Global Fitness for Service Market Size, Share, Growth Analysis By Service Type (Non-destructive Testing (NDT), Engineering Critical Assessment (ECA), Remaining Life Assessment (RLA), Fitness For Purpose (FFP) Assessment), By End-use (Oil & Gas, Chemicals and Petrochemicals, Power Generation, Refining and Midstream, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169546

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

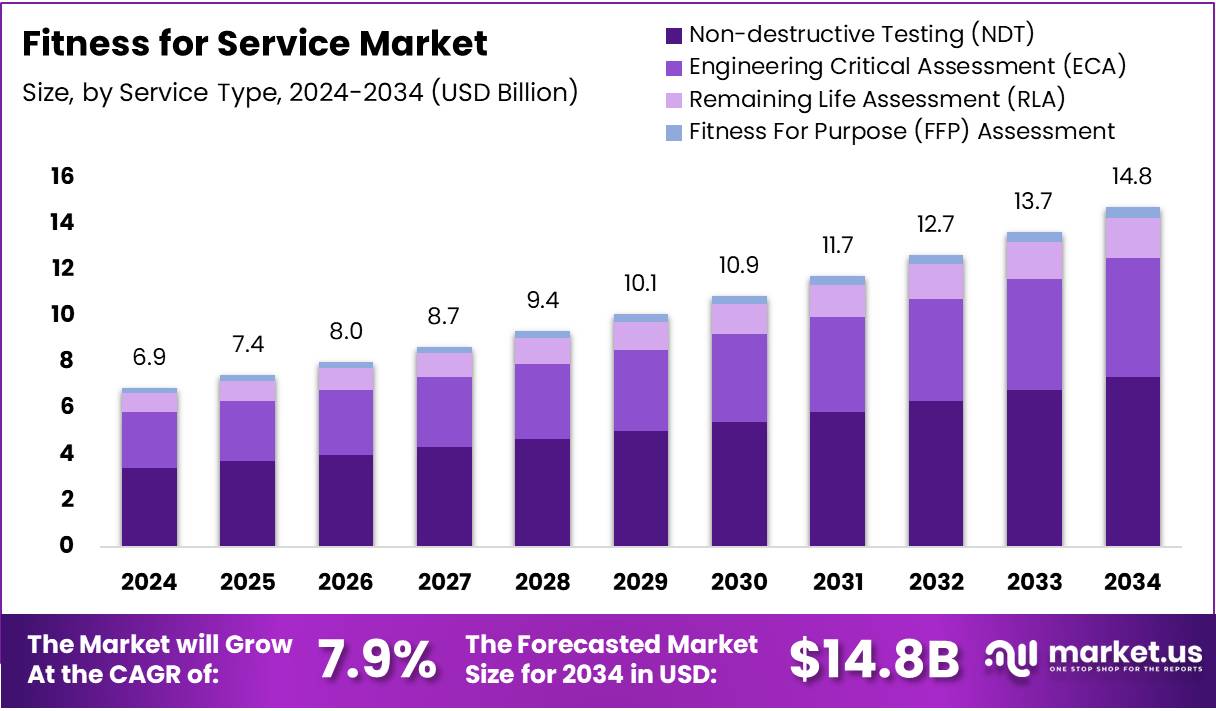

The Global Fitness for Service Market size is expected to be worth around USD 14.8 Billion by 2034, from USD 6.9 Billion in 2024, growing at a CAGR of 7.9% during the forecast period from 2025 to 2034.

The Fitness for Service (FFS) market encompasses systematic engineering evaluations that determine whether equipment containing flaws or damage can continue operating safely within established parameters. This methodology enables asset owners to make informed decisions about continuing operations, implementing repairs, or planning replacements. Organizations increasingly adopt FFS assessments to extend equipment lifespan while maintaining safety standards and regulatory compliance across critical infrastructure.

The market demonstrates substantial growth potential as industries prioritize asset integrity management and operational efficiency. Companies recognize that FFS methodologies deliver significant cost savings by avoiding premature equipment replacement and minimizing unplanned shutdowns. Furthermore, aging infrastructure across oil and gas, chemical processing, and power generation sectors creates expanding opportunities for FFS service providers and technology developers.

Government investment in infrastructure modernization and stringent safety regulations significantly influence market dynamics. Regulatory bodies worldwide mandate comprehensive integrity assessments for pressure-containing equipment, thereby driving FFS adoption. Additionally, environmental protection agencies require demonstration of asset reliability to prevent incidents that could harm communities or ecosystems. These regulatory frameworks establish baseline requirements while encouraging advanced assessment techniques.

The market exhibits diverse technological approaches reflecting varied industry needs and operational contexts. However, this diversity also reveals fragmentation challenges that organizations must navigate when selecting appropriate assessment methodologies. Consequently, standardization efforts gain momentum as stakeholders seek consistency in evaluation practices while maintaining flexibility for specific applications.

Industry adoption patterns indicate significant market penetration and evolving implementation strategies. Research reveals that, 53% of companies utilize FFS procedures within their operations, demonstrating widespread acceptance across industrial sectors. Moreover, 59% of these organizations rely on published procedures rather than developing fully internal methods, highlighting preference for standardized approaches. Research indicates over 40 distinct assessment codes, models and techniques exist for estimating pressure-carrying capacity, underscoring fragmentation across FFS methodologies. Additionally, verification studies document 49 burst-test records for cylindrical vessels under combined loads, supporting validation of established assessment margins and strengthening industry confidence.

Key Takeaways

- The global market is projected to reach USD 14.8 Billion by 2034, up from USD 6.9 Billion in 2024.

- The market grows at a steady 7.9% CAGR during 2025–2034, driven by safety and asset integrity needs.

- Non-destructive Testing (NDT) dominates the service type segment with a 49.8% share in 2024.

- Oil & Gas leads the end-use segment with a 39.3% market share in 2024.

- North America remains the top regional market with a 41.5% share valued at USD 2.8 Billion in 2024.

By Service Type Analysis

Non-destructive Testing (NDT) dominates with 49.8% due to its wide acceptance and proven inspection accuracy.

In 2024, Non-destructive Testing (NDT) held a dominant market position in the By Service Type segment of the Fitness for Service Market, with a 49.8% share. This method helps detect flaws without disrupting operations. Additionally, industries increasingly trust NDT to maintain asset reliability, reduce risks, and extend operational cycles effectively.

Engineering Critical Assessment (ECA) held a significant position in the By Service Type segment of the Fitness for Service Market. The method supports data-driven decisions for structural safety. Moreover, ECA enables companies to determine flaw acceptability, reduce excessive repairs, and optimize maintenance strategies for long-term operational efficiency.

Remaining Life Assessment (RLA) secured an important role in the By Service Type segment of the Fitness for Service Market. This service helps operators estimate remaining operating periods for ageing components. Furthermore, RLA strengthens planning for refurbishment, supports lifecycle extension strategies, and improves overall asset performance in demanding industrial environments.

Fitness For Purpose (FFP) Assessment maintained a valuable position within the By Service Type segment of the Fitness for Service Market. It determines whether equipment can safely operate under real-world conditions. Additionally, FFP helps reduce unnecessary asset replacements and ensures compliance with operational requirements, making it a preferred choice across safety-critical facilities.

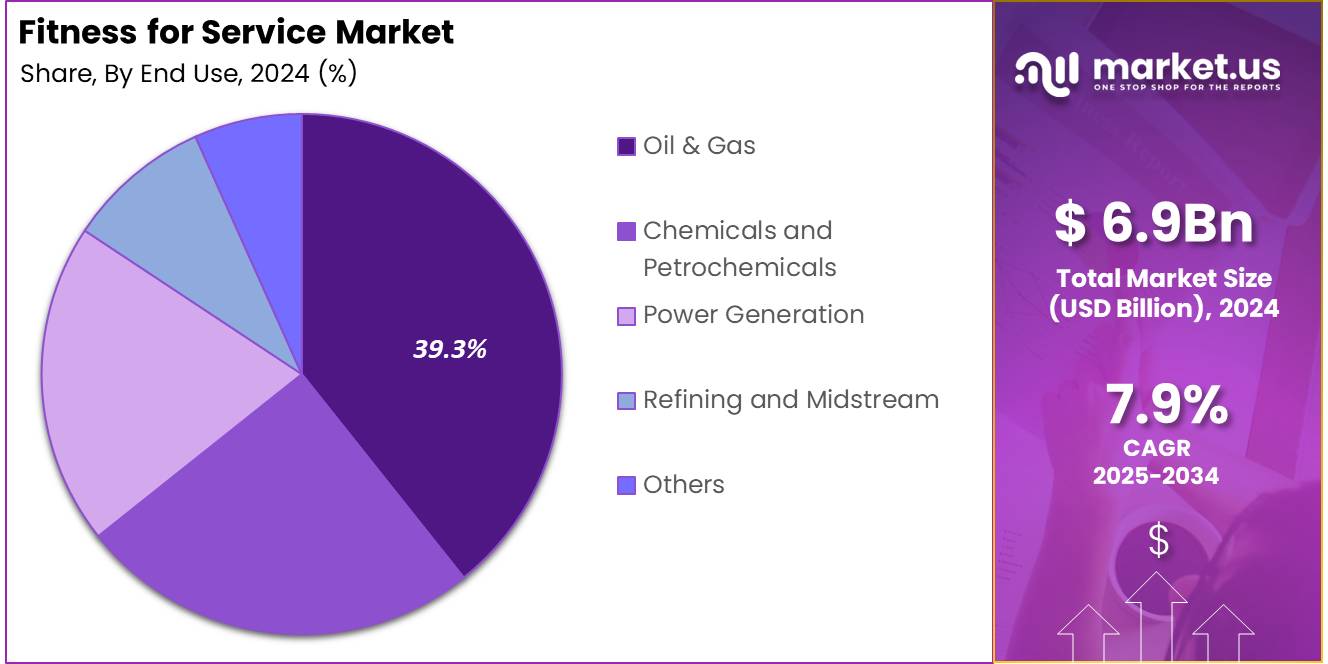

By End-use Analysis

Oil & Gas dominates with 39.3% due to high dependency on asset integrity verification.

In 2024, Oil & Gas held a dominant market position in the By End-use segment of the Fitness for Service Market, with a 39.3% share. This sector relies on frequent integrity checks to manage corrosion, fatigue, and ageing pipelines. Moreover, expanding offshore operations and stricter safety norms continue to push FFS adoption across global assets.

Chemicals and Petrochemicals held a notable position in the By End-use segment of the Fitness for Service Market. Continuous exposure to extreme temperatures and pressures increases the need for periodic structural evaluations. Additionally, regulatory compliance requirements encourage chemical producers to integrate FFS assessments to support stable and safe production environments.

Power Generation played a substantial role in the By End-use segment of the Fitness for Service Market. Ageing industrial boilers, turbines, and pressure systems require continuous monitoring to ensure reliability. Furthermore, the sector increasingly uses FFS assessments to extend plant life cycles and reduce unexpected system failures, supporting smooth power delivery.

Refining and Midstream contributed significantly to the By End-use segment of the Fitness for Service Market. These operations depend on continuous inspection to prevent leakages and maintain product flow. Additionally, as midstream networks expand, companies adopt FFS tools to strengthen operational resilience and avoid high-impact shutdown events.

Others supported steady growth within the By End-use segment of the Fitness for Service Market. Various industries rely on FFS methods to sustain equipment health and minimize long-term costs. Moreover, increasing industrial modernization drives the need for structured asset evaluation practices across diverse operational settings.

Key Market Segments

By Service Type

- Non-destructive Testing (NDT)

- Engineering Critical Assessment (ECA)

- Remaining Life Assessment (RLA)

- Fitness For Purpose (FFP) Assessment

By End-use

- Oil & Gas

- Chemicals and Petrochemicals

- Power Generation

- Refining and Midstream

- Others

Drivers

Strong Regulatory Push for Operational Safety and Asset Integrity Compliance Drives Market Growth

Regulations around equipment safety are becoming stricter, encouraging industries to adopt Fitness for Service (FFS) assessments. Companies now face higher expectations to prove that their assets are safe to operate. This regulatory pressure drives steady demand for FFS services as organizations work to avoid fines, compliance issues, and operational risks.

At the same time, industries are becoming more focused on reducing unplanned downtime. Unexpected equipment failures can lead to high repair costs and production losses. As a result, businesses are increasingly using FFS evaluations to understand the condition of their equipment and prevent costly disruptions. This shift toward proactive maintenance continues to accelerate market growth.

The adoption of standardized frameworks, especially API 579, is also expanding. These guidelines provide trusted methods for evaluating damaged or aging assets, improving consistency and decision-making. More industries prefer standardized assessments because they reduce uncertainty and help teams justify repair or replacement decisions with clear technical evidence.

Restraints

Slow Adoption of FFS Standards Limits Market Expansion

The Fitness for Service (FFS) market faces notable restraints as many emerging industrial regions are slow to adopt standardized assessment frameworks. Several plants still depend on traditional inspection practices instead of structured FFS methodologies. This slows the overall penetration of advanced assessment tools and reduces the pace at which industries modernize their asset integrity programs. As a result, companies in these regions struggle to fully align with global safety expectations.

Furthermore, inconsistent data quality from older industrial assets creates another major limitation. Many facilities operate equipment that has been in service for decades, and their inspection records are often incomplete or outdated. This inconsistency makes it harder for engineers to conduct accurate evaluations and predict failure risks with confidence. Poor-quality data also increases the time and cost required to perform FFS assessments.

Additionally, legacy systems often lack digital documentation, forcing organizations to combine manual notes, old inspection sheets, and scattered operational data. This leads to operational delays and reduces the reliability of assessment outcomes. In many cases, industries must first invest in data cleanup and modernization before leveraging FFS tools effectively.

Growth Factors

Expansion of Digital Twins for Predictive Fitness-for-Service Evaluation Drives Market Growth

The Fitness for Service (FFS) market is creating strong growth opportunities as industries increasingly adopt digital twins for asset evaluation. These virtual models allow companies to monitor real-time conditions, predict failures early, and plan maintenance more efficiently. This shift improves decision-making and reduces operational risks, making digital twins a key enabler of next-generation FFS solutions.

Additionally, the rising demand for FFS tools in decommissioning and life-extension projects is expanding market potential. Many industrial plants, pipelines, and offshore structures are approaching the end of their design life. As companies attempt to safely extend the lifespan of these aging assets, they are turning to FFS evaluations to determine structural health and safe operating limits. This creates consistent long-term demand for specialized assessments.

Furthermore, the increasing use of laser-scanning and high-resolution imaging is strengthening opportunities in structural integrity analysis. These advanced techniques capture precise defect details, enabling more accurate assessments and reducing uncertainty in evaluations. As industries seek greater accuracy and safety assurance, imaging-based inspection methods are becoming essential tools in modern FFS programs.

Emerging Trends

Growing Adoption of AI-Driven Defect Detection Models Drives Market Growth

The Fitness for Service (FFS) market is witnessing strong momentum as industries increasingly adopt AI-based defect detection models. These tools help companies identify cracks, corrosion, and structural weaknesses more accurately. As a result, businesses are improving decision-making and reducing unplanned shutdowns, which is strengthening the overall adoption of FFS solutions across sectors.

At the same time, there is a clear shift toward cloud-based integrity management platforms. Companies prefer cloud systems because they make data sharing faster, support large datasets, and improve collaboration between engineering teams. This transition is helping organizations streamline inspection workflows and maintain better visibility over asset health in real time.

Another major trend shaping the market is the rising use of real-time monitoring sensors in critical equipment. These sensors continuously track parameters such as pressure, vibration, and temperature. This allows maintenance teams to respond quickly when equipment behavior changes. As industries rely more on predictive maintenance, real-time data insights are becoming a key part of FFS assessments.

Regional Analysis

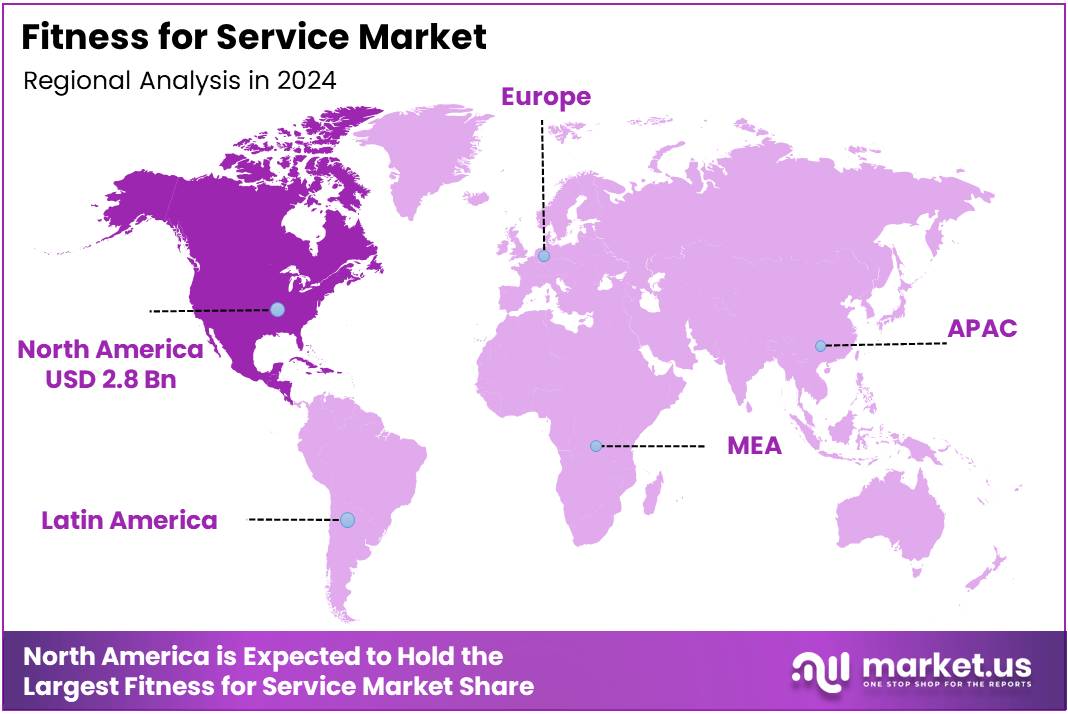

North America Dominates the Fitness for Service Market with a Market Share of 41.5%, Valued at USD 2.8 Billion

North America leads the global fitness for service market with a commanding share of 41.5%, valued at USD 2.8 billion. The region’s dominance stems from extensive aging oil and gas infrastructure, stringent regulatory frameworks, and concentration of major refineries and petrochemical facilities. Advanced technological adoption in digital inspection techniques and strong emphasis on asset integrity management programs further solidify North America’s leading market position.

Europe Fitness for Service Market Trends

Europe represents a significant market driven by mature industrial infrastructure and comprehensive safety regulations. The region’s growth is propelled by established refineries, chemical plants, and power generation facilities requiring continuous asset assessment. Strong adherence to European safety directives and focus on extending asset lifecycles through effective integrity management programs sustain regional demand.

Asia Pacific Fitness for Service Market Trends

Asia Pacific experiences rapid growth fueled by expanding industrialization and rising energy demands across emerging economies. Substantial investments in oil and gas, petrochemical, and power sectors across China, India, Japan, and South Korea create significant opportunities. Growing awareness of asset integrity management and adoption of international safety standards drive market expansion in the region.

Middle East and Africa Fitness for Service Market Trends

The Middle East and Africa region shows considerable potential, primarily driven by extensive oil and gas infrastructure. Gulf Cooperation Council countries dominate demand due to vast hydrocarbon resources and concentration of refineries and petrochemical complexes. Focus on maintaining operational continuity in harsh environments and compliance with international safety standards supports market growth.

Latin America Fitness for Service Market Trends

Latin America demonstrates steady growth supported by significant oil and gas production activities. Brazil and Mexico lead regional demand with their substantial energy sectors and mature refinery infrastructure. Growing investments in infrastructure modernization and adoption of risk-based inspection methodologies drive market development across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Fitness for Service Company Insights

TWI Ltd. remains a key contributor by expanding its engineering assessment services and strengthening its role in structural integrity evaluation. Its long-standing expertise in welding and damage mechanisms supports clients aiming to extend asset life while maintaining regulatory compliance.

MISTRAS Group continues to leverage its strong non-destructive testing foundation and digital monitoring platforms. The company is gaining traction by integrating real-time asset intelligence with FFS methodologies, helping operators reduce failure risks and streamline inspection decision-making. Its broad customer reach enhances its influence across critical sectors.

Equity Engineering Group, Inc. plays an important role through its specialization in API 579-based FFS assessments. Its engineering tools and consulting services help operators optimize maintenance strategies and address complex degradation scenarios. The company’s continued investment in analytical software keeps it highly relevant in process industries.

DNV maintains a strong market position by expanding its risk-based integrity frameworks and simulation tools. The company’s digital-first strategy and experience in energy and marine sectors enhance its ability to deliver comprehensive FFS evaluations. Its global footprint supports multi-region projects requiring consistent assessment standards.

Top Key Players in the Market

- TWI Ltd.

- MISTRAS Group

- Equity Engineering Group, Inc.

- DNV

- Bureau Veritas

- TÜV SÜD

- Intertek Group plc

- John Wood Group PLC

- SGS Société Générale de Surveillance SA

- ABS Group of Companies, Inc.

Recent Developments

- In January 2025, Codeware introduced the latest version of its INSPECT API 579-1 FFS software. The update significantly improves the accuracy and speed of fitness-for-service assessments for pressure vessels, piping, and aboveground storage tanks.

- In October 2024, Creaform (a division of AMETEK) launched VXintegrity 3.0, an advanced nondestructive testing (NDT) software for FFS analysis. This new version enhances inspection precision and streamlines engineering evaluation processes.

- In May 2024, Akselos released a digital twin-based FFS platform that utilizes a powerful 3D structural model engine. The platform enables predictive maintenance and real-time structural integrity assessments for complex assets.

Report Scope

Report Features Description Market Value (2024) USD 6.9 Billion Forecast Revenue (2034) USD 14.8 Billion CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Non-destructive Testing (NDT), Engineering Critical Assessment (ECA), Remaining Life Assessment (RLA), Fitness For Purpose (FFP) Assessment), By End-use (Oil & Gas, Chemicals and Petrochemicals, Power Generation, Refining and Midstream, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape TWI Ltd., MISTRAS Group, Equity Engineering Group, Inc., DNV, Bureau Veritas, TÜV SÜD, Intertek Group plc, John Wood Group PLC, SGS Société Générale de Surveillance SA, ABS Group of Companies, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- TWI Ltd.

- MISTRAS Group

- Equity Engineering Group, Inc.

- DNV

- Bureau Veritas

- TÜV SÜD

- Intertek Group plc

- John Wood Group PLC

- SGS Société Générale de Surveillance SA

- ABS Group of Companies, Inc.