Global Feed Acidulants Market Size, Share, And Enhanced Productivity By Type (Propionic Acid, Formic Acid, Citric Acid, Lactic Acid, Sorbic Acid, Malic Acid, Acetic Acid, Others), By Compound (Blended Compound, Single Compound), By Form (Dry, Liquid), By Function (pH Control, Feed Efficiency, Flavor), By Animal Type (Poultry (Broilers, Layers, Breeders), Swine (Starters, Growers, Saws), Ruminants (Dairy Cattle, Beef Cattle, Others), Pets (Dogs, Cats, Others), Aquaculture, Equine), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174891

- Number of Pages: 223

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

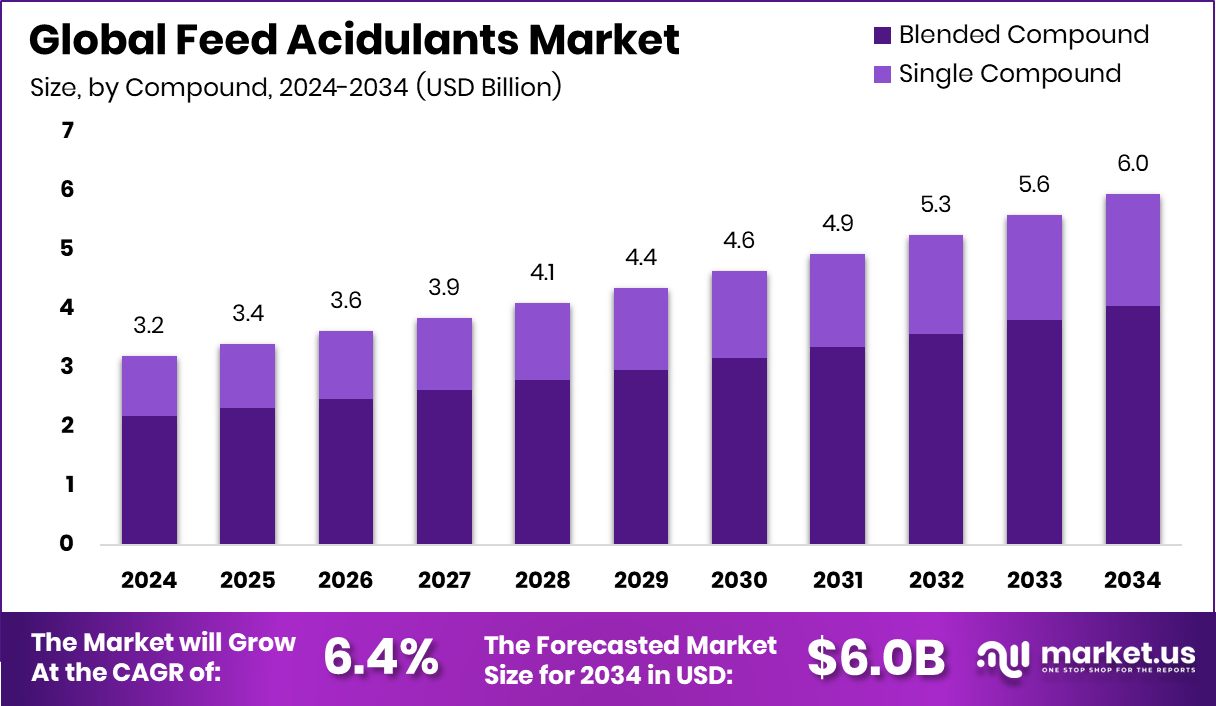

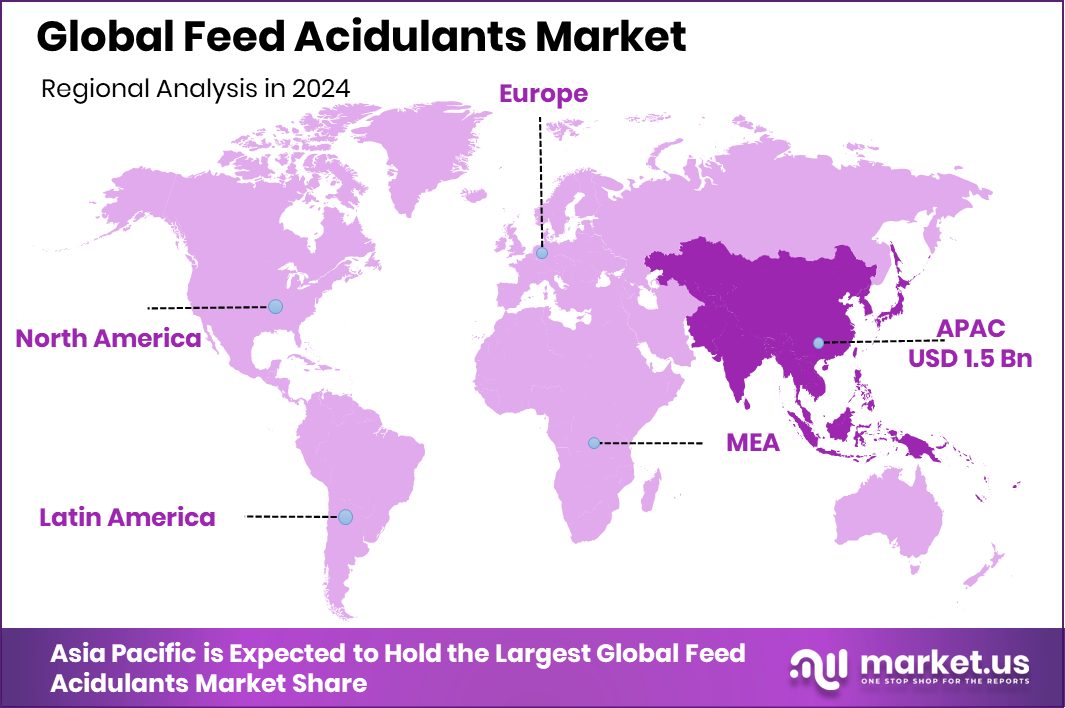

The Global Feed Acidulants Market is expected to be worth around USD 6.0 billion by 2034, up from USD 3.2 billion in 2024, and is projected to grow at a CAGR of 6.4% from 2025 to 2034. The Asia Pacific led with 49.7%, valuing the Feed Acidulants Market at USD 1.5 Bn.

The Feed Acidulants Market refers to the global industry that produces and supplies these organic acids for commercial feed. The market continues to grow as producers look for safer and more sustainable ways to maintain animal health and reduce antibiotic use. This shift also aligns with new technologies in ingredient development, where companies receive funding and grants to improve fermentation, upcycling, and clean-label solutions. These innovations indirectly strengthen acidulant adoption by improving feed safety and quality.

Growth in this market is supported by rising focus on feed hygiene and safe ingredient processing. Industry movements such as BioVeritas securing $65M for fermented upcycled ingredients and Gelesis receiving a $10.6M grant to support manufacturing improvements highlight how investment in clean production benefits the wider feed ingredient landscape. Better production technologies naturally increase demand for high-quality acidulants.

Market demand also grows as producers work to minimize contamination risks in feed supply chains. Incidents like the recall of nearly 5,000 pounds of liquid egg due to undeclared allergens push the feed and food sectors to adopt stronger safety measures. Acidulants play a role in maintaining cleaner processes, which supports ongoing adoption across livestock operations.

Opportunities continue to expand as ingredient innovation gains momentum. New funding, such as Solidec raising $2M in pre-seed funding, Avantium receiving a €3.5M EU grant for CO₂ conversion, OCOchem landing $5M for CO₂-based chemical recycling, and Hapi Drinks winning a $100,000 PepsiCo grant, shows growing investment toward sustainable chemical and food solutions. These advancements support broader interest in natural, safe, and efficient additives—including feed acidulants—as global agriculture moves toward cleaner and more resilient production systems.

Key Takeaways

- The Global Feed Acidulants Market is expected to be worth around USD 6.0 billion by 2034, up from USD 3.2 billion in 2024, and is projected to grow at a CAGR of 6.4% from 2025 to 2034.

- The Feed Acidulants Market grows strongly as propionic acid leads with a dominant 39.6% share.

- In the Feed Acidulants Market, blended compounds hold significant demand, capturing a strong 68.1% portion.

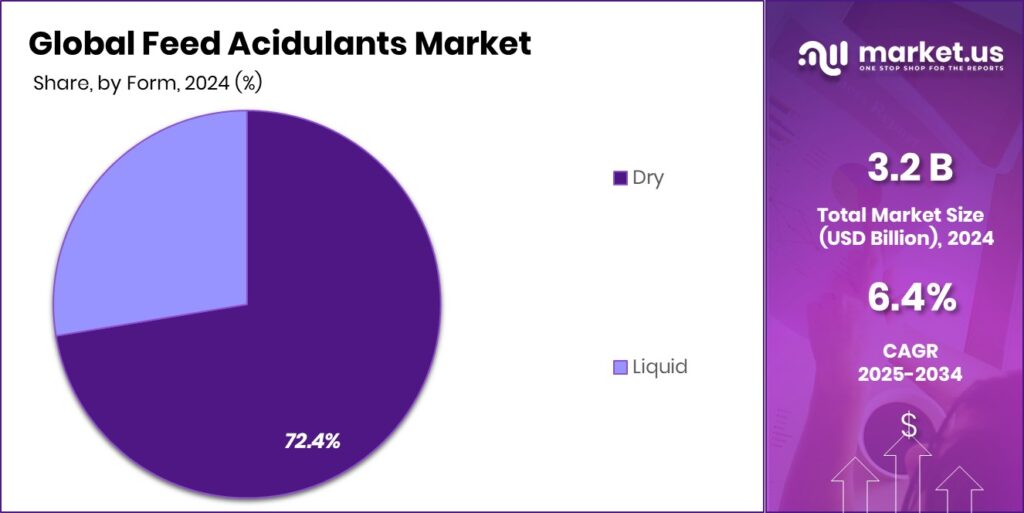

- The Feed Acidulants Market favors dry-form products, which account for a notable 72.4% share.

- pH control remains essential in the feed acidulants market, representing a key 41.2% functional contribution.

- Poultry nutrition drives the Feed Acidulants Market forward, with this animal segment holding a 44.7% share.

- Asia Pacific maintained a 49.7% share, driving the feed acidulant market growth to USD 1.5 Bn.

By Type Analysis

Feed Acidulants Market sees propionic acid as the leading type segment with a 39.6% share.

In 2024, the Feed Acidulants Market by type was led by propionic acid, holding a 39.6% share due to its strong antifungal properties and proven effectiveness in preserving feed quality. Propionic acid is widely used to prevent mold growth in animal feed, especially in humid storage conditions. Feed manufacturers prefer this acid because it helps extend shelf life without affecting nutrient value.

Its consistent performance across poultry, swine, and ruminant feed has supported steady demand. In addition, growing awareness about feed safety and mycotoxin control has encouraged farmers to adopt propionic acid-based solutions. Regulatory acceptance and ease of blending into compound feed further strengthen its role, making it a reliable and cost-effective choice in modern feed formulations.

By Compound Analysis

Feed Acidulants Market shows the blended compound dominating the compound category, accounting for 68.1%.

In 2024, the Feed Acidulants Market by compound type was dominated by blended compounds, accounting for 68.1% of total demand. Blended acidulants combine multiple organic acids to deliver broader benefits, such as improved digestion, pathogen control, and feed stability. These blends allow manufacturers to tailor formulations for specific animal needs and regional farming conditions.

Farmers increasingly prefer blended compounds because they offer balanced performance rather than relying on a single acid. This approach also helps reduce dosage levels while maintaining effectiveness, which supports cost efficiency. As livestock producers focus more on gut health and antibiotic reduction, blended compounds are gaining trust. Their flexibility and consistent results make them a preferred option across commercial feed operations.

By Form Analysis

Feed Acidulants Market indicates the dry form, driven by efficiency at 72.4%.

In 2024, the Feed Acidulants Market by form was strongly led by the dry form, which captured a 72.4% share. Dry acidulants are widely favored due to their ease of handling, longer shelf life, and compatibility with standard feed manufacturing processes. Unlike liquid forms, dry acidulants are easier to store and transport, especially in large-scale feed mills. They also allow precise mixing in compound feed, ensuring uniform distribution of acids.

Feed producers value dry formulations for their stability under varying temperature conditions. Additionally, dry acidulants reduce the risk of corrosion in equipment, lowering maintenance costs. These practical advantages continue to drive widespread adoption across industrial and on-farm feed production systems.

By Function Analysis

Feed Acidulants Market highlights pH control as a key function, holding a 41.2% share.

In 2024, the Feed Acidulants Market by function was led by pH control, holding a 41.2% share as producers focused on improving animal gut health. Maintaining optimal pH levels in the digestive system helps suppress harmful bacteria and supports better nutrient absorption. Acidulants used for pH control are especially important in young animals, whose digestive systems are still developing.

Farmers recognize that stable gut conditions lead to improved feed efficiency and overall performance. This function also supports the reduction of antibiotic use, aligning with global trends toward responsible animal nutrition. As livestock producers seek preventive health solutions, pH control remains a core application driving demand for feed acidulants.

By Animal Type Analysis

Feed Acidulants The market remains poultry-focused, as poultry applications capture 44.7% of demand.

In 2024, the Feed Acidulants Market by animal type was dominated by poultry, with a 44.7% share driven by high feed consumption and intensive production systems. Poultry farming relies heavily on efficient feed conversion and disease prevention, making acidulants a critical component of diets.

Acidulants help control pathogens such as Salmonella while supporting growth and performance. The fast growth cycle of poultry increases the need for consistent feed quality and gut health management. Rising global demand for poultry meat and eggs has further strengthened this segment. As producers aim to improve productivity while meeting food safety standards, the use of feed acidulants in poultry nutrition continues to expand steadily.

Key Market Segments

By Type

- Propionic Acid

- Formic Acid

- Citric Acid

- Lactic Acid

- Sorbic Acid

- Malic Acid

- Acetic Acid

- Others

By Compound

- Blended Compound

- Single Compound

By Form

- Dry

- Liquid

By Function

- pH Control

- Feed Efficiency

- Flavor

By Animal Type

- Poultry

- Broilers

- Layers

- Breeders

- Swine

- Starters

- Growers

- Saws

- Ruminants

- Dairy Cattle

- Beef Cattle

- Others

- Pets

- Dogs

- Cats

- Others

- Aquaculture

- Equine

Driving Factors

Rising Demand for Safe and Clean Feed Additives

The Feed Acidulants Market is growing because farmers want safer and cleaner feed ingredients that improve animal digestion and protect feed from spoilage. A major boost to this shift comes from innovation in sustainable acid production.

For example, TripleW raised $16.5 million in Series B funding to produce lactic acid from food waste, which directly supports cleaner and more affordable acidulant inputs for the feed sector. This kind of funding encourages better-quality organic acids, helping producers maintain hygiene without relying on harsh chemicals.

As livestock systems expand and regulations tighten, these developments make acidulants more important for maintaining feed safety, supporting better gut health, and improving overall animal performance naturally.

Restraining Factors

High Production Costs Limit Wider Adoption Rates

A key restraint in the Feed Acidulants Market is the relatively high production cost of organic acids, which can limit their use in price-sensitive regions. The need for advanced technology, controlled fermentation, and specialized handling increases the cost of producing high-purity acids. This challenge is highlighted by major investments in related industries, such as Floreon securing GBP 250 million to advance bioplastics technology, showing how costly scaling biochemical production can be.

Such large funding requirements reflect why acidulant manufacturing also faces cost pressures. These higher input costs make some farmers hesitate to adopt acidulants fully, especially in traditional livestock markets where margins are tight, and feed prices fluctuate.

Growth Opportunity

Digital Innovation Creates New Efficiency Opportunities

Growth opportunities in the Feed Acidulants Market are expanding as digital tools help producers optimize feed formulation and ingredient use. Better data systems allow farmers to measure gut health improvements and adjust acidulant dosage more effectively. Innovation in the tech world indirectly supports this shift.

For instance, an Israeli startup raised $11 million to use generative AI for better software testing, and Backslash Security secured $8 million to strengthen cloud-native application control. These advancements highlight how smarter digital ecosystems are forming, making it easier for feed producers to use precise, data-driven nutrition strategies. With better monitoring tools, the value of acidulants becomes clearer, opening new opportunities for efficiency and targeted feeding.

Latest Trends

Biotech and Bio-Alternative Solutions Shape New Trends

A major trend shaping the Feed Acidulants Market is the move toward bio-based and sustainable ingredients. Companies and governments are investing heavily in cleaner production pathways that align with agricultural sustainability goals. For instance, Bond Pet Foods raised $17.5 million to build a new facility for alternative protein production, showing rising interest in fermentation-based ingredients.

Likewise, Japan announced around $408 million in funding for a bamboo-based ethanol project in India, highlighting global support for renewable chemical production. These developments reinforce the trend toward greener acidulant sources, improved fermentation processes, and reduced environmental impact, making natural feed acids more appealing to producers seeking long-term sustainability.

Regional Analysis

In 2024, the Asia Pacific Feed Acidulants Market held 49.7%, reaching USD 1.5 Bn.

In the Feed Acidulants Market, the Asia Pacific region dominated with a 49.7% share, valued at USD 1.5 Bn, driven by expanding livestock production and strong commercial feed demand across major countries. This leadership is supported by the region’s large poultry and swine populations, which continue to adopt acidulants to improve feed efficiency and maintain quality under humid storage conditions.

North America followed with steady growth, supported by its structured feed industry and rising focus on gut-health additives across poultry and swine segments. Europe showed consistent demand, driven by strict feed safety regulations and high adoption of organic acid blends to reduce antibiotic use.

In Latin America, the market progressed with expanding poultry exports and increasing integration of acidifiers in compound feed to maintain quality during long transport cycles. The Middle East & Africa recorded gradual growth as the region continued strengthening its poultry and dairy sectors, increasing the use of acidulants to enhance feed stability in high-temperature environments.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE remained a prominent contributor with its wide portfolio of organic acid solutions designed to improve feed hygiene and support gut health. The company’s long-standing focus on sustainable chemistry and performance-driven additives helped strengthen its position among commercial feed producers looking for reliable, science-backed formulations.

Yara continued to maintain relevance in the market by leveraging its expertise in nutrients and agricultural inputs. Its capabilities in producing high-quality feed ingredients positioned it as a dependable supplier for livestock integrators seeking consistent product performance. Yara’s focus on maintaining quality, safety, and stability in feed materials supported its contribution to acidulant usage among poultry and ruminant producers.

Eastman Chemical Company remained influential through its strong presence in organic acids and preservation technologies. Its solutions aligned well with the industry’s shift toward cleaner, safer feed additives. With expertise in chemical engineering and functional feed ingredients, Eastman supported manufacturers aiming to improve shelf life, control microbial risks, and enhance animal performance.

Top Key Players in the Market

- BASF SE

- Yara

- Eastman Chemical Company

- DSM

- Corbion

- Perstorp

- Kemin Industries, Inc.

- Peterlabs Holdings Berhad

- Anpario plc

- Titan Biotech

Recent Developments

- In June 2025, DSM-Firmenich Animal Nutrition & Health introduced GutServ® Biotics, a new postbiotic solution formulated to support piglet health and performance in feed applications. This product reflects innovation in feed additives that contribute to gut health and resilience in livestock, complementing acidulant and preventive nutrition strategies.

- In February 2024, Corbion outlined its Advance 2025 strategy, consolidating business units to focus on functional ingredients and health & nutrition, and simplified operations to support natural preservation and ingredient innovation.

Report Scope

Report Features Description Market Value (2024) USD 3.2 Billion Forecast Revenue (2034) USD 6.0 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Propionic Acid, Formic Acid, Citric Acid, Lactic Acid, Sorbic Acid, Malic Acid, Acetic Acid, Others), By Compound (Blended Compound, Single Compound), By Form (Dry, Liquid), By Function (pH Control, Feed Efficiency, Flavor), By Animal Type (Poultry (Broilers, Layers, Breeders), Swine (Starters, Growers, Saws), Ruminants (Dairy Cattle, Beef Cattle, Others), Pets (Dogs, Cats, Others), Aquaculture, Equine) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Yara, Eastman Chemical Company, DSM, Corbion, Perstorp, Kemin Industries, Inc., Peterlabs Holdings Berhad, Anpario plc, Titan Biotech Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Yara

- Eastman Chemical Company

- DSM

- Corbion

- Perstorp

- Kemin Industries, Inc.

- Peterlabs Holdings Berhad

- Anpario plc

- Titan Biotech