Global Ferro Silicon Market By Type (Atomized Ferrosilicon, Milled Ferrosilicon), By Application (Deoxidizer, Inoculants, Others), By End-use (Carbon and Other Alloy Steel, Stainless Steel, Electric Steel, Cast Iron, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149857

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

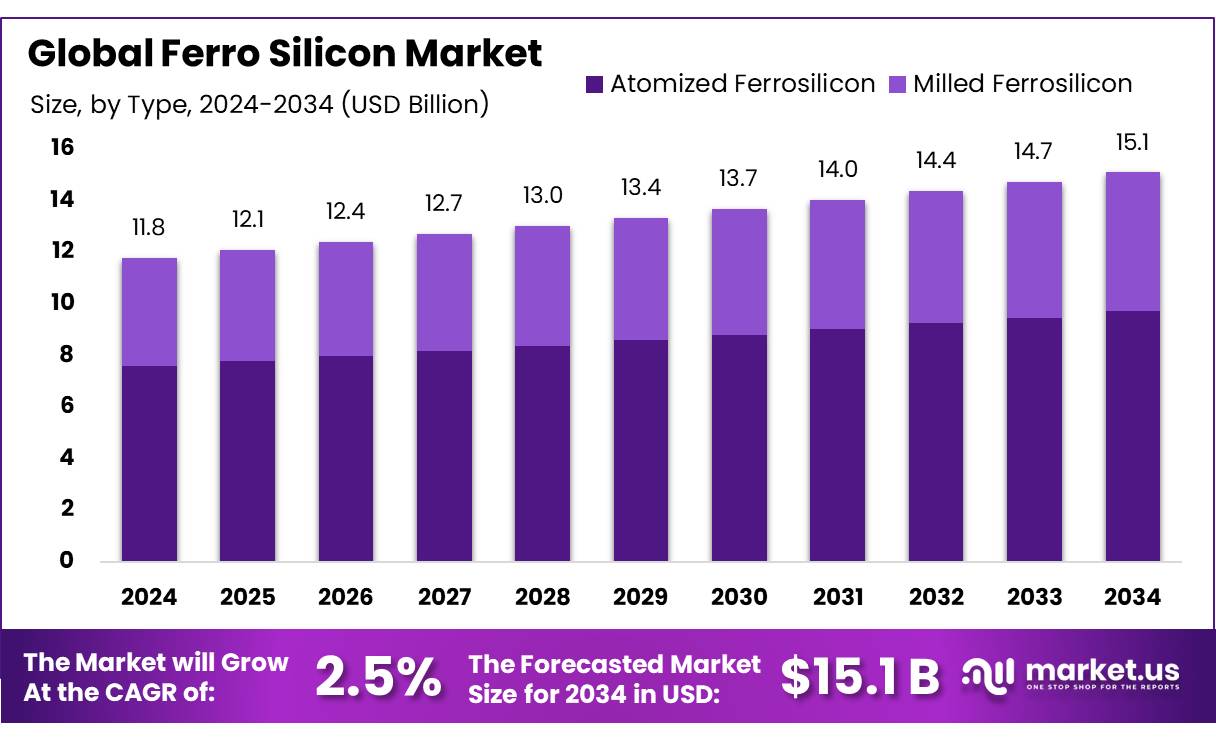

The Global Ferro Silicon Market size is expected to be worth around USD 15.1 Billion by 2034, from USD 11.8 Billion in 2024, growing at a CAGR of 2.5% during the forecast period from 2025 to 2034.

Ferro Silicon Concentrates (FeSi) are integral to the metallurgical industry, primarily utilized as deoxidizers and alloying agents in steel and cast iron production. Their addition enhances the mechanical properties of steel, including strength, hardness, and corrosion resistance, making them indispensable in various industrial applications.

Government initiatives significantly influence the industry’s expansion. The National Steel Policy (NSP) 2017 aims to achieve a crude steel capacity of 300 million tons and increase per capita steel consumption to 160 kg by 2030. Additionally, programs like “Make in India” and the Production-Linked Incentive (PLI) scheme are fostering domestic manufacturing, thereby boosting the demand for ferrosilicon.

The automotive industry’s shift towards electric vehicles (EVs) and lightweight vehicles necessitates specialized steel grades, where ferrosilicon plays a crucial role in enhancing mechanical properties. According to the Indian Ministry of Steel, domestic steel demand is expected to grow by 9-10% in FY25, further driving ferrosilicon consumption.

Infrastructure development is another key driver. Government projects like the Smart Cities Mission and significant investments in construction are increasing the need for high-quality steel, thereby elevating ferrosilicon demand. For instance, in October 2024, Metro Group announced a ₹225 crore investment in a new housing project in the Mumbai Metropolitan Region, reflecting the ongoing infrastructure expansion.

Key Takeaways

- Ferro Silicon Market size is expected to be worth around USD 15.1 Billion by 2034, from USD 11.8 Billion in 2024, growing at a CAGR of 2.5%.

- Atomized Ferrosilicon held a dominant market position, capturing more than a 64.3% share of the global ferro silicon market.

- Deoxidizer held a dominant market position, capturing more than a 69.4% share of the global ferro silicon market.

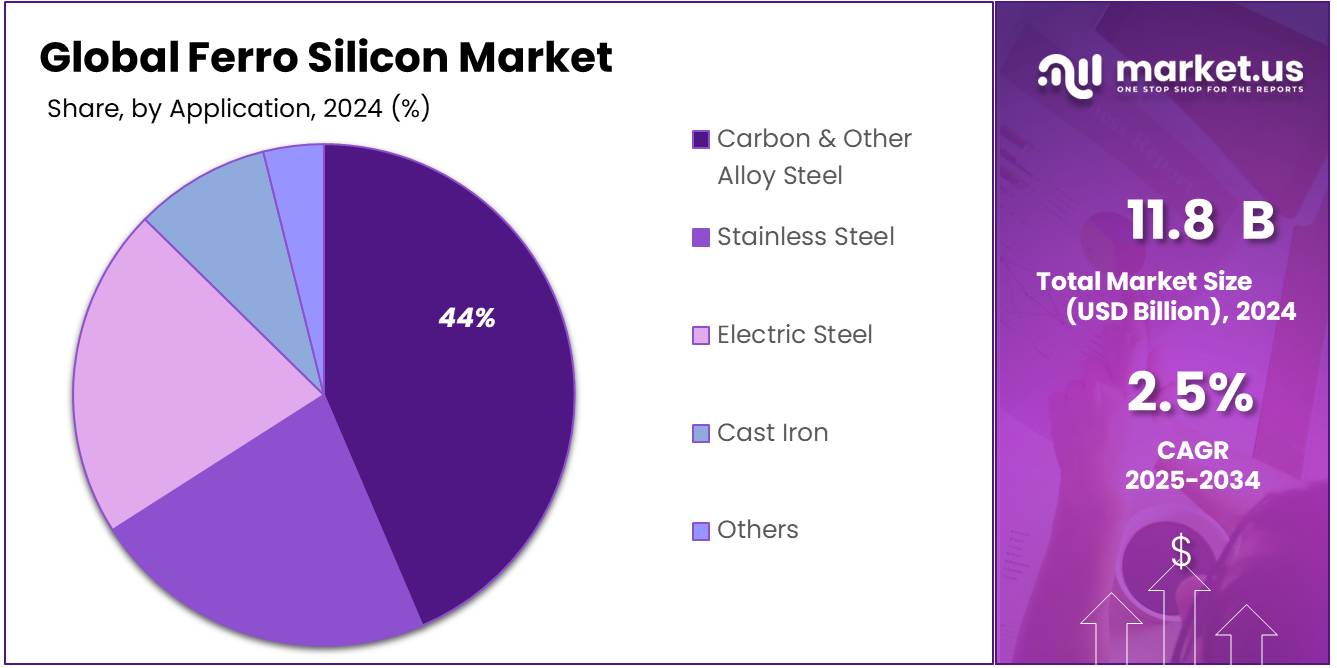

- Carbon & Other Alloy Steel held a dominant market position, capturing more than a 44.8% share of the global ferro silicon market.

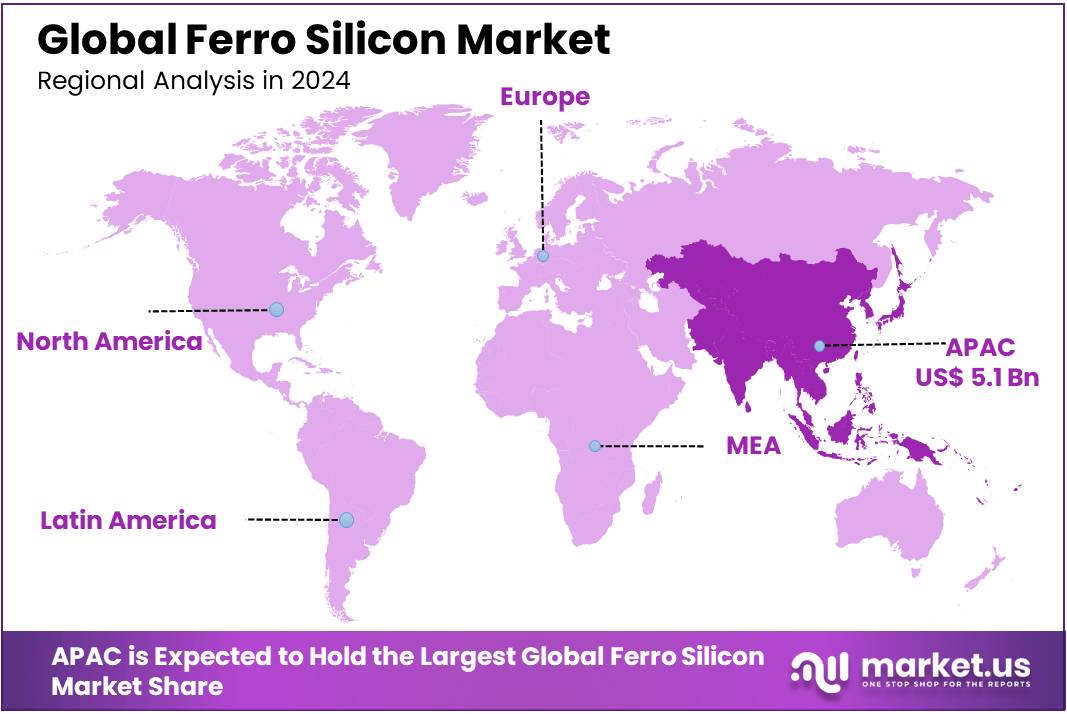

- Asia Pacific (APAC) region emerged as the dominant force in the global ferro silicon market, capturing a substantial 43.9% share, equivalent to approximately USD 5.1 billion.

By Type

Atomized Ferrosilicon leads with 64.3% share in 2024 due to its higher purity and efficiency in dense media separation.

In 2024, Atomized Ferrosilicon held a dominant market position, capturing more than a 64.3% share of the global ferro silicon market by type. This strong lead is mainly because of its superior density control, cleaner separation capabilities, and stable performance, especially in mineral processing industries. The mining sector, particularly in coal and iron ore processing, has favored atomized ferrosilicon for its fine granulation and ability to create precise suspensions in heavy media separation.

Its growing use in magnetite recovery circuits and demand from developing economies have also contributed to its strong presence. The product’s consistent grain size distribution has made it a reliable material across both advanced and traditional separation processes. As of 2025, its market position remains stable, sustained by increasing demand in countries focusing on industrial mineral refinement and raw material optimization.

By Application

Deoxidizer dominates with 69.4% share in 2024 due to its critical role in steelmaking efficiency.

In 2024, Deoxidizer held a dominant market position, capturing more than a 69.4% share of the global ferro silicon market by application. This high share is largely driven by the steel industry’s consistent need to remove oxygen from molten steel during production. Ferro silicon, when used as a deoxidizer, helps improve the quality, strength, and workability of steel by preventing oxidation-related defects.

Its widespread use across both carbon and stainless steel manufacturing has made it indispensable in foundries and steel plants worldwide. By 2025, the demand for ferro silicon as a deoxidizing agent is expected to remain strong, as global infrastructure and automotive sectors continue to expand, especially in fast-growing economies focused on industrial output and construction-grade steel.

By End-use

Carbon & Other Alloy Steel dominates with 44.8% share in 2024 as demand surges from construction and automotive sectors.

In 2024, Carbon & Other Alloy Steel held a dominant market position, capturing more than a 44.8% share of the global ferro silicon market by end-use. This segment leads due to the essential role ferro silicon plays in producing high-performance alloy and carbon steels, which are widely used in infrastructure, automotive, machinery, and energy sectors.

Its contribution to improving tensile strength, corrosion resistance, and hardenability makes it a critical input in advanced steel formulations. As nations invest in roads, buildings, and smart transport systems, the requirement for alloy-enriched steel continues to grow. By 2025, this segment is expected to retain its strong position, supported by increased investments in industrial development and rising steel consumption across Asia-Pacific and the Middle East.

Key Market Segments

By Type

- Atomized Ferrosilicon

- Milled Ferrosilicon

By Application

- Deoxidizer

- Inoculants

- Others

By End-use

- Carbon & Other Alloy Steel

- Stainless Steel

- Electric Steel

- Cast Iron

- Others

Drivers

Rising Steel Demand in India Fuels Ferro Silicon Market Growth

The ferro silicon market is witnessing significant growth, primarily driven by the increasing demand for steel in India. As a critical deoxidizer and alloying agent, ferro silicon is essential in steel manufacturing processes. India, being the world’s second-largest steel producer, has seen its crude steel production reach approximately 151.1 million tonnes in the fiscal year 2024-25, with plans to expand capacity to 300 million tonnes by 2030.

This surge in steel production is mirrored by a substantial rise in domestic consumption. In the first half of 2024-25, India’s finished steel consumption increased by 13.7% year-on-year, totaling 72.824 million tonnes. The Ministry of Steel projects an annual growth rate of 8% in steel demand for both 2024 and 2025, driven by ongoing infrastructure development and urbanization.

To support this growth, the Indian government has implemented several initiatives. The National Steel Policy aims to enhance steel production capacity, while the Production Linked Incentive (PLI) scheme encourages the manufacturing of specialty steel. Additionally, the ‘Green Steel Mission’ with an estimated investment of ₹15,000 crore focuses on reducing carbon emissions in the steel industry.

These developments underscore the critical role of ferro silicon in India’s expanding steel sector. As steel production and consumption continue to rise, the demand for ferro silicon is expected to grow correspondingly, presenting significant opportunities for stakeholders in the ferro silicon market.

Restraints

High Energy Costs and Environmental Regulations Challenge Ferro Silicon Industry

The ferro silicon industry is grappling with significant challenges stemming from high energy costs and stringent environmental regulations. In India, energy expenses constitute a substantial portion of production costs, with estimates indicating that energy bills account for approximately 20-25% of overall production expenses in the ferroalloy sector. This high energy consumption not only escalates operational costs but also contributes to environmental concerns, as the production process is energy-intensive and generates considerable greenhouse gas emissions.

Environmental regulations further compound these challenges. The Indian government has implemented stricter environmental standards, compelling ferro silicon manufacturers to invest in pollution control technologies and sustainable practices. These investments, while necessary for compliance, impose additional financial burdens on producers, potentially affecting their competitiveness in the global market. Moreover, the pressure to reduce carbon emissions aligns with India’s broader commitment to environmental sustainability, as outlined in national policies aimed at mitigating climate change impacts.

The combination of high energy costs and rigorous environmental regulations presents a complex landscape for the ferro silicon industry. Manufacturers must navigate these challenges by adopting energy-efficient technologies and sustainable production methods to remain viable. Failure to adapt could result in decreased profitability and market share, underscoring the importance of strategic investments in innovation and compliance to ensure long-term success in the evolving industrial environment.

Opportunity

Government Initiatives Propel Ferro Silicon Market Growth in IndiaComplementing the NSP, the “Make in India” initiative and the Production-Linked Incentive (PLI) scheme are fostering a conducive environment for domestic manufacturing. These programs aim to enhance self-reliance in steel production, thereby reducing dependency on imports and promoting the use of domestically produced ferro silicon.Infrastructure development is another significant driver. The government’s focus on urbanization and industrialization has led to increased investments in large-scale construction projects, necessitating high-quality steel and, consequently, ferro silicon.These government-led initiatives not only stimulate domestic demand but also position India as a competitive player in the global ferro silicon market. By aligning policy frameworks with industry needs, the Indian government is creating a sustainable growth trajectory for the ferro silicon sector, ensuring its integral role in the nation’s economic development.Trends

India’s Push for Green Steel: A New Direction for Ferro Silicon Demand

India is actively working towards reducing carbon emissions in its steel industry, and this shift is creating new opportunities for ferro silicon producers. The government is developing a green steel policy that includes incentives for using renewable energy in steel production and mandates for a certain percentage of green steel in publicly funded infrastructure projects. Green steel, as defined by India in 2024, emits less than 2.2 tonnes of CO2 per tonne produced.

This policy shift is significant because ferro silicon is a crucial component in steel manufacturing, particularly in electric arc furnace (EAF) processes, which are more environmentally friendly compared to traditional methods. As India aims to increase its steel production capacity to 300 million tonnes by 2030, up from 151.1 million tonnes in 2024-25, the demand for ferro silicon is expected to rise correspondingly.

Moreover, the government’s focus on infrastructure development and urbanization is likely to boost the demand for high-quality steel, further driving the need for ferro silicon. The revised Domestically Manufactured Iron & Steel Products (DMI&SP) Policy 2025, which introduces the “Melt and Pour” rule, aims to enhance the use of domestically produced steel in government projects, thereby supporting local ferro silicon manufacturers.

Regional Analysis

Asia Pacific Leads Ferro Silicon Market with 43.9% Share, Valued at USD 5.1 Billion

In 2024, the Asia Pacific (APAC) region emerged as the dominant force in the global ferro silicon market, capturing a substantial 43.9% share, equivalent to approximately USD 5.1 billion in market value. This dominance is primarily driven by the region’s robust steel production and consumption, particularly in countries like China and India. China, accounting for about 81% of the region’s ferro silicon consumption, remains the largest consumer, followed by Japan and India .

The region’s industrial growth, especially in construction and automotive sectors, has significantly contributed to the increased demand for ferro silicon. In India, for instance, the government’s initiatives like the National Steel Policy aim to boost steel production capacity, further propelling the need for ferro silicon as a deoxidizer and alloying agent. Additionally, the rise in electric vehicle manufacturing in countries like Japan and South Korea has led to a surge in demand for high-quality steel, thereby increasing the consumption of ferro silicon.

Moreover, the Asia Pacific region’s emphasis on infrastructure development has led to increased steel usage, subsequently driving the ferro silicon market. The region’s focus on sustainable and energy-efficient manufacturing processes has also led to the adoption of advanced technologies in ferro silicon production, enhancing product quality and meeting the evolving demands of end-use industries.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

DMS Powders is a prominent South African manufacturer of atomized and milled ferro silicon, primarily serving the dense media separation (DMS) market in mining. The company is known for producing high-purity ferro silicon with controlled particle size, ensuring effective separation in mineral processing. With facilities focused on quality control and export capabilities, DMS Powders serves customers in over 50 countries. Its ferro silicon grades are widely used in diamond, coal, and iron ore beneficiation applications worldwide.

Elkem ASA, headquartered in Norway, is a global leader in silicon-based materials, including ferro silicon. The company operates several production plants in Europe, China, and the U.S., supplying the alloy to industries like steelmaking, foundries, and chemicals. Elkem emphasizes sustainable production and energy efficiency, aligning with green industry trends. In 2024, the company continued expanding its ferroalloy capacity in response to increasing demand from electric arc furnaces and specialty steel applications in Asia and Europe.

Ferroglobe PLC, a global ferroalloy producer headquartered in the UK, operates multiple plants in Europe, North America, and Asia. It is one of the largest producers of ferro silicon, serving sectors such as automotive, construction, and renewable energy. In 2024, the company focused on operational optimization and reduced carbon emissions across its plants. Ferroglobe’s diversified geographic footprint allows it to maintain strong supply capabilities across major steel-producing markets, positioning it as a dependable global supplier.

Top Key Players in the Market

- China National Bluestar (Group) Co. Ltd.

- DMS Powders

- Elkem ASA

- Eurasian Resources Group

- Ferroglobe PLC

- FINNFJORD AS

- Finnfjord AS

- Hindustan Alloys Private Limited

- Indian Metals & Ferro Alloys Limited

- Maithan Alloys Limited

- Mechel PAO

- OM Holdings Ltd.

- Russian Ferro-Alloys Inc.

- SINOGU CHINA

- VBC Ferro Alloys Limited

- Westbrook Resources Ltd.

Recent Developments

In 2024, Finnfjord AS, based in Finnsnes, Norway, stands out in the ferro silicon industry with an annual production capacity of 100,000 tonnes.

In 2024, Eurasian Resources Group (ERG), headquartered in Luxembourg, solidified its position as a leading global producer of ferroalloys, including ferro silicon. Through its subsidiary, Kazchrome, ERG achieved a record ferroalloy output of 1.864 million tonnes, marking a 14% year-over-year increase.

Report Scope

Report Features Description Market Value (2024) USD 11.8 Billion Forecast Revenue (2034) USD 15.1 Billion CAGR (2025-2034) 2.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Atomized Ferrosilicon, Milled Ferrosilicon), By Application (Deoxidizer, Inoculants, Others), By End-use (Carbon and Other Alloy Steel, Stainless Steel, Electric Steel, Cast Iron, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape China National Bluestar (Group) Co. Ltd., DMS Powders, Elkem ASA, Eurasian Resources Group, Ferroglobe PLC, FINNFJORD AS, Finnfjord AS, Hindustan Alloys Private Limited, Indian Metals & Ferro Alloys Limited, Maithan Alloys Limited, Mechel PAO, OM Holdings Ltd., Russian Ferro-Alloys Inc., SINOGU CHINA, VBC Ferro Alloys Limited, Westbrook Resources Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- China National Bluestar (Group) Co. Ltd.

- DMS Powders

- Elkem ASA

- Eurasian Resources Group

- Ferroglobe PLC

- FINNFJORD AS

- Finnfjord AS

- Hindustan Alloys Private Limited

- Indian Metals & Ferro Alloys Limited

- Maithan Alloys Limited

- Mechel PAO

- OM Holdings Ltd.

- Russian Ferro-Alloys Inc.

- SINOGU CHINA

- VBC Ferro Alloys Limited

- Westbrook Resources Ltd.