Global Fingerprint Sensor Market Size, Industry Analysis Report By Type (Area and Touch Sensors, Swipe Sensors), By Technology (Optical, Capacitive, Thermal, Ultrasonic), By Application (Consumer Electronics, Government and Law Enforcement, Military, Defense and Aerospace, Travel and Immigration, Banking and Finance, Healthcare, Smart Homes, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Sept. 2025

- Report ID: 159446

- Number of Pages: 313

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- Adoption Rates

- Investment and Business Benefits

- APAC Market Outlook

- By Type Analysis

- By Technology Analysis

- By Application Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

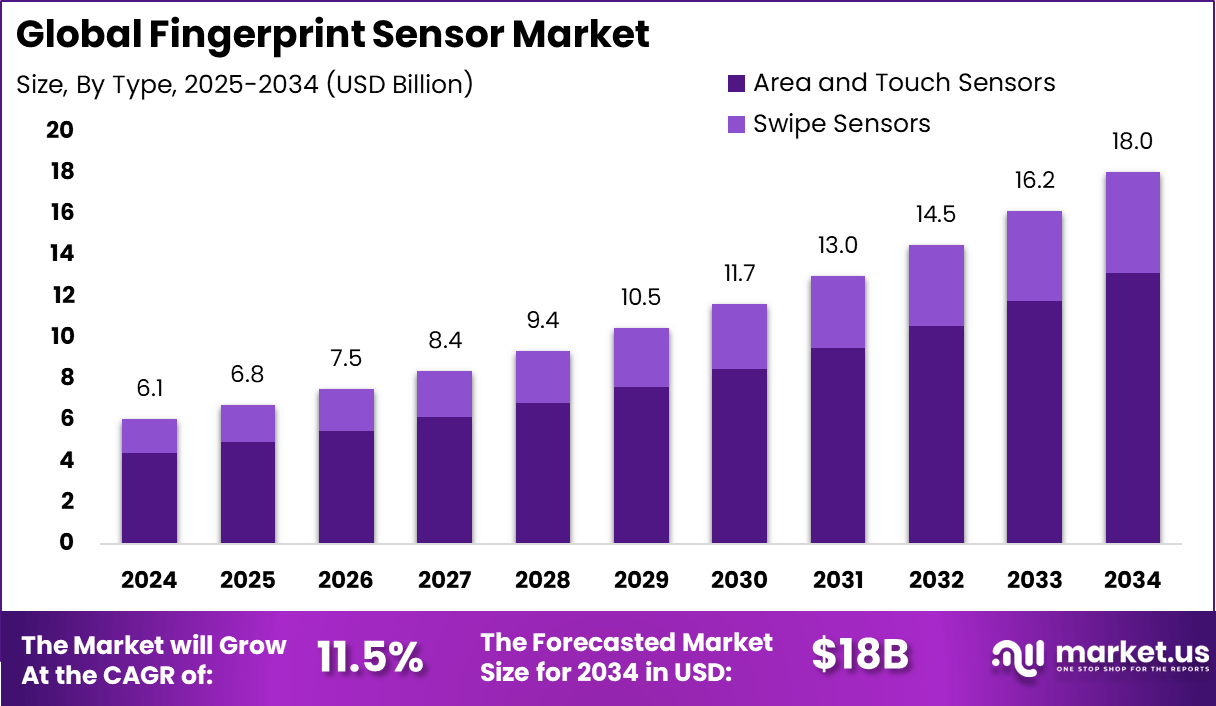

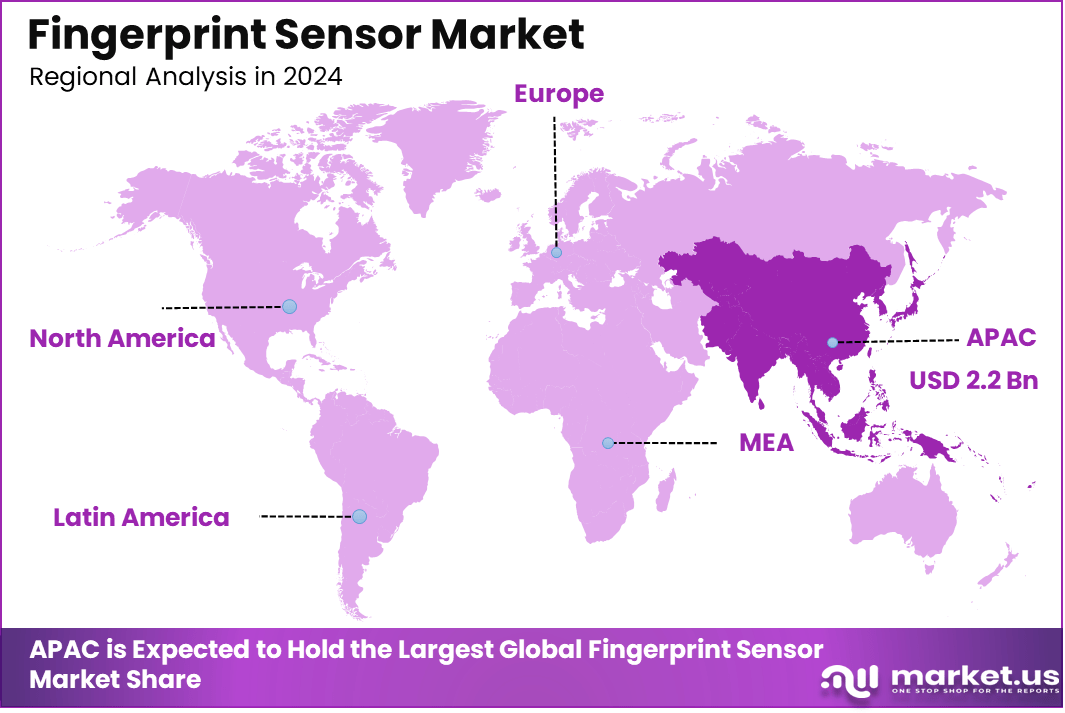

The Global Fingerprint Sensor Market size is expected to be worth around USD 18 Billion By 2034, from USD 6.1 billion in 2024, growing at a CAGR of 11.5% during the forecast period from 2025 to 2034. In 2024, APAC held a dominan market position, capturing more than a 36.8% share, holding USD 2.2 Billion revenue.

The fingerprint sensor market refers to the industry that designs, manufactures, and integrates devices which capture fingerprint patterns for identification and authentication. These sensors are used in smartphones, access control systems, biometric identity programs, financial transactions, smart cards, and secure devices such as laptops or ATMs. Technologies in use include optical, capacitive, ultrasonic, thermal, and hybrid sensor types. Their role is central to biometrics and security systems.

A key driving factor for the fingerprint sensor market is the rising emphasis on security to prevent fraud and identity theft, especially in financial services and digital transactions. Consumers prefer fingerprint unlocking for ease of access while maintaining security. Advances in ultrasonic and optical fingerprint sensor technologies have enhanced accuracy and performance, allowing more seamless integration in devices such as smartphones and payment systems.

Several technology trends are shaping the market. Ultrasonic fingerprint sensors, which can sense through layers of glass or under a display, are gaining prominence because they support sleeker device designs and offer better spoof resistance. Optical and capacitive sensors continue to evolve with improved sensitivity and lower power. Hybrid solutions combining multiple sensor modes help improve reliability in challenging environments

Key Insight Summary

- By type, Area and Touch Sensors led with 73%, reflecting their widespread use in smartphones, tablets, and security devices.

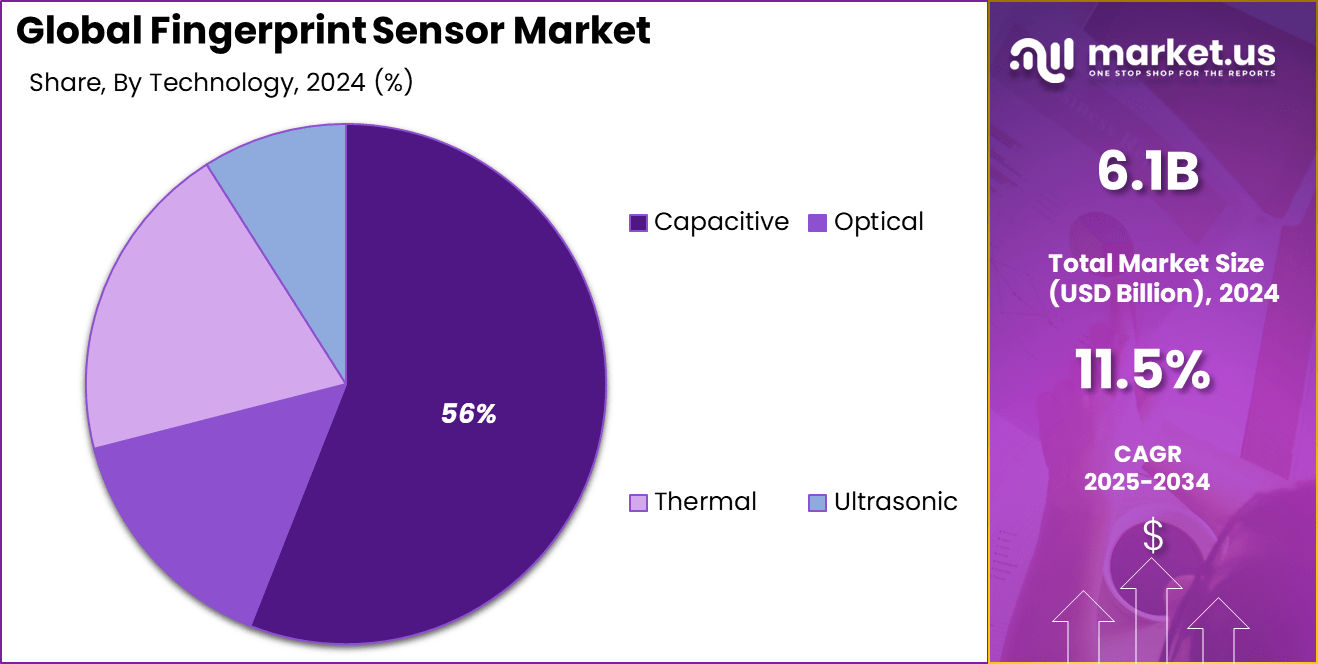

- By technology, Capacitive sensors dominated with 56%, showcasing their accuracy, reliability, and cost-effectiveness compared to other methods.

- By application, Consumer Electronics accounted for 52%, highlighting their role as the primary driver of fingerprint sensor adoption.

- Regionally, Asia Pacific held the largest share at 36.8%, supported by high demand for smartphones, biometric authentication, and rapid digitalization.

Analysts’ Viewpoint

Demand for fingerprint sensors is further boosted by increasing adoption of technologies like under-display sensors, ultrasonics, and integration with Internet of Things (IoT) devices. These technologies offer faster, more reliable, and hygienic authentication methods, especially in the post-pandemic environment where contactless solutions are preferred.

These sensors are used to simplify secure payments, access control, and personalized device settings, attracting adoption in consumer electronics, automotive, healthcare, and government sectors. The constant innovation in sensor design and material has made them smaller, cost-effective, and more user-friendly.

Key reasons for adopting fingerprint sensors include enhanced security, convenience, user trust, and compliance with regulatory requirements. Fingerprints provide a unique, difficult-to-fake identifier, reducing risks of unauthorized access compared to passwords or PINs.

The quick authentication process enhances user experience during device unlocking or transaction authorizations. Governments use fingerprint sensors in national ID programs, strengthening citizen identification systems and reducing fraud. Businesses benefit from improved security and customer confidence in biometric authentication services.

Adoption Rates

Category Adoption Rate (%) Optical Sensors 52.8 Touch Sensors 57.0 Banking Sector (BFSI) 43.6 Investment and Business Benefits

Investment opportunities in the fingerprint sensor market arise from expanding applications in smartphones, banking, automotive, healthcare, and government ID systems. The growing biometric ID initiatives globally drive demand for devices and sensor innovation.

Increased funding in research and development focuses on overcoming challenges like sensor sensitivity to environmental factors and spoofing attempts. Additionally, investments in AI and automation are improving manufacturing efficiencies and sensor accuracy, supporting long-term market growth.

Fingerprint sensor technology offers significant business benefits by enhancing security and enabling smoother user experiences. They reduce reliance on traditional authentication methods prone to breaches, thus limiting fraud and data theft. Businesses in finance, telecom, healthcare, and public services gain from compliant biometric systems that protect sensitive data.

APAC Market Outlook

In 2024, APAC held a dominant market position, capturing more than 36.8% share and generating USD 2.2 billion in revenue in the fingerprint sensor market. The region’s leadership is mainly attributed to the massive adoption of smartphones and consumer electronics across countries like China, India, South Korea, and Japan.

With leading device manufacturers based in APAC, fingerprint sensors have become a standard feature in mid-range and premium smartphones, driving large-scale demand. The affordability of biometric-enabled devices in emerging economies has further expanded adoption, making APAC the fastest-growing hub for fingerprint sensor applications.

The dominance of APAC is also reinforced by government-backed initiatives promoting biometric authentication for identity verification, banking, and public security. Countries such as India have integrated fingerprint sensors into large-scale digital identity programs like Aadhaar, creating one of the world’s largest biometric databases.

By Type Analysis

In 2024, Area and touch sensors dominated the fingerprint sensor market with 73% share. These sensors have become the standard choice in smartphones, tablets, and laptops because they provide better accuracy and faster response compared to swipe or optical variants. Their ability to cover a larger sensing area also makes them reliable for quick secure authentication.

The continued integration of biometric security into everyday devices has further boosted adoption of area and touch sensors. As user expectations for seamless unlocking and payments rise, manufacturers prefer this type of sensor since it balances performance, cost, and device compatibility.

By Technology Analysis

In 2024, Capacitive fingerprint sensors accounted for 56% share of the market. Their widespread use is driven by the ability to capture detailed fingerprint images using electrical signals, which provides higher accuracy and lower error rates. They have become the go-to choice for mobile devices where reliability is critical.

Another advantage of capacitive technology is its durability and resistance to scratches, which makes it suitable for high-use devices. The trend of embedding sensors under display glass and side-mounted buttons also supports the growing demand for this technology in mainstream devices.

By Application Analysis

In 2024, Consumer electronics made up 52% of the market share as fingerprint sensors remain central in smartphones, wearables, and tablets. Increasing adoption for device unlocking, application login, and secure mobile payments has made biometric integration a standard feature for this category.

The focus on merging convenience with higher security has made consumer electronics the leading driver of demand. As device ecosystems expand, fingerprint sensors are also being paired with multi-factor biometric systems to provide both ease of use and protection.

Emerging Trends

Emerging trends in the fingerprint sensor market focus on improved sensor technologies like ultrasonic and optical sensors that read fingerprints through glass or metal surfaces. Optical sensors now account for around 53% market share in 2025 due to their user friendliness and cost-effectiveness. There is a shift towards under-display fingerprint readers and multi-modal biometrics that combine fingerprint data with facial or iris recognition for higher accuracy.

Enhanced anti-spoofing measures and miniaturization of sensors are also changing how fingerprint sensors are integrated, enabling use in a broad range of IoT devices from wearables to smart home systems. North America leads with about 42% market share in 2025 due to early adoption and investments in biometric security.

Growth Factors

Growth factors driving the fingerprint sensors market include the rising demand for secure and convenient authentication in consumer electronics and enterprise environments. Faster processing times, better user experience, and increased regulatory requirements for secure identity verification are boosting adoption in banking, healthcare, and government sectors.

Digital payments and mobile banking are major contributors, with biometric sensors integrated into ATMs and fintech platforms to reduce fraud. The Banking, Financial Services and Insurance sector alone accounted for approximately 44% of the market share in 2025. The increase in connected devices and IoT applications that require reliable user authentication is further expanding demand.

Key Market Segments

By Type

- Area and Touch Sensors

- Swipe Sensors

By Technology

- Capacitive

- Optical

- Thermal

- Ultrasonic

By Application

- Consumer Electronics

- Government and Law Enforcement

- Military, Defense and Aerospace

- Travel and Immigration

- Banking and Finance

- Healthcare

- Smart Homes

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Growing Demand for Biometric Security in Consumer Electronics

A major driver fueling the fingerprint sensor market is the rising demand for biometric authentication in smartphones, laptops, and other consumer electronics. Users increasingly seek secure yet convenient ways to unlock devices and authorize payments without needing passwords or PINs.

For instance, advancements in ultrasonic and optical fingerprint sensors now allow accurate identification even with wet or dirty fingers, enhancing user experience and trust. This technology is also widely integrated into payment platforms, replacing traditional PIN codes, thus speeding up transactions while reducing fraud risks.

The increasing adoption of these sensors in government ID programs and enterprise security systems also supports this growth, as biometric data provides reliable identity verification at scale. This trend is exemplified by developments such as Qualcomm’s ultrasonic in-display fingerprint sensors that offer higher accuracy and faster scanning.

Restraint Analysis

Sensitivity to Environmental Conditions

One significant restraint hindering fingerprint sensor market growth is the sensor’s vulnerability to environmental factors such as moisture, dirt, static electricity, and extreme temperatures. These conditions can reduce sensor accuracy or even lead to malfunction, causing inconvenience or security concerns.

For instance, capacitive fingerprint sensors may register false readings or fail if the finger is wet or oily. This limits their reliability in some environments, such as outdoors or in industrial settings, thereby restricting broader adoption in these sectors.

Additionally, fingerprint sensors can be damaged or contaminated over time, requiring maintenance or replacement, which adds to operational costs. In environments with harsh conditions or heavy use, the sensor’s performance degradation impacts user experience negatively.

Opportunity Analysis

Expansion in Automotive and Smart Home Applications

The fingerprint sensor market holds strong opportunities in emerging sectors such as automotive and smart home technologies. In vehicles, fingerprint sensors can secure access and personalize settings like seat position, mirrors, and climate control, enhancing both convenience and security for drivers.

For example, fingerprint recognition can replace traditional keys or key fobs, making cars harder to steal and access more efficient. The increasing integration of biometric systems in vehicles is expected to drive significant market growth as automakers prioritize advanced security features.

Similarly, smart home devices are increasingly adopting fingerprint sensors to control door locks, security systems, and personalized home settings without the need for physical keys or multiple passwords. This not only improves user convenience but also adds a layer of security to prevent unauthorized access.

Challenge Analysis

Privacy and Data Security Concerns

A critical challenge facing the fingerprint sensor market is the concern over privacy and security of biometric data. Fingerprint data is highly sensitive as it is unique and permanent, making it a high-value target if leaked or stolen. Users and regulators alike worry about how biometric data is collected, stored, and protected from misuse or cyberattacks.

For instance, incidents of biometric data breaches would severely undermine trust in fingerprint authentication technologies and could slow adoption. Moreover, regulatory frameworks around biometric data protection vary by region, complicating global product deployment and requiring companies to invest heavily in security and compliance measures.

Public awareness and education on the benefits and safe use of fingerprint sensors are still evolving, so misperceptions or fears about privacy may deter some users. Addressing these concerns through robust encryption, secure data management, and transparent policies is essential to unlock wider acceptance and market growth.

Competitive Analysis

In the global fingerprint sensor market, Qualcomm Technologies Inc. and Synaptics Inc. are among the top technology innovators. Qualcomm integrates advanced biometric authentication into its mobile SoCs, while Synaptics offers versatile solutions across consumer electronics.

TDK Corporation continues to enhance its sensor capabilities through strategic acquisitions. Fingerprint Cards AB, based in Sweden, plays a key role in supplying fingerprint modules for smartphones and embedded systems. Meanwhile, Shenzhen Goodix Technology Co. Ltd dominates in Asia with high-volume production, particularly in mobile applications.

Egis Technology Inc. and Vkansee Technology Inc. have been instrumental in pushing optical and ultrasonic sensing technologies. Egis specializes in secure biometric solutions, while Vkansee focuses on ultra-thin sensors with high resolution for smart devices. Idex Biometrics ASA targets the financial sector with fingerprint cards for biometric payment solutions.

Next Biometrics Group ASA also contributes with flexible sensors for smart cards and access control. Additionally, NEC Corporation continues to advance multimodal biometrics, integrating fingerprint and facial recognition into unified platforms. Thales Group (Gemalto NV) and Idemia France SAS are key players in identity and security technologies.

Top Key Players in the Market

- Qualcomm Technologies Inc.

- TDK Corporation

- Vkansee Technology Inc.

- Egis Technology Inc.

- Fingerprint Cards AB

- Shenzhen Goodix Technology Co. Ltd

- Idex Biometrics ASA

- NEC Corporation

- Next Biometrics Group ASA

- Synaptics Inc.

- Thales Group (Gemalto NV)

- Idemia France SAS

- Crucialtec Co. Ltd

- Sonavation Inc.

- Others

Recent Developments

- June 2025: NEXT Biometrics secured a NOK 6.3 million purchase order for its newly introduced FAP 20 Basalt L1 Slim ultra-thin fingerprint sensor. This product achieved Level 1 certification for India’s Aadhaar program, targeting robust security for national ID and payment devices. Shipments began in Q3 2025, with potential for follow-up orders up to NOK 25 million annually.

- February 2025: Fingerprint Cards AB partnered with CardLab to launch a next-generation biometric smart card called “Access” featuring Fingerprint Cards’ advanced T-Shape fingerprint sensor. This new product aims to boost security and user experience by replacing passwords with biometric access, offering rapid and reliable identification for secure access systems.

- October 2024: Goodix unveiled an enhanced ultrasonic fingerprint sensor, improving accuracy and performance for mobile and consumer devices. This reflects ongoing innovation focusing on higher reliability under varying conditions.

- October 2024: Infineon Technologies introduced automotive-qualified fingerprint sensor ICs optimized for secure identification and authentication in vehicles. These sensors offer robust performance across wide temperature ranges and integrate advanced encryption, targeting in-vehicle personalization and secure payment applications.

Report Scope

Report Features Description Market Value (2024) USD 6.1 Bn Forecast Revenue (2034) USD 18 Bn CAGR(2025-2034) 11.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Area and Touch Sensors, Swipe Sensors), By Technology (Optical, Capacitive, Thermal, Ultrasonic), By Application (Consumer Electronics, Government and Law Enforcement, Military, Defense and Aerospace, Travel and Immigration, Banking and Finance, Healthcare, Smart Homes, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Qualcomm Technologies Inc., TDK Corporation, Vkansee Technology Inc., Egis Technology Inc., Fingerprint Cards AB, Shenzhen Goodix Technology Co. Ltd, Idex Biometrics ASA, NEC Corporation, Next Biometrics Group ASA, Synaptics Inc.,Thales Group (Gemalto NV), Idemia France SAS, Crucialtec Co. Ltd, Sonavation Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fingerprint Sensor MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Fingerprint Sensor MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Qualcomm Technologies Inc.

- TDK Corporation

- Vkansee Technology Inc.

- Egis Technology Inc.

- Fingerprint Cards AB

- Shenzhen Goodix Technology Co. Ltd

- Idex Biometrics ASA

- NEC Corporation

- Next Biometrics Group ASA

- Synaptics Inc.

- Thales Group (Gemalto NV)

- Idemia France SAS

- Crucialtec Co. Ltd

- Sonavation Inc.

- Others