Global Extended Warranty Market Size, Share, Growth Analysis By Product Type (Consumer Electronics, Home Appliances, Automotive, Industrial Equipment, Others), By Service Provider (OEM, Retailer, Insurer/Broker, Third-party Administrator), By End-user (Individual Consumers, Commercial/Fleet), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175190

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

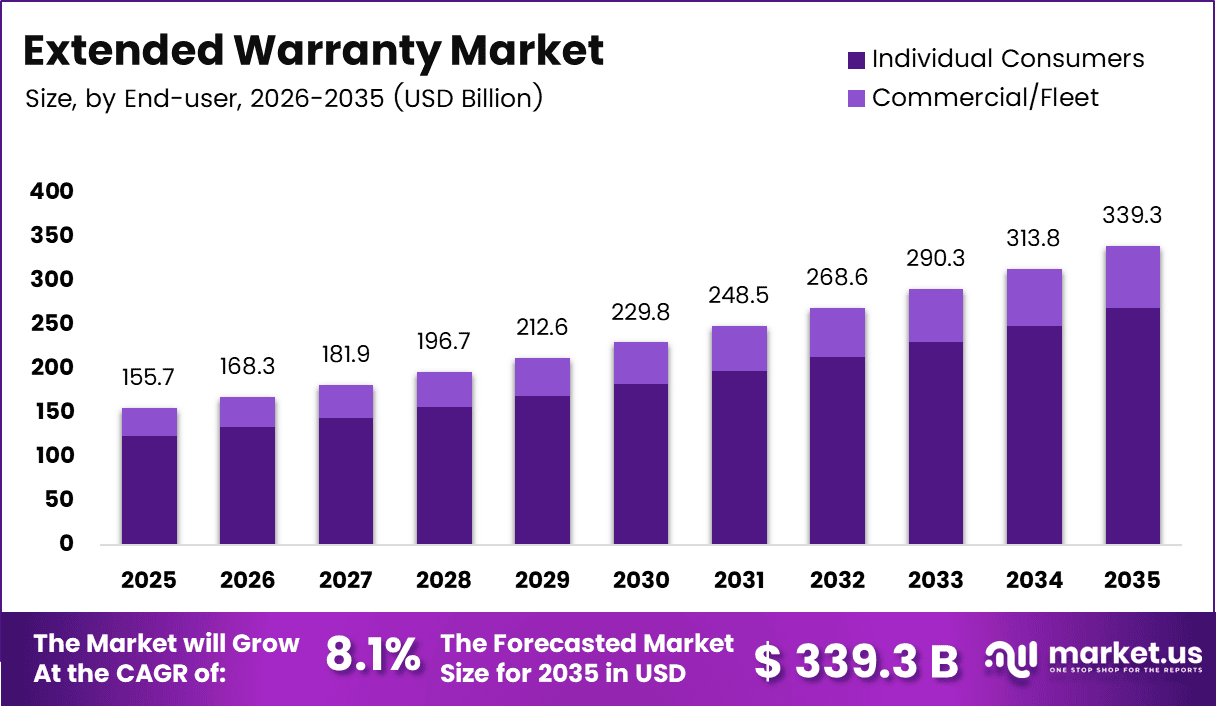

The Global Extended Warranty Market size is expected to be worth around USD 339.3 billion by 2035, from USD 155.7 Billion in 2025, growing at a CAGR of 8.1% during the forecast period from 2026 to 2035.

The extended warranty market represents the ecosystem of service contracts that provide repair, replacement, or maintenance coverage beyond standard manufacturer warranties. From an analyst viewpoint, this market addresses post-purchase risk mitigation for consumers and enterprises. Consequently, it supports predictable ownership costs while strengthening long-term product value assurance across electronics, appliances, and automotive categories.

From a functional perspective, extended warranties bridge the gap between manufacturer coverage limitations and real-world usage cycles. As products integrate complex electronics, sensors, and software, failure risks increase after standard warranty expiration. Therefore, extended warranty solutions are increasingly positioned as essential lifecycle protection tools rather than optional add-ons.

Market growth is supported by rising ownership of premium-priced products and longer replacement cycles. Consumers are retaining vehicles and electronics for extended periods, increasing exposure to out-of-pocket repair costs. As a result, extended warranty adoption aligns closely with cost containment strategies amid inflationary pressure on spare parts and skilled labor.

The automotive segment remains structurally important due to regulatory-backed baseline coverage. According to the US Federal Trade Commission, all new cars in the United States include warranties covering repairs for defined periods, commonly 3 years or 36,000 miles. This framework creates a natural transition point for extended warranty market expansion.

In consumer electronics, transparent pricing models are enhancing adoption across income groups. According to Target Corporation disclosures, a three-year extended warranty costs 79 dollars for electronics priced above 1,000 dollars, 59 dollars for products between 500 and 1,000 dollars, 29 dollars for items priced 200 to 500 dollars, and 19 dollars for electronics under 200 dollars.

Retail price dispersion further reinforces the perceived value of extended protection. According to multi-retailer pricing observations, 36 retailers offered a Panasonic model priced between 1,355 dollars and 1,955 dollars, excluding taxes and shipping. Consequently, extended warranties help consumers hedge against replacement cost uncertainty.

Looking ahead, opportunities are emerging through digital warranty platforms, embedded protection at checkout, and subscription-based coverage models. Government focus on consumer protection disclosure and service contract regulation is expected to standardize practices. As a result, the extended warranty market is anticipated to evolve toward data-driven, customer-centric protection ecosystems.

Key Takeaways

- The Global Extended Warranty Market is valued at USD 155.7 Billion in 2025 and is expected to grow at a CAGR of 8.1% through 2035.

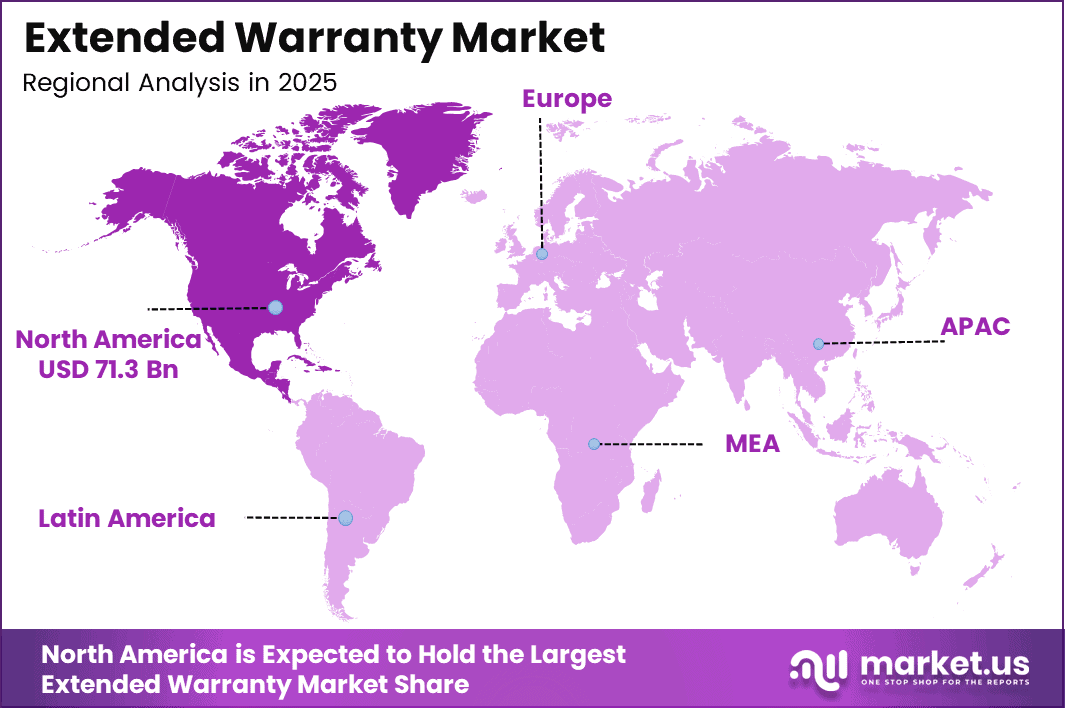

- North America dominates the market with a 45.8% share, accounting for USD 71.3 billion in market value.

- Consumer Electronics leads the product type segment with a dominant share of 45.2%.

- OEMs represent the largest service provider segment, holding a market share of 39.9%.

- Individual Consumers are the primary end users, contributing 79.3% of total market demand.

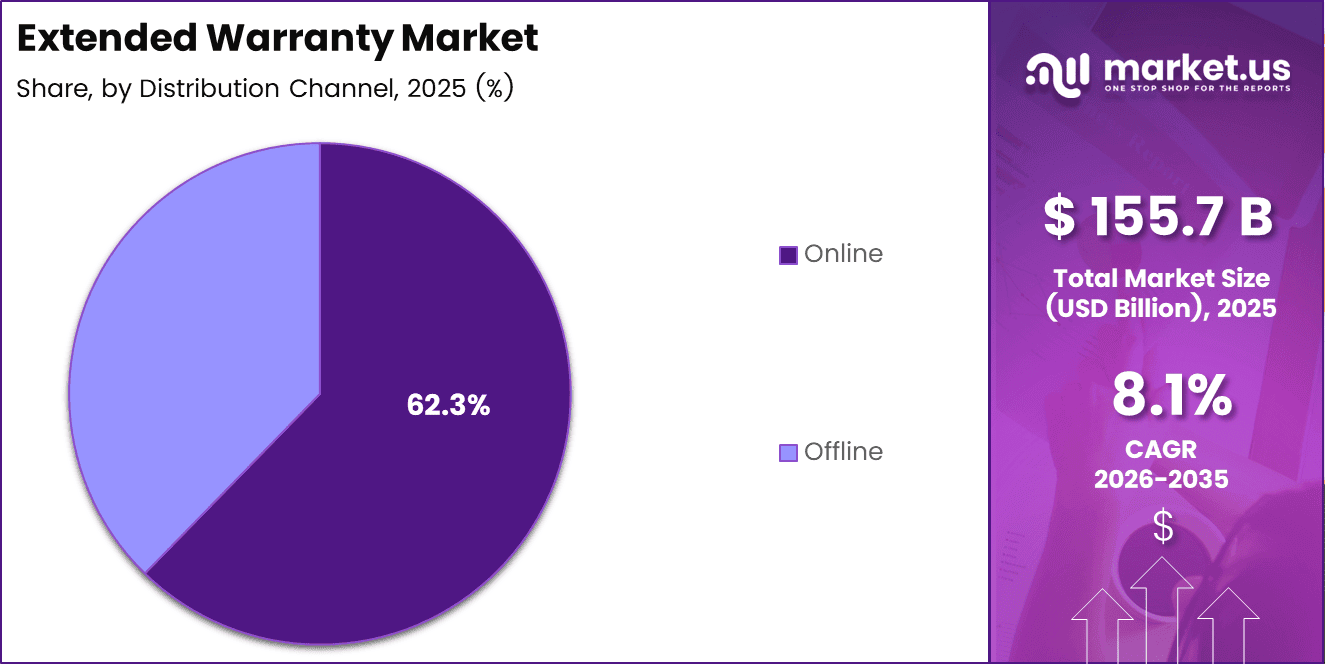

- Online distribution channels account for the largest share at 62.3%, driven by digital purchasing behavior.

Product Type Analysis

Consumer Electronics dominates with 45.2% due to rising device penetration and higher repair cost sensitivity.

In 2025, Consumer Electronics held a dominant market position in the By Product Type Analysis segment of Extended Warranty Market, with a 45.2% share. Demand is driven by smartphones, laptops, and smart devices with shorter innovation cycles. As device prices rise, consumers increasingly prefer extended protection plans to manage post warranty repair expenses and ensure long term usability.

Home Appliances represent a stable sub segment, supported by washing machines, refrigerators, and air conditioners. Consequently, extended warranties help reduce long term maintenance uncertainty for households. Moreover, higher appliance complexity and replacement costs continue to encourage adoption of multi year service coverage, especially in urban residential settings.

Automotive extended warranties focus on mechanical and electronic component protection beyond standard coverage. As vehicles integrate advanced electronics, warranty extensions become relevant for long ownership cycles. Therefore, consumers view these plans as risk mitigation tools against unpredictable repair costs.

Industrial Equipment warranties address downtime risks for machinery and tools. Although adoption remains selective, extended coverage supports operational continuity. Others include niche products where warranty uptake is limited but gradually improving with awareness.

Service Provider Analysis

OEM dominates with 39.9% due to integrated offerings and strong brand trust.

In 2025, OEM held a dominant market position in the By Service Provider Analysis segment of Extended Warranty Market, with a 39.9% share. OEM provided warranties are perceived as reliable since they ensure original parts and authorized servicing. As a result, consumers often prefer manufacturer backed coverage at the point of purchase.

Retailers offer extended warranties as value added services to increase customer retention. These plans are bundled during checkout, making adoption convenient. Consequently, retailers leverage warranties to enhance margins and post sale engagement.

Insurers and brokers provide flexible coverage models with broader risk pooling. Their offerings emphasize affordability and customization. Meanwhile, third party administrators manage claims and servicing, supporting scalability across multiple brands and product categories.

End-user Analysis

Individual Consumers dominate with 79.3% due to high personal ownership of insured products.

In 2025, Individual Consumers held a dominant market position in the By End-user Analysis segment of Extended Warranty Market, with a 79.3% share. High ownership of electronics and appliances drives personal demand. Additionally, consumers prioritize predictable repair costs and convenience.

Commercial and fleet users adopt warranties selectively for cost control and asset protection. These users focus on operational efficiency and downtime reduction. However, adoption remains lower compared to individuals due to in house maintenance capabilities.

Distribution Channel Analysis

Online dominates with 62.3% due to digital purchasing behavior and ease of comparison.

In 2025, Online held a dominant market position in the By Distribution Channel Analysis segment of Extended Warranty Market, with a 62.3% share. Digital platforms enable instant purchase, transparent terms, and price comparison. As e commerce expands, online warranty attachment rates continue to increase.

Offline channels include in store purchases and direct sales interactions. These channels rely on sales personnel recommendations and trust based selling. Although growth is slower, offline distribution remains relevant for high value products and less digitally engaged consumers.

Key Market Segments

By Product Type

- Consumer Electronics

- Home Appliances

- Automotive

- Industrial Equipment

- Others

By Service Provider

- OEM

- Retailer

- Insurer/Broker

- Third-party Administrator

By End-user

- Individual Consumers

- Commercial/Fleet

By Distribution Channel

- Online

- Offline

Drivers

Rising Ownership of High-Value Consumer Electronics and Smart Appliances Drives Market Growth

The extended warranty market is strongly supported by the rising ownership of high-value consumer electronics and smart appliances. Products such as smart TVs, premium smartphones, connected refrigerators, and advanced washing machines carry higher upfront costs, making consumers more cautious about long-term protection. As device prices increase, buyers increasingly view extended warranties as a practical way to protect their investment beyond the standard warranty period.

Another key driver is the increasing repair cost linked to advanced embedded technologies. Modern devices rely on sensors, software, and integrated circuits that are expensive to diagnose and replace. consumers recognize that a single out-of-warranty repair can equal a large portion of the product’s original price, encouraging early warranty adoption.

Growing preference for predictable post-purchase expenses also supports market demand. Extended warranties allow users to avoid sudden repair bills by paying a fixed, known cost upfront. This aligns well with household budgeting behavior, especially for families managing multiple electronic devices.

In addition, OEM-led protection bundling strategies are expanding rapidly. Manufacturers and retailers increasingly bundle extended warranties at the point of sale, simplifying decisions and improving attachment rates. This integrated approach reduces friction and makes extended protection feel like a standard part of ownership.

Restraints

Low Consumer Awareness in Price-Sensitive Emerging Markets Restrains Market Expansion

One of the major restraints in the extended warranty market is low consumer awareness in price-sensitive emerging markets. Many buyers in these regions focus primarily on upfront product cost and remain unfamiliar with the long-term financial benefits of extended coverage. As a result, warranties are often perceived as optional or unnecessary add-ons rather than risk management tools.

Complex claim processes further reduce customer trust and adoption. From an analyst perspective, lengthy documentation, unclear coverage terms, and slow claim approvals create negative customer experiences. These issues weaken confidence and discourage repeat purchases or recommendations.

Another challenge is limited transparency around what is covered and what is excluded. Consumers may only realize coverage gaps when a claim is rejected, leading to dissatisfaction. This experience spreads through word of mouth and impacts overall market perception.

Additionally, fragmented service networks in some regions make it harder to deliver consistent repair quality. When customers face delays or inconsistent service outcomes, the perceived value of an extended warranty declines. Together, low awareness and trust-related issues continue to limit adoption, especially outside mature markets.

Growth Factors

Rapid Penetration of Electric and Connected Vehicles Creates Strong Growth Opportunities

The rapid penetration of electric and connected vehicles presents a major growth opportunity for the extended warranty market. These vehicles rely heavily on batteries, software, and electronic components that are costly to repair or replace. Extended warranties help owners manage long-term ownership risks in a fast-evolving technology environment.

Integration of extended warranties with subscription-based service models is another promising opportunity. Consumers are increasingly comfortable with monthly or annual subscriptions for mobility, electronics, and services. Bundling warranties into these plans simplifies payments and improves customer retention.

Growing demand from small commercial and fleet operators also supports market expansion. Businesses depend on asset uptime and predictable maintenance costs. Extended warranties help fleet managers control expenses, reduce downtime, and plan budgets more effectively.

Expansion of digital sales platforms and embedded insurance further enhances growth prospects. Online purchases and in-app warranty offers allow protection plans to be added seamlessly at checkout. This digital-first approach improves reach, convenience, and conversion rates across consumer and commercial segments.

Emerging Trends

Shift Toward AI-Driven Claims Management and Risk Assessment Shapes Market Trends

A key trending factor in the extended warranty market is the shift toward AI-driven claims management and risk assessment. AI tools help providers detect fraud, assess failure risk, and speed up claim approvals. From an analyst viewpoint, this improves efficiency while reducing operational costs.

Increasing adoption of paperless and app-based warranty management is also reshaping customer experience. Digital platforms allow users to register products, track coverage, and file claims easily. This convenience improves engagement and satisfaction, especially among younger consumers.

Strategic partnerships between OEMs and insurtech providers are becoming more common. These collaborations combine product knowledge with advanced insurance technology, resulting in better pricing, coverage design, and service delivery.

Customizable coverage plans based on usage and device lifecycle are another important trend. Instead of one-size-fits-all policies, providers now offer flexible plans tailored to how products are used. This personalization increases perceived value and supports higher adoption across diverse customer segments.

Regional Analysis

North America Dominates the Extended Warranty Market with a Market Share of 45.8%, Valued at USD 71.3 billion

North America represents the leading regional market for extended warranties, supported by high penetration of premium consumer electronics, vehicles, and home appliances. In 2025, the region accounted for a dominant 45.8% share, reaching a value of USD 71.3 billion, reflecting strong consumer acceptance of protection plans. High awareness levels, well-structured service networks, and widespread OEM bundling strategies continue to support sustained adoption. Additionally, predictable repair cost coverage aligns well with mature consumer financing and credit-based purchasing behavior across the region.

Europe Extended Warranty Market Trends

Europe shows steady growth in the extended warranty market, driven by rising ownership of technologically advanced appliances and automobiles. Consumers across the region demonstrate a strong preference for risk mitigation and cost predictability over the product lifecycle. Strict consumer protection regulations also encourage transparent warranty structures, supporting long-term trust. Growth is further supported by increasing digital sales of protection plans across retail and online channels.

Asia Pacific Extended Warranty Market Trends

Asia Pacific is emerging as a high-growth region for extended warranties due to rapid urbanization and rising disposable incomes. Increasing adoption of smartphones, smart appliances, and electric vehicles is expanding the addressable base for warranty services. Although awareness levels vary by country, improving retail financing and digital distribution are strengthening market penetration. Over time, rising repair costs are expected to further accelerate adoption.

Middle East and Africa Extended Warranty Market Trends

The Middle East and Africa market is gradually expanding, supported by growing demand for consumer electronics and imported vehicles. Extended warranties are gaining traction among higher-income consumer segments seeking protection against expensive replacement parts. However, adoption remains selective due to limited awareness in some markets. Ongoing retail modernization and expansion of authorized service centers are improving long-term growth prospects.

Latin America Extended Warranty Market Trends

Latin America presents moderate growth opportunities for the extended warranty market, driven by increasing appliance and vehicle ownership in urban areas. Consumers show rising interest in managing post-purchase expenses amid economic volatility. Retailer-led warranty offerings and installment-based payment models are supporting adoption. Over time, improving digital sales platforms are expected to enhance regional market accessibility.

U.S Extended Warranty Market Trends

The U.S represents the largest national market within North America, supported by strong consumer awareness and high-value product ownership. Extended warranties are widely adopted across electronics, vehicles, and home systems due to elevated repair costs. Subscription-based protection plans and digital claim management are further enhancing customer engagement. The market continues to benefit from a mature service ecosystem and strong post-sale support infrastructure.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Extended Warranty Company Insights

AIG Inc. remains a pivotal player in the global Extended Warranty Market with its strong financial backing and extensive risk management expertise. The company’s product diversification across automotive, electronics, and appliance segments is expected to support resilient revenue streams, while strategic partnerships and digital policy servicing enhancements are projected to improve customer retention and operational efficiency through data-driven warranty solutions.

Assurant Inc. is anticipated to continue leveraging its global footprint and deep insurer relationships to expand its warranty offerings, particularly in consumer electronics and connected devices. Investment in predictive analytics and customer experience platforms is expected to differentiate its service delivery, supporting sustainable growth and reinforcing its position amidst increasing competition from technology-enabled warranty providers.

Allianz Partners is projected to strengthen its market presence through a focus on integrated protection plans and cross-sell opportunities with travel, health, and lifestyle products. The company’s emphasis on customer service excellence and innovation in claims processing is expected to enhance policyholder satisfaction, while its global scale supports robust distribution channels that can adapt quickly to emerging extended warranty trends.

Asurion, LLC is forecasted to benefit from its technology-centric approach and strong relationships with major retailers and device manufacturers. The company’s investments in AI-driven claim automation and seamless omnichannel support are anticipated to drive operational performance and customer loyalty. Asurion’s ability to offer tailored protection plans that align with evolving consumer preferences positions it well for continued leadership in the extended warranty space.

Top Key Players in the Market

- AIG Inc.

- Assurant Inc.

- Allianz Partners

- Asurion, LLC

- Domestic & General Group Limited

- AmTrust Financial Services, Inc.

- MAPFRE Warranty

- Endurance Warranty Services, LLC

- CARCHEX, LLC

- CarShield

Recent Developments

- In February 2025, the acquisition enhanced iA Financial Group’s access to established dealer relationships and a diversified warranty portfolio. This move supported the company’s long-term strategy to scale its specialty insurance and vehicle protection solutions across Canada.

Report Scope

Report Features Description Market Value (2025) USD 155.7 Billion Forecast Revenue (2035) USD 339.3 Billion CAGR (2026-2035) 8.1% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Consumer Electronics, Home Appliances, Automotive, Industrial Equipment, Others), By Service Provider (OEM, Retailer, Insurer/Broker, Third-party Administrator), By End-user (Individual Consumers, Commercial/Fleet), By Distribution Channel (Online, Offline) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape AIG Inc., Assurant Inc., Allianz Partners, Asurion, LLC, Domestic & General Group Limited, AmTrust Financial Services, Inc., MAPFRE Warranty, Endurance Warranty Services, LLC, CARCHEX, LLC, CarShield Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AIG Inc.

- Assurant Inc.

- Allianz Partners

- Asurion, LLC

- Domestic & General Group Limited

- AmTrust Financial Services, Inc.

- MAPFRE Warranty

- Endurance Warranty Services, LLC

- CARCHEX, LLC

- CarShield