Fabrics For Wall And Ceiling Covering Market Size, Share, And Enhanced Productivity By Material Type (Natural Fibers, Synthetic Fibers), By Fabrics (Polyester, Polycotton, PVC, Others), By Application (Textile-Based Wall Coverings, Stretch Ceilings, Acoustic Panels, Partition Walls, Others), By End-use (Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175076

- Number of Pages: 295

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

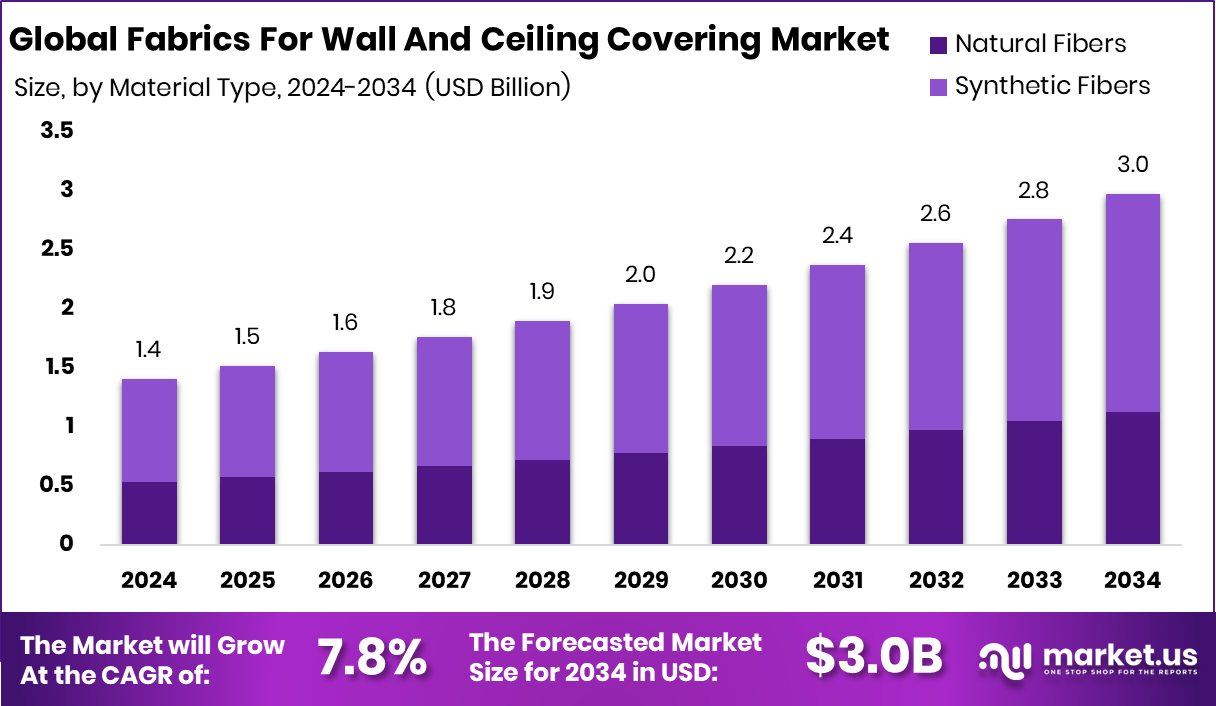

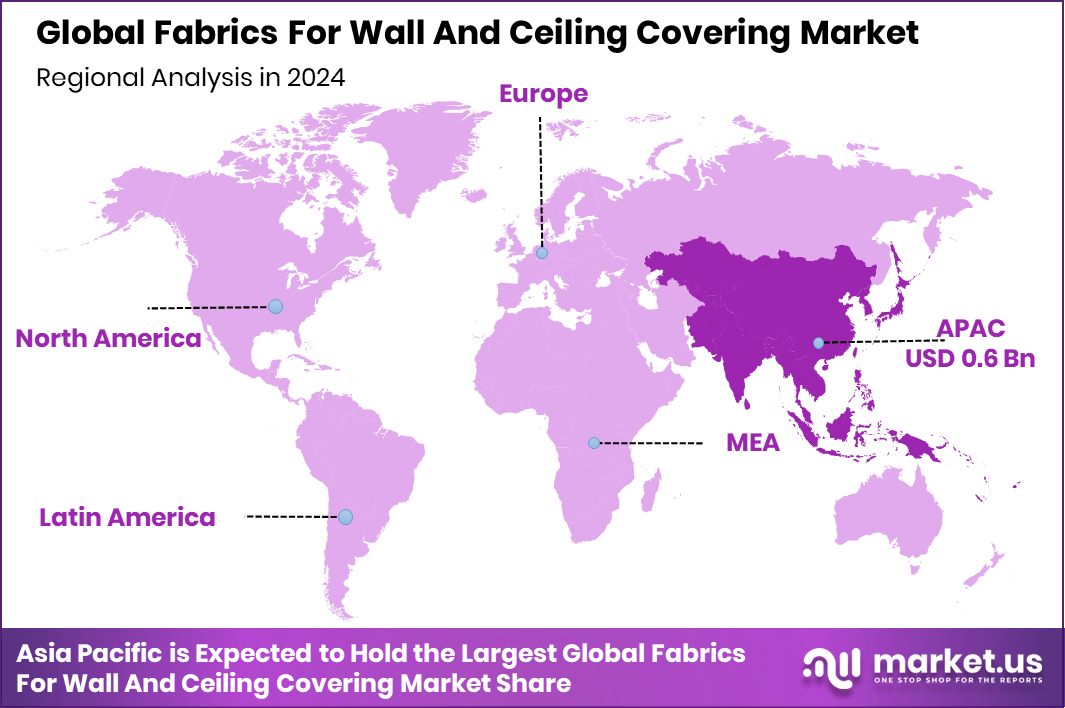

The Global Fabrics for Wall and Ceiling Covering Market is expected to be worth around USD 3.0 billion by 2034, up from USD 1.4 billion in 2024, and is projected to grow at a CAGR of 7.8% from 2025 to 2034. Strong construction growth kept Asia Pacific dominant at 45.8% and USD 0.6 Bn.

Fabrics for wall and ceiling covering are textile materials used to enhance the look, comfort, and acoustic quality of interior spaces. These fabrics add warmth, reduce noise, and offer a softer alternative to painted or hard-surface finishes. They come in various textures, patterns, and performance types, allowing designers to create inviting and functional environments. Modern fabric coverings also support sustainability goals, especially as innovations in fibers and natural materials grow. The field is expanding due to rising interest in healthier indoor environments and the need for visually distinct interiors across homes, offices, and hospitality spaces.

The Fabrics for Wall and Ceiling Covering Market includes all textile-based materials manufactured and supplied for interior wall and ceiling applications. It covers natural fibers, synthetic blends, acoustic fabrics, decorative textiles, and advanced engineered materials. The market grows as building demand improves insulation, better aesthetics, and eco-friendly materials. Rising investments in new fiber technologies and sustainable processing methods are shaping the direction of this sector. With continuous innovation and increasing commercial refurbishment projects, the market is becoming a significant part of modern interior solutions.

Growth is supported by rapid innovations in fiber technology, especially as companies invest in new sustainable materials. Funding such as Fiber Elements, raising €2.6 million for 3D basalt fiber, and Solena, raising $6.7 million for next-gen textiles, highlights strong momentum in material advancement. Expanded biobased research is also fueled by NFW securing $85 million to scale natural material platforms. These contributions push the market toward stronger, greener, and more versatile fabrics. As sustainable buildings gain importance, these advancements directly support long-term market expansion.

Demand increases as interior spaces seek better acoustics, refined aesthetics, and healthier environments. The shift toward natural and high-performance fibers is strengthened by multiple funding activities, including INCA securing $40 million for biocomposites and a Finnish startup receiving €7.7M to advance sustainable materials globally. These developments help manufacturers introduce more durable and low-impact textile surfaces. The growing use of environmentally friendly materials in residential and commercial projects continues to accelerate overall demand.

Opportunities rise from the expanding focus on sustainability, circular materials, and natural fiber solutions. Supportive investments like Bast Fibre Technologies, raising $3.33 million for natural fabric processing, and Fibmold securing $10 million for sustainable packaging fibers, show increasing interest in green innovations. Meanwhile, IndiNature’s £2 million investment to grow natural fibre insulation reflects the broader adoption of eco-friendly building materials. These advancements create opportunities for fabric coverings that offer better comfort, reduced emissions, and strong visual appeal, positioning the market for broader international growth.

Key Takeaways

- The Global Fabrics For Wall And Ceiling Covering Market is expected to be worth around USD 3.0 billion by 2034, up from USD 1.4 billion in 2024, and is projected to grow at a CAGR of 7.8% from 2025 to 2034.

- The Fabrics for Wall and Ceiling Covering Market sees synthetic fibers leading with 62.3% dominance.

- Polyester remains the key material in the Fabrics for Wall and Ceiling Covering Market at 39.7%.

- Textile-Based Wall Coverings drive strong demand in the Fabrics for Wall and Ceiling Covering Market with 38.4% share.

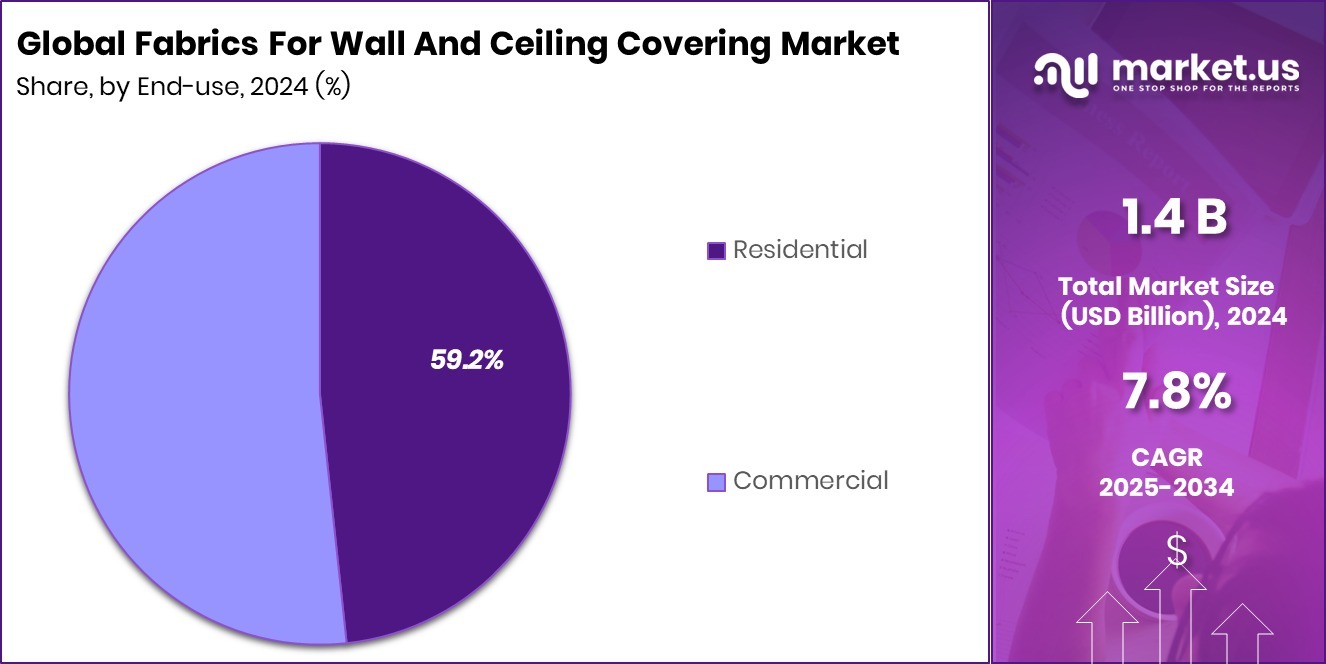

- The Fabrics for Wall and Ceiling Covering Market grows as the commercial end-use accounts for 59.2% today.

- Fabrics for wall and ceiling coverings reached USD 0.6 Bn in the Asia Pacific.

By Material Type Analysis

Synthetic fibers dominate the market with 62.3%, strengthened by rising global funding.

In 2024, the Fabrics for Wall and Ceiling Covering Market saw strong momentum as synthetic fibers maintained a dominant position with a 62.3% share. Their durability, moisture resistance, and cost-effectiveness made them the preferred choice for both modern interiors and high-traffic commercial environments. Synthetic materials also supported better stain resistance and color retention, driving their adoption in large-scale renovation and new construction projects.

Additionally, architects increasingly selected these fibers for their versatility in design applications and compatibility with acoustic insulation solutions. As sustainability standards advanced, manufacturers introduced improved recyclable synthetic options, making them more favorable for eco-conscious projects. This dominance reflects the broad utility and technological innovation surrounding synthetic fiber-based coverings.

By Fabrics Analysis

Polyester leads fabric demand at 39.7%, supported by expanding modernization funding initiatives.

In 2024, polyester remained a key fabric category within the Fabrics for Wall and Ceiling Covering Market, holding a 39.7% share driven by its affordability, lightweight structure, and superior printability. Interior designers valued polyester for its ability to replicate premium textures while maintaining budget-friendly installation costs. Its strong resistance to wear, fading, and environmental stressors made it ideal for residential and commercial décor upgrades.

The growing preference for digitally printed wall coverings further elevated polyester demand, as the material enables sharper visual effects and high-definition impressions. Its compatibility with fire-resistant and antimicrobial treatments also broadened its application in hospitality, corporate spaces, and healthcare environments, reinforcing polyester’s leadership in fabric innovation.

By Application Analysis

Textile-based wall coverings hold 38.4% dominance, driven by steady industry development funding.

In 2024, textile-based wall coverings secured a solid 38.4% share of the Fabrics for Wall and Ceiling Covering Market as demand rose for premium interiors emphasizing comfort and aesthetic depth. These coverings offered enhanced tactile qualities, noise absorption, and visual richness, which appealed to luxury residential projects and upscale commercial spaces.

Growing interest in soft architecture — an approach that integrates fabric elements for warmth and character—further strengthened usage across hotels, boutiques, and boardrooms. Designers increasingly adopted textile solutions for their flexibility in customization and ease of integration with smart building materials. With sustainability trends accelerating, natural and recycled textile blends gained popularity, supporting the shift toward eco-friendly decorative solutions.

By End-use Analysis

Commercial end-use dominates with 59.2%, boosted by infrastructure funding supporting rapid adoption.

In 2024, the commercial sector led the Fabrics for Wall and Ceiling Covering Market with a commanding 59.2% share, driven by extensive upgrades in hospitality, corporate offices, retail outlets, and public infrastructure. Businesses prioritized fabric coverings to improve acoustics, enhance brand identity, and create visually appealing environments that support customer engagement.

The rise of experiential retail and modern workspace concepts further pushed demand for customizable fabric-based designs offering texture and color variation. Commercial buyers also favored materials with fire-retardant, antimicrobial, and high-durability properties, ensuring long-term performance with minimal maintenance. Expansion of hotels, coworking spaces, and global renovation cycles significantly contributed to the segment’s continued dominance throughout the year.

Key Market Segments

By Material Type

- Natural Fibers

- Synthetic Fibers

By Fabrics

- Polyester

- Polycotton

- PVC

- Others

By Application

- Textile-Based Wall Coverings

- Stretch Ceilings

- Acoustic Panels

- Partition Walls

- Others

By End-use

- Residential

- Commercial

Driving Factors

Increasing Use of Regenerated Fibers Drives Market Growth

Growing interest in regenerated and sustainable fibers is becoming a major driving factor for the Fabrics for Wall and Ceiling Covering Market. The push for cleaner materials is supported by fresh investments, such as SaXcell securing €4 million to launch a full-scale regenerated fiber plant. This funding strengthens the supply of eco-friendly fibers that fit well into modern interiors and commercial projects.

At the same time, circular textile efforts are expanding, with Syre raising $100 million to scale next-generation textile recycling. The momentum became even stronger when H&M-backed Syre targeted $700 million after a major industry partnership. Together, these investments create a strong pathway for sustainable fabric production, pushing market growth forward.

Restraining Factors

High Production Challenges Restrain Sustainable Fabric Expansion

One key restraining factor for this market is the challenge of scaling advanced sustainable textiles fast enough to meet rising demand. While innovation continues, many next-generation materials require costly research and specialized processing. Companies working on microbial and chemical textile breakthroughs face high production complexity, as shown by Modern Synthesis raising $4.1 million to grow microbe-based textiles.

Similarly, chemical recycling remains capital-intensive, highlighted by DePoly securing $30 million for plastic-to-textile technology. Another example is Fairbrics raising €22 million to produce polyester fiber from captured CO₂, reflecting the heavy investment needed before mass adoption. These funding efforts show progress, but also reveal the significant barriers that slow the wider use of sustainable wall and ceiling fabrics.

Growth Opportunity

Expanding Textile Recycling Creates Strong Market Opportunity

A major opportunity for the Fabrics for Wall and Ceiling Covering Market lies in the rapid expansion of textile recycling technologies. These solutions convert waste fibers into high-quality materials suitable for interior fabrics. Market potential grows as large funding deals strengthen recycling capacity, such as Infinited Fiber raising $43 million to scale its regenerated fiber platform. This investment widens access to recyclable inputs that can be used in decorative and acoustic coverings.

Growth prospects increase further with Textile Recycler Eeden raising €18 million, helping accelerate efficient fiber-to-fiber recycling. As recycled materials become more available and affordable, designers and builders gain new choices for eco-friendly interior fabrics, creating strong opportunities for industry expansion.

Latest Trends

Rapid Shift Toward Circular Materials Shapes New Trends

The newest trend in this market is the strong shift toward circular textile systems, where materials are reused, regenerated, and continuously cycled into new products. This trend accelerates as companies develop advanced recycling solutions backed by significant funding. For example, Infinited Fiber raising $43 million showcases how regenerated textiles are gaining attention for interior applications.

Another trend-shaping milestone is MacroCycle closing $6.5 million, enabling chemical recycling that turns textile waste into reusable molecules. These innovations support fabrics with lower environmental impact, appealing to architects and builders aiming for greener spaces. As circular materials become more reliable, they influence design preferences and push the market toward more sustainable wall and ceiling fabric choices.

Regional Analysis

The Asia Pacific region led the market in 2024 with a 45.8% share.

In the Fabrics for Wall and Ceiling Covering Market, Asia Pacific remained the leading region, supported by strong construction activity, rapid commercial expansion, and rising interior refurbishment demand. The region held a dominant 45.8% share, valued at USD 0.6 Bn, reflecting sustained investment in hospitality, offices, and urban residential upgrades.

North America followed with steady demand driven by premium interior solutions used across corporate buildings and modern homes, supported by consistent renovation cycles. Europe continued to show stable growth as the region focused on durable and aesthetically advanced wall and ceiling fabrics suited for commercial and institutional spaces.

Meanwhile, the Middle East & Africa saw gradual adoption, influenced by infrastructure development and hospitality projects requiring fabric-based surface enhancement. Latin America experienced moderate progress as developers increasingly preferred textile-based coverings for cost-effective and visually appealing interiors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

REI Co-op continued leveraging its strong foundation in durable outdoor fabrics to offer materials suitable for interior applications that require longevity, breathability, and environmental responsibility. The company’s emphasis on high-quality textile engineering supported the shift toward fabric-based coverings that combine visual appeal with structural resilience. Its commitment to functional materials positioned it well for commercial spaces seeking both practicality and aesthetic balance.

Marmot Mountain, LLC, brought forward its excellence in technical performance fabrics, known for strength, insulation, and resistance to wear. This capability translated effectively into wall and ceiling applications where durability and stability are essential. The company’s material innovation supported demand from projects requiring fabrics capable of handling frequent use, temperature fluctuations, and long-term visual consistency.

Tepastex strengthened its presence through specialized technical textiles engineered for protection, acoustic improvement, and moisture control. Its fabric technology is aligned with modern architectural needs, enabling designers to integrate functional surfaces into commercial and residential interiors. Together, these companies played an important role in shaping fabric-based interior solutions in 2024.

Top Key Players in the Market

- REI Co-op

- Marmot Mountain, LLC

- Tepastex

- FOH HIN Canvas SDN. BHD.

- Big Agnes, Inc.

- Hiltex Industrial Fabrics Pvt, Ltd.

- HEYtex

Recent Developments

- In October 2025, REI Co-op signed a three-year offtake agreement with Ambercycle to scale cycora® regenerated polyester. This deal means REI will source recycled polyester made from old textile waste, helping reduce environmental impact and dependence on new materials. The agreement will let Ambercycle grow production while REI integrates these recycled fabrics into its outdoor gear and products. This step shows REI’s commitment to more sustainable textiles across its offerings.

- In June 2025, Marmot Mountain, LLC introduced the PreCip EVO jacket, an updated version of its well-known rain jacket with more comfort and better design for outdoor use. This new jacket replaced the earlier PreCip Eco model, showing Marmot’s ongoing work in improving performance fabrics and customer options in its clothing line.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Billion Forecast Revenue (2034) USD 3.0 Billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Natural Fibers, Synthetic Fibers), By Fabrics (Polyester, Polycotton, PVC, Others), By Application (Textile-Based Wall Coverings, Stretch Ceilings, Acoustic Panels, Partition Walls, Others), By End-use (Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape REI Co-op, Marmot Mountain, LLC, Tepastex, FOH HIN Canvas SDN. BHD., Big Agnes, Inc., Hiltex Industrial Fabrics Pvt, Ltd., HEYtex Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fabrics For Wall And Ceiling Covering MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Fabrics For Wall And Ceiling Covering MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- REI Co-op

- Marmot Mountain, LLC

- Tepastex

- FOH HIN Canvas SDN. BHD.

- Big Agnes, Inc.

- Hiltex Industrial Fabrics Pvt, Ltd.

- HEYtex