Global Fatty Acid Market By Type(Saturated, Unsaturated), By Source(Animal Source, Plant Source), By Form(Oil, Powder, Capsule), By Length of Chain(Short-chain fatty acids (SCFA), Medium-chain fatty acids (MCFA), Long-chain fatty acids (LCFA), Very long chain fatty acids (VLCFA)), By End-use(Household & Industrial Cleaning, Food & Beverage, Pharmaceutical & Nutraceutical, Personal Care & Cosmetics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: July 2024

- Report ID: 123830

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

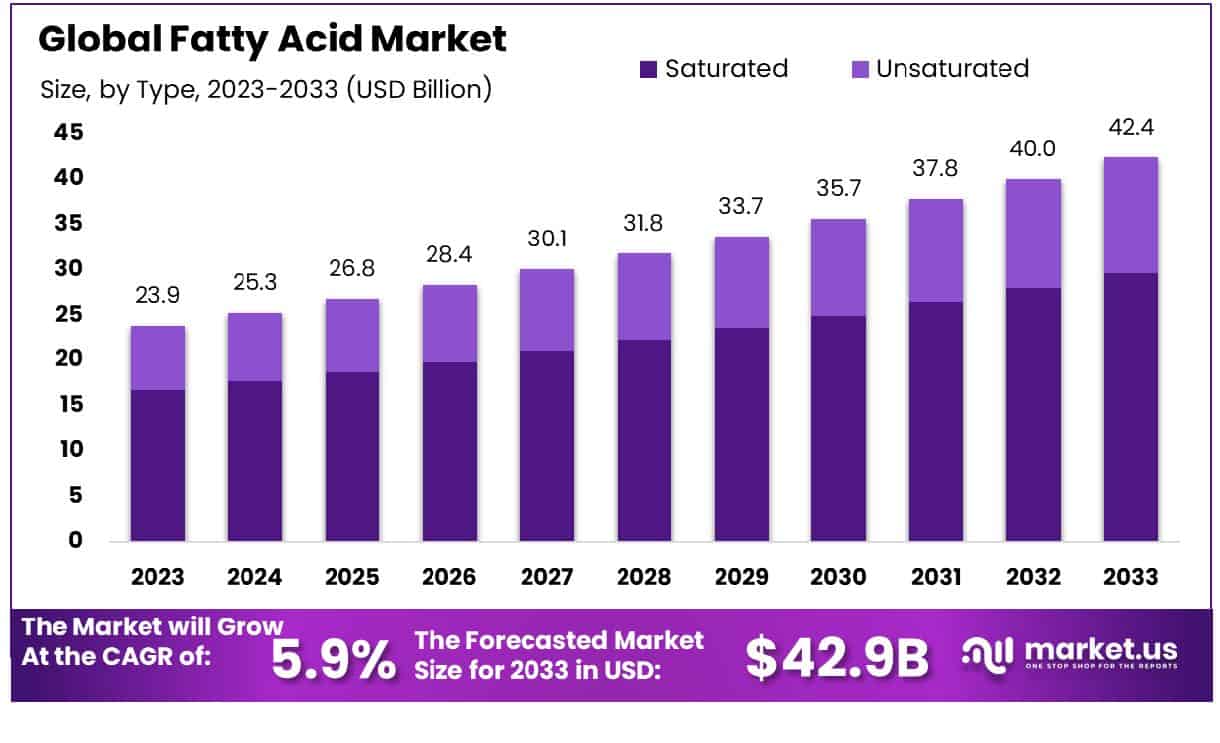

The Global Fatty Acid Market size is expected to be worth around USD 42.4 Billion by 2033, From USD 23.9 Billion by 2023, growing at a CAGR of 5.9% during the forecast period from 2024 to 2033.

The Fatty Acid Market encompasses the global production and distribution of saturated and unsaturated organic compounds primarily derived from natural oils and fats. Serving as essential raw materials in various industries—including personal care, pharmaceuticals, food processing, and industrial manufacturing—fatty acids are integral to the production of detergents, emulsifiers, plastics, and rubber products.

Market dynamics are influenced by factors such as advancements in production technology, shifts in consumer preferences towards sustainable products, and regulatory frameworks. Strategic insights into this market can empower senior executives and product managers to make informed decisions regarding sourcing, innovation, and competitive positioning.

The global market for industrial fatty acids, oils, and alcohols has demonstrated significant growth and diversification, as evidenced by the increase in exports from $78.5 billion in 2021 to $99.9 billion in 2022, marking a robust 27.3% growth year-over-year. This surge is underpinned by a concentrated market structure, where Shannon Entropy indicates a score of 4.45, suggesting that the export market is dominated by 21 leading countries.

This level of concentration points to a competitive yet stable market environment where key players hold significant influence over market dynamics. The primary components of these exports include a substantial $94.9 billion in chemical industry products, preparations, and mixtures not elsewhere classified, which underscores the broad application and essential nature of these products in various industrial processes.

Additionally, the market for prepared additives for cements, mortars, or concretes, and non-refractory mortars and concretes also shows considerable activity, with exports valued at $2.09 billion and $1.29 billion, respectively. These figures not only reflect the economic vitality of this sector but also highlight its critical role in supporting industrial manufacturing capabilities across diverse sectors.

Key Takeaways

- The Global Fatty Acid Market is projected to grow from USD 23.9 billion in 2023 to USD 42.4 billion by 2033, with a CAGR of 5.9%.

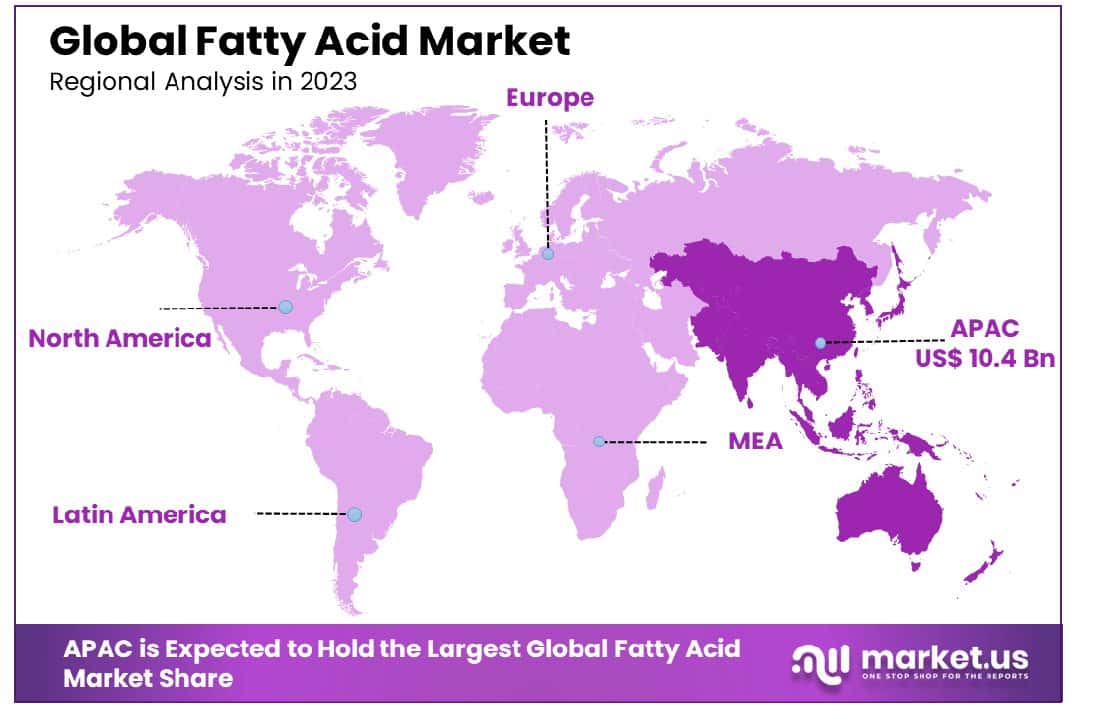

- Asia-Pacific leads Fatty Acid Market at 43.5%, valued at USD 10.4 billion.

- Unsaturated fatty acids dominate the market at 70.2%.

- Animal sources contribute 59.7% to the fatty acid market.

- Oil form leads to fatty acid types, comprising 51.2%.

- Medium-chain fatty acids represent 51.2% of the market.

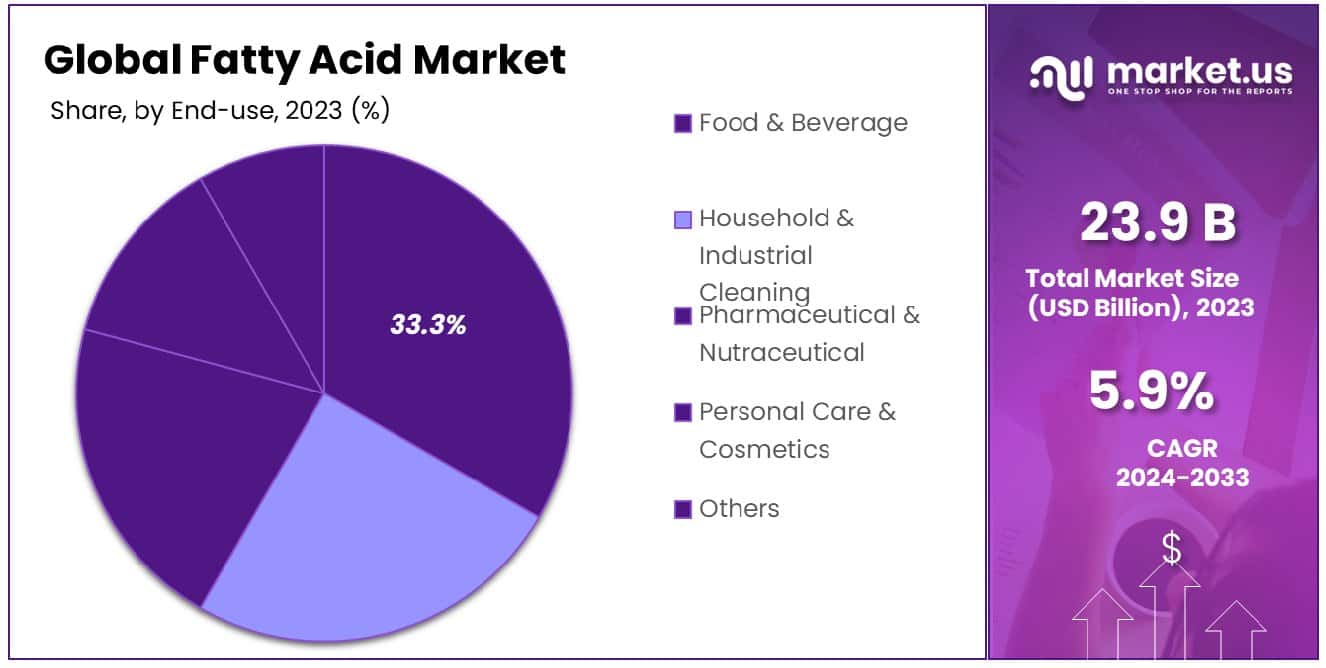

- Food & Beverage end-use stands at 33.3% market share.

Driving Factors

Increasing Demand for Sustainable and Biodegradable Products

The fatty acid market is significantly buoyed by escalating consumer preferences for sustainable and biodegradable products. This shift is predominantly evident in sectors like personal care, where ingredients derived from natural sources are increasingly favored over synthetic alternatives.

As environmental awareness heightens, companies are adapting their product portfolios to include eco-friendly ingredients, thus propelling the demand for fatty acids derived from renewable sources. This trend supports market expansion and aligns with global sustainability goals, making fatty acids a pivotal component in a wide array of environmentally conscious products.

Growth in the Personal Care and Cosmetics Industry

The expansion of the personal care and cosmetics industry serves as a major catalyst for the fatty acid market. Due to their emollient properties, fatty acids are integral in formulating products such as moisturizers, soaps, and shampoos.

This growth is supported by rising disposable incomes and the growing consumer inclination towards grooming and personal hygiene products, further bolstering the demand for high-quality fatty acids in product formulations.

Technological Advancements in Fatty Acid Production Processes

Technological advancements in production processes significantly enhance the fatty acid market’s growth potential. Innovations such as the integration of catalytic processes and the optimization of fermentation techniques not only increase yield but also improve the environmental footprint of production practices.

These advancements reduce production costs and enhance the quality and purity of the final product, meeting the stringent specifications required by industries like pharmaceuticals and food. Consequently, these technological improvements are instrumental in scaling up production capacities while adhering to sustainability standards, thereby meeting the increasing market demand efficiently.

Restraining Factors

Volatility in Raw Material Prices

The fatty acid market is particularly susceptible to the volatility of raw material prices, which primarily include natural oils and fats derived from plant and animal sources. Price fluctuations can be attributed to a variety of factors such as changes in agricultural output, geopolitical tensions, and economic instability, which affect the cost of commodities like palm oil, coconut oil, and tallow.

These instabilities can lead to significant challenges in cost management for producers of fatty acids, potentially narrowing profit margins and impacting overall market growth. The unpredictable nature of raw material costs can deter investment in the fatty acid sector, as stakeholders may perceive increased financial risks associated with production.

Stringent Environmental Regulations

Stringent environmental regulations also play a critical role in shaping the fatty acid market, particularly in regions with rigorous policies on chemical production and waste management. These regulations often require producers to invest in cleaner, more sustainable technologies and processes, which can increase operational costs. However, these regulations also drive innovation within the industry, prompting the development of more efficient and environmentally friendly production methods.

While initially a restraint, compliance with these regulations can enhance the market position of fatty acid producers by aligning with the growing global demand for sustainable and eco-friendly products. This compliance can ultimately serve as a market differentiator, potentially attracting a broader base of environmentally conscious consumers.

By Type Analysis

Unsaturated fatty acids dominate the market, comprising 70.2% due to their extensive health benefits.

In 2023, the “By Type” segment of the Fatty Acid Market was distinctly categorized into two primary types: Saturated and Unsaturated. The Unsaturated type held a dominant market position, capturing more than a 70.2% share. This significant market share can be attributed to the rising consumer awareness regarding the health benefits associated with unsaturated fatty acids, such as improved heart health and lower cholesterol levels. The demand for unsaturated fatty acids has been further bolstered by their widespread applications across various industries including food and beverages, pharmaceuticals, and cosmetics.

Conversely, the Saturated fatty acids accounted for the remaining market share. Despite their lesser prevalence in the market, these fatty acids are integral in numerous industrial applications, contributing to their steady demand. Saturated fatty acids are primarily utilized in the manufacturing of soaps, cosmetics, and the culinary sector, where their ability to remain stable at high temperatures enhances the shelf life of processed foods.

The market dynamics of the Fatty Acid sector are influenced by technological advancements in extraction and processing techniques which have improved the purity and efficiency of fatty acid production. Additionally, regulatory shifts towards healthier product formulations are compelling food processors and cosmetic manufacturers to increasingly incorporate unsaturated fatty acids into their products.

Investment in research and development activities is also a critical factor driving the unsaturated fatty acids market. Innovations aimed at enhancing the health benefits of these acids without compromising on taste or stability are expected to provide new growth opportunities for market expansion.

By Source Analysis

Animal sources provide 59.7% of fatty acids, preferred for their consistent and high-quality output.

In 2023, the “By Source” segment of the Fatty Acid Market was prominently categorized into two main sources: Animal Source and Plant Source. Animal Source held a dominant market position, capturing more than a 59.7% share. This considerable market share is largely driven by the extensive utilization of animal-sourced fatty acids in various industries such as pharmaceuticals, food and beverages, and personal care products. The high demand can be attributed to the established supply chains and well-understood properties of these fatty acids, which are crucial for producing a range of products from dietary supplements to moisturizers.

On the other hand, the Plant Source segment, while smaller in comparison, is witnessing a rapid growth trajectory. This growth is spurred by the increasing consumer preference for vegan and plant-based products, reflecting a broader shift towards more sustainable and ethical consumption patterns. Plant-sourced fatty acids are gaining traction due to their lower environmental impact and alignment with consumer trends favoring clean-label ingredients.

The market dynamics are further influenced by regulatory trends promoting natural and environmentally friendly ingredients, which are accelerating the adoption of plant-sourced fatty acids. Technological advancements in extraction and processing methods are also making plant sources more competitive by enhancing yield and purity, thus promising significant market opportunities for expansion.

By Form Analysis

Oil form is the most common, capturing 51.2% of the market with versatile applications.

In 2023, the “By Form” segment of the Fatty Acid Market was strategically divided into three categories: Oil, Powder, and Capsule. Oil held a dominant market position, capturing more than a 51.2% share. This leading position is primarily due to the versatile application of fatty acid oils across a broad spectrum of industries, including food and beverage, pharmaceuticals, and cosmetics. The preference for oil forms is attributed to its ease of integration into various product formulations and its efficient absorption rates in pharmaceutical and nutraceutical applications.

The Powder form, while holding a smaller market share, is favored in sectors where ease of storage, stability, and controlled dosing are critical. This form is increasingly popular in dietary supplements and meal replacement products, where precision and convenience are highly valued by consumers.

Capsules represent a significant portion of the market, appealing to consumers seeking precise dosage and convenience. This form is particularly prevalent in the consumer health sector, where capsules are used to deliver controlled amounts of fatty acids as part of daily health regimens.

Market dynamics are significantly influenced by consumer preferences and technological advancements in formulation techniques. Innovations in encapsulation and powder processing are enhancing the bioavailability and consumer appeal of these forms. Furthermore, ongoing research into the health benefits of fatty acids continues to drive demand across all forms, with a notable shift towards more consumer-friendly and application-specific formats.

By Length of Chain Analysis

Medium-chain fatty acids (MCFA) represent 51.2%, favored for their energy-boosting properties in diets.

In 2023, the “By Length of Chain” segment of the Fatty Acid Market was comprehensively categorized into four groups: Short-chain fatty acids (SCFA), Medium-chain fatty acids (MCFA), Long-chain fatty acids (LCFA), and Very long chain fatty acids (VLCFA). Medium-chain fatty acids (MCFA) held a dominant market position, capturing more than a 51.2% share. This prevalence is primarily due to MCFAs’ favorable metabolic characteristics, including their ability to be rapidly absorbed and metabolized for energy, making them highly sought after in nutritional supplements and dietary products.

The SCFAs, though smaller in market share, are recognized for their critical role in colon health and as a source of energy for colonic cells, thereby supporting the gut microbiome. Their application in health science continues to grow as research unfolds their potential benefits in preventing metabolic diseases.

LCFAs are essential components in numerous biological processes and are widely utilized in the production of soaps, detergents, and surfactants. Their market presence is solidified by their fundamental roles in cell structure and metabolism.

VLCFAs, while niche, are integral in specialized industries such as biotechnology and pharmaceuticals, particularly in the development of treatments for skin disorders and metabolic syndromes due to their unique functional properties.

Market dynamics within this segment are influenced by ongoing research and development efforts aimed at exploring novel applications of fatty acids. Technological innovations in extraction and processing are also pivotal in driving the utility and adoption of different chain lengths in various industrial applications.

By End-use Analysis

Food & Beverage is the largest end-use sector, accounting for 33.3% of market demand.

In 2023, the “By End-use” segment of the Fatty Acid Market was extensively classified into five categories: Household & Industrial Cleaning, Food & Beverage, Pharmaceutical & Nutraceutical, Personal Care & Cosmetics, and Others. The Food & Beverage sector held a dominant market position, capturing more than a 33.3% share. This leadership is primarily driven by the escalating demand for healthier food options and the widespread use of fatty acids as emulsifiers, flavor enhancers, and shelf-life extenders in various food products.

The Pharmaceutical & Nutraceutical sector also commands a significant portion of the market, leveraging fatty acids’ benefits in medical therapies and health supplements. Their role in aiding the absorption of vitamins and minerals and in the development of modified-release formulations underscores their critical importance in this sector.

In Personal Care & Cosmetics, fatty acids are integral to the formulation of products such as creams, lotions, and cleansers, where they function as emollients and conditioning agents, enhancing the texture and efficacy of skincare products.

The Household & Industrial Cleaning category utilizes fatty acids for their surfactant properties, making them essential in the manufacture of soaps, detergents, and cleaners. Their ability to emulsify dirt, oil, and grease continues to sustain their demand in this segment.

The Others category, which includes applications like animal nutrition and lubricants, showcases the versatility of fatty acids across diverse industrial uses.

Key Market Segments

By Type

- Saturated

- Unsaturated

By Source

- Animal Source

- Plant Source

By Form

- Oil

- Powder

- Capsule

By Length of Chain

- Short-chain fatty acids (SCFA)

- Medium-chain fatty acids (MCFA)

- Long-chain fatty acids (LCFA)

- Very long chain fatty acids (VLCFA)

By End-use

- Household & Industrial Cleaning

- Food & Beverage

- Pharmaceutical & Nutraceutical

- Personal Care & Cosmetics

- Others

Growth Opportunities

Expansion into Emerging Markets with Rising Consumer Incomes

The 2023 growth opportunities for the global Fatty Acid Market are prominently bolstered by the potential expansion into emerging markets, where rising consumer incomes play a pivotal role. As economies such as those in Asia, Africa, and Latin America continue to grow, disposable incomes are increasing, leading to enhanced consumer spending on health and wellness products.

This demographic shift presents a significant opportunity for fatty acid producers to tap into new markets where demand for personal care, dietary supplements, and pharmaceutical products is surging. Moreover, the increased health consciousness among these populations further amplifies the demand for products containing natural ingredients, including fatty acids, aligning with global trends toward healthier lifestyles.

Development of Innovative Applications in Pharmaceutical and Nutraceutical Industries

Another lucrative growth avenue in 2023 lies in the development of innovative applications for fatty acids in the pharmaceutical and nutraceutical industries. Fatty acids, known for their health benefits such as improving heart health and reducing inflammation, are increasingly being incorporated into a variety of pharmaceutical formulations and dietary supplements.

The ongoing research and development in these sectors are continually uncovering new therapeutic uses for fatty acids, ranging from mental health treatments to anti-inflammatory applications. The expansion of fatty acids into these innovative applications not only diversifies the market but also enhances its resilience against economic fluctuations, positioning it for robust growth in the coming years.

Latest Trends

Shift Towards Omega-3 Fatty Acids Due to Health Benefits

In 2023, one of the predominant trends in the global Fatty Acid Market is the significant shift towards omega-3 fatty acids, driven by their well-documented health benefits. Omega-3 fatty acids are crucial for cardiovascular health, brain development, and reducing inflammation, and their increased incorporation in diets around the world has expanded their market demand. Consumers are becoming more health-conscious, which has led to higher consumption of omega-3-rich foods and supplements.

This trend is supported by a growing body of scientific research that underscores the health benefits of omega-3 fatty acids, further encouraging their use in dietary supplements, functional foods, and pharmaceuticals. The demand for omega-3 fatty acids is not only enhancing market growth but also steering product development and innovation in several sectors, including nutraceuticals and functional foods.

Adoption of Green Chemistry in Fatty Acid Manufacturing

Another significant trend in 2023 is the adoption of green chemistry principles in fatty acid manufacturing processes. This approach focuses on reducing waste, lowering energy consumption, and minimizing the use of hazardous substances. Green chemistry techniques in fatty acid production not only align with global sustainability goals but also meet the stringent regulatory standards being implemented worldwide.

This shift is increasingly becoming a competitive advantage for manufacturers as consumers and regulatory bodies demand more environmentally friendly and sustainable practices. The integration of green chemistry is facilitating more efficient production processes and opening up new markets for eco-friendly fatty acid products, positioning manufacturers as leaders in sustainable practices.

Regional Analysis

The Asia-Pacific Fatty Acid Market dominates globally with a 43.5% share, valued at USD 10.4 billion.

In the global landscape of the Fatty Acid Market, regional dynamics play a critical role in shaping market trajectories and opportunities. The Asia-Pacific region emerges as the most dominant, accounting for approximately 43.5% of the market share, valued at USD 10.4 billion. This robust market presence is driven by rapid industrialization, increasing consumer awareness of health and wellness, and substantial investments in sectors like personal care, pharmaceuticals, and food processing. Particularly, countries like China and India are pivotal, with their expanding middle-class populations and escalating demand for products enriched with fatty acids.

North America also presents a significant segment of the fatty acid market, propelled by advanced technological adoption in fatty acid synthesis and a strong emphasis on sustainable and bio-based products. The region’s stringent regulatory landscape governing chemical manufacturing pushes companies towards innovation in green chemistry and eco-friendly production processes.

Europe follows closely, with a mature market characterized by high demand for omega-3 fatty acids, driven by consumer health consciousness and well-established pharmaceutical and nutraceutical sectors. European markets are also seeing a rise in the demand for sustainable and clean-label products, which supports the growth of the fatty acid industry.

Meanwhile, the Middle East & Africa, and Latin America are emerging as potential growth areas due to urbanization, economic development, and increasing health awareness among consumers. These regions offer untapped opportunities for market expansion, particularly in personal care and dietary supplements, influenced by evolving lifestyle patterns and dietary changes.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

Key Players Analysis

In 2023, the global Fatty Acid Market is shaped significantly by the activities and strategies of key players, each contributing uniquely to the industry’s dynamics and growth.

Akzo Nobel and BASF SE are at the forefront in terms of innovation and sustainability, driving advancements in green chemistry and efficient production processes. Their commitment to sustainable practices not only meets stringent global regulations but also appeals to the growing consumer demand for eco-friendly products.

Cargill Incorporated and Wilmar International Ltd. leverage their vast agricultural sourcing networks to ensure a stable and sustainable supply of raw materials, crucial for maintaining a steady production flow given the volatility in raw material prices. Their vertical integration allows them to manage costs effectively, enhancing their competitive edge in the market.

Croda International Plc and DSM NV focus on developing specialized fatty acids for high-value sectors such as pharmaceuticals and nutraceuticals. Their investment in research and development supports the discovery of novel applications, which broadens the scope and reach of fatty acid products.

DOW and Eastman Chemical Company are pivotal in technological advancements, particularly in the optimization of manufacturing processes. Their efforts in catalytic processes and purification technologies have significantly increased yield and product quality.

Arizona Chemicals, Ashland Inc., and Oleon N.V. are recognized for their role in the personal care and cosmetics sectors, where the demand for natural and organic fatty acids is rapidly expanding.

Musim Mas, VVF Ltd., Permata Hijau Group, and Godrej Industries contribute regionally, particularly in Asia-Pacific, the dominating region in the market. Their local presence and deep understanding of regional market dynamics enable them to capture significant market share, especially in emerging markets within their geographic sphere.

Market Key Players

- Akzo Nobel

- Arizona Chemicals

- Ashland Inc.

- BASF SE

- Cargill Incorporated

- Croda International Plc

- DOW

- Eastman Chemical Company

- Koninklijke DSM NV

- Oleon N.V.

- Wilmar International Ltd.

- Musim Mas

- VVF Ltd.

- Permata Hijau Group

- Godrej Industries

Recent Development

- In 2024, Ashland Inc. experienced a fluctuating performance across its business segments throughout the first half of fiscal 2024. In the first quarter, Ashland reported a decrease in sales to $473 million, a 10% drop from the previous year, with net income standing at $26 million.

- In 2023, Akzo Nobel N.V. demonstrated resilience in its performance for the second quarter of 2023, amidst fluctuating market conditions. Despite a 4% decline in revenue due to unfavorable exchange rates, the company managed a 3% increase on a constant currency basis. The operational achievements were highlighted by a 36% rise in operating income, reaching €279 million.

Report Scope

Report Features Description Market Value (2023) USD 23.9 Billion Forecast Revenue (2033) USD 42.4 Billion CAGR (2024-2033) 5.9% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Saturated, Unsaturated), By Source(Animal Source, Plant Source), By Form(Oil, Powder, Capsule), By Length of Chain(Short-chain fatty acids (SCFA), Medium-chain fatty acids (MCFA), Long-chain fatty acids (LCFA), Very long chain fatty acids (VLCFA)), By End-use(Household & Industrial Cleaning, Food & Beverage, Pharmaceutical & Nutraceutical, Personal Care & Cosmetics, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Akzo Nobel, Arizona Chemicals, Ashland Inc., BASF SE, Cargill Incorporated, Croda International Plc, DOW, Eastman Chemical Company, Koninklijke DSM NV, Oleon N.V., Wilmar International Ltd., Musim Mas, VVF Ltd., Permata Hijau Group, Godrej Industries Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Fatty Acid Market Size in 2023?The Global Fatty Acid Market Size is USD 23.9 Billion in 2023.

What is the projected CAGR at which the Global Fatty Acid Market is expected to grow at?The Global Fatty Acid Market is expected to grow at a CAGR of 5.9%(2024-2033).

List the segments encompassed in this report on the Global Fatty Acid Market?Market.US has segmented the Global Fatty Acid Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type(Saturated, Unsaturated), By Source(Animal Source, Plant Source), By Form(Oil, Powder, Capsule), By Length of Chain(Short-chain fatty acids (SCFA), Medium-chain fatty acids (MCFA), Long-chain fatty acids (LCFA), Very long chain fatty acids (VLCFA)), By End-use(Household & Industrial Cleaning, Food & Beverage, Pharmaceutical & Nutraceutical, Personal Care & Cosmetics, Others)

List the key industry players of the Global Fatty Acid Market?Akzo Nobel, Arizona Chemicals, Ashland Inc., BASF SE, Cargill Incorporated, Croda International Plc, DOW, Eastman Chemical Company, Koninklijke DSM NV, Oleon N.V., Wilmar International Ltd., Musim Mas, VVF Ltd., Permata Hijau Group, Godrej Industries

Name the key areas of business for Global Fatty Acid Market?The China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC are leading key areas of operation for Global Fatty Acid Market.

-

-

- Akzo Nobel

- Arizona Chemicals

- Ashland Inc.

- BASF SE

- Cargill Incorporated

- Croda International Plc

- DOW

- Eastman Chemical Company

- Koninklijke DSM NV

- Oleon N.V.

- Wilmar International Ltd.

- Musim Mas

- VVF Ltd.

- Permata Hijau Group

- Godrej Industries