Global Express Delivery Market Size, Share, Growth Analysis By Business (Business to Business (B2B), Business to Customer (B2C)), By Destination (Domestic, International), By Service Level (Same day Delivery, Next day Delivery, Two day Delivery, Expedited Delivery), By End User (E commerce platforms, Document service, Retail, Manufacturing and industrial, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170684

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

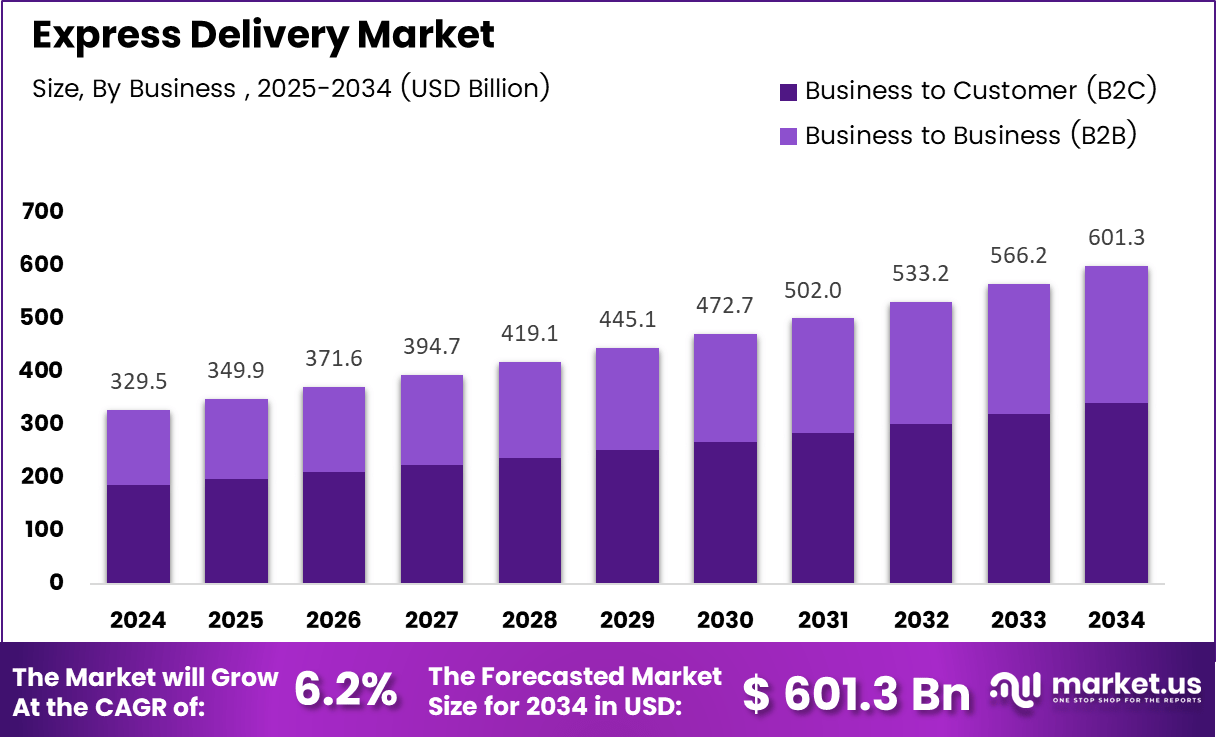

The Global Express Delivery Market size is expected to be worth around USD 601.3 billion by 2034, from USD 329.5 billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034.

The Express Delivery Market refers to logistics and fulfillment services designed to move goods within compressed timeframes, typically same day or 24 to 48 hours. This market supports time sensitive commerce by integrating warehousing, routing, and last mile optimization. Consequently, express delivery has become essential to modern digital and omnichannel retail ecosystems.

From a growth perspective, the express delivery market is expanding alongside rapid e commerce penetration and changing consumer expectations. As customers increasingly value speed and reliability, businesses are prioritizing faster delivery commitments. Therefore, express delivery services are being positioned as revenue enablers rather than cost centers across multiple product categories.

Moreover, rising urbanization and smartphone usage are accelerating demand for on demand logistics solutions. As a result, express delivery is increasingly linked with impulse purchasing, festive sales, and subscription commerce. This shift improves customer lifetime value while reducing shopping cart abandonment across digital platforms offering rapid fulfillment options.

In terms of opportunity, express delivery providers are expanding beyond groceries into electronics, beauty products, and seasonal gift assortments. Consequently, higher basket values and cross category fulfillment are becoming feasible. This diversification strengthens unit economics and improves asset utilization across express delivery networks operating in dense and emerging urban clusters.

Government investment and regulatory support are also shaping market expansion. Policymakers are investing in digital infrastructure, road connectivity, and logistics modernization programs. As a result, express delivery operators benefit from improved transit efficiency and standardized compliance frameworks. Additionally, labor and vehicle regulations increasingly emphasize safety, traceability, and service reliability.

According to industry studies, offering 24 to 48 hour delivery significantly increases customer confidence and reduces shopping cart abandonment. These findings highlight the direct correlation between delivery speed and conversion rates. Therefore, express delivery is increasingly embedded into checkout strategies as a demand stimulation lever.

According to a company service announcement, a rapid delivery model currently covers 19 cities and over 3,000 pin codes, operating 24×7 during peak seasons. Furthermore, adoption is strong across Tier II and emerging cities such as Ambala, Guwahati, Jaipur, Lucknow, Kanpur, and Patna. This trend reflects broad based market scalability beyond metropolitan areas.

Key Takeaways

- The global Express Delivery Market is projected to grow from USD 329.5 billion in 2024 to USD 601.3 billion by 2034, expanding at a 6.2% CAGR.

- By business model, Business to Business dominates the market with a share of 56.9%, reflecting strong demand for time critical commercial shipments.

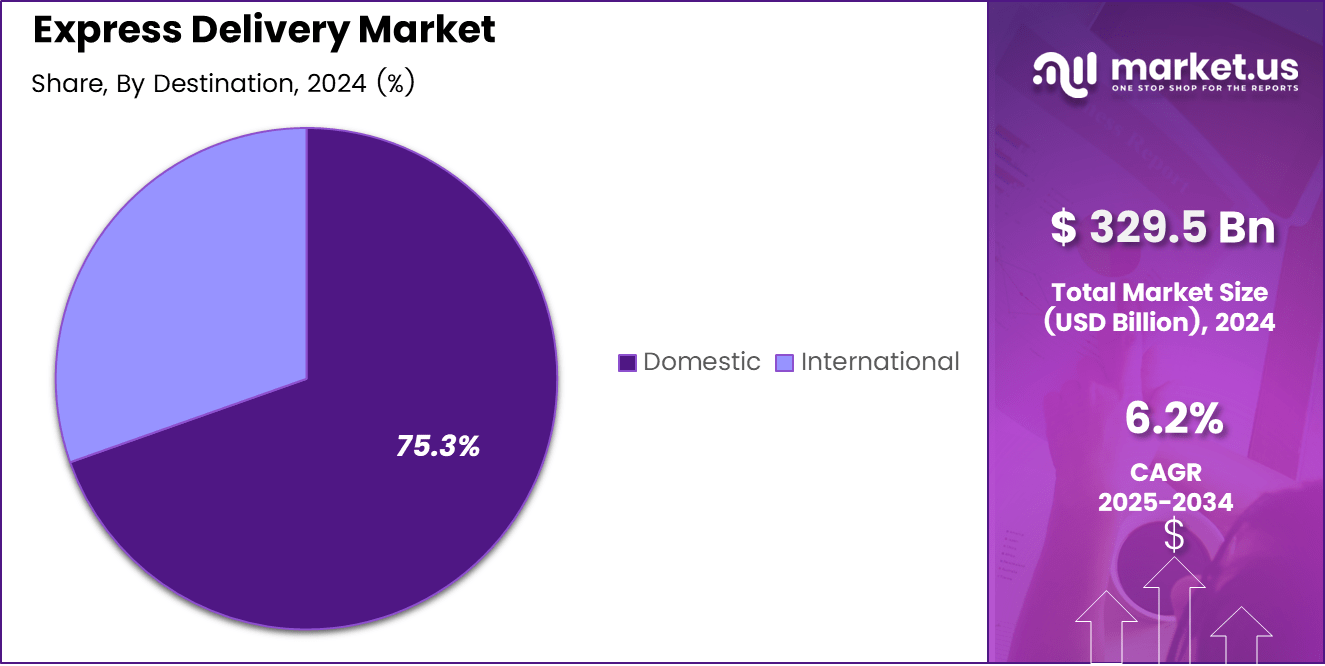

- By destination, Domestic deliveries lead with a market share of 75.3%, supported by dense urban networks and high intra country shipment volumes.

- By service level, Next day Delivery holds the largest share at 37.2%, driven by its balance of speed, cost efficiency, and scalability.

- By end user, E commerce platforms account for a dominant 42.7% share, fueled by rising online orders and rapid fulfillment expectations.

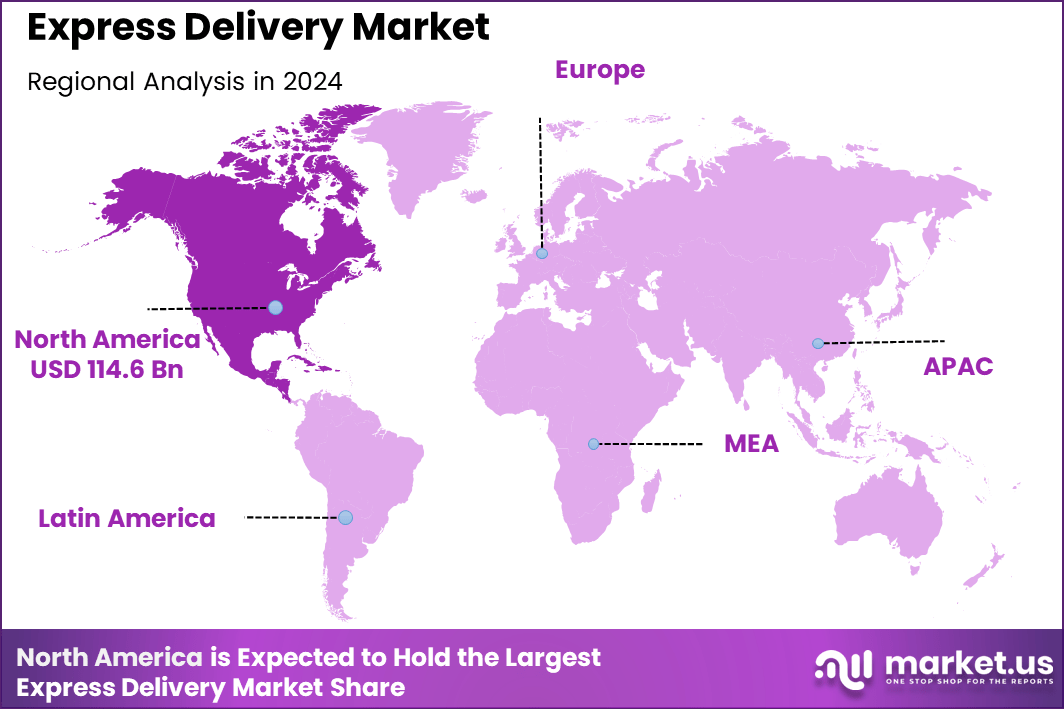

- Regionally, North America leads the Express Delivery Market with a share of 34.8%, valued at USD 114.6 billion.

By Business Analysis

Business to Business (B2B) dominates with 56.9% due to contracted volumes, planned routes, and service level commitments.

In 2024, Business to Business (B2B) held a dominant market position in the By Business Analysis segment of Express Delivery Market, with a 56.9% share. This leadership is supported by recurring dispatches between manufacturers, distributors, and enterprises. Moreover, B2B buyers prioritize reliability, traceability, and pickup scheduling, which strengthens long term relationships. Consequently, carriers optimize networks around predictable lanes and bulk shipments, improving asset utilization and delivery consistency. Additionally, account based pricing and integrated logistics contracts keep B2B demand steady across cycles.

Business to Customer (B2C) supports direct shipments to households and individual recipients, driven by convenience and fast delivery expectations. Meanwhile, service quality depends heavily on last mile reach, customer communication, and delivery experience. As online shopping behaviors expand, B2C volumes rise across parcels, lifestyle goods, and everyday essentials. Additionally, flexible delivery options such as rescheduling and proof of delivery improve satisfaction. Consequently, operators invest in route density, delivery partners, and customer support to manage higher drop counts and address variability in demand.

By Destination Analysis

Domestic dominates with 75.3% due to dense networks, shorter transit distances, and easier coordination across local hubs.

In 2024, Domestic held a dominant market position in the By Destination Analysis segment of Express Delivery Market, with a 75.3% share. This strength comes from frequent intra country shipments supported by established sorting centers and wide last mile coverage. Moreover, domestic movements face fewer cross border handoffs, enabling faster dispatch planning and better delivery predictability. Consequently, businesses use domestic express for replenishment, customer orders, and urgent documents. Additionally, localized return flows are simpler, which supports smoother reverse logistics and repeat purchasing.

International shipments address cross border commerce where speed and compliance are equally important. Meanwhile, performance depends on customs readiness, documentation accuracy, and coordination with global partners. Additionally, variations in regulations and duty processes shape transit timelines. Consequently, shippers choose international express for high urgency items, time critical samples, and premium orders where tracking visibility matters. Moreover, service reliability improves when carriers provide end to end clearance support and proactive exception management, helping reduce delivery uncertainty and protect customer experience across countries.

By Service Level Analysis

Next day Delivery dominates with 37.2% as it balances speed, cost, and network efficiency for a wide range of shipments.

Same day Delivery focuses on urgent, local, and high priority consignments where delivery timing is critical. Moreover, it relies on dense urban coverage, rapid order processing, and flexible rider availability. Consequently, service quality depends on real time routing, pickup discipline, and customer coordination. Additionally, same day is commonly selected for immediate needs and business critical items.

In 2024, Next day Delivery held a dominant market position in the By Service Level Analysis segment of Express Delivery Market, with a 37.2% share. This option is widely used because it delivers fast outcomes without the operational intensity of same day models. Moreover, next day aligns with standard sorting cycles and overnight line haul networks. Consequently, it supports consistent service commitments for both business shipments and consumer parcels.

Two day Delivery serves customers seeking dependable timelines with broader geographic coverage and steadier network planning. Meanwhile, it enables carriers to consolidate loads and use optimized line haul schedules. Additionally, two day service suits non urgent shipments where tracking and reliability remain important. Consequently, it supports cost efficient delivery while maintaining predictable customer expectations across regions.

Expedited Delivery covers priority handling that accelerates movement compared with standard services, often using preferred routing and faster processing. Moreover, it is used when shipment urgency is high but not strictly tied to same day timing. Consequently, operators allocate capacity and monitoring to reduce delays. Additionally, expedited options attract shippers needing quicker completion across wider service areas.

By End-User Analysis

E commerce platforms dominate with 42.7% because high parcel volumes and fast delivery promises require reliable express networks.

In 2024, E commerce platforms held a dominant market position in the By End User Analysis segment of Express Delivery Market, with a 42.7% share. This dominance is driven by frequent consumer orders, high shipment density, and constant demand for tracking visibility. Moreover, platform led promotions and rapid fulfillment expectations increase express usage. Consequently, delivery performance becomes central to customer retention and repeat purchases.

Document service relies on express delivery for time sensitive paperwork, contracts, and compliance related submissions. Meanwhile, senders value chain of custody, proof of delivery, and secure handling. Additionally, predictable pickup and delivery windows reduce operational risk for legal and administrative processes. Consequently, express providers emphasize scanning, tracking, and recipient confirmation to support confidence in document movement.

Retail uses express delivery to support store replenishment, customer home delivery, and omnichannel fulfillment. Moreover, quick shipping helps retailers meet competitive service expectations and reduce cart abandonment pressures. Consequently, retailers prioritize service reliability, returns handling, and delivery experience. Additionally, express partners enable faster inventory balancing across locations, supporting smoother sales continuity and improved customer satisfaction.

Manufacturing and industrial end users depend on express services for critical parts, maintenance items, and production support shipments. Meanwhile, delays can disrupt operations, so dependable transit and tracking matter. Additionally, scheduled pickups and delivery coordination help manage supply continuity. Consequently, express logistics becomes a support layer for uptime, quality control workflows, and urgent inter facility movements.

Others includes diverse users with varying shipment profiles, such as small businesses and service providers. Moreover, this group values flexible service options, accessible pickup points, and transparent tracking. Consequently, demand patterns can be uneven across seasons and locations. Additionally, express carriers improve coverage through partner networks and customer support, helping serve mixed shipment types consistently.

Key Market Segments

By Business

- Business to Business (B2B)

- Business to Customer (B2C)

By Destination

- Domestic

- International

By Service Level

- Same day Delivery

- Next day Delivery

- Two day Delivery

- Expedited Delivery

By End User

- E commerce platforms

- Document service

- Retail

- Manufacturing and industrial

- Others

Drivers

Rapid Expansion of Same Day and Next Day Fulfillment Expectations Drives Market Growth

The express delivery market is strongly driven by the rapid expansion of same day and next day fulfillment expectations across e commerce platforms. Consumers increasingly associate faster delivery with service quality and brand reliability. As a result, retailers are redesigning fulfillment strategies to meet compressed delivery timelines.

Rising demand for time sensitive deliveries in healthcare, food, and critical documents further accelerates market growth. Medicines, diagnostic samples, fresh food, and legal paperwork require speed and reliability. Therefore, express delivery services are becoming essential infrastructure for sectors where delays directly affect outcomes.

Increasing urbanization also supports this growth driver. As cities become more densely populated, last mile delivery networks operate more efficiently. Shorter distances between fulfillment centers and consumers improve delivery speed, reduce costs per drop, and support higher order volumes.

Additionally, the growth of cross border trade is increasing demand for faster international shipping solutions. Businesses engaged in global commerce need predictable transit times to remain competitive. Consequently, express delivery services are evolving to support quicker customs processing and international fulfillment.

Restraints

High Operational Costs Linked to Fuel Price Volatility Restrain Market Expansion

High operational costs remain a major restraint for the express delivery market. Fuel price volatility directly impacts transportation expenses, while labor intensive last mile operations increase overall cost pressure. As a result, maintaining profitability becomes challenging, especially for time critical services.

Infrastructure bottlenecks and traffic congestion further affect delivery timelines. Urban road limitations, peak hour traffic, and inadequate logistics infrastructure reduce route efficiency. Therefore, meeting strict delivery commitments becomes difficult, particularly in high density metropolitan areas.

Regulatory restrictions on urban freight movement also act as a restraint. Many cities enforce delivery time windows, vehicle restrictions, and environmental compliance norms. While these policies aim to reduce congestion and emissions, they limit operational flexibility for express delivery providers.

Additionally, compliance requirements increase administrative costs and slow down service expansion. Smaller operators face greater challenges adapting to regulatory changes. Consequently, cost pressures and infrastructure constraints collectively restrain the pace of express delivery market growth.

Growth Factors

Integration of Automation and AI for Route Optimization Creates New Growth Opportunities

The integration of automation and AI presents strong growth opportunities in the express delivery market. Route optimization, demand forecasting, and delivery scheduling technologies improve operational efficiency. As a result, companies can reduce delays while controlling fuel and labor costs.

Expansion of express delivery services in tier two and tier three cities is another major opportunity. Growing internet penetration and digital commerce adoption in these regions are increasing demand for faster deliveries. Therefore, operators can unlock new volumes beyond major metropolitan areas.

Rising adoption of premium delivery services by SMEs and D2C brands further supports market expansion. Smaller businesses increasingly use express delivery to compete with larger players. Faster shipping improves customer satisfaction and brand differentiation.

Additionally, flexible pricing models and subscription based delivery services are gaining traction. These offerings allow businesses to scale delivery speed based on customer demand. Consequently, express delivery is evolving into a value added service rather than a basic logistics function.

Emerging Trends

Increasing Use of Micro Fulfillment Centers Shapes Market Trends

The express delivery market is witnessing growing use of micro fulfillment centers to shorten delivery distances. These smaller facilities are located closer to consumers, enabling faster order processing. As a result, delivery times are reduced while last mile efficiency improves.

Growing adoption of real time tracking and predictive delivery notifications is another key trend. Customers increasingly expect visibility into order status and delivery timing. Therefore, technology driven transparency is becoming a standard feature in express delivery services.

There is also a shift toward contactless and locker based delivery solutions. These models improve convenience, reduce failed deliveries, and support urban space optimization. Consequently, alternative delivery formats are gaining acceptance among both consumers and businesses.

Strategic partnerships between express carriers and digital commerce platforms further define current trends. Collaboration improves integration between ordering, fulfillment, and delivery systems. As a result, express delivery services are becoming more embedded within digital commerce ecosystems.

Regional Analysis

North America Dominates the Express Delivery Market with a Market Share of 34.8%, Valued at USD 114.6 Billion

North America represents the leading region in the Express Delivery Market, supported by a mature e commerce ecosystem and strong consumer preference for fast shipping. The region accounted for a dominant share of 34.8%, with market value reaching USD 114.6 Billion, reflecting high shipment volumes across retail, healthcare, and business logistics. Advanced digital infrastructure, widespread adoption of same day and next day delivery, and efficient last mile networks continue to strengthen regional performance. In addition, strong logistics investments and high purchasing power sustain consistent demand for premium delivery services.

Europe Express Delivery Market Trends

Europe demonstrates steady growth in express delivery driven by cross border trade within the region and expanding online retail penetration. Dense urban populations and established transportation networks support efficient parcel movement across countries. Regulatory focus on sustainability is encouraging optimized routing and alternative delivery models, shaping service innovation. Demand from healthcare logistics and business shipments also contributes to regional market stability.

Asia Pacific Express Delivery Market Trends

Asia Pacific is emerging as a high growth region due to rapid urbanization, expanding middle class populations, and rising smartphone based commerce. Increasing same day delivery expectations in major metropolitan areas are accelerating network expansion. Strong manufacturing output and export activity further support express delivery demand. Ongoing investments in logistics infrastructure are enhancing regional delivery speed and reliability.

Middle East and Africa Express Delivery Market Trends

The Middle East and Africa region is witnessing gradual expansion as digital commerce adoption improves across key economies. Growth is supported by rising international trade volumes and increasing demand for time sensitive shipments. Urban development and logistics hub investments are improving delivery reach. However, infrastructure gaps in certain areas continue to influence market maturity.

Latin America Express Delivery Market Trends

Latin America shows moderate growth in the express delivery market, driven by improving e commerce penetration and cross border shipping activity. Urban concentration supports express services in major cities, while regional players focus on expanding last mile capabilities. Digital payment adoption and consumer preference for faster delivery are strengthening market momentum. Continued infrastructure development is expected to support long term growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Express Delivery Company Insights

global Express Delivery Market in 2024 is shaped by players that combine scale, technology integration, and network reliability. Leading companies are focusing on speed optimization, cross border connectivity, and value added logistics to address rising same day and next day delivery expectations. Strategic investments in digital platforms, automation, and route optimization are central to maintaining service efficiency amid rising shipment volumes.

Aramex International LLC is recognized for its strong presence across emerging markets, particularly in the Middle East, Asia, and parts of Africa. Its analyst appeal lies in flexible last mile models and growing cross border e commerce solutions tailored to regional trade corridors.

C.H. Robinson Worldwide Inc. brings a freight centric advantage to express delivery through advanced logistics orchestration and data driven network optimization. Analysts view its integrated approach as effective in supporting time critical B2B and hybrid express freight movements.

DHL International GmbH remains a benchmark player due to its extensive global air and ground express network. Its continued focus on digital shipment visibility, customs expertise, and premium international express services reinforces its leadership position in 2024.

FedEx Corporation is valued from an analyst perspective for its strong air express infrastructure and reliable time definite delivery capabilities. Ongoing investments in automation, network efficiency, and service differentiation support its competitiveness across domestic and international express segments.

Top Key Players in the Market

- Aramex International LLC

- C.H. Robinson Worldwide Inc.

- DHL International GmbH

- FedEx Corporation

- Geodis

- OnTrac

- Schenker AG

- SF Express (Group) Co. Ltd.

- United Parcel Service Inc.

- Yamato Holdings Co. Ltd.

Recent Developments

- In Apr 2025, Delhivery announced a ₹14.07 billion all cash acquisition of Ecom Express, covering its assets, team, and delivery network. The acquisition significantly expands Delhivery’s logistics scale, strengthens last mile delivery capabilities, and enhances service reach across India’s e commerce and parcel distribution ecosystem.

Report Scope

Report Features Description Market Value (2024) USD 329.5 billion Forecast Revenue (2034) USD 601.3 billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Business (Business to Business (B2B), Business to Customer (B2C)), By Destination (Domestic, International), By Service Level (Same day Delivery, Next day Delivery, Two day Delivery, Expedited Delivery), By End User (E commerce platforms, Document service, Retail, Manufacturing and industrial, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Aramex International LLC, C.H. Robinson Worldwide Inc., DHL International GmbH, FedEx Corporation, Geodis, OnTrac, Schenker AG, SF Express (Group) Co. Ltd., United Parcel Service Inc., Yamato Holdings Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aramex International LLC

- C.H. Robinson Worldwide Inc.

- DHL International GmbH

- FedEx Corporation

- Geodis

- OnTrac

- Schenker AG

- SF Express (Group) Co. Ltd.

- United Parcel Service Inc.

- Yamato Holdings Co. Ltd.