Global Fabless IC Design Market Size, Share, Industry Analysis Report By Type (IP Design, Full Chip Design), By End User (Semiconductor Companies, Electronic Design Automation (EDA) Providers, OEMs (Original Equipment Manufacturers), Others), By Industry Vertical (Consumer Electronics, Automotive, Telecommunications, Medical Devices, Aerospace and Defense, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 160683

- Number of Pages: 372

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

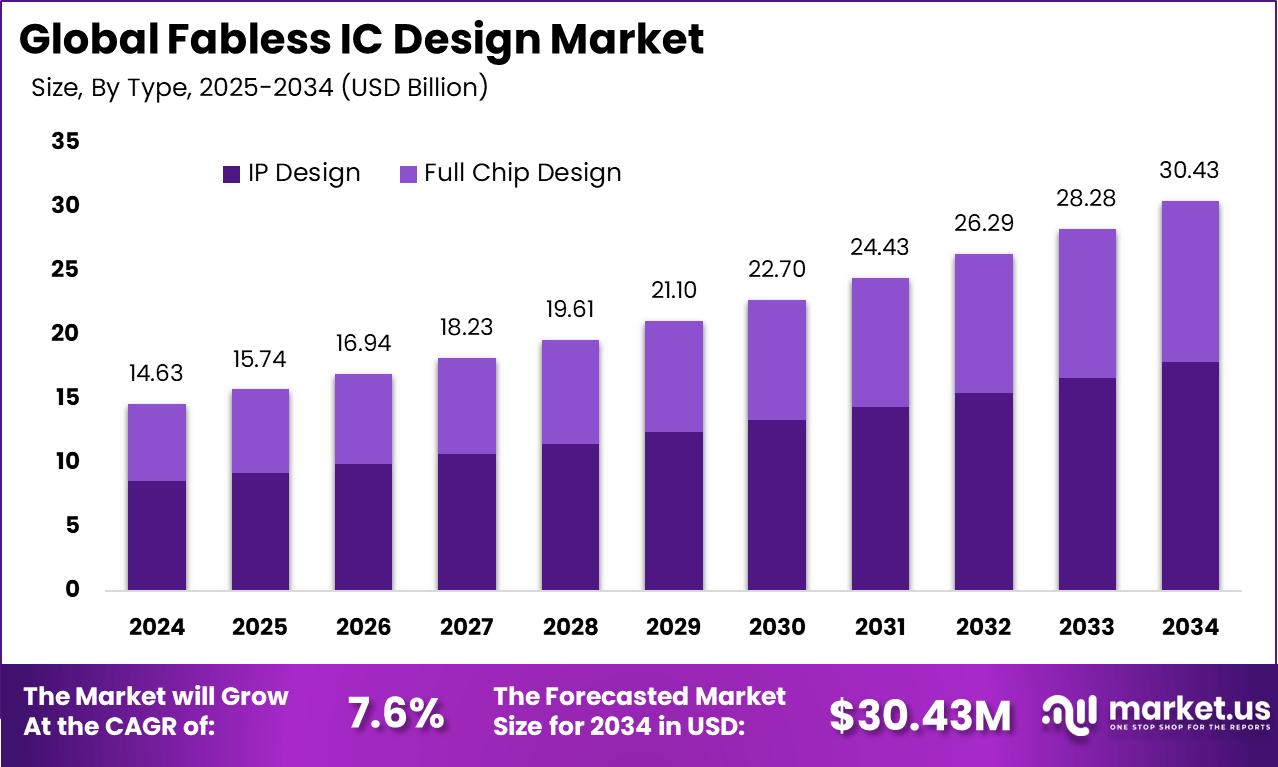

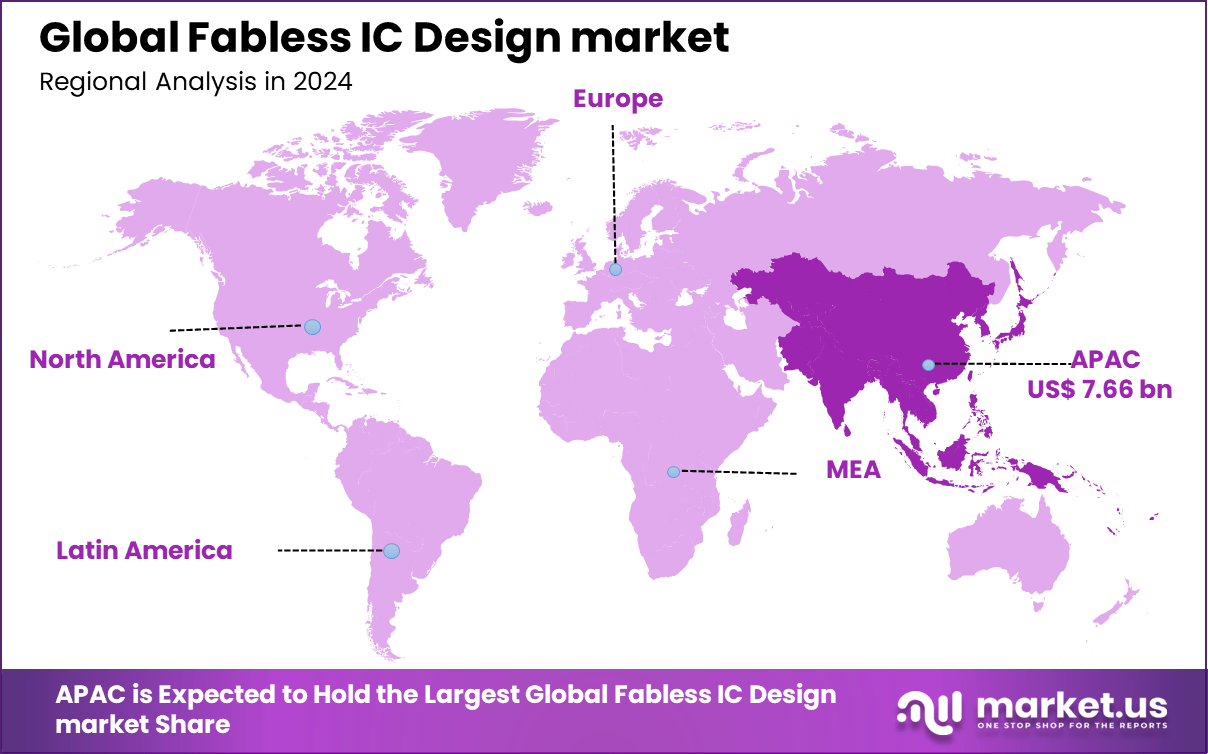

The Global Fabless IC Design Market size is expected to be worth around USD 30.43 billion by 2034, from USD 14.63 billion in 2024, growing at a CAGR of 7.6% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 52.4% share, holding USD 7.66 billion in revenue.

The Fabless IC Design Market focuses on companies that specialize in designing integrated circuits (ICs) but outsource manufacturing to third-party foundries. This model enables fabless companies to prioritize innovation in chip design without the heavy capital costs of owning fabrication plants. Fabless firms develop chips tailored for various industries such as consumer electronics, automotive and AI applications, driving demand for more efficient, smaller, and highly specialized semiconductors.

For instance, In August 2024, VanEck introduced the Fabless Semiconductor ETF (SMHX), giving investors exposure to companies focused on chip design and R&D. The fund targets firms that outsource fabrication to foundries, allowing investors to capitalize on growth in AI, automotive electronics, IoT devices, and advanced packaging technologies

Top driving factors fueling this market include the escalating need for advanced semiconductor chips in smartphones, 5G technology, electric vehicles, and AI. These sectors require high-performance, power-efficient, and scalable chips that only fabless companies can efficiently supply due to their focused R&D capabilities. The move to SoC and heterogeneous integration has increased demand by enabling more functions on a single chip for modern electronics.

For instance, in June 2024, Sinble, a Singapore-based startup, launched its IC design implementation service, focusing on providing tailored solutions for fabless IC design. The company aims to assist clients in the semiconductor industry with efficient, cost-effective design and implementation, targeting sectors like IoT, automotive, and consumer electronics.

Demand analysis shows substantial growth driven by mobile and automotive sectors. More than 60% of fabless IC firms integrate AI-driven chip designs targeting autonomous driving, data centers, and IoT devices. The automotive semiconductor market is growing at over 8% a year as ADAS features need customized chips, pushing fabless firms to innovate quickly for these requirements.

Top Market Takeaway

- By type, IP design dominates with 58.7%, reflecting its critical role in accelerating chip development and reducing time-to-market.

- By end user, semiconductor companies lead with 61.3%, leveraging fabless models for cost efficiency and innovation.

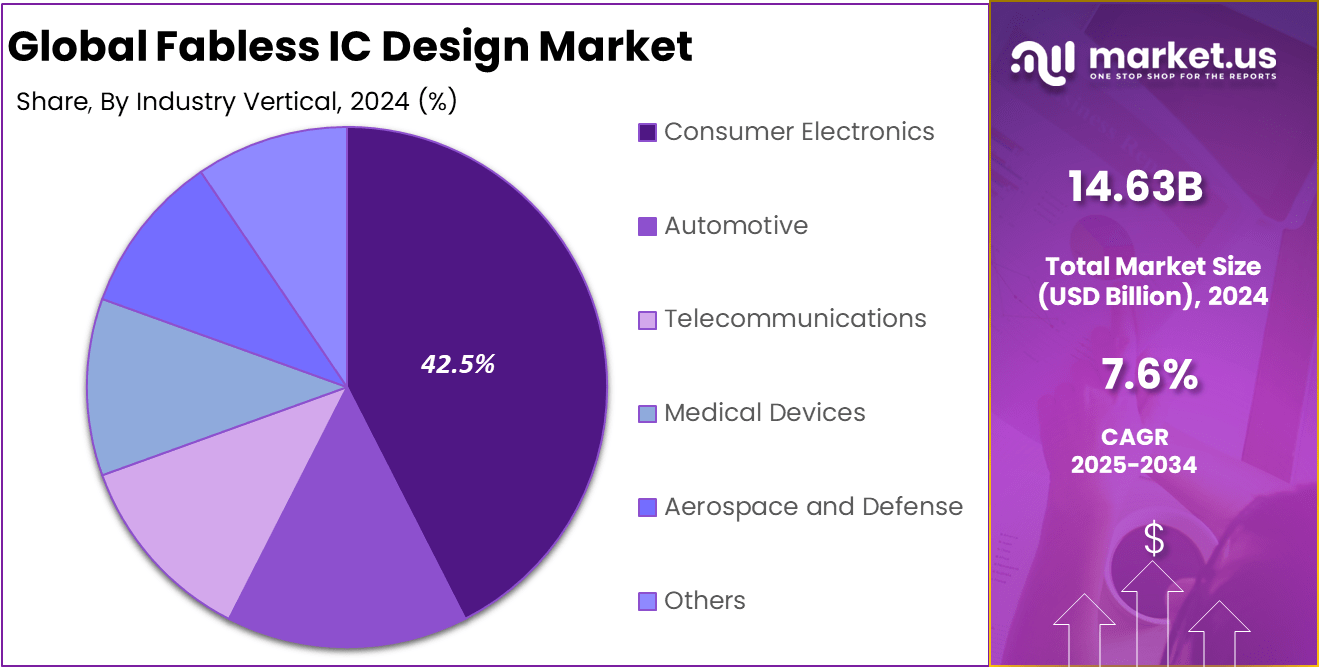

- By industry vertical, consumer electronics holds 42.5%, driven by demand for smartphones, wearables, and smart devices.

- Asia Pacific leads with 52.4%, supported by strong semiconductor ecosystems and rising chip design activities.

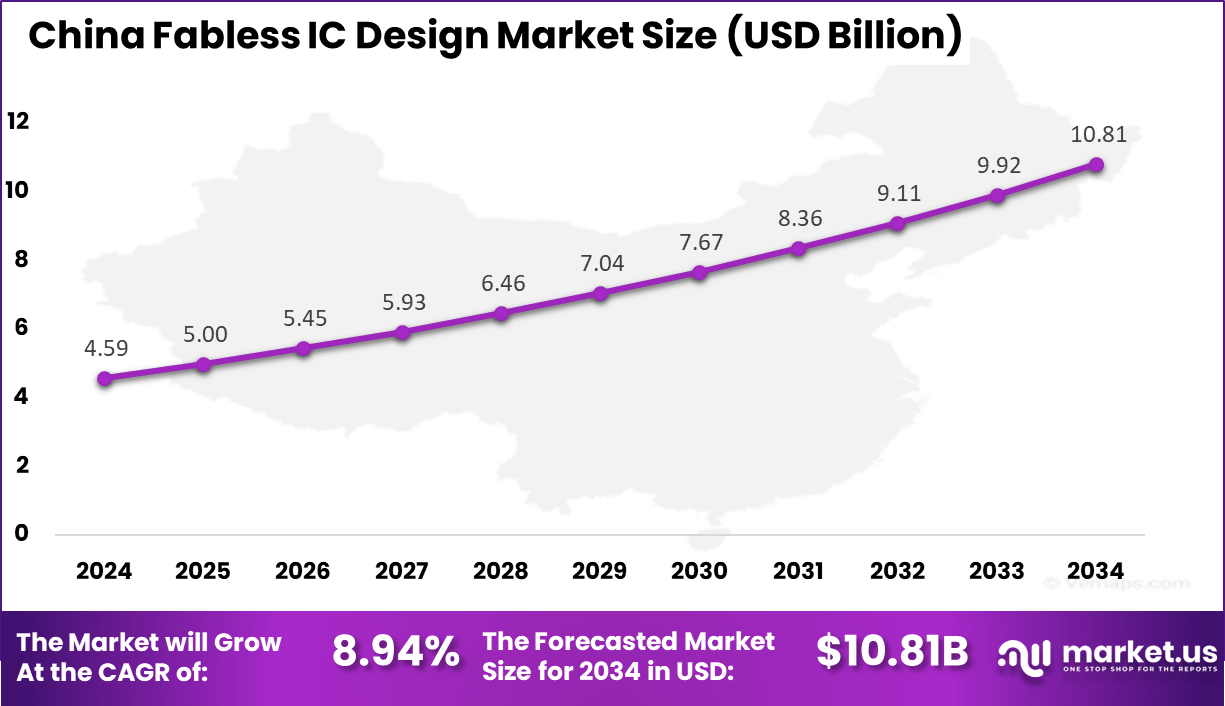

- The China market reached USD 4.59 billion and is expanding at a steady CAGR of 8.94%, highlighting its growing dominance in global IC design innovation.

Analysts’ Viewpoint

Increasing adoption of technologies such as AI accelerators, SoCs embedded with AI engines, 5G, and chiplet architectures supports the fabless business. These technologies enable real-time data analytics, energy efficiency, and greater chip density. The demand for AI-focused semiconductors optimized for parallel processing is rising sharply, as these offer faster computation and lower power use, critical in data centers, autonomous vehicles, and edge computing devices.

Key reasons for adopting the fabless model are cost efficiency and agility. Building and maintaining semiconductor fabrication plants require enormous investment, while fabless companies avoid this by outsourcing production. This approach allows greater focus on chip innovation, flexibility to scale production, and quicker time-to-market. Such benefits have democratized chip design, enabling startups and smaller players to compete with industry giants effectively.

Investment opportunities abound in funding fabless IC design startups and emerging companies focused on SoCs for high-growth sectors such as automotive, AI, and 5G. Venture capital interest is growing as fabless firms present faster innovation cycles and flexible product customization. The partnership ecosystem between fabless designers and advanced foundries also opens avenues for strategic investments that drive market expansion.

Role of Generative AI

The fabless IC design sector is witnessing significant transformation from the integration of generative AI technologies. Generative AI enhances chip design processes by automating layout optimization, improving design accuracy, and accelerating development cycles. Recent data indicates that AI-driven workflows are adopted by over 40% of fabless companies by mid-2025, reducing time-to-market by nearly 25%.

This technology enables more efficient handling of the increasing complexity in chip architectures, especially for AI accelerators and advanced system-on-chip (SoC) designs, thus shaping innovation in the semiconductor ecosystem. In parallel, generative AI plays a crucial role in defect detection and yield optimization during manufacturing support stages.

Industry reports show a boost in chip yields by approximately 12% and a marked drop in manufacturing defects when generative AI methods are applied. This dual impact on design and production processes is fortifying fabless IC firms’ competitive advantage amid rapid market demands for specialized and high-performance chips.

China Market Size

The market for Fabless IC Design within China is growing tremendously and is currently valued at USD 4.59 billion, the market has a projected CAGR of 8.94%. The market is growing tremendously due to the country’s strong push to become more self-reliant in semiconductor technology.

With rising demand for consumer electronics, 5G infrastructure, and automotive innovations, Chinese fabless companies are focusing on developing advanced, localized chip designs. Government support through policies and investments in the semiconductor sector, alongside the increasing need for custom chips in industries like AI and IoT, further boosts this growth.

For instance, in February 2025, the Center for Strategic and International Studies (CSIS) highlighted China’s growing dominance in fabless IC design, driven by significant state investments and the rapid development of domestic semiconductor companies. As part of its strategy to reduce dependence on foreign technologies, China has been accelerating innovation in areas like AI chips, 5G, and semiconductor IP.

In 2024, Asia Pacific held a dominant market position in the Global Fabless IC Design market, capturing more than a 52.4% share, holding USD 7.66 billion in revenue. This dominance is due to its strong semiconductor manufacturing ecosystem and rapid technological advancements.

The region is home to leading fabless companies, especially in China, Taiwan, and South Korea, which are capitalizing on the growing demand for advanced chips in consumer electronics, AI, 5G, and IoT. Additionally, favorable government policies, skilled talent pools, and strong collaborations between design firms and foundries contribute to the region’s market leadership.

For instance, in August 2025, VerveSemi, a fabless chip firm, outlined its roadmap for developing advanced ICs as part of India’s push toward semiconductor self-reliance. This move reinforces Asia Pacific’s growing dominance in the fabless IC design market, highlighting the region’s increasing role in driving innovation and meeting the rising demand for high-performance chips across sectors like AI, IoT, and automotive.

Emerging Trends

Emerging trends in fabless IC design highlight the surge in system-on-chip (SoC) platforms embedded with AI capabilities, capturing almost 45% share of design focus in 2025. The move towards chiplet integration is also reshaping traditional monolithic architectures, offering modular designs that enable faster innovation and cost efficiencies.

For instance, In April 2022, Orca Systems introduced the first fully integrated SoC for direct-to-satellite IoT connectivity, eliminating the need for ground infrastructure and enabling efficient communication in remote areas. The chip combines all required protocols and processing functions in a single design, highlighting advances in fabless IC development.

Growth Factors

The growth in demand for AI-focused semiconductors, driven by data centers, autonomous vehicles, and edge computing, further fuels fabless design advancements. Currently, 60% of new fabless IC projects incorporate AI or machine learning components to meet these sector needs.

Market adoption of 5G and IoT devices is also influencing design requirements, with radio-frequency integrated circuits and mixed-signal chips rising rapidly in both development and deployment. Several factors support the steady expansion of fabless IC design. Increasing demand for consumer electronics, smart devices, and automotive semiconductors is a primary growth driver.

For example, the automotive IC sector, which includes power-efficient chips for electric vehicles and advanced safety systems, is growing at an annual rate exceeding 8%. Fabless companies benefit from the model’s agility and cost-efficiency, as it allows focus on design innovation while outsourcing manufacturing to specialized foundries, ensuring access to advanced technologies without heavy capital investment.

Type Analysis

In 2024, The IP Design segment held a dominant market position, capturing a 58.7% share of the Global Fabless IC Design market. This dominance is due to the increasing demand for intellectual property (IP) cores, such as processors, memory, and connectivity modules, which are crucial for accelerating the development of specialized chips.

Fabless companies leverage IP cores to reduce design time, lower costs, and enhance product differentiation. The growing adoption of customizable and reusable IP in advanced applications like AI, 5G, and IoT further fuels the trend.

For Instance, In February 2025, RRP Semiconductor entered the fabless chip design market by acquiring ASIC IP, enabling the use of existing IP cores to accelerate development and lower costs. This strategy supports the design of high-performance, energy-efficient chips and strengthens the company’s position in the competitive fabless IC landscape.

End User Analysis

In 2024, the Semiconductor Companies segment held a dominant market position, capturing a 61.3% share of the Global Fabless IC Design market. This dominance is due to the increasing demand for advanced semiconductor solutions across industries such as consumer electronics, automotive, and telecommunications.

Semiconductor companies lead in designing high-performance, specialized chips for applications like AI, 5G, and IoT. Their ability to innovate rapidly and scale production through partnerships with foundries further strengthens their market leadership and drives their continued growth.

For instance, In October 2024, ACL Digital joined Intel’s Foundry Accelerator Design Services Alliance, gaining access to advanced tools, IPs, and process technologies. The partnership strengthens its ability to deliver optimized semiconductor design solutions for hyperscalers, telecom, automotive, and IoT sectors.

Industry Vertical Analysis

In 2024, The Consumer Electronics segment held a dominant market position, capturing a 42.5% share of the Global Fabless IC Design market. This dominance is due to the rapid growth in demand for advanced, compact, and energy-efficient chips for devices such as smartphones, wearables, and smart home products.

As consumer electronics continue to evolve with technologies like 5G, AI, and IoT, fabless companies are increasingly focused on designing innovative ICs to meet the performance, size, and power requirements of these highly competitive markets.

For Instance, in June 2024, a semiconductor veteran launched a new fabless chip company in Chennai, focusing on design and testing facilities for consumer electronics. The company aims to cater to the growing demand for specialized chips in products like smartphones, wearables, and smart home devices.

Key Market Segments

By Type

- IP Design

- Full Chip Design

By End User

- Semiconductor Companies

- Electronic Design Automation (EDA) Providers

- OEMs (Original Equipment Manufacturers)

- Others

By Industry Vertical

- Consumer Electronics

- Automotive

- Telecommunications

- Medical Devices

- Aerospace and Defense

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Increased Demand for Custom Semiconductors in Emerging Technologies

The rise of technologies such as artificial intelligence, 5G networks, and automotive electronics is significantly boosting the demand for specialized semiconductors. Fabless IC design firms excel in producing tailored chip designs that offer high performance while maintaining low power consumption, making them indispensable in these fast-evolving sectors.

Their ability to quickly innovate and customize chips for applications ranging from mobile devices to autonomous vehicles supports strong market growth. This demand is propelling fabless companies into central roles within global technology supply chains, fostering innovation and expanding their addressable market globally.

For instance, In March 2025, Amazon reported double-digit growth in consumer electronics demand across tier-2 and tier-3 cities, increasing the need for compact and energy-efficient chips. This trend is driving innovation in fabless IC design as companies develop specialized semiconductors for devices such as smartphones, wearables, and home appliances.

Restraint

Increasing Complexity and Cost of Semiconductor Design

As chip designs become more advanced, the costs and complexity involved in research and development are rising steeply. Fabless firms must invest heavily in skilled engineers and sophisticated design tools to stay competitive.

Additionally, since these companies outsource manufacturing to third-party foundries, they face challenges in controlling quality, managing supply chains, and dealing with fluctuating manufacturing costs. These factors limit growth potential for smaller players and add pressure on all fabless companies to maintain high standards while containing expenses.

Opportunities

AI and Machine Learning Demand

The rapid expansion of AI and machine learning applications presents a significant opportunity for fabless companies to design specialized chips. These chips are crucial for AI acceleration, edge computing, and data centers, sectors poised for substantial growth.

As the demand for high-performance computing continues to rise, fabless companies can seize this opportunity by designing innovative ICs that cater to AI-specific workloads, enhancing performance, efficiency, and scalability. This trend offers substantial long-term growth potential.

For instance, in August 2025, VerveSemi, an Indian fabless semiconductor firm, unveiled its new line of AI-powered integrated circuits (ICs) designed for applications in energy, aerospace, and sensor technologies. These innovative chips are optimized for high-performance, low-power processing, making them ideal for AI-driven tasks in industries that require real-time data analysis and decision-making.

Challenges

Intense Competition

The fabless IC design market is dominated by well-known companies, which makes entry difficult for smaller players. High capital needs, complex technology, and strong brand advantage create barriers. Intense competition forces firms to innovate constantly, build partnerships, and market themselves strategically. New or small companies often survive by targeting niche segments or offering specialized chip designs.

For instance, In September 2024, Tessolve, a semiconductor design arm of Hero Group, revealed plans to pursue an IPO within the next three to four years. The goal is to secure funding to expand its design and testing capabilities in India. This reflects the growing competition in the sector as companies scale up to meet rising demand from industries such as automotive, AI, and telecommunications.

Key Players Analysis

The Fabless IC Design Market is supported by specialized semiconductor design firms such as Faststream Technologies, ACL Digital, and Alchip Technologies, Limited. These companies focus on end-to-end chip design, verification, and system-on-chip (SoC) development for applications in AI, automotive, telecommunications, consumer electronics, and IoT. Their expertise allows clients to outsource design functions while relying on external foundries for fabrication.

Mid-sized innovators including EnSilica, Tessolve, Intrinsix Corp., Sagantec, and CoreHW contribute through ASIC and mixed-signal IC development, RF design, and IP integration services. These players support both startups and established OEMs by offering customized semiconductor solutions with faster time-to-market and lower capital expenditure.

Emerging and regional contributors such as TronicsZone, EDS-India, RioSH, DNCL Technologies, Insilico Tech Services Pvt Ltd, Proxelera, and Allics Technology provide design support, FPGA prototyping, PCB engineering, and low-power IC solutions. Their role is growing in industrial automation, wearables, and embedded systems. .

Top Key Players in the Market

- Faststream Technologies

- ACL Digital

- Alchip Technologies, Limited

- EnSilica

- Tessolve

- Intrinsix Corp.

- Sagantec

- TronicsZone

- EDS-India

- RioSH

- DNCL Technologies

- Insilico Tech Services Pvt Ltd

- CoreHW

- Proxelera

- Allics Technology

- Others

Recent Developments

- In May 2025, EnSilica opened a new engineering hub in Cambridge, expanding its capabilities in advanced semiconductor design. This facility will focus on enhancing the company’s expertise in mmWave and RF integrated circuits, which are crucial for next-generation technologies like 5G, IoT, and automotive applications.

- In January 2025, Alchip Technologies announced the launch of its 3DIC ASIC design services, aimed at enhancing the development of high-performance chips for AI, HPC, and 5G applications. This new service offers a comprehensive solution for 3D integrated circuits (3DICs), allowing for more efficient and compact chip designs by stacking multiple layers of silicon.

Report Scope

Report Features Description Market Value (2024) USD 14.63 Bn Forecast Revenue (2034) USD 30.43 Bn CAGR(2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (IP Design, Full Chip Design), By End User (Semiconductor Companies, Electronic Design Automation (EDA) Providers, OEMs (Original Equipment Manufacturers), Others), By Industry Vertical (Consumer Electronics, Automotive, Telecommunications, Medical Devices, Aerospace and Defense, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Faststream Technologies, ACL Digital, Alchip Technologies, Limited, EnSilica, Tessolve, Intrinsix Corp., Sagantec, TronicsZone, EDS-India, RioSH, DNCL Technologies, Insilico Tech Services Pvt Ltd, CoreHW, Proxelera, Allics Technology, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Faststream Technologies

- ACL Digital

- Alchip Technologies, Limited

- EnSilica

- Tessolve

- Intrinsix Corp.

- Sagantec

- TronicsZone

- EDS-India

- RioSH

- DNCL Technologies

- Insilico Tech Services Pvt Ltd

- CoreHW

- Proxelera

- Allics Technology

- Others