Global Farmers Insurance Market Size, Share, Industry Analysis Report By Coverage (Multi Peril Crop Insurance, Crop Hail Insurance, Others), By Distribution Channel (Banks, Insurance Companies, Broker/Agents, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 162917

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

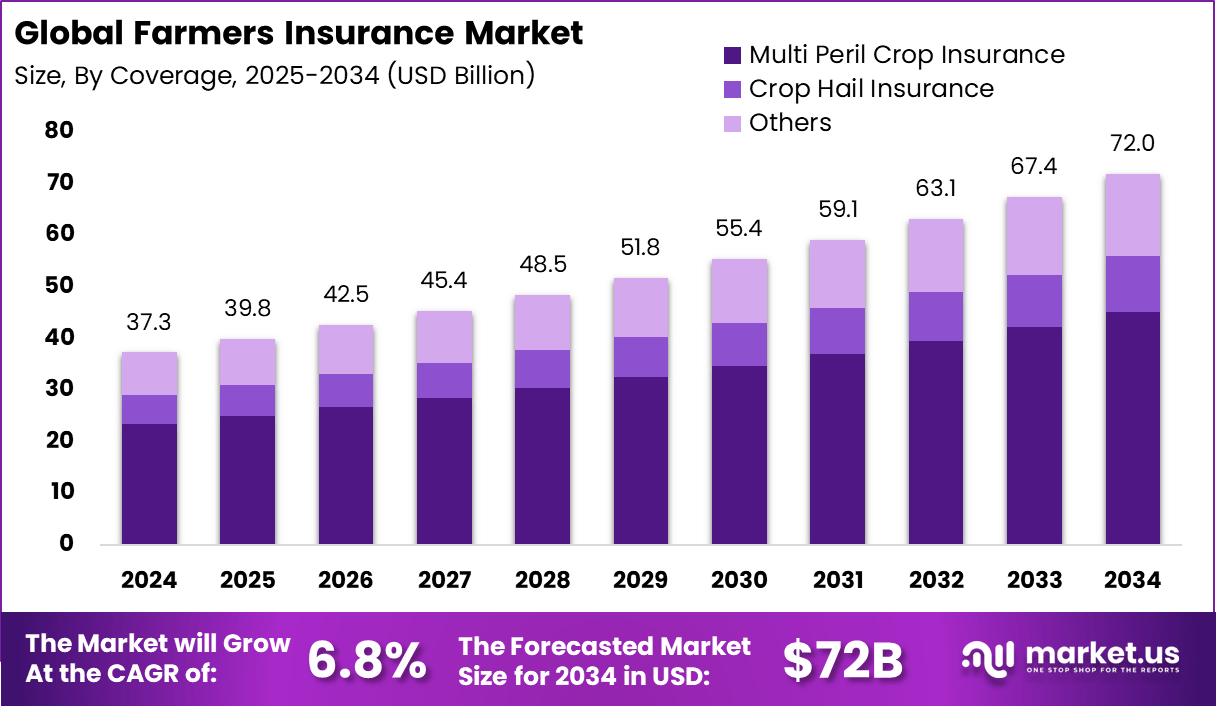

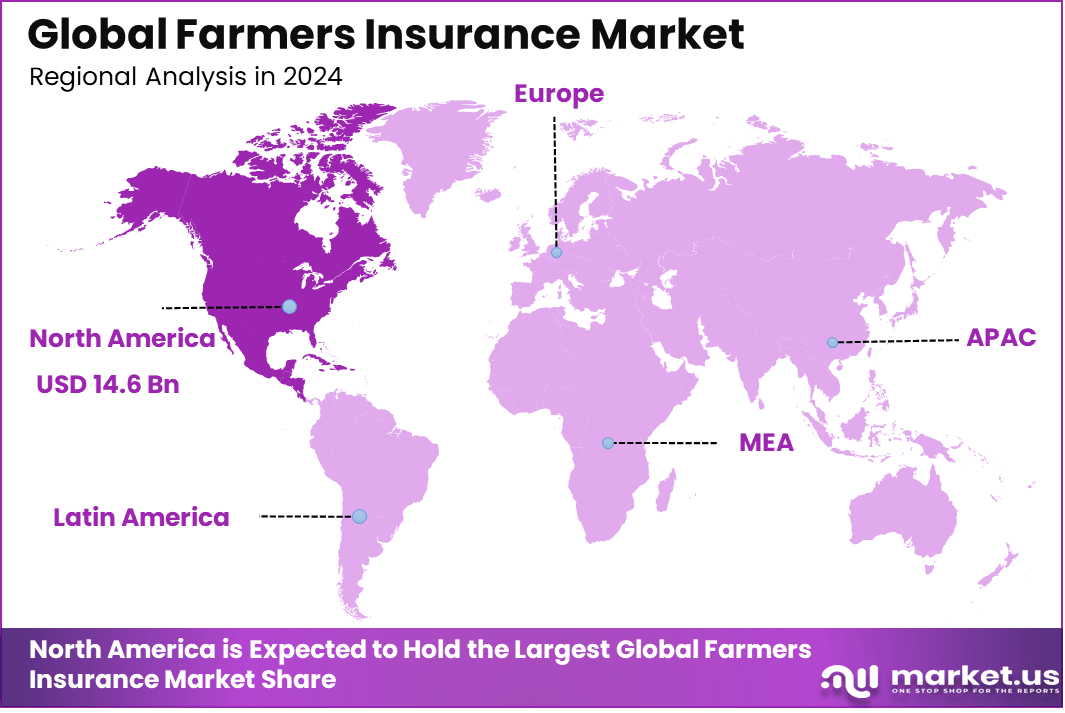

The Global Farmers Insurance Market generated USD 37.3 billion in 2024 and is predicted to register growth from USD 39.8 billion in 2025 to about USD 72 billion by 2034, recording a CAGR of 6.8% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 39.2% share, holding USD 14.6 Billion revenue.

The farmers insurance market encompasses risk-transfer products designed for agricultural operations, including crop, livestock, farm equipment, and farm property insurance. These offerings aim to protect farmers and agribusinesses from various perils such as weather-driven losses, disease outbreaks, equipment damage and operational interruptions. As farming becomes more capital intensive and exposed to climate and market risks, demand for formal farm insurance is rising sharply.

Top driving factors for this market include escalating climate uncertainties and government subsidies that lower premium costs and incentivize adoption. The expansion of commercial farming and agribusiness investments also pushes the need for advanced insurance products. Increasingly, government programs subsidize more than 60% of crop insurance premiums in some regions, encouraging widespread participation.

According to Market.us, The Global Online Insurance Market is projected to reach USD 681.2 billion by 2034, rising from USD 95.6 billion in 2024, reflecting a strong CAGR of 21.7% from 2025 to 2034. In 2024, North America dominated the market with over 34% share, generating approximately USD 32.5 billion in revenue, driven by the widespread adoption of digital platforms and high consumer preference for convenient policy management.

Similarly, the Global AI in Insurance Market is forecasted to grow from USD 5 billion in 2023 to about USD 91 billion by 2033, registering a robust CAGR of 32.7%. This expansion is attributed to the growing use of AI for underwriting, fraud detection, claims automation, and personalized policy recommendations, enhancing both efficiency and customer experience across the insurance sector.

The rising cost of modern farm equipment, now embedded with GPS and other advanced tech, also contributes to higher insurance adoption as farmers want to protect these valuable assets from damage or theft. Farmers with larger operations or technologically advanced farms tend to adopt insurance more readily. Financial status plays a crucial role – wealthier farmers sometimes self-insure using savings and may opt for lower coverage levels.

Top Market Takeaways

- Multi-Peril Crop Insurance dominated with 62.7%, driven by the need to protect farmers against losses from unpredictable weather, pests, and yield fluctuations.

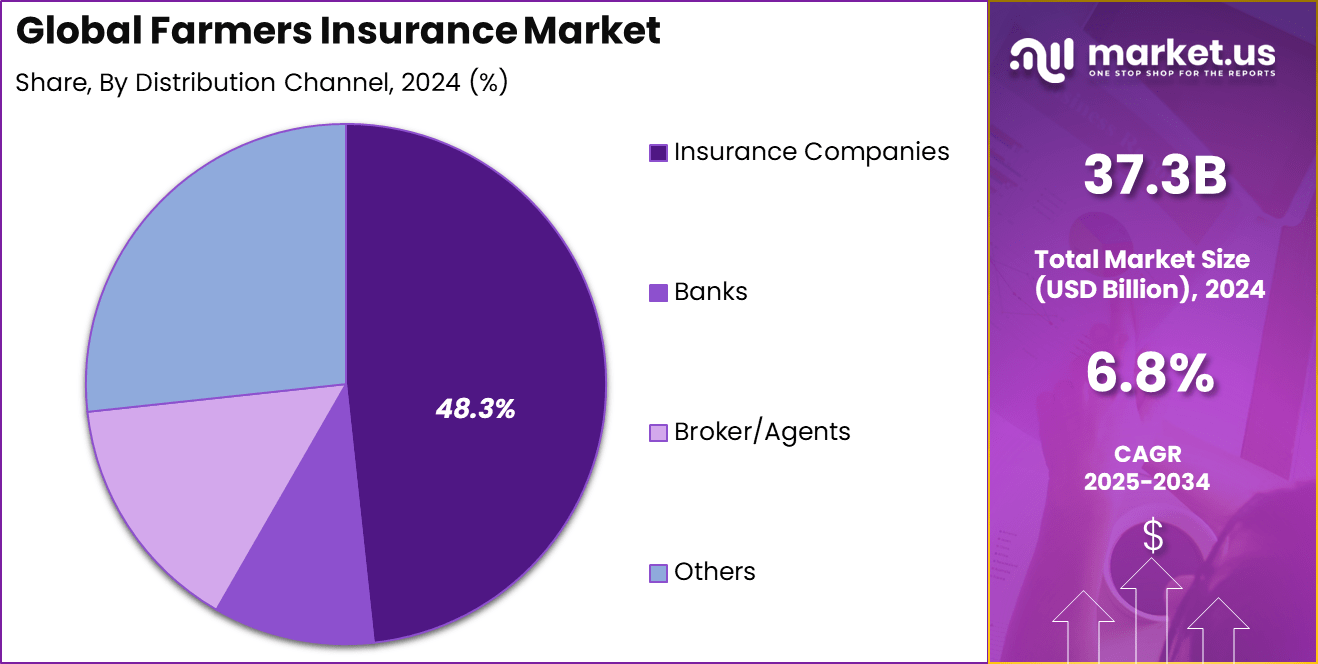

- Insurance Companies accounted for 48.3% of the distribution share, reflecting their strong network reach and expertise in agricultural risk management.

- North America held 39.2% of the global market, supported by well-established insurance frameworks and government-backed agricultural protection programs.

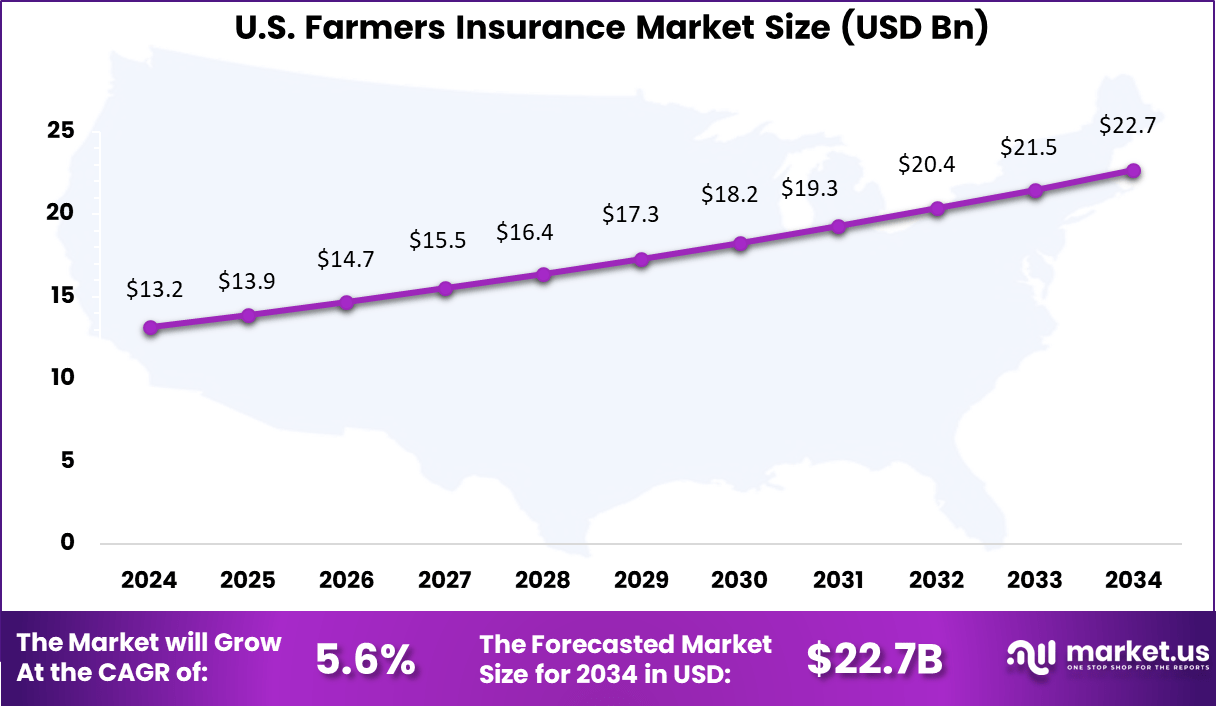

- The US market was valued at USD 13.16 Billion in 2024, growing at a steady 5.6% CAGR, fueled by rising climate risks, crop diversification, and expanding participation in federal insurance schemes.

Analysts’ Viewpoint

Technology adoption in Farmers Insurance is rising sharply, driven by innovations in satellite imagery, drones, IoT sensors, AI risk assessment, and virtual reality training for claims adjusters. These technologies enable more accurate risk evaluation, help speed up claims processing, and improve customer satisfaction. For instance, aerial and satellite imagery programs have enhanced operational efficiency by about 25% in claims handling.

VR-based training has increased claims adjuster confidence and accuracy, reducing error margins by as much as 15% in damage assessments. The key reasons for adopting such technologies include improving risk prediction, reducing turnaround times on claims, and controlling costs for both insurers and insured farmers. By adopting AI and machine learning models, insurers can offer tailored policies based on granular risk data, helping farmers in high-risk areas maintain coverage despite environmental challenges.

Investment opportunities in Farmers Insurance lie in technology integration and expanding coverage into emerging risks linked to climate change and supply chain disruptions. Private insurers and public programs both see potential for growth by introducing flexible, climate-adaptive insurance products. Investment in data analytics platforms and sensor technologies can reduce claims fraud and provide better actuarial data, supporting sustainable business models.

Role of Generative AI

Farmers Insurance is actively implementing generative AI to streamline and enhance their operations, especially in areas like claims processing and fraud detection. By leveraging AI models that analyze vast amounts of data, Farmers can more accurately and swiftly assess claims, reducing human error and speeding up decision-making.

Reports indicate that generative AI helps identify fraud patterns that traditional systems might miss, which is crucial as about 20% of insurance claims are estimated to be fraudulent. This adoption results in improved efficiency and customer satisfaction without compromising coverage quality. Generative AI also plays a significant role in personalizing policy recommendations and customer interactions at Farmers Insurance.

By automating routine tasks, it frees up human agents to focus on complex and sensitive cases, adding a more personalized touch. The company’s leadership in this technology has accelerated digital transformation across their services, driving better business outcomes along with a more intuitive customer experience.

US Market Size

In the United States, the market is valued at about USD 13.16 billion, expanding at a 5.6% CAGR. Federal crop insurance programs covering major grains, fruits, and specialty crops form a significant part of this growth. Increased awareness among farmers about risk management and climate adaptation continues to fuel participation across all farm sizes.

In 2024, North America represents 39.2% of the global farmers insurance market, supported by structured farm subsidy policies, advanced risk modeling, and strong institutional participation. Both Canada and the United States have mature agricultural insurance frameworks that prioritize yield protection and revenue stability.

Emerging Trends

Farmers Insurance is embracing climate-smart insurance products with adoption expected to rise by 35% by 2026, addressing the increasing risk from extreme weather and climate volatility. These tailored products help farmers manage new types of environmental risks, such as droughts and floods, which are becoming more frequent and severe.

Alongside this, the demand for precision agriculture coverage using IoT and satellite data is growing, projected to increase by around 30%, enabling faster and fairer claims handling by leveraging advanced monitoring technologies. Digital engagement platforms like “My Farmers Insurance” are also becoming more widespread, with adoption rates of 50-65%.

These portals allow customers direct access to policies, claims, and support, streamlining interactions and reducing response time. Additionally, there is growing interest in sustainability-linked insurance policies, with a 20-30% uptake expected as these incentivize eco-compliance and sustainable farming practices, reflecting broader regulatory and consumer trends.

Growth Factors

One key growth factor for Farmers Insurance is their ongoing improvement in underwriting performance, with management services fee income increasing by 6%, reflecting effective risk selection and expense management. This enhanced focus on underwriting discipline is helping Farmers achieve better profitability despite competitive pressures in personal lines and the impact of natural disasters like wildfires.

Rate increases and refined risk assessment methods also contribute to stable revenue growth in their core insurance segments. Another driver is the broader market demand for insurance products that respond to evolving customer needs, especially in rural and agricultural communities facing new risks.

The integration of technology, including AI-powered claims and risk evaluation, lowers operational costs and enhances service quality, strengthening customer retention. These factors position Farmers Insurance well to maintain steady growth by adapting to market changes and improving financial resilience.

By Coverage

In 2024, Multi Peril Crop Insurance holds about 62.7% of the farmers insurance market, showing how producers increasingly rely on comprehensive protection against multiple risks such as drought, flood, pest damage, and weather-related yield loss.

This type of coverage helps stabilize farmer income and encourages investment in improved seeds and technology. Widespread policy support and government subsidy programs have made multi peril products the first choice for most growers who need year-round protection.

Growing climate uncertainty across agricultural zones has driven steady interest in these products. As extreme weather events become more frequent, demand for insurance that bundles several risk categories is expected to rise further.

Data-driven underwriting and satellite-based monitoring have improved claim accuracy and encouraged insurers to expand tailored multiperil plans. The segment’s strength reflects an ongoing effort to balance productivity goals with long-term financial security for farm operators.

By Distribution Channel

In 2024, Insurance companies account for 48.3% of the market, maintaining their leading role as the primary distribution channel. Farmers tend to prefer direct engagement with licensed companies that can provide detailed risk assessment, claim support, and multiple coverage options.

These entities often collaborate with government insurance schemes, providing access to subsidized premiums and easier enrollment processes for small to mid-size farms. Their proven claim processing infrastructure makes them a reliable choice across both developed and developing regions.

Technological upgrades such as online claim filing, policy tracking, and AI-based risk evaluation tools have strengthened the reach of these insurers. Many companies now use digital platforms to reduce administrative delays and improve transparency in payout procedures.

Partnerships with agricultural cooperatives, banks, and crop input suppliers are helping insurers expand their service networks. The growing role of digital engagement is transforming how insurers manage farmer relationships, claims accuracy, and rural penetration.

Key Market Segments

By Coverage

- Multi Peril Crop Insurance

- Crop Hail Insurance

- Others

By Distribution Channel

- Banks

- Insurance Companies

- Broker/Agents

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Customizable Insurance Programs

Farmers Insurance attracts customers through its customizable insurance programs that suit a broad range of drivers, including those with diverse driving histories or vehicle types. This adaptability appeals to drivers who seek personalized coverage options tailored to factors like age, driving record, and car model.

The ability to adjust policies to fit unique customer needs fuels Farmers’ market presence and drives continual growth in its client base. This flexible approach also supports policyholders by offering specific programs and perks, such as accident forgiveness and bundling home and auto insurance.

Customers feel valued when their individual circumstances are considered, which improves customer satisfaction and encourages loyalty to the brand. This driver underscores Farmers’ strategic focus on meeting diverse insurance needs effectively.

Restraint

Insurance Premium Costs

One significant restraint for Farmers Insurance is its relatively higher premium rates compared to some competitors. Although Farmers offers quality products and customizable plans, price-sensitive customers and younger or low-income drivers often find cheaper alternatives elsewhere. This pricing barrier limits market penetration among price-conscious segments, which can slow the acquisition of new customers.

Higher premiums may also cause existing customers to reevaluate their policies or switch providers if competitors offer comparable coverage at a lower cost. While the company offers good service and comprehensive options, the premium cost restraint highlights the challenge to balance quality with affordability in a highly competitive insurance market.

Opportunity

Agency Ownership and Growth

Farmers Insurance presents a promising opportunity through its agency ownership model, which enables entrepreneurs to own and operate local agencies. This format offers unlimited earning potential, supported by strong brand recognition and extensive training programs that equip agents for success.

Aspiring business owners have access to capital programs and support to start or acquire agencies, making this model an attractive growth path. This opportunity capitalizes on Farmers’ broad market presence and reputation, allowing agents to build trusted local relationships and tailor services to community needs.

Expanding the agency network not only grows the company’s footprint but also strengthens customer intimacy and responsiveness, helping Farmers capture new business consistently in diverse regional markets.

Challenge

Climate Change Impact

A growing challenge facing Farmers Insurance, like other insurers, is the impact of climate change on underwriting risk. Increasing severe weather events lead to greater loss claims and force the company to limit coverage in high-risk regions, sometimes withdrawing from markets altogether.

This shrinking coverage availability creates difficulties for affected customers needing affordable insurance. Farmers must balance risk exposure with maintaining market accessibility, which is complex as climate risks evolve unpredictably.

Managing this challenge requires innovation in risk assessment, pricing, and policy design to sustain profitability while serving vulnerable farming and homeowners. Climate change impacts threaten traditional insurance models and require proactive company responses to maintain long-term viability.

Competitive Analysis

The Farmers Insurance Market is led by major global and regional insurers such as Great American Insurance Company, American International Group, Inc. (AIG), Chubb, and Zurich. These companies provide comprehensive crop and livestock insurance solutions covering weather-related losses, yield protection, and farm property damage.

Prominent regional players including Agriculture Insurance Company of India Limited, Tokio Marine HCC, QBE Insurance Ltd., and FBL Financial Group, Inc. focus on delivering specialized insurance products designed for local agricultural conditions. Their offerings combine government-backed insurance programs, index-based coverage, and customized policies to protect farmers from unpredictable climate events and market volatility.

Emerging and localized participants such as Kshema General Insurance Limited, Sompo, and other key players are strengthening market penetration through technology-enabled claim processing, satellite-based crop monitoring, and mobile policy management. Their focus on digital tools, quick payouts, and sustainable risk assessment is modernizing agricultural insurance and strengthening farmers’ financial resilience globally.

Top Key Players in the Market

- Great American Insurance Company

- American International Group, Inc.

- Agriculture Insurance Company of India Limited

- Tokio Marine HCC

- FBL Financial Group, Inc

- Kshema General Insurance Limited

- QBE Insurance Ltd.

- Chubb

- Zurich

- Sompo

- Others

Recent Developments

- July 2025: Great American Insurance Company Expanded specialty property & casualty portfolio by acquiring Radion Health, focusing on employer health benefits with AI-driven medical stop-loss insurance. The product line was rebranded as Great American Employer Health Solutions.

- October 2025: American International Group, Inc. (AIG) entered definitive agreements to acquire renewal rights for the majority of Everest Group’s retail insurance portfolios worldwide, representing about $2 billion of premium. The move will boost AIG’s general insurance growth without additional capital requirements, with writing expected to start in early 2026.

Report Scope

Report Features Description Market Value (2024) USD 37.3 Bn Forecast Revenue (2034) USD 72 Bn CAGR(2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage (Multi Peril Crop Insurance, Crop Hail Insurance, Others), By Distribution Channel (Banks, Insurance Companies, Broker/Agents, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Great American Insurance Company, American International Group, Inc., Agriculture Insurance Company of India Limited, Tokio Marine HCC, FBL Financial Group, Inc., Kshema General Insurance Limited, QBE Insurance Ltd., Chubb, Zurich, Sompo, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Great American Insurance Company

- American International Group, Inc.

- Agriculture Insurance Company of India Limited

- Tokio Marine HCC

- FBL Financial Group, Inc

- Kshema General Insurance Limited

- QBE Insurance Ltd.

- Chubb

- Zurich

- Sompo

- Others