements from residential properties to large-scale municipal projects. Additionally, their integrated approach encompassing design, installation, and ongoing support establishes strong client relationships and market presence.

IBS Technics GmbH demonstrates European market leadership through advanced engineering and high-quality barrier manufacturing capabilities. The German-based company supplies sophisticated flood protection systems for critical infrastructure including transportation networks and industrial facilities. Furthermore, their commitment to precision engineering and rigorous testing protocols positions them as preferred suppliers for demanding applications.

AquaFence revolutionizes temporary flood barrier deployment through lightweight, rapidly installable systems suitable for emergency response scenarios. The company’s innovative barrier designs enable quick protection of large perimeters using minimal personnel and equipment resources. Moreover, their focus on user-friendly deployment and storage efficiency addresses critical needs during time-sensitive flood emergencies.

Key players

- FloodBreak LLC

- US Flood Control Corporation

- IBS Technics GmbH

- AquaFence

- AWMA Water Control Solutions

- Blobel Umwelttechnik

- Dam Easy Flood Barriers

- Denilco Environmental Technology

- Flood Control Asia RS Corporation

- Haiyan Yawei

- Megasecur

- MM Engineering

- Mobildeich GmbH

- Muscle Wall

- NoFloods

- Reynaud Cauvin Yvose SA

- Self Closing Flood Barrier (SCFB)

- The Flood Company

- Water-Gate Barrier

- Flood Control International Ltd.

- Ps Industries

- HSI Services Inc.

- StormMeister Flood Protection

- Others

Recent Developments

- January 2025 – PS Industries Inc. acquired Flood Barrier Inc., strengthening comprehensive flood protection solutions throughout the Southeast United States region. This strategic acquisition expands PS Industries’ geographic footprint and enhances service capabilities for customers requiring integrated flood defense systems across vulnerable coastal and riverine areas.

- December 2025 – Investment AB Latour acquired a minority stake in NOAQ Flood Protection AB through its subsidiary Latour Future Solutions AB. This investment supports NOAQ’s expansion of innovative temporary flood barrier technologies and strengthens financial resources for international market development initiatives targeting climate-vulnerable regions worldwide.

- September 2025 – Cascade partnered with Sweden’s NOAQ on flood protection products, establishing collaborative distribution and technology sharing arrangements. This partnership enables Cascade to offer NOAQ’s advanced temporary barrier systems to North American markets while leveraging combined expertise in flood mitigation solutions development.

Report Scope

Report Features Description Market Value (2025) USD 1.61 Billion Forecast Revenue (2035) USD 4.6 Billion CAGR (2026-2035) 11.01% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Removable Flood Barriers, Flip-Up Flood Barriers, Self-Closing Flood Barriers, Drop-Down Flood Barriers, Other Types), By Material (Aluminum, Steel, Concrete, Polymer Composites), By End-User (Government and Municipalities, Residential, Commercial, Industrial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape FloodBreak LLC, US Flood Control Corporation, IBS Technics GmbH, AquaFence, AWMA Water Control Solutions, Blobel Umwelttechnik, Dam Easy Flood Barriers, Denilco Environmental Technology, Flood Control Asia RS Corporation, Haiyan Yawei, Megasecur, MM Engineering, Mobildeich GmbH, Muscle Wall, NoFloods, Reynaud Cauvin Yvose SA, Self Closing Flood Barrier (SCFB), The Flood Company, Water-Gate Barrier, Flood Control International Ltd., Ps Industries, HSI Services Inc., StormMeister Flood Protection, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- FloodBreak LLC

- US Flood Control Corporation

- IBS Technics GmbH

- AquaFence

- AWMA Water Control Solutions

- Blobel Umwelttechnik

- Dam Easy Flood Barriers

- Denilco Environmental Technology

- Flood Control Asia RS Corporation

- Haiyan Yawei

- Megasecur

- MM Engineering

- Mobildeich GmbH

- Muscle Wall

- NoFloods

- Reynaud Cauvin Yvose SA

- Self Closing Flood Barrier (SCFB)

- The Flood Company

- Water-Gate Barrier

- Flood Control International Ltd.

- Ps Industries

- HSI Services Inc.

- StormMeister Flood Protection

- Others