Global Fintech Paas Platforms Market Size, Share, Industry Analysis Report By Service Type (Banking-as-a-Service (BaaS), Payments-as-a-Service (PaaS), Lending-as-a-Service (LaaS), Insurance-as-a-Service (IaaS), Card-as-a-Service (CaaS), Others), By Application (Banking, Insurance, Investment & Wealth Management, Lending & Financing, Payment & Fund Transfer, Regulatory & Compliance, Others), By End-User (Financial Institutions (B2B), FinTechs & Neobanks (B2B2C), Non-Financial Businesses (B2B2C), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 163283

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

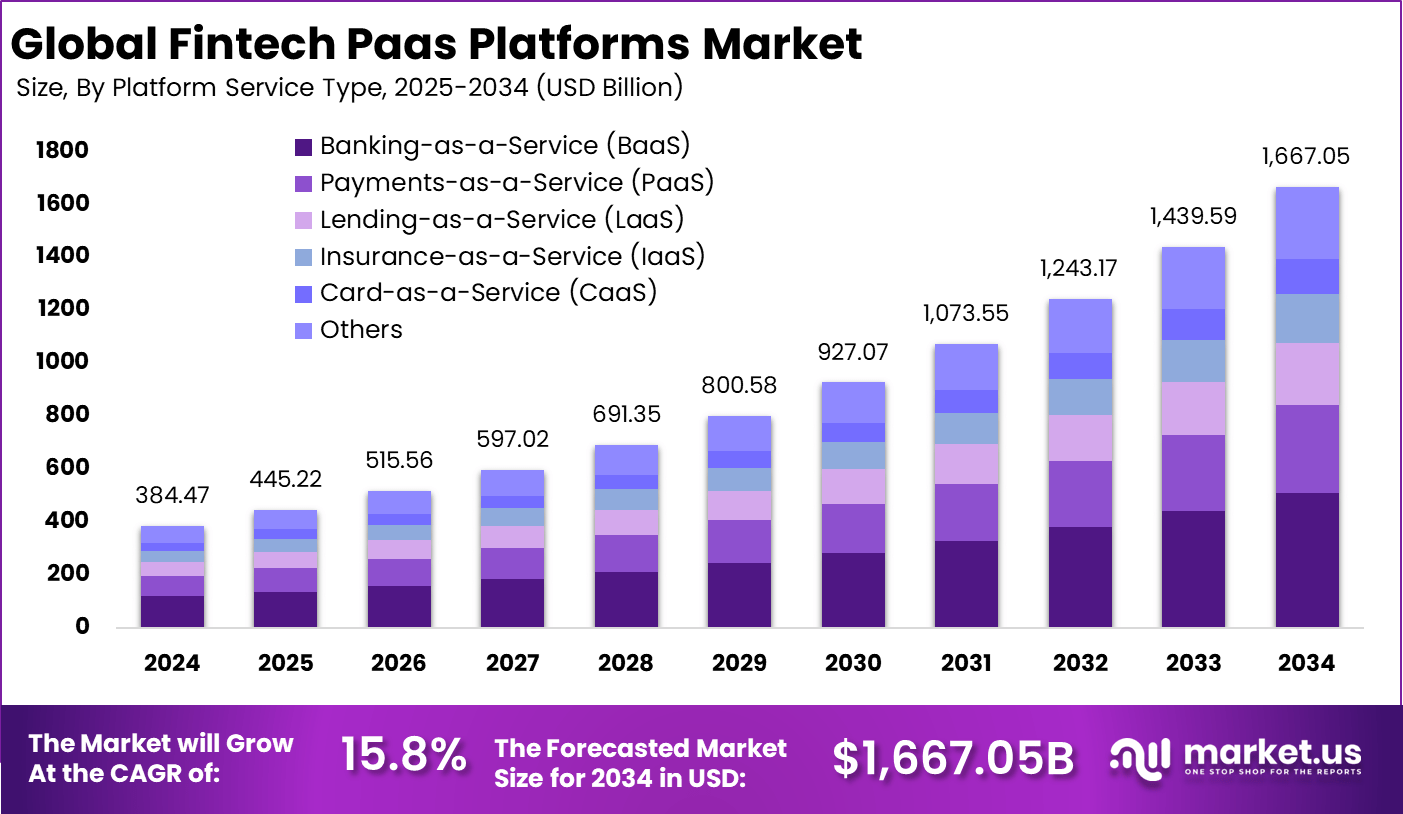

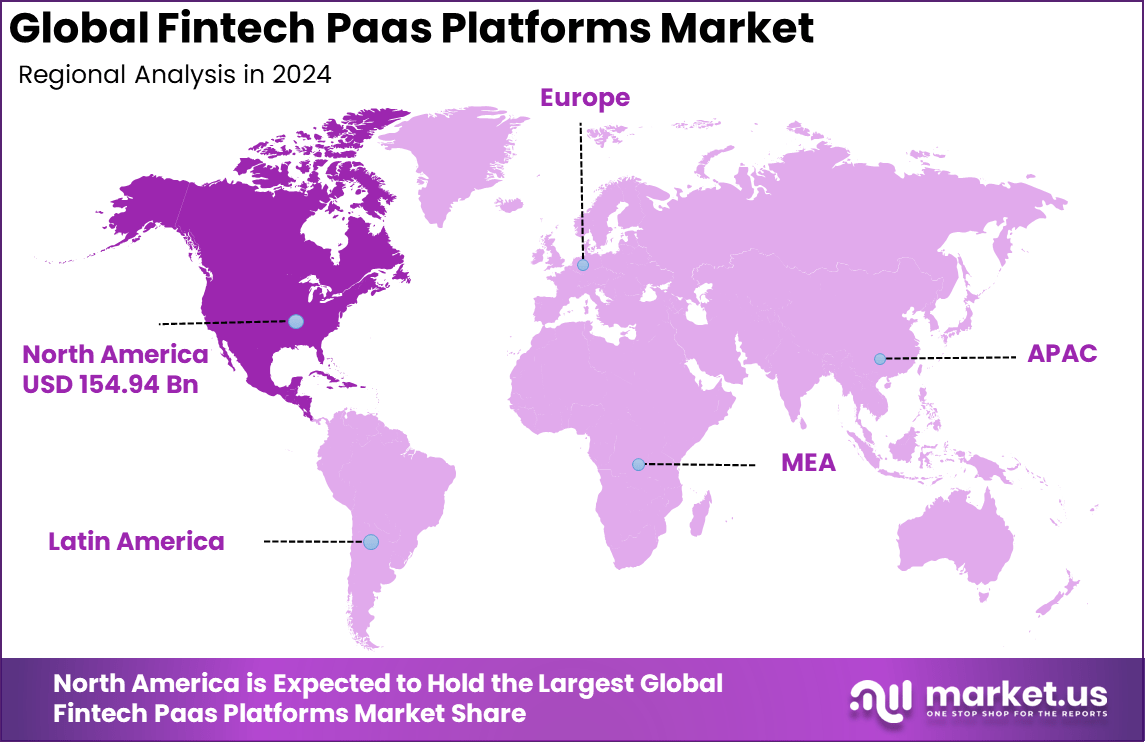

The Global Fintech Paas Platforms Market size is expected to be worth around USD 1,667.05 billion by 2034, from USD 384.47 billion in 2024, growing at a CAGR of 15.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40.3% share, holding USD 154.94 billion in revenue.

The fintech PaaS platforms market refers to cloud-native platforms that provide modular, API-first infrastructure for financial services such as payments, banking, lending, insurance and wealth management. These platforms allow financial institutions, fintech firms and embedded finance providers to launch services more rapidly by reusing core infrastructure.

One major driver is the growing demand for embedded finance services where non-financial businesses integrate financial offerings such as payments or credit into their operations. The proliferation of open banking, regulatory shifts enabling API access to financial data, and increased cloud adoption among incumbents all support the uptake of fintech PaaS.

Technologies enabling fintech PaaS adoption include cloud-native microservices, open APIs, modular fintech building blocks (such as KYC, card issuing, fraud detection), and developer platforms that support plug-and-play integrations. Platforms are increasingly offering advanced analytics, AI-driven risk and fraud modules, and real-time payments capabilities built on modern cloud infrastructure.

According to ElectroIQ, global investments in fintech fell to USD 44.7 billion during the first half of 2025, reflecting a slowdown in funding activity. Despite this decline, major payment networks continue to dominate the fintech sector. Visa maintained its leadership with a market capitalization of USD 662.6 billion in 2025, rising from USD 547 billion in 2024, while Mastercard recorded USD 346.3 billion in 2025, down from USD 389 billion the previous year.

For instance, in February 2025, Rapyd is seeking $300 million in funding at a $3.5 billion valuation, sharply down from its 2021 $9 billion valuation. The company is actively growing through acquisitions with plans to buy a payment processing startup. Rapyd offers APIs for payment, wallets, transfers, card issuing, and fraud protection integrated for third parties.

Key Takeaway

- The Banking-as-a-Service (BaaS) segment led with 30.6%, reflecting rapid adoption of modular banking infrastructure that enables non-bank entities to offer digital financial services.

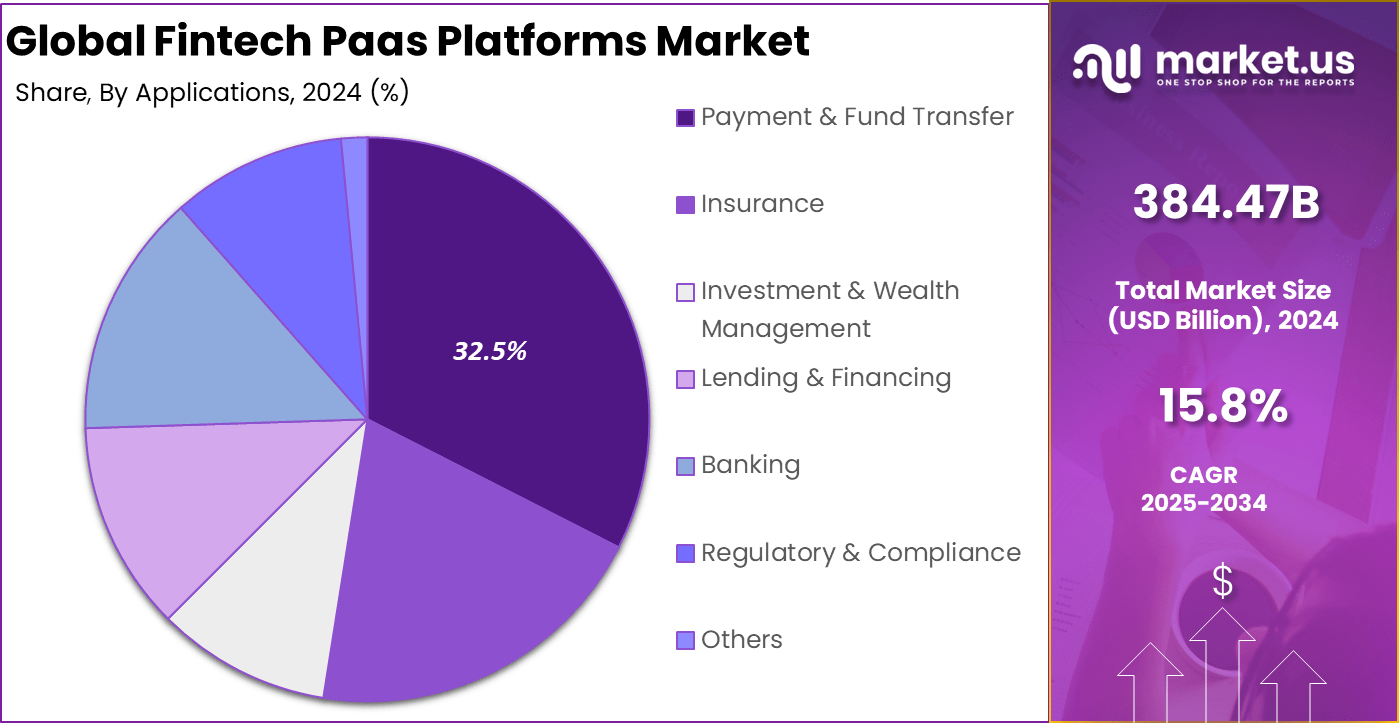

- The Payment & Fund Transfer segment dominated with 32.5%, supported by the growing need for real-time, API-driven payment solutions across digital ecosystems.

- The Non-Financial Businesses (B2B2C) segment captured 51.4%, highlighting the rise of embedded finance models where retail, e-commerce, and technology companies integrate financial services into their platforms.

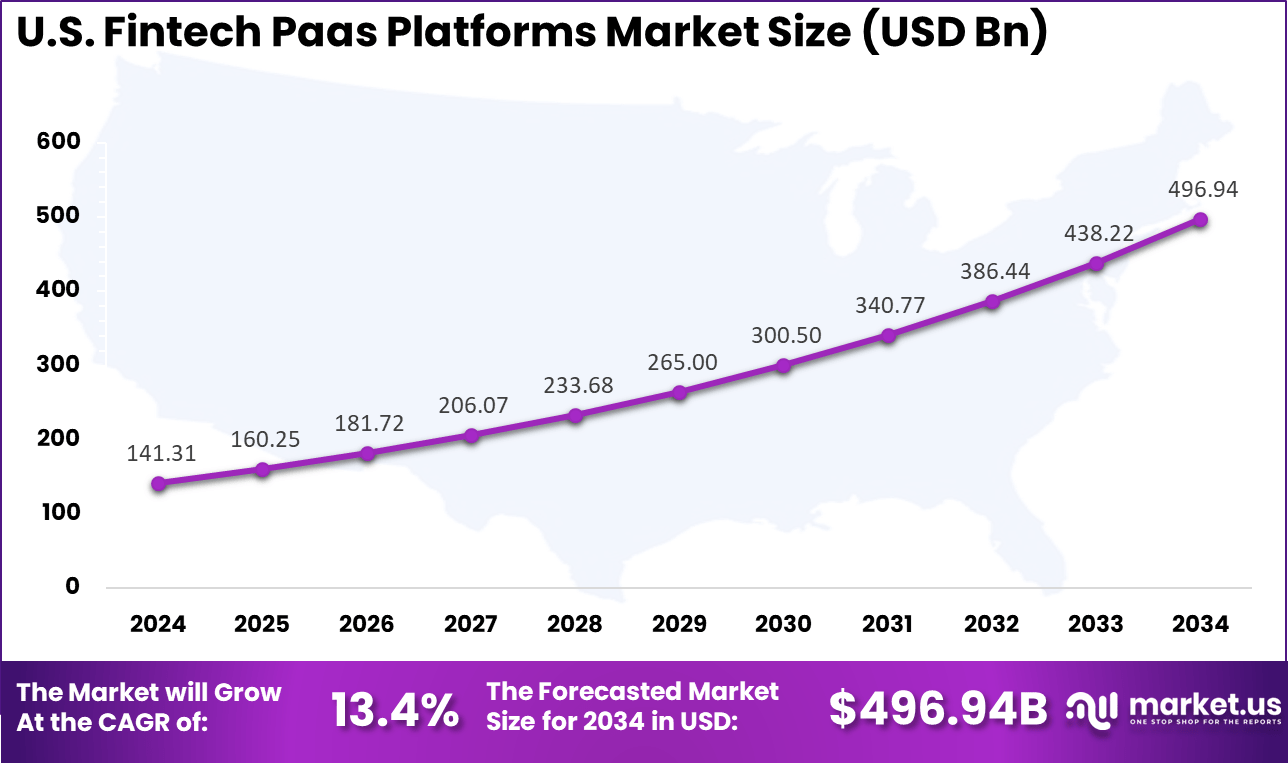

- The US market was valued at USD 141.31 Billion in 2024, expanding at a strong 13.4% CAGR, driven by fintech innovation, regulatory openness, and digital banking partnerships.

- North America maintained a leading 40.3% share of the global market, supported by advanced financial infrastructure, high digital adoption rates, and a vibrant ecosystem of fintech service providers.

Role of Generative AI

Generative AI is playing a key role in transforming fintech PaaS platforms by automating complex data analysis and decision-making processes. About 85% of business leaders expect to use generative AI for routine tasks by the end of 2025, which improves efficiency and reduces errors. This technology helps create personalized financial services, like credit scoring and fraud detection, by learning from past data patterns and generating new scenarios.

It supports smarter loan underwriting and investment advice, making fintech services more accessible and accurate for customers. The generative AI market in fintech is growing at around 35% annually, showing how financial firms are increasingly investing in these intelligent tools to scale operations and improve customer experiences. In fintech PaaS, generative AI bridges data and user interaction, powering chatbots and predictive analysis for enhanced risk management.

It streamlines regulatory compliance by automating data validation and anomaly detection. This shift to AI-driven solutions in fintech leads to smarter automation in payments, wealth management, and algorithmic trading, which ultimately boosts platform performance and customer satisfaction. The rise of generative AI is not just about cost cutting; it also opens new avenues for innovation by simulating financial decisions and generating insights that were difficult to access before.

Investment and Business Benefits

Investment opportunities in the fintech PaaS domain attract venture capital and corporate funding for startups offering specialized payment solutions, RegTech tools, and banking-as-a-service platforms. Investors are drawn to this segment due to the cost-efficiency, operational agility, and potential to disrupt traditional banking models.

Funding rounds often range from a few million to over $100 million as fintech firms expand services globally and deepen API ecosystems designed for rapid customization and compliance management. Businesses adopting fintech PaaS realize benefits such as reduced IT costs, enhanced service reliability, faster functionality rollouts, and improved regulatory compliance.

With cloud-based services, financial institutions avoid costly legacy system upkeep, enabling better scalability and uptime even during transaction spikes. The platforms also offer built-in compliance measures for standards like PCI-DSS and ISO 27001, reducing the compliance burden while safeguarding customer data. The result is improved customer satisfaction, streamlined operations, and new revenue streams through modern digital finance offerings.

U.S. Market Size

The market for Fintech Paas Platforms within the U.S. is growing tremendously and is currently valued at USD 141.31 billion, the market has a projected CAGR of 13.4%. The market is growing due to increased adoption of digital banking, mobile payments, and AI-driven solutions that have enhanced service offerings, making financial transactions more seamless and secure.

Supportive regulatory policies, together with rising consumer demand for faster, convenient digital financial services, have also played a crucial role. Moreover, technological advancements and strategic collaborations among key players continue to accelerate growth, positioning the market for substantial expansion in the coming years.

For instance, in September 2025, Fiserv announced it would end its joint venture with Wells Fargo Merchant Services later in 2025. The Milwaukee-headquartered company is focusing on expanding partnerships, including a key integration with PayPal to enable payments and Venmo services for its customers.

In 2024, North America held a dominant market position in the Global Fintech Paas Platforms Market, capturing more than a 40.3% share, holding USD 154.94 billion in revenue. This dominance is due to a well-established digital infrastructure, high fintech adoption rates, and a robust startup ecosystem supported by venture capital funding.

Regulatory frameworks balancing innovation and security further aid market growth. The region’s widespread consumer preference for digital financial services, combined with collaborations between traditional banks and fintech companies, fuels ongoing expansion and innovation. This solid foundation positions North America as a global leader in fintech PaaS development and deployment.

For instance, in October 2025, Mastercard launched its Mastercard Installments Card for Business, a payment solution aimed at SMEs worldwide. The Purchase, New York-headquartered firm also expanded partnerships to support crypto-funded cards and bolstered its global business payment services.

Service Type Analysis

In 2024, The Banking-as-a-Service (BaaS) segment held a dominant market position, capturing a 30.6% share of the Global Fintech Paas Platforms Market. They provide banks with a way to reduce costs and increase revenue by collaborating with fintech companies. These collaborations enable banks to leverage ready-made digital solutions instead of investing heavily in technical upgrades.

The trust and funding capacity of banks give them an edge in expanding BaaS offerings, making them dominant users in this sector. The BaaS model is also attractive to non-bank financial companies (NBFCs), which are set to grow the fastest within this space. NBFCs are adopting BaaS platforms to provide payment services and avoid the complexity of acquiring traditional banking licenses.

For Instance, in September 2025, Rapyd launched its Stablecoin Payment Solutions, providing a unified platform for businesses to accept, settle, and pay out using stablecoins. This move enhances Rapyd’s BaaS offerings by integrating digital assets into global payments, reducing reliance on fragmented systems, and enabling real-time liquidity across borders. This supports businesses with volatile currencies and complex treasury needs, reinforcing Rapyd’s position in the embedded finance space.

Application Analysis

In 2024, the Payment & Fund Transfer segment held a dominant market position, capturing a 32.5% share of the Global Fintech Paas Platforms Market. These services facilitate digital payments, peer-to-peer transfers, and real-time transactions, which are essential for the growing e-commerce and mobile commerce sectors.

Businesses and consumers alike seek fast, reliable, and secure ways to transfer money digitally, making these solutions highly valued in today’s fast-paced digital economy. The surge in digital transactions and the need for seamless payment experiences have driven demand for robust API-powered payment systems.

These platforms enable instant payments, support fraud prevention, and integrate with various payment methods. As consumers prefer quick and secure transactions, businesses are investing in advanced fund transfer solutions that can adapt to changing needs without heavy infrastructure costs.

For instance, in October 2025, Mastercard introduced its Mastercard Threat Intelligence solution to combat payment fraud at scale. This innovation combines Mastercard’s global fraud insights with curated cyber threat data, helping financial institutions proactively detect and prevent payment fraud. The solution supports secure, efficient payment and fund transfer applications by reducing transaction risks and enhancing merchant compliance worldwide.

End-User Analysis

In 2024, The Non-Financial Businesses (B2B2C) segment held a dominant market position, capturing a 51.4% share of the Global Fintech Paas Platforms Market. These companies embed financial services such as payments, lending, and digital wallets into their platforms, providing their customers with seamless financial experiences embedded directly into their core offerings. This approach helps non-financial firms create more engaging, stickier customer journeys.

The trend of embedded finance is growing rapidly as non-financial companies recognize the benefits of offering financial products without becoming traditional banks. By integrating fintech APIs, these businesses can enhance customer loyalty and generate additional revenue streams. The flexibility offered by fintech PaaS allows such companies to quickly deploy tailor-made financial services aligned with their brand and customer preferences.

For Instance, in October 2025, Cross River Bank launched its Advanced Authorization model, giving fintech partners real-time control over transaction approvals while maintaining regulatory compliance. This innovation supports non-financial businesses embedding fintech into their platforms, allowing dynamic transaction experiences and seamless wallet management. It helps non-financial companies enhance customer journeys by integrating complex financial functions simply and effectively.

Emerging Trends

One of the strongest emerging trends in fintech PaaS platforms is the integration of embedded finance, where financial services are delivered directly within non-financial applications like e-commerce and social media. By 2025, this embedded finance is expected to become widespread, offering seamless transactions without switching apps.

Open banking APIs support this trend, allowing secure data sharing and better customer experiences. Another major trend is the widespread adoption of cloud-based solutions, which provide scalability, flexibility, and improved security for fintech platforms. Cloud services enable faster innovation cycles and better handling of large data volumes, which is critical for real-time financial operations.

Additionally, digital-only banks and neobanks are expanding their presence through fintech PaaS platforms, pushing traditional banks to adapt to hybrid models combining digital and physical services. The rise in decentralized finance and blockchain adoption also drives innovation in fintech PaaS with increased transparency and security. Payments continue to lead revenue growth, with global payments revenue hitting trillions in recent years, showing fintech’s critical role in daily financial transactions.

Growth Factors

The rapid adoption of cloud computing technology is a major growth factor for fintech PaaS platforms as it allows financial institutions to optimize operations and reduce costs. Cloud infrastructure supports faster deployment and seamless integration of fintech services, making it easier for businesses to scale.

Digital onboarding, fraud analytics, and decentralized finance are growing areas boosted by PaaS flexibility and enhanced security features. Another significant driver is the increasing demand for personalized customer experiences driven by AI and data analytics, which helps platforms retain users and increase engagement.

Investments in AI, especially generative AI, and machine learning are accelerating fintech innovation by enabling smarter risk management and fraud detection. Financial institutions are also driven by the need to comply with evolving regulatory requirements efficiently, which fintech PaaS solutions support through automation and transparency.

The rising demand for mobile and digital payments fueled by changing consumer behavior contributes to platform growth. Additionally, partnerships between traditional banks and fintech providers fuel the expansion and adoption of PaaS models, making fintech more accessible and versatile in meeting diverse financial needs.

Key Market Segments

By Service Type

- Banking-as-a-Service (BaaS)

- Payments-as-a-Service (PaaS)

- Lending-as-a-Service (LaaS)

- Insurance-as-a-Service (IaaS)

- Card-as-a-Service (CaaS)

- Others

By Application

- Banking

- Insurance

- Investment & Wealth Management

- Lending & Financing

- Payment & Fund Transfer

- Regulatory & Compliance

- Others

By End-User

- Financial Institutions (B2B)

- FinTechs & Neobanks (B2B2C)

- Non-Financial Businesses (B2B2C)

- E-commerce & Retail

- Gig Economy & On-Demand Platforms

- Telecoms

- Travel & Hospitality

- Real Estate

- Healthcare

- Others

Drivers

Growing Demand for Digital Transformation

Financial institutions and enterprises are increasingly pressed to modernize their operations to remain competitive. Many are looking for streamlined, cost-effective ways to develop and deploy new financial services quickly. Fintech PaaS platforms provide ready-made cloud environments with customizable tools that fulfill this need by accelerating application development and integration. This push for digital solutions is a major growth driver, as businesses seek to improve efficiency without heavy upfront investments.

Cloud adoption continues to rise globally, which supports PaaS market expansion. Companies benefit from scalable platforms that offer built-in integrations for payments, compliance, and analytics, allowing them to launch innovative fintech offerings faster. The increasing use of AI and automation capabilities within these platforms further enhances their value by enabling advanced features like fraud detection and personalized customer experiences.

For instance, in September 2025, Stripe announced the launch of its new API-based platform designed to help businesses accelerate digital banking features. This highlights how leading fintech giants are expanding their services to meet the rising demand for digital transformation, offering scalable and integrated solutions that appeal to a global customer base.

Restraint

Complex Regulatory Environment

A key restraint for fintech PaaS providers is the complex and fragmented regulatory landscape they must navigate. Different countries and regions have varying rules for data privacy, security, and financial transactions. Ensuring compliance across multiple jurisdictions can be costly and operationally challenging, slowing platform adoption and expansion into new markets.

The fast pace of regulatory change requires constant adjustments to platform features and processes. This regulatory complexity adds significant overhead, especially for smaller providers who lack dedicated compliance resources. As a result, it acts as a barrier to entry and innovation, forcing fintech PaaS companies to invest heavily in legal and security infrastructure before scaling operations.

For instance, in July 2025, PayPal disclosed ongoing compliance challenges related to cross-border transactions amid changing international financial regulations. These hurdles restrict its ability to quickly scale new PaaS solutions across different regions, exposing the difficulty in managing diverse regulatory frameworks.

Opportunities

Expansion in Emerging Markets

Emerging markets offer a vast growth opportunity for fintech PaaS platforms as many populations gain access to mobile internet and digital financial services for the first time. These regions are characterized by underbanked users and increasing smartphone penetration, creating a strong demand for accessible and affordable payment and banking solutions.

Governments and financial institutions in these markets promote digital payments and financial inclusion through supportive regulations and incentives. By working closely with local fintech startups, banks, and telecom operators, PaaS providers can tailor solutions that meet local needs, currencies, and regulations.

This approach helps accelerate fintech adoption while unlocking new revenue streams for platform providers in high-growth regions. For instance, in April 2025, Cross River Bank announced a new initiative to expand its banking-as-a-service platform into Latin America.

Challenges

Data Security and Privacy Concerns

Security remains a critical challenge for fintech PaaS platforms, as they handle sensitive financial and personal data. Cyberattacks targeting fintech applications are increasingly sophisticated, making it essential to protect data from breaches and fraud. This requires continuous investment in advanced encryption, monitoring, and compliance with stringent data privacy regulations.

Concerns about security risks can slow customer adoption, especially among enterprises handling large volumes of transactions or sensitive information. Fintech PaaS providers must build strong trust by demonstrating robust security measures and transparent privacy policies. However, maintaining these high standards involves ongoing costs and complexity, pressuring providers to balance security and usability effectively.

For instance, in August 2025, Worldline reported increased costs and operational pressures due to the need for enhanced compliance with evolving GDPR and privacy regulations in Europe. These challenges require continuous upgrades to their platforms, which strain resources and affect competitive flexibility.

Key Players Analysis

The Fintech Platform-as-a-Service (PaaS) Market is led by global financial technology leaders such as Stripe, PayPal, Adyen, Block Inc. (Square), and Mastercard. These companies provide cloud-based platforms that enable digital payments, embedded finance, and real-time transaction processing for banks, fintech startups, and enterprises.

Prominent participants such as Fiserv, Cross River Bank, Envestnet, Rapyd, and Unit focus on enabling financial institutions and technology providers to deploy banking and payment solutions through modular APIs. Their offerings combine compliance management, risk assessment, and automation tools that simplify financial operations for businesses.

Emerging and growth-oriented players including Solid, Upstart, Worldline, Intuit, and other key market participants are enhancing fintech capabilities through AI-driven credit assessment, fraud prevention, and personalized financial analytics. Their focus on scalability, cost efficiency, and open banking integration continues to shape the evolution of fintech infrastructure, making PaaS solutions a vital component of the global financial technology landscape.

Top Key Players in the Market

- Rapyd

- Solid

- Unit

- Cross River Bank

- Stripe

- Mastercard

- Fiserv

- Block Inc.

- Envestnet

- Rapyd

- Upstart

- Fiserv

- Adyen

- Paypal

- Worldline

- Square

- Intuit

- Others

Recent Developments

- In February 2025, Mastercard launched the Mastercard Installments Card for Business, a global commercial card solution for SMEs, facilitating network-based installment payments. It announced multiple partnerships for crypto-funded Mastercard cards in the Asia Pacific and expanded its Mastercard Track business payment service with new global partners.

- In May 2025, Stripe unveiled a major platform upgrade with 60+ new launches, including support for 25 new payment methods, managed payments, smart disputes, and expanded Stripe Tax to 102 countries. It also partnered with NVIDIA to enable GeForce Now subscriptions and expanded partnerships with PepsiCo to digitize restaurant and SME payments.

Report Scope

Report Features Description Market Value (2024) USD 384.4 Bn Forecast Revenue (2034) USD 1,667.0 Bn CAGR(2025-2034) 15.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, nd Emerging Trends Segments Covered By Service Type (Banking-as-a-Service (BaaS), Payments-as-a-Service (PaaS), Lending-as-a-Service (LaaS), Insurance-as-a-Service (IaaS), Card-as-a-Service (CaaS), Others), By Application (Banking, Insurance, Investment & Wealth Management, Lending & Financing, Payment & Fund Transfer, Regulatory & Compliance, Others), By End-User (Financial Institutions (B2B), FinTechs & Neobanks (B2B2C), Non-Financial Businesses (B2B2C) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Rapyd, Solid, Unit, Cross River Bank, Stripe, Mastercard, Fiserv, Block Inc., Envestnet, Rapyd, Upstart, Fiserv, Adyen, Paypal, Worldline, Square, Intuit, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)  Fintech Paas Platforms MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Fintech Paas Platforms MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Rapyd

- Solid

- Unit

- Cross River Bank

- Stripe

- Mastercard

- Fiserv

- Block Inc.

- Envestnet

- Rapyd

- Upstart

- Fiserv

- Adyen

- Paypal

- Worldline

- Square

- Intuit

- Others