Global Financial Services Application Market Size, Share and Analysis Report By Offerings (Software, Services), By Deployment Model (Cloud Based, On Premises), By Enterprise Size (Small and Medium Enterprises (SME’s), Large Enterprises), By End-User (Banking, Insurance, Capital Markets, FinTech / Neo-banks), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 175424

- Number of Pages: 241

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Fintech Statistics

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- Major Trends

- By Offerings

- By Deployment Model

- By Enterprise Size

- By End-User

- By Region

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Increasing Adoption Technologies

- Investment and Business Benefits

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

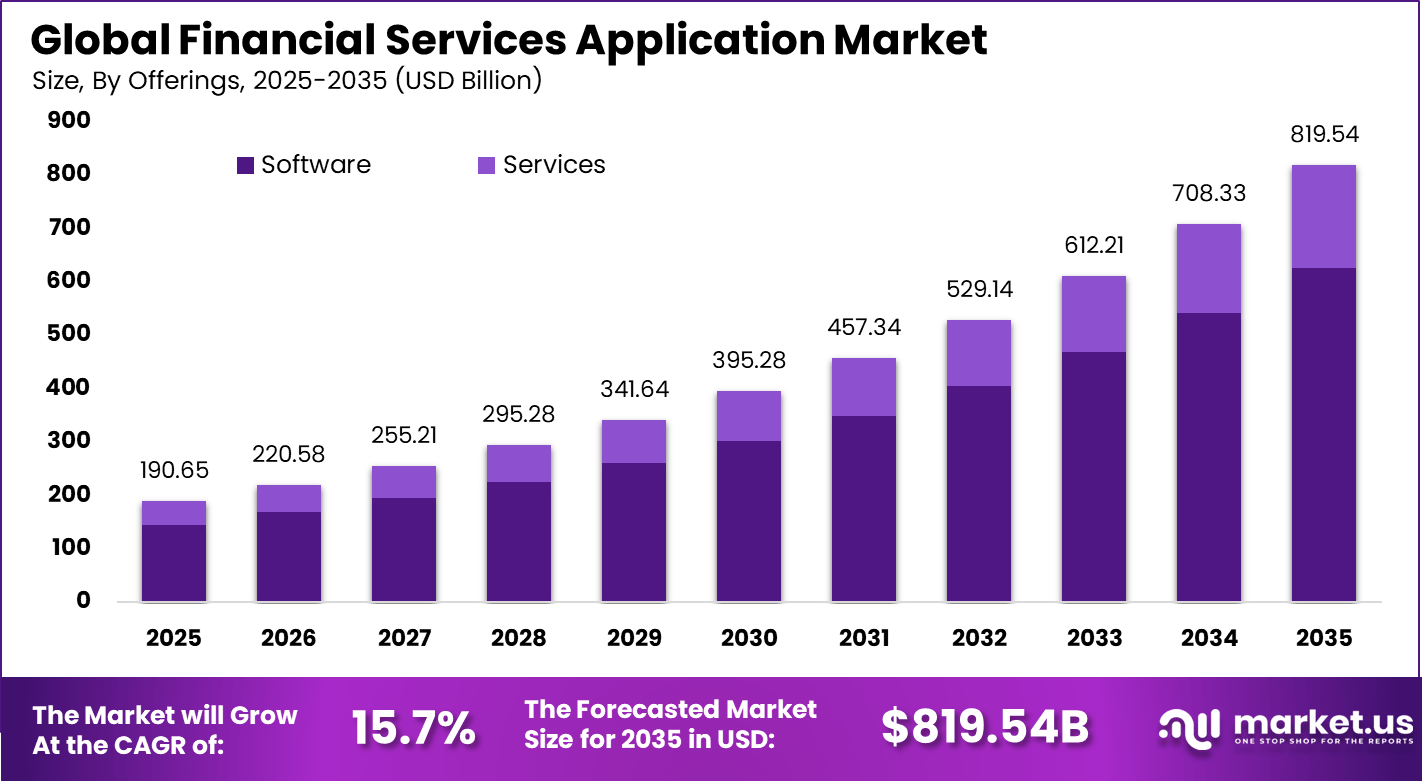

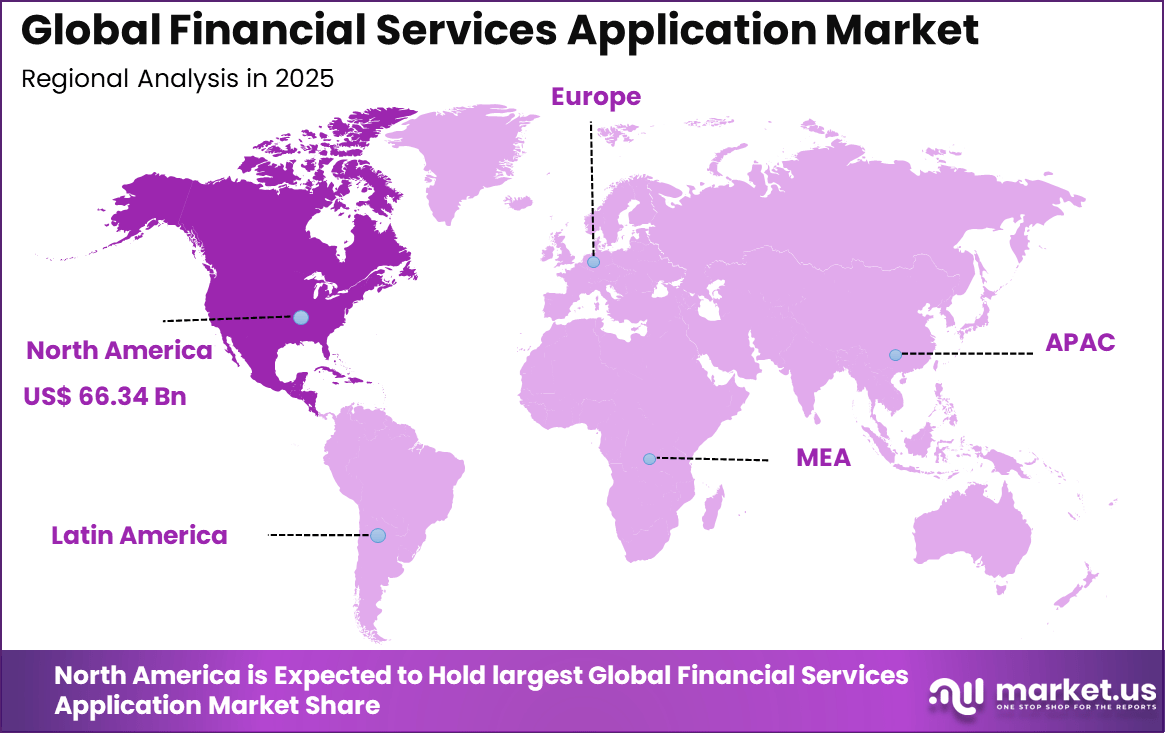

The Global Financial Services Application Market represents a compelling USD 819.54 billion opportunity by 2035, driven by rapid digital transformation across banking, insurance, and fintech sectors. The market is projected to expand at a robust CAGR of 15.7%, highlighting strong enterprise adoption, recurring revenue potential, and attractive long-term returns for investors. North America held a dominant market position, capturing more than a 34.8% share, holding USD 66.34 billion in revenue.

Financial Services Application Market refers to software applications designed to support core operations, customer engagement, risk management, and regulatory compliance across financial institutions. These applications cover functions such as payments, lending, wealth management, insurance operations, accounting, reporting, and customer relationship management. They serve as the digital backbone that enables financial organizations to deliver services securely, efficiently, and at scale.

The market has expanded as financial services increasingly rely on software-driven processes rather than manual or paper-based workflows. The market reflects the broader digital transformation of banking and financial services. Institutions are moving toward application-centric models to improve speed, accuracy, and service availability. Financial services applications enable real-time data processing and consistent service delivery across channels.

One of the main driving factors of the Financial Services Application Market is the steady rise in digital financial activity among consumers and businesses. Customers increasingly prefer mobile and online platforms for banking, payments, and investments, reducing dependence on physical branches. This shift has pushed financial institutions to deploy robust applications that can support high transaction volumes while maintaining reliability and security.

According to industry analysis, AI adoption and digital transformation continued to accelerate across the financial sector in 2025. More than 42% of global banks fully deployed AI driven automation, supporting cost reduction and faster service delivery, while cybersecurity breaches in finance accounted for 21.6% of all global data breaches, highlighting growing security risks.

The fintech industry valuation is expected to reach USD 335 billion, supported by rising demand for decentralized and embedded finance, and insurtech firms recorded a 28% increase in global investments driven by AI based claims and underwriting solutions. At the customer level, 74% now demand personalized financial services, pushing institutions to increase investment in AI, data analytics, and CRM platforms.

Key Takeaway

- In 2025, the Software segment dominated the Global Financial Services Application Market with a 76.5% share, reflecting strong reliance on digital platforms for core financial operations.

- In 2025, the On-Premises deployment segment captured a 60.2% share, driven by security, compliance, and data control requirements.

- In 2025, Large Enterprises led adoption with a 72.7% share, supported by complex operational needs and higher technology investments.

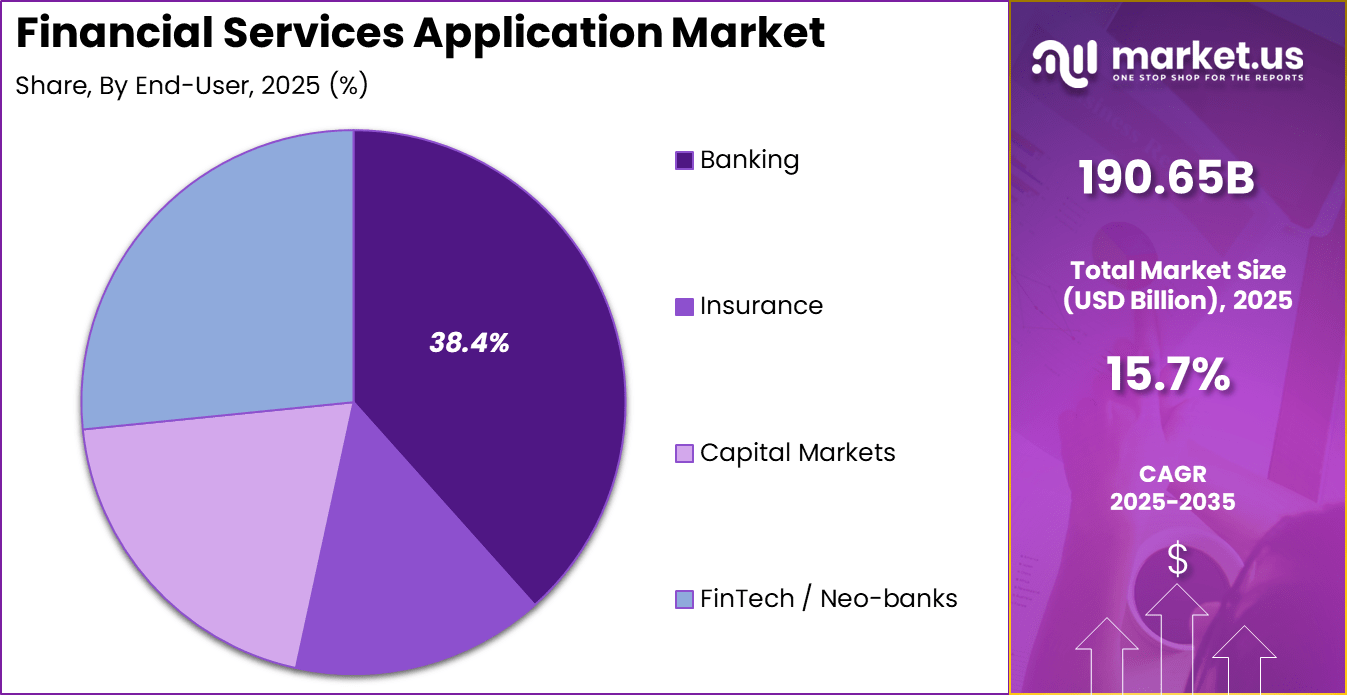

- In 2025, the Banking segment accounted for 38.4% of market demand, highlighting extensive use of applications for transaction processing, risk management, and customer services.

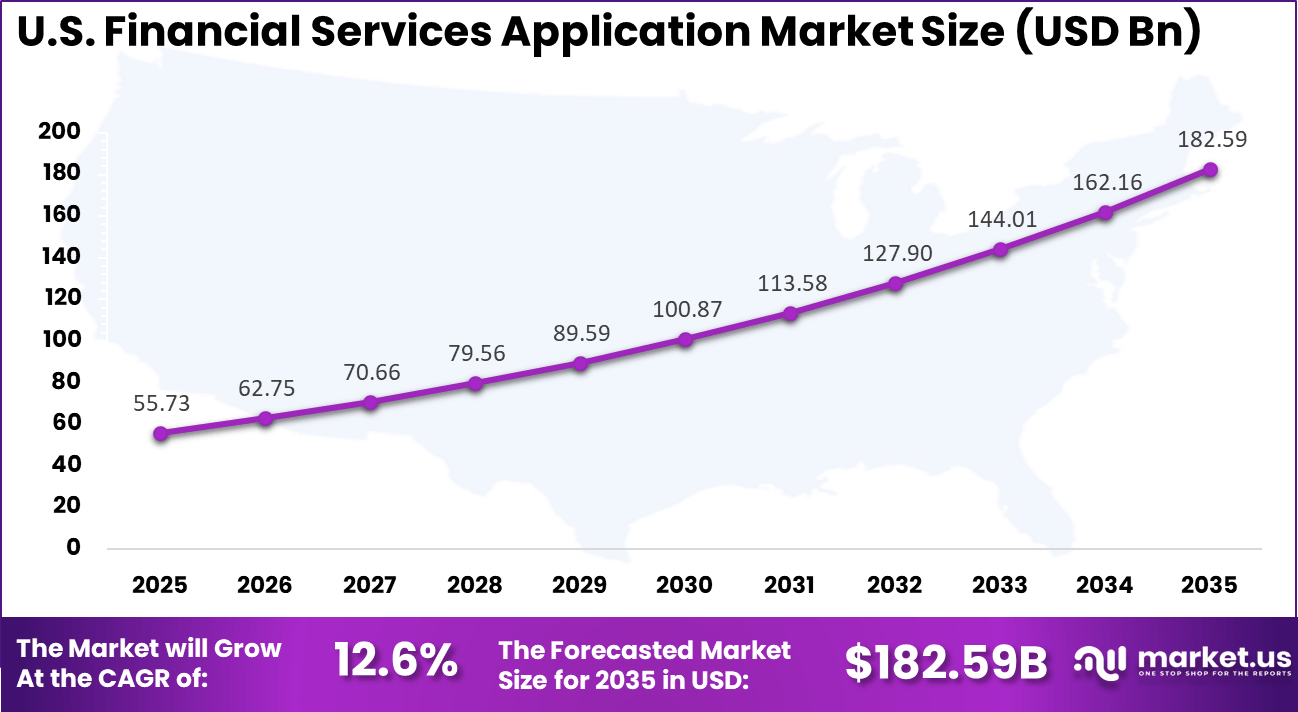

- The U.S. Financial Services Application Market was valued at USD 55.73 Billion in 2025, expanding at a strong 12.6% CAGR due to ongoing digital transformation.

- In 2025, North America held a dominant position with more than a 34.8% share, supported by advanced financial infrastructure and early technology adoption.

Fintech Statistics

- According to demandsage, Around 30,000 fintech startups operate globally.

- North America leads with nearly 12,000 fintech companies.

- Global fintech industry revenue reached about USD 201.91 billion.

- Fintech industry revenue increased by nearly 100% between 2017 and 2023.

- The United States accounted for over 36.75% of global fintech investment deals.

- About 4 out of 10 financial service firms believe blockchain will transform service delivery.

- Visa is the leading fintech company in the U.S., with a market capitalization of USD 662.6 billion.

- Globally, around 64% of consumers have adopted fintech services.

- Fintech adoption in the United States stands at approximately 46%.

- More than 75% of global users rely on fintech platforms for payments and money transfers.

- Tencent is the largest fintech company worldwide, with a market value exceeding USD 766.8 billion.

- Over 25% of small and medium enterprises globally use fintech services.

- Nearly two thirds of financial transactions are now completed through online payment modes.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Digital transformation in banking Modernization of core banking and customer platforms ~6.9% Global Short Term Regulatory compliance requirements Demand for secure and auditable systems ~5.8% North America, Europe Short Term Rising transaction volumes Need for scalable processing platforms ~4.9% Global Mid Term Growth of data driven finance Analytics based decision support ~4.1% Global Mid Term Focus on operational efficiency Automation of internal workflows ~3.6% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Cybersecurity threats Increasing exposure to financial data breaches ~5.1% Global Short Term High implementation complexity Integration with legacy systems ~4.4% Global Mid Term Regulatory changes Evolving compliance standards ~3.8% North America, Europe Mid Term Vendor lock in Limited flexibility across platforms ~3.0% Global Long Term Skill shortages Lack of specialized application experts ~2.4% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration High deployment cost Capital intensive on premises systems ~6.2% Emerging Markets Short to Mid Term Long implementation cycles Extended deployment and testing periods ~5.3% Global Mid Term Data migration challenges Risk during legacy system transition ~4.5% Global Mid Term Security and privacy concerns Handling sensitive financial information ~3.7% North America, Europe Long Term Limited SME adoption Budget constraints in smaller institutions ~2.9% Global Long Term Major Trends

- AI and automation are reshaping financial applications through hyper personalization, fraud detection, and process automation, with AI adoption expected to reach 85% across the finance industry by 2026.

- Embedded finance and open banking are expanding rapidly, enabling non financial platforms such as e commerce and travel apps to deliver financial services through APIs, with the Embedded Finance Market size is expected to be worth around USD 700.1 Billion By 2033, growing at a CAGR of 24.10%.

- Cryptocurrency adoption is accelerating, as crypto related app downloads increased by 133% during the first three quarters of 2024, reflecting rising interest in digital assets.

- Security and trust have become critical priorities, with stronger focus on biometric authentication and transparent data practices, and 69% of users considering financial firms trustworthy when data usage is clearly disclosed.

By Offerings

Software accounts for 76.5%, highlighting its dominant role in financial services applications. Software platforms support core banking, payments, risk management, and customer engagement. Centralized applications improve process efficiency and data accuracy. Integration across departments supports consistent operations. Reliability and compliance remain essential.

The dominance of software is driven by the shift toward digital operations. Financial institutions rely on configurable applications to meet changing needs. Software allows faster updates and feature enhancements. Automation reduces manual processing errors. This sustains strong demand for software offerings.

For Instance, in March 2025, Finastra rolled out an upgraded Lending Cloud Service backed by IBM. It handles corporate lending tools like Loan IQ on Microsoft Azure with full managed support. Clients get quick setups, automated processes, and AI insights for better decisions. This software suite cuts costs and ensures top uptime, helping lenders stay compliant and innovative in North America and Europe.

By Deployment Model

On premises deployment holds 60.2%, reflecting preference for internal control over systems. Financial institutions manage sensitive customer and transaction data. Local deployment supports strict security and regulatory requirements. Custom configurations align with internal policies. Performance predictability remains important.

Adoption of on premises deployment is driven by compliance and data sovereignty needs. Many institutions operate under strict regulatory oversight. Internal hosting reduces exposure to external risks. IT teams retain direct system management. This sustains continued use of on premises models.

For instance, in May 2025, Accenture grew its deal with OP Financial Group to shift insurance apps to Guidewire’s cloud platform from on-premises setups. They simplify products using AI and analytics for smoother staff and customer flows. This hybrid path helps traditional on-premises users modernize step by step, keeping security tight during transitions.

By Enterprise Size

Large enterprises represent 72.7%, making them the primary adopters of financial services applications. These organizations manage complex operations across multiple regions. Applications support high transaction volumes and regulatory reporting. Centralized systems improve governance and control. Scale increases the need for automation.

Adoption among large enterprises is driven by operational complexity. Manual processes are not efficient at scale. Enterprise applications support standardization across units. Data integration improves decision-making. This sustains strong enterprise-level adoption.

For Instance, in March 2025, IBM teamed with Finastra on managed services for lending cloud apps aimed at large banks. Using WatsonX on Azure, it offers scale, security, and AI for corporate clients. Big enterprises gain from expert handling of mission-critical tools, ensuring smooth growth without in-house burdens.

By End-User

The banking sector accounts for 38.4%, making it the leading end-user segment. Banks use applications for core operations and customer services. Digital platforms support account management and transactions. Security and reliability remain priorities. Compliance requirements influence system design.

Growth in banking adoption is driven by digital transformation. Banks expand online and mobile services. Applications improve service efficiency and customer experience. Automation supports regulatory reporting. This sustains steady adoption in banking.

For Instance, in July 2025, SBI Group in Japan chose nCino’s platform for its new mortgage guarantee unit, SBI Credit Guarantee. The system covers apps to contracts fully, with fast rollout for market entry. It powers quick screenings and executions, helping banks like SBI handle guarantees efficiently alongside partners like San Ju San Bank.

By Region

North America accounts for 34.8%, supported by advanced financial infrastructure. Institutions in the region invest in application modernization. Regulatory frameworks encourage secure digital systems. Technology adoption supports operational efficiency. The region remains influential.

For instance, in January 2026, FIS completed the strategic acquisition of Global Payments’ Issuer Solutions business, expanding its market opportunity by $28 billion in the global issuer space. This move strengthens FIS’s position as a leading fintech provider with enhanced AI offerings and loyalty solutions for major credit issuers. The transaction generates significant revenue synergies and bolsters North American dominance in financial services applications.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn) Adoption Maturity North America Advanced banking IT infrastructure 34.8% USD 66.35 Bn Advanced Europe Regulatory driven application modernization 28.6% USD 54.52 Bn Advanced Asia Pacific Rapid expansion of digital banking 23.9% USD 45.59 Bn Developing Latin America Financial inclusion initiatives 7.1% USD 13.54 Bn Developing Middle East and Africa Early stage financial digitalization 5.6% USD 10.65 Bn Early

The United States reached USD 55.73 Billion with a CAGR of 12.6%, reflecting steady market growth. Expansion is driven by digital banking initiatives. Financial institutions upgrade legacy systems. Demand for scalable applications continues. Market momentum remains stable.

For instance, in May 2025, nCino unveiled AI-powered banking solutions at nSight 2025, including Banking Advisor with 18 capabilities for automation in onboarding, risk management, and lending. These enhancements drive efficiency and competitive advantage for U.S. financial institutions.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Pattern Large banking institutions Very High ~38.4% Security, compliance, scalability Long term platform investments Financial service providers High ~27.6% Process automation and efficiency Strategic deployments Technology vendors High ~18.3% Platform expansion R and D driven Government and regulators Moderate ~9.2% Financial system stability Policy based SMEs Low ~6.5% Cost sensitive digitization Selective adoption Technology Enablement Analysis

Technology Layer Enablement Role Impact on Growth (%) Adoption Status Core banking applications Transaction processing and account management ~7.2% Mature Risk and compliance platforms Regulatory reporting and controls ~6.3% Mature Data analytics engines Customer and risk insights ~5.4% Growing API integration layers System interoperability ~4.6% Growing Workflow automation Process efficiency and cost reduction ~3.9% Mature Increasing Adoption Technologies

Cloud computing has played a major role in the adoption of modern financial services applications. Cloud based platforms allow institutions to scale operations, deploy updates faster, and support remote access while maintaining high availability. These advantages have encouraged financial organizations to modernize legacy systems and adopt cloud friendly architectures.

Artificial intelligence and machine learning technologies are also being increasingly integrated into financial applications. These technologies support functions such as fraud detection, credit assessment, customer service automation, and predictive analytics. Their adoption enables institutions to process large volumes of data more efficiently and improve decision accuracy.

Financial institutions adopt advanced applications to improve customer experience and engagement. Digital interfaces, personalized insights, and real time notifications help build stronger relationships with customers. Applications that deliver consistent and intuitive experiences across devices are viewed as critical tools for customer retention.

Another key reason for adoption is operational efficiency. Automation of tasks such as transaction processing, reconciliation, and compliance checks reduces manual effort and error rates. This allows organizations to focus resources on strategic initiatives rather than routine administrative work.

Investment and Business Benefits

Investment opportunities in the Financial Services Application Market are linked to solutions that enhance automation, analytics, and interoperability. Platforms that integrate artificial intelligence for real time insights and process optimization are gaining attention as financial institutions seek competitive differentiation. These capabilities support smarter decision making and improved service delivery.

Opportunities also exist in applications that support open digital ecosystems through secure integration and data sharing. Software that enables collaboration between financial institutions, fintech providers, and third party services is becoming increasingly important. Such platforms support innovation while maintaining data security and regulatory compliance.

Financial services applications provide measurable benefits in terms of efficiency and scalability. By automating high volume processes, institutions can handle growing transaction loads without proportionate increases in operational costs. This contributes to improved productivity and more predictable service performance.

These applications also strengthen risk management and governance. Real time monitoring, automated alerts, and data analytics help institutions identify potential risks early and respond more effectively. As a result, organizations achieve better compliance, improved resilience, and greater confidence in their financial operations.

Key Market Segments

By Offerings

- Software

- Core Banking Platforms Audit

- Risk and Compliance

- Business Transaction Processing

- BI Analytics and AI Suites

- Customer Experience

- CRM Enterprise IT (ERP, HR, Finance)

- Services

- Consulting Integration and Migration

- Training and Support

- Operations and Managed Services

By Deployment Model

- Cloud Based

- On Premises

By Enterprise Size

- Small and Medium Enterprises (SME’s)

- Large Enterprises

By End-User

- Banking

- Insurance

- Capital Markets

- FinTech / Neo-banks

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Global technology and consulting leaders such as Accenture plc, International Business Machines Corporation, and Microsoft Corporation play a central role in large-scale financial services applications. Their platforms support core banking transformation, data analytics, cloud migration, and AI-driven automation. Strong consulting capabilities enable end-to-end implementation for banks and insurers. These players benefit from deep domain expertise and long-term relationships with global financial institutions.

Core banking and financial software specialists such as Fidelity National Information Services, Inc., Fiserv, Inc., and Temenos AG focus on transaction processing, digital banking, and payments modernization. Finastra Group Holdings Limited and Avaloq Group AG strengthen this segment with modular and API-driven systems. Their solutions help institutions improve efficiency, scalability, and compliance. Adoption is strong among retail banks, wealth managers, and payment service providers seeking faster product innovation.

IT service providers and next-generation fintech platforms such as Infosys Limited, Tata Consultancy Services Limited, and Cognizant Technology Solutions Corporation support customization and integration at scale. Mambu B.V. and nCino, Inc. drive adoption of cloud-native and agile banking models. Jack Henry and Associates, Inc. and Intellect Design Arena Limited address regional and mid-market needs. Other players expand innovation and competitive diversity.

Top Key Players in the Market

- Accenture plc

- Fidelity National Information Services, Inc. (FIS)

- Fiserv, Inc.

- International Business Machines Corporation (IBM)

- Infosys Limited

- Finastra Group Holdings Limited

- Oracle Corporation

- SAP SE

- Tata Consultancy Services Limited

- Temenos AG

- Microsoft Corporation

- Salesforce, Inc.

- Avaloq Group AG

- Intellect Design Arena Limited

- Jack Henry and Associates, Inc.

- Cognizant Technology Solutions Corporation

- NCR Corporation

- Silverlake Axis Ltd

- Mambu B.V.

- nCino, Inc.

- Others

Recent Developments

- In September 2025, Finastra launched its modern ACH payment solution for the U.S. market and unveiled the Intelligent Routing Module at Sibos 2025. These innovations simplify payments and trade finance integration. Enhancements to Fusion Invest also target annuities, showing Finastra’s focus on future-proof banking tech.

- In May 2025, Oracle introduced Banking Retail Lending Servicing and Collections Cloud Services, accelerating digital transformation. These SaaS solutions optimize loan servicing and reduce risk, with IDC noting 30% of banks prioritizing lending innovation. Oracle empowers personalized borrower experiences efficiently.

Report Scope

Report Features Description Market Value (2025) USD 190.6 Bn Forecast Revenue (2035) USD 819.5 Bn CAGR (2025-2035) 15.7% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offerings (Software, Services), By Deployment Model (Cloud-Based, On-Premises), By Enterprise Size (Small and Medium Enterprises (SME’s), Large Enterprises), By End-User (Banking, Insurance, Capital Markets, FinTech / Neo-banks) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Accenture plc, Fidelity National Information Services, Inc. (FIS), Fiserv, Inc., International Business Machines Corporation (IBM), Infosys Limited, Finastra Group Holdings Limited, Oracle Corporation, SAP SE, Tata Consultancy Services Limited, Temenos AG, Microsoft Corporation, Salesforce, Inc., Avaloq Group AG, Intellect Design Arena Limited, Jack Henry and Associates, Inc., Cognizant Technology Solutions Corporation, NCR Corporation, Silverlake Axis Ltd, Mambu B.V., nCino, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Financial Services Application MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Financial Services Application MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Accenture plc

- Fidelity National Information Services, Inc. (FIS)

- Fiserv, Inc.

- International Business Machines Corporation (IBM)

- Infosys Limited

- Finastra Group Holdings Limited

- Oracle Corporation

- SAP SE

- Tata Consultancy Services Limited

- Temenos AG

- Microsoft Corporation

- Salesforce, Inc.

- Avaloq Group AG

- Intellect Design Arena Limited

- Jack Henry and Associates, Inc.

- Cognizant Technology Solutions Corporation

- NCR Corporation

- Silverlake Axis Ltd

- Mambu B.V.

- nCino, Inc.

- Others