Global Flight School Insurance Market Size, Share and Analysis Report By Coverage Type (Liability Insurance, Hull Insurance, Student Pilot Insurance, Instructor Insurance, Others), By Provider (Private Insurance Companies, Government-backed Insurance, Others), By End-User (Individual Flight Schools, University-affiliated Flight Schools, Commercial Pilot Training Centers, Others), By Distribution Channel (Direct Sales, Brokers/Agents, Online Platforms, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 176248

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Insurance Statistics and Trends

- Drivers Impact Analysis

- Restraint Impact Analysis

- By Coverage Type

- By Provider

- By End User

- By Distribution Channel

- Regional Perspective

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

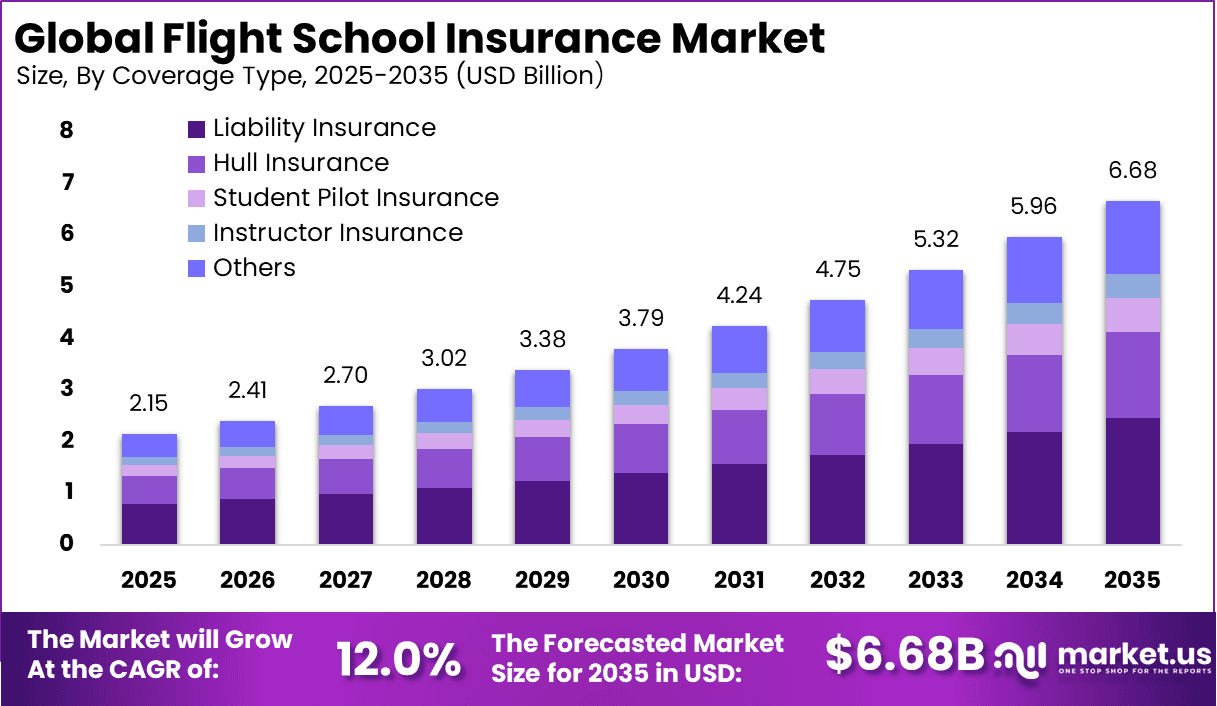

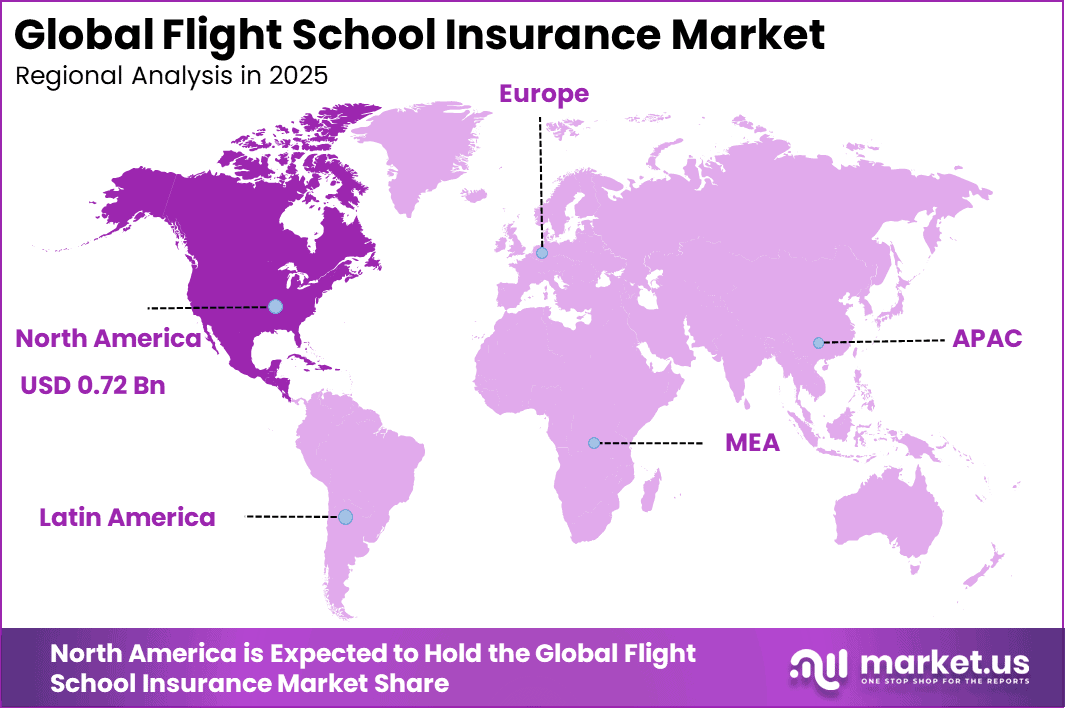

The Global Flight School Insurance Market size is expected to be worth around USD 6.68 billion by 2035, from USD 2.15 billion in 2025, growing at a CAGR of 12.0% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 33.7% share, holding USD 0.72 billion in revenue.

The flight school insurance market refers to specialised insurance products crafted to protect flight training organisations from the financial risks associated with aviation training activities. These insurance solutions typically combine liability coverage, hull protection for aircraft, student pilot coverage, and instructor liability protection tailored to the unique operational characteristics of flight schools.

Policies in this market seek to mitigate risks from accidents, third party claims, and asset damage that may occur during training flights or while aircraft are on the ground. The complexity of aviation regulatory frameworks and the high value of training aircraft make insurance an essential part of risk management for flight schools and training centres.

One major driving factor is the intrinsic risk profile of flight training activities, which involves repeated takeoffs, landings, and maneuver practice. These operational patterns increase the probability of incidents that could lead to property damage or liability claims, thus making insurance a fundamental requirement rather than an optional service. Liability coverage protects against legal and financial obligations if third parties are harmed or property is damaged during training flights.

Demand for flight school insurance is closely linked to enrolments in pilot training and the overall health of the aviation training sector. As airlines and general aviation operators seek trained pilots, flight schools expand their operations to accommodate rising student numbers. Flight training involves substantial investment in aircraft and instructors, and insurance is seen as a necessary safeguard to protect those investments.

For instance, in August 2025, USAIG (United States Aircraft Insurance Group) partnered with Embry-Riddle Aeronautical University Professional Education to offer tuition assistance for safety and risk management courses through its Performance Vector program. This initiative supports policyholders, especially flight schools and training operations, in enhancing pilot skills and loss prevention. It’s a smart move that reinforces USAIG’s leadership in aviation safety education.

Key Takeaway

- By coverage type, liability insurance led with 36.7%, reflecting the need to protect against student accidents, third party injury, and property damage during training operations.

- By provider, private insurance companies accounted for 48.9%, supported by specialized aviation underwriting expertise and customized policy offerings.

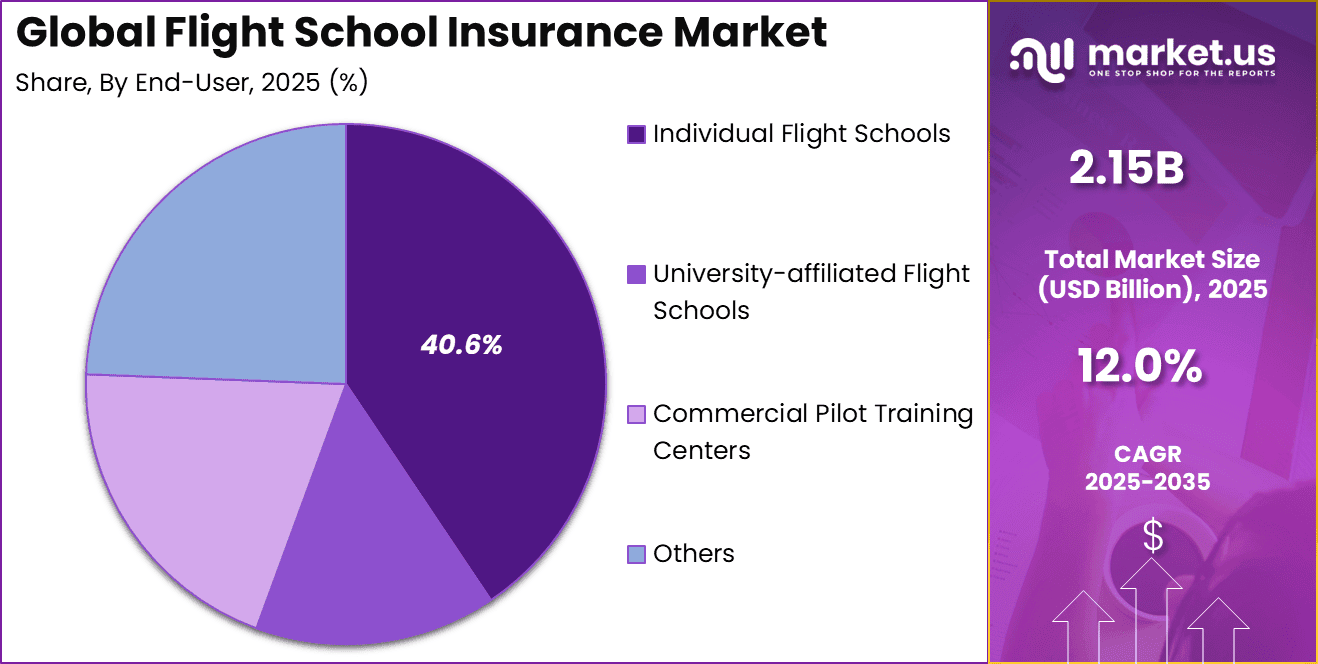

- By end user, individual flight schools held 40.6%, as independent training academies represent a large share of pilot training activity.

- By distribution channel, direct sales captured 38.7%, indicating preference for direct engagement, faster policy issuance, and clearer coverage terms.

- North America represented 33.7% of the global market, supported by a high concentration of flight schools and strong aviation training infrastructure.

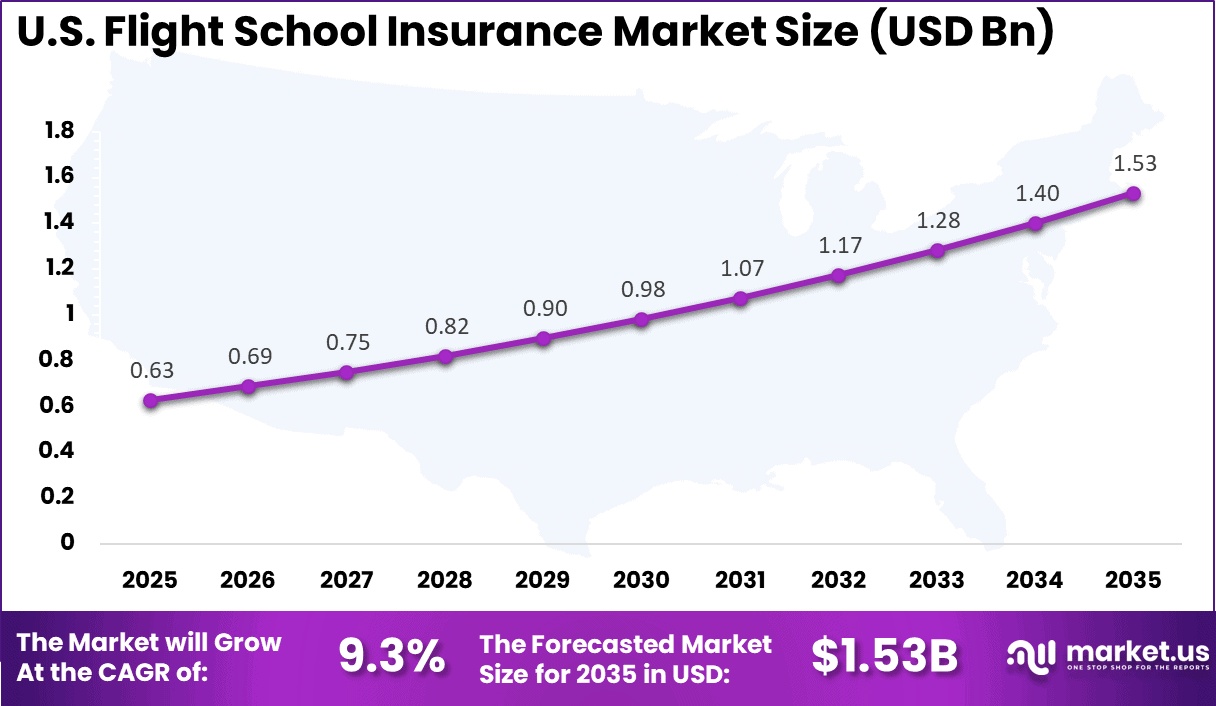

- The US market was valued at USD 0.63 billion and is growing at a 9.3% CAGR, driven by rising demand for pilot training and aviation workforce development.

Key Insurance Statistics and Trends

- Annual insurance costs for training aircraft vary by model, with a Cessna 172 averaging around USD 4,000, a Piper Seminole about USD 7,000, and a Cirrus SR20 close to USD 10,000.

- Flight schools with strong safety programs, structured training processes, and manufacturer approved maintenance practices can reduce premiums by 10% to 15%.

- Hull claim costs have risen sharply, with average claim values now about 60% higher than pre COVID levels.

- Insurers are applying stricter standards, often requiring instructors to log more than 1,000 total flight hours and at least 200 hours in the specific aircraft type.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline Rising global demand for commercial and private pilots +3.4% North America, Europe, Asia Pacific Medium term Expansion of flight training academies and aviation schools +2.9% North America, Asia Pacific Short to medium term Higher insurance requirements for student pilot training aircraft +2.3% Global Short term Growth in recreational aviation and private flying +1.9% North America, Europe Medium term Increased safety oversight and compliance standards +1.5% North America, Europe Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline High insurance premiums for training aircraft fleets -2.4% Global Short to medium term Limited insurance awareness among smaller flight schools -1.9% Emerging Markets Medium term Volatility in aviation fuel and operating costs -1.6% Global Medium term Complex underwriting due to accident risk exposure -1.3% North America, Europe Medium term Uneven aviation regulation enforcement across regions -1.0% Emerging Markets Long term By Coverage Type

Liability insurance represents the leading coverage category in the Flight School Insurance Market, accounting for 36.7% of overall adoption. This dominance is closely linked to the high risk environment associated with pilot training activities, including aircraft operation, student instruction, and ground handling. Liability exposure related to bodily injury and third party property damage makes this coverage essential for flight schools.

The importance of liability insurance is further reinforced by aviation authority requirements and contractual obligations with airports and aircraft lessors. Many training facilities are required to maintain active liability policies to operate legally. As safety oversight increases, liability coverage continues to be treated as a core protection rather than a supplementary option.

For Instance, in September 2025, AOPA pushed non-owned liability insurance for flight instructors giving lessons outside school aircraft. The policy covers court costs and claims from instruction mishaps. With more freelance teaching, this fills gaps in standard school coverage. It grows liability demand as instructors seek personal protection amid rising training activity.

By Provider

Private insurance companies lead the provider segment with a share of 48.9%. Their strong position is supported by specialized underwriting expertise in aviation risk and the ability to customize policies for flight training operations. These providers are often preferred due to their experience in handling aviation specific claims and regulatory compliance.

The presence of tailored aviation insurance products strengthens trust among flight school operators. Private insurers frequently offer flexible coverage structures aligned with fleet size, aircraft type, and training intensity. This adaptability sustains their leadership within the provider segment.

For instance, in January 2026, BWI Aviation launched tailored flight school policies for instruction and rental ops, from small to large fleets. As a family firm, they focus on nationwide coverage with low premiums. This appeals to private schools expanding amid pilot shortages. Their expert brokers help match risks, driving private provider growth.

By End User

Individual flight schools account for 40.6% of total insurance demand. This segment includes independently operated training academies that manage their own aircraft, instructors, and student programs. Their operational structure exposes them directly to financial and legal risk, increasing reliance on comprehensive insurance coverage.

Insurance adoption among individual flight schools is driven by licensing requirements and reputational considerations. Students and aviation partners often prefer institutions that demonstrate strong risk management practices. As a result, insurance coverage is increasingly viewed as a prerequisite for long term operational stability.

For Instance, in September 2025, Avemco expanded its Safety Rewards for recurrent training credits at individual schools. Pilots get premium discounts for extra FAASTeam courses. Small schools use this to attract renters and cut costs. Growth comes from personalized plans fitting tight budgets in training hubs.

By Distribution Channel

Direct sales represent 38.7% of policy distribution within the Flight School Insurance Market. This channel is favored for its clarity and efficiency, allowing flight schools to engage directly with insurers or authorized agents. Direct communication helps ensure accurate risk assessment and policy alignment with aviation operations.

Digital platforms have further strengthened the role of direct sales. Online consultations and streamlined documentation reduce administrative effort for training institutions. This channel continues to gain relevance as flight schools seek faster policy issuance and transparent coverage terms.

For Instance, in January 2025, BWI Aviation Insurance promoted direct quotes via their site for flight schools, skipping brokers for faster deals. Owners share rosters and get custom liability fast. This channel speeds renewals as training demand spikes. Direct access to experts builds loyalty for ongoing sales.

Regional Perspective

North America holds a significant position in the Flight School Insurance Market, accounting for 33.7% of overall activity. The region benefits from a well established aviation training infrastructure, strong regulatory oversight, and consistent demand for commercial and private pilot certification. Insurance penetration remains high due to strict compliance standards.

The presence of numerous training academies and controlled airspace environments increases insurance necessity. Risk management is deeply embedded within aviation operations across the region. These structural conditions support North America’s sustained influence in the market.

For instance, in November 2025, Global Aerospace continued supporting U.S. flight schools through partnerships with institutions like Embry-Riddle Aeronautical University, addressing the aviation talent shortage with insurance-backed training programs and safety initiatives for general aviation operations.

United States Market Overview

The United States represents the largest share within North America, with a market value of USD 0.63 Bn. The market is expanding at a 9.3% CAGR, supported by rising demand for certified pilots, expansion of regional aviation programs, and increased investment in flight training capacity. Insurance coverage remains a mandatory requirement across most training operations.

Regulatory enforcement and litigation exposure further encourage insurance adoption among U.S. flight schools. Independent academies and training centers increasingly prioritize coverage to protect assets and maintain operational continuity. These factors collectively support steady growth within the U.S. segment.

For instance, in October 2025, Avemco maintained affordable student pilot liability insurance starting at $95, protecting trainees from lawsuits during lessons even when flight school policies fall short. This specialized coverage highlights Avemco’s dominance in supporting U.S. flight training by filling critical gaps in instructor and school protections.

Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Aviation-focused insurers High Medium North America, Europe Stable long-term underwriting growth Commercial insurance providers Medium Low to Medium Global Portfolio diversification opportunity Specialty aviation underwriting firms High Medium to High North America Premium pricing power in niche segments Private equity firms Medium Medium North America, Europe Consolidation of specialized insurance books Venture capital investors Low to Medium High North America Selective interest via insurtech platforms Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~)% Primary Function Geographic Relevance Adoption Timeline Digital underwriting and online policy management +2.6% Faster policy issuance North America, Europe Short term Flight data analytics for risk assessment +2.1% Improved pricing accuracy North America Medium term Simulation-based safety training data integration +1.8% Lower incident rates Global Medium term Automated claims processing platforms +1.5% Faster settlements Global Medium to long term Integration with flight school management systems +1.2% Policy retention and bundling North America Long term Key Market Segments

By Coverage Type

- Liability Insurance

- Hull Insurance

- Student Pilot Insurance

- Instructor Insurance

- Others

By Provider

- Private Insurance Companies

- Government-backed Insurance

- Others

By End-User

- Individual Flight Schools

- University-affiliated Flight Schools

- Commercial Pilot Training Centers

- Others

By Distribution Channel

- Direct Sales

- Brokers/Agents

- Online Platforms

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

The flight school insurance market is largely driven by the inherently high risk associated with flight training operations. Training environments typically involve student pilots, professional instructors, and frequent takeoffs and landings, which statistically represent the most critical phases of flight.

These conditions elevate the likelihood of incidents that may result in personal injury or property damage, leading operators to seek comprehensive insurance coverage that can absorb significant financial liabilities. The presence of regulatory requirements in many countries further reinforces the adoption of specialised insurance, as compliance with aviation safety standards often mandates specific levels of liability protection.

Restraint Analysis

A key restraint in the flight school insurance market stems from the high cost and complexity of obtaining adequate coverage. The specialised nature of aviation insurance, coupled with the elevated risk profile of flight training activities, typically results in premiums that can strain the budgets of smaller or emerging flight schools.

Policy terms and coverage exclusions can also be difficult for operators to navigate without expert guidance, creating barriers for less experienced organisations. This complexity can result in underinsurance or delays in policy adoption, limiting growth in segments where cost sensitivity is high.

Opportunity Analysis

An important opportunity within the flight school insurance market lies in the expansion into emerging regions with growing aviation sectors. Regions such as Asia Pacific, Latin America, and the Middle East and Africa are experiencing increased investment in aviation infrastructure and pilot training programmes.

As aviation activity grows in these markets, demand for tailored insurance solutions is expected to rise, supported by favourable government policies and a growing emphasis on aviation safety and regulatory compliance. Expanding digital distribution channels and insurtech innovations also present opportunities to make insurance more accessible and customised for diverse flight school needs.

Challenge Analysis

A significant challenge confronting the flight school insurance market is the need to balance comprehensive risk protection with affordability and simplicity of coverage. Flight schools require policies that not only protect against a wide range of aviation related risks but also remain financially viable for operators of varying sizes.

Insurers must navigate the tension between providing robust coverage and maintaining premiums at levels that do not deter adoption. Additionally, regulatory complexity and evolving safety standards require insurers to continuously adapt offerings, further complicating product design and operational planning in this specialised segment.

Key Players Analysis

Major aviation insurers such as Allianz Global Corporate & Specialty, AIG, Global Aerospace, and AXA XL hold strong positions in the flight school insurance market. Their policies typically cover aircraft hull, third-party liability, student pilot risk, and instructor liability. These providers focus on complex aviation risk underwriting and global regulatory compliance. Strong reinsurance backing and claims expertise support trust among commercial flight training organizations.

Specialized aviation-focused insurers and underwriting groups such as USAIG, Starr Aviation, and Old Republic Aerospace emphasize tailored coverage for training fleets and pilot schools. Avemco Insurance Company and QBE Aviation are widely used by general aviation operators. These players focus on risk profiling, safety programs, and loss prevention. Adoption is driven by mandatory insurance requirements and growing pilot training demand.

Aviation insurance brokers and service providers such as Gallagher Aviation, Marsh Aviation, and AOPA Insurance Services play a key role in policy placement and advisory. Tokio Marine HCC – Aviation and Hallmark Financial Services expand underwriting capacity. Other regional brokers and underwriters enhance competition and customization. This landscape supports stable coverage availability for flight schools across training, charter, and recreational aviation segments.

Top Key Players in the Market

- Allianz Global Corporate & Specialty

- AIG (American International Group)

- Global Aerospace

- Starr Aviation

- USAIG (United States Aircraft Insurance Group)

- AOPA Insurance Services

- Avemco Insurance Company

- AXA XL

- Old Republic Aerospace

- QBE Aviation

- Falcon Insurance Agency

- London Aviation Underwriters

- Brown & Associates

- Phoenix Aviation Managers

- BWI Aviation Insurance

- Travers & Associates

- Gallagher Aviation (Arthur J. Gallagher & Co.)

- Marsh Aviation

- Hallmark Financial Services

- Tokio Marine HCC – Aviation

- Others

Recent Developments

- In January 2025, Marsh Aviation acquired Acumen Solutions Group, bolstering its aviation and risk management offerings in the upper Midwest. This move expands specialized coverage for flight training operations. Marsh continues building a stronger network for aviation clients.

- In October 2025, AOPA Insurance Services highlighted non-owned liability coverage needs for freelance flight instructors via targeted guidance. With rising training demand, AOPA’s push for proper insurance protects instructors outside school fleets. Practical advice from a trusted player.

Report Scope

Report Features Description Market Value (2025) USD 2.1 Bn Forecast Revenue (2035) USD 6.6 Bn CAGR(2026-2035) 12.0% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type (Liability Insurance, Hull Insurance, Student Pilot Insurance, Instructor Insurance, Others), By Provider (Private Insurance Companies, Government-backed Insurance, Others), By End-User (Individual Flight Schools, University-affiliated Flight Schools, Commercial Pilot Training Centers, Others), By Distribution Channel (Direct Sales, Brokers/Agents, Online Platforms, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Allianz Global Corporate & Specialty, AIG (American International Group), Global Aerospace, Starr Aviation, USAIG (United States Aircraft Insurance Group), AOPA Insurance Services, Avemco Insurance Company, AXA XL, Old Republic Aerospace, QBE Aviation, Falcon Insurance Agency, London Aviation Underwriters, W. Brown & Associates, Phoenix Aviation Managers, BWI Aviation Insurance, Travers & Associates, Gallagher Aviation (Arthur J. Gallagher & Co.), Marsh Aviation, Hallmark Financial Services, Tokio Marine HCC – Aviation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Flight School Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Flight School Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Allianz Global Corporate & Specialty

- AIG (American International Group)

- Global Aerospace

- Starr Aviation

- USAIG (United States Aircraft Insurance Group)

- AOPA Insurance Services

- Avemco Insurance Company

- AXA XL

- Old Republic Aerospace

- QBE Aviation

- Falcon Insurance Agency

- London Aviation Underwriters

- Brown & Associates

- Phoenix Aviation Managers

- BWI Aviation Insurance

- Travers & Associates

- Gallagher Aviation (Arthur J. Gallagher & Co.)

- Marsh Aviation

- Hallmark Financial Services

- Tokio Marine HCC – Aviation

- Others