Global Failure Analysis Market By Technology (Secondary ION Mass Spectrometry (SIMS), Energy Dispersive X-ray Spectroscopy (EDX),,Other Technologies), By Equipment (Scanning Electron Microscope (SEM), Focused Ion Beam (FIB) System, Other Equipment), By End-user Industry (Automotive, Oil and Gas, Defense, Other End-user Industries), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 167610

- Number of Pages: 266

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

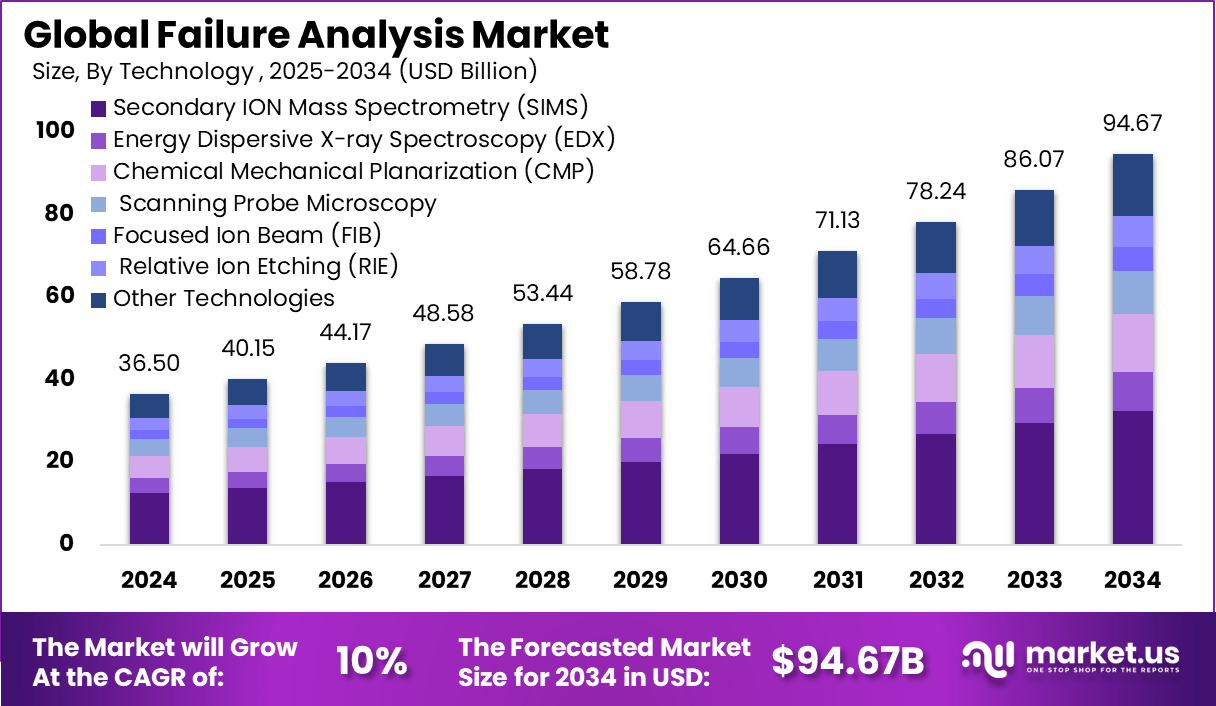

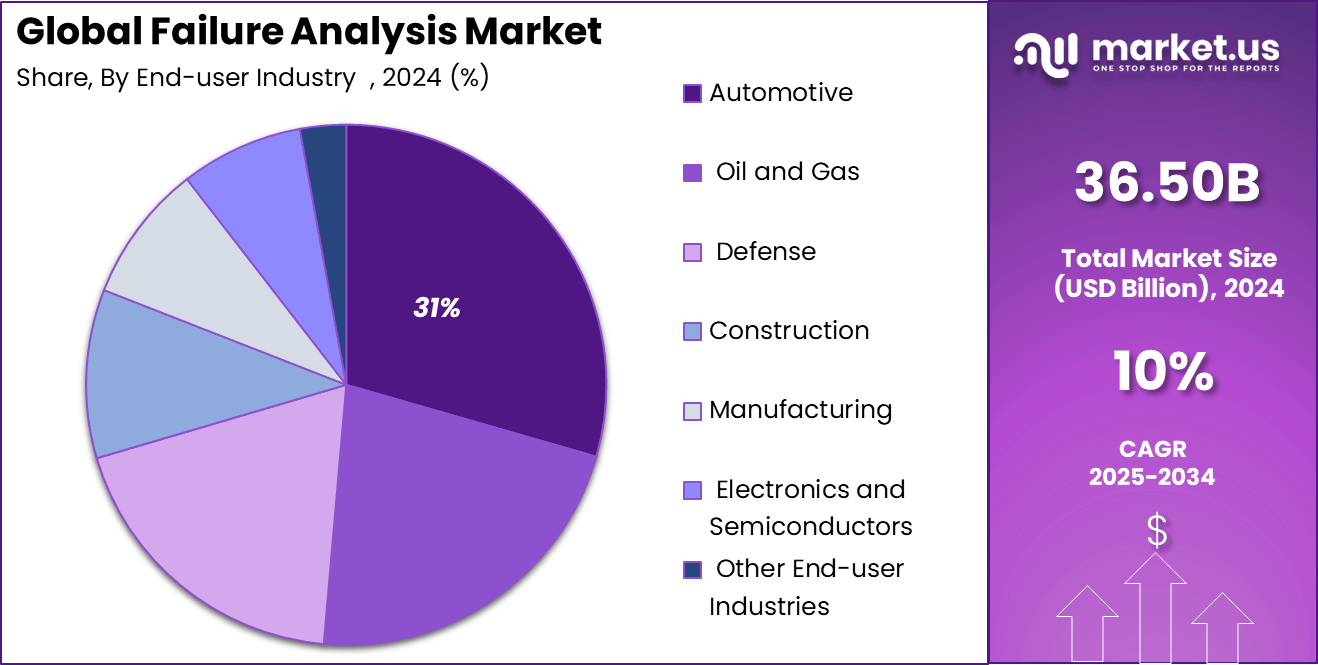

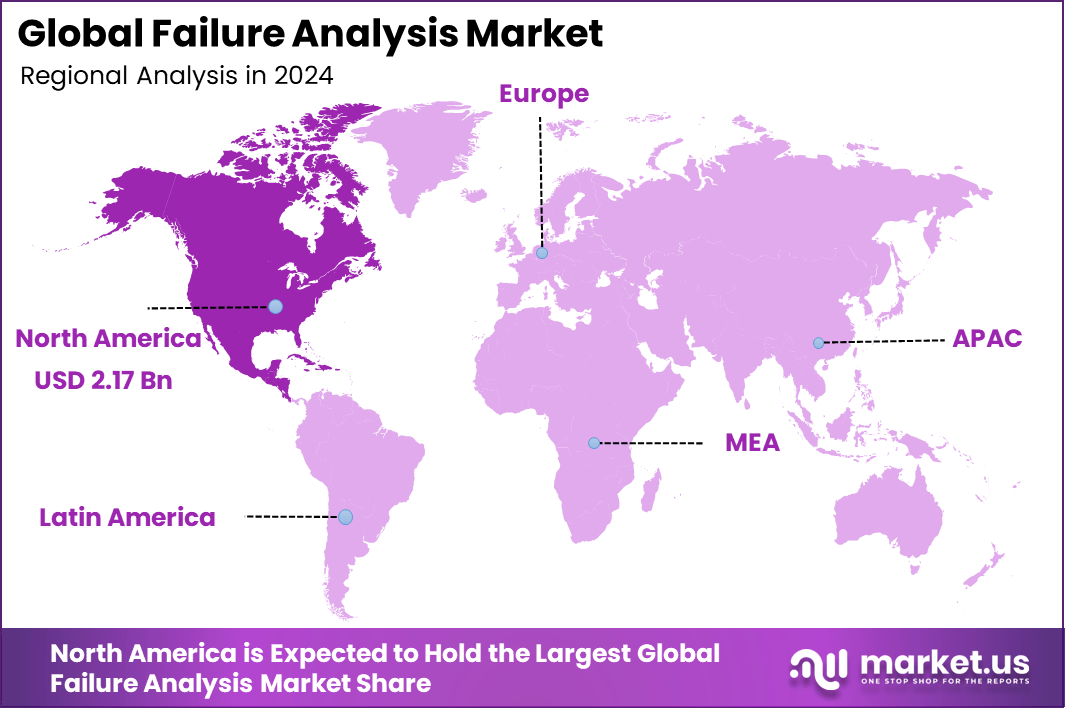

The Global Failure Analysis Market generated USD 36.50 billion in 2024 and is predicted to register growth from USD 40.15 billion in 2025 to about USD 94.67 billion by 2034, recording a CAGR of 10% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 36.5% share, holding USD 2.17 Billion revenue.

The failure analysis market has expanded as manufacturers and engineering teams increase their focus on product reliability, defect prevention and root cause investigation. Growth reflects rising complexity in electronic components, industrial equipment and advanced materials. Failure analysis services and tools are now widely used across sectors to examine defects, understand structural weaknesses and improve long term product quality.

The growth of the market can be attributed to increasing miniaturisation of components, rising product safety expectations and the need to reduce warranty expenses. Industries depend on failure analysis to understand why materials, circuits or assemblies fail under stress. Strict regulatory standards and rapid technological innovation further push companies to strengthen diagnostic and quality assurance capabilities.

Demand analysis highlights robust interest from sectors like semiconductors, automotive, and aerospace. For instance, the semiconductor industry notably invests heavily in failure analysis to minimize defects and ensure performance, with major firms upgrading facilities accordingly. The growing adoption of 5G, IoT, and AI in electronics further amplifies the need for sophisticated failure analysis tools, especially in Asia-Pacific markets.

Top Market Takeaways

- By technology, Secondary Ion Mass Spectrometry (SIMS) leads with approximately 34.2% share. SIMS is valued for its high sensitivity in trace element detection and depth profiling critical for semiconductor and materials failure diagnostics.

- By equipment, Scanning Electron Microscopy (SEM) holds about 37.3% share, widely used due to its high-resolution surface imaging and elemental analysis essential in electronics, automotive, aerospace, and materials testing.

- By end-user industry, automotive leads with 30.9% share, driven by stringent safety and quality requirements, rising adoption of electric and autonomous vehicles, and the complexity of advanced automotive components demanding thorough failure analysis.

- Regionally, North America commands about 36.5% of the global market, supported by advanced manufacturing infrastructure, stringent regulatory norms, and investments in R&D.

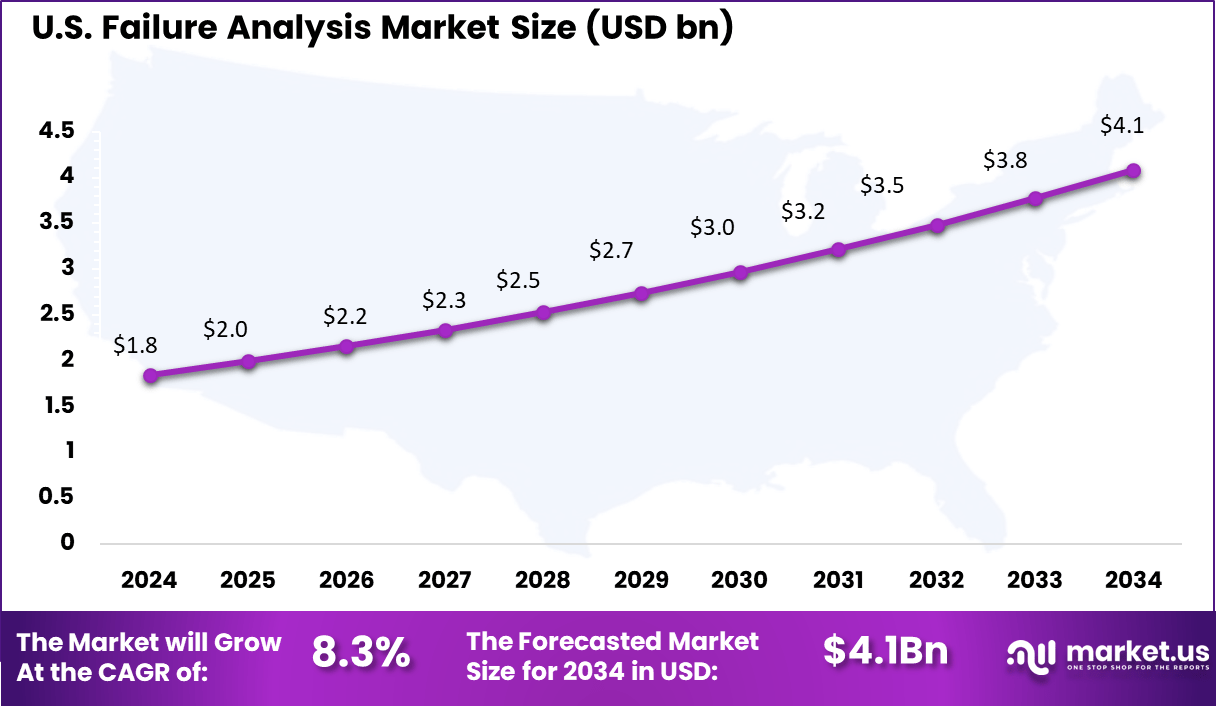

- The U.S. market size is estimated at approximately USD 1.84 billion in 2025.

- The market is expected to grow at a CAGR of around 8.3%, driven by technological advancements in failure analysis tools, integration of AI and machine learning for predictive analytics, and increased demand for product reliability across multiple industries including automotive, electronics, and aerospace.

By Technology

Secondary Ion Mass Spectrometry (SIMS) dominates the failure analysis market with a strong 34.2% share. It is highly valued for its exceptional ability to identify elemental compositions at extremely low concentrations, providing detailed chemical profiling crucial for diagnosing material defects and contamination.

SIMS is especially critical in semiconductor failure analysis, enabling manufacturers to pinpoint issues at the nanoscale, facilitating quality control and process optimization. SIMS technology’s unrivaled sensitivity and depth profiling capabilities have made it a cornerstone for industries requiring rigorous material assessment, including aerospace, automotive, and medical devices.

As demand grows for ultra-precise diagnostics to support advancements in microelectronics and nanotechnology, SIMS will continue to lead failure analysis methodologies by enabling early detection and minimization of product defects.

By Equipment

Scanning Electron Microscopes (SEM) hold a commanding 37.3% share in failure analysis equipment due to their wide applicability and cost-effectiveness. SEM offers high-resolution imaging and detailed surface morphology insights, which are invaluable in investigating micro- and nano-scale failures in materials and devices.

Its ability to combine imaging with elemental analysis through techniques like Energy Dispersive X-ray Spectroscopy (EDX) makes SEM a versatile tool for electronic, material science, and forensic investigations. The reliability of SEM in offering rapid, non-destructive testing contributes heavily to its adoption in diverse industrial sectors.

Continuous improvements in automation, imaging resolution, and integration with other analytical methods reinforce SEM’s position as a fundamental instrument in failure diagnostics while enabling faster decision-making and more accurate root cause analysis.

By End-User Industry

The automotive industry accounts for a significant 31% share of the failure analysis market. The industry relies on advanced failure analysis technologies to ensure vehicle safety, enhance reliability, and meet stringent regulatory requirements.

Increasing adoption of electric and autonomous vehicles necessitates comprehensive testing of complex battery systems, sensors, and electronic control units. Failure analysis is critical in identifying faults that can lead to recalls, accidents, or performance degradation.

Automakers are increasingly investing in state-of-the-art failure analysis to support the development of lightweight materials, advanced composites, and intricate electronic components. Demand for precise, real-time diagnostics accelerates as vehicle complexity grows, driving continuous innovation in failure analysis tools tailored for automotive manufacturing and quality assurance.

Primary Drivers Behind Adoption

- Root cause identification: Helps pinpoint the exact cause of failures, avoiding guesswork and enabling precise corrective actions.

- Regulatory compliance: Supports meeting strict safety, quality, and environmental standards required in aerospace, automotive, electronics, and more.

- Quality improvement: Provides insights that lead to design enhancements, improved materials, and better manufacturing processes.

- Risk mitigation: Detects potential safety hazards before they cause accidents, protecting employees, consumers, and assets.

- Cost control: Reduces warranty claims, recalls, and production downtime by addressing failures proactively.

- Innovation support: Enables continuous product development and optimization through detailed failure data analysis.

- Sustainability focus: Helps identify inefficient processes or material waste, aiding eco-friendly manufacturing initiatives.

- Complex product demands: Provides the detailed analysis necessary as products grow more complex with advanced electronics and materials.

Benefits

- Improved reliability: Enhances product and system reliability, resulting in higher customer satisfaction and brand reputation.

- Reduced downtime: By understanding failure mechanisms, companies can implement preventive maintenance that minimizes unplanned outages.

- Cost savings: Prevents expensive recalls, repairs, and waste, positively impacting the bottom line.

- Competitive advantage: Companies leveraging failure data to innovate stay ahead by improving quality and performance continuously.

- Enhanced safety: Failure analysis ensures safer products and workplaces, reducing liabilities and fostering trust.

- Informed decision-making: Provides reliable data for making smarter design, procurement, and operational choices.

- Sustainable operations: Supports initiatives to minimize environmental impact by identifying and eliminating inefficiencies.

- Long-term asset protection: Extends equipment and product life cycles through targeted improvements and maintenance.

Emerging Trends

Key Trends Description AI and Machine Learning Integration Adoption of AI/ML to automate failure detection, predictive maintenance, and root cause analysis. Increased Use of Non-Destructive Testing Growing preference for X-ray, ultrasonic, and infrared thermography to analyze defects without damage. Digital Twins and Simulation Leveraging simulation tools and digital twins to predict failures and optimize design before manufacturing. Automation and Remote Diagnostics Enhanced automation and remote analysis capabilities improving efficiency and reducing human error. Industry 4.0 and Smart Manufacturing Integration with IoT and real-time monitoring systems for continuous quality control and failure prevention. Growth Factors

Key Factors Description Rising Demand in Semiconductor and Electronics Growth driven by miniaturization and complexity in chips requiring precise failure analysis. Stricter Safety and Regulatory Compliance Regulations demanding rigorous testing and certification in automotive, aerospace, and healthcare sectors. Expansion in Emerging Markets Increasing manufacturing base in Asia-Pacific and other regions fueling market growth. Technological Advancements Innovation in imaging, microscopy, and analytical techniques boosting detection accuracy and speed. Growing Investment and R&D Increased capital flow into developing advanced failure analysis equipment and methodologies. Key Market Segments

By Technology

- Secondary ION Mass Spectrometry (SIMS)

- Energy Dispersive X-ray Spectroscopy (EDX)

- Chemical Mechanical Planarization (CMP)

- Scanning Probe Microscopy

- Focused Ion Beam (FIB)

- Relative Ion Etching (RIE)

- Other Technologies

By Equipment

- Scanning Electron Microscope (SEM)

- Focused Ion Beam (FIB) System

- Transmission Electron Microscope (TEM)

- Dual Beam System

- Other Equipment

By End-User Industry

- Automotive

- Oil and Gas

- Defense

- Construction

- Manufacturing

- Electronics and Semiconductors

- Other End-User Industries

Regional Analysis

North America accounted for a significant 36.5% share of the global failure analysis market, valued at approximately USD 1.84 billion. The region’s leadership is driven by a high concentration of advanced manufacturing sectors including aerospace, automotive, semiconductors, and electronics, which demand rigorous failure analysis to ensure product reliability and compliance with stringent regulatory standards.

Continuous investments in research and development, adoption of cutting-edge analytical techniques such as scanning electron microscopy and X-ray inspections, and integration of AI for data-driven diagnostics further propel market growth. North America’s robust infrastructure and focus on quality control reinforce its dominant position in the global failure analysis landscape.

The United States, which constitutes the core of the North American failure analysis market, strong demand stems from defense, aerospace, and semiconductor manufacturing sectors. The U.S. market benefits from a mature ecosystem of failure analysis service providers and equipment manufacturers, combined with significant government initiatives promoting innovation and reshoring of semiconductor production.

With an increasing emphasis on product safety, sustainability, and technological advancements, the U.S. market exhibits steady growth driven by sophisticated failure analysis workflows and expanded service networks. This solid foundation ensures that the U.S. continues to lead the failure analysis market in North America, setting global benchmarks for precision and reliability.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Geopolitical Tensions and Naval Modernization

The undersea warfare systems market is driven by increasing geopolitical tensions and the urgent need for naval modernization globally. Nations are investing heavily to strengthen maritime defense capabilities, especially in critical sea lanes and contested waters.

This drives demand for advanced undersea platforms like submarines, unmanned underwater vehicles (UUVs), sonar systems, and torpedoes to ensure strategic dominance and secure national interests. Moreover, growing naval budgets, particularly in regions like North America and Asia Pacific, support the development and deployment of sophisticated undersea warfare technologies.

Restraint

High Costs and Technical Complexity

Despite growth opportunities, the sector faces restraints due to the high costs and technical complexity associated with undersea warfare systems. The research, development, and production of advanced submarine platforms and underwater weaponry require significant capital investments and skilled labor. This complexity limits accessibility for smaller or developing nations.

Operational challenges such as maintaining equipment in harsh underwater environments demand specialized support infrastructure and ongoing funding. These financial and technical barriers slow broader adoption and modernization efforts, constraining market expansion.

Opportunity

Expansion of Unmanned Underwater Vehicle (UUV) Applications

Unmanned Underwater Vehicles (UUVs) present a major opportunity within the undersea warfare systems market. UUVs offer persistent surveillance, mine countermeasure capabilities, and covert reconnaissance with reduced risk to personnel. Their increasing deployment enhances naval operational reach and efficiency, making them attractive to global navies.

Integration of artificial intelligence and autonomous navigation in UUVs opens new missions including undersea communication relay and anti-submarine warfare. As these technologies mature and costs decline, UUV adoption is expected to expand across various military and dual-use applications, driving future market growth.

Challenge

Supply Chain Disruptions and Cybersecurity Threats

The market faces challenges from global supply chain disruptions affecting critical component availability for undersea systems. Geopolitical conflicts and export restrictions create procurement delays and escalate costs, impacting defense readiness and procurement timelines.

Additionally, cybersecurity threats pose significant risks, as connected undersea platforms generate sensitive operational data. Protecting these systems from cyber intrusion, data breaches, and operational interference requires robust security frameworks, continuous monitoring, and advanced encryption, posing ongoing challenges for manufacturers and operators.

Competitive Analysis

Presto Engineering, TUV SUD, Rood Microtec, Eurofins EAG Laboratories, and SGS lead the failure analysis market with strong capabilities in semiconductor diagnostics, material characterization, and reliability testing. Their services help manufacturers identify defects, validate product quality, and ensure compliance with industry standards. These companies focus on advanced microscopy, electrical fault isolation, and high-precision analytical techniques.

CoreTest Technologies, Materials Testing Inc., McDowell Owens Engineering, Exponent, TechInsights, Hitachi High-Tech Analytical Science, and Intertek strengthen the competitive landscape with specialized expertise in mechanical, chemical, and electronic failure investigations. Their solutions support sectors such as aerospace, automotive, medical devices, and telecommunications. These providers emphasize root-cause analysis, accelerated stress testing, and detailed reporting.

NanoScope Services, Applus+ Laboratories, Advanced Nanolab, Toray Engineering, Tescan Orsay Holding, Leica Microsystems, Keysight Technologies, Crane Engineering, and others expand the market with niche capabilities in nanostructure imaging, focused ion beam analysis, and advanced instrumentation. Their tools support high-resolution defect detection and next-generation material studies. These companies help organizations reduce product failures, improve durability, and optimize designs.

Top Key Players in the Market

- Presto Engineering Inc.

- TUV SUD

- Rood Microtec GmbH

- Eurofins EAG Laboratories

- SGS SA

- CoreTest Technologies Inc.

- Materials Testing Inc.

- McDowell Owens Engineering Inc.

- Exponent Inc.

- TechInsights Inc.

- Hitachi High-Tech Analytical Science Ltd.

- Intertek Group plc

- NanoScope Services Ltd

- Applus+ Laboratories Inc.

- Advanced Nanolab Pte Ltd

- Toray Engineering Co., Ltd.

- Tescan Orsay Holding

- Leica Microsystems Inc.

- Keysight Technologies Inc.

- Crane Engineering Inc.

- Others

Future Outlook

The future outlook for the failure analysis market is positive, with steady growth driven by increasing demand for high-quality, reliable products across industries like electronics, aerospace, automotive, and healthcare. Technological advancements such as AI, machine learning, and automated inspection systems are expected to enhance the precision and speed of failure detection.

Regulatory pressures, complex manufacturing processes, and the push for zero-defect production will further fuel market growth. The market is projected to expand significantly over the coming years, reflecting growing adoption of advanced failure analysis equipment globally.

Opportunities lie in

- Integration of AI and machine learning to improve defect detection accuracy and predictive maintenance capabilities.

- Growing demand from semiconductor, automotive, and aerospace sectors for detailed failure analysis to ensure product safety and reliability.

- Expansion of failure analysis capabilities into additive manufacturing and green manufacturing processes to support sustainability goals.

Recent Developments

- May, 2025, Eurofins EAG Laboratories expanded its analytical and testing services to support semiconductor companies, enhancing value in prototype testing, yield improvement, and material purity verification for semiconductor manufacturing.

- June, 2025, TÜV SÜD has been officially recognized as a certification body for Textile Exchange Standards in Bangladesh, India, and Vietnam, expanding its global presence and supporting sustainable textile production through audits and lab analysis

Report Scope

Report Features Description Market Value (2024) USD 36.50 Bn Forecast Revenue (2034) USD 94.67 Bn CAGR(2025-2034) 10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Technology (Secondary ION Mass Spectrometry (SIMS), Energy Dispersive X-ray Spectroscopy (EDX),,Other Technologies), By Equipment (Scanning Electron Microscope (SEM), Focused Ion Beam (FIB) System, Other Equipment), By End-user Industry (Automotive, Oil and Gas, Defense, Other End-user Industries) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Presto Engineering Inc., TUV SUD, Rood Microtec GmbH, Eurofins EAG Laboratories, SGS SA, CoreTest Technologies Inc., Materials Testing Inc., McDowell Owens Engineering Inc., Exponent Inc., TechInsights Inc., Hitachi High-Tech Analytical Science Ltd., Intertek Group plc, NanoScope Services Ltd, Applus+ Laboratories Inc., Advanced Nanolab Pte Ltd, Toray Engineering Co., Ltd., Tescan Orsay Holding, Leica Microsystems Inc., Keysight Technologies Inc., Crane Engineering Inc., and others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Presto Engineering Inc.

- TUV SUD

- Rood Microtec GmbH

- Eurofins EAG Laboratories

- SGS SA

- CoreTest Technologies Inc.

- Materials Testing Inc.

- McDowell Owens Engineering Inc.

- Exponent Inc.

- TechInsights Inc.

- Hitachi High-Tech Analytical Science Ltd.

- Intertek Group plc

- NanoScope Services Ltd

- Applus+ Laboratories Inc.

- Advanced Nanolab Pte Ltd

- Toray Engineering Co., Ltd.

- Tescan Orsay Holding

- Leica Microsystems Inc.

- Keysight Technologies Inc.

- Crane Engineering Inc.

- Others