Global Event Logistics Market Size, Share, Growth Analysis By Type (Distribution Systems, Inventory Management, Freight Forwarding), By Event Size (Small (up to 500 attendees), Medium (500 to 2,000 attendees), Large (2,000 to 10,000 attendees), Mega (over 10,000 attendees)), By Application (Entertainment and Media, Sports Event, Trade Fair & Corporate Events, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170570

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

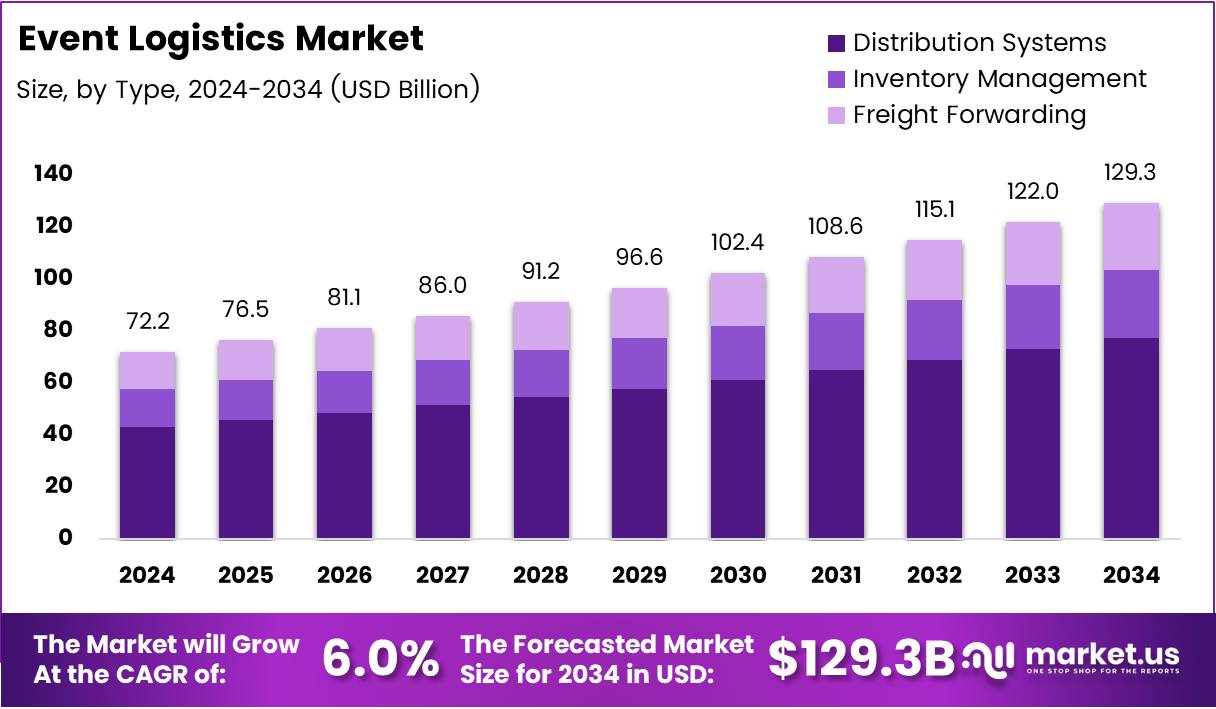

The global Event Logistics Market is projected to reach approximately USD 129.3 billion by 2034, up from USD 72.2 billion in 2024, expanding at a CAGR of 6.0% during the forecast period from 2025 to 2034. This sector encompasses specialized transportation, warehousing, inventory management, and coordination services designed specifically for temporary events ranging from corporate conferences to large-scale entertainment festivals.

Event logistics serves as the backbone of successful event execution worldwide. Unlike traditional supply chain operations, this market demands time-sensitive coordination, flexible infrastructure deployment, and seamless multi-location synchronization. Companies operating in this space manage everything from equipment transportation to on-site installation and post-event dismantling.

The market is experiencing robust growth driven by increasing globalization of business activities. Corporate conferences, international trade shows, and experiential marketing campaigns continue to proliferate across major business hubs. Additionally, the live entertainment industry has rebounded significantly, creating sustained demand for specialized logistics providers who can handle complex audiovisual equipment and stage infrastructure.

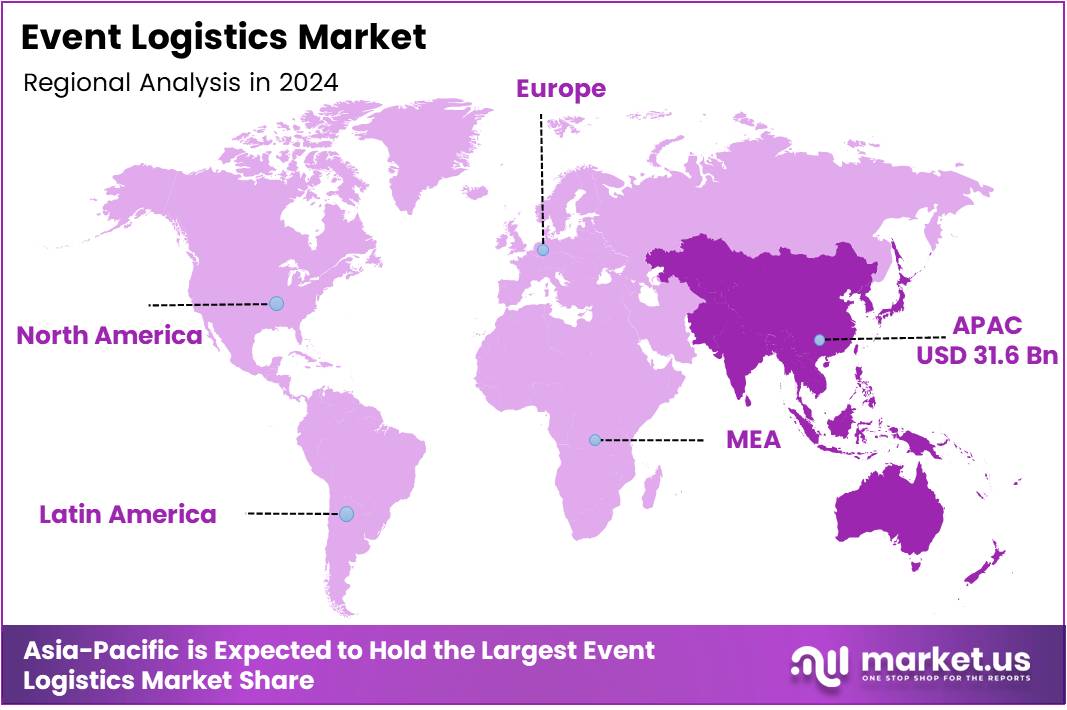

Emerging economies across Asia-Pacific, the Middle East, and Africa represent significant expansion opportunities. These regions are witnessing rising investments in convention centers, sports stadiums, and cultural venues. Furthermore, governments are actively promoting tourism and international business events, leading to improved infrastructure and streamlined regulatory frameworks that facilitate cross-border event logistics operations.

Technological integration is reshaping operational efficiency within the sector. Digital tracking systems, RFID technology, and real-time visibility platforms enable better asset management and coordination. Simultaneously, sustainability concerns are pushing providers toward carbon-neutral transport solutions, reusable event structures, and eco-friendly packaging materials that reduce environmental impact while maintaining operational excellence.

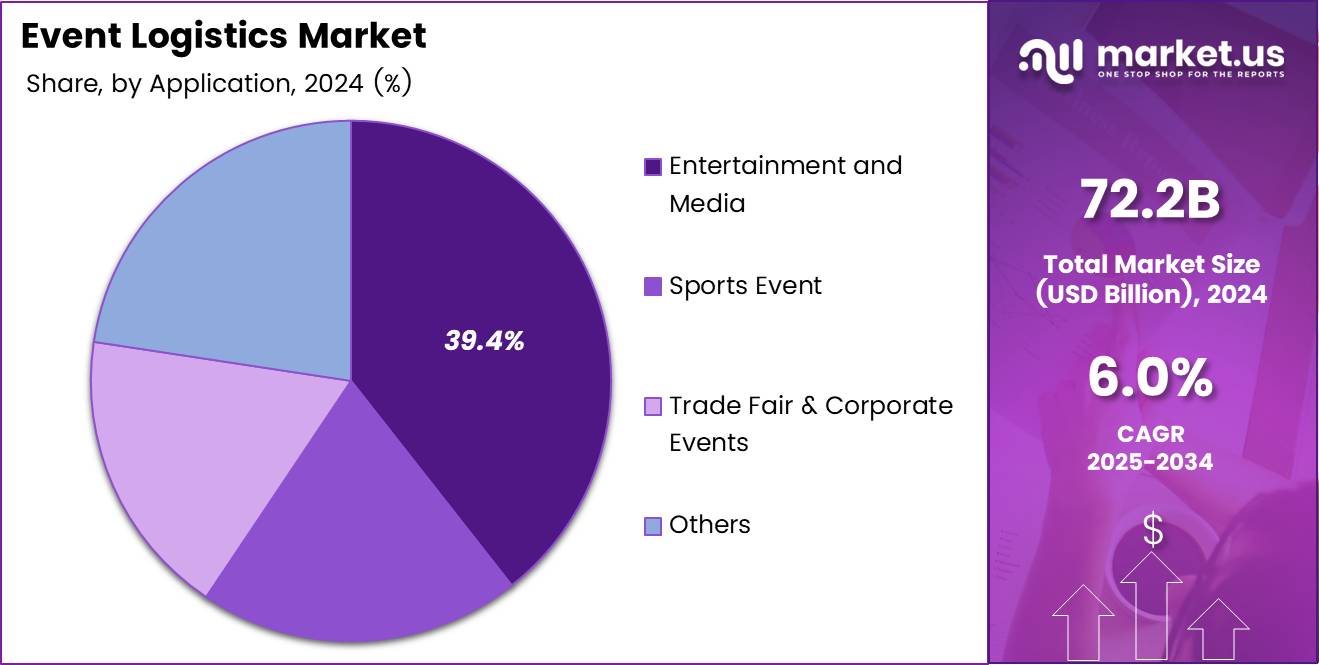

According to industry data, the Asia-Pacific region dominates the market with 43.9% share, valued at USD 31.6 billion. This regional leadership stems from rapid urbanization, growing middle-class populations, and substantial government investments in infrastructure development. Distribution systems currently represent the largest service type, commanding 44.7% of the market, while entertainment and media applications hold 39.4% share, reflecting strong demand from content production and live performance sectors.

Key Takeaways

- Global Event Logistics Market expected to grow from USD 72.2 billion in 2024 to USD 129.3 billion by 2034 at 6.0% CAGR.

- Asia-Pacific region leads with 43.9% market share, valued at USD 31.6 billion.

- Distribution Systems segment dominates by type with 44.7% market share.

- Medium events (500-2,000 attendees) hold largest share at 38.9% by event size.

- Entertainment and Media application segment commands 39.4% market share.

Type Analysis

Distribution Systems dominate with 44.7% due to critical role in equipment movement and venue delivery coordination.

In 2024, Distribution Systems held a dominant market position in the By Type segment of Event Logistics Market, with 44.7% share. This segment encompasses the physical movement of event materials, equipment, and supplies from origin points to venues. Distribution networks must operate with precision timing, ensuring all components arrive synchronized for seamless event setup and execution.

Inventory Management represents another crucial service component within event logistics operations. This segment focuses on tracking, storing, and managing event assets throughout their lifecycle. Providers maintain temporary warehousing facilities near venues, enabling rapid deployment and retrieval. Advanced inventory systems utilize barcode scanning and digital cataloging to prevent loss or misplacement of high-value items during multi-location events.

Freight Forwarding completes the service portfolio by handling international shipments and customs clearance procedures. This segment becomes essential for global events requiring cross-border transportation of specialized equipment. Freight forwarders navigate complex regulatory requirements, arrange multi-modal transport, and ensure compliance with varying international standards, making them indispensable partners for event organizers operating across multiple countries.

Event Size Analysis

Medium events (500-2,000 attendees) dominate with 38.9% reflecting optimal balance between complexity and profitability.

In 2024, Medium events (500 to 2,000 attendees) held a dominant market position in the By Event Size segment of Event Logistics Market, with 38.9% share. This category represents corporate conferences, regional trade shows, and mid-scale concerts that require professional logistics coordination without mega-event complexity. Medium events offer consistent demand patterns and manageable operational requirements, making them attractive to logistics providers seeking stable revenue streams.

Small events (up to 500 attendees) constitute the foundational segment for many logistics providers. These intimate gatherings include corporate meetings, product launches, and local festivals requiring basic transportation and setup services. While individual contracts generate lower revenues, their frequency and geographic distribution provide steady business volumes. Providers often use small events as entry points for building client relationships that later expand into larger engagements.

Large events (2,000 to 10,000 attendees) demand sophisticated coordination and substantial resource deployment. This segment includes major conferences, music festivals, and sporting competitions requiring complex logistics infrastructure. Providers must manage multiple vendors, coordinate diverse equipment types, and maintain strict timelines. These events generate significant revenues but require specialized expertise and substantial upfront capital investment in equipment and personnel.

Mega events (over 10,000 attendees) represent the pinnacle of logistics complexity and scale. International sporting championships, global summits, and major entertainment festivals fall into this category. These events require months of advance planning, dedicated project teams, and extensive coordination with multiple stakeholders. Despite generating premium revenues, mega events carry higher operational risks and demand providers with proven track records in large-scale event execution and crisis management capabilities.

Application Analysis

Entertainment and Media dominates with 39.4% driven by live performance resurgence and content production growth.

In 2024, Entertainment and Media held a dominant market position in the By Application segment of Event Logistics Market, with 39.4% share. This segment encompasses concerts, award ceremonies, film productions, and broadcast events requiring specialized handling of audiovisual equipment. The resurgence of live entertainment post-pandemic has accelerated demand for logistics providers capable of managing complex technical requirements and tight production schedules across multiple venues.

Sports Events constitute a vital application segment requiring specialized logistics expertise. Major tournaments, league championships, and international competitions demand precise coordination of athletic equipment, broadcasting infrastructure, and spectator amenities. Logistics providers must navigate venue-specific requirements, manage tight timelines between matches, and ensure equipment reliability under high-pressure conditions. This segment values reliability and experience over cost considerations.

Trade Fair and Corporate Events represent business-focused applications demanding professional execution and reliability. This category includes industry exhibitions, corporate conferences, and B2B networking events where logistics failures directly impact business outcomes. Providers must coordinate booth installations, conference technology, and promotional materials while maintaining flexibility for last-minute changes. Corporate clients prioritize seamless execution and professional service standards that reflect positively on their brand reputation.

Others applications encompass diverse event types including cultural festivals, community gatherings, and governmental ceremonies. This residual category captures specialized niches requiring customized logistics solutions. While individually smaller, these events collectively contribute meaningful market volume and allow providers to demonstrate versatility across different event formats, building comprehensive service portfolios that attract diverse client bases seeking one-stop logistics solutions.

Key Market Segments

By Type

- Distribution Systems

- Inventory Management

- Freight Forwarding

By Event Size

- Small (up to 500 attendees)

- Medium (500 to 2,000 attendees)

- Large (2,000 to 10,000 attendees)

- Mega (over 10,000 attendees)

By Application

- Entertainment and Media

- Sports Event

- Trade Fair & Corporate Events

- Others

Drivers

Surge in Global Corporate Conferences and Experiential Marketing Events Drives Market Expansion

The proliferation of international business conferences and trade shows continues accelerating market growth substantially. Companies increasingly view in-person events as essential for relationship building, product demonstrations, and brand positioning. Consequently, corporate event budgets have expanded significantly, creating sustained demand for professional logistics coordination that ensures flawless execution and positive attendee experiences.

Experiential marketing campaigns have emerged as powerful brand engagement tools across industries. Organizations invest heavily in immersive pop-up experiences and interactive installations that require sophisticated logistics planning. These activations demand flexible coordination, rapid deployment capabilities, and creative problem-solving skills that specialized logistics providers uniquely offer, driving outsourcing trends and market expansion opportunities.

Rising demand for end-to-end logistics coordination across multi-city and international events reflects growing event complexity. Organizers increasingly prefer single-provider solutions that manage entire logistics chains from initial planning through final dismantling. This consolidation trend benefits established providers with comprehensive service portfolios and global operational networks capable of delivering consistent quality across diverse geographic locations simultaneously.

Growth of live entertainment, sports championships, and cultural festivals creates sustained demand for time-critical logistics services. These events operate under inflexible deadlines where delays cause significant financial losses and reputational damage. Specialized providers who understand entertainment industry requirements and can execute under pressure command premium pricing, contributing substantially to overall market revenue growth and profitability expansion.

Restraints

High Cost Volatility From Last-Minute Changes Challenges Profitability and Client Relationships

Event logistics providers face significant cost unpredictability stemming from last-minute transportation adjustments and on-site handling modifications. Clients frequently request changes as event dates approach, requiring providers to secure premium-priced rush services and deploy additional resources on short notice. These unplanned costs erode profit margins substantially, particularly when contracts lack adequate change-order provisions or penalty clauses.

Operational risks from permit delays, customs clearance complications, and regulatory non-compliance create substantial challenges. International events require navigating diverse regulatory frameworks where documentation errors or bureaucratic delays can prevent critical equipment from arriving on schedule. Such complications generate client dissatisfaction, financial penalties, and reputational damage that discourage market entry and limit expansion strategies for smaller providers lacking regulatory expertise.

The compressed timelines inherent in event logistics amplify operational pressures significantly. Unlike traditional supply chains with flexible delivery windows, events operate on fixed dates where delays are unacceptable. This time sensitivity forces providers to maintain excess capacity, pay premium rates for guaranteed services, and accept elevated risk levels that reduce profitability and make accurate cost forecasting extremely difficult for financial planning purposes.

Growth Factors

Expansion Into Emerging Markets Creates Substantial Revenue Opportunities Across Asia and Africa

Emerging economies across Asia-Pacific, the Middle East, and Africa present significant expansion opportunities for event logistics providers. These regions are experiencing rapid economic development, growing middle classes, and substantial investments in convention infrastructure. Governments actively promote tourism and international business events, creating favorable regulatory environments and improved transportation networks that facilitate market entry for experienced logistics operators seeking geographic diversification.

Integration of digital tracking technologies, RFID systems, and real-time visibility platforms transforms operational efficiency substantially. These innovations enable providers to monitor asset locations continuously, predict potential delays, and optimize resource allocation dynamically. Enhanced visibility reduces loss rates, improves client confidence, and enables premium service offerings that justify higher pricing while simultaneously lowering operational costs through improved utilization rates.

Rising demand for sustainable and carbon-neutral event logistics solutions creates differentiation opportunities for forward-thinking providers. Corporate clients increasingly prioritize environmental responsibility, seeking partners who offer green transport options, reusable event structures, and comprehensive sustainability reporting. Providers investing in electric vehicle fleets, renewable energy partnerships, and circular economy principles position themselves advantageously for long-term contracts with environmentally conscious multinational corporations.

Growing popularity of hybrid events and large-scale pop-up activations requires modular logistics models with enhanced flexibility. These event formats combine physical and digital components while operating across multiple locations simultaneously. Providers developing scalable solutions that adapt quickly to changing requirements and integrate physical logistics with digital coordination platforms capture emerging demand segments that traditional logistics models cannot adequately serve.

Emerging Trends

Adoption of Smart Warehousing Near Venues Transforms Event Logistics Operational Models

Temporary micro-fulfillment centers and smart warehousing facilities near major event venues are revolutionizing last-mile logistics efficiency. Providers establish pop-up storage hubs equipped with automated inventory systems that enable rapid deployment and retrieval of event assets. These facilities reduce transportation distances, lower costs, and provide flexibility for handling last-minute requests, significantly improving client satisfaction while optimizing operational resource utilization.

Data-driven planning for crowd flow management, asset placement, and load optimization enhances event execution quality substantially. Advanced analytics platforms process historical data, weather patterns, and real-time inputs to predict optimal logistics configurations. These insights enable providers to position resources proactively, prevent bottlenecks, and adjust operations dynamically, delivering superior outcomes that traditional planning methods cannot match consistently.

The shift toward eco-friendly packaging, reusable event structures, and green transport fleets reflects growing environmental consciousness across the industry. Providers are replacing single-use materials with durable alternatives, investing in electric and hybrid vehicles, and implementing comprehensive recycling programs. These sustainability initiatives meet client expectations, reduce long-term costs, and position companies favorably as environmental regulations tighten globally.

Growing reliance on specialized logistics for high-value audiovisual equipment and stage infrastructure creates premium service niches. Entertainment and broadcast events require handling of delicate, expensive technology with specialized packaging, climate control, and security protocols. Providers developing expertise in these technical requirements command premium pricing and build strong client relationships in the lucrative entertainment sector where equipment reliability directly impacts production success.

Regional Analysis

Asia-Pacific Dominates the Event Logistics Market with 43.9% Share, Valued at USD 31.6 Billion

The Asia-Pacific region leads the global Event Logistics Market with 43.9% market share, valued at USD 31.6 billion, driven by rapid urbanization and substantial infrastructure investments. Countries across this region are building world-class convention centers, sports stadiums, and entertainment venues that attract international events. Additionally, growing middle-class populations with increased discretionary spending fuel demand for concerts, festivals, and corporate gatherings requiring professional logistics coordination and sophisticated supply chain management.

North America Event Logistics Market Trends

North America maintains a mature and highly competitive event logistics landscape characterized by established providers and sophisticated client expectations. The region benefits from excellent transportation infrastructure, streamlined customs procedures, and a robust corporate events calendar. Major cities host numerous international conferences, trade shows, and entertainment productions that generate consistent demand for premium logistics services with emphasis on technology integration and sustainability practices.

Europe Event Logistics Market Trends

Europe represents a significant market with diverse event types spanning cultural festivals, sporting championships, and business conferences across multiple countries. The region’s logistics providers excel at managing cross-border operations within the European Union’s unified regulatory framework. Additionally, strong emphasis on environmental sustainability drives adoption of green logistics solutions, while historic venues and tight urban environments require specialized expertise in navigating complex operational constraints.

Middle East and Africa Event Logistics Market Trends

The Middle East and Africa region shows rapid growth potential fueled by government investments in tourism infrastructure and international event hosting. Gulf nations particularly are positioning themselves as global event destinations through mega-projects and hosting rights for major sporting championships. However, providers must navigate varying regulatory environments, infrastructure gaps in certain areas, and cultural considerations that influence operational approaches and service delivery models.

Latin America Event Logistics Market Trends

Latin America presents emerging opportunities driven by growing economies and increasing international event hosting across major cities. The region benefits from strong cultural traditions of festivals and celebrations that require logistics support. However, market development faces challenges including infrastructure limitations, regulatory complexity, and economic volatility that require providers to maintain operational flexibility and develop strong local partnerships for successful market penetration.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Event Logistics Company Insights

Agility operates as a global supply chain services provider with specialized event logistics capabilities across emerging markets, particularly strong in the Middle East and Asia-Pacific regions. The company leverages its extensive network and customs expertise to facilitate complex international event shipments efficiently.

C.H. Robinson Worldwide, Inc. brings comprehensive third-party logistics expertise to the event sector, utilizing its vast carrier network and technology platforms to coordinate multi-modal transportation solutions. Their data-driven approach optimizes routing and cost management for time-sensitive event deliveries globally.

DHL Group maintains market leadership through its dedicated events logistics division offering end-to-end solutions for major international conferences, sporting championships, and entertainment productions. Their global infrastructure and specialized handling capabilities serve high-profile clients requiring absolute reliability and premium service standards.

Kuehne+Nagel delivers integrated event logistics through its contract logistics and freight forwarding divisions, emphasizing technological innovation and sustainable solutions. The company’s expertise in complex project logistics translates effectively to large-scale event coordination requiring meticulous planning and execution excellence across multiple venues simultaneously.

Additional key players shaping the competitive landscape include CEVA Logistics, DB Schenker, FedEx, Rhenus Group, United Parcel Service of America Inc., and XPO Inc., each contributing specialized capabilities and geographic strengths that collectively advance industry standards and service innovation.

Key Companies

- Agility

- C.H. Robinson Worldwide, Inc.

- CEVA Logistics

- DB SCHENKER

- DHL Group

- FedEx

- Kuehne+Nagel

- Rhenus Group

- United Parcel Service Of America, Inc.

- XPO, Inc.

Recent Developments

- In February 2024, Rock-it Cargo acquired SOS Global to create the largest global specialty logistics provider in the sports and broadcast market, strengthening its position in high-value entertainment logistics and expanding service capabilities across international sporting events.

- In May 2025, GCL (Global Critical Logistics) announced a strategic controlling investment from Providence Equity Partners, with Providence becoming the majority shareholder and ATL Partners retaining a minority stake, enabling accelerated growth and enhanced operational capabilities.

- In May 2025, Hyve Group acquired Manifest, a global supply chain and logistics industry event, marking its entry into the fast-evolving logistics event space and expanding its portfolio into specialized industry gatherings focused on supply chain innovation.

- In December 2025, Global Critical Logistics rebranded as The Rock-It Company, consolidating its live event and logistics divisions under a unified banner to strengthen brand identity and streamline operations across entertainment and broadcast logistics segments.

Report Scope

Report Features Description Market Value (2024) USD 72.2 Billion Forecast Revenue (2034) USD 129.3 Billion CAGR (2025-2034) 6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Distribution Systems, Inventory Management, Freight Forwarding), By Event Size (Small (up to 500 attendees), Medium (500 to 2,000 attendees), Large (2,000 to 10,000 attendees), Mega (over 10,000 attendees)), By Application (Entertainment and Media, Sports Event, Trade Fair & Corporate Events, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Agility, C.H. Robinson Worldwide, Inc., CEVA Logistics, DB SCHENKER, DHL Group, FedEx, Kuehne+Nagel, Rhenus Group, United Parcel Service Of America, Inc., XPO, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Agility

- C.H. Robinson Worldwide, Inc.

- CEVA Logistics

- DB SCHENKER

- DHL Group

- FedEx

- Kuehne+Nagel

- Rhenus Group

- United Parcel Service Of America, Inc.

- XPO, Inc.