Global Feed Mixer for Livestock Market Size, Share Analysis Report By Type (Pull-Type, Stationary, Others), By Capacity (Small Capacity, Medium Capacity, Large Capacity), By Mixing Technology (Vertical Auger, Horizontal Auger, Paddle Mixer), By Application (Dairy Cattle Farms, Beef Cattle Farms, Sheep Farms, Mixed Livestock Operations, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 172723

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

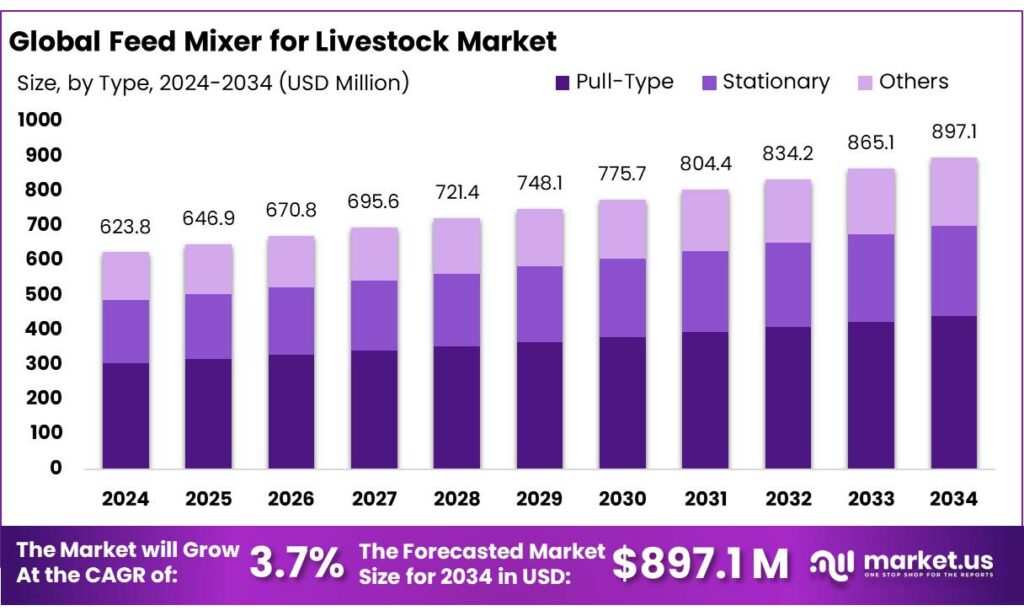

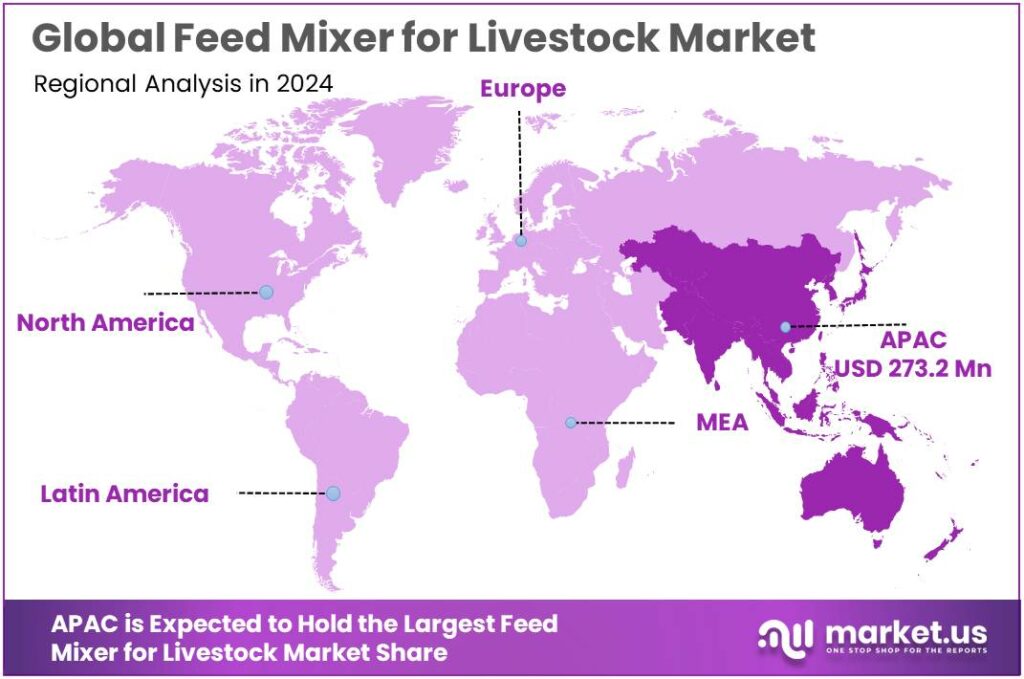

The Global Feed Mixer for Livestock Market size is expected to be worth around USD 897.1 Million by 2034, from USD 623.8 Million in 2024, growing at a CAGR of 3.7% during the forecast period from 2025 to 2034. In 2024 Asia Pacific (APAC) held a dominant market position, capturing more than a 43.8% share, holding USD 273.2 Million in revenue.

Feed mixers for livestock sit at the practical intersection of animal nutrition, feed safety, and on-farm productivity. They blend grains, oilseed meals, forages, premixes, and micro-ingredients into a consistent ration—either as total mixed rations (TMR) for ruminants or as precisely dosed mash/pellet feed inputs for poultry and swine systems. As commercial feeding becomes more specification-driven, mixing quality turns into a measurable lever for feed conversion, animal health, and waste reduction.

The industrial scenario is supported by the scale of the feed and protein system. Global feed output rebounded to about 1.396 billion metric tons in 2024, reinforcing the throughput pressure on mills and the rising use of standardized, mechanically mixed rations. At the industry level, IFIF notes world compound feed production at over 1 billion tonnes annually, with global commercial feed manufacturing generating over US$400 billion in annual turnover—figures that highlight why efficiency and quality control investments remain persistent. On the demand side, the OECD-FAO outlook estimates global meat production rose 1.3% in 2024 to 365 Mt, keeping sustained pull-through for feed grains, additives, and reliable mixing systems.

Key driving factors are largely economic and operational. Feed is widely treated as one of the biggest controllable costs in animal production, so producers and integrators focus on reducing waste and improving ration repeatability. In the United States—one of the most industrialized livestock markets—USDA ERS notes that in 2024 cattle production represented about 22% of $515 billion in total cash receipts for agricultural commodities, underscoring how even modest efficiency gains can matter at scale.

On the policy side, government-backed programs that expand feed and livestock infrastructure can indirectly accelerate mixer adoption. In India, the Department of Animal Husbandry and Dairying’s Animal Husbandry Infrastructure Development Fund (AHIDF) was announced at ₹15,000 crore, and a December 2025 government release reported ₹10,320 crores in loans sanctioned across 428 approved projects, alongside ₹429.49 crores in interest subvention released—capital that supports modernization in areas such as feed manufacturing and allied animal-husbandry infrastructure.

In Europe, the EU indicates EUR 264 billion of EU funds dedicated to CAP Strategic Plans for 2023–2027, which—through national plans—can support farm modernization and productivity investments that indirectly lift demand for feed preparation equipment. In the United States, conservation-linked funding can also accelerate upgrades to livestock operations; a legislative side-by-side summary notes $8.45 billion allocated to EQIP via the Inflation Reduction Act, with $1.75 billion for FY 2024 and $3.0 billion for FY 2025, supporting practice adoption that can include improved on-farm management systems and infrastructure.

Key Takeaways

- Feed Mixer for Livestock Market size is expected to be worth around USD 897.1 Million by 2034, from USD 623.8 Million in 2024, growing at a CAGR of 3.7%.

- Pull-Type held a dominant market position, capturing more than a 48.9% share.

- Medium Capacity held a dominant market position, capturing more than a 48.6% share in the feed mixer for livestock market.

- Vertical Auger held a dominant market position, capturing more than a 52.2% share in the feed mixer for livestock market.

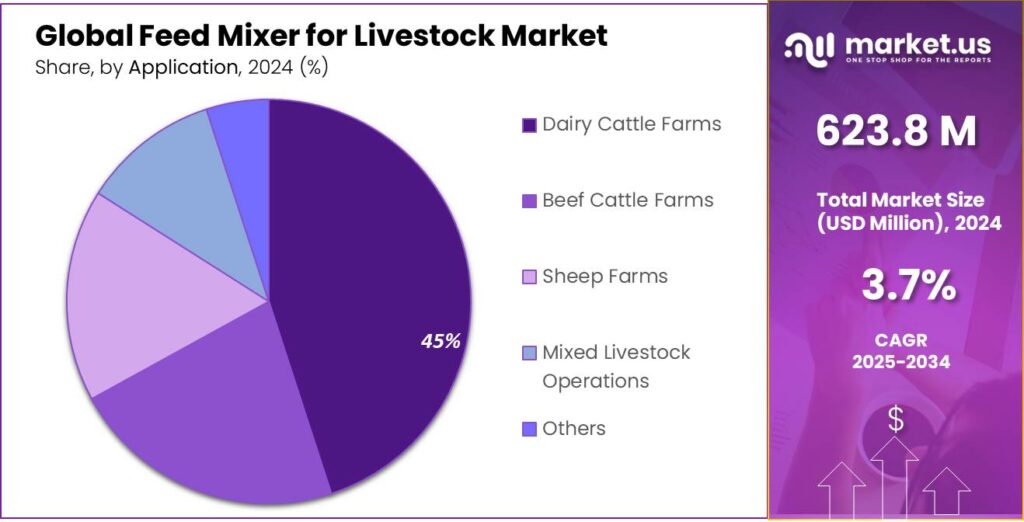

- Dairy Cattle Farms held a dominant market position, capturing more than a 45.5% share in the feed mixer for livestock market.

- Asia Pacific (APAC) region emerged as the dominant market for feed mixers for livestock, capturing 43.8% share of market revenue, equivalent to approximately USD 273.2 million.

By Type Analysis

Pull-Type Feed Mixers lead with a 48.9% share due to ease of use and suitability for large farms.

In 2024, Pull-Type held a dominant market position, capturing more than a 48.9% share in the feed mixer for livestock market. This leadership was mainly driven by its strong adoption among medium-to-large livestock farms where high feed volume handling and operational efficiency are critical. Pull-type feed mixers are designed to be attached to tractors, which allows farmers to mix and distribute feed across wider farm areas with less manual effort. Their ability to handle bulky rations, including silage, grains, and supplements, made them a practical choice for dairy and beef operations in 2024.

The segment also benefited from lower upfront equipment costs compared to self-propelled units, while still offering high capacity and reliable performance. In 2025, demand for pull-type mixers continued to remain stable, supported by farm mechanisation trends and the need to reduce feeding time and labor dependency. Their simple mechanical structure and ease of maintenance further supported repeat purchases, especially in regions with expanding commercial livestock production. As productivity and feed consistency remained key priorities, pull-type feed mixers sustained their strong position within the overall market.

By Capacity Analysis

Medium Capacity feed mixers dominate with a 48.6% share due to balanced output and cost efficiency.

In 2024, Medium Capacity held a dominant market position, capturing more than a 48.6% share in the feed mixer for livestock market. This segment gained strong preference because it effectively served both small commercial farms and growing mid-sized dairy and cattle operations. Medium-capacity mixers offered an optimal balance between batch volume and operational flexibility, allowing farmers to prepare consistent feed rations without investing in high-cost, large-scale equipment.

Moving into 2025, demand for medium-capacity feed mixers remained resilient, supported by the expansion of organized livestock farming and rising focus on animal nutrition efficiency. Ease of handling, moderate fuel consumption, and lower maintenance requirements made this segment a practical long-term investment for farmers. As livestock producers continued to prioritise productivity and cost control, medium-capacity feed mixers maintained a strong and stable position within the overall market.

By Mixing Technology Analysis

Vertical Auger feed mixers lead with a 52.2% share due to efficient mixing and lower power needs.

In 2024, Vertical Auger held a dominant market position, capturing more than a 52.2% share in the feed mixer for livestock market. This leadership was mainly supported by its ability to deliver uniform mixing while handling a wide range of feed ingredients, including long fiber forages and silage. Vertical auger systems were widely preferred because they required less horsepower compared to horizontal designs, making them suitable for farms using standard tractors.

In 2024, farmers increasingly selected this technology for its simple design, which allowed easier loading, reduced feed separation, and consistent ration quality. The vertical auger also supported quicker mixing cycles, helping livestock operations save time during daily feeding routines. In 2025, demand continued to remain strong as farms focused on improving feed efficiency and animal health through well-mixed rations. Lower maintenance needs and durable construction further strengthened adoption, especially in dairy and beef farms. As operational reliability and mixing performance remained critical, vertical auger technology maintained its leading position across the market.

By Application Analysis

Dairy cattle farms lead with a 45.5% share driven by daily feed consistency needs.

In 2024, Dairy Cattle Farms held a dominant market position, capturing more than a 45.5% share in the feed mixer for livestock market. This dominance was largely supported by the daily requirement for uniform and nutritionally balanced feed rations in milk production systems. Dairy farms rely heavily on consistent mixing of silage, grains, and supplements to maintain animal health and stable milk yields. In 2024, feed mixers were widely adopted across dairy operations to reduce feed wastage and improve feeding efficiency, especially in farms managing large herds.

The use of mechanised mixing also helped lower labor dependency and improved feeding schedules. Moving into 2025, demand from dairy cattle farms remained strong as producers continued to invest in equipment that supports productivity and feed management accuracy. Rising focus on herd nutrition, along with expansion of organized dairy farming, further supported this segment. As reliable feed preparation remained central to milk quality and output, dairy cattle farms sustained their leading role within the overall market.

Key Market Segments

By Type

- Pull-Type

- Stationary

- Others

By Capacity

- Small Capacity

- Medium Capacity

- Large Capacity

By Mixing Technology

- Vertical Auger

- Horizontal Auger

- Paddle Mixer

By Application

- Dairy Cattle Farms

- Beef Cattle Farms

- Sheep Farms

- Mixed Livestock Operations

- Others

Emerging Trends

Automation and Digital Controls Make Feed Mixing Smarter and More Accurate

One of the biggest recent trends in the feed mixer market for livestock is the shift toward automation and digital controls. Farmers and feed manufacturers are no longer satisfied with older machines that run at a fixed speed and rely on manual checks. Instead, they increasingly demand mixers that use sensors, programmable logic controllers (PLCs), and real-time data to improve accuracy, reduce waste, and make daily routines easier. This trend reflects how everyday farm work is becoming more data-driven, and how livestock producers are focusing on consistent nutrition not just for growth, but for animal welfare and profitability.

- Across the world, livestock systems are producing more feed than ever before, and that is pushing users toward smarter mixing. The Alltech Global Feed Survey 2024 reported that world feed production reached 1.396 billion metric tons, up 1.2% year-on-year, with data gathered from 28,235 feed mills in 142 countries. When so much feed is being made and used every day, even small variations in ingredient mix can cost money or affect feed conversion.

On-farm mixers for dairy, beef, and even small ruminants are also going digital. Sensors can now alert operators when bearings are overheating, when mixes are complete, or when maintenance is due. Some systems even connect to mobile apps, so farmers can start, stop, or track mixers from their phone while they tend other chores. This practical convenience makes technology adoption feel natural rather than intimidating.

Drivers

Rising Industrial Feed Output Pushes Farms Toward Consistent, Safer Mixing

One major driving factor for feed mixers in livestock is the steady scaling of commercial feed production and the need to keep every batch consistent as volumes rise. Across the world, feed is no longer a small, local input; it is a large, organized industry that must deliver the same ration quality day after day. The International Feed Industry Federation (IFIF) estimates world compound feed production at over 1 billion tonnes annually and links global commercial feed manufacturing to an annual turnover of over US$400 billion.

The scale signal is even clearer in the latest global feed survey results shared by Alltech. Its Agri-Food Outlook (based on its feed survey) reports 2024 world feed production of 1.396 billion metric tons, up 1.2% year over year, reflecting the industry’s continued expansion. The same survey framework describes coverage across 142 countries and 28,235 feed mills in 2024, showing how widely industrial feed manufacturing has spread.

Government-backed modernization is also reinforcing this “scale + standardization” push. In India, the Department of Animal Husbandry and Dairying notes the creation of the Rs. 15,000 crore Animal Husbandry Infrastructure Development Fund (AHIDF) to support livestock-sector infrastructure, including projects such as animal feed plants.

- The demand story is being pulled by volume, accountability, and consistency. As global feed output climbs to 1.396 billion metric tons and the industrial base spans 28,235 feed mills, livestock businesses increasingly need equipment that can deliver uniform rations, reduce human error, and support record-driven operations.

Restraints

High Feed-Cost Volatility Squeezes Cash Flow for Equipment Upgrades

A major restraining factor for the Feed Mixer for Livestock market is the financial pressure created by volatile feed ingredient prices and tight farm margins. When day-to-day feed costs swing, many livestock operators postpone capital spending, even if they know a better mixer would improve ration consistency. In practical terms, a mixer is often viewed as an “upgrade,” while feed purchases are a “must-pay” expense. That imbalance becomes sharper when the market is uncertain, because farmers protect liquidity first and delay machinery replacement, spare parts stocking, and automation add-ons.

- Trusted industry numbers show how quickly feed economics can shift. In the USDA Economic Research Service Livestock, Dairy, and Poultry Outlook (January 2024), the report notes that in November 2023 the U.S. corn price was $4.66 per bushel, alfalfa hay was $207.0 per short ton, and soybean meal averaged $464.3 per short ton.

The same USDA report also illustrates why confidence can weaken even when output remains steady. It states the all-milk price in November 2023 averaged $21.70 per hundredweight (cwt), down $3.70 from November 2022, while the milk-feed ratio was 2.12. For a dairy operator, this kind of movement is a reminder that revenue and feed costs do not always move in a friendly direction at the same time. When milk checks soften, farms commonly tighten budgets on “nonessential” spending, and equipment like feed mixers can fall into that delayed category—even if maintenance costs on older units are climbing.

This restraint is amplified by the reality that feed manufacturing and procurement operate at massive scale, which can transmit global price shocks into local farm budgets. IFIF notes that world compound feed production is “just over” one billion tonnes annually, and that global commercial feed manufacturing generates an estimated annual turnover of over US$400 billion.

Opportunity

Government-Backed Modernization Is Opening a Big Upgrade Cycle

India is a clear example of how policy can unlock investment appetite in feed preparation. The Department of Animal Husbandry and Dairying highlights the Animal Husbandry Infrastructure Development Fund (AHIDF) of ₹15,000 crore, designed to incentivize investment across areas that explicitly include Animal Feed Plant projects. For mixer suppliers, this matters because new feed plants and upgraded feed lines typically require dependable mixing as a core step—whether it is batch mixing for compound feed or blending for mineral premixes and additives.

India is a clear example of how policy can unlock investment appetite in feed preparation. The Department of Animal Husbandry and Dairying highlights the Animal Husbandry Infrastructure Development Fund (AHIDF) of ₹15,000 crore, designed to incentivize investment across areas that explicitly include Animal Feed Plant projects. For mixer suppliers, this matters because new feed plants and upgraded feed lines typically require dependable mixing as a core step—whether it is batch mixing for compound feed or blending for mineral premixes and additives.

- This opportunity is amplified by the sheer scale of global feed manufacturing that must be served with reliable equipment. Alltech’s global feed survey reports world feed production increased in 2024 by 1.2% to 1.396 billion metric tons. The same industry reporting around the survey indicates the dataset covered 142 countries and 28,235 feed mills in 2024, showing how broad and operationally complex the feed system has become.

Europe also provides a long runway for modernization spending that can support equipment investments across farms and agri-processing. A European Commission summary document on the CAP Strategic Plans notes total public expenditure of €307 billion for the 2023–2027 period, and the Commission’s CAP planning documents also describe €264 billion in EU funds dedicated to CAP Strategic Plans over 2023–2027.

Regional Insights

APAC leads with a 43.8% share and USD 273.2 million in 2024, underpinned by expanding livestock production and mechanisation.

In 2024, the Asia Pacific (APAC) region emerged as the dominant market for feed mixers for livestock, capturing 43.8% share of market revenue, equivalent to approximately USD 273.2 million. The region’s leadership was driven by rapid growth in commercial livestock farming, particularly in countries such as China, India, and Southeast Asian markets, where rising demand for dairy, poultry, and beef products pushed producers to adopt mechanised feed mixing solutions. APAC’s livestock sector experienced steady growth as population increases, rising incomes, and shifting dietary patterns supported higher consumption of animal-derived proteins.

Medium and large farms invested in feed mixers to improve feed uniformity, reduce wastage, and maintain consistent nutrient delivery across herds. Pull-type and vertical auger machines gained traction due to their compatibility with locally available tractors and reasonable capital investment compared to fully self-propelled units, aligning with farm budgets and operational needs. In 2024, smallholder producers also began transitioning toward mechanised feed preparation, supported by government programmes and financing initiatives aimed at improving rural productivity.

Distribution expansion through agricultural equipment dealers and online channels enhanced accessibility for feed mixers across both developed and emerging APAC markets. Moving into 2025, demand remained resilient as livestock producers focused on enhancing feed conversion ratios and overall farm efficiency, which sustained the region’s dominant position. Continued emphasis on precision feeding, mechanisation, and value chain optimisation reinforced APAC’s role as a key growth engine for the global feed mixer market, reflecting broader agricultural modernisation trends across the region.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

KUHN Group is a global leader in agricultural machinery, with over 2,000 dealers in 100+ countries by 2024. Its feed mixers, including vertical and horizontal systems, support dairy and beef producers with high-capacity mixing and durable build quality. Annual sales in livestock equipment exceeded €1.4 billion in 2023, reflecting broad adoption and strong brand recognition among large commercial farms worldwide.

Triolet Feed Mixers (Netherlands) is known for robust horizontal and vertical feed mixers tailored for dairy and beef farms. By 2024, the company’s mixers served 4000+ farms across Europe, North America and Australia, integrating advanced mixing technology and strong chassis design. Triolet reported growth in its export segment, with over 30% year-on-year increase in machine orders, driven by rising mechanisation in livestock nutrition.

Highline Manufacturing Ltd. (Canada) produces a wide range of feed mixers, manure spreaders, and delivery equipment. By 2024, Highline’s mixers were used by commercial livestock producers in 20+ countries, with annual production capacity exceeding 5,000 units. The company’s systems are valued for reliability and low maintenance, particularly among expanding dairy operations.

Top Key Players Outlook

- KUHN

- Supreme International

- Triolet

- Highline Manufacturing

- Groupe Anderson

- DuraTech Industries

- Jaylor International

- Harsh International

- Vermeer Corporation

- NDEco

Recent Industry Developments

By 2024, Groupe Anderson Inc. produced more than 1 000 units per year from its local manufacturing base and distributed these machines across 22 countries, reflecting growing international demand for plant‑based livestock feeding technology backed by solid build quality and technical support.

In 2024, Triolet B.V. in the Netherlands, the company built on more than 75 years of experience in feeding technology and supplied machines to over 50 countries worldwide, exporting more than 80% of its products to global markets including North America, Europe, Australia, and Asia.

Report Scope

Report Features Description Market Value (2024) USD 623.8 Mn Forecast Revenue (2034) USD 897.1 Mn CAGR (2025-2034) 3.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Pull-Type, Stationary, Others), By Capacity (Small Capacity, Medium Capacity, Large Capacity), By Mixing Technology (Vertical Auger, Horizontal Auger, Paddle Mixer), By Application (Dairy Cattle Farms, Beef Cattle Farms, Sheep Farms, Mixed Livestock Operations, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape KUHN, Supreme International, Triolet, Highline Manufacturing, Groupe Anderson, DuraTech Industries, Jaylor International, Harsh International, Vermeer Corporation, NDEco Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Feed Mixer for Livestock MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Feed Mixer for Livestock MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- KUHN

- Supreme International

- Triolet

- Highline Manufacturing

- Groupe Anderson

- DuraTech Industries

- Jaylor International

- Harsh International

- Vermeer Corporation

- NDEco