Global Flat Steel Market By Product(Sheet and Strips, Plates), By Material Type (Carbon Steel, Alloy Steel, Stainless Steel, Tool Steel), By Application (Building & infrastructure, Automotive and other Transport, Mechanical equipment, Other Applications), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 28446

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

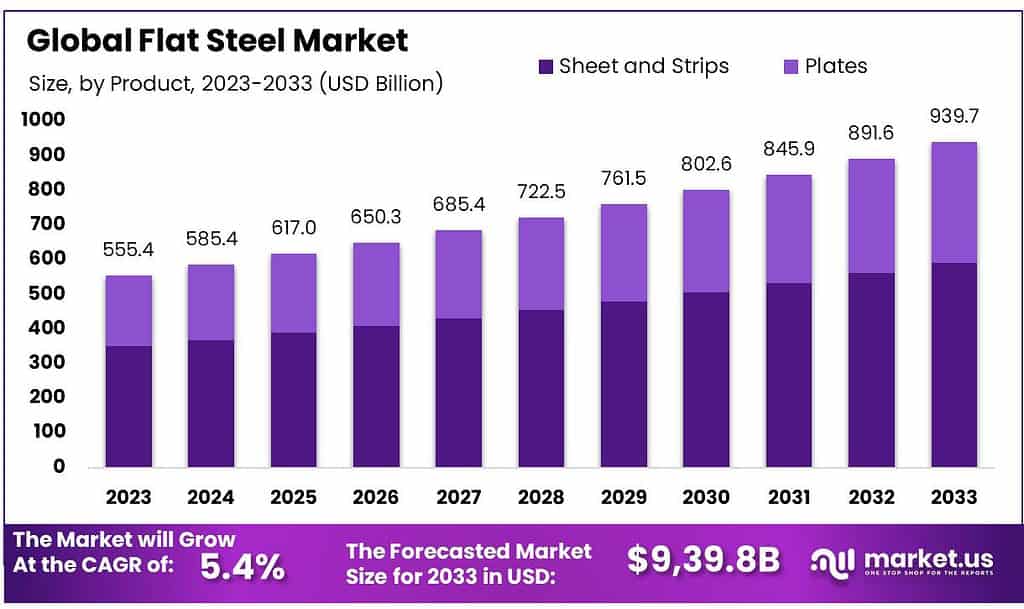

The global flat steel market size is expected to be worth around USD 939.8 billion by 2033, from USD 555.4 billion in 2023, growing at a CAGR of 5.4% during the forecast period from 2023 to 2033.

The market is expected to see a significant increase in demand due to its extensive use in construction, automobile, and mechanical equipment. The iron and steel industry influences the country’s economic performance and development.

It is the most widely used and easily recyclable material on Earth. The industrialization of a region is a critical factor in determining GDP growth. A rapid industrialization process in developing countries is likely to lead to an increase in consumer demand.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Growth Projection: The global flat steel market is poised to grow significantly, reaching an estimated worth of around USD 939.8 billion by 2033. This growth is anticipated at a CAGR of 5.4% from the USD 555.4 billion in 2023.

- Usage Diversity: Flat steel finds extensive applications across various sectors like construction, automotive, and mechanical equipment. Its versatility and ease of use contribute to its widespread adoption in these industries.

- Product Analysis: Sheets and strips constitute a significant portion (over 63.2%) of the flat steel market in 2023, especially in automotive and construction. Plates, accounting for 36.8%, are crucial in sectors requiring high tensile strength and resistance, such as bridges and shipbuilding.

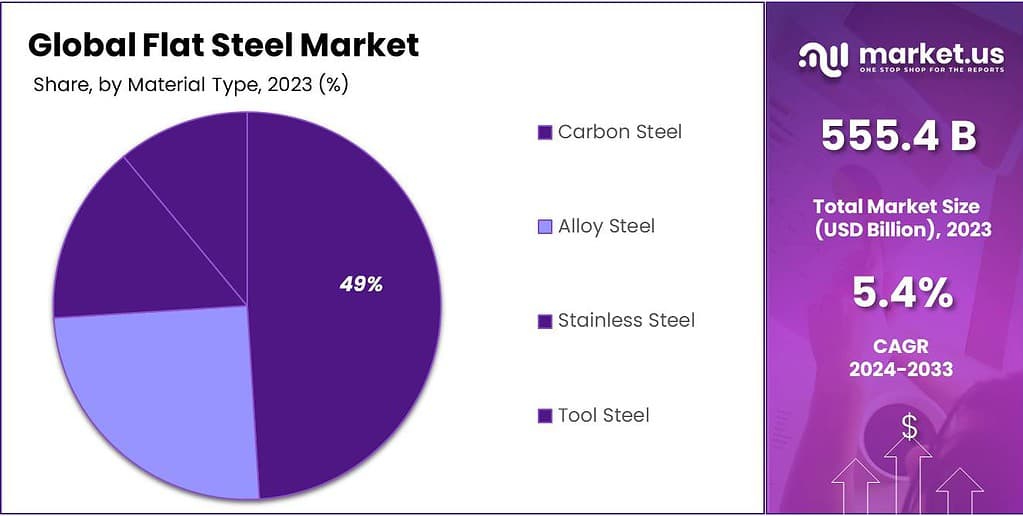

- Material Types and Applications: Carbon steel dominates the market (over 49%), owing to its affordability and strength, particularly in construction and manufacturing. Stainless steel, valued for its corrosion resistance and strength, holds promise for vehicle structural components.

- Automotive Sector Impact: Nearly half of the total revenue in 2023 is attributed to the automobile segment. Flat steel’s use in vehicles significantly contributes to their strength and durability while maintaining relatively low costs.

- Market Drivers: Urbanization, increasing population, and the middle-class’s rising homeownership trends drive the demand for flat steel in construction. Innovative construction projects and infrastructure developments further fuel this demand.

- Market Challenges: Volatility in steel prices due to fluctuating raw material costs and geopolitical events poses challenges. Environmental concerns regarding steel production and market dependency on sectors like construction and automotive are also notable hurdles.

- Opportunities: The market’s growth potential lies in its essential role across industries and ongoing innovations in manufacturing methods. As infrastructure projects expand globally, the demand for flat steel in construction and transportation systems rises.

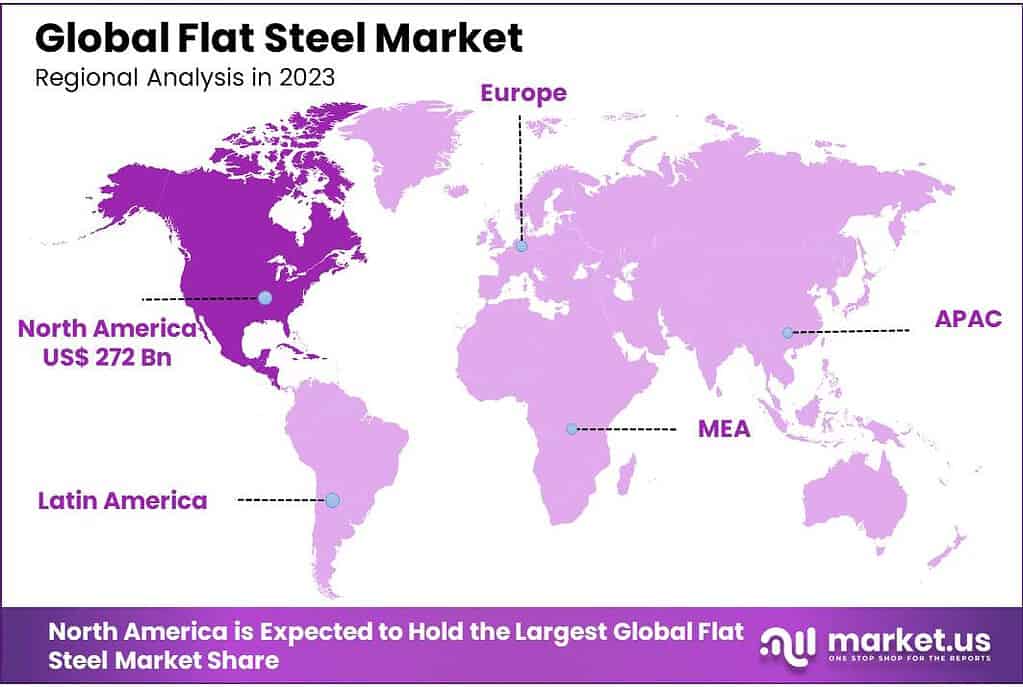

- Regional Analysis: North America holds the largest share in 2023, followed by Asia-Pacific and Europe, each contributing to the market’s growth through various industries like construction, transport, and machinery.

- Key Players and Recent Developments: Major players like ArcelorMittal and others are pivotal in driving innovations and sustainability in steel production. Initiatives like ArcelorMittal’s XCarb signify efforts toward reducing CO2 emissions in steelmaking.

Product Analysis

In 2023, Sheets & strips were the most popular in the flat steel market, making up over 63.2% of sales. This segment includes thin, flat pieces used in various industries like automotive and construction.

It also comes in a variety of tools depending on your application. They are widely used in architecture, industry, and transport because of their advantages, such as corrosion-resistant and adhesive solid and welding properties.

There are two types of sheets: hot-rolled and cold-rolled. Because of their excellent workability, cold-rolled sheets can be used for automobiles and electrical appliances. Carbon sheets can be used in many machine structure applications, including chain parts, automotive AT, automotive clutch parts, and seat belts. Steel plates can be more than 3/16 inches thick. They are made on either a coiled or discrete plate mill. Unique dishes are available that are low-alloy and heat-treated for specific applications, such as mining and logging equipment.

In 2021, plates accounted for 36.8% of the market in volume. In 2021, containers accounted for 36.8% of the market volume. They are used in bridges, shipbuilding, offshore structures, storage tanks, boilers & pressure vessels, and machinery with high tensile strength and resistance to atmospheric corrosion, seawater resistance, and abrasion resistance.

Material Type Analysis

In 2023, Carbon Steel led the flat steel market, holding over 49% of the share. It’s a versatile and widely-used material known for its strength and affordability, making it a popular choice in various industries like construction and manufacturing.

Due to the advantages of flat carbon products over other materials, such as cost efficiency, safety, resistance to corrosion, environmental friendliness, and cost-effectiveness, demand for them is expected to increase. The utilization of carbon steel will be driven by the growth of major end-use industries like construction and automotive. Stainless Steel has many advantages over other materials, including higher cryogenic toughness and hot strength, excellent corrosion resistance, flexibility, attractive appearance, and higher strength and hardness. These properties will open up new possibilities for the material’s use in vehicle structural components.

Note: Actual Numbers Might Vary In the Final Report

Application Analysis

In terms of revenue, the automobile segment accounted for 48.3% of total revenue in 2023. Flat products have allowed automobile manufacturers to attain the expected standards of strength, protection, and durability for their vehicles at relatively low costs compared to other materials. The market growth for automotive applications is expected to be limited by the increasing focus on fuel efficiency and weight loss.

Flat steel products are expected to see the fastest volume growth of 3.8% between 2017 and 2025. This is due to their high mechanical strength, toughness, weldability, and high mechanical strength. The carbon steel-based hot-rolled, cold-rolled, and galvanized flat products’ excellent features make them suitable for the construction of light and heavy components.

About 70.0% of the automobile’s weight is made up of iron & steel. The World Steel Association estimates that the automotive industry accounts for nearly 12.0% of the world’s steel consumption. ArcelorMittal is a crucial producer of automotive steel. ArcelorMittal was responsible for 16.7% of the global automotive sheet market. The replacement of lightweight materials with lighter products to increase fuel efficiency has led to flat product penetration in the automotive and other transport applications segments.

Маrkеt Ѕеgmеntѕ

By Product

- Sheet and Strips

- Plates

By Material Type

- Carbon Steel

- Alloy Steel

- Stainless Steel

- Tool Steel

By Application

- Building & infrastructure

- Automotive and other Transport

- Mechanical equipment

- Other Applications

Drivers

The escalating pace of urbanization and the expanding global population have sparked a significant surge in the construction industry’s growth. This upswing directly fuels the demand for flat steel, a pivotal material used in constructing robust frames, structural supports for staircases, roofing, welded structures, and sheds.

Moreover, the increasing affluence of the middle class has led to a rising trend in multiple homeownership and a greater emphasis on house redevelopment and renovations. These dynamics further propel the construction sector’s momentum, thereby amplifying the market for flat steel.

The magnitude of construction projects, including towering skyscrapers, intricate infrastructure developments, and sturdy steel bridges, significantly contributes to the consumption of steel plates. Concurrently, the infrastructure sector’s demand for steel in building highways, roads, and railway projects is projected to witness substantial growth in the foreseeable future.

This mounting need is underpinned by the continuous innovation observed within the steel industry, coupled with the rapid progression of varied construction ventures. These collective factors converge to propel the continuous expansion of the flat steel market, driven by its integral role in the construction landscape.

Restraints

The flat steel market encounters a notable challenge stemming from the volatile nature of steel prices and the raw materials essential for its production, such as coal, iron, and scrap steel. These raw materials often experience frequent fluctuations owing to the intricate dynamics of supply and demand.

Moreover, the manufacturing costs are significantly impacted, subsequently influencing storage capacities and overall pricing structures.

The ripple effect of these price fluctuations extends beyond the steel production realm, directly affecting the final prices of products utilizing steel. Consequently, any changes in steel prices exert a direct influence on the ultimate cost of the end products.

This inherent linkage makes the market susceptible to sudden and dramatic shifts in steel prices, which can soar or plummet drastically due to swift changes in demand or unforeseen geopolitical events.

The swift escalations or declines in steel prices consequent to such events pose substantial challenges to market expansion within the forecasted period. These fluctuations act as restraining factors, impeding the smooth proliferation of the flat steel market and introducing uncertainties for businesses reliant on steel as a primary material.

Opportunity

The flat steel market offers a substantial opportunity driven by its wide-ranging uses across industries. It’s crucial in construction for creating sturdy structures and is a key ingredient in safer vehicles within the automotive sector. As infrastructure projects expand, the demand for flat steel in building roads, railways, and transportation systems is also growing.

The push for more sustainable steel production methods opens doors for environmentally friendly steel products, appealing to conscious consumers and industries. Its versatility extends to machinery and consumer goods, broadening its reach across various sectors.

Overall, the growth potential of the flat steel market is rooted in its essential role across industries, ongoing innovations in steel manufacturing, and the continuous expansion of global infrastructure and construction projects. This makes it an exciting space with plenty of opportunities for growth and innovation.

Challenges

In the flat steel market, there are several challenges that companies face. Fluctuating raw material prices, such as those for coal, iron, and scrap steel, can disrupt production costs and overall pricing structures. This unpredictability affects the profitability and stability of companies operating in this space.

Additionally, environmental concerns surrounding steel production, particularly regarding carbon dioxide (CO2) emissions, pose a significant challenge. Meeting stringent environmental regulations while ensuring cost-effective and sustainable production methods remains a hurdle for many players in the industry.

Another challenge is the competition within the market. Companies must continuously innovate to stay ahead, especially with emerging alternatives or substitutes for steel in various applications. Finding ways to differentiate their products and maintain a competitive edge is crucial in such a dynamic market.

Moreover, the market’s dependence on sectors like construction and automotive exposes it to economic fluctuations. Market demand can be impacted by changes in these key sectors, leading to uncertain market conditions and demand fluctuations for flat steel.

Overall, navigating through volatile raw material prices, addressing environmental concerns, facing competition, and managing market dependencies remain significant challenges in the flat steel industry. Finding sustainable solutions while staying competitive is crucial for companies to thrive in this challenging landscape.

Regional Analysis

In 2023, North America accounted for the largest share of global Flat Steel Market revenue. It is expected to account for 49.43% of the Flat Steel Market share in 2023 among others.

The massive investment opportunities in North America and Canada are expected to grow North America’s construction industry. Europe was third in revenue share, with 18.6% in 2021. The market is expected to see a rise in flat product demand due to the growth of industries like construction, transport, and machinery, as well as the growing demand from the UK and Germany.

Note: Actual Numbers Might Vary In the Final Report

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

With the large number of multinational companies operating high production volumes, this industry is highly competitive. market companies are highly integrated, from flat steel production to sales and distribution to different locations.

High production capacity is the basis of companies such as Tata Steel Limited and ArcelorMittal. The market has seen a lot of cross-border trade as distribution channels can meet local and global demand.

Маrkеt Кеу Рlауеrѕ

- АrсеlоrМіttаl

- Аnѕtееl Grоuр

- Ваоѕtееl Grоuр

- Ваоtоu Ѕtееl

- Веnхі Ѕtееl

- СЅС

- Еvrаz Grоuр

- Fаngdа Ѕtееl

- Gеrdаu

- Аnуаng Ѕtееl

Recent developments

In March 2021, ArcelorMittal launched XCarb, a bold initiative to cut CO2 emissions in steelmaking. They invested in projects targeting carbon reduction from blast furnaces, marking a firm step toward sustainable steel production.

Report Scope

Report Features Description Market Value (2023) USD 555.4 Billion Forecast Revenue (2033) USD 939.8 Billion CAGR (2023-2032) 5.4% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product(Sheet and Strips, Plates), By Material Type (Carbon Steel, Alloy Steel, Stainless Steel, Tool Steel), By Application (Building & infrastructure, Automotive and other Transport, Mechanical equipment, Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape АrсеlоrМіttаl, Аnѕtееl Grоuр, Ваоѕtееl Grоuр, Ваоtоu Ѕtееl, Веnхі Ѕtееl, СЅС, Еvrаz Grоuр, Fаngdа Ѕtееl, Gеrdаu, Аnуаng Ѕtееl Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is flat steel?Flat steel refers to steel that is produced in a flat-rolled form, typically with a width-to-thickness ratio larger than 10. It includes products such as sheets, strips, and plates, used in various industries due to their versatility and ease of fabrication.

What are the key types of flat steel products?Flat steel products include hot-rolled coils, cold-rolled coils, galvanized sheets, tinplate, and coated steel (such as galvanized or polymer-coated steel). Each type has specific properties suitable for different applications.

What factors influence the flat steel market’s growth?Market growth is influenced by factors such as economic development, urbanization, infrastructure projects, automotive production, technological advancements in steel manufacturing processes, and fluctuations in raw material prices.

How important is sustainability in the flat steel industry?Sustainability is increasingly important, leading to innovations in steel production methods to reduce carbon emissions, increase energy efficiency, and promote recycling of steel products.

-

-

- ArcelorMittal

- Ansteel Group

- Baosteel Group

- Baotou Steel

- Benxi Steel

- CSC

- Evraz Group

- Fangda Steel

- Gerdau

- Anyang Steel