Global FemTech Market by Type (Products, Software, and Services), By Application (Reproductive Health, Pregnancy & Nursing Care, General Healthcare & Wellness, and Pelvic & Uterine Care) By End-User (Direct-to-Consumer, Hospitals, Fertility Clinics, Surgical Centers, and Diagnostics Centers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 104415

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

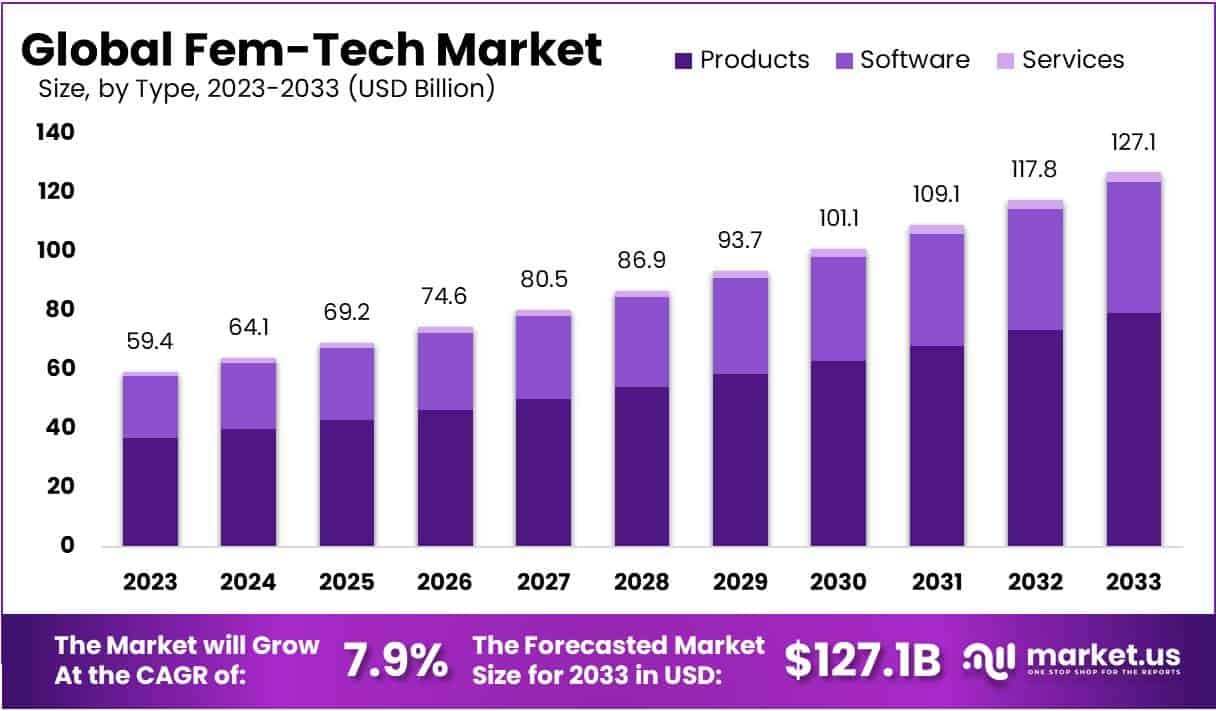

Global FemTech Market size is expected to be worth around USD 127.1 Billion by 2033 from USD 59.4 Billion in 2023, growing at a CAGR of 7.9% during the forecast period from 2024 to 2033.

FemTech, short for “female technology,” refers to a rapidly growing sector within the technology industry that focuses on developing innovative products, services, and software to address women’s specific health and wellness needs. It encompasses a wide range of areas, including reproductive health, menstrual care, pregnancy, and nursing care, women’s sexual wellness, general wellness, and more.

The global FemTech market has been gaining significant attention and experiencing remarkable growth in recent years. The increased awareness of women’s health issues, technological advancements, and changing cultural attitudes have contributed to this market’s expansion. FemTech solutions aim to empower women by providing them with convenient, accessible, and personalized healthcare options.

Key Takeaways

- The FemTech market size was valued at USD 59.4 Billion in 2023.

- The projected market size for 2033 is USD 127.1 Billion.

- The market is expected to grow at a CAGR of 7.9% from 2024 to 2033.

- The global FemTech market is segmented into three main types: Products, Software, and Services.

- Among these segments, the Products segment holds the largest market share.

- The Pregnancy & Nursing Care segment is expected to be the most dominant application in the FemTech market.

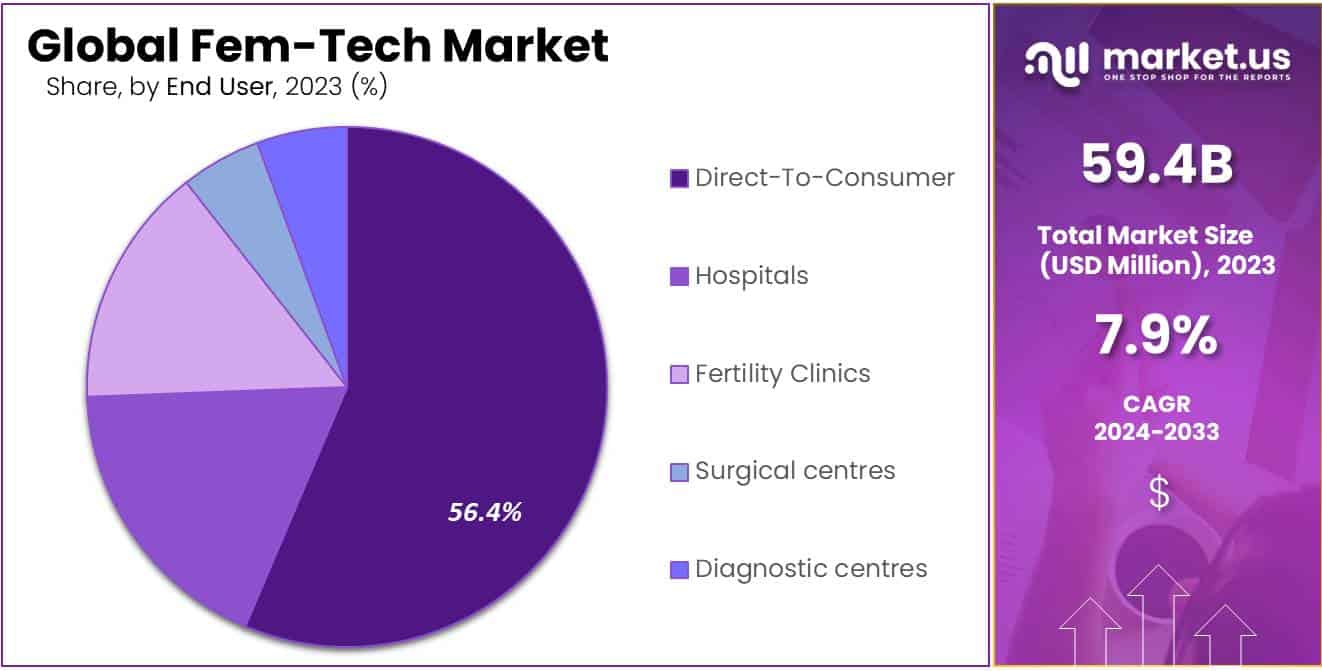

- The Direct-To-Consumer (DTC) segment holds the highest share in the FemTech market.

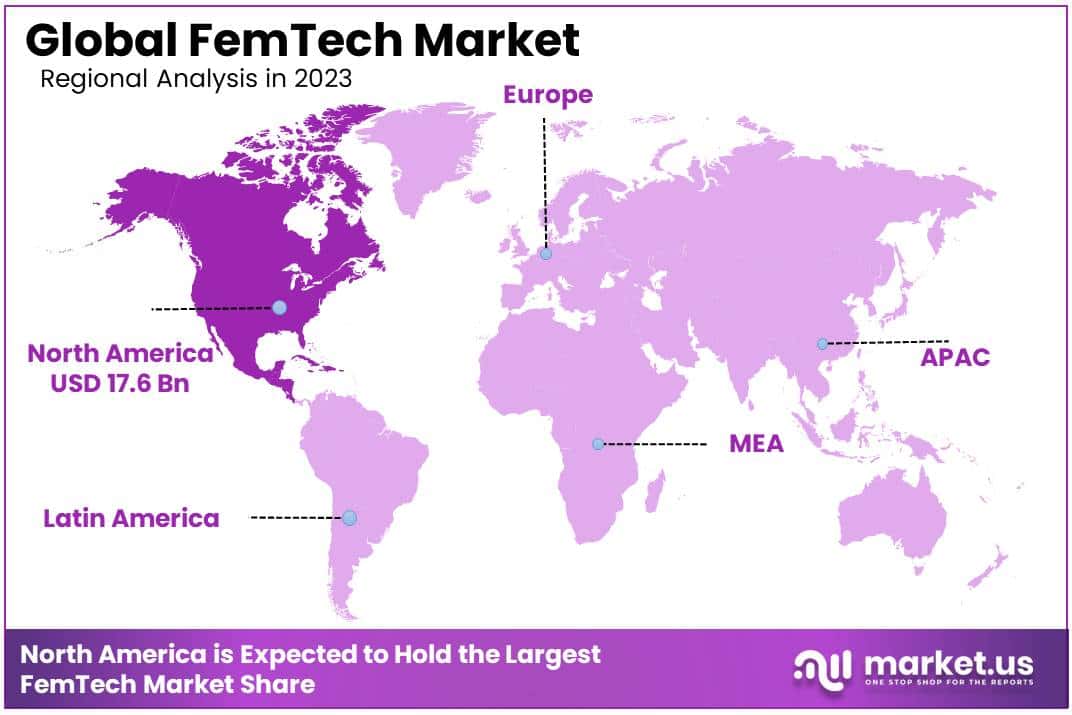

- North America region has the largest share of the global FemTech market.

- Clue and Natural Cycles are FDA-approved digital contraceptive apps.

- Clue received FDA approval in March 2021.

- A femtech startup received seed funding of USD 3.2 million in August 2022.

- Maven Clinic raised USD 90 million for Series E funding in November 2022.

- In total, Maven Clinic has raised over USD 300 million in funding.

- The market for companion diagnostics is fragmented with many local and regional players.

Type Analysis

The type analysis of the global FemTech market categorizes the market into three main segments: Products, Software, and Services.

In 2023, the Products segment held a dominant market position, capturing more than a 62.4% share. The product segment includes physical products that cater to women’s health and wellness needs. These products can range from innovative menstrual care products, fertility tracking devices, pregnancy and nursing care products, sexual wellness products, and more. Companies in this segment focus on developing and manufacturing tangible goods that directly address specific aspects of women’s health.

The software segment comprises applications, platforms, and digital solutions that leverage technology to provide women with health-related information, tracking tools, data analysis, and personalized insights. These software solutions may include mobile apps for menstrual tracking, fertility prediction, pregnancy monitoring, telemedicine platforms, and wellness management software. The software segment empowers women to manage their health proactively and make informed decisions. The services segment encompasses various healthcare services specifically designed for women.

These services may include virtual consultations with healthcare professionals, telemedicine services, online counseling, personalized coaching, and specialized clinics focused on women’s health. Service providers within the FemTech market aim to deliver convenient, accessible, and specialized healthcare experiences tailored to women’s needs.

Among these segments, the largest market share in the FemTech industry is currently held by the Products segment. Several factors contribute to the prominence of this segment. Products in the FemTech market have a direct physical presence, providing women with tangible solutions for their health and wellness needs. This includes innovative and user-friendly products like menstrual cups, fertility trackers, pregnancy monitoring devices, and sexual wellness products. The physical nature of these products resonates with consumers and addresses specific aspects of their health concerns.

Application Analysis

The Pregnancy and nursing Care Market is Expected to be the Most Dominant Due to the Growing Demand for Sophisticated Devices and Consumables like Smart Breast Pumps.

In 2023, the Pregnancy and Nursing care segment held a dominant market position, capturing more than a 49.5% share. There has been an increasing focus on maternal health worldwide, leading to a greater emphasis on pregnancy and postpartum care. FemTech solutions tailored to pregnancy and nursing care effectively address the specific needs of expectant and new mothers, encompassing areas such as fetal development tracking, vital sign monitoring, breastfeeding support, and postpartum recovery management.

Moreover, there is a growing demand for remote monitoring capabilities within the FemTech industry. Pregnancy & Nursing Care solutions offer remote monitoring features, allowing healthcare providers to closely monitor the health and well-being of pregnant women and new mothers from a distance. This is particularly valuable in scenarios where in-person visits may be challenging or inconvenient, such as during a pandemic or for individuals residing in rural or remote areas.

End-User Analysis

The Direct-To-Consumer Segment Holds the Highest Share of the Market

In 2023, the Direct-To-Consumer segment held a dominant market position, capturing more than a 56.4% share. DTC models offer enhanced accessibility, allowing FemTech companies to reach consumers directly through their websites or online platforms. This streamlined purchasing experience removes intermediaries, providing convenience and ease of access to products and services.

Secondly, the DTC approach empowers consumers by enabling direct communication, fostering trust, and empowering women in health decisions. Privacy and discretion also play a significant role, as DTC channels allow women to browse, research, and purchase intimate or sensitive FemTech products discreetly. Additionally, DTC companies leverage technology to provide personalized solutions, collecting user data to offer tailored recommendations and insights. This personalized approach, coupled with direct engagement and brand loyalty, contributes to the DTC segment’s dominance in the FemTech market.

Key Market Segments

By Type

- Products

- Software

- Services

By Application

- Reproductive Health

- Pregnancy and Nursing Care

- General Healthcare and Wellness

- Pelvic and Uterine Care

By End-User

- Direct-To-Consumer

- Hospitals

- Fertility Clinics

- Surgical centers

- Diagnostics Centers

Drivers

Increasing Awareness and Demand

Women are growing aware of the importance of proactive health management and personalized care. As women become more informed and empowered, they seek technology-driven solutions catering to their unique needs. This increased demand for women-centric healthcare products and services is a significant driver of the FemTech market.

Technological Advancements

Rapid technological advancements, such as wearable devices, mobile apps, artificial intelligence, and data analytics, have opened up new opportunities in women’s health. These technological advancements enable the development of innovative solutions for various areas like reproductive health, fertility tracking, pregnancy care, menopause management, pelvic health, and more. The integration of technology into women’s health has expanded the possibilities and fueled the growth of the FemTech market.

Shifting Cultural Attitudes and Societal Support

There has been a positive shift in cultural attitudes towards women’s health, with increased recognition of the importance of addressing women’s specific healthcare needs. Governments, healthcare organizations, and policymakers have also shown support for women’s health initiatives, which has created a conducive environment for FemTech companies to thrive. This societal support and recognition have been instrumental in driving the growth of the FemTech market.

Restraints

Privacy and Security Concerns

FemTech solutions often deal with sensitive and personal health data. Privacy and security concerns related to data collection, storage, and transmission can be a significant restraining factor for the market. Women may hesitate to share their personal health information due to concerns about data breaches, unauthorized access, or misuse. Building trust and addressing privacy and security concerns is crucial for the widespread adoption of FemTech solutions.

Opportunity

Increasing Awareness and Focus on Women’s Health

There is a growing emphasis on women’s health and well-being, with increased awareness about specific health issues affecting women. This awareness has created a demand for personalized and accessible healthcare solutions, paving the way for FemTech companies to develop innovative products and services.

Supportive Regulatory Environment

Regulatory bodies and governments are recognizing the potential of FemTech and are creating a supportive environment for its growth. Regulatory frameworks and initiatives aimed at promoting women’s health and advancing digital health technologies contribute to the market’s opportunities.

Collaboration and Partnerships

Collaboration between FemTech companies, healthcare providers, and research institutions can foster innovation and improve the delivery of women’s healthcare. Partnerships with established healthcare organizations provide access to expertise, resources, and a wider customer base, creating opportunities for market expansion.

Trends

To Maximize Resources for Women’s Health, Smart Wearable Device Manufacturers and Mobile Application Developers are Integrating their Innovative Product Design Strategies

FemTech companies are developing innovative solutions to address sexual health and wellness, including devices for pelvic floor strengthening, sexual wellness apps, and products to improve sexual satisfaction and intimacy. Moreover, Women increasingly use technology to track their menstrual cycles, monitor ovulation, and gain insights into their reproductive health. This trend has been fueled by the desire for natural family planning, pregnancy planning, and addressing fertility challenges.

Regional Analysis

North America Region Accounted Significant Share of the Global FemTech Market

In 2023, North America held a dominant market position, capturing more than a 29.7% share and holds USD 17.6 Billion market value for the year due to the increased number of patients. North America has a highly developed healthcare infrastructure and a robust ecosystem of technology and innovation, which provides a conducive environment for the growth of FemTech companies.

The region has numerous prominent technology hubs, such as Silicon Valley, where startups and established firms can thrive and receive significant funding and support. Moreover, the region has a large population of tech-savvy consumers who are early adopters of innovative technologies.

Key Regions

North America

- The US

- Canada

- Mexico

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Clue and Natural Cycles Are a Few FDA Approved Digital Contraceptive Apps That Use Bayesian Modeling for The Prediction Of The Most Fertile Days (The High-Risk Window)

The company’s strong investment in research to create a superior portfolio of treatment options has helped it become a market leader. Flo Health, Inc., Apple Inc., Clue By Biowink GmbH, Glow Inc.; Google, Inc. Natural Cycles USA Corp.; Withings, and Fitbit, Inc. are just a few major players in this market.

Market players worldwide are developing innovative products and technological solutions to meet the growing healthcare needs of women. The FDA approved Clue in March 2021 for Clue Birth Control, a digital contraceptive integrated into Clue. It can be used to predict ovulation using a tool for birth control.

Market Key Players

With the presence of many local and regional players, the market for companion diagnostics is fragmented. Market players are subject to intense competition from top market players, particularly those with strong brand recognition and high distribution networks. Companies have gained various expansion strategies, such as partnerships and product launches, to stay on top of the market.

The following are some of the major players in the Global FemTech Market industry

- Flo Health Inc.

- Natural Cycles USA Corp

- Glow Inc.

- Clue by Biowink GmbH

- Google Inc.

- Apple Inc.

- Withings

- Fitbit Inc.

- Other Key Players

Recent Development

- In December 2023, L3 Technologies Inc. acquired Invicti Security, a leading app security software provider, for $400 million. This move strengthens L3’s cybersecurity portfolio, focusing on solutions tailored for women’s health and safety.

- In November 2023, Nutech Company Limited launched “Nutech Mama”, a mobile app offering personalized pregnancy and childcare guidance to rural Indian mothers. The app utilizes AI for health tips, doctor consultations, and community forums.

- In October 2023, Westminster Group Plc partnered with femtech startup “Fertility Circle” to provide discounted fertility preservation and egg freezing services. This collaboration broadens access to crucial fertility treatments for women within their clinic network.

- In September 2023, OD Security unveiled “Guardian Angel”, a wearable panic button and GPS tracker designed for women’s safety. The device, with a single press, connects to emergency services and trusted contacts, enhancing personal security measures.

Report Scope

Report Features Description Market Value (2023) USD 59.4 Billion Forecast Revenue (2033) USD 127.1 Billion CAGR (2024-2033) 7.9% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type- Device, Software, and Others; By Application – Reproductive Health, Pregnancy and Nursing Care, General Healthcare and Wellness, and Other Applications, By End-Users- Direct-To-Consumer, Hospitals, Fertility Clinics, Surgical centers, Diagnostics Centers, and Others Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Flo Health Inc., Natural Cycles USA Corp, Glow Inc., Clue by Biowink GmbH, Google Inc., Apple Inc., Withings, Fitbit Inc., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the FemTech market in 2023?The FemTech market size is USD 59.4 billion in 2023.

What is the projected CAGR at which the FemTech market is expected to grow at?The FemTech market is expected to grow at a CAGR of 7.9% (2024-2033).

List the segments encompassed in this report on the FemTech market?Market.US has segmented the FemTech market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type the market has been segmented into Products, Software, and Services. By Application the market has been segmented into Reproductive Health, Pregnancy & Nursing Care, General Healthcare & Wellness, and Pelvic & Uterine Care. By End-User the market has been segmented into Direct-to-Consumer, Hospitals, Fertility Clinics, Surgical Centers, and Diagnostics Centers.

List the key industry players of the FemTech market?Flo Health Inc., Natural Cycles USA Corp, Glow Inc., Clue by Biowink GmbH, Google Inc., Apple Inc., Withings, Fitbit Inc., Other Key Players

Which region is more appealing for vendors employed in the FemTech market?North America is expected to account for the highest revenue share of 29.7% and boasting an impressive market value of USD 17.6 billion. Therefore, the FemTech industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for FemTech?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the FemTech Market.

-

-

- Flo Health Inc.

- Natural Cycles USA Corp

- Glow Inc.

- Clue by Biowink GmbH

- Google Inc.

- Apple Inc.

- Withings

- Fitbit Inc.

- Other Key Players